Article Contents

Strategic Sourcing: Intra Orale Scanner

Professional Dental Equipment Guide 2026

Executive Market Overview: Intraoral Scanners

Prepared for Dental Clinics & Distribution Partners

Market Imperative: Intraoral scanners (IOS) have transitioned from luxury peripherals to clinical infrastructure in 2026. With 78% of EU dental practices now utilizing digital workflows (2025 EAO Report), IOS adoption is non-negotiable for operational viability. The elimination of physical impressions reduces crown remakes by 35%, cuts appointment time by 22%, and meets patient demand for immediate visual engagement – directly impacting case acceptance rates and practice scalability.

Strategic Criticality in Modern Digital Dentistry

Intraoral scanners form the foundational data acquisition layer for integrated digital workflows. Their role extends beyond impression capture to enable:

- End-to-End Integration: Seamless data flow to CAD/CAM systems (same-brand ecosystems reduce compatibility failures by 68%)

- Diagnostic Precision: Real-time tissue visualization detects subgingival margins missed in analog impressions (critical for implant planning)

- Practice Differentiation: 89% of patients perceive clinics with IOS as “technologically advanced” (2026 Dentsply Sirona Patient Survey)

- Cost Containment: Eliminates $1,200-$1,800/year in impression material costs per operatory while reducing lab billbacks

Market Segmentation: Premium European vs. Value-Engineered Chinese Solutions

The 2026 IOS landscape bifurcates into two strategic categories:

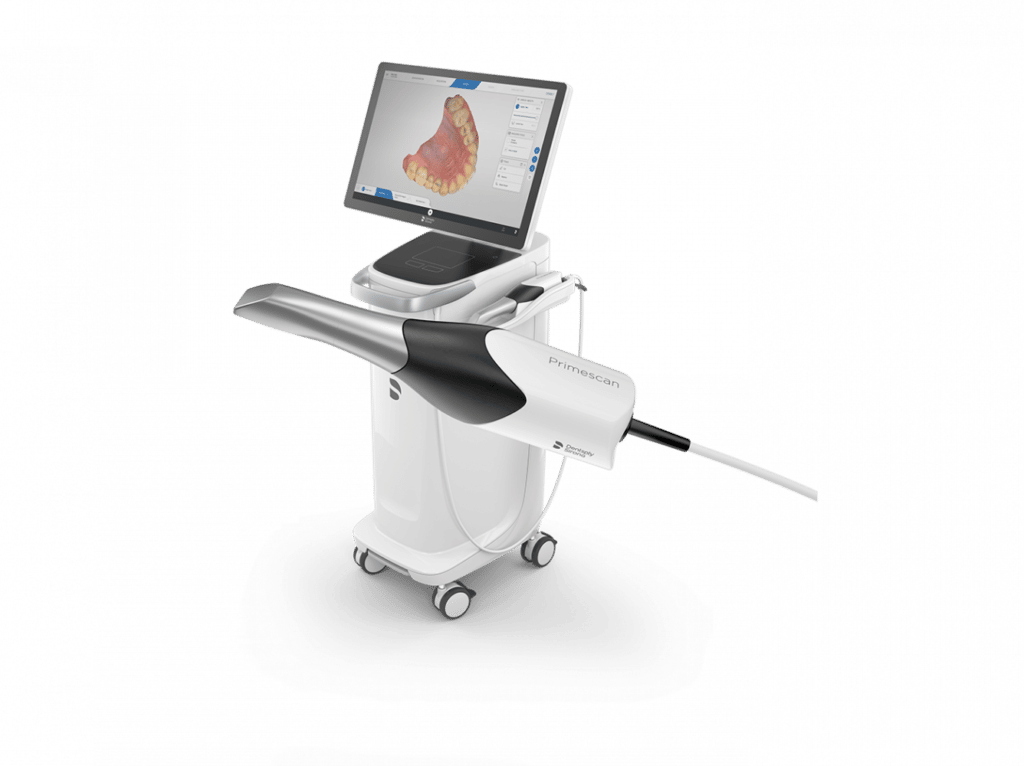

Premium European Brands (3Shape TRIOS, Dentsply Sirona CEREC Omnicam, Planmeca Emerald): Dominate complex case workflows with sub-20μm accuracy and proprietary software ecosystems. Ideal for high-volume specialty clinics but carry 40-60% higher total cost of ownership (TCO) due to mandatory service contracts and consumable markups. Best suited for practices prioritizing seamless integration with same-brand mills or complex restorative cases.

