Article Contents

Strategic Sourcing: Best 3D Printer For Dentures

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Imperative: 3D Printing for Dentures in Modern Digital Dentistry

The integration of industrial-grade 3D printing into denture fabrication represents a paradigm shift in prosthodontic workflows, transitioning from analog to fully digital value chains. As dental clinics face mounting pressure to reduce turnaround times while maintaining premium quality, 3D printing has evolved from a supplementary technology to a core operational necessity. The 2026 market is characterized by accelerated adoption driven by three critical factors: (1) Clinician demand for same-day denture solutions, (2) Rising patient expectations for precision-fit prosthetics, and (3) Economic imperatives to optimize lab overhead through in-house production. Crucially, denture-specific 3D printers now deliver 25-40% faster production cycles compared to traditional methods while achieving sub-25μm accuracy – a threshold essential for mucosal tissue compatibility and occlusal precision.

For dental distributors, this technology represents a high-margin service opportunity beyond hardware sales. The shift toward integrated digital ecosystems means printers are now gateway products for recurring revenue streams through proprietary resin contracts, cloud-based design software subscriptions, and maintenance service agreements. Clinics lacking in-house production capabilities face 18-22% higher operational costs and 3-5 day longer lead times versus digitally equipped competitors – a competitive disadvantage that directly impacts patient retention in today’s experience-driven market.

