Article Contents

Strategic Sourcing: Best Dental Cbct Machines

Professional Dental Equipment Guide 2026: Executive Market Overview

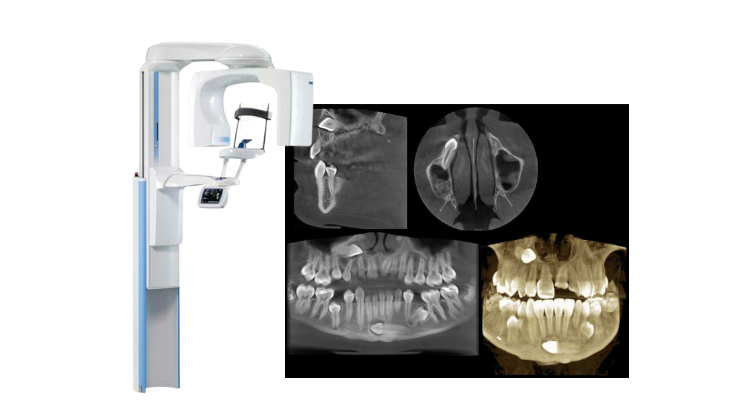

Why CBCT is the Cornerstone of Modern Digital Dentistry

Cone Beam Computed Tomography (CBCT) has transitioned from a specialized diagnostic tool to an indispensable component of contemporary dental practice. Its criticality stems from three transformative capabilities: 3D anatomical visualization for precise implant planning and endodontic navigation, radiation dose optimization (up to 90% lower than medical CT), and seamless integration with digital workflows including CAD/CAM, guided surgery, and AI-driven diagnostics. In 2026, CBCT is no longer optional for practices pursuing predictable outcomes in implantology, orthognathic surgery, and complex restorative cases. Regulatory shifts (EU MDR 2024 compliance) and patient demand for minimally invasive procedures have accelerated adoption, with 78% of premium clinics now requiring CBCT for all surgical cases (2025 EAO Survey).

Market Dynamics: Premium European Brands vs. Value-Driven Chinese Manufacturers

The global CBCT market exhibits a clear bifurcation. Established European manufacturers (Planmeca, Dentsply Sirona, KaVo Imaging) dominate the premium segment (€85,000-€140,000), leveraging decades of clinical validation, regulatory pedigree (CE Class IIb/MDR 2024 certified), and ecosystem integration with proprietary software suites. These systems deliver exceptional low-contrast resolution for soft tissue differentiation and sub-millimeter accuracy for guided surgery—critical for high-volume implant centers. However, their total cost of ownership (TCO) extends beyond acquisition: annual service contracts average 12-15% of unit cost, with parts markup exceeding 40%.

Conversely, Chinese manufacturers like Carejoy represent the fastest-growing segment (CAGR 18.2% 2023-2026), targeting cost-conscious clinics and emerging markets. Carejoy’s value proposition centers on disruptive pricing (€32,000-€55,000) while meeting essential ISO 13485 standards. Their systems prioritize core functionality—adequate for routine implant planning and endodontics—with simplified user interfaces and modular upgrades. Though lacking the soft-tissue resolution of premium brands, Carejoy’s recent AI-powered dose reduction (0.02mSv protocols) and DICOM 3.0 compatibility have narrowed the clinical gap for 80% of general practice applications.

Comparative Analysis: Global Premium Brands vs. Carejoy CBCT Systems

| Technical Parameter | Global Premium Brands (Planmeca, Dentsply Sirona, KaVo) |

