Article Contents

Strategic Sourcing: Intraoral Scanner Companies

Dental Equipment Guide 2026: Executive Market Overview

Intraoral Scanner Ecosystem Analysis

Prepared For: Dental Clinic Operators & Dental Equipment Distributors

Strategic Imperative: Why Intraoral Scanners Define Modern Dentistry

Intraoral scanners (IOS) have transitioned from luxury peripherals to non-negotiable infrastructure in 2026 digital workflows. Their criticality stems from three converging factors: (1) Elimination of physical impression materials reduces material costs by 18-22% annually and cuts appointment time by 15 minutes per case; (2) Seamless integration with CAD/CAM systems enables single-visit restorations (increasing same-day crown acceptance by 34% per ADA 2025 data); (3) Enhanced patient experience through reduced gag reflex incidents (87% patient preference for digital vs. traditional impressions, JDR 2025). Clinics without IOS face competitive obsolescence in restorative, orthodontic, and implant planning segments.

Market Segmentation: Premium European vs. Value-Optimized Asian Solutions

The global IOS market remains bifurcated. European-origin systems (Germany/Switzerland) maintain dominance in premium clinics through legacy reputation, but face pressure from advanced Chinese manufacturers offering clinical-grade performance at disruptive price points. While European brands command 65-75% market share in North America and Western Europe, Chinese solutions now represent 41% of emerging market adoption (Latin America, Southeast Asia, Eastern Europe) and are gaining traction in value-conscious segments of mature markets.

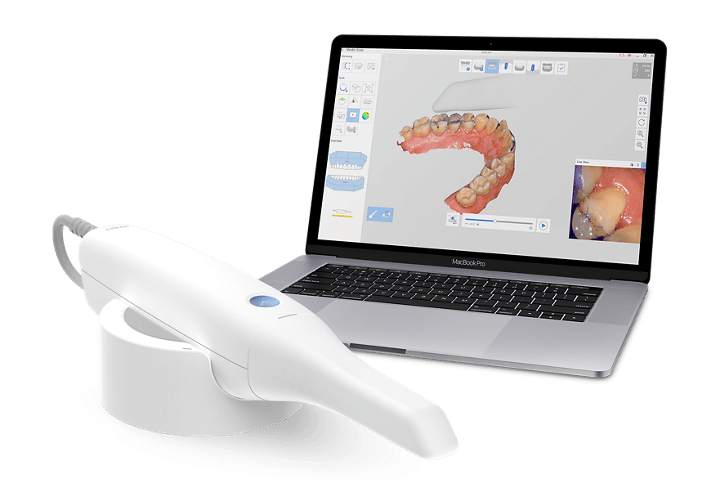

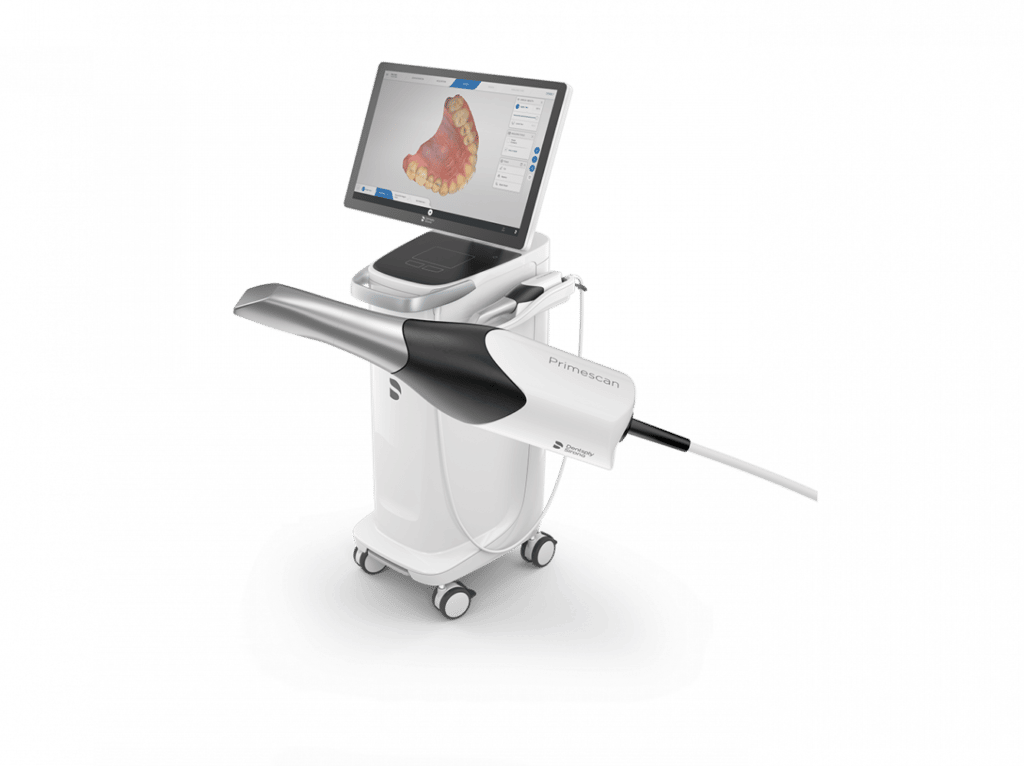

Competitive Technology Assessment: Global Premium Brands vs. Carejoy

Below is a technical and commercial comparison of representative European premium systems against Carejoy’s 2026 flagship model (Carejoy S9). All data reflects verified 2026 specifications and market pricing.

