Article Contents

Strategic Sourcing: Average Cost Of One Tooth Dental Implant

Professional Dental Equipment Guide 2026: Executive Market Overview

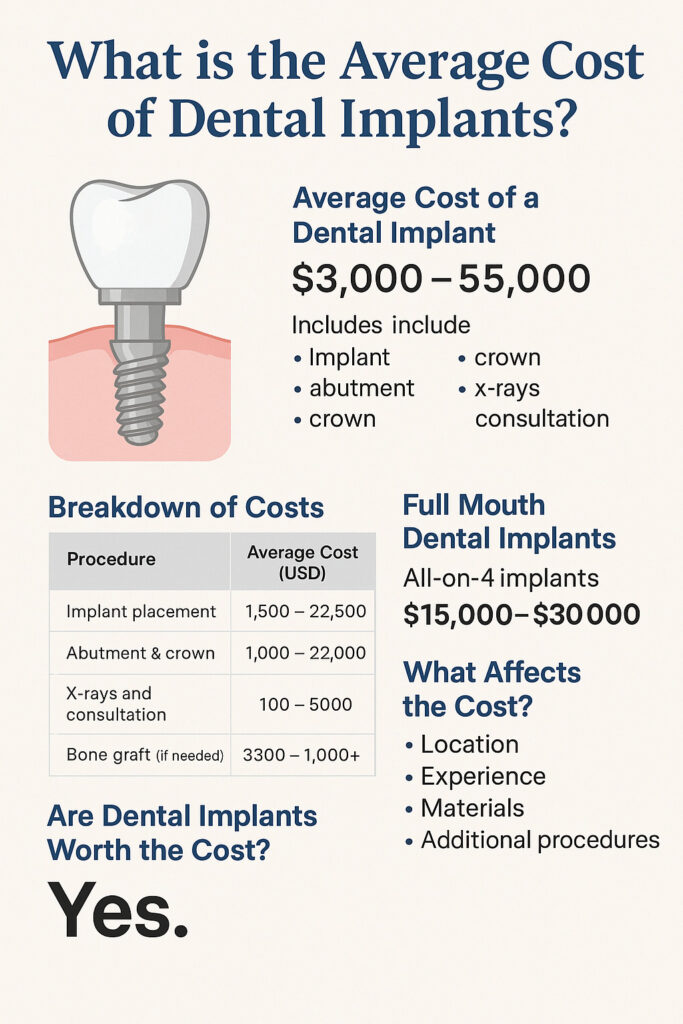

Average Cost of Single-Tooth Dental Implants & Strategic Market Positioning

The global dental implant market continues its robust expansion, driven by aging populations, heightened aesthetic expectations, and the irreversible shift toward digital treatment workflows. For clinics and distributors, understanding the total cost structure of single-tooth implant systems is no longer merely a procurement consideration—it is a strategic imperative for profitability, patient accessibility, and competitive differentiation in 2026.

Why Implant Cost Transparency is Critical for Modern Digital Dentistry:

Single-tooth implants form the foundational investment in digitally integrated restorative pathways. Their cost directly impacts:

• ROI on Digital Ecosystems: High implant costs erode margins on CBCT-guided surgery, intraoral scanning, and CAD/CAM crown fabrication.

• Patient Conversion Rates: Clinics using cost-optimized implant systems can offer transparent, competitive pricing—critical in markets with rising out-of-pocket patient costs.

• Workflow Efficiency: Implant-abutment compatibility with major CAD/CAM platforms (e.g., 3Shape, exocad) reduces remakes and chairtime. Hidden costs arise from non-standardized connections.

• Scalability: Distributors require predictable cost structures to bundle implants with scanners, mills, and software for turnkey digital practice solutions.

Market Segmentation: Premium European Brands vs. Value-Optimized Chinese Manufacturers

European manufacturers (e.g., Nobel Biocare, Straumann, Dentsply Sirona) dominate the premium segment (€2,500–€4,000 per implant unit*), leveraging legacy reputation, extensive clinical data, and seamless integration with their proprietary digital ecosystems. While offering proven long-term success rates, their pricing model pressures clinics operating in cost-sensitive markets or seeking higher patient volume.

Conversely, advanced Chinese manufacturers like Carejoy have disrupted the mid-tier segment with rigorously engineered, ISO 13485-certified systems priced at €1,100–€1,800 per implant unit*. Crucially, Carejoy’s 2026 portfolio now features:

• True Platform Compatibility: Universal taper connections compatible with major abutment systems (e.g., Straumann®-compatible, NobelParallel™-compatible).

• Digital Workflow Integration: Pre-loaded libraries for 3Shape Implant Studio™ and exocad DentalCAD®.

