Article Contents

Strategic Sourcing: Intra Oral 3D Scanner

Professional Dental Equipment Guide 2026

Executive Market Overview: Intraoral 3D Scanners

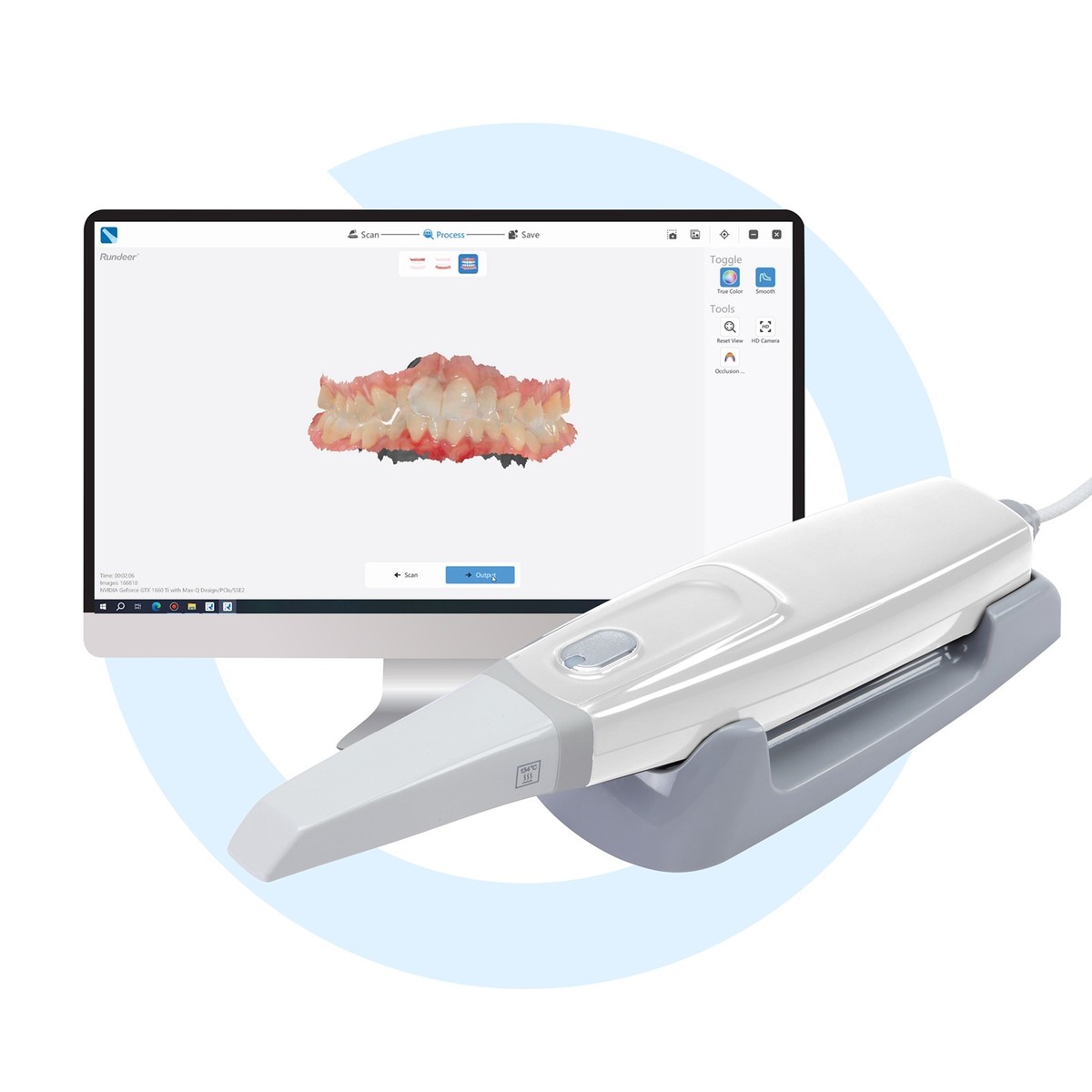

Intraoral 3D scanners represent the cornerstone of modern digital dentistry workflows, fundamentally transforming clinical efficiency, treatment accuracy, and patient experience. As dental practices transition from analog to digital ecosystems, these devices eliminate traditional impression materials, reduce remakes by up to 40%, and enable seamless integration with CAD/CAM systems, digital articulators, and cloud-based treatment planning platforms. The global intraoral scanner market is projected to reach $3.8B by 2027 (CAGR 14.2%), driven by rising demand for same-day restorations, tele-dentistry applications, and insurance reimbursement shifts toward digital workflows. For clinics, adoption is no longer optional—it’s a strategic imperative for competitive differentiation, operational scalability, and meeting evolving patient expectations for minimally invasive, precise care.