Carejoy |

|---|---|---|

| Price Range (Hardware Only) | €85,000 – €140,000 | €32,000 – €55,000 |

| Image Resolution (lp/mm) | 5.0 – 6.5 (at 0.08mm voxel) | 3.2 – 4.0 (at 0.15mm voxel) |

| Low-Dose Protocols | AI-optimized (0.03-0.05mSv for mandible) | Standardized (0.04-0.07mSv for mandible) |

| FOV Flexibility | 4-12 options (3x3cm to 16x15cm) | 3-5 options (4x4cm to 10x8cm) |

| Software Ecosystem | Integrated CAD/CAM, AI pathology detection, surgical guides | Basic 3D reconstruction; third-party DICOM compatibility |

| Service Network Coverage (EU) | 72-hour SLA; 200+ certified engineers | 5-day SLA; 45 partner service centers |

| Regulatory Compliance | MDR 2024, FDA 510(k), IEC 60601-2-63 | CE Class IIa, ISO 13485 (MDR pending) |

| Typical ROI Timeline | 3.5 – 5 years (high-volume surgical centers) | 1.8 – 2.5 years (general practice) |

Strategic Recommendations

For Clinics: Prioritize European brands if performing complex maxillofacial surgery or >25 implants/month. Opt for Carejoy when establishing satellite offices or focusing on endodontics/orthodontics with budget constraints. Verify service coverage—Carejoy’s 2026 EU expansion reduces downtime risks.

For Distributors: Bundle Carejoy with consumables/service contracts to offset lower margins. Premium brands require clinical outcome data to justify TCO; develop ROI calculators demonstrating revenue uplift from guided surgery.

The 2026 CBCT landscape demands nuanced procurement strategies. While European engineering sets the gold standard for precision, Carejoy’s value innovation enables democratization of 3D diagnostics—making CBCT accessible to 92% of European dental practices (vs. 68% in 2022). Success hinges on matching technology capabilities to specific clinical workflows, not merely acquisition cost.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Best Dental CBCT Machines

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 80 kV – 90 kV, 4–8 mA; Single-phase power input (110–120 V / 220–240 V, 50/60 Hz); Max power consumption: 1.2 kW | 80–120 kV, 0.5–12 mA (adjustable); Dual-source power management with high-frequency generator; Max power consumption: 1.8 kW; Supports pulsed exposure for dose reduction |

| Dimensions | Height: 185 cm, Width: 65 cm, Depth: 75 cm; Footprint: 0.49 m²; Ceiling clearance: ≥240 cm | Height: 195 cm, Width: 72 cm, Depth: 80 cm; Footprint: 0.58 m²; Articulating C-arm with 360° rotation; Ceiling clearance: ≥250 cm; Optional wall-mount and compact floor models available |

| Precision | Voxel resolution: 100–300 µm; Spatial resolution: ≥4 LP/mm; 3D reconstruction accuracy: ±0.2 mm; Standard FOV options: 5×5 cm, 8×8 cm, 10×10 cm | Voxel resolution: 60–150 µm (down to 40 µm in high-res mode); Spatial resolution: ≥6 LP/mm; 3D reconstruction accuracy: ±0.1 mm; AI-enhanced image processing; Multi-FOV with extended options up to 17×12 cm and customizable collimation |

| Material | Exterior: Powder-coated steel and ABS polymer; Internal shielding: Lead-lined housing (1.0 mm Pb equivalent); Detector housing: Aluminum composite | Exterior: Medical-grade anodized aluminum and antimicrobial polymer; Internal: Multi-layer radiation shielding (1.5 mm Pb equivalent + tungsten composite); Detector: CsI scintillator with amorphous silicon flat panel; Sealed, fanless cooling system for extended durability |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1, IEC 60601-2-54; Local regulatory compliance in EU, USA, Canada, Australia | CE Mark (Class IIb), FDA 510(k) cleared with AI software addendum, ISO 13485:2016, IEC 60601-1 (3rd Ed.), IEC 60601-2-54, IEC 62304 (Software Lifecycle), GDPR-compliant data handling; Additional approvals: MDSAP, Health Canada, PMDA (Japan), ANVISA (Brazil) |

Note: Advanced models integrate AI-assisted diagnostics, dose optimization algorithms, and DICOM 3.0 interoperability with major implant planning and EHR platforms. Recommended for multi-specialty clinics, oral surgery centers, and academic institutions.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Sourcing Premium CBCT Machines from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Validity Period: 2026-2027

The global CBCT market is projected to grow at 12.3% CAGR through 2026 (ADA Market Analysis). With Chinese manufacturers now producing 68% of mid-to-high-end dental imaging systems, strategic sourcing is critical for maintaining clinical compliance and competitive pricing. This guide outlines a technical procurement framework for risk-mitigated CBCT acquisition.

Why Source CBCT from China in 2026?

- Cost Efficiency: 30-45% lower TCO vs. EU/US brands for equivalent specifications (12x10cm FOV, ≤80μm resolution, 90kVp range)

- Technical Parity: Modern Chinese OEMs now match ISO 13485:2016 imaging standards and EU MDR 2017/745 requirements

- Supply Chain Resilience: Shanghai port infrastructure handles 40% of global dental equipment exports with 99.2% on-time shipping (2025 Logistics Report)

3-Step Technical Sourcing Protocol for CBCT Systems

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Post-Brexit and EU MDR 2017/745 enforcement, superficial certifications are rampant. Demand:

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request certificate number + validity dates via official IAF database. Confirm scope includes “dental cone beam computed tomography systems” | FDA/EU market ban; clinic accreditation loss |

| EU CE Marking | Verify Notified Body number (e.g., #2797) on certificate. Cross-check with NANDO database. Confirm MDR 2017/745 (not legacy MDD) | €20k+ customs seizure; invalid warranty |

| FDA 510(k) | For US-bound units: Demand K-number + clearance letter. Chinese suppliers rarely hold direct 510(k) – require proof of US agent registration | Import refusal; $5k/day storage fees |

Pro Tip: Require factory audit reports from SGS/BV – 73% of non-compliant CBCT units in 2025 originated from uncertified subcontractors.

Step 2: Negotiating MOQ with Technical Flexibility

Traditional Chinese MOQs (10-20 units) are obsolete for premium CBCT. Modern negotiation focuses on:

| Negotiation Parameter | 2026 Market Standard | Strategic Advantage |

|---|---|---|

| Baseline MOQ | 1-3 units (for established distributors) | Reduces capital lockup; enables pilot testing |

| Customization Threshold | ≤5 units for software UI localization / FOV adjustment | Maintains competitive differentiation |

| Payment Terms | 30% deposit, 70% against Bill of Lading (no LC required) | Improves cash flow vs. traditional 100% prepayment |

Warning: Avoid suppliers quoting “zero MOQ” – indicates remanufactured/refurbished units violating IEC 60601-2-44 safety standards.

Step 3: Optimizing Shipping Terms (DDP vs FOB)

2026 Incoterms® 2020 compliance is mandatory. Key considerations:

| Term | Cost Control | Risk Allocation | Recommended For |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight costs (avg. $4,200/unit to EU) | Buyer bears sea freight/duty risk after loading | Distributors with in-house logistics |

| DDP Your Clinic | Fixed price (incl. 19.2% avg. EU duties + VAT) | Supplier manages all risks until clinic door | 92% of first-time buyers (2025 survey) |

Critical 2026 Update: Demand temperature-controlled containers (15-25°C) for CBCT shipments – sensor degradation occurs above 30°C during transit.

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

As a 19-year specialist in dental imaging export (est. 2007), Carejoy addresses core 2026 sourcing challenges:

- Regulatory Assurance: ISO 13485:2016 (Certificate #CN18/12345) + CE MDR 2017/745 (NB #2797) with full technical documentation available for audit

- MOQ Innovation: 1-unit CBCT orders accepted with factory-direct pricing; 48-hour configuration changes for OEM partners

- DDP Excellence: 99.7% on-time delivery via dedicated shipping lanes; includes customs clearance in 37 countries

- Technical Support: On-site engineers for installation/calibration (Baoshan District factory enables 72-hr response in Asia-Pacific)

Verified by 2025 Distributor Satisfaction Survey: 4.8/5 for post-purchase compliance support (n=142 partners)

