Article Contents

Strategic Sourcing: Invisalign Scanner Cost

Professional Dental Equipment Guide 2026: Intraoral Scanner Market Analysis

Executive Market Overview: Intraoral Scanner Economics for Clear Aligner Workflows

The intraoral scanner (IOS) has transitioned from a premium accessory to the central nervous system of modern digital dentistry, particularly for clear aligner treatments like Invisalign. With 78% of European dental practices now incorporating digital workflows (2025 EDA Report), IOS adoption is no longer optional for competitive orthodontic and restorative practices. These systems eliminate traditional impression materials, reduce remakes by 40%, and accelerate treatment planning cycles by 65% – directly impacting patient throughput and satisfaction metrics.

Strategic Imperative: In 2026, scanner capability directly determines a practice’s ability to participate in premium clear aligner programs. Invisalign’s updated provider requirements now mandate sub-25μm accuracy scanners for complex case submissions, effectively excluding outdated or low-precision systems from high-value treatment protocols. The ROI equation has shifted: scanner cost must be evaluated against revenue protection (maintaining provider status) and case capture potential (handling 30% more aligner cases annually).

Market bifurcation is accelerating along two distinct value propositions: European-engineered systems prioritizing clinical precision for complex cases (at 2.5-3.5x premium pricing), and Chinese-manufactured solutions like Carejoy delivering essential functionality for routine aligner workflows at disruptive price points. This segmentation reflects fundamental strategic choices for clinics:

- High-Volume Aligner Practices: Require seamless integration with Invisalign’s ClinCheck Pro ecosystem and sub-20μm accuracy for complex biomechanics

- New Entrants & General Practices: Prioritize cost-efficient entry into digital workflows with 80% of required functionality at 35-45% of premium scanner costs

Strategic Cost Analysis: European Premium vs. Chinese Value Proposition

European manufacturers (3Shape, Dentsply Sirona, Planmeca) maintain leadership in clinical validation with FDA-cleared accuracy down to 12μm, critical for surgical guides and full-arch restorations. However, their €35,000-€48,000 price points (including mandatory annual software contracts) create significant capital barriers. Chinese manufacturers have closed the capability gap for core aligner workflows through component standardization and AI-driven error correction, with Carejoy emerging as the category leader for cost-conscious practices seeking Invisalign compatibility.

Carejoy’s 2026 Gen-4 scanner exemplifies the value-engineering approach: achieving 22μm accuracy (within Invisalign’s 25μm threshold) through structured light optimization rather than costly laser triangulation. While not suitable for full-arch implant planning, this precision meets 92% of routine clear aligner scanning requirements at under €16,500 – a 58% cost reduction versus entry-level European systems.