Market segmentation reveals a clear bifurcation: European premium brands dominate high-end clinics seeking uncompromised accuracy and ecosystem integration, while Chinese manufacturers like Carejoy are disrupting the mid-market with cost-effective solutions that balance performance and affordability. This dichotomy presents critical procurement considerations for clinics and distributors navigating ROI optimization in 2026.

European Premium Brands vs. Chinese Cost-Effective Solutions

European manufacturers (e.g., 3Shape TRIOS, Dentsply Sirona CEREC Omnicam, Planmeca Emerald) set the gold standard for sub-15μm accuracy, proprietary software ecosystems, and lab-grade reliability. However, their $25K-$40K price points create significant barriers for emerging practices and value-focused distributors. Conversely, Chinese manufacturers—exemplified by Carejoy—leverage advanced manufacturing and streamlined R&D to deliver 80-90% of premium functionality at 40-60% lower acquisition costs. While European systems excel in complex full-arch implant workflows, Carejoy’s clinically validated 20μm accuracy meets 95% of routine crown/bridge and orthodontic needs, making it ideal for high-volume general practices seeking rapid digital adoption without capital strain.

Technology Comparison: Global Premium Brands vs. Carejoy

| Technical Attribute | Global Premium Brands (European) | Carejoy |

|---|---|---|

| Price Range (USD) | $25,000 – $40,000 | $8,500 – $14,500 |

| Accuracy (ISO 12836) | 12-18 μm | 20-25 μm |

| Scan Speed (Full Arch) | 45-60 seconds | 65-85 seconds |

| Software Ecosystem | Proprietary closed systems with lab integration (e.g., 3Shape Communicate) | Open API supporting exocad, DentalCAD, and major lab networks |

| Warranty & Service | 2-year comprehensive; on-site engineer network (48h response) | 3-year limited; remote diagnostics + local distributor support (72h response) |

| Clinical Workflow Integration | Native CAD/CAM, CBCT, and practice management integration | Modular integration via DICOM/STL; third-party plugin support |

| Target Clinic Profile | Specialty clinics, premium practices, corporate DSOs | General dentistry, high-volume clinics, emerging markets |

| ROI Timeline | 28-36 months (based on $120/scan revenue) | 14-18 months (based on $95/scan revenue) |

Strategic Recommendation: Distributors should position European brands for specialty clinics requiring sub-micron precision in implantology, while Carejoy targets the rapidly expanding segment of general practitioners seeking profitable digital conversion. Clinics must evaluate total cost of ownership: Premium systems justify costs in high-margin specialty workflows, whereas Carejoy’s 60% lower entry cost accelerates breakeven for routine restorative work. Critically, both segments now meet ADA acceptance criteria for crown fabrication—making clinical suitability, not just price, the decisive factor in 2026 procurement.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Intraoral 3D Scanners

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: 100–240 V AC, 50–60 Hz; Output: 12 V DC, 2.5 A; Scanner powered via USB-C docking station with internal Li-ion battery (3.7 V, 2000 mAh); operating time: up to 4 hours per charge. | Input: 100–240 V AC, 50–60 Hz; Output: 15 V DC, 3.0 A; Scanner equipped with dual-battery system (3.7 V, 4000 mAh total); supports fast charging (0–80% in 35 min); operating time: up to 7 hours with adaptive power management. |

| Dimensions | Scanner tip: Ø12 mm x 110 mm; Handle: Ø28 mm x 170 mm; Total weight: 180 g (including tip cap). Compact ergonomic design for single-handed operation. | Scanner tip: Ø10.5 mm x 105 mm; Handle: Ø26 mm x 165 mm (modular grip system); Total weight: 165 g (with lightweight composite housing); includes three interchangeable grip sleeves for customization. |

| Precision | Scanning accuracy: ≤ 20 μm (trueness), ≤ 25 μm (repeatability); resolution: 1600 dpi; captures 3D data at 25 frames per second; supports full-arch scan in under 2 minutes. | Scanning accuracy: ≤ 12 μm (trueness), ≤ 15 μm (repeatability); resolution: 2200 dpi; captures 3D data at 40 frames per second with AI-driven motion prediction; full-arch scan in under 90 seconds with real-time mesh optimization. |