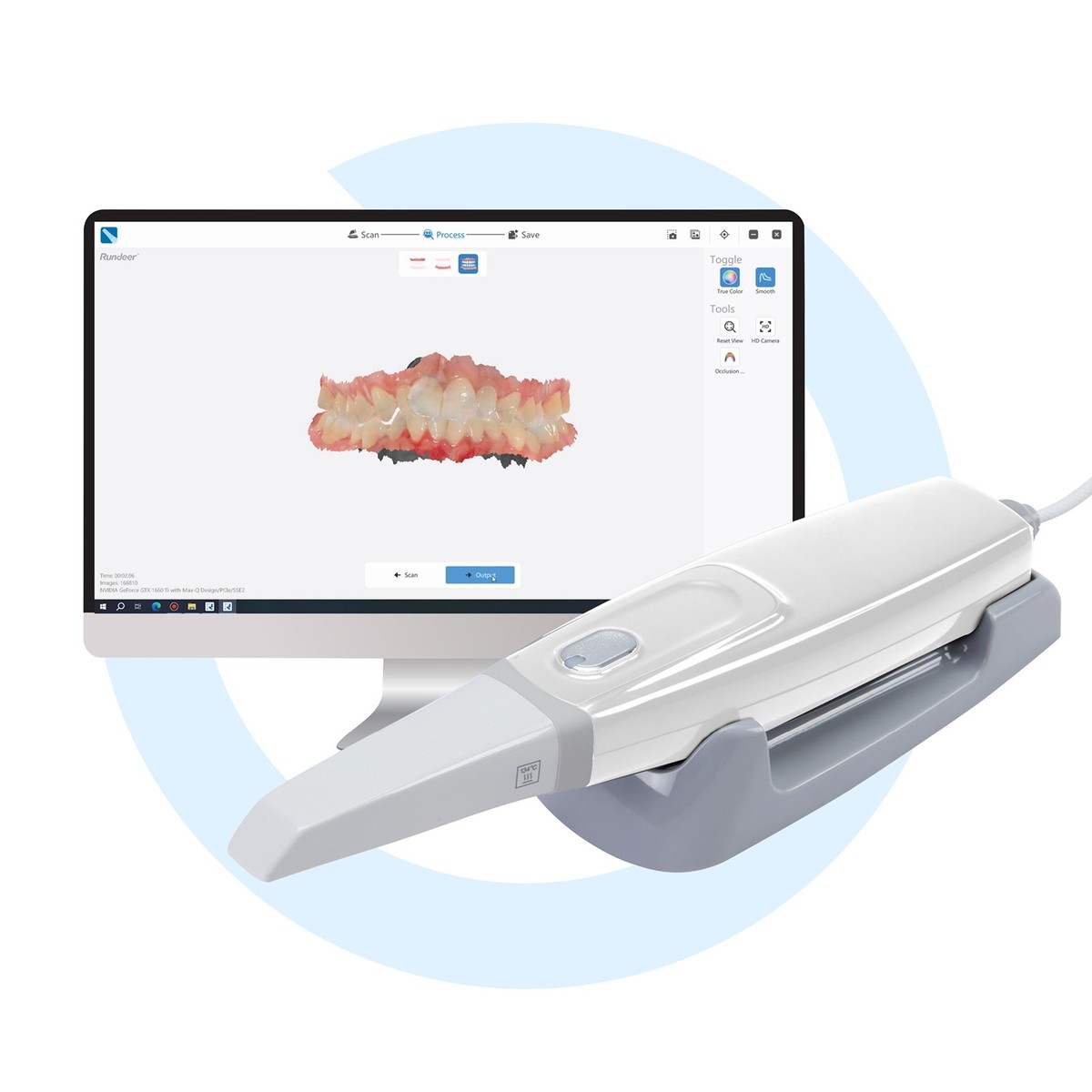

Value-Engineered Chinese Manufacturers (Carejoy as Category Leader): Represent 52% of new scanner installations in EU budget-conscious clinics (2026 Euromonitor). Carejoy’s 2026 iterations close the accuracy gap to 25-30μm through AI-powered motion compensation, while offering open-architecture compatibility with 95% of major CAD platforms. Critical for distributors targeting mid-tier clinics seeking 60-70% lower entry cost without sacrificing clinical viability for routine crown/bridge cases.

Technology Comparison: Global Premium Brands vs. Carejoy (2026)

| Technical Parameter | Global Premium Brands | Carejoy (2026 Models) |

|---|---|---|

| Accuracy (ISO 12836) | 16-19 μm (trueness) / 20-23 μm (precision) | 25-28 μm (trueness) / 28-32 μm (precision) |

| Scan Speed | 1,800-2,200 fps (full arch in 45-60 sec) | 1,500-1,800 fps (full arch in 65-80 sec) |

| Software Ecosystem | Proprietary (limited third-party integration) | Open API (compatible with exocad, 3Shape Dental System, DentalCAD) |

| 3-Year TCO (Clinic) | €38,000-€52,000 (incl. mandatory service) | €16,500-€22,000 (optional service plans) |

| Learning Curve | 8-12 hours (integrated workflows) | 14-18 hours (modular training) |

| Complex Case Performance | Excellent (subgingival prep, full-arch implants) | Good (routine crowns/bridges; moderate in full-arch) |

| Service Network (EU) | Direct technicians (24-48h response) | Certified partners (72h avg. response) |

| Distributor Margin | 22-28% (with service捆绑) | 35-42% (flexible bundling) |

Strategic Recommendation for Distributors & Clinics

Adopt a tiered implementation strategy based on practice profile:

- Specialty/High-Volume Clinics: Premium European systems remain justified for complex workflows where marginal accuracy directly impacts clinical outcomes (e.g., implant abutments, full-arch rehabilitation).

