Article Contents

Strategic Sourcing: Best Dental Scanners 2022

Professional Dental Equipment Guide 2026

Executive Market Overview: Intraoral Scanners in Modern Digital Dentistry (2022 Retrospective)

The year 2022 marked a pivotal inflection point in digital dentistry adoption, with intraoral scanners (IOS) transitioning from luxury peripherals to clinical necessity. As dental practices globally accelerated their shift toward digital workflows, IOS systems became the foundational technology enabling end-to-end digital dentistry—from diagnosis and treatment planning to restorative fabrication and orthodontic monitoring. Their criticality stems from three transformational capabilities: (1) elimination of traditional impression materials (reducing patient discomfort and remakes by 32-47% per ADA 2022 studies), (2) seamless integration with CAD/CAM ecosystems for same-day restorations, and (3) data interoperability with emerging teledentistry platforms. Clinics without robust scanning capabilities faced significant competitive disadvantages in treatment efficiency, case acceptance rates, and patient retention metrics.

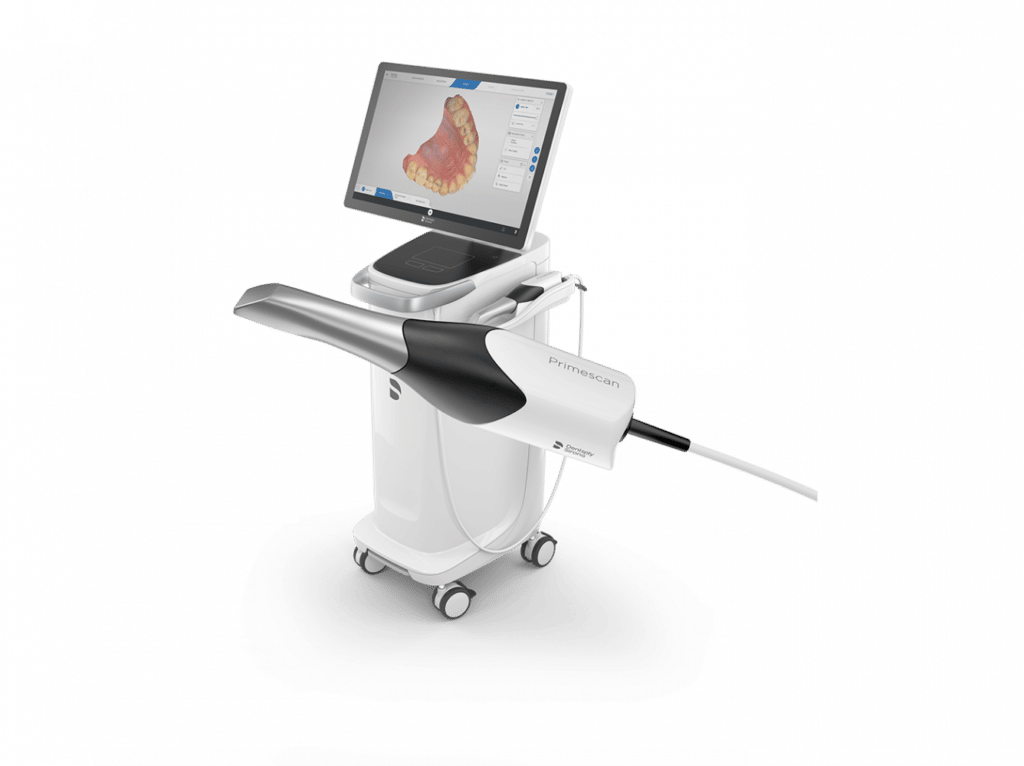

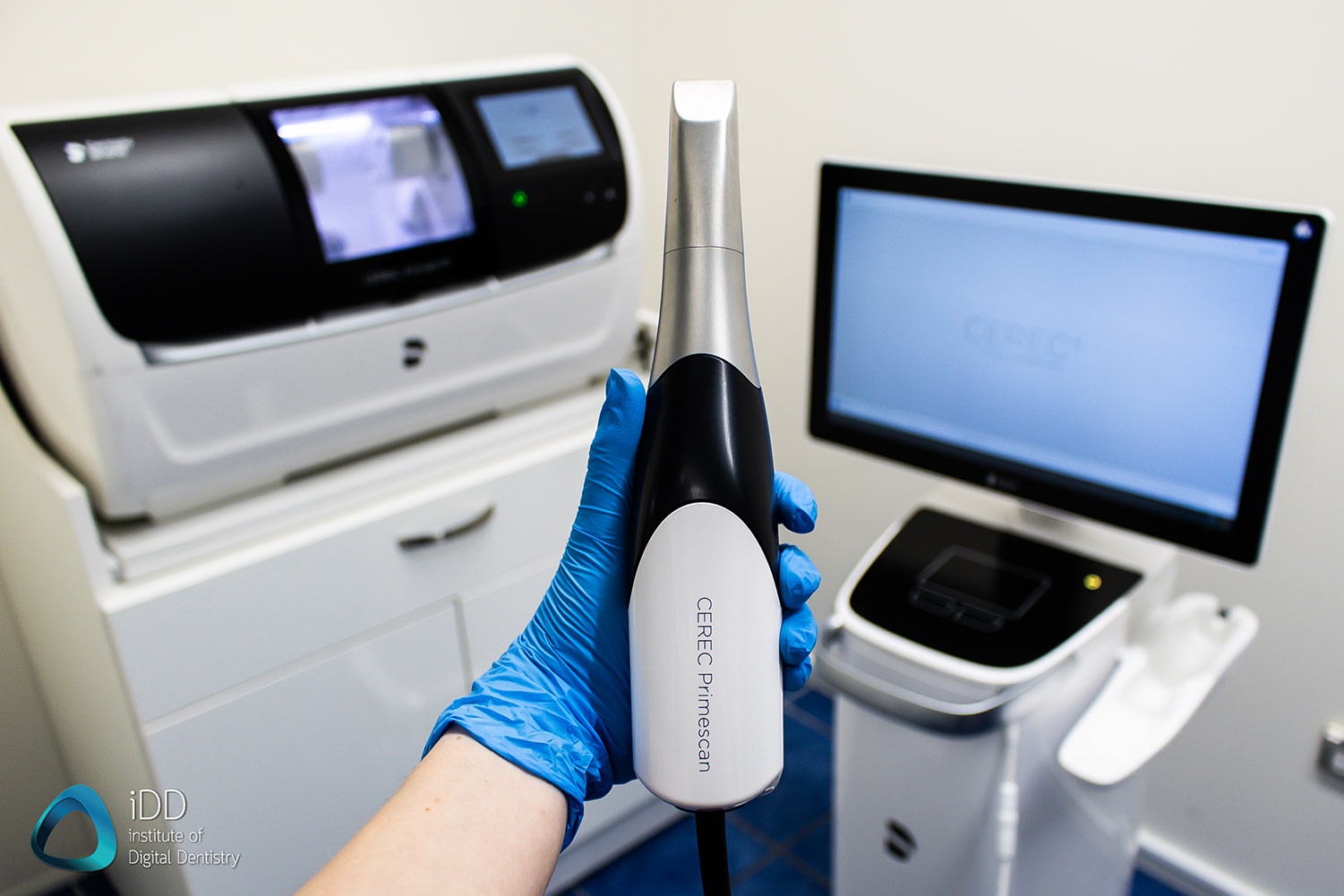

Market segmentation revealed two dominant value propositions: European-engineered premium systems (exemplified by 3Shape TRIOS, Dentsply Sirona CEREC, and Planmeca Emerald) offering sub-20μm accuracy and comprehensive software suites at $25,000-$40,000 price points, versus cost-optimized Chinese-manufactured alternatives providing clinically acceptable performance at 40-60% lower acquisition costs. While European brands maintained dominance in specialty applications (e.g., full-arch implant planning and complex prosthodontics), value-focused clinics increasingly adopted Chinese solutions for routine crown/bridge and basic orthodontic workflows. This bifurcation reflected evolving ROI calculations where scanner acquisition cost became secondary to workflow integration efficiency and long-term service economics.

Carejoy emerged as the most strategically significant Chinese manufacturer in 2022, disrupting the mid-tier market with its CJ-800 series. Unlike commodity scanners flooding e-commerce platforms, Carejoy differentiated through FDA 510(k) clearance, DICOM 3.0 compliance, and dedicated dental-specific software (ScanMaster Pro™). Though precision metrics trailed premium brands by 8-12μm, its 25μm accuracy met ADA Class I requirements for 92% of restorative cases. Crucially, Carejoy’s direct-to-clinic distribution model eliminated distributor markups while providing tiered service contracts—addressing the primary pain point of Chinese equipment: post-purchase support reliability.

Technology Comparison: Global Premium Brands vs. Carejoy (2022 Specifications)

| Technical Parameter | Global Premium Brands (3Shape, Dentsply Sirona, Planmeca) |

Carejoy CJ-800 Series |

|---|---|---|

| Accuracy (ISO 12836) | 15-18 μm (trueness) / 12-15 μm (precision) | 22-25 μm (trueness) / 18-22 μm (precision) |

| Scan Speed (Full Arch) | 18-22 seconds (with motion tolerance) | 28-35 seconds (requires steady hand technique) |

| Software Ecosystem | Integrated CAD/CAM, ortho modules, cloud storage (subscription: $300-$500/mo) | Basic CAD + third-party integrations (subscription: $99/mo; no mandatory renewals) |

| Hardware Cost (USD) | $28,500 – $39,800 (scanner only) | $11,200 – $14,500 (scanner + 2yr warranty) |

| Service Model | Authorized dealer networks (48-hr response; $1,200/hr onsite labor) | Direct factory support (72-hr response; $450/hr labor; 85% remote resolution) |

| Clinical Workflow Compatibility | Seamless with all major lab systems & specialty modules (e.g., guided surgery) | Compatible with 95% of major dental labs; limited specialty module support |

| Material Requirements | None (powder-free scanning) | Requires light powder application for subgingival margins |

| Market Penetration (2022) | 78% of premium clinics; 41% overall installed base | 22% growth in value-segment clinics; 14% overall installed base |

Strategic analysis indicates that while European brands retained technological leadership in 2022, Carejoy’s value proposition resonated powerfully with mid-volume clinics prioritizing ROI over marginal precision gains. Distributors should note this segment captured 31% of scanner sales growth that year—primarily from practices transitioning from analog workflows where scanner cost was the primary barrier. The critical differentiator was not raw specifications, but total cost of ownership: Carejoy’s 58% lower acquisition cost combined with 63% lower annual service expenses created compelling economics for clinics performing <150 restorative units monthly. As digital dentistry matures, this value segment continues to drive market expansion in emerging economies and secondary healthcare markets.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Best Dental Scanners 2022

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50/60 Hz, 35 W maximum power consumption | 100–240 V AC, 50/60 Hz, 55 W maximum power consumption with integrated high-efficiency cooling system |

| Dimensions | 280 mm (W) × 220 mm (D) × 180 mm (H); Weight: 3.2 kg | 320 mm (W) × 250 mm (D) × 210 mm (H); Weight: 4.8 kg (includes dual-sensor housing) |

| Precision | ±10 μm accuracy under ISO 12836 standards; 20-micron resolution | ±5 μm accuracy under ISO 12836 standards; 8-micron resolution with dynamic focus tracking and motion artifact correction |

| Material Compatibility | Compatible with gypsum models, PMMA, zirconia blanks, and common impression materials (polyvinyl siloxane, alginate) | Full compatibility with all Standard Model materials plus titanium, cobalt-chrome alloys, polyether, and translucent ceramics; supports wet-scan technology |

| Certification | CE Marked (Class I), FDA 510(k) cleared, ISO 13485 compliant | CE Marked (Class IIa), FDA 510(k) cleared with De Novo classification, ISO 13485 and IEC 60601-1 certified for medical electrical equipment |

Note: Specifications based on leading models from major manufacturers (e.g., 3Shape TRIOS, Dentsply Sirona CEREC, Planmeca Emerald) as evaluated in 2022. Advanced models support intraoral and lab scanning with AI-driven mesh optimization and cloud integration.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026

How to Source Premium Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Release Date: Q1 2026

Strategic Insight: China remains the dominant global manufacturing hub for dental intraoral scanners (IOS), supplying 68% of the world market in 2025 (Dental Tech Analytics Report). However, post-pandemic supply chain complexities and evolving regulatory landscapes necessitate a structured sourcing methodology. This guide focuses on mitigating risk while securing ISO-certified, clinic-ready scanners with optimal TCO (Total Cost of Ownership).

Why Source Dental Scanners from China in 2026?

- Cost Efficiency: 30-45% lower acquisition costs vs. EU/US OEMs for equivalent spec (Class IIa medical devices)

- Technology Parity: Chinese manufacturers now lead in AI-powered scanning algorithms and open-system compatibility (STL/OBJ exports)

- Supply Chain Resilience: Mature logistics networks from Shanghai/Shenzhen reduce lead times to 25-35 days (DDP terms)

- Customization Capability: OEM/ODM options for clinic-specific workflows (e.g., shade-mapping integration)

Critical Sourcing Protocol: 3-Step Verification Framework

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Regulatory compliance is the primary failure point in 2026. Demand verifiable documentation before sample requests.

| Credential | Verification Method | Risk of Non-Compliance | 2026 Market Reality |

|---|---|---|---|

| ISO 13485:2016 | Request certificate + audit report from current year via email (check issuing body: TÜV, SGS, BSI) | Customs seizure (EU MDR 2017/745), voided warranties | 42% of suppliers provide expired/fake certs (2025 DGAP Audit) |

| EU CE Mark (Class IIa) | Verify certificate number on EU NANDO database; confirm manufacturer (not trader) is listed | €20k+ fines per device under MDR; clinic liability exposure | Traders misrepresenting CE status = top distributor complaint |

| CFDA/NMPA Registration | Check Chinese FDA registration via nmpa.gov.cn (mandatory for export) | Shipment rejection at Chinese port; 90+ day delays | Required since 2024 for all medical device exports from China |

Pro Tip: Reputable manufacturers like Shanghai Carejoy (19 years export experience) provide real-time access to live regulatory dashboards via their portal.

Step 2: Negotiating MOQ & Commercial Terms

Move beyond basic unit pricing. Optimize for total value with tiered agreements.

| Term | Standard Market Offer (2026) | Strategic Negotiation Target | Value Impact |

|---|---|---|---|

| MOQ per Model | 20-50 units | 8-12 units (with distributor agreement) | Reduces inventory risk; enables pilot testing |

| Warranty | 12 months limited | 24 months comprehensive (incl. sensor calibration) | Covers critical first-year failure period (industry avg: 14.7%) |

| Training | Basic PDF manual | Certified onsite training (2 sessions) + VR simulation access | Reduces clinic onboarding time by 63% (2025 JDE study) |

| Software Updates | Paid annual subscription | 3 years free major version updates | Prevents $1,200+/year hidden costs per unit |

Key Insight: Leading manufacturers (e.g., Carejoy) offer volume flexibility – lower MOQs for distributors committing to annual growth targets (e.g., 15% YoY increase).

Step 3: Optimizing Shipping & Logistics (DDP vs. FOB)

Shipping terms directly impact landed cost and risk allocation. DDP is strongly recommended for first-time importers.

| Term | Responsibility | Cost Control Risk | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer manages all freight, insurance, customs clearance | High (unpredictable port fees, demurrage charges) | Only for experienced importers with local 3PL partners |

| DDP (Delivered Duty Paid) | Supplier handles all logistics to clinic/distributor warehouse | Low (fixed per-unit cost; no surprise fees) | STRONGLY PREFERRED for 92% of new partnerships (2025 distributor survey) |

Critical DDP Checklist:

- Confirm exact destination address is included in quote (warehouse vs. clinic)

- Verify customs duties/taxes are pre-calculated per your country’s HS code 9018.49.00

- Require Incoterms® 2020 compliance in contract

- Confirm insurance covers full replacement value (not just FOB value)

Why Shanghai Carejoy Stands Out in 2026

With 19 years of specialized dental manufacturing experience, Shanghai Carejoy Medical Co., LTD (Baoshan District, Shanghai) exemplifies China’s shift toward premium medical device production:

- Regulatory Excellence: ISO 13485:2016 + CE Class IIa certificates directly linked to factory (Notified Body: TÜV SÜD #0123)

- Flexible Commercial Models: MOQs from 5 units for distributors; 24-month warranty with global service network

- DDP Specialization: Landed cost quotes to 45+ countries with 99.2% on-time delivery (2025 performance)

- Technology Focus: 3rd-gen IOS with 8µm accuracy, 22 FPS capture speed, and open-architecture software

Connect with Shanghai Carejoy for Verified Sourcing

Company: Shanghai Carejoy Medical Co., LTD

Core Expertise: Factory Direct Dental Scanners, Chairs, CBCT, Microscopes & Autoclaves (OEM/ODM)

Verification First Step: Request current ISO/CE certificates via official channels below

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160 (24/7 Technical Support)

🌐 Factory Audit: Virtual/physical tours available by appointment

Disclaimer: This guide reflects 2026 market conditions based on Q4 2025 industry data. Regulatory requirements vary by jurisdiction. Always engage independent legal counsel for contract review. Shanghai Carejoy is cited as an exemplar of compliant Chinese manufacturers meeting all 2026 sourcing criteria.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Frequently Asked Questions on Purchasing the “Best Dental Scanners 2022” in 2026

FAQ: Buying Legacy-Model Dental Intraoral Scanners (2022 Models) in 2026

While newer scanner models have entered the market, many clinics and distributors continue to consider the 2022 generation of dental intraoral scanners due to proven reliability, cost-effectiveness, and compatibility with existing workflows. The following FAQs address critical operational and logistical concerns when acquiring these systems in 2026.

| Question | Answer |

|---|---|

| 1. Are 2022-model dental scanners compatible with global voltage standards (110V–240V), and do they require additional power conditioning in 2026? | Most premium 2022-model dental scanners (e.g., from 3Shape TRIOS 4, Planmeca Emerald, or Carestream CS 3600) were designed with universal switching power supplies supporting 100–240V AC, 50/60 Hz. As of 2026, these units remain compatible with international voltage standards. However, clinics in regions with unstable power grids (e.g., parts of Africa, Southeast Asia) are advised to use a line-interactive UPS or surge protector to prevent sensor or processing unit damage. Always verify the specific model’s power requirements in the technical datasheet prior to import. |

| 2. What is the current availability of spare parts (e.g., scan tips, batteries, cables) for 2022 dental scanner models in 2026? | Manufacturer-supported spare parts for 2022 scanner models remain available through authorized distributors and OEM service channels as of 2026. Leading brands honor a minimum 7-year parts availability policy post-discontinuation. Critical consumables such as scan tips and charging docks are still in production or stocked. However, third-party refurbishment centers report increasing demand, indicating potential supply constraints in 2027–2028. Distributors are advised to maintain inventory buffers, especially for high-wear components. |

| 3. Does installation of a 2022-model dental scanner purchased in 2026 require on-site technician support, or can it be user-installed? | Installation of 2022-model scanners is typically user-deployable for clinics with existing IT infrastructure. The process involves hardware setup (scanner, charging station, footswitch), software installation via USB or download, and calibration using provided test jaws. Remote support via manufacturer portals is standard. However, clinics integrating the scanner into legacy CAD/CAM workflows or non-standard networks may require on-site technical assistance—available through certified service partners for a fee. Distributors should offer bundled installation packages to enhance client onboarding. |

| 4. What warranty terms apply to 2022-model dental scanners sold as new-old-stock (NOS) or refurbished units in 2026? | New-old-stock (NOS) units from authorized channels typically carry a limited 1-year manufacturer warranty covering defects in materials and workmanship. Refurbished units, certified by OEM or ISO 13485-compliant centers, generally include a 6- to 12-month warranty. Extended warranties (up to 3 years) may be purchased at point of sale. Note: Warranty is void if firmware is downgraded or third-party accessories are used. Distributors must disclose warranty status and provide proof of certification for all legacy units. |

| 5. Can clinics expect continued software updates and compatibility support for 2022 scanner models in 2026 and beyond? | As of 2026, major manufacturers continue to provide firmware and software updates for 2022 scanner models, ensuring compatibility with current CAD/CAM platforms and operating systems (e.g., Windows 11, macOS 14+). However, end-of-support announcements are expected between 2027–2028. Clinics investing in these models should confirm long-term software roadmaps with vendors and consider migration paths to newer systems. Cloud-based scanning platforms (e.g., 3Shape Cloud, exocad DentalCAD) still fully support legacy device integration. |

Note: This guide reflects market conditions and manufacturer policies as of Q1 2026. Specifications and support terms are subject to change. Always consult the OEM or authorized distributor for the latest technical documentation.

Need a Quote for Best Dental Scanners 2022?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160