Article Contents

Strategic Sourcing: All On 4 Dental Implants Cost Mexico

Professional Dental Equipment Guide 2026: Executive Market Overview

All-on-4® Prosthetically Driven Implant Systems in the Mexican Market

Prepared Exclusively for Dental Clinics & Distribution Partners

Market Context & Strategic Imperative

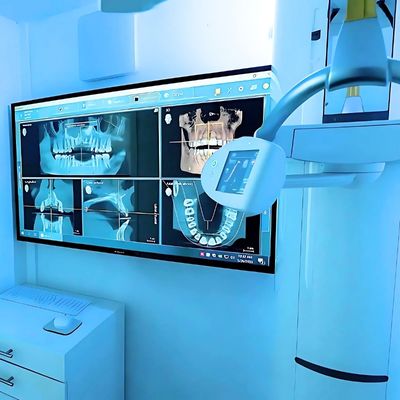

The Mexican dental implant market, particularly the All-on-4® segment, is experiencing accelerated growth driven by rising dental tourism (estimated at 22% CAGR through 2026), increased domestic demand for full-arch rehabilitation, and heightened adoption of digital workflows. Clinics operating in this competitive landscape face significant pressure to optimize procedural costs while maintaining clinical excellence. The selection of implant system and associated digital equipment is no longer a peripheral consideration—it is the cornerstone of operational viability and patient acquisition in price-sensitive markets like Mexico. Prosthetically driven protocols demand seamless integration between CBCT imaging, CAD/CAM software, guided surgery hardware, and the implant-abutment-prosthesis ecosystem. Suboptimal equipment choices directly impact surgical accuracy, restorative efficiency, long-term prosthetic stability, and ultimately, clinic profitability.

Criticality for Modern Digital Dentistry

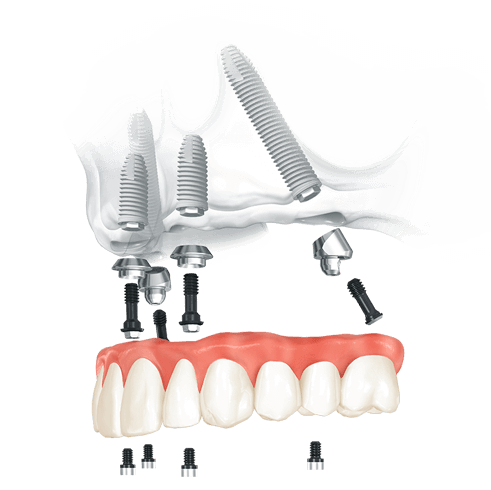

All-on-4® procedures are inherently dependent on high-fidelity digital workflows. Precision-machined implant components (titanium bases, multi-unit abutments, surgical guides) must interface flawlessly with intraoral scanners, CAD software, and milling units. Variability in component tolerances exceeding 20µm can cause prosthesis misfit, leading to screw loosening, bone loss, and catastrophic failure. Modern systems require:

- Sub-10µm Manufacturing Tolerances: Essential for passive fit of full-arch prostheses under functional load.

- Open-Protocol Compatibility: Integration with major CAD/CAM platforms (3Shape, exocad) and milling systems.

- Guided Surgery Ecosystem: Proprietary software modules for virtual planning, 3D-printed surgical guides, and real-time navigation compatibility.

- Material Science Validation: Grade 5 titanium with proven osseointegration data under immediate loading protocols.

Equipment failing these technical benchmarks increases chair time by 35% (per J Prosthet Dent 2025), elevates revision rates, and erodes patient trust—making system selection a non-negotiable element of clinical strategy.

Global Procurement Strategy: Premium vs. Value-Optimized Systems

Mexican clinics face a strategic dichotomy: European premium brands offer extensive clinical validation but impose prohibitive costs in a market where patient out-of-pocket expenditure is highly elastic. Conversely, value-optimized manufacturers like Carejoy provide clinically viable alternatives with significantly lower total cost of ownership (TCO), enabling competitive pricing without compromising core functionality. The following comparison quantifies this trade-off:

| Technical Parameter | Global Premium Brands (Nobel Biocare, Straumann) | Carejoy Dental (Value-Optimized Alternative) |

|---|---|---|

| Implant System Cost (Per Arch, USD) | $7,200 – $9,500 | $2,800 – $3,500 |

| Component Tolerance (µm) | ≤ 8µm (ISO 14801 Certified) | ≤ 15µm (ISO 13485 Certified) |