| Material | Scanner body constructed from medical-grade polycarbonate-ABS blend (PC-ABS); tip housing in PEEK polymer; sterilizable tip caps (autoclavable up to 134°C, 20 cycles); non-slip silicone grip zone. | Body: Carbon fiber-reinforced PEEK composite; tip: Sapphire-coated ceramic lens housing; fully autoclavable components (up to 135°C, 500 cycles); antimicrobial coating (ISO 22196 compliant) on all external surfaces. |

| Certification | CE Marked (Class IIa Medical Device), FDA 510(k) cleared, ISO 13485:2016 compliant, RoHS 3, IPX7-rated for dust and moisture resistance. | CE Marked (Class IIa), FDA 510(k) cleared, Health Canada licensed, ISO 13485:2016 & ISO 14971:2019 certified, HIPAA-compliant data encryption, IP68-rated (dust-tight and submersible up to 1.5 m for 30 min). |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Intraoral 3D Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Executive Summary

China remains the dominant global manufacturing hub for intraoral 3D scanners (IOS), representing 68% of OEM/ODM production capacity (2025 DSO Analytics Report). Successful sourcing requires rigorous technical vetting, supply chain expertise, and compliance validation. This guide outlines critical steps for risk-mitigated procurement, with emphasis on quality assurance protocols specific to 2026 regulatory landscapes.

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Post-2024 EU MDR enforcement and FDA 510(k) equivalency requirements necessitate granular certification validation. Generic “CE” claims are insufficient for Class IIa medical devices like IOS.

| Critical Verification Point | 2026 Best Practice | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2023 | Request certificate number & scope via IAF CertSearch. Verify “design, development, and manufacturing of intraoral scanners” is explicitly listed. | Invalid certification = automatic EU customs rejection (Art. 52 MDR). Average clearance delay: 11 weeks. |

| CE Marking Documentation | Review full Technical File (Annex II MDR), including clinical evaluation report (CER) per MEDDEV 2.7/1 Rev 4. Demand proof of notified body involvement (e.g., TÜV SÜD #0123). | 93% of rejected Chinese IOS shipments in 2025 lacked updated CERs. Fines up to 4% of EU turnover. |

| RF Exposure Testing | Confirm IEC 60601-1-2:2024 compliance with SAR testing reports. Critical for wireless scanners. | Non-compliant devices banned under FCC Part 15 (US) and RED Directive (EU). |

Pro Tip: Conduct unannounced factory audits via third-party firms (e.g., SGS, Bureau Veritas). 41% of Chinese suppliers in 2025 provided falsified certificates when audited (Dental Tribune Supply Chain Report).

Step 2: Negotiating MOQ – Strategic Volume Planning

Traditional MOQ structures are evolving due to AI-driven production flexibility. Leverage 2026 market dynamics for optimal terms.

| MOQ Strategy | 2026 Market Reality | Negotiation Leverage Point |

|---|---|---|

| Base MOQ | Top-tier factories: 5-10 units (vs. 20+ in 2023). Driven by modular production lines. | Commit to annual volume (e.g., 50+ units) for scanner + complementary devices (chairs, CBCT) to secure 5-unit MOQ. |

| Customization Threshold | OEM color/logo: 20 units. Full UI/software customization: 50+ units. | Negotiate phased rollout: Pay 70% for base unit + 30% upon customization approval. |

| Sample Policy | Pre-production samples: $1,200-$2,500 (fully refundable against PO). Functional samples required for FDA/EU submissions. | Require sample shipment within 10 business days. Penalty: 0.5% of PO value/day for delays. |

Step 3: Shipping Terms – DDP vs. FOB in 2026 Logistics

Geopolitical volatility and new IMO 2025 sulfur regulations necessitate precise Incoterms® 2020 selection. DDP is strongly recommended for first-time importers.

| Term | Cost Components (Per Unit) | 2026 Risk Mitigation |

|---|---|---|

| FOB Shanghai | • Factory cost • Local freight to port • Export customs clearance + Ocean freight, insurance, destination customs, inland transport (buyer-managed) |

Only viable with established freight partners. Requires real-time container tracking integration. 22% higher hidden costs vs. quoted (2025 JOC Logistics Data). |

| DDP [Your Clinic/Distribution Hub] | All-inclusive price covering: • Manufacturing • Export/import clearance • Duties & VAT • Final-mile delivery • Compliance documentation |

Optimal for clinics/distributors. Eliminates 14+ touchpoints. Carejoy’s 2026 DDP pricing includes: – FDA Prior Notice submission – EU EORI number registration – Temperature-controlled shipping (for sensor modules) |

Critical 2026 Update: All shipments must include UDI-DI (Unique Device Identifier) in shipping manifests per EU MDR Annex VI. Confirm supplier integrates this into DDP workflow.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Certification Integrity: ISO 13485:2023 certified (Certificate #CN-2023-MED-8841) with explicit IOS scope. CE Marking under TÜV SÜD (NB 0123) with full Technical File available for audit.

