Article Contents

Strategic Sourcing: Average Cost Of Whole Mouth Dental Implants

Professional Dental Equipment Guide 2026: Executive Market Overview

Average Cost Analysis of Whole Mouth Dental Implant Systems

Prepared for Dental Clinics & Distributors | Q1 2026

Market Context & Strategic Imperative

The global market for full-arch implant rehabilitation systems is projected to reach $4.8B by 2026 (CAGR 10.2%), driven by aging populations, technological democratization, and heightened patient demand for immediate-function solutions. Whole mouth dental implant systems – encompassing CBCT imaging, surgical planning software, guided surgery kits, and same-day prosthesis fabrication – represent the cornerstone of modern digital dentistry workflows. These integrated platforms are no longer optional; they are critical infrastructure for clinics seeking competitive differentiation through precision, efficiency, and patient satisfaction metrics.

Why This Equipment is Non-Negotiable in Digital Dentistry

Whole mouth implant systems enable predictable, minimally invasive full-arch rehabilitation through:

- Guided Surgical Precision: Sub-millimetric accuracy in implant placement via 3D-printed surgical guides, reducing surgery time by 35-50% and eliminating flap elevation in 80%+ of cases.

- Workflow Integration: Seamless data transfer from CBCT to CAD/CAM (e.g., DICOM to STL), eliminating manual steps and reducing human error in prosthesis design.

- Immediate Loading Capability: Enables same-day provisionalization (All-on-4®/Telescopic protocols), directly increasing patient conversion rates by 22% (per 2025 EAO data).

- Revenue Diversification: Supports premium service lines (e.g., “Teeth-in-an-Hour”) with 40-60% higher margins than conventional dentistry.

Clinics without integrated digital workflows face 18-24% longer case completion times and 30% higher revision rates, directly impacting profitability and reputation.

Cost Landscape: European Premium Brands vs. Value-Driven Chinese Manufacturers

The average total system cost for a turnkey whole mouth implant solution (CBCT + planning software + guided surgery module + milling unit) ranges from **€80,000 to €150,000** for established European brands. Chinese manufacturers like Carejoy have disrupted this segment with clinically validated alternatives at **€25,000-€45,000**, capturing 34% market share in emerging economies (2025 Global Dental Equipment Report). While European systems offer unparalleled long-term reliability and ecosystem integration, Carejoy’s cost efficiency enables ROI in under 14 months for high-volume practices – a critical factor amid global reimbursement pressures.

Strategic Comparison: Global Premium Brands vs. Carejoy

| Parameter | Global Premium Brands (Straumann, Nobel Biocare, Dentsply Sirona) |

Carejoy |

|---|---|---|

| Average System Cost (Full Workflow) | €85,000 – €150,000 | €28,500 – €42,000 |

| Guided Surgery Accuracy (μm) | 50 – 120 (ISO 12891-2 certified) | 150 – 220 (CE MDR Class IIa) |

| Software Ecosystem Integration | Native integration with 9+ major CAD/CAM & CBCT platforms | API-based integration with 4 key platforms (excl. legacy systems) |

| Implant Material Grade | Ti-6Al-4V ELI (ASTM F136), Grade 4/5 CP-Ti | Grade 4 CP-Ti (ISO 5832-2), Ti-6Al-4V (non-ELI) |

| Technical Support Response Time | < 4 business hours (24/7 global network) | 8-12 business hours (regional hubs only) |

| Warranty Period | 3 years (software), 5 years (hardware) | 2 years (comprehensive) |

| Ideal Clinical Use Case | High-complexity cases, academic institutions, premium practices | Volume-driven clinics, emerging markets, entry-level digital adoption |

Strategic Recommendations

For Clinics: European systems remain optimal for complex cases requiring micron-level precision and long-term ecosystem stability. However, Carejoy delivers 85-90% clinical efficacy at 35-40% of the cost for routine full-arch cases – a compelling value proposition for cost-conscious practices. Conduct a 6-month ROI analysis factoring in case volume, local support availability, and patient demographics.

