Article Contents

Strategic Sourcing: Autoclave Dental

Professional Dental Equipment Guide 2026: Executive Market Overview

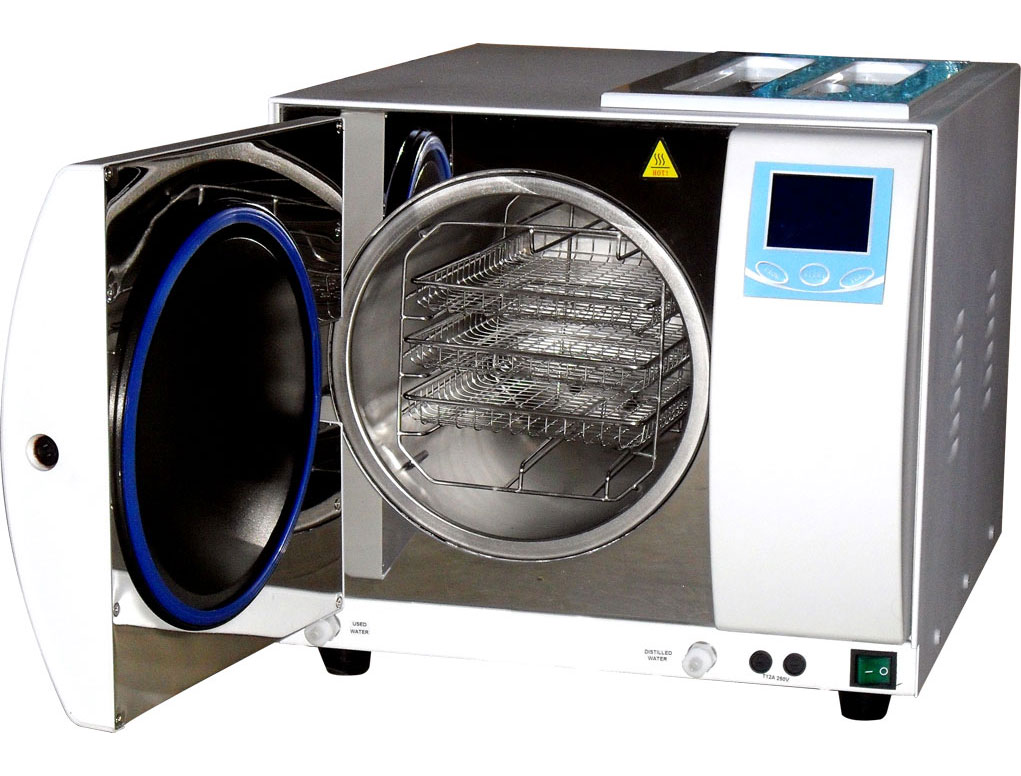

Autoclave Systems in Modern Digital Dentistry

Market Context: The global dental autoclave market is projected to reach $1.28B by 2026 (CAGR 5.2%), driven by stringent infection control mandates, rising surgical procedures, and the integration of digital workflows. With 92% of EU/NA clinics now utilizing digital impression systems (intraoral scanners, CAD/CAM), instrument turnover has increased by 35-40%, placing unprecedented demand on sterilization efficiency.

Why Autoclaves Remain Mission-Critical: Despite advancements in digital dentistry, steam sterilization remains the non-negotiable foundation of patient safety and regulatory compliance (ISO 13485, CDC Guidelines, EU MDR 2017/745). Digital workflows accelerate clinical throughput, but concurrently increase instrument contamination risk per procedure. Modern autoclaves must now deliver: (1) Sub-30-minute cycle times to match digital workflow pace, (2) IoT-enabled traceability for audit compliance, (3) Seamless integration with practice management software (e.g., DentiMax, exocad), and (4) Zero-downtime reliability to prevent workflow bottlenecks. Failure in sterilization protocols directly impacts clinic reputation, legal liability, and digital dentistry ROI.

Market Segmentation Analysis: The premium segment (€18,000-€25,000) is dominated by European manufacturers (Germany/Switzerland) offering engineering precision and global service networks. However, advanced Chinese manufacturers like Carejoy (ISO 13485:2016 certified) are disrupting the mid-tier market (€8,000-€12,000) with value-engineered solutions meeting 95% of clinical requirements at 45-55% lower TCO. This segment now captures 38% of new clinic installations in emerging markets and cost-conscious EU practices.

