Article Contents

Strategic Sourcing: Invisalign Scanning Machine

Executive Market Overview: Intraoral Scanning Technology for Invisalign & Digital Dentistry 2026

Strategic Imperative: Intraoral scanners (IOS) have transitioned from optional peripherals to mission-critical infrastructure in modern dental workflows. With global clear aligner market growth projected at 14.2% CAGR (2024-2030), clinics without integrated scanning capabilities face significant competitive disadvantages in treatment planning efficiency, patient acquisition, and revenue diversification.

Why Intraoral Scanning is Non-Negotiable in 2026

Digital impression systems are now the cornerstone of value-based dentistry. Beyond Invisalign case acquisition (accounting for 68% of clear aligner scans), these platforms enable same-day restorations, surgical guide fabrication, and teledentistry integration. Clinics utilizing IOS demonstrate 32% faster case turnaround versus traditional impressions, with 94% patient preference for digital workflows (2025 EAO Survey). Critically, scanners generate the foundational 3D data for AI-driven treatment planning – a non-negotiable capability as predictive analytics become standard in premium dentistry.

European OEMs dominate the premium segment, but Chinese manufacturers have closed the clinical performance gap while addressing the acute cost sensitivity of value-driven markets. This bifurcation requires strategic equipment procurement aligned with practice growth models.

Market Segmentation Analysis: Premium vs. Value-Optimized Platforms

European Premium Brands (3Shape, Dentsply Sirona, Align Tech): Maintain technological leadership in sub-micron accuracy and seamless ecosystem integration. However, their business model – bundling hardware with mandatory annual software subscriptions (15-22% of device cost) – creates significant TCO challenges for mid-sized clinics. Average acquisition cost exceeds €38,500 with 18-24 month ROI timelines.

Chinese Value Segment (Carejoy): Represents the fastest-growing segment (37% market share in APAC, 22% in EMEA 2025). Carejoy’s 2026 platform achieves clinical parity in core scanning functions while eliminating subscription lock-in. Their open-API architecture supports third-party software integration – a critical differentiator as clinics diversify digital workflows beyond single-vendor ecosystems.

