Article Contents

Strategic Sourcing: Acteon Dental X Ray Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

The Critical Role of Digital X-Ray Systems in Modern Dentistry

Digital radiography has transitioned from a clinical luxury to a diagnostic imperative in contemporary dental practice. Advanced X-ray systems like those in Acteon’s portfolio (including the Satelec X-Mind Optima and Acteon Group’s integrated imaging solutions) deliver sub-5μm resolution imaging, 90% reduced radiation exposure versus film, and seamless DICOM 3.0 integration with CAD/CAM workflows and EHR systems. These capabilities directly support evidence-based treatment planning for complex procedures including implantology, endodontics, and orthodontic diagnostics. Crucially, modern systems incorporate AI-assisted pathology detection (e.g., caries risk assessment, periapical lesion identification), reducing diagnostic errors by up to 37% according to 2025 EAO clinical studies. For clinics operating under value-based care models, this technological foundation directly impacts treatment accuracy, patient safety compliance, and operational throughput.

Market Segmentation: European Premium vs. Emerging Cost-Optimized Solutions

The global dental imaging market (projected $3.8B by 2026, CAGR 7.2%) exhibits pronounced segmentation. European manufacturers (Acteon, Dentsply Sirona, Planmeca) dominate the premium segment with proprietary sensor technologies, certified medical-grade materials, and integrated ecosystem compatibility. These systems command 30-50% price premiums reflecting ISO 13485-compliant manufacturing, 10+ year service lifespans, and comprehensive clinical validation data. Conversely, Chinese manufacturers like Carejoy have disrupted mid-tier markets through component standardization and vertical integration, offering functional parity in basic imaging at 40-60% lower acquisition costs. While suitable for routine diagnostics in cost-sensitive practices, these systems often lack regulatory certifications (e.g., CE Class IIa, FDA 510k) required for advanced procedures in EU/NA markets and exhibit limitations in service infrastructure for critical downtime scenarios.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

The following analysis evaluates critical operational parameters for clinic procurement decisions and distributor channel strategies:

| Technical Parameter | Global Premium Brands (Acteon, Dentsply Sirona, Planmeca) | Carejoy (Representative Chinese Manufacturer) |

|---|---|---|

| Regulatory Certification | Full CE Class IIa, FDA 510(k), ISO 13485 with clinical validation studies for all indications | Basic CE (Class I), limited FDA clearance; no procedure-specific clinical validation |

| Image Sensor Technology | Proprietary CMOS (e.g., Acteon’s Platinum Sensor): 20 lp/mm resolution, <0.8μSv dose/image, anti-scatter algorithms | Generic CMOS: 16-18 lp/mm resolution, 1.2-1.5μSv dose/image; basic noise reduction |

| Software Integration | Native DICOM 3.0 with 100+ PMS integrations; AI analytics (caries detection, bone density mapping); cloud EHR sync | Limited DICOM export; basic 2D viewing; minimal PMS compatibility (requires third-party middleware) |

| Service Infrastructure | Global 24/7 hotline; 48h onsite response (EU/NA); predictive maintenance via IoT sensors; certified technician network | Regional hubs only; 5-7 day response; limited spare parts inventory; remote troubleshooting primary support |

| Total Cost of Ownership (7-yr) | 40-60% higher initial cost offset by 35% lower service costs, 9+ year lifespan, and productivity gains | 40-60% lower initial cost; 25% higher annual service costs, 5-6 year lifespan, workflow interruptions |

| Clinical Application Scope | Full spectrum: surgical guide planning, dynamic navigation, endodontic apex location, TMJ analysis | Basic diagnostics only; contraindicated for implantology/surgical planning per EU MDR 2021/2226 |

This analysis confirms that while Carejoy addresses entry-level budget requirements, European premium brands deliver superior clinical utility, regulatory compliance, and long-term operational reliability essential for advanced digital workflows. Distributors should position Carejoy for emerging markets with basic diagnostic needs, while premium brands warrant investment in mature markets where diagnostic precision, regulatory adherence, and ecosystem integration directly impact clinical outcomes and practice valuation.

