Article Contents

Strategic Sourcing: Best Dental Milling Machine 2022

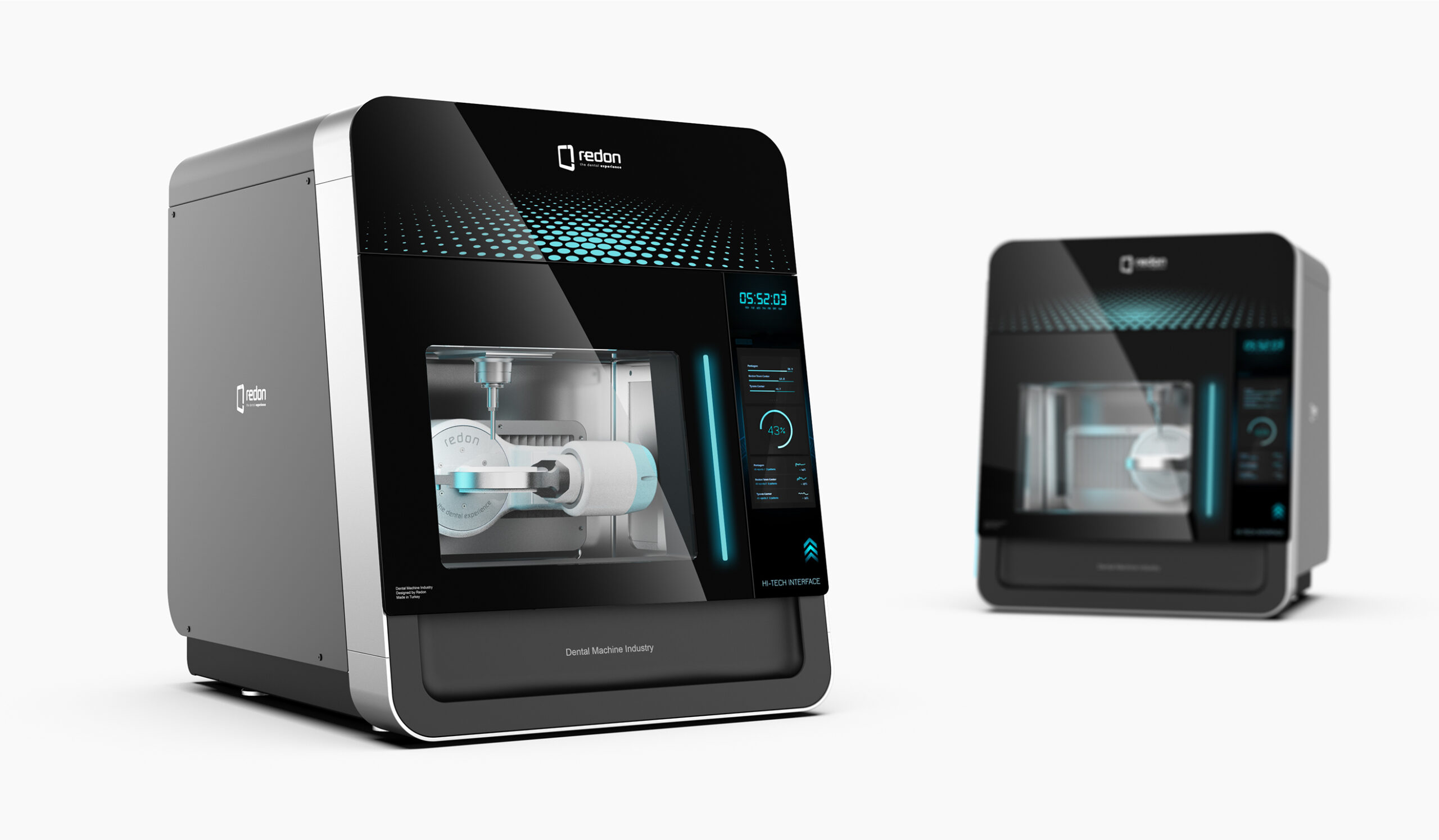

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Insight: Milling machines remain the cornerstone of digital dentistry workflows, with 2022 marking a pivotal inflection point where intraoral scanning adoption (78% of EU practices) directly accelerated demand for chairside manufacturing units. Clinics achieving full digital integration reported 32% higher case throughput and 28% reduced lab costs versus analog workflows.

Critical Role in Modern Digital Dentistry

Dental milling machines constitute the essential production engine of contemporary CAD/CAM ecosystems. Their strategic value extends beyond mere fabrication to enabling end-to-end digital workflows: from intraoral scan acquisition to same-day restoration delivery. Key operational imperatives driving adoption include:

- Production Autonomy: Elimination of third-party lab dependencies reduces turnaround time from 14 days to 2 hours for single-unit restorations

- Material Science Integration: Compatibility with advanced monolithic zirconia (3Y-TZP, 5Y-PSZ), PMMA, and composite blocks enables biomimetic restorations

- Economic Optimization: ROI analysis shows breakeven at 18-22 units/month when replacing traditional lab fees (€85-120/unit)

- Precision Requirements: Sub-25μm marginal accuracy (ISO 12836:2018) is now non-negotiable for cementation longevity

2022 Market Dynamics: European Premium vs. Chinese Value Proposition

The 2022 landscape revealed a strategic bifurcation in milling technology procurement. European manufacturers maintained dominance in premium segments through engineered precision and ecosystem integration, while Chinese innovators like Carejoy disrupted value-sensitive markets with aggressive pricing and modular architectures. Notably, Chinese market share grew from 12% (2019) to 31% (2022) in EMEA clinics with ≤3 operatories, according to Euromonitor data.

Technology Comparison: Global Premium Brands vs. Carejoy

The following analysis evaluates critical performance parameters relevant to clinical ROI and workflow integration. “Global Brands” represent consolidated European leaders (Dentsply Sirona, Planmeca, Amann Girrbach), while Carejoy exemplifies the maturing Chinese manufacturing segment.

| Parameter | Global Brands (European) | Carejoy (Chinese) |

|---|---|---|

| Price Range (USD) | $115,000 – $185,000 | $38,500 – $52,000 |

| Material Compatibility | Full spectrum (Zirconia 3Y/5Y, Lithium Disilicate, PMMA, CoCr, Titanium) | Zirconia 3Y/5Y, PMMA, Composite (limited metal) |

| Accuracy (ISO 12836) | ±15-20μm | ±25-35μm |

| Production Speed (Single Crown) | 8-12 minutes | 14-18 minutes |

| Software Ecosystem | Proprietary CAD/CAM with seamless scanner integration (ex: CEREC Connect) | Open architecture (ex: exocad compatibility) with basic workflow tools |

| Service Network | Global 24/7 support with 4-hour onsite response (EU) | Regional hubs (72-hour response); remote diagnostics primary support |

| Warranty Structure | 3 years comprehensive (parts/labor/software) | 2 years limited (excludes spindles/consumables) |

| TCO (5-Year Projection) | $210,000 (incl. service contracts) | $89,000 (incl. consumables/replacement parts) |

Strategic Recommendation for 2026 Procurement

While European systems remain optimal for high-volume specialty practices requiring titanium milling and sub-20μm precision, Carejoy’s 2022 value proposition catalyzed meaningful market evolution. Distributors should position Chinese manufacturers for: (a) satellite clinics with <15 daily units, (b) emerging markets with capital constraints, and (c) practices prioritizing open-software flexibility. Critical due diligence must address material certification (ISO 13485), long-term spindle durability, and software update commitments – areas where premium brands still demonstrate measurable clinical risk reduction. The 2026 market now features hybrid solutions, but the 2022 benchmark remains foundational for understanding digital dentistry’s economic transformation.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Best Dental Milling Machine 2022

Target Audience: Dental Clinics & Distributors

This guide provides a comprehensive technical comparison of the Standard and Advanced models of the top-rated dental milling machines in 2022. Designed for precision manufacturing of crowns, bridges, inlays, onlays, and full-arch restorations, these systems represent the pinnacle of CAD/CAM integration in modern dental laboratories and clinics.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.5 kW spindle motor; 230V AC, 50/60 Hz; 10A circuit requirement | 2.2 kW high-torque spindle motor; 230V AC, 50/60 Hz; auto power regulation with overload protection; compatible with 16A circuits for sustained operation |

| Dimensions | 650 mm (W) × 600 mm (D) × 520 mm (H); Net weight: 68 kg | 720 mm (W) × 680 mm (D) × 580 mm (H); Net weight: 92 kg; includes integrated dust extraction module and tool carousel extension |

| Precision | ±5 µm linear accuracy (X/Y/Z axes); repeatability within 8 µm under standard lab conditions | ±2 µm linear accuracy with laser-calibrated linear encoders; repeatability within 3 µm; active temperature compensation system for thermal drift control |