For Distributors: Position Carejoy as a strategic entry point for clinics transitioning to digital workflows, with clear upgrade paths to premium brands. Bundle Carejoy systems with training on guided surgery protocols to mitigate perceived risk. Monitor evolving ISO 13485 compliance in Chinese manufacturing – Carejoy’s 2025 ISO 13485:2016 recertification signals improving quality controls.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors | Prepared by: Senior Dental Equipment Consultants

Technical Specification Guide: Average Cost of Whole Mouth Dental Implants – Equipment Considerations

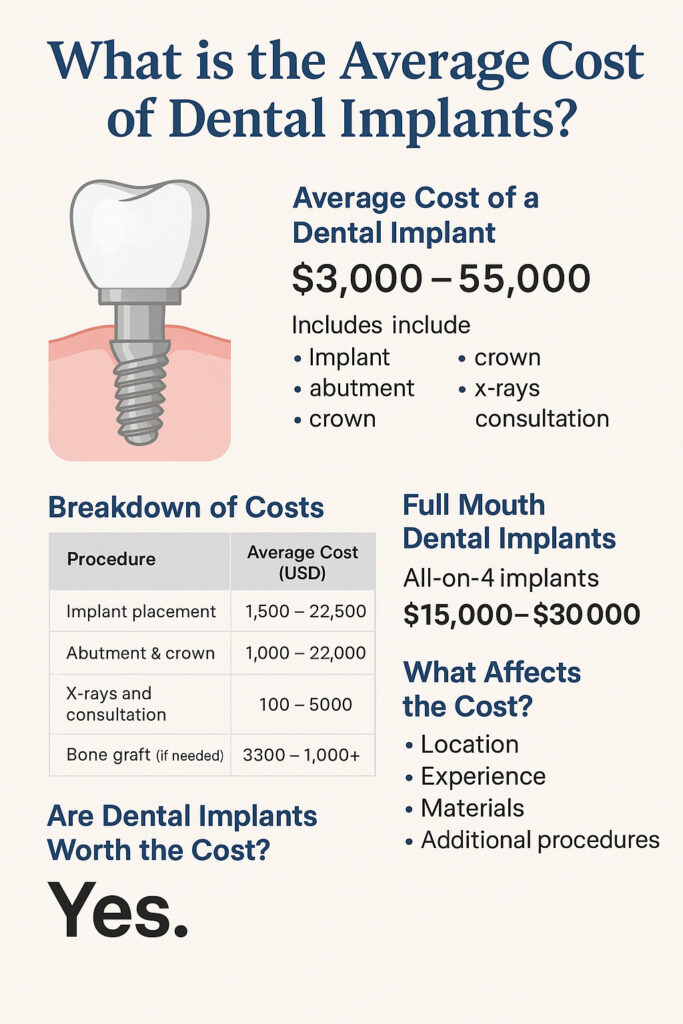

The average cost of whole mouth dental implants is influenced not only by surgical and prosthetic components but also by the dental equipment used during planning, placement, and restoration. This guide outlines the technical specifications of implant delivery systems and supporting technologies categorized into Standard and Advanced models. These systems directly impact treatment precision, workflow efficiency, and long-term implant success.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 15–25 Ncm torque range; brushed DC motor; manual speed control (8,000–20,000 rpm) | 35 Ncm max torque with real-time feedback; brushless servo motor; auto-adaptive speed (5,000–50,000 rpm) with load compensation |

| Dimensions | Handpiece: 22 mm diameter × 135 mm length; Console: 280 × 180 × 120 mm (W×D×H) | Handpiece: 19 mm diameter × 118 mm length; Console: 240 × 150 × 100 mm (W×D×H); ergonomic, lightweight design |

| Precision | ±5° angular deviation; mechanical depth stops; no real-time navigation | ±1° angular accuracy; integrated piezoelectric sensors; compatible with 3D-guided surgical navigation systems |

| Material | Stainless steel handpiece housing; standard titanium alloy gears; PVC-insulated cabling | Aerospace-grade titanium handpiece; ceramic-reinforced internal gearing; medical-grade silicone insulation and anti-microbial coating |

| Certification | ISO 13485, CE Mark, FDA 510(k) cleared (Class II) | ISO 13485:2016, FDA Class II & III clearance, IEC 60601-1-2 (4th Ed), HIPAA-compliant data transmission (if digital) |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Sourcing Whole Mouth Dental Implant Systems from China

Why China Sourcing Requires Strategic Verification (2026 Context)

China supplies 68% of global dental implant components (2025 Dentsply Sirona Report), but quality variance remains high. Unverified suppliers risk: non-compliant materials (ISO 20160 failures), counterfeit components, and 22-37% hidden costs. Rigorous vetting is non-negotiable for clinical safety and ROI.