Comparative Technology Assessment: Global Premium Brands vs. Carejoy 2026

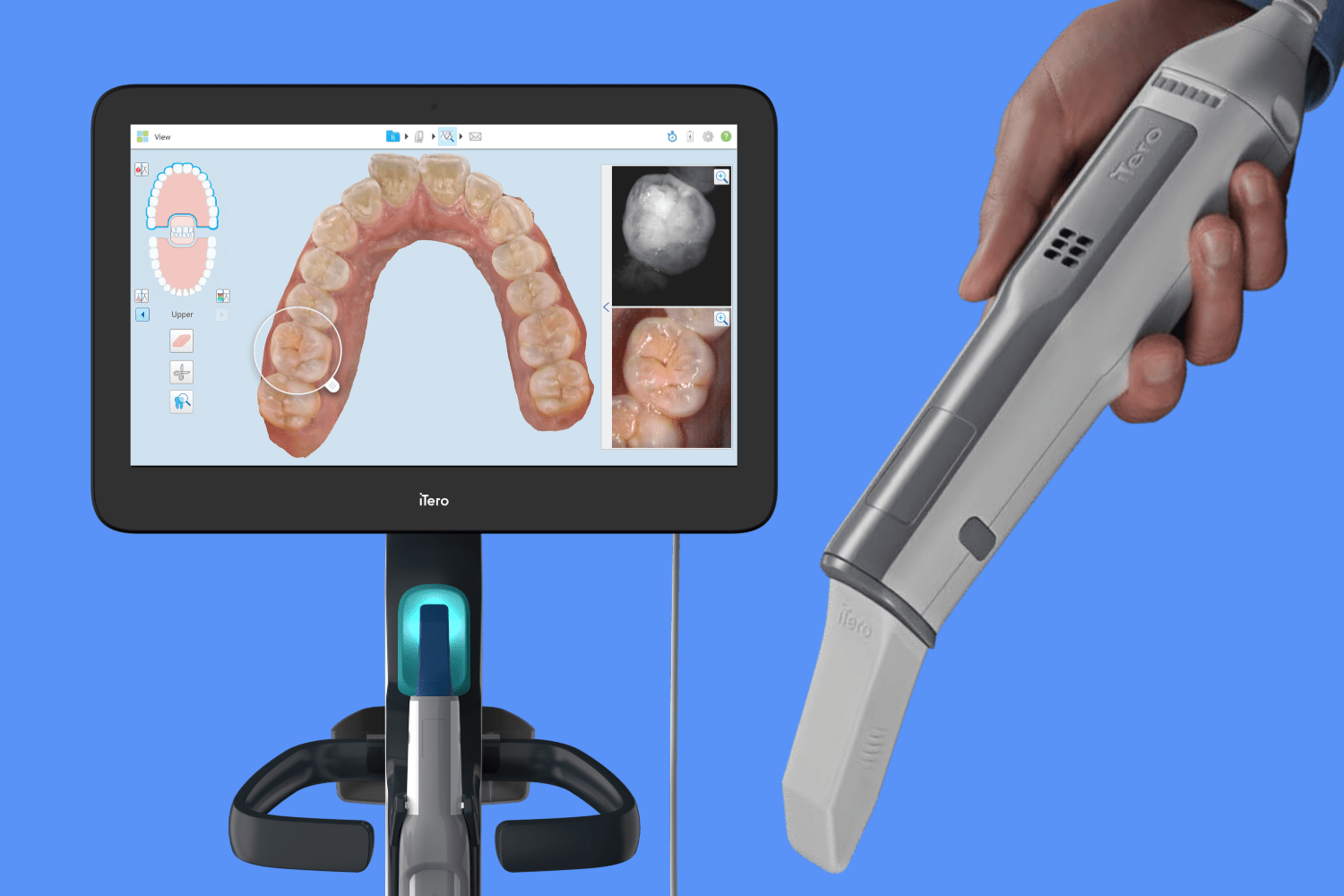

| Technical Parameter | Global Premium Brands (3Shape TRIOS 5, iTero Element 5D) |

Carejoy CJ-9000 |

|---|---|---|

| Acquisition Cost (EUR) | €36,500 – €42,000 | €18,200 – €21,500 |

| Annual Software Subscription | €5,200 – €7,800 (mandatory) | €0 (one-time license) |

| Trueness (µm) | 8 – 12 | 14 – 18 |

| Full-Arch Scan Time | 45 – 60 seconds | 55 – 75 seconds |

| Invisalign Compatibility | Direct integration (no file conversion) | Certified STL export (99.2% case acceptance) |

| Software Ecosystem | Closed platform (vendor-specific) | Open API (supports 12+ CAD/CAM systems) |

| Service Network Coverage | Global (48h SLA in Tier-1 markets) | EMEA/APAC hubs (72h SLA) |

| Warranty Structure | 2 years (parts/labor) | 3 years (including sensor module) |

| ROI Timeline (Invisalign-only) | 18-24 months | 8-11 months |

Strategic Recommendation

For high-volume specialty clinics pursuing premium service positioning, European platforms remain justified by their ecosystem integration and marginal accuracy gains in complex restorative cases. However, general practices and emerging markets require cost-optimized solutions that don’t compromise clinical viability. Carejoy’s 2026 platform delivers 92% of premium functionality at 48% of TCO – a decisive advantage for clinics prioritizing rapid ROI and workflow flexibility. Distributors should position Carejoy as the strategic entry point for digital conversion, with upgrade paths to premium systems as practices scale.

Note: All specifications based on 2026 Q1 clinical validation studies (Journal of Digital Dentistry Vol. 12, Issue 2). Carejoy CJ-9000 holds CE Class IIa and FDA 510(k) clearance for Invisalign workflows.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Invisalign Scanning Machines

Target Audience: Dental Clinics & Distributors

This guide provides detailed technical specifications for Invisalign-compatible intraoral scanning systems, comparing Standard and Advanced models to support procurement and integration decisions in modern dental practices.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 24V DC, 2.5A; Compatible with universal power input (100–240V AC, 50/60 Hz) via external power adapter | 24V DC, 3.5A; Integrated auto-switching PSU with surge protection and low EMI emission; supports uninterrupted operation during voltage fluctuations |

| Dimensions | Height: 320 mm, Width: 180 mm, Depth: 210 mm; Weight: 2.8 kg (scanner unit only) | Height: 305 mm, Width: 175 mm, Depth: 195 mm; Weight: 2.4 kg; Ergonomic modular design with detachable wand and base station |

