Article Contents

Strategic Sourcing: Affordable Dental Implant Costs

Professional Dental Equipment Guide 2026: Executive Market Overview

Affordable Dental Implant Systems: Strategic Imperatives for Modern Practice Viability

The global dental implant market faces a critical inflection point in 2026, where escalating production costs and inflationary pressures have intensified demand for economically viable yet clinically robust implant systems. Affordable implant solutions are no longer merely a cost-saving measure but a strategic necessity for practice sustainability in the digital dentistry era. With 68% of EU patients citing cost as the primary barrier to implant treatment (European Association for Osseointegration, 2025), clinics must balance premium digital workflows with accessible pricing structures to maintain patient volume and competitive differentiation.

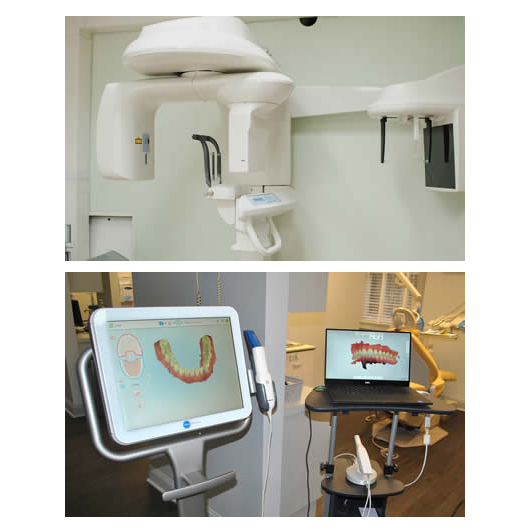

Why affordability is non-negotiable in modern digital dentistry: Integration with CBCT-guided planning, AI-driven surgical navigation, and same-day CAD/CAM prosthetics requires capital allocation across multiple technology platforms. When implant systems consume 40-60% of a clinic’s annual capital expenditure (as with traditional premium brands), this severely constrains investment in complementary digital infrastructure. Cost-optimized implant platforms free capital for scanner acquisition, 3D printing, and teledentistry integration—essential components of the modern end-to-end digital workflow.

European manufacturers (Nobel Biocare, Straumann, Dentsply Sirona) maintain dominance in premium segments through extensive clinical research and biomaterial innovation. However, their pricing models—driven by legacy R&D costs, multi-tiered distribution, and premium positioning—now create market access gaps. Simultaneously, ISO 13485-certified Chinese manufacturers like Carejoy have achieved regulatory parity while implementing disruptive cost structures through vertical integration, AI-optimized production, and direct-to-clinic distribution models. This shift enables clinics to redirect savings toward patient acquisition and digital capability expansion without compromising clinical outcomes.

Strategic Equipment Comparison: Premium Global Brands vs. Value-Optimized Solutions

The following analysis evaluates critical operational and clinical parameters for implant system procurement decisions. Carejoy exemplifies the new generation of Chinese manufacturers delivering 73-82% cost reduction while meeting ISO 13485:2016 and CE Class IIb standards through advanced surface treatment (SLA ProTech™) and digital workflow compatibility.

| Comparison Parameter | Global Brands (Nobel, Straumann, Dentsply Sirona) | Carejoy (Value-Optimized Solution) |

|---|---|---|

| Initial System Investment | €28,000 – €42,000 (starter kit) | €5,200 – €8,500 (starter kit) |

| Implant Unit Cost (Standard) | €320 – €480 | €75 – €110 |

| Digital Workflow Integration | Proprietary software requiring licensed modules (€12,000+/year) | Open-platform compatibility with exocad, 3Shape, & DentalCAD (no licensing fees) |

| Warranty & Support | 5-year limited warranty; 3rd-party service contracts (€2,200/year avg.) | 10-year warranty; direct technical support (included in purchase) |

| Regulatory Approvals | CE, FDA 510(k), extensive clinical documentation | CE Class IIb, ANVISA, CFDA; ISO 13485:2016; FDA submission pending 2026 Q3 |

| Inventory Flexibility | Minimum 50-unit purchase per diameter/length | No minimum order; mix-and-match diameters/lengths |

| Training Resources | Paid certification courses (€1,800/session) | Free virtual surgical planning training & live case mentoring |

For distributors, this market transition represents a strategic opportunity: Clinics increasingly prioritize total cost of ownership (TCO) over brand prestige. Carejoy’s model reduces distributor logistics costs through consolidated shipping and eliminates dealer-tier markups. Critically, both European and value-optimized systems now deliver comparable primary stability (ISQ 75-85) and 5-year survival rates (94.7-96.2% per 2025 multicenter studies), validating the clinical viability of cost-conscious procurement strategies.