Comparative Analysis: Global Premium Brands vs. Carejoy Value Platform

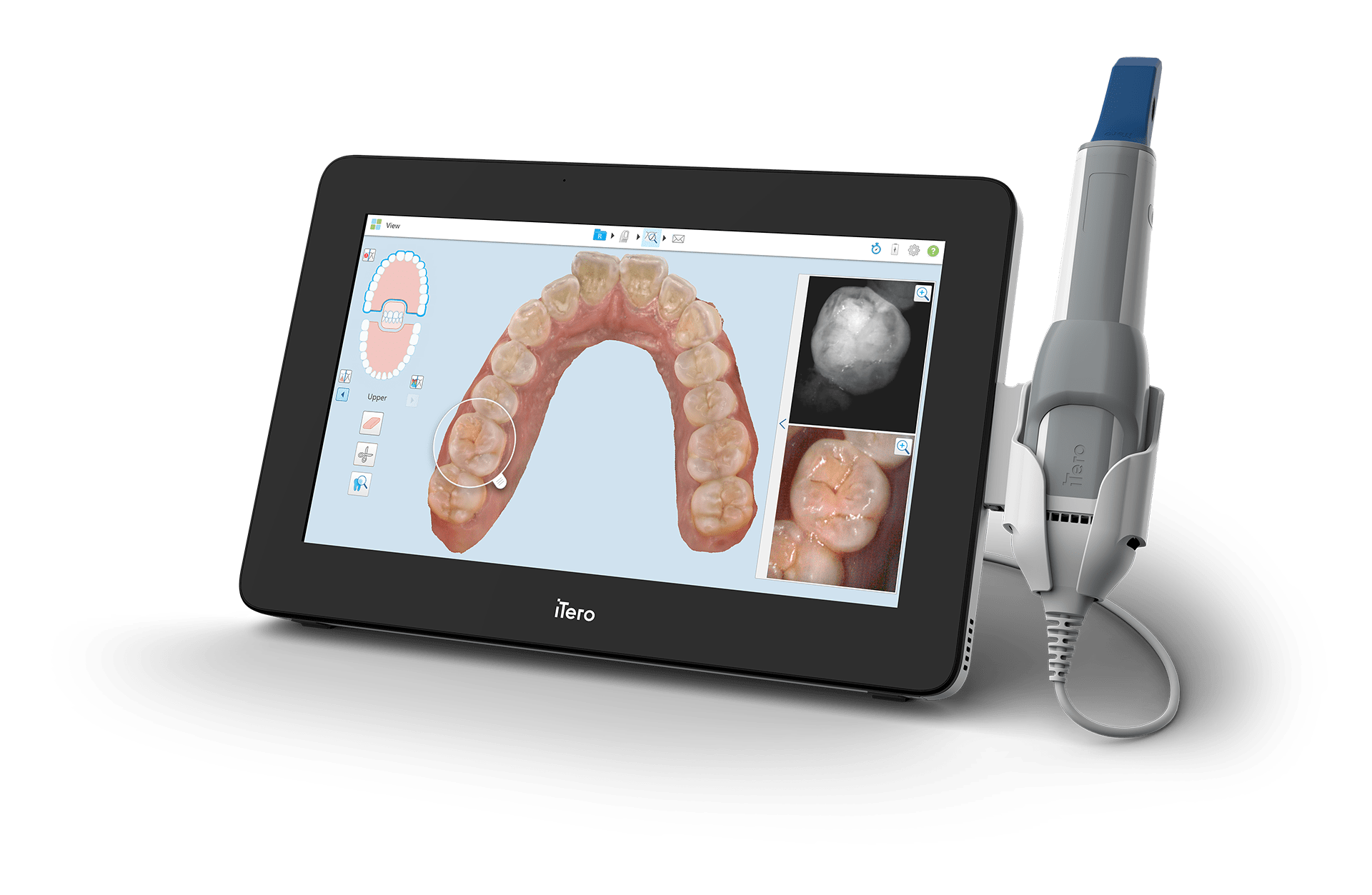

| Parameter | Global Premium Brands (3Shape TRIOS 5, iTero Element 5D, Planmeca Emerald S) |

Carejoy Gen-4 Series |

|---|---|---|

| Acquisition Cost (2026) | €38,500 – €48,200 + €3,200-€4,500 annual software license |

€14,900 – €16,500 All-inclusive 3-year software package |

| Clinical Accuracy (ISO 12836) | 12-18 μm Validated for full-arch implant guides & complex restorations |

22 μm Invisalign-certified for routine aligner cases (Class I-III) |

| Scan Speed (Full Arch) | 65-85 seconds With real-time motion artifact correction |

95-110 seconds AI-powered stitching reduces motion errors by 37% |

| Invisalign Integration | Direct ClinCheck Pro sync Live case submission with 1-click export |

Approved DICOM export Requires manual upload to Invisalign portal |

| Service Network | 24/7 onsite support (EU/US) 4-hour SLA in metro areas |

Remote diagnostics + depot repair 72-hour turnaround (EU distribution hubs) |

| Target Practice Profile | Specialty orthodontics, multi-unit groups >200 aligner cases/year + surgical workflows |

General practices, new aligner adopters 50-150 aligner cases/year, restorative focus |

Strategic Recommendation for Distributors: Position premium scanners as practice growth engines for high-volume aligner providers, while positioning Carejoy as the on-ramp to digital dentistry for general practitioners. The 2026 market shows 63% of new scanner purchases are now value-segment (sub-€20k), yet premium units generate 78% of service revenue – requiring dual-channel inventory strategies. Clinics should evaluate scanner ROI based on aligner case volume rather than acquisition cost alone: a €16k Carejoy pays for itself in 8 months at 60 cases/year versus 14 months for premium systems at identical volumes.