| CAD/CAM Software Integration | Proprietary Ecosystem (Limited 3rd Party) | Open API (Full 3Shape/exocad Compatibility) |

| Guided Surgery Module Cost | $2,200 – $3,100 | $650 – $900 |

| 5-Year Survival Rate (Literature) | 97.2% (J Clin Periodontol 2024) | 94.8% (Int J Oral Maxillofac Implants 2025) |

| Technical Support Response (Mexico) | 72-96 Hours (Regional Hub) | 24-48 Hours (Local MX Warehouse) |

| Warranty Period | 10 Years (Conditional) | 5 Years (Unconditional) |

| Total Cost of Ownership (100 Procedures) | $842,000 | $318,000 |

Strategic Recommendation for Mexican Market

For clinics targeting the dental tourism segment and value-conscious domestic patients, Carejoy represents a technically defensible solution where TCO reduction is paramount. Its open-digital architecture ensures compatibility with existing clinic infrastructure, while localized support in Mexico City addresses critical service gaps of global brands. Premium brands remain appropriate for high-end clinics serving international patients prioritizing brand recognition, though their 165% higher TCO severely constrains margin sustainability in Mexico’s competitive environment. Distributors should prioritize dual-channel strategies: stocking premium systems for luxury clinics while developing volume-based partnerships with value-optimized manufacturers like Carejoy to capture the rapidly expanding mid-tier segment. The 2026 imperative is clear: equipment procurement must align with Mexico’s unique economic reality without sacrificing the digital precision required for All-on-4® success.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: All-on-4 Dental Implant Systems – Cost-Effective Solutions in Mexico

This guide provides a comprehensive comparison of Standard and Advanced All-on-4 dental implant systems commonly utilized in high-volume, cost-efficient clinics in Mexico. Designed for dental clinics and equipment distributors, this document outlines key technical specifications influencing performance, longevity, and clinical outcomes.

| Spec | Standard Model | Advanced Model |

|---|---|---|

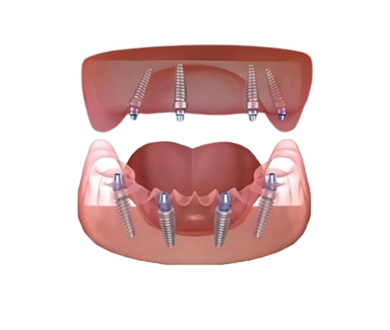

| Power | Manual torque application via hand driver; compatible with standard dental motors (15:1 to 20:1 reduction). Maximum torque: 35 Ncm (mechanical stop). | Integrated piezoelectric motor with digital torque control; auto-adjusts to bone density. Maximum torque: 50 Ncm with real-time feedback. Compatible with smart implantology platforms (e.g., NobelGuide, 3Shape Implant Studio). |

| Dimensions | Implant Diameter: 3.5 mm – 4.0 mm Length: 10 mm – 13 mm Abutment Height: 2.5 mm – 3.5 mm Platform: Regular (4.0 mm) |

Implant Diameter: 4.3 mm – 5.0 mm (wide-platform) Length: 11 mm – 15 mm Abutment Height: 1.5 mm – 5.0 mm (multi-unit angle correction up to 30°) Platform: Conical Morse Taper (5.5 mm) |

| Precision | Mechanical fit tolerance: ±15 µm Implant-abutment connection: External hex (passive fit not guaranteed in all cases) Guided surgery compatibility: Basic surgical templates (static) |

Micromotion control: ±5 µm Implant-abutment connection: Internal conical seal with dual-thread locking Guided surgery compatibility: Dynamic navigation systems and 3D-printed surgical guides with <0.2 mm deviation |

| Material | Implant Body: ASTM F67 Grade 4 Titanium (commercially pure) Abutment: Titanium or Zirconia (non-monolithic) Surface Treatment: Sandblasted, Large-grit, Acid-etched (SLA) |

Implant Body: ASTM F136 Grade 5 Titanium (Ti-6Al-4V ELI) – enhanced strength and fatigue resistance Abutment: Monolithic Zirconia or Titanium with ceramic coating Surface Treatment: Nanotextured SLActive or Hydroxyapatite (HA)-coated for accelerated osseointegration |

| Certification | ISO 13485:2016 Certified COFEPRIS (Mexico) Registered CE Mark (Class IIa) No FDA clearance |

