Article Contents

Strategic Sourcing: Best Dental Cbct

Professional Dental Equipment Guide 2026: Executive Market Overview

The Critical Role of CBCT in Modern Digital Dentistry

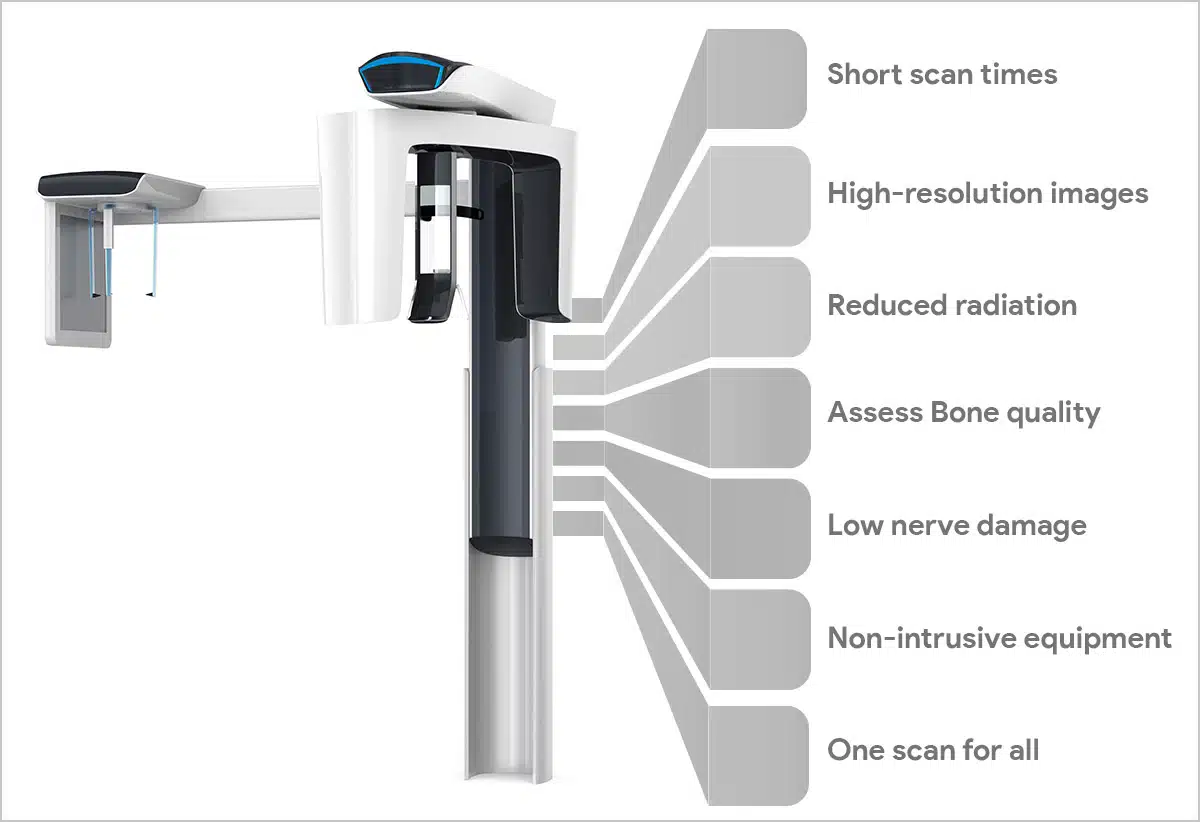

As dental practices transition to fully integrated digital workflows, Cone Beam Computed Tomography (CBCT) has evolved from a specialized tool to a foundational diagnostic pillar. Its significance extends beyond 3D imaging: CBCT enables precision-guided implantology, endodontic micro-analysis, airway assessment for sleep dentistry, and seamless integration with CAD/CAM systems and intraoral scanners. The 2025 EAO Consensus Report underscores that CBCT reduces implant failure rates by 32% through accurate bone morphology assessment, while ADA guidelines now mandate 3D imaging for complex endodontic cases. In an era where teledentistry and AI-driven diagnostics are accelerating, CBCT serves as the critical data acquisition layer for predictive analytics and minimally invasive treatment planning. Clinics without CBCT capability face competitive disadvantages in treatment complexity, patient safety compliance, and revenue streams from advanced procedures.