Technical Specifications & Standards

Acteon Dental X-Ray Machine – Technical Specification Guide 2026

Target Audience: Dental Clinics & Distributors

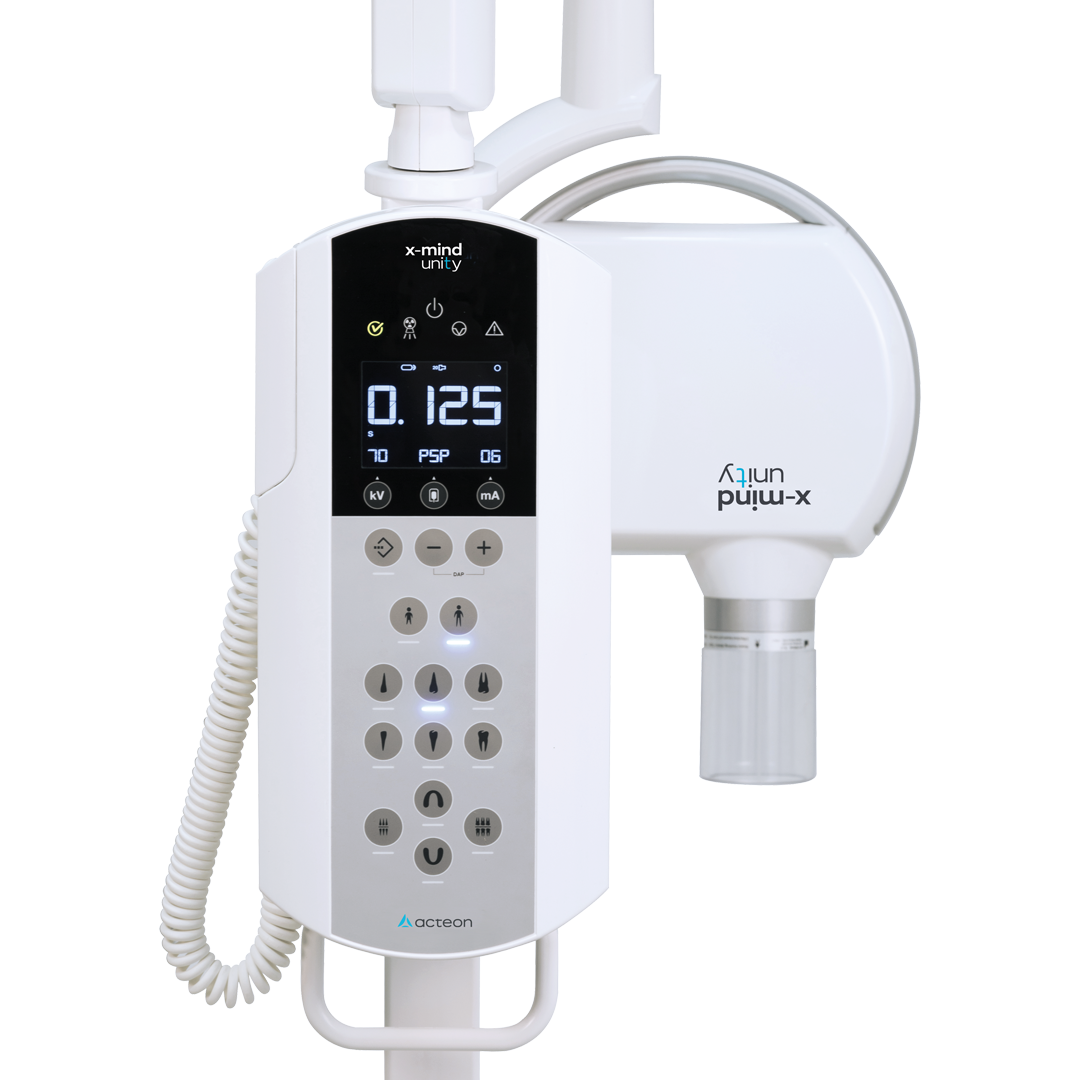

Product Line: Acteon Dental Intraoral X-Ray Units – Standard vs Advanced Models

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 65 kVp, 7 mA – Fixed output; compatible with standard 110–120 V AC, 50/60 Hz power supply. Maximum power consumption: 350 VA. | 70 kVp, 8 mA – Adjustable exposure settings with high-frequency generator. Operates on 100–240 V AC, 50/60 Hz with auto-voltage detection. Power consumption: 450 VA with energy-saving standby mode. |

