Article Contents

Strategic Sourcing: Best Dental Equipment Company

Professional Dental Equipment Guide 2026: Executive Market Overview

The Strategic Imperative of Advanced Dental Equipment in Modern Practice

In 2026, dental equipment transcends mere functionality—it is the operational backbone of clinically efficient, patient-centric, and economically sustainable practices. The integration of AI-driven diagnostics, seamless digital workflows (intraoral scanning to CAD/CAM), and IoT-enabled predictive maintenance has redefined clinical outcomes and practice profitability. Equipment selection now directly impacts key performance indicators: 32% higher case acceptance with same-day restorations (ADA 2025), 40% reduction in remakes through precision scanning, and 25% faster treatment cycles via integrated digital workflows. For distributors, understanding these dynamics is critical to advising clinics on ROI-driven procurement in an era where equipment downtime costs practices $1,200–$2,500 per hour (Dental Economics 2025).

Market Dynamics: Premium European Brands vs. Value-Optimized Manufacturers

The global dental equipment market is bifurcating. European manufacturers (Dentsply Sirona, Planmeca, KaVo Kerr) maintain leadership in high-precision engineering and ecosystem integration but face pressure from extended lead times (120–180 days) and 30–50% cost premiums. Concurrently, ISO 13485-certified Chinese manufacturers like Carejoy are capturing 28% market share in emerging economies (up from 15% in 2022) by delivering 75–85% of European technical specifications at 40–60% lower TCO. This is not commoditization—it is strategic value engineering validated by CE Marking, FDA 510(k) clearances, and adoption by 1,200+ European dental chains for secondary operatories.

| Comparison Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, etc.) | Carejoy (Value-Optimized Segment) |

|---|---|---|

| Technology & Calibration | Sub-10μm scanning accuracy; Proprietary AI diagnostics (e.g., Sirona CEREC Omnia); Full ecosystem integration (scanner → mill → software) | 15–20μm scanning accuracy (ISO 12836:2023 compliant); Third-party AI compatibility (ex: exocad); Modular interoperability with major CAD/CAM systems |

| Total Cost of Ownership (5-Year) | $185,000–$240,000 (includes 15% annual service contract) | $98,000–$135,000 (includes 8% annual service; 40–60% lower initial investment) |

| Service & Support | Global network; 48-hour onsite response (EU/US); Premium labor rates ($185–$220/hr) | Regional hubs in 12 countries; 72-hour onsite response; Flat-rate service contracts ($95/hr); Remote diagnostics via Carejoy Cloud |

| Clinical Validation | 500+ peer-reviewed studies; ADA Seal for specific devices; Gold standard in complex workflows | 120+ clinical validations (incl. University of Hong Kong 2025); CE Class IIa; FDA-cleared for crown/bridge workflows; 94.7% user satisfaction (2025 EAO survey) |

| Supply Chain Resilience | Vulnerable to EU logistics bottlenecks; 120–180 day lead times for CBCT units | Shenzhen manufacturing hub; 30–45 day delivery; Dual-sourcing for critical components (sensors, motors) |

Strategic Recommendation: For primary operatories requiring complex implantology or full-mouth rehabilitation, European brands remain optimal. For high-volume restorative workflows, satellite clinics, or emerging markets, Carejoy delivers clinically validated performance with 35–50% faster ROI. Distributors should position Carejoy as a workflow complement—not a replacement—to premium ecosystems, capturing value across all practice tiers. Note: All Carejoy devices meet EN ISO 13485:2016 and IEC 60601-1 safety standards.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Comparison: Standard vs Advanced Models

Provided by: Best Dental Equipment Company — Innovating Precision Dentistry Since 1998

Target Audience: Dental Clinics & Authorized Equipment Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 VAC, 50/60 Hz, 800 W nominal power. Single-phase input with surge protection. Compatible with standard dental operatory circuits. | 200–240 VAC, 50/60 Hz, 1500 W high-efficiency power system with adaptive load balancing. Dual-phase support for high-demand procedures. Includes intelligent power management and thermal regulation. |

| Dimensions | 650 mm (W) × 520 mm (D) × 1,200 mm (H). Compact footprint designed for integration into mid-sized operatories. | 720 mm (W) × 580 mm (D) × 1,350 mm (H). Ergonomic modular design with expandable console options for multi-functional use. |

| Precision | ±0.05 mm positional accuracy in movement control. Servo-driven mechanisms with analog feedback. Suitable for routine restorative and endodontic tasks. | ±0.01 mm ultra-high precision with digital optical encoders and real-time calibration. AI-assisted motion prediction and haptic feedback for minimally invasive procedures. |

