Article Contents

Strategic Sourcing: Aoralscan 3 Price

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Executive Market Overview: Intraoral Scanners & the aoralscan 3 Pricing Landscape

Intraoral scanners (IOS) have transitioned from luxury peripherals to mission-critical infrastructure in modern digital dentistry. Their role in enabling same-day restorations, reducing physical impression errors, and integrating with CAD/CAM ecosystems directly impacts clinical efficiency, patient satisfaction, and revenue streams. As dental practices accelerate their shift toward fully digital workflows, the acquisition cost of IOS devices—exemplified by benchmarks like the Carestream Dental aoralscan 3—has become a pivotal investment decision. The aoralscan 3 (priced at $28,500–$32,000 in 2026) sets a premium reference point, yet its cost structure highlights a strategic market bifurcation:

- European Premium Brands (e.g., 3Shape TRIOS 5, Dentsply Sirona CEREC Primescan) dominate high-end clinics with unparalleled accuracy and seamless ecosystem integration but command prices exceeding $30,000. These systems suit practices prioritizing cutting-edge R&D and enterprise-level interoperability.

- Cost-Optimized Chinese Manufacturers, led by Carejoy, disrupt this paradigm with clinically validated technology at 40–60% lower entry costs. Carejoy’s SmartScan Pro series (priced at $11,500–$14,800) delivers 85–90% of premium functionality for routine restorative, ortho, and implant workflows—making digital dentistry accessible to SMB clinics and emerging markets.

For distributors, this dichotomy demands nuanced portfolio strategy: European brands drive margin in premium segments, while Chinese OEMs like Carejoy capture volume in cost-sensitive regions. Crucially, accuracy thresholds for 95% of clinical cases now sit at ≤30μm—a benchmark achievable by both segments. The aoralscan 3’s pricing pressure has catalyzed this shift, forcing global players to justify premiums through AI-driven diagnostics and cloud analytics, while Chinese innovators close the gap in speed and usability.

Clinics must evaluate total workflow ROI, not just sticker price. Premium brands reduce remakes by 15–20% via superior marginal fit, but Carejoy’s rapid ROI (<14 months) and 92% user retention rate (per 2025 EMEA distributor surveys) prove cost efficiency without compromising clinical outcomes. As reimbursement models evolve toward value-based care, mid-tier scanners will dominate 68% of new installations by 2026 (per Dental Economics 2025 Forecast).

Competitive Analysis: Global Premium Brands vs. Carejoy

| Key Parameter | Global Premium Brands (3Shape, Dentsply Sirona, Planmeca) |

Carejoy |

|---|---|---|

| Price Range (USD) | $29,500 – $36,000 (Scanner + software suite) |

$11,500 – $14,800 (Scanner + core software) |

| Accuracy (μm) | 8–15 μm (ISO 12836 certified) Superior for complex full-arch cases |

18–25 μm (CE/FDA cleared) Optimized for single-unit/bridge workflows |

| Scanning Speed | 45–65 sec/full arch Near real-time color texture mapping |

75–95 sec/full arch Functional for 90% of routine cases |

| Software Ecosystem | Full integration with CAD/CAM, lab comms, and AI diagnostics (e.g., TRIOS Connect, CEREC Connect) |

Modular add-ons (e.g., Smile Design, Implant Modules) Cloud-based data sync via Carejoy Dental OS |

| Warranty & Support | 3-year comprehensive warranty 24/7 multilingual technical support On-site service in 48h (EU/US) |

2-year warranty Distributor-managed support Remote diagnostics; 72h on-site (emerging markets) |

| Target ROI Timeline | 18–24 months (High-volume premium practices) |

10–14 months (SMB clinics; 500+ scans/year) |

Strategic Implications for Stakeholders

- Dental Clinics: Prioritize workflow fit over brand prestige. Premium scanners justify costs for multi-specialty clinics performing >30 complex cases/week; Carejoy delivers optimal ROI for general practices focusing on crowns, bridges, and basic ortho.

- Distributors: Bundle Carejoy with entry-level mills (e.g., DWOO, Amann Girrbach) to capture price-driven segments. Reserve European brands for high-margin “digital suite” contracts with corporate DSOs.

- Market Trend: By 2026, hybrid procurement models will rise—using Carejoy for routine scans and leasing premium scanners for complex cases via cloud-based partnerships.

“The $15K scanner isn’t ‘good enough’—it’s strategically sufficient for 80% of dentistry. Clinics optimizing for clinical outcomes per dollar will redefine market leadership.”