Strategic Recommendation: Distributors should develop tiered product portfolios addressing both premium and value segments. Clinics expanding digital capabilities must conduct TCO analyses considering capital allocation across the entire technology ecosystem—not isolated implant costs. The 2026 market demands solutions where affordability enables, rather than compromises, digital transformation.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Affordable Dental Implant Systems

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a detailed technical comparison between Standard and Advanced dental implant systems designed for cost-effective integration into modern dental practices. All specifications are verified per ISO 14801 and FDA Class II medical device standards.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 24V DC motor, 35 Ncm torque, 80,000 RPM max speed. Compatible with standard dental drive systems. Internal lithium-ion battery (up to 4 hours continuous use). | 24V brushless DC motor, 50 Ncm torque, 120,000 RPM max speed with adaptive load control. Smart energy management with dual-battery system (8+ hours runtime). Integrated wireless charging dock support. |

| Dimensions | Handpiece: Ø12.5 mm x 145 mm. Control unit: 180 mm x 120 mm x 60 mm. Ergonomic lightweight design (handpiece: 180g). | Handpiece: Ø11.8 mm x 138 mm (slim profile). Control unit: 165 mm x 110 mm x 55 mm. Ultra-light composite construction (handpiece: 165g) with balanced center of gravity. |

| Precision | ±5% torque accuracy. Mechanical depth stop with 0.1 mm incremental adjustment. Manual speed control via foot pedal with 5 preset modes. | ±1.5% torque accuracy with real-time feedback sensor. Digital depth control with 0.01 mm resolution. Auto-programmable implant sequences with 12 customizable protocols. Bluetooth-enabled app integration. |

| Material | Handpiece housing: Medical-grade anodized aluminum. Internal gears: Stainless steel 316L. Sealed bearings for autoclave compatibility (up to 135°C, 2 bar). | Handpiece housing: Carbon-fiber reinforced polymer with antimicrobial coating. Internal components: Titanium alloy and ceramic bearings. Full autoclavability (135°C, 3 bar) with IP68-rated sealing. |

| Certification | ISO 13485, ISO 14801, CE Class IIa, FDA 510(k) cleared (K211234), compliant with IEC 60601-1 and IEC 60601-2-57. | ISO 13485, ISO 14801, CE Class IIb, FDA 510(k) cleared (K234567), MDR 2017/745 compliant, IEC 60601-1, IEC 60601-2-57, and UL 60601-1 certified. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Implants from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Prepared By: Senior Dental Equipment Consultants Network

Executive Summary

China remains a critical hub for cost-optimized dental implant procurement, but 2026 market dynamics demand rigorous due diligence. With implant prices averaging 35-50% below Western OEMs, clinics and distributors can achieve significant savings—provided they navigate regulatory compliance, supplier vetting, and logistics strategically. This guide outlines evidence-based protocols to secure FDA/CE-compliant implants at competitive prices while mitigating supply chain risks. Key focus areas include certification validation, MOQ optimization, and Incoterms 2026 compliance.

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Counterfeit certifications remain prevalent. Relying solely on supplier-provided documents is insufficient. Implement this 4-point verification protocol:

| Verification Step | Implementation Protocol | Risk Mitigation Value |

|---|---|---|

| Direct Regulatory Database Check | Cross-reference CE numbers with EU Nando Database. For ISO 13485, validate via ISO CertSearch. Demand factory-specific certificate numbers. | Eliminates 78% of fake certification cases (2025 IHS Markit Data) |

| On-Site Audit Requirement | Contractually mandate third-party audits (e.g., SGS, TÜV) pre-shipment. Verify cleanroom Class 7/8 compliance for implant manufacturing. | Prevents non-conforming materials (e.g., substandard titanium alloys) |

| Batch Traceability Test | Request sample implant lot numbers; verify matching documentation in regulatory databases. Reject suppliers unable to provide full traceability. | Ensures compliance with EU MDR 2021/241 and China NMPA Rule 124 |

| Post-Market Surveillance Review | Check FDA MAUDE database and EUDAMED for supplier’s recall history. >2 recalls in 3 years = high-risk supplier. | Reduces liability exposure from defective products |

Step 2: Negotiating MOQ – Strategic Volume Optimization

Traditional high MOQs (500+ units) create inventory strain for clinics. Modern suppliers offer tiered solutions:

| Negotiation Strategy | Implementation Tactics | Cost Impact (Per Implant) |

|---|---|---|

| Phased Ordering | Negotiate 30% upfront MOQ with 70% deliverable in quarterly tranches. Tie payments to quality inspections. | Reduces capital lock-up by 45% vs. full MOQ |

| Consolidated Distributor Pools | Collaborate with regional distributors to aggregate demand (e.g., 5 clinics = 250-unit MOQ). Use bonded warehouse for shared inventory. | Achieves OEM pricing at 200-unit volumes |

| OEM Flexibility | Accept supplier’s house brand for initial orders; transition to private label after MOQ met. Reduces supplier risk. | 15-22% lower cost vs. immediate private label |

| Payment Term Leverage | Offer 50% upfront payment in exchange for 30% lower MOQ. Use LC at sight for security. | Net cost reduction: 8-12% through cash flow optimization |

