Article Contents

Strategic Sourcing: Best Dental Milling Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Imperative: Dental Milling Machines in the Digital Dentistry Ecosystem

Dental milling machines represent the operational cornerstone of modern digital dentistry workflows. As clinics transition from analog to fully integrated digital pipelines, in-house milling capability has evolved from a luxury to a clinical and economic necessity. These systems enable same-day restorations (CEREC-style workflows), reduce laboratory outsourcing costs by 40-60%, minimize remakes through precision manufacturing, and enhance patient satisfaction via expedited treatment cycles. Critically, milling machines serve as the physical interface between intraoral scanning data and final restorations—transforming digital impressions into monolithic zirconia, PMMA, composite, or metal frameworks with micron-level accuracy. Clinics without in-house milling face diminishing competitiveness in an era where 78% of patients now expect same-day crown services (2025 DSO Benchmarking Report).

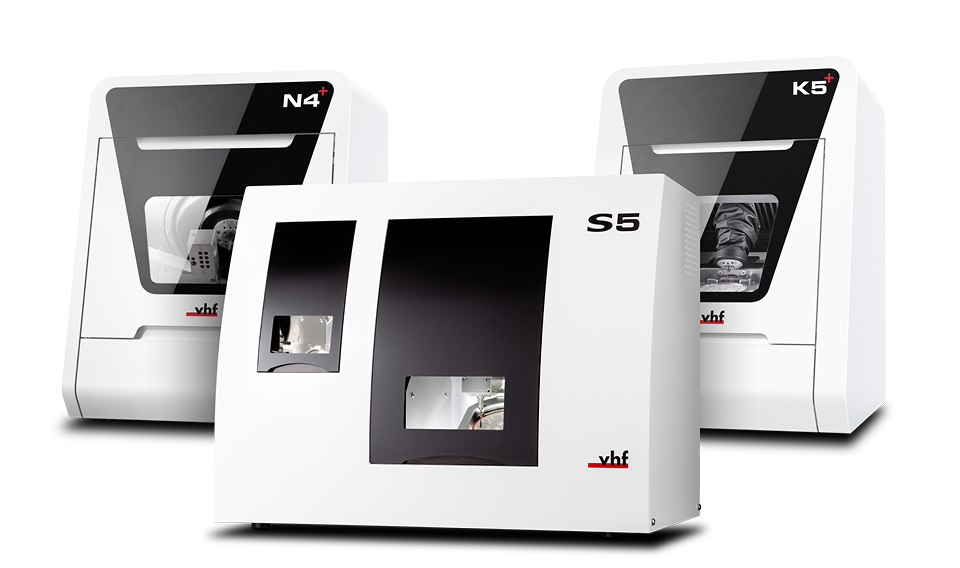

Market Segmentation: Premium European vs. Value-Engineered Asian Solutions

The global dental milling market bifurcates into two strategic segments. European manufacturers (e.g., Dentsply Sirona, Amann Girrbach, Planmeca) dominate the premium tier with systems engineered for maximum precision, material versatility, and seamless ecosystem integration. These platforms command $85,000–$150,000+ price points, justified by clinical-grade reliability, comprehensive service networks, and proprietary software suites. Conversely, Chinese manufacturers—exemplified by Carejoy—deliver compelling value-engineered alternatives at $28,000–$45,000. While historically associated with quality concerns, next-generation Chinese systems now achieve clinically acceptable precision (±15–25µm) through improved linear guides, thermal compensation algorithms, and ISO 13485-certified manufacturing. This segment targets cost-conscious private practices, emerging-market clinics, and distributors seeking higher-margin entry points into digital dentistry.