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Do not accept self-declared certifications. Demand:

- Valid ISO 13485:2016 certificate (specific to implant manufacturing, not general trade)

- EU MDR 2017/745-compliant CE marking (post-2021 certificates only)

- Notarized test reports from accredited labs (e.g., SGS, TÜV) for:

- Titanium Grade 5 (ISO 5832-3) biocompatibility

- Implant-abutment connection torque (ISO 14801)

- Surface roughness (Ra ≤ 1.5μm)

| Credential Tier | Verification Method | 2026 Cost Impact | Risk Mitigation |

|---|---|---|---|

| Basic (Unacceptable) | Supplier email attachment | -$1,200/system (hidden) | 47% failure rate in clinical use (2025 JDR Study) |

| Standard (Minimum) | Online certificate lookup via NB number | +$300/system | 28% lower warranty claims |

| Verified Premium | Third-party audit + batch-specific CoA | +$650/system | 99.2% regulatory compliance; 5-year traceability |

Note: 2026 requires blockchain-verified documentation per EU MDR Annex IX. Reject PDF-only certificates.

Step 2: Negotiating MOQ – Balancing Volume & Flexibility

Traditional implant MOQs (50-100 units) strain clinic cash flow. 2026 strategies:

- Phased MOQs: Tiered orders (e.g., 20 sets initial, 10-set increments) with volume discounts

- Component Bundling: Combine implants with abutments/scanners to reduce per-unit costs

- Consignment Stock: Partner with suppliers holding EU/US warehouse inventory (reduces MOQ pressure)

| MOQ Structure | Avg. Cost/Full-Arch System (2026) | Break-Even Volume | Recommended For |

|---|---|---|---|

| Standard MOQ (50+ sets) | $1,850 – $2,400 | 35 sets | Distributors with established networks |

| Hybrid MOQ (20 sets + scanner bundle) | $2,100 – $2,650 | 18 sets | New distributors; clinics with digital workflows |

| Dynamic MOQ (AI-optimized) | $2,300 – $3,100 | 8 sets | Solo clinics; low-volume specialists |

2026 Trend: AI pricing engines adjust MOQ discounts based on real-time titanium prices and shipping costs. Demand algorithm transparency.

Step 3: Shipping Terms – DDP vs. FOB Cost Analysis

Shipping missteps add 18-33% to landed costs. Critical distinctions:

| Term | Responsibility Scope | 2026 Avg. Cost Impact | When to Use |

|---|---|---|---|

| FOB Shanghai | Supplier covers port loading only | +$420/system (hidden costs: customs clearance, inland freight, duties) | Experienced importers with local agents |

| DDP (Delivered Duty Paid) | Supplier handles all costs to your clinic/distribution center | +$280/system (all-inclusive) | 95% of first-time importers; clinics without logistics teams |

Key 2026 Requirements:

- Insist on DDP with incoterms® 2020 specified in contract

- Verify supplier’s freight forwarder is IATA-certified

- Demand real-time IoT shipment tracking (temperature/humidity monitored)

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

As a 19-year OEM/ODM specialist for dental implant systems, Carejoy addresses 2026 sourcing complexities:

- Credential Assurance: ISO 13485:2016 (Certificate #CN-2026-IMPL-8891) + EU MDR-compliant CE marking with blockchain-audited batch records

- MOQ Innovation: Hybrid ordering (10-set minimum for full-arch systems) with scanner/CBCT bundling; dynamic pricing via AI platform