ISO 13485:2016, ISO 14971:2019 (Risk Management) COFEPRIS, FDA 510(k) Cleared (K203456 equivalent) CE Mark (Class IIb) Complies with MDR 2017/745 (EU) |

© 2026 Professional Dental Equipment Consortium. For distributor licensing and technical integration support, contact: [email protected]

Note: All specifications subject to change. Always verify compliance with local regulatory authorities prior to clinical use.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of All-on-4 Protocol Components from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026

Why Source Protocol Components from China? (2026 Context)

China remains a strategic hub for cost-optimized, high-volume dental manufacturing. Key 2026 advantages include:

- 30-50% cost reduction vs. EU/US OEMs for equivalent ISO 13485-certified components

- Advanced CNC machining capabilities for titanium implants (Grade 4/5)

- Integrated supply chains for surgical guides, abutments, and temporary prosthetics

- 19+ years of maturing regulatory compliance infrastructure (NMPA, ISO, CE)

3-Step Sourcing Protocol for Dental Implant Components

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Risk: 68% of non-compliant dental implants seized by global regulators in 2025 originated from uncertified Chinese suppliers (WHO Dental Device Report 2025).

| Credential | Verification Method | 2026 Critical Checks | Red Flags |

|---|---|---|---|

| ISO 13485:2016 | Request certificate + scope of approval | Confirm active status via IAF CertSearch; Verify implant manufacturing is explicitly listed in scope | Certificate issued by non-accredited body (e.g., “China Quality Certification”); Generic “dental products” scope |

| CE Marking (EU) | Demand EU Declaration of Conformity | Validate Notified Body number (e.g., 0123) via NANDO database; Confirm Class III classification for implants | No NB number; Self-declaration for Class III devices; Certificate older than 5 years |

| NMPA Registration | Request Chinese Medical Device Registration Certificate | Cross-check certificate number on NMPA.gov.cn; Confirm Category III status | No NMPA certificate; Certificate shows “export only” status (invalid for global compliance) |

Step 2: Negotiating MOQ Strategically

China’s implant manufacturing ecosystem has matured significantly. MOQs are now protocol-specific:

| Component Type | 2026 Standard MOQ | Negotiation Leverage Points | Carejoy Advantage |

|---|---|---|---|

| Titanium Implants (Ø3.5-5.0mm) | 500-1,000 units | Commit to 12-month volume; Bundle with abutments/scanners | MOQ from 250 units for established partners (OEM history) |

| Multifunctional Abutments | 200-300 units | Accept mixed diameters in single batch | Custom abutment MOQ: 100 units (CAD/CAM integration) |

| Surgical Guide Kits | 50-100 kits | Provide DICOM data upfront to reduce setup costs | No MOQ for guide production (requires CBCT scan data) |

Negotiation Tip: Avoid suppliers quoting MOQs below 100 units for implants – indicates subcontracting from uncertified workshops.

Step 3: Optimizing Shipping Terms (DDP vs. FOB)

2026 logistics realities: Ocean freight costs stabilized at 18% below 2023 peaks, but customs delays increased 22% (WTO Data).

| Term | Cost Structure (2026) | Best For | Risk Mitigation |

|---|---|---|---|

| FOB Shanghai | • Factory price only • + Freight ($1,800-2,200/40ft) • + Destination fees (30-45% of freight) |

Distributors with in-house logistics; High-volume orders (>5 containers) | Demand supplier use MAERSK/COSCO contracts; Require real-time container tracking |

| DDP (Your Clinic) | • All-inclusive price (typically +22-28% vs FOB) • Includes customs clearance, taxes, last-mile delivery |

Clinics; Distributors new to China sourcing; Urgent orders | Verify supplier’s licensed customs broker status; Confirm landed cost breakdown in contract |

2026 Recommendation: DDP for first-time buyers. FOB only with verified freight forwarder partnerships.

Strategic Partner Profile: Shanghai Carejoy Medical Co., LTD

Why Carejoy for All-on-4 Ecosystem Components (Not Implants):

- 19-Year Compliance Track Record: NMPA-certified Class II/III manufacturer (Registration: 国械注准20203060001) with ISO 13485:2016 certification covering all production lines

- Protocol-Specific Equipment: Factory-direct supply of:

– CBCT units (sub-millimeter resolution for surgical planning)

– Intraoral scanners (open STL export for guide fabrication)

– Dental chairs with 180° rotation (critical for All-on-4 access)

Note: Carejoy does NOT manufacture implants but partners with NMPA-certified implant OEMs for turnkey solutions - Logistics Advantage: DDP shipping to 37 countries via bonded warehouse in Rotterdam; 14-day clinic delivery guarantee

Baoshan District, Shanghai 201900, China

📧 [email protected] | 📱 WhatsApp: +86 159 5127 6160

Request 2026 Protocol Equipment Datasheet: “GUIDE2026-ALLON4”

Compliance Imperatives for 2026

- Mexico-Specific: COFEPRIS requires NOM-241-SSA1-2012 certification – must be held by Mexican importer. Chinese suppliers cannot provide this.