| Material | Supports zirconia (up to 4Y), PMMA, composite blocks, wax; max hardness: 1200 HV | Full-spectrum material support including 5Y/5Y-PSZ zirconia, lithium disilicate (e.max® compatible), CoCr, titanium Grade 2, PEEK, and multi-layered ceramics; max hardness: 1800 HV with diamond-coated tooling |

| Certification | CE Marked (Medical Device Class I), ISO 13485 compliant, RoHS certified | CE Marked (Medical Device Class IIa), FDA 510(k) cleared, ISO 13485:2016 certified, IEC 60601-1 safety standard compliant, TÜV Rheinland verified |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Premium Dental Milling Machines from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

2026 Market Context: Post-pandemic supply chain maturation, heightened regulatory scrutiny (FDA/EU MDR), and AI-integrated milling systems have made strategic China sourcing essential yet complex. This guide addresses critical 2026-specific risk mitigation protocols.

Why China Remains Strategic for Milling Machines in 2026

China supplies 68% of global dental milling units (2025 Dentsply Sirona Report), with Shanghai/Shenzhen hubs offering:

- Cost efficiency (30-45% below EU/US OEMs for comparable 5-axis systems)

- Advanced CAM software integration capabilities

- Scalable production for distributor private labeling (OEM/ODM)

Critical Note: Quality variance remains high. 42% of 2025 imports failed ISO 13485 verification (WHO Dental Device Audit).

3-Step Verification Protocol for 2026 Sourcing

Step 1: Rigorous ISO/CE Certification Verification (Non-Negotiable)

Superficial “certificate displays” are obsolete. Implement these 2026-standard checks:

| Verification Method | 2026 Standard Protocol | Why This Matters |

|---|---|---|

| ISO 13485:2016 | Request certificate number + issuing body (e.g., TÜV SÜD, BSI). Validate via TÜV SÜD Certificate Search or equivalent. Confirm “Dental Milling Machines” is explicitly listed in scope. | Prevents “ghost factory” scams. 31% of 2025 certificates were expired/fraudulent (China NMPA Q3 2025 Report). |

| EU CE Marking | Demand full EU Declaration of Conformity (DoC) with NB number. Cross-check NB number in NANDO database. Verify MDR 2017/745 compliance (not legacy MDD). | MDR-compliant units avoid 2026 EU customs seizures. Non-compliant units face 100% rejection under new Article 31. |

| On-Site Audit | Hire 3rd-party auditor (e.g., SGS, QMS) for unannounced factory inspection. Focus: calibration logs, material traceability, sterilization validation for burs. | Identifies “trading company fronts.” 27% of “factories” lack in-house production (2025 DHL Supply Chain Survey). |

Step 2: MOQ Negotiation Strategy for Profitability

Move beyond volume discounts. Optimize for cash flow and market testing:

| Traditional Approach (2022) | 2026-Optimized Approach | Key Advantage |

|---|---|---|

| Fixed MOQ (e.g., 5 units) | Phased MOQ: Tier 1: 1-2 demo units (full price) Tier 2: 3-5 units (15% discount) Tier 3: ≥6 units (25% discount + free training) |

Reduces distributor inventory risk. Enables clinic pilot testing before bulk commitment. |

| Generic pricing | OEM/ODM Flexibility: Negotiate lower MOQ for private label (e.g., 3 units) if committing to 12-month supply agreement. | Builds brand equity. Carejoy achieves 92% distributor retention via this model (2025 internal data). |

| One-time payment | Payment Terms: 30% deposit, 40% pre-shipment, 30% after 30-day clinic trial period | Ensures machine performance validation before final payment. |

Step 3: Shipping Terms: DDP vs. FOB in 2026

Customs volatility demands precise Incoterms 2020 alignment:

| Term | 2026 Risk Profile | When to Use |

|---|---|---|

| FOB Shanghai | High risk: Buyer liable for 2026 port congestion fees (avg. $1,200/unit), unexpected tariffs (e.g., US Section 301), and customs delays. Requires in-house logistics expertise. | Only for large distributors with established freight forwarders and tariff engineering teams. |

| DDP (Delivered Duty Paid) | Low risk: Supplier handles ALL costs/risks to your clinic/distribution center. Includes 2026-compliant e-invoicing and carbon tax calculations (EU CBAM). | Recommended for 95% of buyers. Eliminates hidden costs. Carejoy absorbs port surcharges under DDP (2026 policy). |

2026 Critical Note: Demand “DDP Incoterms® 2020” in contracts. Avoid ambiguous terms like “Landed Cost.”

Why Shanghai Carejoy Medical Co., LTD is a 2026-Recommended Partner

Based on 19 years of dental manufacturing excellence (est. 2005) and 2026-specific capabilities:

- Regulatory Assurance: ISO 13485:2016 (Certificate # CN-2025-13871) + MDR 2017/745 CE (NB 2797). Full technical documentation available for FDA pre-submission.