| Parameter | Global Premium Brands (e.g., Dentsply Sirona, Amann Girrbach) | Carejoy (Representative Value Segment) |

|---|---|---|

| Positioning | Gold-standard clinical performance; integrated digital ecosystem | Cost-optimized entry into in-house digital fabrication |

| Price Range (USD) | $85,000 – $150,000+ | $28,000 – $45,000 |

| Material Versatility | Full spectrum: Zirconia (all densities), Lithium Disilicate, CoCr, Titanium, PMMA, Wax | Targeted: Zirconia (up to 5Y), PMMA, Wax, Resin composites (limited metal) |

| Accuracy (ISO 12836) | ±8–12 µm (trueness), ±5–8 µm (precision) | ±18–25 µm (trueness), ±12–18 µm (precision) |

| Software Ecosystem | Proprietary CAD/CAM suites with cloud integration, AI-driven design optimization, multi-unit frameworks | Open-architecture compatibility (exocad, 3Shape); limited AI features; basic framework tools |

| Service & Support | Global 24/7 technical support; on-site engineers; 2–5 year comprehensive warranties | Regional service hubs; remote diagnostics; 1-year limited warranty; extended contracts available |

| Ideal User Profile | High-volume DSOs, specialty clinics, practices demanding maximum material flexibility and uptime | Single- or multi-doctor private practices; emerging markets; clinics prioritizing ROI on digital transition |

*Data reflects 2026 market averages. Precision metrics measured per ISO 12836 on standardized test geometries. Material compatibility varies by specific model.

Strategic Recommendation for Stakeholders

For Dental Clinics: Premium European systems remain optimal for high-volume practices requiring maximum material versatility and clinical precision. However, Carejoy-type platforms deliver 85–90% of clinical functionality at 40–60% lower TCO, making them viable for 80% of routine single-unit restorations. Prioritize systems with open CAD compatibility to avoid vendor lock-in.

For Distributors: The value segment (led by Carejoy) represents the fastest-growing channel (22% CAGR 2024–2026). Margin structures exceed 35% vs. 20–25% for premium brands. Success requires bundling with training and service contracts—addressing historical concerns about technical support. Position Carejoy not as “budget” but as “strategically optimized” for core workflows.

As digital dentistry matures, milling machines will increasingly integrate with AI-driven design automation and hybrid additive-subtractive workflows. Clinics delaying adoption risk significant competitive erosion, while distributors must balance premium and value portfolios to capture full-market demand.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Best Dental Milling Machines

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 800 W AC motor, 24 V DC supply, 3.5 A operating current | 1500 W high-torque spindle motor, 48 V DC supply, 6.2 A operating current with active cooling system |

| Dimensions (W × D × H) | 420 mm × 580 mm × 380 mm | 520 mm × 680 mm × 450 mm (integrated dust extraction module) |

| Precision | ±5 µm linear accuracy, 0.1° angular tolerance | ±2 µm linear accuracy with laser calibration system, 0.05° angular tolerance |

| Material Compatibility | Zirconia (up to 5Y), PMMA, composite blocks, wax | Full-spectrum: Zirconia (3Y to 5Y), lithium disilicate, CoCr, titanium Grade 2, PMMA, hybrid ceramics, wax, and experimental polymer blocks |

| Certification | CE Marked, ISO 13485:2016, FDA Class I registered | CE Marked, ISO 13485:2016, FDA 510(k) cleared Class II, IEC 60601-1 compliant, RoHS 3 certified |

Note: The Advanced Model supports 5-axis simultaneous milling and integrates with CAD/CAM ecosystems via open STL/DXF protocols. Recommended for high-volume laboratories and multi-unit clinical networks. The Standard Model is optimized for single-operator clinics with moderate daily production.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Strategic Sourcing of Dental Milling Machines from China

Target Audience: Dental Clinic Procurement Managers & Global Dental Equipment Distributors