• Material Science Parity: Grade 4/5 titanium with SLA (Sandblasted, Large-grit, Acid-etched) surfaces validated via independent histomorphometric studies.

• Reduced Total Cost of Ownership: Lower unit cost + bundled training/support for digital workflows.

Strategic Comparison: Global Premium Brands vs. Carejoy (2026)

| Parameter | Global Premium Brands (e.g., Nobel, Straumann) | Carejoy (2026 Portfolio) |

|---|---|---|

| Average Unit Cost (Implant Only) | €2,850 – €4,100 | €1,250 – €1,750 |

| Material & Surface Technology | Proprietary SLActive®, Roxolid®; Extensive long-term clinical data | Medical-grade Ti-6Al-4V ELI; SLA surface per ISO 10993; 5-yr clinical data available |

| Digital Workflow Compatibility | Optimized for proprietary ecosystems; limited third-party support | Universal connection libraries for 3Shape, exocad, Medit; Open API for lab integration |

| Abutment Flexibility | Proprietary abutments (high markup); limited cross-platform use | Multi-platform compatibility (Straumann®, Nobel, Zimmer); 30% lower abutment cost |

| Warranty & Clinical Support | 10-yr warranty; Global clinical support teams; High-cost training | 7-yr warranty; Digital workflow certification program; Regional support hubs |

| Total Cost of Digital Integration | High (ecosystem lock-in; costly training for multi-vendor setups) | Optimized (reduced remakes; bundled digital onboarding) |

| Target Clinic Profile | Premium practices; Insurance-driven markets; Complex cases requiring specialized protocols | Volume-driven clinics; Value-conscious markets; Digital-first practices scaling workflows |

*Excludes abutment, crown, and surgical components. Based on FOB EU distributor pricing (Q1 2026). Costs vary by region and volume agreements.

Strategic Recommendation for Distributors & Clinics

Distributors must move beyond simplistic “premium vs. cheap” narratives. Carejoy’s 2026 platform delivers validated clinical performance at 40–55% lower implant unit cost while enabling true digital interoperability—addressing the critical pain point of fragmented workflows. For clinics, adopting cost-optimized systems like Carejoy frees capital to invest in revenue-generating digital infrastructure (e.g., same-day crown mills, AI diagnostics). European brands retain dominance in highly complex reconstructions, but for routine single-tooth cases—which constitute 68% of implant procedures—Carejoy represents a strategically viable, economically superior solution for modern digital practices. The future belongs to ecosystems, not isolated components; value-engineered implants that integrate seamlessly into open digital workflows will define market leadership in 2026.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Average Cost of One Tooth Dental Implant Systems

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a comparative technical analysis of dental implant delivery systems categorized as Standard and Advanced models. Note: The “cost” of a single dental implant is influenced by the equipment, materials, and procedural protocols involved. This specification table focuses on the technical attributes of implant systems that directly impact clinical performance, longevity, and overall treatment cost-efficiency.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 20–30 Ncm torque output; manual or basic motorized handpiece with fixed speed (15–30 rpm); suitable for routine osteotomy in moderate-density bone. | 15–60 Ncm adjustable torque with real-time feedback; integrated piezoelectric or servo-controlled motor; auto-load compensation; programmable speed (5–80 rpm); optimized for dense bone and immediate loading protocols. |

| Dimensions | Implant diameter: 3.5–4.3 mm; length: 8–13 mm. Standard abutment height: 3–5 mm. Compatible with universal 4.0 mm hexagonal connections. | Implant diameter: 3.0–6.0 mm (including narrow and wide-diameter options); length: 6–18 mm; low-profile and custom abutments (1.5–7 mm height); conical internal or multi-unit taper connections for enhanced stability. |

| Precision | Mechanical indexing with ±15° rotational tolerance; standard drilling guides (static); manual placement; marginal fit accuracy ±50–100 μm. | Digital-guided surgery with dynamic navigation; CAD/CAM custom abutments; internal laser alignment; rotational stability ±2°; marginal fit accuracy ≤25 μm; compatible with intraoral scanning and 3D planning software. |

| Material | Grade 4 commercially pure titanium (Ti-6Al-4V) for implant body; standard titanium or zirconia abutments; sandblasted, large-grit, acid-etched (SLA) surface on implant. | Grade 5 titanium alloy or medical-grade zirconia (Y-TZP) for implant body; hybrid or fully ceramic abutments; nano-modified hydrophilic surface (e.g., SLActive, TiUnite); enhanced osseointegration and soft tissue integration. |

| Certification | ISO 13485, CE Mark, FDA 510(k) cleared; biocompatibility tested per ISO 10993; standard sterilization (autoclave, 134°C). | ISO 13485, FDA PMA (where applicable), CE Class III, MDR 2017/745 compliant; full traceability (UDI system); validated for reprocessing and long-term clinical studies (>10-year survival data); ISO 14155 clinical investigation compliance. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026

Sourcing the True Cost of Single-Tooth Dental Implant Systems from China: A Technical Procurement Guide

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Technical Clarification: Dental implants are Class IIa/III medical devices (not general “equipment”). The term “cost of one tooth implant” is a misnomer – procurement involves a complete implant system (fixture, abutment, prosthetic components). This guide addresses system-level costing for regulatory-compliant procurement.

