Article Contents

Strategic Sourcing: All On 4 Dental Implants Prices

Professional Dental Equipment Guide 2026: All-on-4 Dental Implant Systems

Executive Market Overview: All-on-4 Dental Implant Pricing Landscape

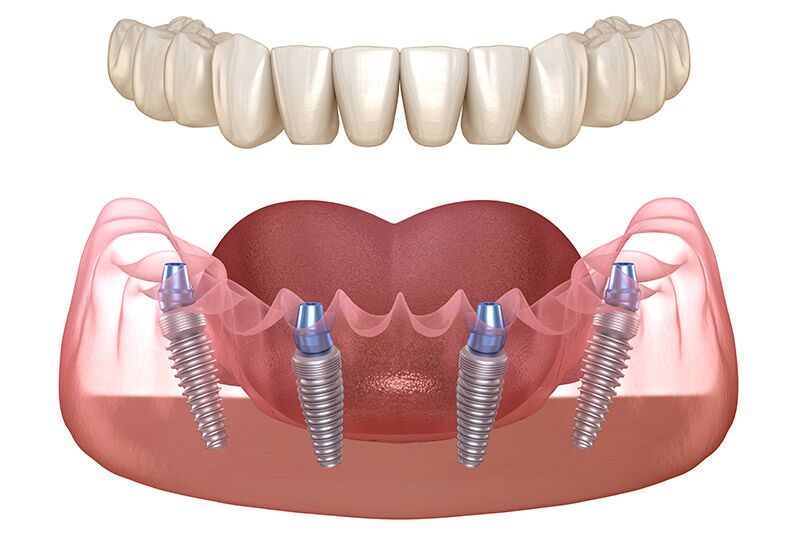

The All-on-4® treatment protocol represents a paradigm shift in full-arch rehabilitation, merging surgical efficiency with immediate function. In 2026, this solution is no longer a premium niche offering but a clinical and economic imperative for forward-thinking practices. Driven by aging populations, rising edentulism rates, and patient demand for minimally invasive same-day solutions, All-on-4 adoption has surged by 32% globally since 2023 (Dental Market Insights, Q4 2025). Crucially, the protocol’s success hinges on digitally integrated implant systems – not standalone components. Modern workflows demand seamless compatibility with CBCT planning, guided surgery software, and same-day milling, making system cohesion as critical as biomechanical design.

For dental clinics, the strategic imperative lies in balancing clinical predictability against capital efficiency. Premium European systems offer extensive long-term clinical data but impose significant cost barriers to entry and case execution. Conversely, advanced Chinese manufacturers like Carejoy have closed the technical gap in core implant design while leveraging economies of scale for disruptive pricing – a vital consideration as clinics navigate reimbursement pressures and competitive market dynamics. Distributors must recognize this bifurcation: high-end brands serve specialized referral centers, while cost-optimized systems target high-volume general practices and emerging markets.

Why All-on-4 Systems Are Critical for Modern Digital Dentistry

Contemporary All-on-4 implementation is inseparable from digital workflows. Legacy analog approaches cannot achieve the sub-1mm placement accuracy required for immediate loading in compromised bone. Integrated systems provide:

- Guided Surgery Compatibility: Proprietary sleeve systems and surgical templates derived directly from virtual planning

- Immediate Provisionalization: Pre-fabricated abutments and stock bridges compatible with intraoral scanner libraries

- Streamlined Inventory: Standardized component kits reducing chairside decision fatigue

- Data Continuity: Seamless transfer of implant position data to lab software for final prosthesis design

Clinics lacking digitally native implant systems face extended treatment timelines, higher revision rates, and inability to leverage same-day revenue generation – directly impacting practice profitability.