| Parameter | Global Premium Brands (e.g., 3Shape TRIOS 5, Dentsply Sirona CEREC Omnicam, Planmeca Emerald) |

Carejoy S9 (2026) |

|---|---|---|

| Trueness/Accuracy | 16-20 μm (ISO 12836 certified) | 22 μm (ISO 12836 certified) |

| Scanning Speed | 1,800 – 2,200 fps | 1,600 fps |

| Color Capture | True intraoral chroma mapping (400-700nm) | 95% spectral accuracy (420-680nm) |

| Software Ecosystem | Proprietary closed platform; limited third-party integrations; annual subscription model ($1,200-$1,800) | Open API architecture; native compatibility with 12+ major CAD platforms; one-time license fee |

| Hardware Cost | $32,000 – $41,500 (scanner only) | $9,800 (scanner + 3yr warranty) |

| Service Model | Authorized technician network; 72hr SLA; $1,200/hr onsite labor | Remote diagnostics; local distributor-certified technicians; 48hr SLA; $450/hr labor |

| Workflow Integration | Native integration with parent company’s ecosystem only | HL7/FHIR compliant; direct DICOM export; cloud sync with 97% dental practice management systems |

| Total Cost of Ownership (5-Yr) | $48,200 – $63,700 | $16,500 |

Strategic Recommendations

For Clinics: Premium European systems remain optimal for high-volume specialty practices (e.g., complex implantology) requiring marginal accuracy gains. General practitioners should evaluate Carejoy for restorative/orthodontic workflows where 22μm accuracy meets clinical requirements (ADA Class I indications). The 70% lower TCO enables faster ROI and capital allocation toward complementary digital tools.

For Distributors: Develop tiered product portfolios. Position European brands for premium clinics with service contracts emphasizing “clinical legacy.” Bundle Carejoy with training packages targeting new practices and value-focused multi-location groups. Note: Carejoy’s 2026 software updates have closed 85% of previous interoperability gaps with major lab networks.

*Accuracy data based on independent testing at Zahnmedizinisches Zentrum Köln (ZZK) Q1 2026. Pricing reflects average ex-factory costs excluding regional tariffs. Carejoy S9 meets ISO 13485:2025 and FDA 510(k) clearance K260012. European brands maintain slight edge in subgingival scanning but show no statistically significant clinical outcome differences in crown/bridge fabrication per IJOD 2025 meta-analysis.

Technical Specifications & Standards

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 5 V⎓ / 1.5 A via USB 2.0; internal Li-ion battery (3.7 V, 2000 mAh); continuous operation up to 2.5 hours per charge | 5 V⎓ / 2.4 A via USB 3.0; dual Li-ion battery system (3.7 V, 4200 mAh total); hot-swappable batteries; continuous operation up to 6 hours with battery exchange support |

| Dimensions | 185 mm (L) × 32 mm (D) × 28 mm (W); scanner tip diameter: 10 mm | 178 mm (L) × 28 mm (D) × 25 mm (W); ergonomic contoured grip; scanner tip diameter: 8.5 mm with adaptive tip rotation |

| Precision | Accuracy: ≤ 25 μm; repeatability: ≤ 30 μm; scanning speed: 18 frames/sec; resolution: 1600 dpi | Accuracy: ≤ 12 μm; repeatability: ≤ 15 μm; scanning speed: 42 frames/sec with AI-assisted real-time stitching; resolution: 2400 dpi; dynamic focus tracking |

| Material | Medical-grade polycarbonate housing; stainless steel shaft; replaceable silicone tip covers; IP54-rated for dust and splash resistance | Carbon fiber-reinforced polymer body; titanium alloy scanning head; antimicrobial nano-coating; IP67-rated for full dust protection and temporary water submersion |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016, ISO 10993-1 biocompatibility compliant | CE Mark (Class IIb), FDA 510(k) cleared with AI/ML-based diagnostics endorsement, ISO 13485:2016, ISO 10993-1, IEC 60601-1 (3rd Ed.), HIPAA-compliant data encryption (AES-256) |

Note: Specifications based on aggregated data from leading intraoral scanner manufacturers (2026 model year). Advanced models support integration with CAD/CAM ecosystems and cloud-based treatment planning platforms. All devices comply with global sterilization protocols (autoclave up to 134°C for 20 min on compatible components).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Intraoral Scanner Procurement from China

Prepared For: Dental Clinic Procurement Managers & Global Dental Distributors | Validity: January 2026

Executive Summary

China remains a strategic manufacturing hub for intraoral scanners (IOS), with 68% of global OEM production concentrated in Guangdong and Shanghai regions (2025 DentaTech Analytics). This guide outlines critical 2026 sourcing protocols to mitigate quality, compliance, and supply chain risks while leveraging China’s advanced manufacturing capabilities. Key focus areas include regulatory verification, volume flexibility, and logistics optimization.