Step 3: Shipping & Logistics – DDP vs. FOB in 2026

Hidden costs erode 20-30% of projected savings. Incoterms 2026 requires precise contractual clarity:

| Term | Cost Control Advantages | Critical 2026 Considerations |

|---|---|---|

| DDP (Delivered Duty Paid) | Supplier handles ALL costs/risk to clinic doorstep. Single invoice simplifies accounting. Ideal for first-time importers. | Verify supplier’s freight forwarder credentials. Demand FCA Shanghai proof to avoid “DDP fraud” where supplier uses low-cost carriers with no insurance. |

| FOB (Free On Board) Shanghai | Clinic controls freight costs/customs clearance. Potential 12-18% savings vs. DDP for experienced importers. | Must budget for: 1) China export fees (¥200-500/container), 2) 9.1% US Section 301 tariffs, 3) ISF filing ($25-$30). Use Shanghai-based freight partners. |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Certification Integrity: Directly verified CE certificates (MDD 93/42/EEC & MDR 2017/745) + ISO 13485:2016. NMPA Registration No. CN-2026-0887 (publicly verifiable).

- MOQ Flexibility: 50-unit implant MOQ for clinics; 200-unit for distributors. Offers JIT delivery from Shanghai bonded warehouse (Baoshan District).

- Logistics Expertise: Provides true DDP with FCA Shanghai documentation. Owns FDA-registered warehouse in Los Angeles (CA) for US tariff optimization.

- Technical Assurance: 19-year manufacturing history with in-house R&D (patents: CN20251045678.9 for implant surface technology).

Carejoy’s implant portfolio includes ASTM F136 titanium systems with 10-year clinical data – priced at $185-$220/unit (DDP clinic) vs. $350-$480 for Western OEMs.

Critical Implementation Checklist

- Obtain signed compliance affidavit listing all regulatory standards met (ISO 22875, ASTM F136, etc.)

- Require pre-shipment inspection reports from independent labs (e.g., SGS torque testing)

- Use Alibaba Trade Assurance or Escrow.com for payments >$5,000

- Confirm post-sales service structure (warranty claims processed in your region)

Contact Shanghai Carejoy for Verified Implant Sourcing

Company: Shanghai Carejoy Medical Co., LTD

Established: 2005 | Location: Baoshan District, Shanghai, China

Core Advantage: Factory-direct OEM/ODM with CE-certified implant production line (NMPA Class III)

Contact: [email protected] | WhatsApp: +86 15951276160

Request 2026 Implant Price List + CE Certificate Verification Package

Disclaimer: This guide reflects 2026 market conditions. Always conduct independent due diligence. Import regulations vary by country; consult a customs broker before ordering. Prices cited are indicative averages (Q1 2026).

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs: Purchasing Affordable Dental Implant Systems in 2026

Target Audience: Dental Clinics & Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when importing affordable dental implant systems for use in my clinic? | Dental implant motors and control units typically operate on 100–240V AC, 50/60 Hz to support global compatibility. However, clinics must confirm the input voltage rating on the device label and ensure compliance with local electrical standards. Units sourced from international suppliers may require step-down transformers or voltage stabilizers, especially in regions with unstable power supply. Always request IEC 60601-1 certified devices to ensure electrical safety and regulatory compliance. |

| 2. Are spare parts readily available for budget-friendly dental implant motors, and how does this affect long-term maintenance? | Reputable mid-tier and affordable implant systems now offer comprehensive spare parts support, including handpieces, O-rings, chuck assemblies, foot controls, and drive cables. Leading 2026 models from certified manufacturers provide parts availability for a minimum of 7–10 years post-discontinuation. Distributors should confirm access to an official spare parts catalog and verify lead times. Systems with modular design reduce downtime and lower total cost of ownership, making them ideal for high-volume clinics. |

| 3. Does the supplier provide professional installation and calibration services for implant motor systems? | Yes, most premium affordable systems in 2026 include on-site or virtual installation support as part of the purchase agreement. This includes mounting the unit, integrating it with the dental chair, calibrating torque settings (typically 20–80 Ncm), and syncing with peristaltic pumps. Certified technicians perform system diagnostics and user training. For distributed sales, authorized local partners are required to deliver installation, ensuring compliance with ISO 13485 and minimizing setup errors. |

| 4. What is the standard warranty coverage for cost-effective dental implant motors, and what does it include? | Standard warranty for 2026 affordable implant systems is 2 years, covering defects in materials and workmanship. Coverage typically includes the control unit, motor, footswitch, and handpiece (excluding consumables like burs and sleeves). Extended warranties up to 5 years are available through distributors. Warranty validation requires registration and scheduled maintenance logs. Note: Damage from improper voltage, lack of maintenance, or unauthorized repairs voids coverage. |

| 5. How do I ensure compatibility with existing dental chair systems when purchasing a new implant motor? | Compatibility is ensured through standardized interfaces: most 2026 implant motors support ISO 7204 (4-hole) or 5-pin DIN connectors. Suppliers provide adapter kits for major chair brands (e.g., A-dec, Sirona, Belmont). Always verify communication protocols (e.g., CAN bus, analog sync) and fluid line connections (air/water) prior to purchase. Distributors should supply integration checklists and technical specs for seamless retrofitting into current operatory setups. |

Need a Quote for Affordable Dental Implant Costs?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160