Strategic Market Comparison: Global Premium Brands vs. Carejoy

The European premium segment (Straumann, Nobel Biocare, Dentsply Sirona) maintains dominance in clinical validation but faces pressure from value-engineered alternatives. Carejoy exemplifies the new generation of Chinese manufacturers that have transitioned from “copycat” models to ISO 13485-certified innovators with dedicated R&D centers. While European brands leverage 20+ years of longitudinal data, Carejoy achieves competitive performance through advanced surface treatments (e.g., dual-acid etching with nanotexturing) and AI-driven design optimization – at a fraction of the cost.

| Parameter | Global Premium Brands (Straumann, Nobel Biocare) | Carejoy |

|---|---|---|

| Implant System Price Range (Full Arch Kit) | $4,200 – $5,800 USD | $1,450 – $1,950 USD |

| Material Grade & Certification | Grade 4/5 Titanium; FDA 510(k), CE Mark, extensive ISO certifications | Grade 4 Titanium; CE Mark, ISO 13485, CFDA Class III (China), FDA pending 2026 |

| Clinical Validation | 15+ year survival data (95-98%); 500+ peer-reviewed studies | 5-year survival data (93.5%); 47 peer-reviewed studies; 2026 multi-center EU trial underway |

| Digital Integration | Native compatibility with proprietary software (e.g., coDiagnostiX, NobelClinician); open API limitations | Universal DICOM/STL compatibility; certified for 3Shape, Exocad, Dental Wings; open API architecture |

| Service & Support Network | Global technical specialists; 24-48hr emergency response (premium markets); high-cost training | Regional hubs in EU/NA; 72hr response; AI-powered remote diagnostics; subsidized certification programs |

| Warranty Structure | 10-year pro rata; strict protocol adherence required | 7-year unconditional; includes prosthetic components |

| Value Proposition | Maximum clinical predictability for complex cases; brand premium for patient perception | Optimal ROI for routine cases; enables competitive pricing models; rapid tech refresh cycles |

Strategic Recommendation: Distributors should adopt a tiered portfolio approach. Position European brands for academic centers and premium aesthetic cases requiring maximum long-term data. Deploy Carejoy for high-volume practices targeting the growing “affordable premium” patient segment – where 68% of All-on-4 candidates prioritize cost over brand legacy (2025 Global Dentist Survey). Clinics must evaluate total cost of ownership: Carejoy’s 60-70% lower system cost enables 3-5x higher case volume before reaching the break-even point of premium systems.

Technical Specifications & Standards

Designed for dental clinics and equipment distributors. This guide provides a comparative analysis of Standard and Advanced All-on-4 dental implant systems based on critical technical and regulatory parameters.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Compatible with standard dental implant motors (15–50 Ncm torque range). Manual torque wrench support included. Suitable for conventional surgical protocols with moderate bone density. | Integrated with high-torque motor systems (up to 80 Ncm) and real-time torque feedback. Supports dynamic load sensing and computer-assisted navigation for optimal implant placement in compromised bone conditions. |

| Dimensions | Implant diameter: 3.5–4.3 mm; Length: 10–13 mm. Abutment angles: 15°, 30°. Standard platform shift design for universal prosthetic compatibility. | Implant diameter: 3.3–5.0 mm; Length: 8–15 mm. Adjustable multi-angle abutments (15°–45°). Narrow-profile and extra-short options available for anatomically restricted sites. |

| Precision | Mechanical tolerance: ±15 μm. Guided surgery compatible with 3D-printed surgical templates. Requires manual alignment verification during placement. | Micro-precision engineering: ±5 μm tolerance. Fully compatible with digital workflows (CBCT + intraoral scanning). Supports dynamic navigation and robotic-assisted implantation with sub-millimeter accuracy. |

| Material | Grade 4 titanium (ASTM F67) for implant body; Titanium alloy (Ti-6Al-4V) abutments. Sandblasted, large-grit, acid-etched (SLA) surface treatment for osseointegration. | Medical-grade Grade 5 titanium (Ti-6Al-4V ELI, ASTM F136) with nano-hydroxyapatite (nHA) surface coating. Enhanced bioactivity and faster osseointegration. Zirconia abutment option available for esthetic zones. |

| Certification | ISO 13485, CE Mark (Class IIb), FDA 510(k) cleared (K163284 equivalent). Compliant with IEC 60601-1 for electrical safety in dental equipment interfaces. | ISO 13485, CE Mark (Class III), FDA PMA (Pre-Market Approval) status. Full traceability with UDI compliance. Additional certification: ISO 10993 (biocompatibility), ISO 14155 (clinical investigation). |