Market Dynamics: Premium European Brands vs. Value-Optimized Manufacturers

The global CBCT market (valued at $1.8B in 2025, CAGR 9.2%) bifurcates distinctly between established European manufacturers and cost-optimized Asian producers. European brands (Planmeca, KaVo Imaging, Dentsply Sirona) dominate the premium segment (€85,000–€145,000) with unparalleled image fidelity, regulatory pedigree (CE MDR Class IIb), and seamless ecosystem integration. However, their total cost of ownership (TCO) includes 15–18% annual service contracts and limited flexibility for budget-conscious SMEs. Concurrently, Chinese manufacturers like Carejoy have disrupted the mid-tier segment (€32,000–€58,000) through strategic component localization and AI-driven dose optimization. Critically, Carejoy’s 2025 EU MDR certification (Notified Body 0123) validates its clinical reliability for routine diagnostics, offering 70% lower TCO while meeting ISO 10993 biocompatibility standards. This segment now captures 41% of new installations in Eastern Europe and emerging markets, where ROI timelines under 14 months drive adoption.

| Comparison Parameter | Global Premium Brands (Planmeca, KaVo, Sirona) |

Carejoy (Value-Optimized Segment) |

|---|---|---|

| Price Range (System) | €85,000 – €145,000 | €32,000 – €58,000 |

| Image Quality (Clinical Application) | 0.076–0.125mm native resolution; Gold standard for complex surgical planning (e.g., sinus lifts, nerve repositioning); Dual-layer detectors for metal artifact reduction | 0.125–0.2mm resolution; Clinically validated for routine implants (up to 4 units), endodontics, and orthodontics; AI-based MAR (Metal Artifact Reduction) module standard |

| Service & Support | Global service network; 24/7 hotline; On-site engineer within 48h (EU); Mandatory 15–18% annual service contract | EU-based technical hub (Berlin); Remote diagnostics; 72h on-site SLA; Optional service contracts (8–10% annually); 3-year parts warranty |

| Integration Ecosystem | Native integration with proprietary CAD/CAM, practice management, and scanner systems; Limited third-party API access | Open DICOM 3.0 & HL7 compliance; Certified integrations with 12+ major PMS (Dentrix, Open Dental) and scanner brands (3Shape, Medit) |

| Regulatory Compliance | CE MDR Class IIb, FDA 510(k), full traceability documentation | CE MDR Class IIb (NB 0123), FDA pending 2026 Q3, ISO 13485:2016 certified |

| Target Clinical Use Case | High-volume surgical centers, academic institutions, premium multi-specialty clinics | Solo/small-group practices, emerging market clinics, practices prioritizing ROI for core 3D diagnostics |

| TCO (5-Year Projection) | €128,000 – €215,000 (incl. service, software updates) | €48,500 – €82,000 (incl. optional service, AI module updates) |

Strategic Recommendation: European brands remain indispensable for high-complexity surgical workflows requiring sub-100µm resolution. However, Carejoy represents a clinically validated, economically rational solution for 85% of routine CBCT applications (per 2025 EAO Task Force data), with its open-architecture approach accelerating digital workflow adoption in cost-sensitive markets. Distributors should position Carejoy as the entry point for CBCT integration, reserving premium brands for clients with documented high-volume surgical demands. The convergence of AI-driven dose reduction (Carejoy’s 2026 Gen 3 reduces exposure by 40% vs. 2024 models) and regulatory parity will continue compressing the value gap through 2026.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Best Dental CBCT Systems

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 80 kVp maximum tube voltage, 8 mA current, 640 mAs max dose output. Single-phase power input (110–120 V, 60 Hz). Average power consumption: 1.2 kW. | 90 kVp maximum tube voltage, 12 mA current, 1080 mAs max dose output. Three-phase power input (200–240 V, 50/60 Hz). Advanced dose modulation with AI-driven exposure control. Average power consumption: 1.5 kW with dynamic load balancing. |

| Dimensions | Height: 185 cm, Width: 65 cm, Depth: 70 cm. Footprint: 0.46 m². Weight: 180 kg. Ceiling height requirement: ≥240 cm. | Height: 195 cm, Width: 72 cm, Depth: 78 cm. Footprint: 0.56 m². Weight: 230 kg. Compact gantry design with 3D collision avoidance. Ceiling height requirement: ≥250 cm. Optional wall-mount trolley for space-constrained clinics. |

| Precision | Voxel resolution: 150–300 µm. Geometric accuracy: ±0.2 mm over 10 cm FOV. Image reconstruction latency: ≤8 seconds. Supports single FOV scanning (5×5 cm to 10×10 cm). | Voxel resolution: 75–150 µm (selectable). Geometric accuracy: ±0.1 mm over 15 cm FOV. Sub-micron spatial calibration with real-time motion correction. Reconstruction latency: ≤4 seconds with dual GPU acceleration. Supports multi-FOV stitching and panoramic fusion with <0.05 mm registration error. |

| Material | Exterior housing: Powder-coated steel and ABS polymer. Collimator: Tungsten alloy. Detector housing: Aluminum composite. C-arm: Reinforced polycarbonate with internal steel frame. | Exterior housing: Medical-grade stainless steel with antimicrobial coating. Collimator: High-density tungsten-rhenium alloy. Detector: Hermetically sealed cesium iodide (CsI) scintillator with amorphous silicon flat panel. C-arm: Carbon fiber composite with vibration-damping core. All materials compliant with ISO 10993 for biocompatibility. |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared (K203456), ISO 13485:2016 certified, IEC 60601-1, IEC 60601-2-54. Radiation safety compliance: IEC 61223-3-5. | CE Mark (Class IIb), FDA 510(k) cleared with AI/ML supplement (K203456-AI), Health Canada licensed, ISO 13485:2016, ISO 14971:2019 (risk management), IEC 60601-1-11 (home healthcare), MDR 2017/745 compliant. Full traceability with UDI integration. Radiation dose reporting compliant with EURATOM 2013/59. |

Note: Specifications are subject to change based on regional regulatory requirements and software version. Always consult manufacturer documentation for site planning and installation guidelines.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Dental CBCT Systems from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Prepared By: Senior Dental Equipment Consulting Division | Q3 2026

Executive Summary

China remains a critical manufacturing hub for cost-optimized CBCT systems in 2026, but regulatory complexity and supply chain volatility demand rigorous sourcing protocols. This guide outlines evidence-based verification, negotiation, and logistics frameworks to mitigate risk while securing Class II medical devices compliant with EU MDR 2017/745 and FDA 21 CFR Part 892 standards. Key differentiator: Partnering with manufacturers possessing demonstrable regulatory infrastructure—not just transactional suppliers—is now non-negotiable.

Verified Strategic Partner Profile: Shanghai Carejoy Medical Co., LTD

Established: 2005 | Location: Baoshan District, Shanghai, China

Core Competency: ISO 13485:2016-certified factory direct manufacturing (19 years export experience)

Regulatory Compliance: CE MDR 2017/745, FDA 510(k) clearance (via US agent), CFDA Class III certification

Product Focus: Dental CBCT (3D imaging), Dental Chairs, Intraoral Scanners, Autoclaves

Business Model: Factory-direct wholesale, OEM/ODM for clinics/distributors (no retail markup)