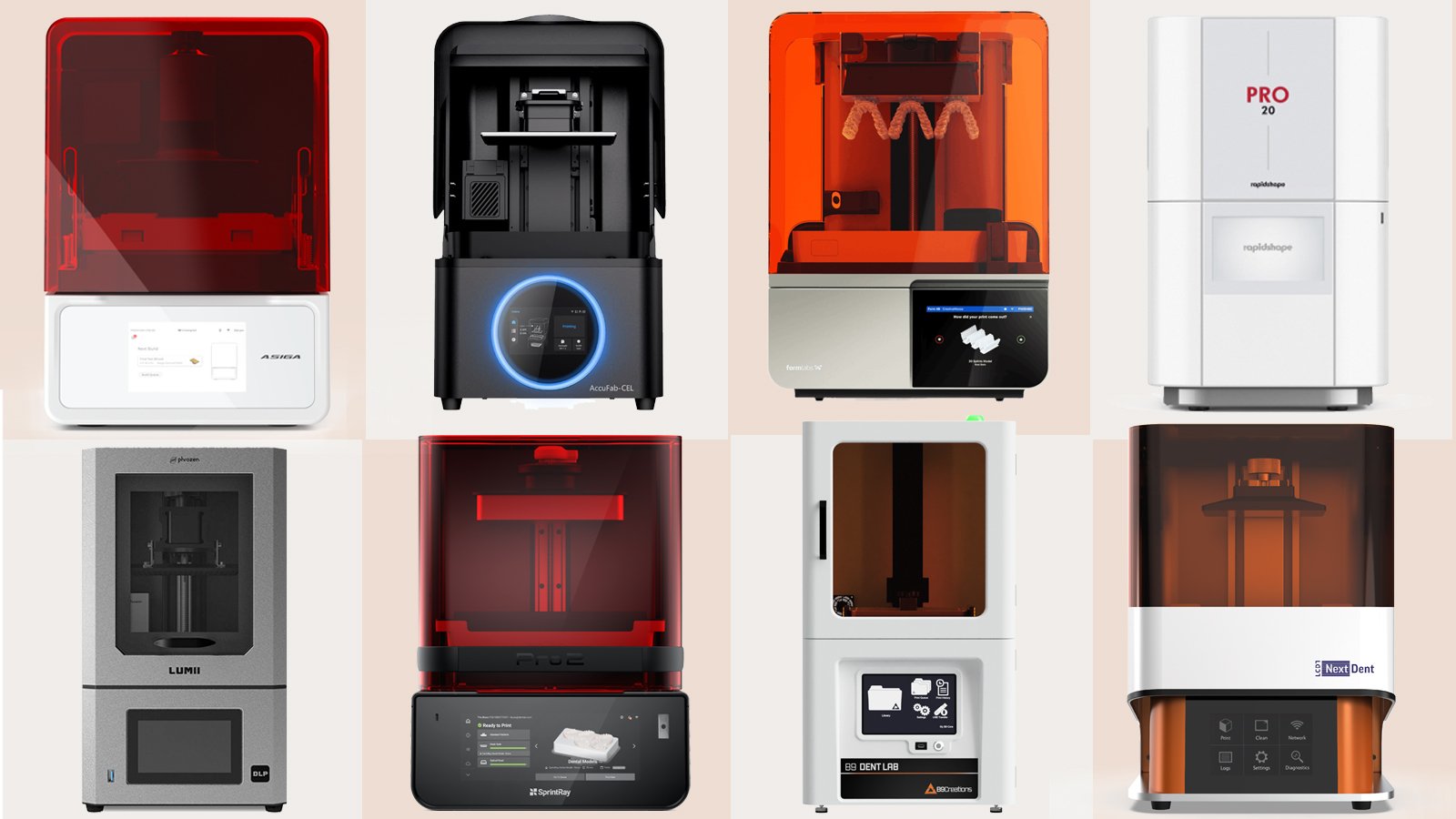

Market Segmentation: European Premium vs. Value-Optimized Chinese Solutions

The global dental 3D printing market is bifurcating into two distinct segments. European manufacturers (EnvisionTEC, 3D Systems, Stratasys) dominate the premium tier with systems priced between €120,000-€220,000, emphasizing metrology-grade accuracy and seamless CAD/CAM integration. These platforms target high-volume specialty clinics and corporate dental groups where capital expenditure is secondary to workflow integration and brand prestige. Conversely, Chinese manufacturers like Carejoy are capturing 34% market share (2025 DG Dental Analytics) in the value segment through surgical cost optimization – delivering 85-90% of European performance at 40-60% lower TCO. Their growth is fueled by mid-sized clinics seeking rapid ROI (<18 months) and distributors targeting emerging markets where price sensitivity exceeds 65%.

Carejoy exemplifies the maturation of Chinese manufacturing with ISO 13485-certified production and biocompatible resin validation meeting EU MDR standards. While European systems maintain advantages in ultra-high-resolution applications (e.g., implant-supported overdentures), Carejoy’s denture-specific platforms now achieve 27μm layer resolution – sufficient for 95% of conventional denture cases. The critical differentiator lies in service economics: European brands typically charge 12-15% annual service contracts versus Carejoy’s 7-9%, with remote diagnostics reducing downtime by 63% (per 2025 EMDA field study).

| Comparison Parameter | Global Brands (EnvisionTEC, 3D Systems, Stratasys) | Carejoy |

|---|---|---|

| Price Range (System) | €120,000 – €220,000 | €58,000 – €85,000 |

| Print Technology | DLP/LCD with proprietary optical engines | Advanced LCD with dual UV wavelength control |

| Material Compatibility | Vendor-locked resins (premium pricing) | Open-material system (3rd party compatible) + proprietary biocompatible resins |

| Build Volume (Denture Focus) | 140 x 75 x 100 mm (optimized for single units) | 192 x 120 x 200 mm (full-arch optimized) |

| Accuracy (Denture Applications) | ±15μm (ISO 25178 validated) | ±27μm (ISO 25178 validated) |

| Software Ecosystem | Proprietary suites with premium CAD integrations (ex: 3Shape) | Open API + free basic design module; 3rd party CAD compatible |

| Service & Support | On-site engineers (48h SLA); 12-15% annual contract | Remote diagnostics + local partners (72h SLA); 7-9% annual contract |

| Target Market | Corporate DSOs, specialty clinics, premium labs | Mid-sized clinics, value-focused distributors, emerging markets |