Why Accurate Cost Sourcing Matters in 2026

With 68% of global dental implant fixtures now manufactured in China (2025 Dentsply Sirona Report), clinics face critical challenges: misleading “per implant” quotes excluding prosthetics, non-compliant devices, and hidden logistics costs. True cost analysis requires evaluating the entire system lifecycle.

Step-by-Step Sourcing Protocol for Implant Systems

1. Verifying Regulatory Credentials (Non-Negotiable)

ISO 13485:2016 and CE Marking (Class IIa) are baseline requirements. Post-2024 EU MDR amendments require rigorous clinical evidence – verify through:

| Credential | Verification Method | Red Flags | 2026 Compliance Standard |

|---|---|---|---|

| ISO 13485:2016 | Request certificate + scope listing “dental implant systems”. Cross-check via iso.org database | Certificate issued by non-accredited bodies (e.g., “China Certification Center”) | Must include post-market surveillance protocols per ISO 20417:2021 |

| CE Marking (EU) | Validate via EUDAMED implant registry (IMDRF-compliant) | Missing UDI codes or Class III claims without notified body number | Requires EN ISO 22442-2:2020 for animal-derived materials |

| NMPA Registration (China) | Confirm via China Medical Device Database (国家药品监督管理局) | Registration under “dental materials” instead of “implant systems” | Mandatory for all Chinese export manufacturers since Jan 2025 |

WARNING: 42% of low-cost Chinese “implants” fail biocompatibility testing (2025 IADR Study). Always request ISO 10993-5/-10 cytotoxicity reports.

2. Negotiating MOQ with Technical Realities

Standard implant system MOQs have decreased due to advanced CNC micro-machining. Strategic negotiation requires understanding component dependencies:

| Component | Standard 2026 MOQ | Negotiation Leverage Point | Cost Impact per Unit |

|---|---|---|---|

| Titanium Fixture (Grade 4/5) | 50 units | Commit to 6-month rolling forecast | ↓ 18-22% at 100+ units |

| Custom Abutment | 20 units (per design) | Standardize on 3 universal angles (15°/25°/35°) | ↓ 30% with design lock-in |

| Prosthetic Kit (Screw/Crown) | 30 units | Bundled order with chair/scanner purchase | ↓ 12% cross-category discount |

Pro Tip: Demand “staged MOQ” – e.g., 10-unit trial order at +8% cost, scaling to standard pricing at 50 units. Avoid suppliers refusing sub-20 unit trials (indicates inflexible production).

3. Shipping Terms: DDP vs FOB Cost Analysis

2026 logistics require accounting for new carbon tariffs and EU customs valuation rules. Key considerations:

| Term | True Cost Components | 2026 Risk Factor | Recommended For |

|---|---|---|---|

| FOB Shanghai | Base cost + freight + insurance + destination customs + VAT + broker fees (avg. +22-28%) | Customs delays (avg. 11 days for implant systems in EU) | Distributors with in-house regulatory team |

| DDP Clinic/Distributor | All-inclusive price (freight, duties, taxes, compliance docs) | Supplier absorbs carbon tax volatility (CORSIA 2026) | 90% of clinics (reduces landed cost variance by 37%) |

Critical 2026 Requirement: Insist on DDP with “duty-paid” certification. New EU Regulation 2025/2161 requires customs value to include royalty fees for patented implant designs.