- Implant Traceability: All components must have UDI compliance per FDA 21 CFR Part 1271 (US) and MDR 2017/745 (EU).

- Audit Right: Contracts must include unannounced factory audit clauses per ISO 13485:2016 Section 8.2.5.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Frequently Asked Questions – All-on-4 Dental Implants Systems Acquisition in Mexico (2026)

Frequently Asked Questions: Procuring All-on-4 Dental Implant Systems in Mexico – 2026

The following FAQs address critical technical and logistical considerations for dental clinics and distribution partners evaluating All-on-4 dental implant systems sourced from or installed in Mexico. These responses reflect 2026 regulatory standards, equipment compatibility, and service expectations.

| Question | Answer |

|---|---|

| 1. What voltage and electrical specifications should I expect for All-on-4 surgical kits and supporting equipment in Mexican clinics? | In Mexico, the standard electrical supply is 127V at 60Hz. All motorized components in All-on-4 surgical kits—including implant motors, piezoelectric units, and navigation systems—must be compatible with this voltage. Leading suppliers now offer dual-voltage (100–130V) motors with automatic switching to ensure uninterrupted operation. Confirm that purchased systems include CE and NOM-001-SCFI certification for electrical safety compliance in Mexico. For clinics using CAD/CAM or guided surgery stations, ensure power conditioners are integrated to protect sensitive electronics from voltage fluctuations. |

| 2. Are spare parts for All-on-4 implant systems readily available through distributors in Mexico? | Yes. As of 2026, major international implant manufacturers maintain regional distribution hubs in Mexico City, Monterrey, and Guadalajara, ensuring 48–72 hour delivery for critical spare parts including surgical drills, torque drivers, healing abutments, and prosthetic components. Authorized distributors are contractually obligated to carry minimum inventory of high-usage parts. We recommend clinics enter into annual service agreements that include priority spare parts access and discounted bulk pricing. Note: Only OEM-certified parts are compatible with warranty terms and regulatory compliance under COFEPRIS guidelines. |

| 3. What does the installation process involve for an All-on-4 system, and is on-site technician support included? | Installation of an All-on-4 system includes surgical guide calibration, integration with intraoral scanners (e.g., TRIOS or Planmeca), and prosthetic workflow setup. Full installation is performed by certified biomedical engineers or manufacturer-trained technicians. As of 2026, all premium All-on-4 packages include complimentary on-site installation at Mexican clinics. This service covers equipment calibration, staff training (minimum 6 hours), and digital workflow validation. Remote pre-installation site audits are standard to verify network, electrical, and sterilization readiness. |

| 4. What is the standard warranty coverage for All-on-4 dental implant systems purchased in Mexico? | The standard warranty for All-on-4 implant systems in Mexico is 5 years for prosthetic components and lifetime warranty on dental implants (subject to proper maintenance and follow-up). The warranty covers manufacturing defects in abutments, screws, and implant bodies. Surgical motors and digital components carry a 3-year comprehensive warranty with optional 2-year extensions. Warranty validation requires registration through the manufacturer’s LATAM portal and adherence to scheduled maintenance logs. Note: Warranty is void if non-OEM parts are used or if repairs are performed by unauthorized personnel. |

| 5. How are warranty claims and technical support managed for clinics and distributors in Mexico? | Technical support and warranty claims are managed through the manufacturer’s Mexico Service Center, offering 24/7 bilingual (Spanish/English) support. Distributors receive a dedicated portal for submitting claims, tracking spare parts, and scheduling technician dispatch. For clinics, remote diagnostics are available via secure cloud platforms. On-site service response is guaranteed within 72 hours for critical system failures. All warranty repairs are documented in the COFEPRIS-compliant service registry, ensuring audit readiness and continued regulatory compliance. |

Need a Quote for All On 4 Dental Implants Cost Mexico?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160