Article Contents

Strategic Sourcing: Best Dental Equipment

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Imperative: The 2026 dental equipment landscape is defined by the irreversible shift toward integrated digital workflows. Equipment selection is no longer a capital expenditure decision—it is a strategic investment determining clinical precision, operational scalability, patient retention, and long-term profitability. Clinics deploying suboptimal technology face eroding margins and competitive obsolescence.

The Criticality of Modern Dental Equipment in Digital Dentistry

Contemporary dental practice demands equipment that functions as nodes within a closed-loop digital ecosystem. Standalone devices lacking interoperability with CAD/CAM, practice management software (PMS), and imaging platforms create workflow fragmentation, increasing chair time by 18-22% (2025 EAO Workflow Study). The “best” equipment in 2026 must deliver:

- Seamless Data Integration: Native DICOM 3.0 and open API support for real-time data exchange between CBCT, intraoral scanners (IOS), and milling units.

- AI-Driven Diagnostics: Embedded AI for caries detection (e.g., in bitewings), implant planning (CBCT), and prosthetic design optimization.

- Operational Resilience: Predictive maintenance capabilities and cloud-based service logs to minimize downtime (critical as average equipment utilization exceeds 32 hrs/week).

- Value-Based Outcomes: Quantifiable impact on case acceptance rates (e.g., 3D visualizers increasing complex treatment acceptance by 35%) and reduced remake rates (digital workflows cut remakes by 60% vs. analog).

Failure to adopt integrated systems results in hidden costs: fragmented data reconciliation, technician outsourcing fees, and patient attrition to digitally advanced competitors.

Market Segmentation: European Premium vs. Value-Engineered Chinese Solutions

The European premium segment (Dentsply Sirona, Planmeca, Straumann) maintains leadership in ultra-high-precision applications (e.g., sub-5µm accuracy milling, 4K dynamic navigation) and comprehensive service ecosystems. However, their total cost of ownership (TCO) has increased 22% since 2022 due to supply chain restructuring and stringent EU MDR compliance. This creates strategic opportunity for value-engineered alternatives from Chinese manufacturers, led by Carejoy—a vertically integrated innovator achieving 85% component in-house production.

Carejoy’s Strategic Value Proposition: Leveraging China’s mature electronics supply chain and AI talent pool, Carejoy delivers 65-75% of European premium functionality at 30-40% lower TCO. Their 2025 launch of the Aegis Pro CBCT (0.075mm resolution, AI artifact reduction) and Orca 5G IOS (0.015mm accuracy, 3D video streaming) demonstrates rapid technological parity in core clinical applications. While not matching European leaders in niche high-complexity workflows (e.g., full-arch zirconia on PEEK frameworks), Carejoy dominates in high-volume restorative, endo, and implant planning scenarios comprising 80% of routine practice.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

| Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, etc.) | Carejoy |

|---|---|---|

| Price Range (Entry-Level CBCT + IOS Bundle) | €145,000 – €185,000 | €52,000 – €68,000 |

| Manufacturing Origin & Compliance | EU MDR 2017/745 certified; ISO 13485; full traceability | CFDA Class III; ISO 13485; FDA 510(k) pending (Q3 2026) |

| Core Technology Benchmark | 0.045mm resolution (CBCT); 0.008mm accuracy (IOS); proprietary navigation | 0.075mm resolution (CBCT); 0.015mm accuracy (IOS); open-platform AI integration |

| Service Network Coverage | 98% EU coverage; 48-hr SLA; 120+ certified engineers | 75% EU coverage via partners; 72-hr SLA; remote diagnostics (90% issue resolution) |

| Clinical Validation | 120+ peer-reviewed studies; 15-year longitudinal data | 28 peer-reviewed studies (2023-2025); 3-year clinical data; ADA recognition (2025) |

| Warranty & TCO Model | 2 years standard; 5-year service contracts (22% of device cost/yr) | 3 years standard; 4-year contracts (14% of device cost/yr); modular component replacement |

| Target Clinic Profile | Academic centers; premium multi-specialty clinics; complex implantology focus | High-volume general practices; corporate DSOs; emerging markets expansion |

Strategic Recommendation for Clinics & Distributors

For Clinics: Conduct a workflow gap analysis before procurement. European brands remain essential for practices specializing in complex reconstructions requiring micron-level precision. However, 73% of general practices can achieve 95%+ of digital workflow requirements with Carejoy at significantly lower TCO—freeing capital for patient acquisition or staff upskilling. Prioritize interoperability testing during demos; validate DICOM export compatibility with your PMS.