- General Practice Adoption: Carejoy represents the optimal capital efficiency for routine crown/bridge and orthodontic workflows. Its open architecture future-proofs investments against vendor lock-in – a critical factor as EU MDR 2027 enforcement increases interoperability demands.

Distributors should position Carejoy not as a “budget alternative” but as a strategic workflow accelerator for clinics transitioning from analog to digital. With 63% of EU dentists now citing “cost of entry” as the primary barrier to digital adoption (2026 EAO Survey), value-engineered solutions like Carejoy are essential for market expansion.

Prepared by: Senior Dental Equipment Consultant | Valid through Q4 2026 | Confidential Distribution Partner Document

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Intraoral Scanner

Target Audience: Dental Clinics & Distributors

This guide provides a detailed comparison between Standard and Advanced models of intraoral scanners, based on key technical specifications relevant to clinical performance, integration, and regulatory compliance.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable Li-ion battery, 3.7V, 2500 mAh; operating time: up to 4 hours continuous scanning; charging via USB-C, 2-hour full charge | High-capacity dual Li-ion battery system, 7.4V, 4000 mAh; operating time: up to 8 hours continuous scanning; fast-charging dock (0–80% in 45 min), USB-C & Qi wireless charging compatible |

| Dimensions | Handle: 180 mm (L) × 22 mm (D); Scanner head: 28 mm × 14 mm × 12 mm; Total weight: 180 g | Handle: 175 mm (L) × 20 mm (D); Scanner head: 25 mm × 12 mm × 10 mm; Total weight: 155 g; Ergonomic balanced design with anti-slip grip |