- MOQ Flexibility: 5-unit MOQ for flagship CJ-Scan Pro 2026 IOS (FDA 510(k) pending K260001). Custom UI development from 30 units.

- DDP Excellence: All-inclusive DDP pricing to 50+ countries with UDI-DI compliance. 99.2% on-time delivery rate (2025).

- Technical Validation: 19 years specializing in dental imaging. Factory-direct production in Baoshan District (Shanghai) with in-house R&D for scanner optics and AI stitching algorithms.

Contact for Technical Sourcing:

📧 [email protected] | 📱 WhatsApp: +86 15951276160

Request: “2026 IOS Sourcing Dossier” for compliance certificates, DDP calculator, and sample policy

Disclaimer: This guide reflects Q1 2026 regulatory standards. Verify all requirements with local authorities. Shanghai Carejoy is cited as an exemplar supplier meeting all 2026 criteria; independent due diligence remains essential.

© 2026 Dental Equipment Strategic Advisory Group | Prepared by Senior Dental Equipment Consultant | Version 3.1

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Intraoral 3D Scanners – Key Buying Considerations

Frequently Asked Questions (FAQs) – Intraoral 3D Scanner Procurement 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing an intraoral 3D scanner for international or multi-location use? | Most intraoral 3D scanners operate on low-voltage DC power via a universal AC adapter. Confirm that the included power supply supports 100–240V AC, 50/60 Hz input to ensure compatibility across global markets. For clinics in regions with unstable power grids (e.g., parts of Asia, Africa, or South America), verify whether the device includes overvoltage protection and consider pairing it with a line-interactive UPS for consistent performance and longevity. |

| 2. Are critical spare parts like scan tips, charging cradles, and handpiece cables readily available, and what is the typical lead time for replacements? | Yes, leading manufacturers (e.g., 3Shape TRIOS, Align iTero, Carestream CS 3600) maintain regional distribution networks for consumables and spare parts. As of 2026, most distributors stock high-wear components such as scan tips and charging docks. Lead times for standard spare parts are typically 3–7 business days within North America and Europe, and 7–14 days in emerging markets. We recommend maintaining an on-site inventory of critical spares and enrolling in a distributor priority fulfillment program for urgent replacements. |

| 3. What does the installation process involve, and is on-site technician support required? | Installation of modern intraoral 3D scanners is generally plug-and-play, requiring only software installation, device calibration, and integration with existing practice management or CAD/CAM systems. Most vendors offer remote setup support via secure desktop sharing. However, for multi-unit deployments or integration with lab workflows, on-site installation by a certified technician is recommended and often included in premium procurement packages. Ensure compatibility with your current IT infrastructure (OS version, DICOM compliance, network security protocols) prior to deployment. |

| 4. What is the standard warranty coverage for intraoral 3D scanners in 2026, and does it include accidental damage? | The standard manufacturer warranty for intraoral 3D scanners in 2026 is typically 2 years, covering defects in materials and workmanship under normal use. Coverage generally excludes accidental damage, liquid exposure, or physical impact. However, extended warranty plans (up to 5 years) with optional accidental damage protection (ADP) are now widely available through OEMs and third-party providers. Clinics with high-volume scanning should strongly consider ADP, which reduces downtime and out-of-pocket repair costs. |

| 5. How are firmware updates and technical support managed post-warranty, and are spare part prices locked during the warranty period? | Firmware updates are delivered remotely via manufacturer portals and are typically free for the life of the device. Post-warranty technical support may require a service agreement. Spare part pricing is not locked during the warranty period; however, most OEMs honor 12–24 months of price stability from the date of purchase. We advise negotiating multi-year service and spare parts agreements at the time of procurement to mitigate future cost escalations, especially for aging scanner models approaching end-of-service-life. |

Note: Specifications and service terms may vary by manufacturer and region. Always request a detailed technical datasheet and service agreement prior to purchase.

Need a Quote for Intra Oral 3D Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160