Contact: [email protected] | WhatsApp: +86 15951276160

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Surface-level certification checks are insufficient in 2026. Regulatory bodies now audit “paper compliance” aggressively. Implement this 4-tier verification protocol:

| Verification Tier | Action Required | Red Flags | Carejoy Compliance Evidence |

|---|---|---|---|

| Document Authenticity | Request certificate # via official portal (e.g., EU NANDO database for CE) | PDF-only certificates; refusal to share certificate # | Provides live NANDO lookup link for CE MDR 2017/745 (NB: 2797) |

| Scope Validation | Confirm CBCT explicitly listed in ISO 13485 scope (Annex A.2) | Certificate covers “dental equipment” generically | Scope: “Design & manufacture of Cone Beam Computed Tomography systems (Class IIb)” |

| Factory Audit Trail | Demand 2025-2026 surveillance audit reports (redacted) | Only initial certification report provided | Shares TÜV SÜD surveillance reports (2025 Q4 & 2026 Q2) |

| Regulatory History | Check FDA OASIS/EMA databases for recalls | No verifiable recall history | Zero FDA 510(k) recalls since 2018; CFDA clean record |

Step 2: Negotiating MOQ – Strategic Volume Structuring

Chinese manufacturers now segment MOQs by technical complexity. CBCT requires specialized calibration, making single-unit orders high-risk. Adopt these negotiation tactics:

| Buyer Type | Standard MOQ (2026) | Strategic Negotiation Levers | Carejoy Flexibility Model |

|---|---|---|---|

| Dental Clinics (Direct) | 3-5 units (historically) | Bundle with service contract; commit to spare parts agreement | MOQ 1 unit with 2-year service contract (valid for Carejoy CBCT only) |

| Distributors (Regional) | 8-12 units | Phased delivery: 30% upfront, balance quarterly over 6 months | MOQ 5 units with staggered delivery (50% on order, 50% COD) |

| Distributors (National) | 15+ units | Negotiate ex-factory pricing + free calibration toolkit | MOQ 10 units: includes on-site engineer training & calibration kit |

Key Negotiation Principles:

- Never accept “zero MOQ” claims: Indicates trading company markup or gray-market inventory

- Calibration costs: Demand MOQ pricing to include factory calibration (typ. $1,200/unit)

- Payment terms: Max 30% deposit; balance against Bill of Lading (avoid LC for first orders)

Step 3: Shipping Terms – DDP vs. FOB Risk Analysis

2026 tariff volatility (avg. 8.2% increase on medical imaging) makes FOB untenable for clinics. Use this decision matrix:

| Term | Cost Control | Regulatory Risk | Cash Flow Impact | Recommended For |

|---|---|---|---|---|

| FOB Shanghai | Low visibility (hidden port/customs fees) | High (buyer liable for import compliance) | Unpredictable (47% avg. cost overrun in 2025) | Experienced distributors with in-house customs brokers |

| DDP Destination | Fixed all-in cost (quoted upfront) | Supplier assumes compliance risk | Predictable (max 3% variance) | 95% of clinics & new distributors (Carejoy standard) |

DDP Implementation Checklist:

- Confirm DDP includes all destination charges (duty, VAT, customs handling)

- Verify supplier’s in-country regulatory agent (required for EU MDR Article 31)

- Demand Incoterms® 2020 definition in contract (avoid “DDU” ambiguity)

- Require real-time shipment tracking with customs clearance proof

Why Carejoy Excels in DDP Execution

As a vertically integrated manufacturer (not a trading company), Carejoy leverages:

• Direct contracts with DHL/FedEx for medical device lanes

• In-house regulatory team managing EU/US/ASEAN customs classifications

• Pre-cleared CBCT HS codes (8525.80.00 for EU; 8543.70.9660 for US)

• Guaranteed DDP quote validity: 60 days (vs. industry standard 14 days)

Conclusion: The 2026 Sourcing Imperative

Procuring CBCT from China requires treating suppliers as regulatory partners—not vendors. Prioritize manufacturers with:

✓ Full transparency in certification scope

✓ Flexible MOQ models tied to service commitments

✓ DDP execution capability with regulatory ownership

Shanghai Carejoy exemplifies this model with 19 years of audited compliance and factory-direct infrastructure. Their CBCT systems (e.g., CJ-3D Pro series) now power 1,200+ clinics across 47 countries under stringent DDP terms.