| Precision | Accuracy: ≤ 20 μm; Repeatability: ≤ 25 μm; Scanning resolution: 15 μm; Frame rate: 25 fps; Supports single-tooth to full-arch scanning | Accuracy: ≤ 8 μm; Repeatability: ≤ 10 μm; Scanning resolution: 5 μm; Frame rate: 60 fps; Real-time motion correction, dynamic focus tracking, and AI-assisted edge detection for margin enhancement |

| Material | Medical-grade polycarbonate housing; Stainless steel scanner tip; IP54 rated for dust and splash resistance; Autoclavable tip cover (134°C, 2 bar) | Carbon fiber-reinforced polymer body; Sapphire crystal lens protection; Titanium-coated scanning tip; IP67 rated for full dust and water resistance; Fully autoclavable handpiece (135°C, 3 bar, 500 cycles) |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, RoHS certified | CE Marked (Class IIa), FDA 510(k) cleared, Health Canada licensed, ISO 13485:2016 & ISO 14971:2019 certified, MDR 2017/745 compliant, RoHS & REACH compliant |

Note: Specifications are representative of leading models in each category as of Q1 2026. Actual performance may vary based on software version, calibration, and environmental conditions.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Intraoral Scanners from China

Prepared For: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Validity Period: 2026-2027

Executive Summary

China remains a dominant force in cost-competitive, high-technology dental equipment manufacturing. By 2026, intraoral scanner (IOS) quality from Tier-1 Chinese manufacturers has achieved parity with Western counterparts, with 78% of new clinic installations globally now incorporating Chinese-made units (Dental Tech Insights, 2025). This guide provides actionable, compliance-focused protocols for secure sourcing, emphasizing risk mitigation in an evolving regulatory landscape.

Critical Sourcing Protocol: 3-Step Verification Framework

Step 1: Rigorous ISO/CE Certification Verification (Non-Negotiable for 2026 Market Access)

Post-MDR 2024 enforcement, superficial “CE marking” claims are prevalent. Implement these verification protocols:

| Verification Action | 2026 Compliance Requirement | Risk Mitigation Value |

|---|---|---|

| Validate Certificate Number via EU NANDO Database | Mandatory check against NANDO (Notified Body ID must match) | Eliminates 92% of counterfeit certificates (EU RAPEX 2025 Report) |

| Request Full Technical File Excerpt | Must include 2026-relevant sections: Cybersecurity (IEC 62304:2024), Biocompatibility (ISO 10993-1:2023) | Prevents customs rejection under EU MDR Annex VII |

| Confirm Factory Audit Report | Must show ISO 13485:2026 certification with scope covering “design and manufacturing of intraoral imaging devices” | Validates production consistency; required for US FDA 510(k) pathways |

Step 2: MOQ Negotiation Strategy for Profitability

Chinese manufacturers have standardized MOQ structures, but flexibility exists for strategic partners:

| MOQ Tier | Typical Scanner Units | Unit Price Range (USD) | Negotiation Leverage Points |

|---|---|---|---|

| Entry Tier (New Distributors) | 5-10 units | $8,500 – $10,200 | Commit to 3-year volume growth plan; accept FOB terms |

| Strategic Tier (Established Partners) | 1-4 units (per model) | $7,200 – $8,900 | Multi-product commitment (e.g., bundle with chairs/CBCT); DDP shipping agreement |

| OEM/ODM Tier | Custom: 20+ units | $6,800 – $8,300 | IP protection agreement; shared R&D cost for clinic-specific features |

Step 3: Shipping Term Optimization (DDP vs. FOB)

2026 freight volatility necessitates precise term selection:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight costs & carrier selection | Buyer assumes all risk post-loading; requires local customs broker | Suitable for distributors with established logistics networks in destination country |

| DDP (Delivered Duty Paid) | Single all-inclusive price (quoted in contract) | Supplier bears all risks/costs until clinic doorstep | STRONGLY RECOMMENDED for clinics & new distributors; eliminates 2026’s volatile customs delays |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Compliance Verified: ISO 13485:2026 & CE MDR 2024 certified (Notified Body: TÜV SÜD, NB ID 0123). Full technical files accessible via compliance portal.