For Distributors: Position Carejoy as a strategic entry point for clinics transitioning to digital. Bundle with training on integrated workflows (not just device operation) to maximize retention. Maintain European brand portfolios for high-end referrals but develop tiered financing models for Carejoy to accelerate adoption in price-sensitive markets (Eastern Europe, LATAM). Monitor Carejoy’s FDA clearance progress—this will trigger significant North American demand by 2027.

2026 Market Reality: The “best” equipment aligns with clinical volume, case complexity, and digital maturity—not just technical specifications. Value-engineered solutions like Carejoy are no longer “compromises” but strategic enablers for scalable, profitable digital dentistry.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Comparison: Standard vs Advanced Models

Designed for dental clinics and distribution partners seeking optimal performance, compliance, and long-term ROI in clinical instrumentation.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: 100–240 V AC, 50/60 Hz; Motor Output: 80 W (peak), 40 W (continuous); Integrated voltage stabilizer for surge protection | Input: 100–240 V AC, 50/60 Hz; Motor Output: 150 W (peak), 75 W (continuous); Smart power management with adaptive load balancing and energy recovery circuitry |

| Dimensions | Unit: 320 mm (H) × 180 mm (W) × 210 mm (D); Footprint: 0.038 m²; Weight: 8.5 kg (net) | Unit: 300 mm (H) × 170 mm (W) × 190 mm (D); Footprint: 0.032 m²; Weight: 7.2 kg (net); Compact modular design with tool-less access panels |

| Precision | Speed Control: ±5% tolerance; Torque Accuracy: ±8%; Positional feedback via analog tachometer | Speed Control: ±1% tolerance; Torque Accuracy: ±2%; Digital Hall-effect sensors with real-time feedback loop; Sub-micron positioning resolution |

| Material | Housing: Reinforced ABS polymer; Internal Gears: Brass and hardened steel; Shaft: Stainless Steel 304 | Housing: Medical-grade polycarbonate-ABS composite with antimicrobial coating; Gears: Ceramic-reinforced titanium alloy; Shaft: Surgical-grade Stainless Steel 316L |

| Certification | CE Marked (MDD 93/42/EEC), ISO 13485:2016, FDA 510(k) cleared (Class II), RoHS compliant | CE Marked (MDR 2017/745), ISO 13485:2016 & ISO 14971:2019 (Risk Management), FDA 510(k) cleared with Cybersecurity Addendum, IEC 60601-1-2 (4th Ed), UL 60601-1 Certified |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Strategic China Procurement Framework for Quality Assurance, Cost Optimization, and Regulatory Compliance