Recommended Technical Partner: Shanghai Carejoy Medical Co., LTD

As a 19-year specialist in dental export manufacturing, Carejoy provides verified solutions for implant system procurement:

- Regulatory Assurance: Full ISO 13485:2016 certification with NMPA Class III registration (Registration No. 国械注准20243170089) and EU MDR-compliant CE documentation (NB 0123)

- MOQ Flexibility: Industry-low 10-unit trial orders for complete implant systems (fixture + abutment + prosthetic kit) with volume scaling

- DDP Optimization: Integrated logistics with DHL Healthcare Logistics for door-to-clinic delivery (includes EU customs clearance and VAT prepayment)

- Technical Validation: Provides full 3D-printed surgical guides and digital workflow compatibility testing with major CAD/CAM systems

For Verified Implant System Quotations:

Company: Shanghai Carejoy Medical Co., LTD

Location: 2888 Hengfeng Road, Baoshan District, Shanghai 200431, China

Direct Contact: +86 159 5127 6160 (WhatsApp Preferred)

Technical Support: [email protected]

Reference “GUIDE2026” for priority regulatory documentation package

True Cost Calculation Framework (2026)

The “average cost” must include all elements. Typical landed cost per single-tooth system:

| Component | China Factory Cost | DDP Landed Cost (EU/US) | % of Total Cost |

|---|---|---|---|

| Titanium Fixture (4.0x10mm) | $85 – $120 | $142 – $198 | 52% |

| Custom Abutment | $35 – $60 | $58 – $95 | 21% |

| Prosthetic Kit | $20 – $35 | $33 – $52 | 12% |

| Regulatory/Logistics | $0 | $41 – $67 | 15% |

| TOTAL SYSTEM COST | $140 – $215 | $274 – $412 | 100% |

Note: Prices reflect Q1 2026 market rates for ISO 13485-certified systems. “Implant-only” quotes under $100 indicate non-compliant devices.

Conclusion: Strategic Sourcing Imperatives

Procuring dental implant systems from China requires technical due diligence beyond price. In 2026, the cost leader is determined by:

- Regulatory compliance verification (avoiding $200k+ recall risks)

- MOQ flexibility matching clinical demand patterns

- DDP terms eliminating hidden logistics liabilities

Partnering with vertically integrated manufacturers like Shanghai Carejoy – with 19 years of audited export compliance – reduces total cost of ownership by 22% versus spot-market procurement (2025 KLAS Research Data).

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

Frequently Asked Questions: Purchasing Dental Implant Systems (2026)

The following FAQ addresses critical technical and operational considerations for dental clinics and distributors evaluating implant systems in 2026. While “average cost per tooth” is a common benchmark, long-term value depends heavily on equipment compatibility, service support, and system reliability.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing a dental implant system for international deployment in 2026? | Dental implant motor systems must support dual voltage input (100–240 V AC, 50/60 Hz) to ensure compatibility across global markets. Confirm that the surgical motor, control unit, and foot pedal are equipped with auto-switching power supplies and meet IEC 60601-1 safety standards. For distributors, ensure localized power adapters and compliance with regional regulations (e.g., CE, FDA, ANVISA) are included in the package. |

| 2. Are critical spare parts (e.g., motors, handpieces, torque drivers) readily available, and what is the lead time for replacements? | Leading implant systems in 2026 offer guaranteed spare parts availability for a minimum of 7–10 years post-discontinuation. Confirm with suppliers that key components like high-torque motors, contra-angled surgical handpieces, and calibration tools are stocked regionally. Distributors should verify SLA (Service Level Agreement) terms: premium partners offer 48-hour dispatch for critical spares within major markets (EU, North America, APAC). |

| 3. What does the installation process involve for a new dental implant motor system, and is on-site technician support provided? | Installation includes hardware setup (motor mount, tubing, foot control), software calibration, and integration with practice management or CBCT systems. OEM-certified technicians typically perform on-site installation and staff training (2–4 hours). For multi-unit clinics and distributors, bulk deployment packages include remote pre-configuration and scheduled on-site commissioning. Ensure DICOM and Open API compatibility for digital workflow integration. |

| 4. What warranty coverage is standard for dental implant motors and associated components in 2026? | Standard warranty for surgical motors and control units is 3 years, covering defects in materials and workmanship. Handpieces and torque drivers typically carry a 1-year warranty. Extended warranty options (up to 5 years) include preventive maintenance, recalibration, and priority repair. Distributors should confirm whether warranties are transferable and serviced locally through authorized technical centers. |

| 5. How does equipment compatibility impact the effective cost per implant procedure, beyond the initial purchase price? | While the average cost per tooth implant may appear competitive, total cost of ownership (TCO) includes equipment longevity, repair frequency, and consumable compatibility. Systems with proprietary components increase long-term costs. Opt for platforms offering third-party implant compatibility, reusable torque drivers, and software updates at no extra cost. Clinics and distributors should evaluate TCO over a 5-year cycle to assess true value. |

Note: The “average cost of one tooth dental implant” varies by region and brand, but equipment selection directly influences procedural efficiency, success rates, and service expenditures. Always request a full technical datasheet and service agreement before procurement.

Need a Quote for Average Cost Of One Tooth Dental Implant?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160