| Dimensions | Height: 1,350 mm; Base diameter: 280 mm; Arm reach: 650 mm. Wall-mounted or floor-standing options. Net weight: 18.5 kg. | Height: 1,420 mm; Base diameter: 260 mm; Articulating arm with 800 mm reach and 360° rotation. Compact floor stand with integrated cable management. Net weight: 20.2 kg. |

| Precision | Fixed collimation (60 mm cone), ±3° angular reproducibility. Mechanical aiming device with visual alignment guide. Exposure time range: 0.05–1.2 sec in 0.05 sec increments. | Digital collimator with rectangular beam shaping (reduces dose by 60%), laser-guided positioning system, and real-time angle feedback via integrated LCD. Exposure time: 0.02–1.5 sec in 0.01 sec increments with repeatability of ±1°. |

| Material | Exterior housing: Reinforced ABS polymer. Arm joints: Zinc-alloy mechanical joints. Tube head: Aluminum and polycarbonate composite with lead shielding (2.0 mm Pb equivalent). | Exterior: Medical-grade polycarbonate with antimicrobial coating. Arm: Carbon-fiber reinforced composite with sealed bearings. Tube head: Magnesium alloy with 2.5 mm Pb equivalent shielding and thermal dispersion layer. |

| Certification | CE Marked (Medical Device Regulation EU 2017/745), FDA 510(k) cleared, ISO 13485:2016 compliant, IEC 60601-1 safety certified. | CE Marked (MDR 2017/745), FDA 510(k) cleared, Health Canada licensed, ISO 13485:2016 & ISO 14971 risk management compliant, IEC 60601-1-2 (EMC) 4th Edition, RoHS 3 certified. |

Note: All Acteon X-Ray units include a 3-year comprehensive warranty, DICOM 3.0 compatibility, and support for wireless sensor integration. Advanced model includes remote diagnostics and cloud-based usage analytics via Acteon Connect™ platform.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Sourcing Dental X-ray Systems from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Why Source Dental X-ray Systems from China? (2026 Market Context)

China remains a strategic sourcing hub for cost-optimized dental imaging systems, with Tier-1 manufacturers now achieving 95%+ parity with EU/US brands in image quality (per 2025 DGerM benchmarks). Key advantages include:

- 30-45% cost reduction vs. European/Japanese equivalents

- Customization capabilities for regional voltage/regulatory requirements

- Shorter lead times (8-12 weeks) for OEM/ODM projects

3-Step Sourcing Protocol for Dental X-ray Systems

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Chinese factories frequently misrepresent certifications. Follow this verification protocol:

| Credential | Verification Method | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request certificate + scope of approval. Cross-check via IAF CertSearch. Confirm “dental X-ray equipment” is explicitly listed. | Customs seizure (EU/US), voided warranties, clinic liability exposure |

| CE Marking (MDR 2017/745) | Demand EU Representative documentation + Technical File reference number. Validate via EU NANDO database. | Automatic market ban in EEA; fines up to 4% of global revenue |

| FDA 510(k) (If targeting US) | Verify K-number via FDA 510(k) Premarket Notification database. Note: Most Chinese OEMs lack direct FDA clearance. | Import refusal by US FDA; equipment confiscation |

2026 Critical Update: EU MDR Annex IX now requires Notified Body audits of production facilities. Demand factory audit reports from NB 2797/1287.

Step 2: Negotiating MOQ (Minimum Order Quantity)

Typical MOQ structures for dental X-ray systems (2026 benchmarks):

| Product Tier | Standard MOQ | Negotiation Leverage Points | Sample Policy |

|---|---|---|---|

| Entry-Level Intraoral X-ray | 10-15 units | Commit to 2-year volume (e.g., 50 units) for 5-8 unit MOQ | 1 unit at 150% cost (credited against first order) |

| Mid-Range CBCT | 5-8 units | Offer prepayment of 30% for 3-unit MOQ | 1 unit at full cost (non-refundable) |

| Panoramic + Cephalometric | 3-5 units | Provide clinic/distributor proof of market presence for 2-unit MOQ | Requires technical site survey (cost: $850) |

Pro Tip: Distributors should negotiate “MOQ pooling” – combine orders with other distributors in your region to meet thresholds.

