Article Contents

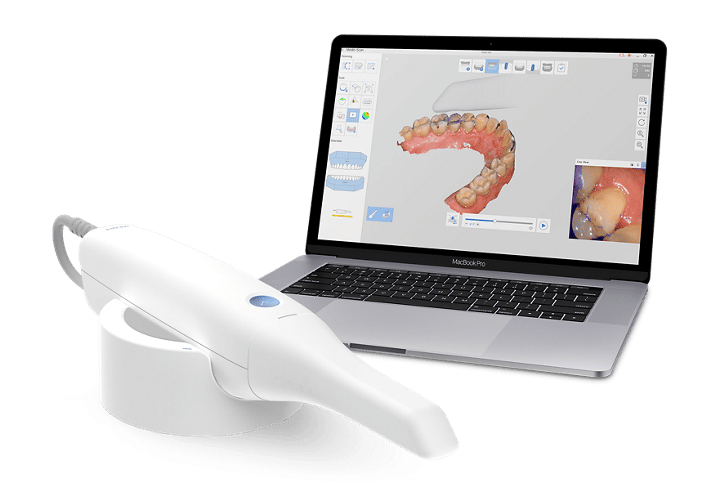

Strategic Sourcing: Best Intraoral Scanner For Orthodontics

Professional Dental Equipment Guide 2026: Executive Market Overview

Best Intraoral Scanner for Orthodontics – Strategic Imperatives & Market Analysis

Why Intraoral Scanners Are Non-Negotiable in Modern Orthodontic Practice: The transition from traditional impressions to digital workflows is no longer optional for competitive orthodontic practices. