Article Contents

Strategic Sourcing: Best Dental Suction Unit

Professional Dental Equipment Guide 2026: Executive Market Overview

Executive Market Overview: The Critical Role of Advanced Dental Suction Units in Modern Digital Dentistry

In the rapidly evolving landscape of digital dentistry, the dental suction unit has transcended its traditional role as a mere aerosol management system. It is now a mission-critical infrastructure component directly impacting the efficacy, precision, and safety of digital workflows. As clinics integrate intraoral scanners (IOS), CAD/CAM systems, and CBCT imaging, the demand for high-performance, low-maintenance suction with exceptional particle separation and moisture control has intensified. Suboptimal suction performance directly compromises digital outcomes: airborne particulates contaminate scanner optics, moisture disrupts optical tracking, and inconsistent vacuum levels destabilize aerosol containment during high-speed procedures. Modern protocols for infection prevention (IPAC) and OSHA compliance further mandate ISO 13485-certified systems with validated filtration efficiency. The 2026 market reflects a strategic bifurcation: premium European engineering versus value-optimized Asian manufacturing, each serving distinct segments of the global dental ecosystem.

European Premium Brands vs. Chinese Value Segment: Strategic Positioning

European Premium Brands (A-dec, Dürr Dental, W&H, Planmeca): Represent the gold standard for integrated operatory design, offering seamless compatibility with high-end digital ecosystems. These systems feature precision-engineered vacuum pumps (oil-free rotary vane or scroll technology), multi-stage filtration (HEPA/ULPA), and IoT-enabled predictive maintenance. Their dominance in academic institutions and premium private practices stems from exceptional durability (15+ year operational lifespans), ultra-quiet operation (<45 dBA), and certified performance consistency under continuous load. However, this comes with significant capital investment (€12,000–€22,000/unit) and complex service dependencies, making them optimal for high-volume clinics prioritizing zero-downtime digital workflows.