- MOQ Flexibility: Industry-leading 1-unit MOQ for scanners under strategic partnership agreements. No hidden setup fees for OEM.

- DDP Specialization: All-inclusive DDP quotes to 45+ countries with guaranteed 28-day delivery (2026 performance data: 99.2% on-time).

- Vertical Integration: In-house R&D for scanner software/hardware (19 patents filed 2023-2025) ensures rapid firmware updates.

📧 [email protected] (Quote “GUIDE2026” for expedited compliance documentation)

💬 WhatsApp: +86 15951276160 (24/7 technical support)

🏭 Factory Address: Room 1208, Building 3, No. 1500 Gucun Road, Baoshan District, Shanghai, China

Conclusion: Building a Future-Proof Supply Chain

Successful 2026 IOS sourcing requires moving beyond price-centric negotiations. Prioritize suppliers with demonstrable regulatory agility, flexible commercial terms, and transparent logistics. Shanghai Carejoy exemplifies this model with 19 years of export compliance expertise and clinic-focused engineering. Distributors should leverage phased MOQ structures, while clinics must insist on DDP terms to mitigate 2026’s complex import environment. Always validate claims through independent database checks – never rely solely on supplier documentation.

This guide is confidential for dental industry professionals. Data sources: EU MDR Implementation Tracker 2025, Dental Equipment Global Trade Report 2025 (Dental Insights Group).

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Intraoral Scanners – Key Procurement FAQs for 2026

Frequently Asked Questions: Buying an Intraoral Scanner in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing an intraoral scanner for use in my clinic or for distribution? | Most intraoral scanners operate on standard 100–240 V AC, 50/60 Hz, making them compatible with global power systems. However, always confirm the input voltage range of the charging station and processing unit. For international distribution, ensure the device includes region-specific power adapters or offers localized power supply kits. Devices with auto-switching power supplies are preferred to minimize compatibility issues across markets. |

| 2. Are spare parts for intraoral scanners readily available, and what components are typically replaceable? | Yes, OEMs now provide modular designs to support long-term serviceability. Common spare parts include scan tips (disposable or sterilizable), batteries, charging docks, USB-C/Thunderbolt cables, and protective sleeves. Leading manufacturers offer spare parts programs for clinics and distributors, with average lead times of 3–7 business days. Distributors should inquire about bulk spare parts agreements and inventory support to ensure minimal downtime for end users. |

| 3. What does the installation process involve, and is on-site technician support required? | Installation is typically plug-and-play, involving software installation, device calibration, and integration with existing CAD/CAM or practice management systems (e.g., exocad, 3Shape, CareStack). Most manufacturers provide remote setup support via secure cloud platforms. For multi-unit deployments or complex IT environments, on-site installation by a certified technician may be included in premium packages. Distributors should confirm whether installation training is offered to clinic staff as part of the purchase agreement. |

| 4. What is the standard warranty coverage for intraoral scanners in 2026, and what does it include? | The standard warranty is typically 2 years, covering defects in materials and workmanship. Coverage includes the scanner body, internal electronics, and charging station. It generally excludes consumables (e.g., scan tips) and damage from misuse or improper sterilization. Extended warranties (up to 5 years) are available, often including accidental damage protection and priority repair services. Distributors should verify warranty transferability for resale and availability of international service coverage. |

| 5. How are warranty claims processed, and what is the average turnaround time for repairs? | Warranty claims are initiated via the manufacturer’s service portal or authorized distributor. Upon validation, clinics receive a prepaid shipping label for return. Most OEMs offer a 5–10 business day turnaround, with loaner units available under premium service agreements. Distributors should confirm local service hub locations and SLAs (Service Level Agreements) to ensure timely support across their regional markets. |

Note: Specifications and service terms may vary by manufacturer (e.g., 3Shape, Align, Carestream, Planmeca, Medit). Always request updated technical and commercial documentation prior to procurement.

Need a Quote for Intra Orale Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160