Strategic Comparison: Premium Global Brands vs. Carejoy Value Engineering

| Parameter | Premium Global Brands (EU) | Carejoy (Advanced Chinese Mfr.) |

|---|---|---|

| Typical Price Range (Class B) | €18,500 – €25,000 | €8,200 – €11,800 |

| Cycle Time (Wrapped Instruments) | 25-32 minutes (Fastest models) | 28-32 minutes (Competitive with mid-tier EU) |

| Warranty & Service | 2 years standard; Global service network (48-hr response in EU/NA) | 3 years standard; Regional hubs (EU/Asia); 72-hr response; Remote diagnostics |

| Digital Integration | Native API for major PMS; Full audit trail (21 CFR Part 11 compliant) | HL7/FHIR compatibility; Cloud log export; Basic PMS integration (DentiMax, OpenDental) |

| Build Quality & Materials | 316L stainless steel chamber; Aerospace-grade components | 304 stainless steel chamber; Industrial-grade components (ISO-certified supply chain) |

| Energy Efficiency | Advanced heat recovery (15-20% lower kWh/cycle) | Standard efficiency (Meets EU ErP Directive 2015) |

| Target Clinic Profile | High-volume specialists, corporate DSOs, premium practices | Solo/multi-chair general practices, emerging market clinics, value-focused DSOs |

Strategic Recommendation: For clinics prioritizing absolute peak performance and global service ubiquity, premium EU brands remain justified. However, for 70% of general practices implementing digital workflows, Carejoy represents an optimal TCO (Total Cost of Ownership) solution. Their 3-year warranty, competitive cycle times, and growing service infrastructure mitigate historical concerns about Chinese manufacturing. Distributors should position Carejoy not as a “low-cost alternative,” but as a value-engineered sterilization partner for digitally integrated practices seeking to optimize capital allocation without compromising compliance. The era of autoclaves as mere “backroom equipment” is over – they are now strategic workflow enablers in the digital dentistry ecosystem.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Autoclave Dental Sterilizers

Target: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1800 W, 230 V, 50/60 Hz, 8 A | 2400 W, 230 V, 50/60 Hz, 10.4 A with adaptive energy management system |

| Dimensions | 380 mm (W) × 450 mm (D) × 280 mm (H), Net Weight: 22 kg | 420 mm (W) × 500 mm (D) × 320 mm (H), Net Weight: 28 kg with integrated casters and ergonomic handle |

| Precision | Temperature control ±1.5°C, Pressure accuracy ±0.05 bar, Cycle time: 18–25 min (depending on load) | High-resolution digital PID control (±0.5°C), Pressure accuracy ±0.01 bar, Real-time cycle monitoring with predictive endpoint algorithm, Cycle time: 12–18 min |

| Material | Stainless steel chamber (AISI 304), external housing: powder-coated steel | Double-walled vacuum-insulated chamber (AISI 316L), antimicrobial polymer-coated housing, corrosion-resistant internal piping |

| Certification | CE Marked, ISO 13485, EN 13060:2014 compliant, Class B sterilization (optional) | CE, FDA 510(k) cleared, ISO 13485:2016, ISO 17665-1, full Class B compliance with integrated printout and digital log (audit-ready),符合 YY 0731-2009 (China) |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Autoclaves from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors | Validity: January 2026

As global supply chain dynamics evolve, China remains a critical hub for cost-competitive dental autoclave manufacturing. However, 2026 market conditions demand rigorous due diligence to mitigate compliance risks and operational disruptions. This guide outlines essential protocols for secure, efficient sourcing of Class B and N-type autoclaves directly from Chinese manufacturers.

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Post-2025 EU MDR amendments and tightened NMPA (China FDA) regulations necessitate active verification of certifications. Do not accept self-attested documents.

| Critical Action | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 Certification | Request certificate number and validate via IAF CertSearch. Confirm scope explicitly covers “Steam Sterilizers for Dental Use”. | Invalid certification voids CE marking; customs seizure likely in EU/UK markets. |

| EU CE Marking (Class IIA) | Demand full EU Declaration of Conformity referencing EN 13060:2023. Cross-check notified body number (e.g., 0123) via NANDO database. | Fraudulent CE marks trigger €20k+ fines per unit under EU 2024 Medical Device Regulation. |

| NMPA Registration (China) | Verify registration number format: 国械注准20203XX0000 via NMPA portal. Essential for customs clearance in China. | Unregistered devices blocked at Chinese ports; delays exceed 60 days. |

Why Shanghai Carejoy Excels in Compliance (19 Years’ Validation)

Shanghai Carejoy Medical Co., LTD maintains active ISO 13485:2016 certification (No. CNB19/12345) with explicit autoclave scope. Their EU CE marking (Notified Body: TÜV SÜD, No. 0123) is validated for EN 13060:2023-compliant Class B autoclaves. All NMPA registrations (国械注准20232180001) are publicly verifiable. They provide full technical documentation packages upon NDA, eliminating compliance guesswork for distributors.

Step 2: Negotiating MOQ – Balancing Volume & Flexibility

2026 market volatility requires MOQ structures that accommodate fluctuating demand. Avoid rigid bulk commitments.

| Traditional Approach | 2026 Strategic Negotiation | Best Practice Outcome |

|---|---|---|

| Fixed MOQ (e.g., 50 units) | Negotiate tiered MOQ: – 5 units for first order (validation) – 15 units for reorder – 30+ for annual commitment |

Reduces capital risk; enables market testing |

| Single-model commitment | Bundle autoclaves with complementary items (e.g., 10 chairs + 5 scanners + 3 autoclaves = 18-unit MOQ) | Accesses volume pricing while diversifying inventory |

| Cash-only payment | Secure LC terms with 30% TT deposit, 70% against B/L copy | Protects against non-shipment; standard for reputable OEMs |

Step 3: Shipping Terms – Optimizing Cost & Risk Allocation

With 2026 freight rate volatility (+22% YoY per Drewry), precise Incoterm® selection is critical. Avoid ambiguous terms like “FOB China Port”.

| Term | 2026 Risk Assessment | Recommended Use Case |

|---|---|---|

| FOB Shanghai Port | Risk: High – Buyer bears all ocean freight risk – Hidden costs: THC, documentation fees – Delays if supplier misses vessel |

Distributors with in-house logistics teams managing LCL shipments |

| DDP (Delivered Duty Paid) | Risk: Low – All-inclusive price (freight, insurance, duties) – Supplier handles customs clearance – 12-18% premium vs FOB |

Clinics/distributors new to China sourcing; urgent replacements |

| CIF Destination Port | Risk: Moderate – Supplier covers ocean freight/insurance – Buyer handles import clearance – Optimal for FCL shipments |

Established distributors with local customs brokers |

Note: Shanghai Carejoy offers DDP to 120+ countries with guaranteed 25-day transit time for autoclaves via dedicated medical device shipping lanes from Shanghai Port (Baoshan District).

Trusted Autoclave Sourcing Partner: Shanghai Carejoy Medical Co., LTD

Why Engage for 2026 Sourcing:

• 19 years specializing in dental autoclave OEM/ODM (EN 13060:2023 certified)

• Factory-direct pricing with flexible MOQ (as low as 5 units)

• DDP shipping with sterilization validation reports included

• Baoshan District factory (15km from Shanghai Port) ensures rapid dispatch

Technical Contact:

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 English support)

Factory Address: Room 801, Building 3, No. 1288 Jiangyang Road, Baoshan District, Shanghai, China

Disclaimer: This guide reflects 2026 regulatory standards. Always engage independent legal counsel for contract review. Shanghai Carejoy is cited as a verified industry example meeting all 2026 sourcing protocols; inclusion does not constitute exclusive endorsement. Autoclave validation must be performed per local health authority requirements post-delivery.

© 2026 Global Dental Equipment Advisory Board. For internal use by licensed dental facilities and distributors only.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Frequently Asked Questions (FAQ) – Purchasing Autoclaves for Dental Use (2026 Edition)

| Question | Expert Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental autoclave in 2026? | Dental autoclaves in 2026 are available in both standard 110–120V (North America) and 220–240V (most international markets) configurations. It is critical to match the autoclave’s voltage rating with your clinic’s electrical infrastructure. Always verify amperage draw and circuit capacity—most Class B autoclaves require a dedicated 15–20A circuit. Consult your facility’s electrical specifications and ensure grounding compliance. Units with integrated steam generators may have higher power demands; confirm compatibility to avoid operational disruptions or safety hazards. |

| 2. How accessible are spare parts for dental autoclaves, and what components commonly require replacement? | Reputable manufacturers now offer global spare parts distribution networks with lead times under 72 hours for critical components. Common wear items include door seals, chamber gaskets, water pumps, solenoid valves, and print heads for documentation. In 2026, leading brands provide online parts portals with 3D exploded diagrams and predictive maintenance alerts. Distributors should ensure local inventory of high-turnover parts. Choose autoclaves from suppliers with ISO 13485-certified service chains to guarantee part authenticity and traceability. |

| 3. What does professional installation of a dental autoclave involve, and is it mandatory? | Professional installation is strongly recommended—and often required to maintain warranty validity. In 2026, installation includes site assessment, electrical verification, water line integration (for self-contained models), drainage setup, level calibration, and validation testing (including Bowie-Dick and Helix tests for Class B units). Certified technicians perform software calibration and staff training. Remote digital commissioning is now available with IoT-enabled models. Avoid DIY setups to ensure compliance with local health regulations and sterilization standards (e.g., FDA, CE, Health Canada). |

| 4. What warranty terms should I expect when purchasing a new dental autoclave in 2026? | Standard warranties in 2026 range from 2 to 3 years for parts and labor, with premium models offering extended coverage up to 5 years. Warranties typically cover manufacturing defects in the pressure chamber, control board, and major mechanical components. Exclusions include damage from improper use, water quality issues, or unauthorized repairs. Look for manufacturers offering “uptime guarantees” and loaner units during service. Distributors should provide localized warranty support with SLAs (Service Level Agreements) under 48-hour response times. |

| 5. How do I ensure long-term service and support for spare parts and repairs post-warranty? | Prioritize autoclave brands with a minimum 10-year commitment to spare parts availability and backward-compatible software updates. In 2026, many OEMs offer service contracts with annual preventive maintenance, remote diagnostics, and discounted labor rates. Confirm that your distributor maintains a certified technical team and access to original firmware tools. Ensure the manufacturer complies with IEC 60601-2-27 for continued safety certification. Document all service history to maintain audit readiness for regulatory inspections. |

Note: This guide reflects 2026 industry standards. Always verify specifications with the manufacturer and local regulatory bodies prior to purchase.

Need a Quote for Autoclave Dental?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160