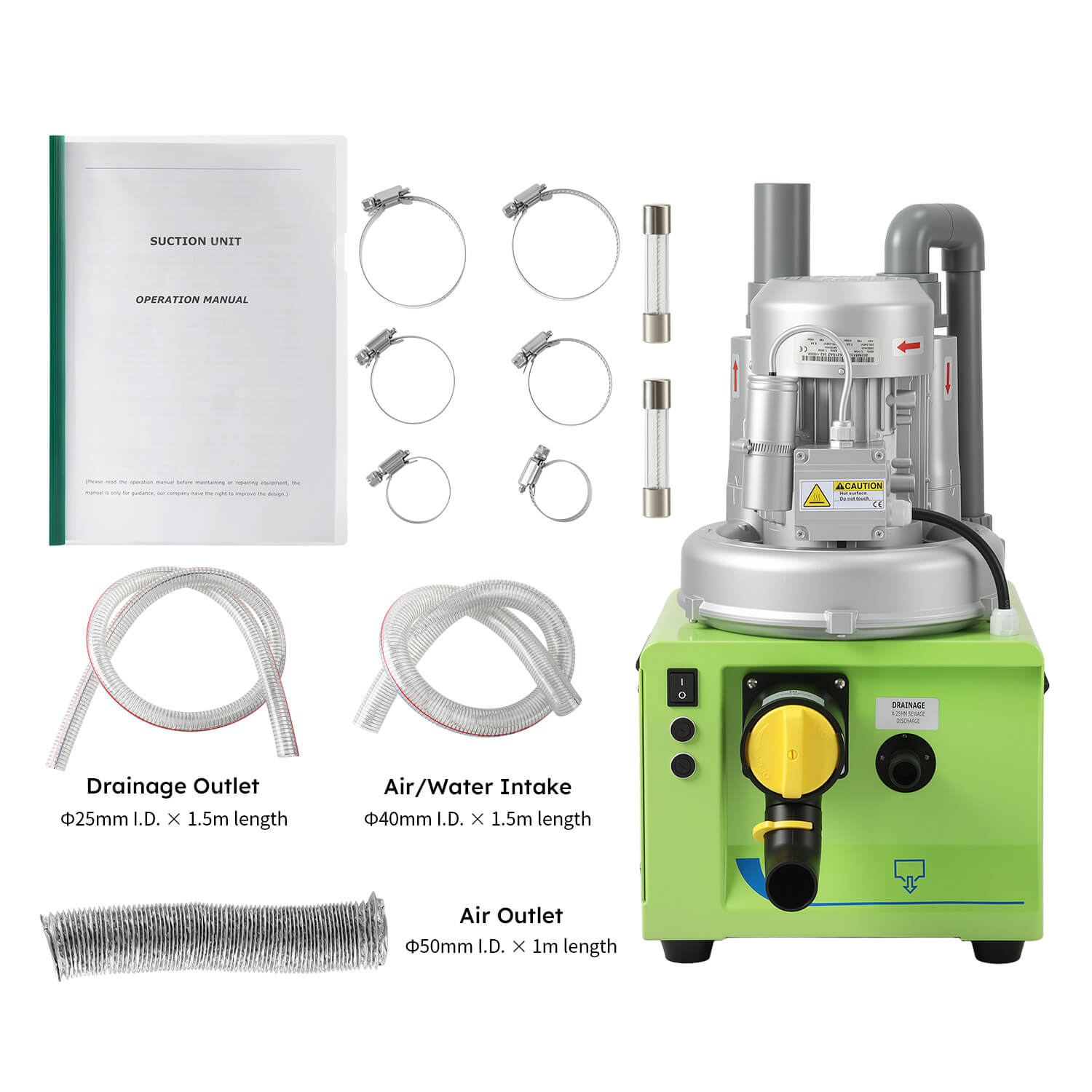

Chinese Value Segment (Carejoy as Benchmark): Addresses the critical need for accessible digital readiness in budget-conscious and emerging markets. Carejoy exemplifies the maturation of Chinese manufacturing with ISO 13485 certification, standardized modular components, and competitive suction performance meeting ISO 15006:2022 standards. While lacking the deep digital integration of premium brands, Carejoy units deliver reliable core functionality (32–38 L/min suction, <52 dBA noise) at 40–60% lower acquisition cost (€5,500–€8,500). Recent 2025–2026 iterations show marked improvements in dry vacuum pump longevity and HEPA filtration compliance, positioning them as viable solutions for single-operatories, satellite clinics, and practices with moderate digital adoption.

Comparative Analysis: Global Premium Brands vs. Carejoy (2026 Specifications)

| Technical Parameter | Global Premium Brands (A-dec, Dürr Dental, W&H) |

Carejoy (2026 Models) |

|---|---|---|

| Core Suction Power | 38–45 L/min (ISO 15006 Class A) | 32–38 L/min (ISO 15006 Class B) |

| Acquisition Cost (Per Operatory) | €12,000 – €22,000 | €5,500 – €8,500 |

| Noise Level (Continuous Operation) | 42–48 dBA (QuietScan™ Technology) | 48–54 dBA (Standard) |

| Filtration System | 4-Stage (Coarse + HEPA 14 + ULPA 15 + Carbon) | 3-Stage (Coarse + HEPA 13 + Hydrophobic) |

| Digital Integration | Native API for CAD/CAM & IOS; Real-time analytics via clinic OS | Basic IoT monitoring (app-based); No native digital ecosystem sync |

| Maintenance Cycle | 2,000 hours (Predictive diagnostics) | 1,200 hours (Scheduled alerts) |

| Warranty & Service | 5 years full coverage; On-site engineer network (48h SLA) | 3 years limited; Regional depot repair (7–10 day turnaround) |

| IPAC Compliance | ISO 22307:2023 certified; Validated biofilm resistance | ISO 13485:2016; Meets EN 1822:2009 HEPA standards |

Strategic Recommendation: The “best” suction unit is defined by clinical workflow intensity and digital integration depth. High-volume digital centers requiring uninterrupted scanner/CAD-CAM operation should prioritize European premium systems for their reliability and ecosystem synergy. Conversely, Carejoy presents a compelling value proposition for clinics adopting foundational digital tools (e.g., single IOS unit) or operating in cost-sensitive environments where total cost of ownership (TCO) is paramount. Distributors should note Carejoy’s 55%+ gross margin potential versus 30–40% for premium brands, with growing demand in APAC, LATAM, and value-tier European markets.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Best Dental Suction Units