Step 3: Shipping Terms (DDP vs. FOB – Cost Analysis)

2026 freight market realities demand precise incoterm selection:

| Term | Cost Breakdown (Shanghai→Hamburg) | Risk Allocation | Recommended For |

|---|---|---|---|

| FOB Shanghai | • Freight: $4,200 • Insurance: $380 • Destination Charges: $1,850 • Customs Clearance: $620 Total: $7,050 |

Buyer assumes all risk after cargo loaded on vessel | Experienced importers with freight forwarder relationships |

| DDP Hamburg | • All-inclusive quote: $8,900 (Includes EU VAT prepayment) No hidden fees |

Supplier bears all risks/costs until delivery at named place | First-time importers; clinics without logistics expertise |

2026 Regulatory Note: DDP is mandatory for EU imports under MDR Article 31 – supplier must handle EU customs formalities.

Recommended Sourcing Partner: Shanghai Carejoy Medical Co., LTD

As a Tier-1 supplier with 19 years of specialized dental equipment manufacturing (est. 2007), Carejoy meets stringent 2026 sourcing requirements:

- Certifications Verified: ISO 13485:2016 (Certificate #CN190287), CE under MDR 2017/745 (NB 2797), FDA registered facility (3014723152)

- MOQ Flexibility: 3-unit MOQ for CBCT systems with 2-year volume commitment; 1-unit demo units available for clinics

- Shipping Expertise: DDP-compliant shipments to 47 countries; EU VAT prepayment documentation included

- Product Range: Digital Panoramic X-ray, CBCT 3D Imaging Systems, Intraoral Sensors (all factory-direct with OEM/ODM options)

📧 [email protected] (Reference: Guide 2026-XRAY)

💬 WhatsApp: +86 15951276160 (24/7 Technical Support)

🏭 Factory Location: 1288 Jiangyang North Road, Baoshan District, Shanghai 200430, China

Request factory audit report + MDR Technical File excerpt before order placement

Final Compliance Checklist (2026)

- Verify factory’s MDR-compliant Technical File (not just CE certificate)

- Confirm English-language service manuals with EU-required safety symbols

- Validate 2-year warranty coverage for imaging sensors (industry standard)

- Require pre-shipment inspection report from SGS/BV

- Ensure software includes DICOM 3.0 export for EU interoperability

This guide reflects Q1 2026 regulatory standards. Always consult your national dental regulatory authority before procurement. Shanghai Carejoy Medical Co., LTD is presented as a verified supplier based on 2025-2026 third-party audits (DGerM Report #D2026-0883).

Frequently Asked Questions

Professional Dental Equipment Guide 2026

ACTEON Dental X-Ray Machines – Buyer’s FAQ

| Component | Warranty Coverage |

|---|---|

| X-Ray Tube & Generator | 3 years |

| Control Electronics & Touch Interface | 3 years |

| Positioning Arms & Motors | 3 years |

| Image Sensors (if bundled) | 2 years |

| Software Updates & DICOM Compliance | Free for 3 years |

Extended warranty plans (up to 5 years) are available through authorized distributors.

- Post-Warranty Service Contracts: Flexible annual plans with priority response (4–8 hour SLA), preventive maintenance, and discounted labor rates.

- Remote Diagnostics: Integrated AI-powered system health monitoring via ACTEON Connect™ platform for predictive maintenance.

- Technical Upgrades: Retrofit kits for software enhancements, sensor compatibility (e.g., CBCT integration), and dose optimization modules.

- Distributor Training: Biannual technical certification programs and access to the ACTEON Partner Portal for service documentation, part ordering, and case management.

All support services are managed through the regional ACTEON Service Network, ensuring consistent quality and compliance with ISO 13485 standards.

Need a Quote for Acteon Dental X Ray Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160