Publication Date: Q1 2026 | Validity Period: 2026-2027

As global demand for precision dental CAD/CAM solutions surges, China remains a strategic manufacturing hub for dental milling machines. However, 2026 market dynamics necessitate rigorous due diligence to mitigate quality, compliance, and supply chain risks. This guide outlines critical steps for sourcing certified, reliable milling systems directly from Chinese manufacturers.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Post-EU MDR 2021 and updated FDA QSR requirements, valid ISO 13485:2016 certification is mandatory for all Class II medical devices. China’s National Medical Products Administration (NMPA) now enforces stricter alignment with IMDRF standards. Avoid suppliers with:

- Expired or unverifiable certificates

- Certifications covering only “general machinery” (not Class II medical devices)

- CE marks issued by non-notified bodies (verify via NANDO database)

| Credential Verification Step | 2026 Critical Actions | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request certificate + scope document showing “dental CAD/CAM milling systems” explicitly listed. Cross-check with certification body’s online registry (e.g., SGS, TÜV) | Customs seizure (EU/US), voided warranties, clinic liability exposure |

| CE Marking | Confirm certificate references MDR 2017/745 (not old MDD 93/42/EEC). Verify Notified Body number format (e.g., “0123”) via NANDO | EU market ban, distributor contract termination |

| NMPA Registration | Demand NMPA Class II registration certificate (国械注准) for dental milling equipment. Valid registrations now require clinical performance data | Chinese export license denial, shipment delays |

Step 2: Negotiating MOQ (Minimum Order Quantity)

2026 market shifts favor flexible MOQ structures. Leading manufacturers now offer tiered models to accommodate clinics and distributors:

| Buyer Type | 2026 Standard MOQ Range | Negotiation Leverage Points | Strategic Recommendation |

|---|---|---|---|

| Dental Clinics (Direct) | 1-2 units (for premium models) | Commit to service contract; bundle with consumables (burs, blocks) | Target suppliers with clinic-focused service networks (e.g., on-site engineers) |

| Regional Distributors | 5-10 units (model-dependent) | Multi-year volume commitment; co-marketing investment; exclusive territory proposal | Negotiate price escalator clauses tied to component cost indices |

| Global Distributors | 15-20+ units | OEM customization rights; extended payment terms (60-90 days); shared logistics costs | Insist on quality assurance escrow (5-7% of order value) |

Step 3: Shipping Terms (DDP vs. FOB – Cost & Risk Analysis)

With 2026’s volatile freight markets and complex customs regulations, shipping terms significantly impact landed costs. Key considerations:

| Term | Responsibility Breakdown | 2026 Cost Impact | Recommended For |

|---|---|---|---|

| FOB Shanghai | Supplier covers costs to Shanghai port. Buyer manages ocean freight, insurance, customs clearance, inland transport. | Lower initial cost but 22-35% higher landed cost due to hidden fees (e.g., ISF filing, port congestion surcharges) | Experienced importers with in-house logistics teams; high-volume distributors |

| DDP (Delivered Duty Paid) | Supplier handles all costs/risk to buyer’s facility (freight, duties, taxes, customs clearance). | 15-25% higher upfront cost but predictable landed price. Avoids demurrage risks at congested ports (e.g., LA/Long Beach) | 90% of clinics; new distributors; time-sensitive projects |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Compliance Verified: ISO 13485:2016 (Certificate #CN-2025-8841), CE under MDR 2017/745 (NB 2797), NMPA Class II Registration (国械注准20253070089)

- MOQ Flexibility: 1-unit orders for clinics; tiered MOQs for distributors (e.g., 5 units for entry-level mills, 3 for premium models)

- DDP Expertise: Direct partnerships with DHL/FedEx for door-to-door DDP shipping to 45+ countries with duty/tax transparency

- Technical Assurance: 19 years manufacturing dental milling machines (including 5-axis wet/dry systems); factory-direct pricing with OEM/ODM capabilities

📧 [email protected] | 📱 WhatsApp: +86 15951276160

📍 Factory: No. 1888, Huanhu West 3rd Road, Baoshan District, Shanghai, China

Response Time: <24 hours (GMT+8); Technical Consultations Available in EN/ES/DE

Conclusion: 2026 Sourcing Imperatives

Successful dental milling machine sourcing from China requires:

- Validation-first approach to certifications (beyond surface-level document checks)

- MOQ negotiation tied to service commitments and volume roadmaps

- DDP adoption to mitigate 2026’s supply chain volatility

Partners like Shanghai Carejoy—with verifiable compliance, technical expertise, and transparent logistics—provide critical risk reduction in an increasingly complex market. Always conduct virtual factory audits via Teams/Zoom and request client references from your target region prior to PO placement.