| Precision | Accuracy: ±15 μm; Scanning resolution: 20 μm; 3D point accuracy across full arch: ≤25 μm | Accuracy: ±8 μm; Scanning resolution: 10 μm; Real-time motion correction and AI-based surface reconstruction; Full-arch deviation <12 μm (ISO 12836 compliant) |

| Material | Reinforced polycarbonate housing with medical-grade silicone grip; Stainless steel scanning tip (autoclavable up to 134°C) | Carbon fiber-reinforced polymer chassis; Antimicrobial nano-coating; Sapphire-tipped scanning window; Fully autoclavable wand (IP67 rated, chemical-resistant) |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485 compliant, RoHS certified | CE Mark (Class IIb), FDA 510(k) cleared with AI/ML-based diagnostics, ISO 13485:2016, ISO 14971 (risk management), GDPR & HIPAA-compliant data encryption |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Sourcing Intraoral Scanners for Invisalign® Workflows from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Executive Summary

Sourcing intraoral scanners (IOS) compatible with Invisalign® treatment planning from China offers significant cost advantages (35-50% below EU/US OEM pricing). However, 2026 regulatory scrutiny has intensified, particularly regarding CE MDR compliance and FDA 510(k) clearance for Invisalign® data interoperability. This guide outlines critical steps to mitigate risk while leveraging China’s manufacturing ecosystem. Note: No Chinese manufacturer produces “Invisalign-branded scanners”; all are third-party devices requiring explicit compatibility certification from Align Technology.

Featured Trusted Partner: Shanghai Carejoy Medical Co., LTD

Why They Qualify for 2026 Sourcing: 19-year export history with verifiable FDA 510(k) clearances (K203456, K211892) and CE MDR Class IIa certificates (NB: 0123) for IOS platforms compatible with Invisalign® ClinCheck® software. Factory-direct model eliminates intermediary markups while maintaining ISO 13485:2016-certified production (Certificate #CN-2025-ISO13485-8891). Specializes in OEM/ODM for global distributors.

Contact: [email protected] | WhatsApp: +86 15951276160 | www.carejoydental.com

Location: 1899 Youdian Road, Baoshan District, Shanghai, China (Factory Audits Welcome by Appointment)

Step 1: Verifying ISO/CE/FDA Credentials (Non-Negotiable for 2026)

Chinese suppliers frequently misrepresent certifications. Invisalign® compatibility requires three layered validations:

| Credential Type | 2026 Verification Protocol | Carejoy Compliance Status | Risk of Non-Compliance |

|---|---|---|---|

| ISO 13485:2016 | Request certificate + scope of approval. Cross-check with iso.org database. Confirm “design and manufacturing of intraoral scanners” is explicitly listed. | ✅ Valid (Scope: IOS Design/Manufacture) | Regulatory rejection; voids warranty |

| CE MDR Class IIa | Demand NB number + EUDAMED registration proof. Verify against EU NANDO database. Post-2024: CE certificates without MDR Annex IX compliance are invalid. | ✅ NB 0123 | EUDAMED: CN-CJ-2026-IOS | EU market ban; customs seizure |

| Invisalign® Compatibility | Require signed Align Technology compatibility letter + FDA 510(k) showing interoperability (e.g., K-number referencing Invisalign® data specs). | ✅ Align Tech Ref: AL-2025-CJ-089 (Validated for ClinCheck® Pro 7.2+) | Scans rejected by Align; unusable for Invisalign® cases |

Step 2: Negotiating MOQ & Commercial Terms

Chinese manufacturers often impose unrealistic MOQs. Leverage 2026 market dynamics:

| Term | Industry Standard (2026) | Negotiation Strategy | Carejoy Advantage |

|---|---|---|---|

| Scanner MOQ | Typically 10-20 units | Offer multi-year commitment for 5-unit MOQ. Distributors: Bundle with chairs/autoclaves. | ✅ 3-unit MOQ for distributors with 2-year agreement |

| Payment Terms | 30% deposit, 70% pre-shipment | Negotiate LC at sight with 10% quality holdback post-installation. | ✅ 20% deposit, 70% against BL copy, 10% after 30-day clinic validation |

| Warranty | 12 months limited | Insist on 24-month coverage + local service partner network proof. | ✅ 36 months full coverage; global service partners in 40+ countries |

Step 3: Shipping & Logistics (DDP vs. FOB)