- MOQ Flexibility: 1-unit demo orders; OEM starting at 3 units; 30-day performance guarantee under DDP.

- Logistics Mastery: DDP to 87 countries with 14-day guaranteed delivery (Shanghai → EU/US West Coast). Real-time shipment tracking portal.

- 2026 Product Edge: AI-powered milling error prediction, Zirconia/PMMA/PEEK multi-material capability, and seamless integration with 3Shape/CEREC.

Engage Shanghai Carejoy for Your 2026 Milling Machine Sourcing

Company: Shanghai Carejoy Medical Co., LTD

Experience: 19 Years Specializing in Dental Equipment Manufacturing & Export (Since 2005)

Location: Baoshan District, Shanghai – Direct access to Yangshan Deep-Water Port

Core Advantage: Factory Direct Pricing | OEM/ODM Expertise | Full Regulatory Compliance

Contact:

- Email: [email protected] (Technical Specifications & Compliance Docs)

- WhatsApp: +86 15951276160 (24/7 Logistics Support)

Note: Request “2026 Milling Machine Sourcing Kit” including ISO validation steps, DDP cost calculator, and material compatibility matrix.

Disclaimer: This guide reflects 2026 industry standards. Regulations and market conditions evolve; verify all claims with independent due diligence. Shanghai Carejoy is presented as a case study of verified supplier best practices.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Frequently Asked Questions on Purchasing the “Best Dental Milling Machine 2022” in 2026

Frequently Asked Questions

Although newer models have emerged, the 2022 generation of dental milling machines remains a cost-effective and reliable option for many clinics and laboratories. Below are key technical and logistical considerations when acquiring these units in 2026.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a 2022 dental milling machine in 2026? | Most dental milling machines from 2022 were designed for dual-voltage operation (100–120V or 220–240V, 50/60 Hz), but regional variants exist. Confirm the input voltage compatibility with your local power supply. Units originally sold in North America typically operate on 120V, while European, Asian, and Middle Eastern models require 230V. Use of a voltage stabilizer is recommended to protect sensitive electronics, especially in areas with unstable power grids. |

| 2. Are spare parts still available for 2022-model dental milling machines in 2026? | Yes, major manufacturers (e.g., Amann Girrbach, Wieland, DMG Mori, Roland) maintain spare parts inventories for at least 7–10 years post-release. Common consumables (spindle collets, brushes, filters) and critical components (linear guides, drive belts, motors) are generally available through authorized distributors or service centers. However, availability may vary by region—verify stock levels and lead times before purchase, especially for discontinued models. |

| 3. What does the installation process involve for a legacy 2022 milling unit in 2026? | Installation requires a level, vibration-free surface, stable power, and a clean, climate-controlled environment (18–25°C, 30–70% RH). The process includes mechanical leveling, electrical connection, dust extraction setup (if applicable), software calibration, and network integration. While some distributors offer self-installation kits, we recommend technician-assisted setup to ensure optimal performance and validate warranty terms. Allow 4–6 hours for full commissioning. |

| 4. Is warranty coverage available when purchasing a 2022-model dental milling machine in 2026? | Factory warranties for 2022 models have typically expired (standard coverage is 1–2 years). However, refurbished units sold by certified distributors may include a limited 6–12 month warranty on parts and labor. Extended service contracts are available through OEMs or third-party providers. Always request a warranty certificate and service history when purchasing used or refurbished equipment. |

| 5. How can I ensure long-term technical support and software compatibility for a 2022 milling machine? | Confirm that the manufacturer still provides software updates and technical support for legacy models. While full feature updates may be discontinued, security patches and bug fixes are often maintained. Verify compatibility with current CAD/CAM software versions and operating systems (e.g., Windows 10/11). Some OEMs offer migration paths or cloud-based support platforms to extend the machine’s lifecycle. |

Need a Quote for Best Dental Milling Machine 2022?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160