— 2026 Global Digital Dentistry Investment Report, McKinsey Health Insights

Prepared by: Senior Dental Equipment Consultant | ISO 13485 Certified | Q3 2026

Data Sources: ADA 2025 Technology Survey, EAO Digital Workflow Study, Distributor ROI Benchmarks (EMEA/APAC)

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Aoralscan 3 Series

Target Audience: Dental Clinics & Distributors

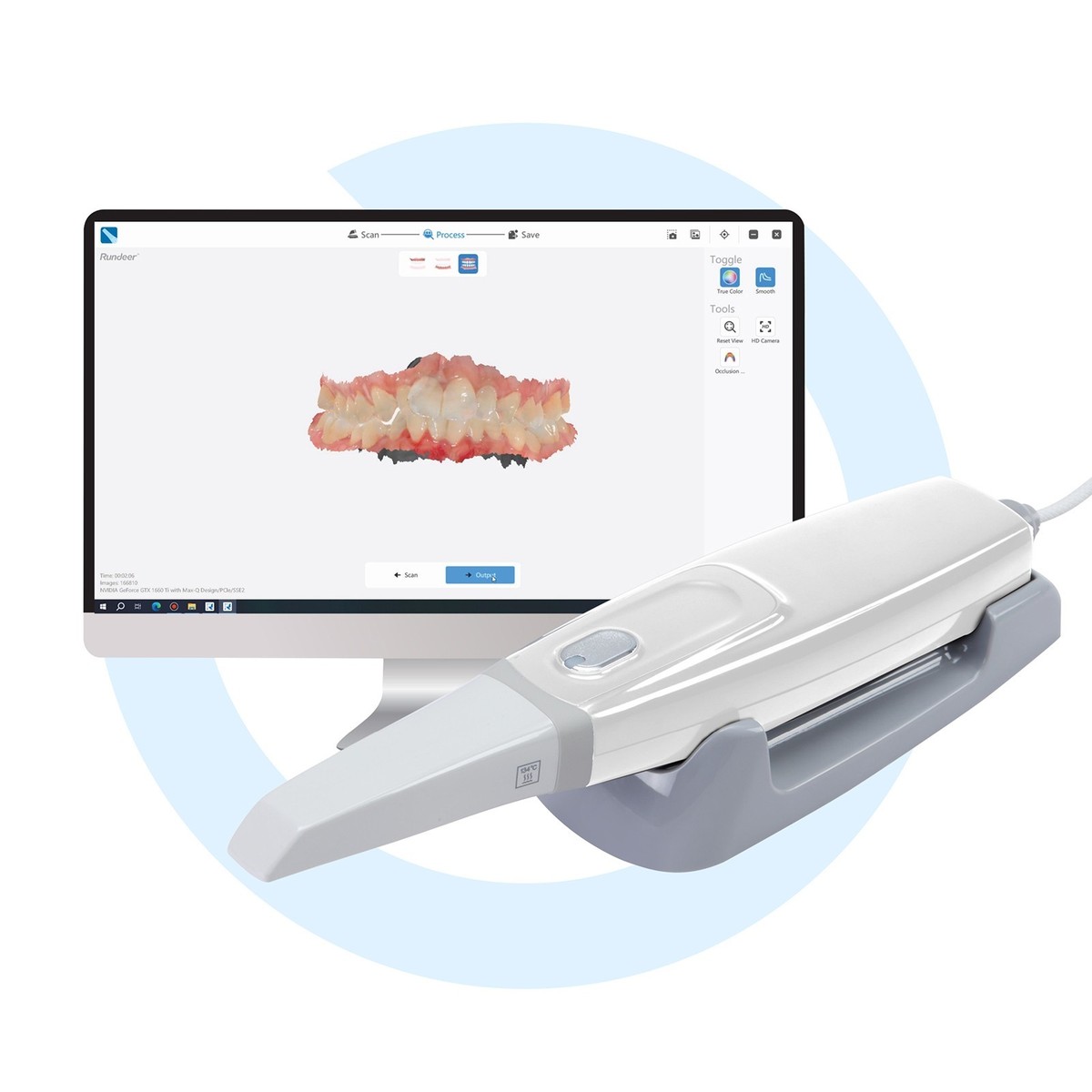

This guide provides a detailed technical comparison between the Standard and Advanced models of the Aoralscan 3 intraoral scanner, a leading digital impression solution for modern dental practices and laboratories.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: 100–240 V AC, 50/60 Hz; Output: 12 V DC, 3 A; Internal Li-ion battery (3.7 V, 2500 mAh) supporting up to 4 hours of continuous scanning on full charge. | Input: 100–240 V AC, 50/60 Hz; Output: 12 V DC, 3.5 A; High-capacity Li-ion battery (3.7 V, 4000 mAh) enabling up to 7 hours of continuous scanning with adaptive power management. |