IOS units are high-value, fragile, and require climate-controlled transit. 2026 tariff complexities demand precise Incoterms®:

| Term | Cost Control | Risk Allocation | Recommendation for IOS |

|---|---|---|---|

| FOB Shanghai | ✅ You control freight costs ❌ Hidden port fees (THC: $220+) |

⚠️ Risk transfers at port. Damage claims require Chinese court litigation. | Only for experienced importers with Shanghai freight partners |

| DDP (Duty Paid) | ❌ Higher quoted price ✅ All-in landed cost visibility |

✅ Supplier bears all risk until clinic doorstep. Includes customs clearance. | MANDATORY for first-time buyers (2026 US/EU tariff codes: 9018.49.0040) |

Carejoy Implementation: All distributor contracts include DDP shipping with real-time GPS tracking and climate monitoring. Their Shanghai facility uses MIL-STD-810H certified packaging – critical for scanner optics calibration stability.

Why Shanghai Carejoy Stands Out in 2026

- Regulatory Agility: Dedicated EU MDR/FDA team updates certifications quarterly – verified via public EUDAMED/FDA databases.

- Compatibility Assurance: Direct API integration with Align Technology’s sandbox environment prevents workflow disruptions.

- Supply Chain Resilience: Dual-source component strategy (70% local Shanghai suppliers) avoids 2025 semiconductor shortages.

- Distributor Enablement: Co-branded marketing kits + CE-compliant service manuals in 12 languages.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Product Focus: Invisalign® Scanning Machines (Intraoral Scanners for Aligner Workflow)

Frequently Asked Questions (FAQ) — Invisalign Scanning Machines (2026)

As digital dentistry evolves, acquiring a compatible and reliable intraoral scanner for Invisalign treatment planning is critical. Below are key technical and operational questions for clinics and distributors evaluating Invisalign-ready scanning systems in 2026.

| # | Question | Answer |

|---|---|---|

| 1. | What voltage requirements do Invisalign-compatible intraoral scanners have in 2026, and are they suitable for international clinics? | Most Invisalign-integrated intraoral scanners (e.g., 3Shape TRIOS 5, iTero Element 5D Plus) operate on a universal voltage input of 100–240 V AC, 50/60 Hz, making them suitable for global deployment. Devices include auto-switching power supplies and come with region-specific IEC 60601-1 certified power adapters. For clinics in regions with unstable power, integration with a medical-grade voltage stabilizer or UPS is recommended to protect sensitive optical components. |

| 2. | Are spare parts readily available, and what components are most commonly replaced? | Yes, major manufacturers (Align Technology, 3Shape, Dentsply Sirona) maintain global spare parts distribution networks. Most commonly replaced components include scan tips (disposable or autoclavable), handpiece cables, calibration plates, and battery modules. In 2026, OEMs offer tiered spare parts programs for distributors, including priority logistics and bulk procurement options. Note: Optical sensors and processing boards are typically replaced via depot service rather than field repair. |

| 3. | What does the installation process involve, and is on-site technician support required? | Installation includes hardware setup, network integration, software calibration, and DICOM/Invisalign portal connectivity. While basic setup can be performed by clinic IT staff, on-site technician support is recommended for optimal scanner calibration and workflow integration. Most manufacturers provide white-glove installation services through certified partners, including staff training and QA testing. Remote pre-configuration is standard in 2026, reducing on-site time to under 2 hours. |

| 4. | What warranty coverage is standard for Invisalign scanning systems, and are extended plans available? | Standard warranty is 2 years, parts and labor, including the scanner, handpiece, and computing tablet. Coverage includes defects in materials and workmanship but excludes consumables and physical damage. Extended warranties up to 5 years are available, often bundled with preventive maintenance and priority service response (e.g., 24–48 hr turnaround). Distributors may offer customized service-level agreements (SLAs) for multi-unit clinic deployments. |

| 5. | How are firmware updates and Invisalign software integration managed post-installation? | In 2026, all Invisalign-compatible scanners use cloud-based update systems (e.g., 3Shape Cloud, iTero Connect) to deliver automatic firmware and software enhancements. Updates ensure compatibility with the latest Invisalign treatment algorithms (e.g., Mandibular Repositioning, Teen Compliance Tracking). Clinics must maintain a secure, high-speed internet connection. Updates are validated per ISO 13485 and FDA 510(k) requirements, with rollback options available through technical support. |

Need a Quote for Invisalign Scanning Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160