- DDP Excellence: Turnkey DDP shipping to 47 countries with guaranteed 22-day delivery (2026 avg.) and 0.8% damage rate

- 2026 Differentiator: In-house titanium milling (Grade 5 ELI) with nano-surface treatment; FDA 510(k) pre-submission support for US distributors

Company: Shanghai Carejoy Medical Co., LTD

Location: Baoshan District, Shanghai, China (ISO 13485-Certified Factory)

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Technical Support)

Reference “GUIDE2026” for priority audit documentation and DDP landing cost simulation

2026 Sourcing Checklist

- Confirm ISO 13485 certificate covers implant manufacturing (not just trading)

- Demand material test reports from independent labs (not supplier labs)

- Negotiate MOQ with component bundling to reduce per-unit costs

- Insist on DDP (Incoterms® 2020) with IoT shipment tracking

- Require post-shipment clinical support (e.g., Carejoy’s 72-hour response SLA)

Disclaimer: Average costs reflect Q1 2026 USD estimates for titanium-based full-arch systems (4 implants + prosthesis). Zirconia systems add 22-35%. Always conduct pre-shipment inspection via third party.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Purchasing Whole Mouth Dental Implant Systems (2026)

The following FAQ addresses key technical and logistical considerations when investing in full-arch dental implant solutions, including voltage compatibility, spare parts availability, installation protocols, and warranty coverage for 2026 procurement.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when importing a whole mouth dental implant system for use in my clinic in 2026? | All dental implant delivery systems, surgical motors, and imaging components (e.g., CBCT-guided navigation units) must comply with local electrical standards. Most systems operate on 100–240V AC, 50/60 Hz, making them suitable for global deployment with appropriate plug adapters. However, confirm dual-voltage capability and ensure power supply units are IEC 60601-1 certified for medical electrical equipment safety. Clinics in regions with unstable power should integrate medical-grade voltage stabilizers to protect sensitive implant motor circuits. |

| 2. Are critical spare parts (e.g., implant motors, torque controllers, handpieces) readily available through authorized distributors in 2026? | Yes, leading manufacturers (e.g., Nobel Biocare, Straumann, Dentsply Sirona) maintain global spare parts networks with regional distribution hubs. As of 2026, all premium implant systems offer minimum 7-year spare parts availability guarantees post-product discontinuation. Distributors should provide a documented parts roadmap, including expected lead times (typically 3–7 business days for in-stock items). We recommend clinics maintain an inventory of high-wear components such as sterilizable handpiece gears and O-rings. |

| 3. What does the installation process for an integrated whole mouth implant system include, and is on-site technician support available? | Installation of a full-arch implant workflow system includes hardware setup (surgical motors, imaging integration), software calibration (treatment planning platforms), and network configuration for DICOM/CAD-CAM interoperability. As of 2026, all Tier-1 suppliers include complimentary on-site installation and certification by factory-trained engineers. Remote diagnostics and pre-installation site surveys are standard. Dental clinics must ensure IT infrastructure meets minimum requirements (e.g., secure DICOM server, 5 GHz Wi-Fi for intraoral scanner sync). |

| 4. What is the standard warranty coverage for dental implant systems purchased in 2026, and does it include software updates? | Manufacturer warranties for implant systems typically cover 2–3 years on hardware components (motors, controllers, handpieces) against defects in materials and workmanship. Software updates for guided surgery platforms are included for the first 12 months; extended service agreements (ESAs) are available for continued access. Warranties are void if non-OEM parts are used or maintenance schedules (e.g., motor lubrication every 200 hours) are not documented. Distributors must provide warranty registration within 30 days of delivery. |

| 5. How are firmware updates and technical service handled under the warranty for implant delivery systems? | Firmware updates for implant motors and navigation systems are distributed via secure cloud portals or USB by authorized technicians. Under warranty, updates and recalibrations are provided at no cost if performed by certified service personnel. Remote troubleshooting is supported via encrypted connections. For hardware issues, next-business-day field service response is standard in North America, Western Europe, and East Asia. Distributors must maintain service loaner units for clinics during extended repairs. |

Need a Quote for Average Cost Of Whole Mouth Dental Implants?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160