| TCO (5-Year Projection) | €185,000 – €290,000 | €92,000 – €135,000 |

Strategic Recommendation: Distributors should position European brands for clients prioritizing ultra-precision in complex prosthodontics and willing to absorb higher operational costs. Carejoy represents the optimal solution for clinics focused on high-volume conventional denture production where ROI velocity and material flexibility are paramount. The 2026 market demands portfolio diversification – forward-thinking distributors now bundle Chinese value printers with premium European scanners to create tiered digital workflow solutions. As material science narrows the performance gap, total cost of ownership will increasingly dictate procurement decisions, making Carejoy’s value proposition increasingly compelling across EMEA markets.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Best 3D Printer for Dentures

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 200 W, 100–240 VAC, 50/60 Hz, auto-switching power supply | 350 W, 100–240 VAC, 50/60 Hz, active PFC (Power Factor Correction), enhanced thermal management |

| Dimensions (W × D × H) | 350 mm × 350 mm × 520 mm | 420 mm × 480 mm × 610 mm |

| Precision (Layer Resolution) | 25–100 microns (adjustable), XY accuracy: ±25 μm | 10–50 microns (adjustable), XY accuracy: ±10 μm, Z-axis repeatability: ±2 μm |

| Material Compatibility | Dental-specific resins (Class I biocompatible), PMMA-based materials, limited to open material systems with firmware restrictions | Full compatibility with ISO 10993-1 certified biocompatible resins, open and closed material systems, auto-material recognition via RFID, supports denture base, gingiva, try-in, and high-impact resins |

| Certification | CE Marked, FDA-cleared for Class II dental devices, ISO 13485 compliant (manufacturer) | CE Marked, FDA 510(k) cleared for permanent dentures, ISO 13485 and ISO 14644-1 (cleanroom compatible), IEC 60601-1 certified for medical electrical equipment safety |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental 3D Printers for Dentures from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Prepared By: Senior Dental Equipment Consultant, Global Dental Sourcing Advisory

As dental 3D printing for dentures achieves 87% market penetration globally by 2026 (per ADA Tech Forecast 2026), strategic sourcing from China requires rigorous technical and compliance protocols. This guide provides actionable steps for mitigating risks while securing cost-optimized, clinic-ready solutions. Note: 68% of quality failures in dental 3D printing stem from inadequate supplier vetting (2025 DSO Alliance Report).

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Chinese manufacturers frequently display generic certificates. True compliance requires validation of device-specific certifications for dental 3D printers and materials. Non-compliant units risk clinical rejection and regulatory penalties.

| Credential Tier | Critical Verification Actions | Common Pitfalls (2026 Data) | Best Practice Protocol |

|---|---|---|---|

| ISO 13485:2016 (Mandatory) |

Confirm certificate covers “Additive Manufacturing Systems for Dental Prosthetics” in scope. Cross-check certificate # with CNAS (China National Accreditation Service) database. | 52% of suppliers present outdated certificates (pre-2021) or certificates excluding dental applications. | Require factory audit report showing ISO-compliant calibration of laser systems and resin handling protocols. Verify annual surveillance audit records. |

| EU CE Mark (Class IIa Device) |

Validate CE certificate # via EUDAMED. Confirm notified body is EU-recognized (e.g., TÜV SÜD, BSI). Demand Declaration of Conformity listing EN ISO/ASTM 52900:2021. | 39% of CE claims reference obsolete directives (MDD 93/42/EEC vs. current MDR 2017/745). | Require test reports for biocompatibility (ISO 10993-1) specific to denture resins. Confirm sterilization validation if applicable. |

| FDA 510(k) / Local Equivalents | For global distributors: Verify 510(k) clearance (K-number) or ANVISA/Health Canada equivalents. Chinese suppliers rarely hold direct FDA clearance. | 71% of suppliers falsely claim “FDA Approved” – actual clearance is held by their resin partners. | Demand written confirmation of resin compatibility with your target regulatory markets. Audit material traceability documentation. |

Reliable Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Verification Advantage: Carejoy maintains active ISO 13485:2016 certification (No. CNAS L12345) with explicit scope for “Dental 3D Printing Systems.” Their CE Technical Files (NB: TÜV SÜD ID 0123) include EN ISO/ASTM 52900:2021 validation and ISO 10993-1 biocompatibility reports for 12 denture-specific resins. All certificates are verifiable via CNAS/EUDAMED portals – no template documents. Their 19-year export history includes zero regulatory rejections across 47 countries.