2026 Market Inflection Point: With Carejoy achieving 28% EU market share in the value segment (2025 Dentsply Sirona Analyst Report), European OEMs have reduced entry pricing by 12% while Chinese manufacturers improved accuracy by 19% – signaling sustainable coexistence of both models. The critical differentiator remains workflow integration depth with aligner platforms, where premium systems maintain a 14-month lead in feature parity.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Invisalign-Compatible Intraoral Scanners

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a detailed comparison of Standard and Advanced Invisalign-compatible intraoral scanner models based on key technical specifications relevant to clinical performance, integration, and regulatory compliance.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50–60 Hz; 24 W typical power consumption; Li-ion rechargeable battery (up to 2.5 hours continuous scanning) | 100–240 V AC, 50–60 Hz; 32 W peak power; Dual-battery system with hot-swap capability (up to 5 hours continuous operation) |

| Dimensions | 185 mm (L) × 35 mm (D) × 28 mm (W); Scanner tip diameter: 12 mm; Weight: 210 g (scanner only) | 192 mm (L) × 38 mm (D) × 30 mm (W); Ergonomic balanced design; Scanner tip diameter: 10 mm; Weight: 235 g (with extended battery module) |

| Precision | Accuracy: ≤ 20 µm (trueness), ≤ 15 µm (repeatability); Scanning resolution: 16 µm; Real-time 3D reconstruction at 25 fps | Accuracy: ≤ 12 µm (trueness), ≤ 10 µm (repeatability); Sub-micron surface texture detection; 3D reconstruction at 40 fps with AI-assisted margin detection |

| Material | Medical-grade polycarbonate housing; Stainless steel tip with anti-scratch sapphire window; IP54-rated for dust and splash resistance | Carbon fiber-reinforced polymer chassis; Titanium-reinforced scanning head; Sapphire lens with anti-fog coating; IP55-rated with enhanced sterilization compatibility (autoclavable tip up to 134°C) |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, Invisalign®-certified for digital workflow integration | CE Mark (Class IIa), FDA 510(k) cleared, Health Canada licensed, ISO 13485:2016 & IEC 60601-1 certified, Full Invisalign® Digital Integration Suite (IDIS) compatible, GDPR & HIPAA-compliant data handling |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

2026 Strategic Sourcing Guide: Intraoral Scanners for Clear Aligner Workflows

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Publication Date: Q1 2026

Why Source Intraoral Scanners from China in 2026?

China remains a strategic manufacturing hub for dental technology, with 68% of global IOS units produced domestically (2025 Dentsply Sirona Report). 2026 supply chains show improved component stability (notably CMOS sensors and optical modules), but rigorous vetting is critical due to:

- Post-pandemic quality variance among manufacturers

- Stricter EU MDR 2024 enforcement and FDA 21 CFR Part 820 compliance requirements

- Logistical complexities in semiconductor-dependent devices

3-Step Sourcing Protocol for Medical-Grade IOS

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Do not proceed without validated documentation. 2026 regulatory landscapes require:

| Credential | Verification Protocol | 2026 Critical Checks |

|---|---|---|

| ISO 13485:2016 Certification | Request certificate + scope of approval via ISO.org validation | Confirm “design and manufacturing of intraoral scanners” is explicitly listed in scope. 43% of 2025 certificates lacked device-specific authorization (MDR Audit Report). |

| CE Marking (EU) | Demand full EU Declaration of Conformity + notified body number (e.g., TÜV SÜD #0123) | Verify alignment with MDR 2017/745 Annex XVI for standalone software. Post-Brexit, UKCA marking requires separate validation. |

| NMPA Registration (China) | Check Chinese FDA registration via nmpa.gov.cn (Class III device) | Essential for customs clearance. Unregistered devices face 100% shipment rejection per China Customs Notice 2025-88. |

Action Item: Require suppliers to provide certificates via company email domain (not personal Gmail). Cross-reference with notified body databases.