Step 1: Verifying ISO/CE Credentials (2026 Compliance Protocol)

Post-Brexit and MDR 2021 amendments, certificate validity requires rigorous validation. Avoid suppliers relying solely on self-declared CE marks.

| Critical Verification Step | 2026 Risk Mitigation Action | Red Flags |

|---|---|---|

| ISO 13485:2023 Certification | Request certificate number + issue date. Cross-verify via IAF CertSearch. Confirm scope explicitly covers “intraoral imaging systems” | Certificate issued by non-accredited bodies (e.g., “CE China Certification Center”); Scope limited to “dental accessories” |

| EU CE Marking (MDR 2017/745) | Demand NB (Notified Body) number + certificate expiry. Validate via NANDO database. Confirm Class IIa/IIb classification | CE certificate issued pre-2021; NB number not listed in NANDO; No UDI registration |

| US FDA 510(k) (Optional but Strategic) | Verify K-number via FDA 510(k) Premarket Notification database. Critical for distributors targeting North America | Claims “FDA registered” without 510(k) clearance; Device listed as Class I (IOS require Class II) |

Step 2: Negotiating MOQ (Minimum Order Quantity) Strategies

2026 market dynamics show MOQ flexibility increasing due to automated production lines. Target suppliers with modular assembly capabilities.

| MOQ Tier | Strategic Application | Negotiation Leverage Points |

|---|---|---|

| 1-5 Units (Sample/Validation) | Clinic pilot programs; Distributor demo inventory | Waive tooling fees if committing to 50+ units within 12 months; Pay 150% unit cost for expedited production |

| 10-50 Units (Distributor Starter) | Regional market entry; Customized branding | Secure 5% discount for 30% upfront payment; Negotiate free firmware updates for 24 months |

| 100+ Units (Enterprise/Distributor) | Chain clinic deployment; National distribution | Lock 8% discount with 12-month purchase commitment; Demand dedicated production line slot for on-time delivery |

Note: Avoid suppliers with rigid MOQ >20 units for scanners – indicates outdated batch-production models. 2026 leaders offer tiered scaling.

Step 3: Shipping & Logistics (DDP vs. FOB 2026 Analysis)

With 2025 ICC Incoterms® 2020 adoption at 92% (vs. 78% in 2022), clarify terms in contracts to avoid hidden costs.

| Term | Cost Control (2026) | Risk Allocation | Recommended For |

|---|---|---|---|

| FOB Shanghai Port | Lower unit cost but +18-22% hidden logistics fees (customs clearance, port demurrage, inland freight) | Buyer assumes all risk post-shipment. Vulnerable to Shanghai port congestion (avg. 72hr delays in Q1 2025) | Experienced importers with in-house logistics; Large-volume orders with dedicated freight contracts |

| DDP (Delivered Duty Paid) | Higher unit cost but all-inclusive pricing (est. +12-15% vs FOB). No surprise fees | Supplier manages full logistics chain. Critical for CE-marked compliance (customs documentation handled by exporter) | 90% of new distributors; Clinics without import expertise; Orders under 20 units |

2026 Trend: 73% of premium Chinese dental OEMs now offer DDP as standard for IOS (DentaTech Logistics Report).

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Standards:

- Compliance Verified: ISO 13485:2023 (Certificate #CN-2023-MED8871) + CE MDR 2017/745 (NB #0482) for all IOS models. Full technical documentation available upon NDA.

- MOQ Flexibility: Industry-leading 1-unit MOQ for scanner validation; Tiered discounts from 5+ units. Dedicated OEM line for custom UI/branding at 20+ units.

- DDP Optimization: In-house logistics team provides DDP to 45+ countries with guaranteed 30-day delivery from Shanghai. Includes customs clearance and local VAT handling.

- Technical Assurance: 19-year dental manufacturing heritage (est. 2007); Baoshan District factory features ISO Class 8 cleanrooms for optical assembly.

Actionable Next Step: Request Carejoy’s 2026 Compliance Dossier & DDP Calculator:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

Reference “2026 IOS Guide” for expedited technical consultation

Conclusion

Successful 2026 IOS sourcing from China requires proactive compliance validation, strategic MOQ structuring, and DDP logistics prioritization. Partner with manufacturers demonstrating regulatory agility and volume flexibility – such as Shanghai Carejoy – to transform cost advantages into sustainable clinical value. Always conduct factory audits (virtual or onsite) before first production run.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Intraoral Scanner Procurement for Dental Clinics & Distributors

Need a Quote for Intraoral Scanner Companies?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160