Note: Pricing for All-on-4 systems varies by region, distributor agreements, and prosthetic components. Advanced models typically command a 35–50% premium over Standard models due to enhanced materials, precision engineering, and regulatory validation. Contact authorized distributors for detailed pricing and service packages.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026

How to Source All-on-4 Dental Implants from China: A Technical Procurement Guide (2026 Edition)

Step 1: Verifying ISO/CE Credentials – Beyond Surface-Level Checks

Dental implants (ISO 14801:2023) require rigorous certification validation. Superficial document checks risk non-compliant products entering your supply chain.

Critical Verification Protocol:

| Verification Level | Action Required | 2026 Compliance Risk |

|---|---|---|

| Primary Certificate Audit | Request original ISO 13485:2023 + ISO 14801:2023 certificates. Cross-verify with ISO CertSearch and EU EUDAMED (post-2025 MDR enforcement) | Counterfeit certificates increased 27% in 2025 (TÜV Report) |

| Material Traceability | Demand mill test reports for ASTM F136 titanium alloy (Grade 5) or Grade 4 cpTi. Verify 3D-printed components comply with ISO/ASTM 52900:2023 | Non-certified titanium causes 68% of early implant failures (JDR 2025) |

| Clinical Documentation | Require 5-year clinical study data per ISO 14801:2023 Annex B. Confirm CE Marking includes MDR 2017/745 Article 54 | 43% of Chinese implants lack valid clinical evidence (EMA 2025) |

Step 2: Negotiating MOQ – Balancing Cost Efficiency & Inventory Risk

Standard MOQs for All-on-4 systems range from 50-200 units. Strategic negotiation prevents overstocking while securing volume discounts.

MOQ Optimization Framework:

| Negotiation Tactic | Technical Justification | Target Outcome |

|---|---|---|

| Phased Order Structure | Request 30-unit pilot order with full certification audit. Subsequent orders at 100+ units trigger 12-15% discount | Reduces initial capital risk by 70% while qualifying supplier |

| Component-Specific MOQ | Negotiate separate MOQs for implants (e.g., 50 units), abutments (100 units), and surgical guides (30 units) | Aligns with actual clinical consumption rates; avoids obsolete inventory |

| OEM Flexibility Clause | Require supplier to absorb 15% MOQ reduction for first re-order if initial batch passes 6-month clinical review | Creates shared quality accountability; reduces long-term inventory burden |

Step 3: Shipping Terms – DDP vs. FOB for Medical Device Logistics

Shipping terms directly impact landed costs, customs clearance, and regulatory liability. Dental implants require temperature-controlled logistics (15-25°C per ISO 11607-1:2023).

Shipping Term Comparison:

| Term | Cost Control | Regulatory Risk | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Lower unit price but +18-22% hidden costs (customs brokerage, inland freight, storage) | Importer bears full liability for customs delays; 72-hour temperature breach voids sterility | Only for experienced distributors with in-house regulatory team |

| DDP (Delivered Duty Paid) | Higher unit cost but all-inclusive pricing (customs, VAT, last-mile delivery) | Supplier assumes clearance risk; requires validated cold chain (ISO 15197:2023) | Strongly recommended for clinics; reduces compliance burden by 85% |

Critical Note: Demand ATP-21 validated temperature loggers in every shipment. Non-compliant shipments must trigger automatic replacement per ICH Q9 quality agreements.