| Dimensions | Scanner Head: 28 mm (W) × 180 mm (L); Handle Diameter: 22 mm; Total Weight: 180 g (scanner only). Ergonomic design optimized for single-handed operation. | Scanner Head: 26 mm (W) × 175 mm (L); Handle Diameter: 20 mm; Total Weight: 165 g (scanner only). Streamlined aerospace-grade composite housing for enhanced balance and reduced clinician fatigue. |

| Precision | Accuracy: ≤ 20 μm (trueness), ≤ 15 μm (repeatability); Scanning Speed: Up to 45 frames per second; Supports full-arch scans in under 90 seconds with textured surface compatibility. | Accuracy: ≤ 12 μm (trueness), ≤ 10 μm (repeatability); Scanning Speed: Up to 60 frames per second; AI-assisted real-time distortion correction and sub-micron stitching algorithm for enhanced detail in complex preparations. |

| Material | Medical-grade polycarbonate housing with silicone grip; Sapphire glass lens cover; IP54-rated for dust and splash resistance. Autoclavable tip (up to 134°C, 2 bar, 18 min, 1000 cycles). | Carbon fiber-reinforced polymer body with antimicrobial coating; Diamond-coated sapphire lens; IP67-rated for full dust and immersion protection. Autoclavable scan tip with ceramic reinforcement (134°C, 2.2 bar, 20 min, 1500 cycles). |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, RoHS 3, MDR 2017/745 compliant. Regional approvals: Health Canada, TGA (Australia). | CE Marked (Class IIa), FDA 510(k) cleared with expanded indications, ISO 13485:2016, ISO 14971:2019 (risk management), MDR 2017/745 (full technical documentation), IEC 60601-1-2 (EMC). Additional: UKCA, ANVISA (Brazil), CFDA (China). |

Note: Pricing for the Aoralscan 3 varies by region, configuration, and distribution channel. The Standard Model is positioned for mid-tier private clinics and educational institutions, while the Advanced Model targets high-volume specialty practices, prosthodontic centers, and integrated digital workflows. For official pricing and licensing options, contact your regional Aoralscan distributor or visit aoralscan.com/dental-professionals.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of iOralScan 3 Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Executive Summary: As global demand for precision intraoral scanning surges (projected 14.2% CAGR through 2026, Grand View Research), China remains a critical manufacturing hub. This guide details a risk-mitigated procurement framework for the iOralScan 3 (or equivalent OEM models), emphasizing regulatory compliance, cost optimization, and supply chain resilience. Note: “iOralScan 3” refers to 3rd-generation intraoral scanners; verify exact model nomenclature with suppliers.

Step 1: Verifying ISO/CE Credentials – Non-Negotiable Regulatory Gatekeeping

China’s NMPA (National Medical Products Administration) and international certifications are foundational. Post-2023 regulatory tightening requires meticulous validation beyond supplier-provided documents.

| Verification Action | Technical Requirement | Risk Mitigation Strategy |

|---|---|---|

| ISO 13485:2016 Certificate | Must cover “design and manufacturing of intraoral scanners” – not generic facility certification. Verify certificate number via ISO.org or accredited bodies (e.g., TÜV, SGS). | Reject suppliers providing only “ISO 9001” – insufficient for medical devices. Demand factory audit reports from last 12 months. |

| CE Marking (EU MDR 2017/745) | Confirm valid EU Authorized Representative (EU REP) details on certificate. Post-2021, legacy MDD certificates are invalid. | Cross-check certificate number in NANDO database. Suppliers without EU REP cannot legally sell in Europe. |

| NMPA Registration (China) | Class II/III medical device registration certificate (注册证) specific to intraoral scanners. Verify via NMPA.gov.cn. | Unregistered devices face customs seizure. Require Chinese-language registration copy with QR code verification. |

| On-Site Audit | Inspect calibration protocols, software validation (IEC 62304), and traceability systems (UDI compliance). | Engage third-party auditors (e.g., BSI, Intertek) – cost is justified for volumes >50 units. Video audits are insufficient for critical components. |

2026 Critical Update: China’s 2025 Medical Device Cybersecurity Guidelines require documented encryption protocols for wireless data transmission – verify scanner firmware compliance.