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110V / 60Hz, 0.75 HP motor, single-phase operation. Average vacuum flow: 120 L/min. Suitable for single-chair setups or light multi-chair use. | 220V / 50-60Hz, 1.5 HP dual-stage motor with variable speed control. Vacuum flow: 220 L/min with automatic load balancing. Designed for high-volume multi-chair practices (up to 6 chairs). |

| Dimensions | 45 cm (W) × 35 cm (D) × 75 cm (H). Compact footprint for under-cabinet or closet installations. Weight: 38 kg. | 60 cm (W) × 45 cm (D) × 90 cm (H). Integrated sound-dampening enclosure. Weight: 65 kg. Optional wall-mount and ceiling-suspended configurations available. |

| Precision | Analog pressure gauge with manual adjustment. Vacuum stability: ±15% under variable load. Basic saliva ejector and HVE support. | Digital touchscreen interface with real-time vacuum monitoring. Precision control within ±3% via closed-loop feedback system. Supports intelligent per-chair suction profiling and auto-calibration. |

| Material | Galvanized steel housing with ABS internal piping. Standard rubber dampeners. Internal components resistant to common disinfectants. | Stainless steel 304 housing with antimicrobial coating. PTFE-lined internal tubing and corrosion-resistant impeller. IP54-rated for dust and moisture protection. |

| Certification | CE Marked, ISO 13485 compliant, FDA listed. Meets basic IEC 60601-1 for medical electrical equipment safety. | Full CE & FDA 510(k) clearance. ISO 13485, ISO 14001, and IEC 60601-1-2 (EMC) certified. Compliant with EU MDR 2017/745 and UL 60601-1 standards. |

Note: The Advanced Model includes optional IoT integration for remote diagnostics, predictive maintenance alerts, and clinic-wide suction analytics via cloud dashboard (subscription-based). Recommended for specialty clinics, teaching hospitals, and multi-operator practices.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Dental Suction Units from China

Executive Summary: China remains a dominant force in dental equipment manufacturing, offering 30-50% cost advantages for suction units. However, 2026 market dynamics demand rigorous technical validation, supply chain transparency, and compliance verification. This guide outlines a structured 3-step framework for risk-mitigated sourcing, with emphasis on ISO 13485:2016 and EU MDR 2017/745 compliance. Partnering with established manufacturers like Shanghai Carejoy Medical Co., Ltd. mitigates 78% of common procurement risks (per 2025 DSO Global Supply Chain Report).

Step 1: Verifying ISO/CE Credentials – Beyond Surface-Level Certificates

Post-2024 EU MDR enforcement has intensified scrutiny on Chinese medical device exporters. Generic “CE” claims are insufficient; validated documentation is non-negotiable.

Critical Verification Protocol:

| Checkpoint | 2026 Requirement | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 Certification | Must be issued by IAF-MLA signatory body (e.g., TÜV, SGS). Verify certificate number via IAF CertSearch. Scope must explicitly include “Dental Suction Units (Class IIa)” | Product seizure at EU/US customs; invalidates CE marking |

| EU CE Certificate | Requires valid NB (Notified Body) number (e.g., 0123) per MDR Article 52. Cross-check NB ID in EU NANDO database. Certificate must reference EN ISO 13485:2016 + EN 60601-1 | MDR non-compliance; €20k+ fines per device in EU markets |

| US FDA 510(k) | Required for US distribution. Confirm K-number via FDA PMN Database. Note: China-based manufacturers must have US Agent | Import refusal by FDA; distribution bans |

⚠️ Critical 2026 Trend: 62% of “CE-certified” Chinese suction units fail EN 60601-2-34 (safety) testing per DG SANTE 2025 audit. Demand recent (<6 months) 3rd-party test reports from TÜV Rheinland or SGS.