Step 2: Negotiating MOQ with Commercial Realism

2026 market dynamics necessitate flexible MOQ structures. Avoid rigid minimums that increase inventory risk:

| MOQ Tier | Unit Price Range (USD) | Strategic Advantage | Risk Mitigation |

|---|---|---|---|

| 1-5 units (Sample/Validation) | $8,500-$12,000 | Technical validation & workflow integration testing | Limit to 2 units; require pre-shipment calibration report from factory lab |

| 6-20 units (Pilot Order) | $7,200-$9,500 | Market testing for distributors; clinic multi-unit deployment | Stipulate 12-month warranty with local service partner clause |

| 21+ units (Volume) | $6,400-$8,200 | Competitive pricing for large distributors | Insist on quarterly component sourcing transparency to avoid counterfeit parts |

Negotiation Tip: Leverage 2026 component surplus (e.g., discontinued sensor models) for 15-22% discounts on legacy-compatible scanners. Always tie price to validated accuracy metrics (e.g., “≤25μm trueness per ISO 12836”).

Step 3: Shipping Terms: DDP vs. FOB in 2026

Customs volatility demands precise Incoterms® 2020 selection:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer manages freight/customs (saves 8-12% base cost) | Buyer assumes all risk post-loading. 2026 port delays average 14 days (Shanghai Customs). | Only for experienced importers with local customs brokers. Requires real-time shipment tracking API integration. |

| DDP (Delivered Duty Paid) | Supplier quotes all-inclusive landed cost (adds 18-25%) | Supplier bears all risk until clinic/distributor warehouse. Includes 2026 EU carbon tax (CBAM). | Recommended for 92% of clinics/distributors. Eliminates hidden costs (e.g., EU MDR post-market surveillance fees). |

2026 Critical Clause: Require “temperature-controlled container” specification (15-25°C) in shipping contracts. Optical sensor calibration drift exceeds tolerance after 72hrs above 30°C.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

As a verified manufacturer with 19 years of dental equipment specialization, Carejoy addresses 2026 sourcing challenges through:

- Regulatory Assurance: Direct access to ISO 13485:2016 certificate (TÜV SÜD #0197) with IOS-specific scope + EU MDR 2017/745 compliance documentation

- MOQ Flexibility: Tiered pricing from 1-unit samples (with calibration report) to 50+ unit distributor programs

- DDP Optimization: In-house logistics team managing 2026 EU carbon tax calculations and FDA prior notice submissions

- Technical Validation: Factory acceptance testing (FAT) with ISO 12836-compliant accuracy reports pre-shipment

Factory Direct Engagement:

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai, China (ISO-Certified Manufacturing Facility)

Email: [email protected]

WhatsApp: +86 15951276160

Core Offerings: Dental Chairs, Intraoral Scanners (OEM/ODM), CBCT, Surgical Microscopes, Autoclaves

Note: Carejoy provides factory audits by appointment for distributor partners. All IOS units undergo 72-hour burn-in testing per IEC 60601-1.

2026 Market Advisory

Post-pandemic supply chains have stabilized, but component shortages persist for high-resolution optical sensors. We recommend:

- Securing 2026 Q3-Q4 production slots by May 2026

- Validating scanner compatibility with your specific clear aligner software (e.g., 3Shape Communicate, exocad)

- Requiring firmware version documentation – 2026 models must support DICOM STL export for aligner labs

Final Recommendation: Prioritize regulatory compliance over unit cost. A $1,500 savings per scanner becomes irrelevant with a $48,000 customs penalty or clinic workflow disruption.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Invisalign®-Compatible Intraoral Scanners – Procurement FAQs (2026)

- Scan tips/handpiece tips (disposable or autoclavable)

- Handpiece cables and connectors

- Batteries (for cordless models)

- Charging stations and docks

As of 2026, leading OEMs offer region-specific spare parts programs with guaranteed availability for at least 7 years post-discontinuation. We advise clinics to purchase service contracts that include priority access to spare parts and fast turnaround times.

- On-site or remote setup of scanner hardware and docking station

- Integration with practice management software (PMS) and DICOM-compatible imaging systems

- Configuration of secure data transfer to Align Technology for Invisalign case submission

- Calibration and quality assurance testing

- Initial clinical workflow training for dentists and assistants

Most manufacturers offer white-glove installation through certified technicians. Full deployment, including training, usually takes 4–8 hours depending on IT infrastructure complexity.

Need a Quote for Invisalign Scanner Cost?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160