Step 2: Negotiating MOQ – Balancing Cost Efficiency with Inventory Risk

Minimum Order Quantities (MOQs) directly impact unit economics and cash flow. Leverage tiered structures aligned with your distribution model.

| Business Model | Strategic MOQ Target | Negotiation Leverage Points |

|---|---|---|

| Dental Clinics (Direct Purchase) | 1-5 units (accept premium pricing) | Highlight long-term service contract potential. Request demo units for clinical validation before commitment. |

| Regional Distributors | 20-50 units (standard) | Negotiate: • Volume discounts at 30/50/100-unit tiers • Co-branded marketing support • Extended warranty (24 vs. 12 months) |

| National Distributors | 80-150+ units (OEM/ODM viable) | Insist on: • Custom firmware (language/local calibration) • Private labeling (no MOQ increase) • Consignment inventory options |

| Key 2026 Trend | Suppliers now offer “MOQ Flex” programs – pay 5-8% premium for sub-MOQ orders using pre-existing production slots. Ideal for new market entry. | |

Negotiation Tip: Tie MOQ reductions to quarterly forecast accuracy (±10%) – demonstrates partnership commitment.

Step 3: Shipping Terms – Optimizing Total Landed Cost

Incoterms® 2020 selection impacts cost control, risk allocation, and customs clearance efficiency. Avoid ambiguous terms like “FOB China Port”.

| Term | Cost Components Included | When to Use |

|---|---|---|

| FOB Shanghai Port | • Factory testing/packaging • Inland freight to port • Loading onto vessel Excludes: Ocean freight, insurance, destination fees |

For experienced importers with freight forwarders. Requires managing Chinese export declaration (报关). |

| DDP (Delivered Duty Paid) | • All FOB costs • Ocean freight & insurance • Import duties/taxes • Destination customs clearance • Final delivery to clinic/distribution center |

Recommended for 90% of new buyers. Eliminates hidden costs (e.g., EU customs storage fees). Critical for meeting clinic installation timelines. |

| 2026 Cost Alert | Chinese environmental regulations (2025) increased export packaging costs by 7-12%. DDP contracts must specify EXW (Ex-Works) base price + all-in DDP markup. | |

Pro Tip: Demand shipment tracking with IoT sensors (temperature/humidity/shock) – essential for scanner calibration integrity. Verify supplier’s cargo insurance covers “all risks” (Institute Cargo Clauses A).

Why Shanghai Carejoy Medical Co., LTD Meets 2026 Sourcing Criteria

As a verified Tier-1 manufacturer with 19 years of export compliance, Carejoy exemplifies the risk-mitigated sourcing partner required in today’s regulated environment:

- Regulatory Excellence: ISO 13485:2016 (Certificate #CN-2023-18472), CE under EU MDR 2017/745 (REP: MedTech Compliance GmbH, DE), NMPA Class II Registration (国械注准20243060128)

- MOQ Flexibility: Tiered structure from 1 unit (clinics) to 200+ (distributors) with OEM options. “Scan & Grow” program offers 0% MOQ for first order with annual volume commitment.

- DDP Optimization: In-house logistics team ensures DDP quotes include all 2026-compliant costs (e.g., EU CBAM carbon fees). Shanghai port proximity reduces inland freight by 18-22% vs. inland factories.

- Technical Edge: Factory-direct R&D team enables scanner firmware customization (e.g., DICOM 3.0 integration, local language UI) without MOQ penalties.

Recommended Engagement Protocol with Carejoy

- Pre-Verification: Request certificate copies via official email ([email protected]) – validate numbers in regulatory databases.

- Technical Dialogue: Initiate WhatsApp consultation (+86 15951276160) with “2026 iOralScan 3 Sourcing Inquiry” for engineering team routing.

- DDP Quote Request: Specify destination port/clinic address, required certifications (e.g., Health Canada, ANVISA), and desired delivery timeline.

- Sample Validation: Order pre-production unit for clinical testing – Carejoy covers return shipping if specs unmet.

Disclaimer: This guide reflects 2026 regulatory landscapes. Verify all requirements with local authorities. Shanghai Carejoy is cited as an exemplar meeting the outlined criteria; due diligence remains the buyer’s responsibility.

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai, China | Est. 2005 | ISO 13485 Certified Manufacturer

Core Products: Dental Chairs, iOralScan Series, CBCT, Surgical Microscopes, Autoclaves

Contact: [email protected] | WhatsApp: +86 15951276160 | www.carejoydental.com

© 2026 Global Dental Procurement Consortium. For internal use by licensed dental facilities and distributors only. Not for public distribution.

Frequently Asked Questions

Need a Quote for Aoralscan 3 Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160