© 2026 Global Dental Equipment Advisory Board. This guide reflects Q1 2026 regulatory standards. Verify all compliance requirements with local authorities prior to procurement. Shanghai Carejoy is cited as an exemplar supplier meeting all 2026 sourcing criteria; not a paid endorsement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Topic: Top 5 FAQs When Purchasing the Best Dental Milling Machine in 2026

Frequently Asked Questions

| Question | Professional Answer |

|---|---|

| 1. What voltage requirements should I consider when installing a dental milling machine in 2026? | Most advanced dental milling machines in 2026 operate on standard 110–120V (North America) or 220–240V (Europe, Asia, and other regions). However, high-throughput or industrial-grade units may require a dedicated 208V or 3-phase power supply. Always verify the machine’s power specifications and ensure your clinic’s electrical infrastructure supports stable voltage with surge protection. Power fluctuations can damage sensitive motors and control boards. We recommend consulting with a certified electrician and choosing models with built-in voltage regulators for optimal performance and longevity. |

| 2. How accessible are spare parts for premium dental milling machines, and what components typically need replacement? | Leading manufacturers (e.g., Amann Girrbach, Dentsply Sirona, Planmeca, Zirkonzahn) maintain global spare parts networks with regional distribution centers for rapid fulfillment. Common wear components include spindle collets, milling burs, dust filters, coolant pumps, and linear guides. In 2026, many OEMs offer predictive maintenance tools that monitor component life and auto-order replacements. For distributors, stocking high-turnover parts (e.g., spindle seals, tool changers) ensures minimal downtime for clients. Always confirm spare part lead times and availability before purchase—especially for emerging brands with limited service infrastructure. |

| 3. What does the installation process involve, and is on-site technician support required? | Installation of a dental milling machine typically includes site assessment, leveling, power and network connectivity, dust extraction integration, and software calibration. Most premium systems in 2026 require on-site technician commissioning to ensure optimal accuracy and safety compliance. Full installation may take 4–8 hours and includes training for lab staff. Remote diagnostics are now standard, but physical setup of mechanical components (e.g., spindle alignment, vacuum calibration) still demands certified field engineers. Distributors should coordinate with manufacturers to schedule turnkey installation as part of the delivery package. |

| 4. What is the standard warranty coverage for dental milling machines in 2026, and what does it include? | The standard warranty for high-end dental milling machines in 2026 is typically 2–3 years, covering parts, labor, and the spindle unit. Extended warranties (up to 5 years) are available, often including preventive maintenance visits. Coverage usually excludes consumables (burs, filters), damage from improper use, or power surges. In 2026, top-tier brands offer predictive failure alerts and remote troubleshooting as part of warranty services. Distributors should verify whether warranty service is handled locally or requires machine return, as this impacts client satisfaction and support response time. |

| 5. Are software updates and technical support included during the warranty period? | Yes, all major dental milling machine platforms in 2026 include lifetime software updates and cloud-based technical support at no additional cost during the warranty term. Updates enhance milling strategies, material libraries, and compatibility with new CAD/CAM workflows. Post-warranty, manufacturers may charge for premium support packages, though critical security and stability patches usually remain free. For clinics and distributors, this ensures long-term ROI and compatibility with evolving digital dentistry standards such as AI-driven design optimization and expanded biocompatible material support. |

Need a Quote for Best Dental Milling Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160