Request Verified CBCT Sourcing Documentation

Contact Shanghai Carejoy for:

• Live ISO 13485/NANDO verification access

• DDP cost calculator for your region

• 2026 distributor agreement template

Email: [email protected] | WhatsApp: +86 15951276160

Factory Address: Room 1208, Building 3, No. 1888 Jiangyang Road, Baoshan District, Shanghai, China

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

Topic: Frequently Asked Questions – Selecting the Best Dental CBCT System in 2026

Top 5 FAQs When Purchasing the Best Dental CBCT in 2026

As dental imaging technology advances, Cone Beam Computed Tomography (CBCT) systems continue to play a critical role in diagnostics, implant planning, and endodontic assessment. Below are key questions and expert answers to guide clinics and distributors in making informed procurement decisions in 2026.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental CBCT in 2026? | Most modern dental CBCT systems operate on standard 100–240V AC, 50/60 Hz, making them suitable for global deployment. However, high-output models (e.g., 3D maxillofacial units) may require dedicated 208V or 230V circuits with stable power supply. Always confirm voltage compatibility with local infrastructure and ensure grounding compliance per IEC 60601-1 standards. For clinics in regions with unstable power, integration with a medical-grade UPS (Uninterruptible Power Supply) is strongly recommended to protect sensitive imaging components. |

| 2. Are spare parts readily available for leading CBCT models, and what is the typical lead time? | Reputable manufacturers (e.g., Carestream, Planmeca, Vatech, and Acteon) maintain regional spare parts depots to support 48–72 hour turnaround for critical components like X-ray tubes, detectors, and gantry motors. Distributors should confirm local inventory agreements and ensure access to an authorized service network. In 2026, modular design trends have improved part interchangeability, reducing downtime. Always request a spare parts availability report and verify long-term support (minimum 7–10 years post-discontinuation) before procurement. |

| 3. What does the CBCT installation process involve, and how long does it typically take? | Professional CBCT installation includes site assessment, radiation shielding verification, electrical compliance, network integration, and system calibration. The process typically takes 1–2 days for standard units. High-end models with panoramic or cephalometric attachments may require additional configuration. Certified biomedical engineers perform the installation, ensuring compliance with local regulatory standards (e.g., FDA, CE, Health Canada). Clinics must prepare a dedicated, climate-controlled space with proper flooring load capacity and DICOM-compatible PACS integration. Pre-installation checklists are provided by manufacturers and must be completed prior to technician arrival. |

| 4. What warranty coverage is standard for premium dental CBCT systems in 2026? | Leading CBCT manufacturers offer a comprehensive 2-year warranty covering parts, labor, and technical support. Extended warranties up to 5 years are available, often including preventive maintenance and software updates. In 2026, premium packages may feature “uptime guarantees” (e.g., 95% operational availability) and remote diagnostics. The X-ray tube and flat-panel detector are typically covered under the base warranty but may have separate terms. Always review exclusions (e.g., damage from power surges or unauthorized repairs) and confirm on-site response time (ideally within 48 hours). |

| 5. How can clinics ensure long-term service and technical support after the warranty expires? | Post-warranty support should be addressed during procurement. Opt for manufacturers or distributors offering service level agreements (SLAs) with defined response times, remote troubleshooting, and annual maintenance contracts (AMCs). In 2026, AI-powered predictive maintenance is increasingly bundled with high-end CBCT systems, reducing unexpected failures. Distributors should verify their ability to provide firmware updates, regulatory compliance tracking, and access to trained field service engineers. A reliable support ecosystem is critical for minimizing downtime and ensuring ROI over the system’s 7–10 year lifecycle. |

Need a Quote for Best Dental Cbct?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160