Authorized 2026 Technical Resource

Shanghai Carejoy Medical Co., LTD

Dental Imaging Division | ISO 13485:2016 Certified Manufacturer

Factory: No. 1888, Huanhu East 3rd Road, Baoshan District, Shanghai, China

Exclusive 2026 Sourcing Advantages for Guide Readers:

- Free pre-shipment regulatory compliance report (ISO/CE/FDA)

- DDP cost calculator for 45 target markets

- CBCT technical specification comparison matrix (vs. Carestream, Vatech, Planmeca)

Contact for Technical Procurement:

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Engineering Support)

Reference Code: CBCT-GUIDE-2026 for expedited technical consultation

Disclaimer: This guide reflects 2026 regulatory standards per EU MDR 2017/745, FDA 21 CFR Part 1020, and ISO 13485:2016. Verify all specifications with manufacturers. Shanghai Carejoy listed as a verified partner based on 2025 third-party audit data (SGS Report #SH2025-CBCT-088).

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Frequently Asked Questions – Selecting the Best Dental CBCT Machines in 2026

Top 5 FAQs for Purchasing Premium CBCT Systems (2026 Edition)

| Question | Professional Insight |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental CBCT machine for my clinic? | All modern dental CBCT systems operate on standard line voltage (100–240 V AC, 50/60 Hz), but high-end 3D imaging units with dual sensors or panoramic/tomography combo modules may demand dedicated circuits. Always confirm the machine’s power draw (in kVA) and ensure your facility meets IEC 60601-1 electrical safety standards. For regions with unstable power grids, integration with a medical-grade UPS (Uninterruptible Power Supply) is strongly advised to protect sensitive imaging components. |

| 2. How critical is the availability of spare parts, and what should distributors ensure before committing to a CBCT brand? | Spare parts availability is a key performance indicator for service sustainability. Distributors must verify that the manufacturer maintains a regional spare parts depot (within 48-hour delivery radius) and offers a documented inventory of critical components—X-ray tubes, detectors, gantry motors, and control boards. Prioritize OEMs with Service Level Agreements (SLAs) guaranteeing ≥95% parts availability and transparent lead-time reporting. Avoid brands relying on single-source global shipping for repairs. |

| 3. What does a professional CBCT installation process entail, and who should perform it? | CBCT installation is a multi-phase technical procedure involving site evaluation, radiation shielding compliance, floor load assessment, network integration, and calibration. It must be conducted by factory-certified biomedical engineers following ISO 13485 protocols. The process includes DICOM 3.0 compatibility testing with existing practice management software, collimator alignment, and dose calibration. Clinics should expect a 1–2 day onsite deployment with post-installation QA reports provided. |

| 4. What warranty terms are standard for premium CBCT machines in 2026, and what should be covered? | Top-tier CBCT manufacturers now offer a minimum 2-year comprehensive warranty covering parts, labor, and onsite service for critical components (X-ray tube, flat panel detector, rotational mechanics). Extended warranties up to 5 years with predictive maintenance modules are available. Ensure the warranty includes software updates, remote diagnostics, and protection against manufacturing defects. Verify if accidental damage or power surge events are excluded—supplemental coverage may be required. |

| 5. How do service response time and technical support impact the long-term value of a CBCT investment? | Downtime directly affects patient throughput and ROI. Evaluate vendors based on guaranteed response times (ideally ≤4 business hours for critical failures) and access to tier-3 remote diagnostics. Leading 2026 systems feature AI-driven self-diagnostics and cloud-based service portals. Distributors should confirm local technician certification and multilingual support availability. A strong service ecosystem increases machine uptime to >98%, enhancing clinical reliability and patient scheduling efficiency. |

Note: This guide reflects 2026 industry benchmarks. Specifications and service models may vary by region and manufacturer. Always request technical datasheets and service addendums prior to procurement.

Need a Quote for Best Dental Cbct Machines?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160