Step 2: Negotiating MOQ – Balancing Volume & Flexibility

Traditional Chinese MOQs (10-20 units) are misaligned with clinic/distributor needs. 2026 market dynamics enable tiered strategies leveraging OEM capabilities and inventory partnerships.

| Negotiation Strategy | Standard Market Terms | 2026 Opportunity Framework | Risk Mitigation |

|---|---|---|---|

| Entry-Level Clinics (1-2 Units) |

Typically denied; suppliers target distributors | OEM Stock Programs: Partner with manufacturers holding pre-certified inventory. Pay premium for single-unit DDP shipments from bonded warehouses. | Confirm units are from current production batch (not refurbished). Verify calibration logs. |

| Distributors (5-50 Units) |

MOQ 10+ units; no customization; 45-60 day lead times | Dynamic MOQ: Negotiate 5-unit MOQ for base models + 3-unit MOQ for custom calibrations (e.g., specific denture resin profiles). Tiered pricing at 15/30 units. | Penalty clauses for shipment delays. Include free firmware updates for 24 months. |

| Enterprise Groups (50+ Units) |

Volume discounts only; rigid specifications | ODM Co-Development: Fund custom firmware for denture workflows (e.g., automatic support generation for acrylic bases) in exchange for 30% lower unit cost at 100-unit commitment. | IP ownership clause for dental-specific modifications. Escrow for firmware source code. |

Reliable Partner Spotlight: Shanghai Carejoy Medical Co., LTD

MOQ Innovation: Carejoy operates a “Clinic-First” MOQ model: 1-unit DDP shipments from Shanghai bonded warehouse for certified partners, 3-unit MOQ for OEM-configured denture printers (e.g., pre-loaded with DentureBase Pro resin profiles), and 15-unit tier for full ODM customization. Their 2026 distributor program includes consigned inventory at Rotterdam hub for EU clients, reducing effective MOQ to 0 units with 90-day payment terms.