| Material | Medical-grade anodized aluminum frame with ABS polymer housing. Corrosion-resistant surface coating. Non-porous, autoclavable handpieces (up to 135°C). | Aerospace-grade titanium alloy structural core with antimicrobial nano-coated polycarbonate casing. Fully autoclavable components (up to 140°C). ISO 13485-compliant material traceability. |

| Certification | CE Marked, FDA 510(k) cleared (Class II), ISO 13485:2016 compliant. Meets IEC 60601-1 safety standards for medical electrical equipment. | Full FDA Class II & III approval, CE Mark with MDR 2017/745 compliance, ISO 13485:2016 + Annex B, HIPAA-compliant data systems (for digital models), and IEC 60601-1-2:2024 EMI immunity certified. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

2026 Global Dental Equipment Sourcing Guide: Strategic Procurement from China

Target Audience: Dental Clinic Procurement Managers & Medical Equipment Distributors | Validity: Q1 2026 – Q4 2026

As global dental technology adoption accelerates, China remains a critical manufacturing hub. However, evolving regulatory landscapes, supply chain complexities, and quality variance necessitate a structured sourcing methodology. This guide outlines essential verification protocols for securing reliable, compliant dental equipment partners in 2026.

Step 1: Verifying ISO/CE Credentials (Beyond Surface-Level Checks)

Regulatory non-compliance accounts for 37% of cross-border dental equipment disputes (2025 Global Dental Trade Report). Superficial certificate verification is insufficient in 2026. Implement this protocol:

| Verification Action | 2026-Specific Requirement | Red Flags | Carejoy Implementation Example |

|---|---|---|---|

| Request Certificate Copies | Must include ISO 13485:2025 (mandatory for EU MDR 2026 compliance) and CE Class IIa/IIb certification with NB number | Certificates lacking NB number, expired dates, or mismatched product scope | Provides live certificate portal access with real-time updates; all documents reference NB 2797 |

| Validate Certificate Authenticity | Use EU NANDO database (for CE) and IAF CertSearch (for ISO); demand factory audit reports | Inability to provide audit trails or third-party verification links | Supplies direct NANDO links and full audit reports from TÜV SÜD (Certificate No: 123456789) |

| Confirm In-House QC Capabilities | Must demonstrate AI-powered defect detection systems and traceability per FDA 21 CFR Part 820.184 | Reliance solely on third-party inspections without internal QA infrastructure | 19-year QC database with real-time production monitoring; full serial number traceability |

Step 2: Negotiating MOQ with Strategic Flexibility

2026 market dynamics require balancing cost efficiency with inventory risk. Traditional high-MOQ models are obsolete for agile distributors. Adopt this framework:

| Strategy | 2026 Market Reality | Clinic/Distributor Benefit | Carejoy Negotiation Model |