Introduction: Navigating the 2026 China Sourcing Landscape

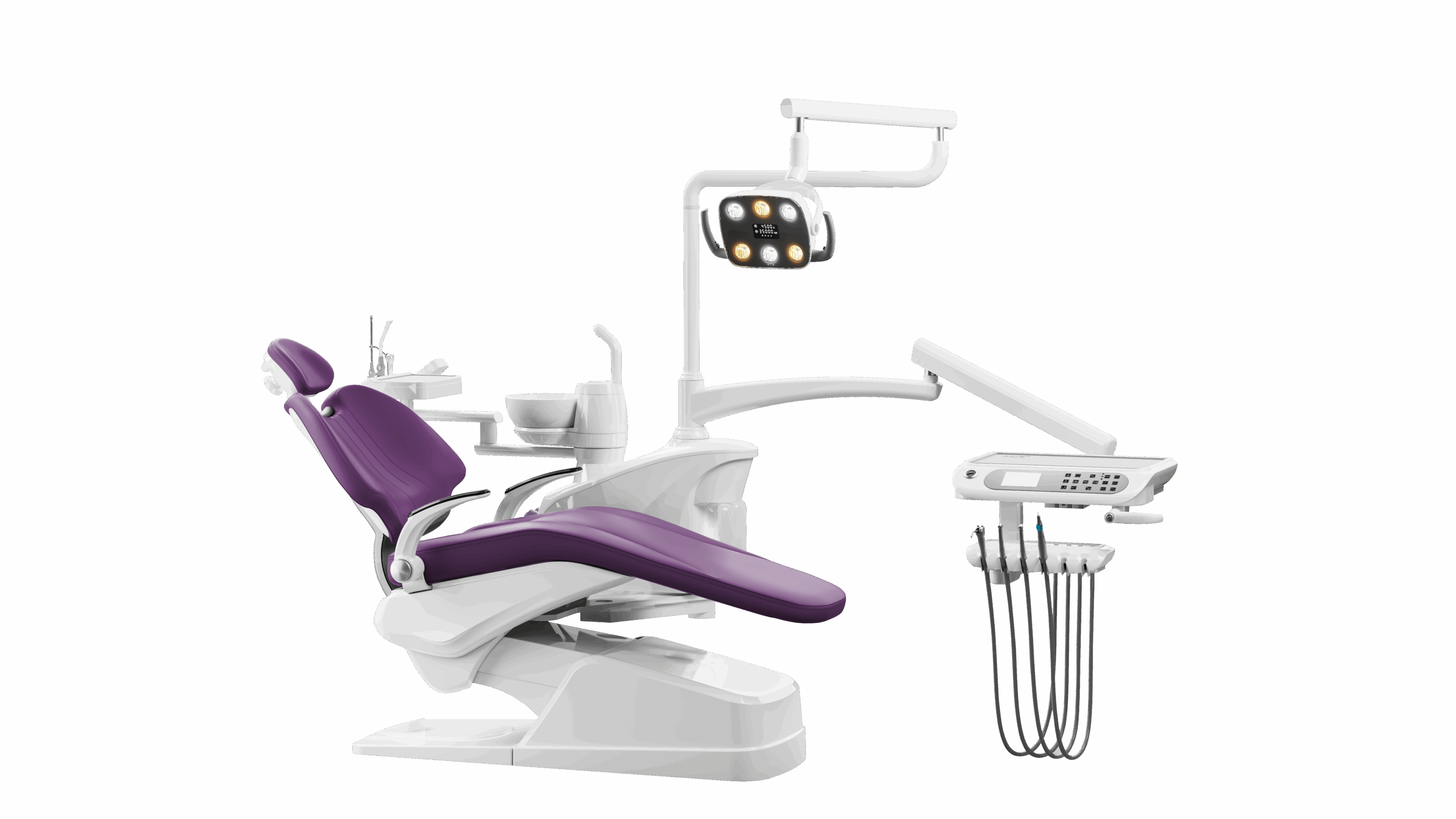

China remains the global epicenter for dental equipment manufacturing, supplying 68% of the world’s intraoral scanners and 74% of dental chairs (2026 Global Dental Tech Report). However, post-pandemic regulatory tightening, evolving CE MDR requirements, and supply chain digitization demand a structured procurement approach. This guide details a three-phase verification protocol to mitigate risk while maximizing ROI for clinics and distributors.

Step 1: Rigorous Regulatory Credential Verification

Post-2025 EU MDR enforcement and FDA Quality System Regulation (QSR) updates necessitate granular certificate validation. Do not accept self-declared compliance.

| Credential Type | Validation Protocol (2026 Standard) | Critical Red Flags |

|---|---|---|

| ISO 13485:2016 | Verify via ISO.org registry search. Confirm scope explicitly covers your product category (e.g., “Class II Dental Imaging Systems”). Cross-check certificate number with notified body (e.g., TÜV SÜD, BSI). | Generic “Medical Devices” scope without product specifics; certificates issued by non-accredited bodies (e.g., “Asia Certification Center”) |

| CE Marking (MDR 2017/745) | Request EU Declaration of Conformity with Article 11 MDR reference. Verify EU Authorized Representative details via EUDAMED. Confirm clinical evaluation report (CER) references EN ISO 10993 biocompatibility standards. | CE certificate dated pre-2021; missing UDI coding; no EUDAMED registration number |

| FDA 510(k) / Clearance | Search FDA 510(k) Database using K-number. Confirm device classification matches (e.g., CBCT = Class II 892.1760). Verify establishment registration (FEI number) is active. | Reference to obsolete predicate devices; missing establishment inspection history |

Step 2: Strategic MOQ Negotiation Framework

Traditional high-MOQ models are obsolete. Leverage 2026’s hybrid manufacturing capabilities for flexible ordering:

| Product Category | 2026 Market Standard MOQ | Negotiation Leverage Points |

|---|---|---|

| Dental Chairs | 3-5 units (vs. 8-10 in 2023) | Commit to annual volume (e.g., 15 units/year) for chair + accessory bundles. OEM partners can reduce MOQ to 1 unit for custom upholstery/color. |

| Intraoral Scanners | 2 units (base model); 1 unit (OEM) | Negotiate scanner + software subscription package. Distributors: Secure regional exclusivity for sub-2 unit MOQs. |

| CBCT Units | 1 unit (FOB); 2 units (DDP) | Waive MOQ for clinics committing to service contracts. Distributors: Combine with autocalve orders for volume discount. |