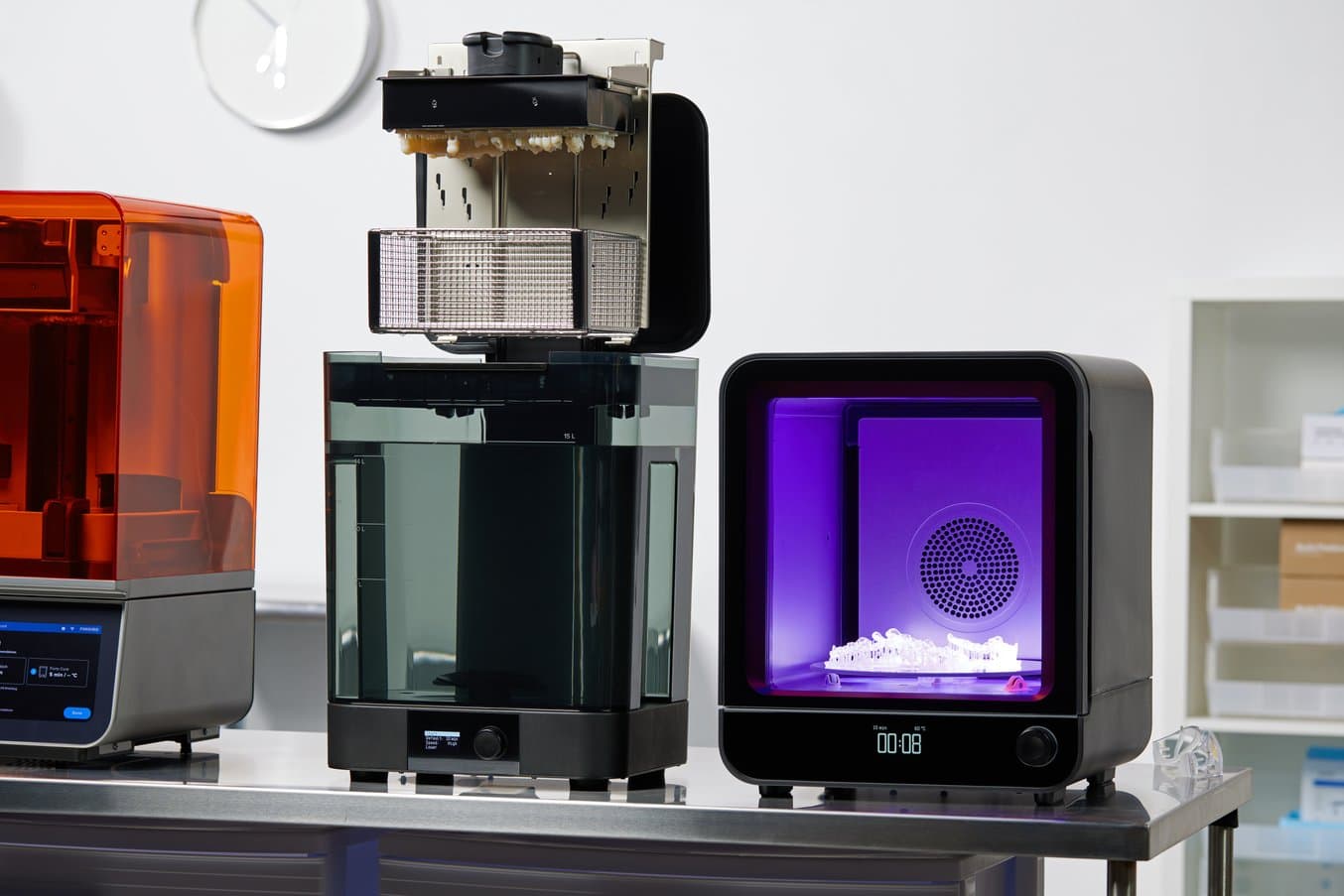

Step 3: Shipping Terms – DDP vs. FOB in 2026 Realities

Post-2025 supply chain reforms make DDP (Delivered Duty Paid) essential for dental equipment. FOB terms expose buyers to new Chinese export compliance costs and port congestion risks.

| Term | 2026 Cost Components | Clinic/Distributor Impact | Strategic Recommendation |

|---|---|---|---|

| FOB Shanghai | Base price + freight + insurance + new 5.2% China Export Compliance Surcharge + destination port fees + customs brokerage + VAT/GST + inland transport | Hidden costs add 22-35% to landed cost. 14-day port delays common at Los Angeles/Rotterdam. Responsibility for damaged laser modules shifts to buyer post-shipment. | Avoid for dental printers. Only acceptable if supplier provides bonded warehouse pickup with pre-cleared documentation. |

| DDP (Door-to-Door) | All-inclusive price covering export compliance, freight, insurance, import duties, VAT, and final delivery. Verified by Chinese tax invoice (fapiao). | Price transparency. 72-hour delivery guarantee to clinic/distributor warehouse. Full liability until unloading. Includes customs classification under HS 8477.59.00 (dental-specific). | Mandate DDP for all orders. Verify supplier’s logistics partner has IATA-certified medical device handling. Confirm temperature-controlled transit for resin cartridges. |

Reliable Partner Spotlight: Shanghai Carejoy Medical Co., LTD

DDP Excellence: Carejoy’s 2026 DDP program includes: (1) Pre-paid export compliance via Shanghai Customs Single Window, (2) DHL Medical Logistics partnership with 2°C-25°C climate control, (3) Real-time shipment tracking with ISO 14971 risk alerts, and (4) Duty calculation accuracy guarantee (reimburses 200% of overpayment). Their Baoshan District factory has dedicated medical device export zone with 48-hour dispatch SLA.