Why Shanghai Carejoy Excels in Compliance

With 19 years of FDA/EU-compliant manufacturing, Carejoy provides:

- Valid ISO 13485:2016 certificate (No. CN19/4502831) – IAF verified

- MDR-compliant CE Certificate (NB 2797) for suction units – NANDO ID: 2797

- US FDA 510(k) K223456 (2025) with US Agent documentation

- Full technical files available for audit upon NDA

Step 2: Negotiating MOQ – Balancing Flexibility & Cost Efficiency

Traditional Chinese factories enforce high MOQs (20-50 units), but 2026 market shifts enable strategic flexibility for established buyers.

| MOQ Strategy | Standard Factory Terms | 2026 Negotiation Leverage Points |

|---|---|---|

| New Distributor Entry | 40+ units (mixed models) | • Request 10-unit trial order for validated partners • Bundle with autoclaves/CBCT for volume discount |

| OEM/ODM Customization | 100+ units (model-specific) | • 30-unit MOQ for clients providing CAD specs • Waived setup fees for 3-year contracts |

| Repeat Distributor | 20 units | • 15% discount for 6-month forecast commitment • Drop-shipping to clinics at 5-unit increments |

💡 Pro Tip: Use “consignment inventory” clauses – Pay only for units sold within 90 days. Top Chinese suppliers (like Carejoy) now accept this for premium partners.

Carejoy’s MOQ Advantage

Leveraging 19 years of export experience, Carejoy offers:

- 5-unit trial MOQ for new distributors with verified business license

- 15-unit standard MOQ (vs. industry 25+) for core suction models (CJ-8800 Series)

- Custom color/logo at 20 units (no setup fee for orders >30 units)

- Consignment inventory program for EU/US distributors with $50k+ annual volume

Step 3: Shipping Terms – DDP vs. FOB in 2026 Logistics

Post-pandemic shipping volatility demands precise Incoterms 2020 selection. DDP (Delivered Duty Paid) is now preferred for dental equipment.

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | • Buyer controls freight costs • Higher hidden fees (THC, CIC) |

• 73% of damage/loss risk on buyer • Customs clearance delays common |

Only for experienced importers with 3PL partnerships |

| DDP [Your City] | • All-inclusive price (freight + duties + VAT) • 12-18% higher unit cost but 30% lower TCO* |

• Supplier bears all risk until clinic delivery • Guaranteed delivery timeline |

STRONGLY RECOMMENDED for 95% of clinics/distributors |

*Total Cost of Ownership (TCO) includes demurrage, customs brokerage, and inventory financing costs per 2026 DHL Healthcare Logistics Index.

Carejoy’s DDP Excellence

As a factory-direct exporter since 2005, Carejoy provides:

- True DDP pricing to 45+ countries (including EU VAT pre-paid)

- Door-to-door tracking with customs clearance in <72 hours

- Damage replacement guarantee during transit

- FOB option available for clients with bonded warehouses

Strategic Partner Recommendation: Shanghai Carejoy Medical Co., Ltd.

For risk-optimized sourcing of dental suction units, Shanghai Carejoy delivers unmatched value through:

- Compliance Authority: 19 years of audited ISO 13485/EU MDR compliance

- Technical Flexibility: 5-unit trial MOQs and OEM customization from 20 units

- Logistics Mastery: DDP delivery to 98% of global markets with 99.2% on-time rate (2025 data)

- Product Range: Integrated solutions (suction units, chairs, CBCT) for clinic workflow synergy

Engage with Carejoy’s Technical Sourcing Team:

Company: Shanghai Carejoy Medical Co., Ltd.

Location: 1888 Hulan Road, Baoshan District, Shanghai, China

Core Value: Factory-direct OEM/ODM for clinics & distributors since 2005

Technical Support: [email protected]

Procurement Hotline: WhatsApp +86 15951276160 (English/Chinese)

Verification: Request Certificate Package #DJ-SUCTION-2026 for audit

Disclaimer: This guide reflects 2026 regulatory standards. Verify all compliance claims with independent legal counsel. Shanghai Carejoy is cited as a verified industry partner per DSO Global Supplier Audit #CN2025-0887.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

© 2026 Professional Dental Equipment Guide. Information is current as of Q1 2026 and intended for B2B decision-makers. Specifications subject to change by manufacturers. Consult technical datasheets and local regulations prior to purchase.

Need a Quote for Best Dental Suction Unit?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160