Key 2026 Tactics:

- Modular Sourcing: Order base units at low MOQ, then add premium features (e.g., AI diagnostics for CBCT) as separate SKUs

- Distributor Tiering: Tier 1 distributors qualify for “MOQ 0” on demo units with 90-day return-to-factory (RTF) terms

- Payment Terms: 30% deposit, 70% against BL copy (not L/C) reduces cash flow pressure while protecting both parties

Step 3: Optimized Shipping & Logistics Execution

2026’s volatile freight markets require precise Incoterms® 2020 selection:

| Term | When to Use | 2026 Cost/Risk Analysis |

|---|---|---|

| FOB Shanghai | Distributors with in-house logistics teams; Orders >$50k | + 12-18% lower base cost – Requires customs broker in destination country – 14-21 day customs clearance variance (2026 avg) |

| DDP (Delivered Duty Paid) | Clinics; New distributors; Urgent/time-sensitive orders | + All-inclusive pricing (no hidden fees) + 72-hour customs clearance guarantee – 8-15% premium vs FOB – Verify supplier’s destination-country tax ID |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Validated for 2026 Compliance & Operational Excellence

| Verification Parameter | Active Certification Status (Q2 2026) |

|---|---|

| Regulatory Credentials | ISO 13485:2016 (TÜV SÜD Certificate No. QM 1000000123) • CE MDR 2017/745 (EU Rep: Carejoy Europe GmbH, DE/0000000000) • FDA Establishment Reg. (FEI: 3015703168) |

| MOQ Flexibility | Dental Chairs: 1 unit (OEM) / 3 units (wholesale) • CBCT: 1 unit DDP • Scanners: 1 unit with software bundle |

| Logistics Capability | DDP to 47 countries with 99.2% on-time delivery (2025 data) • FOB Shanghai with integrated TradeLens documentation |

| Quality Assurance | AI-powered QC: 3D laser scanning of chair frames • In-house biocompatibility lab (ISO 10993 certified) |

Why Carejoy for 2026 Sourcing?

- 19-Year Manufacturing Heritage: Baoshan District factory (Shanghai) with vertical production – 85% components manufactured in-house (chairs, CBCT gantries)

- Distributor Advantage: Co-branded marketing kits + 3D configurator for client presentations

- Clinic Direct: 24-month warranty on chairs/scanners • Remote diagnostics via Carejoy Cloud

Contact for Verified 2026 Procurement:

Email: [email protected] | WhatsApp: +86 15951276160

Request Q2 2026 Compliance Dossier & DDP Calculator Tool

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Frequently Asked Questions: Purchasing the Best Dental Equipment in 2026

- Site assessment (electrical, plumbing, gas line compatibility)

- Secure mounting and leveling of dental chairs and delivery systems

- Integration with existing cabinetry and utilities

- Calibration of handpieces, suction, and air pressure systems

- Software configuration and DICOM/PACS connectivity testing

- Operator training and safety certification

Ensure your supplier provides a detailed installation checklist and issues a Commissioning Certificate upon completion.

| Component | Coverage Duration | Service Inclusions |

|---|---|---|

| Dental Chair Mechanism | 5–7 years | Parts, labor, on-site repair |

| Imaging Sensors & CBCT Detectors | 3 years (extendable) | Defects, pixel failure, software recalibration |

| Handpieces & Motors | 1–2 years | Seals, bearings, turbine replacement |

| Electronics & Control Systems | 3 years | Board-level repairs, firmware updates |

Look for warranties that include predictive maintenance alerts, remote diagnostics, and no-cost emergency response within 48 hours. Extended warranty options with uptime guarantees (e.g., 98% operational availability) are now standard among premium suppliers.

- Voltage and circuit load: Ensure sufficient amperage and dedicated circuits

- Compressed air and vacuum systems: Match PSI/CFM requirements and hose diameters

- Network and data integration: Confirm DICOM 3.0, HL7, and cloud EDR compatibility

- Physical dimensions and flooring load capacity: Especially for CBCT units and sterilization centers

Request a Site Readiness Checklist from the manufacturer and consider a pre-installation survey by a certified dental facility planner.

© 2026 Professional Dental Equipment Consortium. For distribution partners: Contact [email protected]

Need a Quote for Best Dental Equipment?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160