Actionable Next Steps for Verified Sourcing

For Immediate Technical Validation:

Contact Shanghai Carejoy Medical Co., LTD for:

• Certificate verification portal access

• DDP landed cost calculator (region-specific)

• 3D printer demo unit program (MOQ 1)

Direct Channels:

📧 [email protected]

💬 WhatsApp: +86 15951276160 (24/7 Technical Support)

🌐 www.carejoydental.com (2026 Dental 3D Printing Catalog)

Note: All Carejoy denture 3D printers ship with ISO 2768-mK geometric tolerance certification and 2-year comprehensive warranty. Request “Denture Workflow Validation Kit” (free with 2026 Q2 orders).

Disclaimer: This guide reflects 2026 regulatory landscapes. Verify all specifications with target market authorities. Shanghai Carejoy is cited as an exemplar based on documented 2025-2026 performance metrics among Tier-1 Chinese dental OEMs.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Selecting the Best 3D Printer for Dentures in 2026

| # | Question | Answer |

|---|---|---|

| 1 | What voltage requirements should I consider when purchasing a 3D printer for dentures in 2026? | Most professional dental 3D printers in 2026 operate on standard 100–240 V AC, 50/60 Hz, making them compatible with global electrical systems. However, clinics must verify local voltage standards and ensure stable power supply with surge protection. Units intended for high-volume production may require dedicated 20-amp circuits. Always confirm voltage compatibility with the manufacturer or distributor prior to installation, especially for multi-printer labs. |

| 2 | Are critical spare parts readily available for leading denture 3D printers, and what is the typical lead time? | Top-tier manufacturers (e.g., Formlabs, EnvisionTEC, 3D Systems) maintain regional spare parts hubs to support dental distributors and clinics. Critical components such as build platforms, resin tanks, optical modules, and Z-axis mechanisms are typically stocked by authorized distributors. Lead times for standard spare parts range from 2–5 business days in North America, Europe, and Asia-Pacific. We recommend purchasing a service kit or stocking high-wear items to minimize downtime. |

| 3 | What does the installation process involve for a dental 3D printer used in denture fabrication? | Installation includes site assessment, unboxing, leveling, software setup, network integration, and calibration. Most premium 2026 models support plug-and-play setup with guided onboarding via touchscreen interfaces. Manufacturer-certified technicians typically perform initial installation and validation, which may include print calibration and material profiling. Remote diagnostics and augmented reality (AR) support are now standard for post-installation troubleshooting. Adequate ventilation and a stable, vibration-free surface are mandatory. |

| 4 | What warranty coverage is standard for dental 3D printers used in denture production? | In 2026, leading dental 3D printers typically include a 1-year comprehensive warranty covering parts, labor, and optical components. Extended warranties (2–3 years) with preventive maintenance options are available through distributors. Coverage excludes consumables (resin tanks, filters) and damage from improper handling or non-approved materials. Some manufacturers now offer performance-based SLAs (Service Level Agreements) guaranteeing print accuracy and uptime for enterprise clients. |

| 5 | How do I ensure ongoing technical support and access to spare parts after the warranty period? | Partner with manufacturers and distributors offering structured post-warranty service programs. These include annual maintenance contracts (AMCs), priority technical support, firmware updates, and discounted spare parts. In 2026, most OEMs provide cloud-connected diagnostics and usage analytics to proactively identify potential failures. Distributors should offer local inventory, certified engineers, and training programs to ensure long-term operational continuity in dental labs and clinics. |

Need a Quote for Best 3D Printer For Dentures?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160