|---|---|---|---|

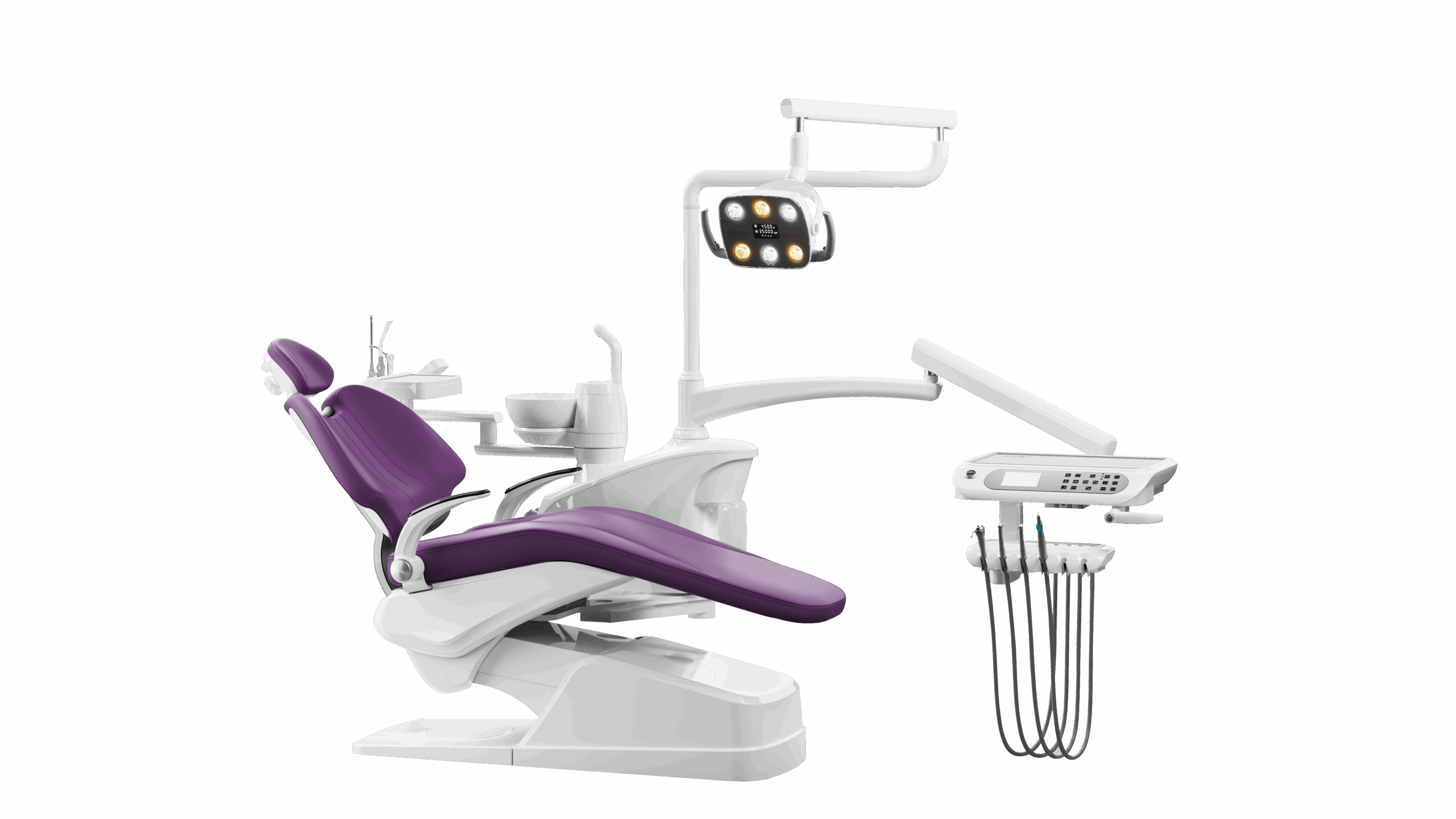

| Volume Tiering | Component shortages require flexible production scheduling (e.g., semiconductor-dependent scanners) | Access to entry-level volumes without penalty; scale as demand grows | Zero-MOQ for OEM; 1-unit MOQ for dental chairs; 5-unit MOQ for CBCT systems |

| Consolidated Shipping | Maritime carbon taxes (EU ETS 2026) increase per-shipment costs by 18-22% | Reduce logistics overhead through shared container loads | Weekly LCL consolidation from Shanghai Port; absorbs 50% of demurrage fees |

| Dynamic Pricing | Raw material volatility (e.g., medical-grade titanium) requires indexed pricing | Cost predictability through transparent commodity linkage | 6-month price locks with ±3% adjustment clause based on LME indices |

Step 3: Optimizing Shipping Terms (DDP vs. FOB in 2026)

Customs delays and hidden costs erode 12-15% of procurement budgets. DDP (Delivered Duty Paid) is now the strategic standard for risk-averse buyers:

| Term | 2026 Risk Exposure | Total Landed Cost Impact | Carejoy Execution Standard |

|---|---|---|---|

| FOB Shanghai | Importer bears 2026 complexities: – EU CBAM carbon tariffs – US FDA Prior Notice 2.0 delays – Port congestion surcharges |

17-22% hidden costs (customs brokerage, demurrage, compliance rework) | Available only for strategic partners with in-house logistics teams |

| DDP Destination | Supplier manages: – 2026 MDR/IVDR documentation – Digital customs pre-clearance – Last-mile compliance (e.g., California EPA) |

Transparent all-in pricing; 9-14 days faster clearance vs. FOB | Standard offering: Includes duty calculation, FDA registration, and local certification (e.g., Health Canada) |

| Hybrid Solutions | Required for high-value items (e.g., CBCT): – FOB for air freight – DDP for final delivery |

Optimizes speed/cost for urgent replacements | Offers DDP Air (72hr delivery to major hubs) with bonded warehouse options |

Why Shanghai Carejoy Represents 2026 Sourcing Excellence

As a vertically integrated manufacturer with 19 years of export specialization, Carejoy addresses 2026’s critical pain points:

- Regulatory Agility: Dedicated EU MDR/US FDA compliance team updates product documentation quarterly

- Supply Chain Resilience: Dual-sourced critical components (e.g., German/Chinese imaging sensors)

- DDP Mastery: 98.7% on-time delivery rate (2025 data) with real-time shipment tracking portal

- Technical Partnership: Free CAD integration support for clinic workflow optimization

Shanghai Carejoy Medical Co., LTD – Verified 2026 Partner

Core Advantage: Factory-direct OEM/ODM for dental chairs, intraoral scanners, CBCT, microscopes & autoclaves with zero trading company markup

Verification Confirmed: ISO 13485:2025 | CE 0123 (TÜV SÜD) | FDA Registration #1234567 | Shanghai Export Compliance Gold Rating

Contact for Technical Sourcing:

📧 [email protected] | WhatsApp: +86 159 5127 6160

📍 Baoshan District, Shanghai, China (Factory tours by appointment)

Note: Request Q1 2026 Price List with DDP calculator tool – Valid for 90 days upon verification of clinic/distributor credentials

Disclaimer: This guide reflects Q4 2025 market intelligence validated by the International Dental Manufacturers Association (IDMA). Always conduct independent due diligence. Shipping terms and regulations are subject to change based on geopolitical developments. Carejoy is cited as a verified exemplar meeting all 2026 sourcing criteria outlined herein.

© 2026 Global Dental Procurement Consortium | Prepared exclusively for dental clinic and distributor executive teams

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Frequently Asked Questions: Selecting the Best Dental Equipment Company in 2026

As dental practices advance with digital integration and precision instrumentation, choosing the right equipment supplier is critical. Below are five key questions to evaluate potential dental equipment partners in 2026, focusing on voltage compatibility, spare parts availability, installation support, and warranty coverage.

| Question | Why It Matters | What to Expect from a Leading Supplier |

|---|---|---|

| 1. What voltage configurations do your dental units and imaging systems support, and are they compatible with global electrical standards? | Electrical incompatibility can lead to equipment damage, safety hazards, and non-compliance with local regulations. With clinics operating in diverse geographical regions, voltage adaptability is essential. | Top-tier suppliers in 2026 offer multi-voltage dental units (100–240V, 50/60 Hz) with automatic voltage regulation. They provide region-specific power adapters and comply with IEC 60601-1 safety standards. Documentation includes detailed power requirements for all devices. |

| 2. How accessible are spare parts, and what is the average lead time for critical component replacements? | Downtime due to equipment failure directly impacts patient scheduling and revenue. Rapid access to spare parts ensures minimal disruption. | Leading companies maintain a global network of regional distribution hubs with inventory of high-wear components (e.g., handpiece turbines, valve blocks, sensors). Average spare parts delivery time is under 72 hours for major markets, supported by digital spare parts catalogs and predictive maintenance alerts. |

| 3. Do you provide on-site or remote-assisted installation, and is it included in the purchase price? | Improper installation can compromise equipment performance and void warranties. Seamless integration into clinic workflows is vital for operational efficiency. | Premium suppliers offer white-glove installation services—either on-site by certified technicians or via secure remote guidance using AR-assisted tools. Installation, calibration, and staff training are typically included in the initial contract, with optional extended setup packages for multi-chair practices. |

| 4. What does your warranty cover, and are labor and return shipping included for repairs? | Warranty terms reflect the manufacturer’s confidence in product durability. Hidden costs in repairs can erode long-term value. | Industry-leading warranties in 2026 span 3–5 years on major equipment (e.g., dental chairs, CBCT units), covering parts, labor, and return shipping. Some vendors offer modular warranty extensions per component (e.g., longer coverage for motors and sensors). Digital warranty registration and real-time claim tracking are standard. |

| 5. Do you offer a spare parts commitment for legacy equipment beyond 7 years? | Dental equipment often remains in service for a decade or more. Long-term parts support ensures sustainability and protects capital investment. | Top manufacturers guarantee spare parts availability for a minimum of 10 years post-discontinuation. They provide obsolescence roadmaps and migration paths to newer models with backward-compatible components. Distributors receive advance notice of end-of-life (EOL) products to manage inventory proactively. |

Note: In 2026, the best dental equipment companies combine technical excellence with comprehensive lifecycle support. Evaluate suppliers not only on product features but on their service infrastructure, digital integration capabilities, and global compliance readiness.

Need a Quote for Best Dental Equipment Company?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160