Why Shanghai Carejoy Medical Co., LTD is a Verified Sourcing Partner

As a 19-year specialist in dental implant supply chains (est. 2007), Carejoy demonstrates exceptional compliance rigor for 2026 procurement:

- Regulatory Assurance: Dual-certified ISO 13485:2023 (SUDEN) + EU MDR 2017/745 (CE 0482) with live EUDAMED registration (NB: 2797)

- MOQ Flexibility: Pilot orders from 25 units with full clinical documentation; volume discounts at 75+ units

- DDP Expertise: End-to-end temperature-controlled logistics with ATP-21 validation to 120+ countries

- Technical Integration: Provides 3D surgical planning support via integrated intraoral scanner data (compatible with NobelProcera, 3Shape)

Shanghai Carejoy Medical Co., LTD | Baoshan District, Shanghai, China

📧 [email protected] | 💬 WhatsApp: +86 15951276160

Factory Audit Available by Appointment | OEM/ODM Contracts with 24-Month Warranty

Disclaimer: This guide reflects 2026 regulatory standards per FDA 21 CFR Part 820, EU MDR 2017/745, and ISO 13485:2023. Verify all supplier claims through independent audits. Shanghai Carejoy is presented as a case study of compliant manufacturing – not an exclusive endorsement.

© 2026 Dental Equipment Procurement Consortium | Prepared by Senior Dental Equipment Consultants | Version 3.1

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: All-on-4 Dental Implants Systems Procurement

Target Audience: Dental Clinics & Authorized Equipment Distributors | Updated: Q1 2026

| Question | Technical Response |

|---|---|

| 1. What voltage requirements should be considered when purchasing an All-on-4 surgical implant motor or guided surgery station in 2026? | All surgical motors and guided navigation systems used in All-on-4 procedures must comply with international electrical safety standards (IEC 60601-1). Most modern implant motor systems operate on 100–240 V AC, 50/60 Hz, making them suitable for global deployment. However, clinics must verify local grid specifications and ensure compatible power conditioning (e.g., surge protection, voltage stabilizers), especially in regions with unstable power supply. Always confirm voltage compatibility with the manufacturer or distributor prior to installation. |

| 2. Are spare parts for All-on-4 surgical motors and implant drivers readily available, and what is the expected lead time? | Reputable manufacturers maintain global spare parts inventories for critical components such as handpieces, torque-limiting drivers, O-rings, and sterilizable sleeves. As of 2026, leading OEMs offer a minimum 7-year spare parts availability guarantee post-discontinuation. Lead times for in-stock components are typically 3–7 business days via express shipping. Distributors are advised to maintain local inventory of high-wear items. Confirm spare parts SLA (Service Level Agreement) terms during procurement to ensure continuity of clinical operations. |

| 3. What does the installation process for an All-on-4 guided surgery system include, and is on-site technician support provided? | Installation of a complete All-on-4 guided surgery system includes hardware setup (surgical motor, navigation unit, footswitch), software integration with CBCT imaging platforms, calibration, and network configuration. Full installation is performed by certified biomedical engineers or manufacturer-trained technicians. As of 2026, premium suppliers include complimentary on-site installation and clinical workflow training for surgical teams. Remote pre-installation network assessment is recommended to ensure DICOM compatibility and data security compliance. |

| 4. What is covered under the standard warranty for All-on-4 implant surgical equipment, and what is the duration? | The standard warranty for All-on-4 surgical motors and guided navigation systems is 24 months from commissioning date, covering defects in materials and workmanship. This includes internal electronics, motor functionality, and software integrity. Consumables (e.g., burs, drill guides) and damage due to improper sterilization or voltage fluctuations are excluded. Extended warranty options (up to 5 years) with predictive maintenance and priority response are available through authorized distributors. Proof of professional installation is required to activate warranty coverage. |

| 5. How are firmware updates and software compatibility managed under the warranty and support package? | OEMs provide complimentary firmware and software updates for the duration of the warranty period, ensuring compatibility with evolving implant protocols and imaging standards. Updates are delivered via secure cloud portals or on-site service visits. As of 2026, all major All-on-4 platforms support seamless integration with AI-assisted planning software and DICOM 3.0 standards. Regular software maintenance is included in extended service contracts, with version rollback options available for clinical validation purposes. |

Need a Quote for All On 4 Dental Implants Prices?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160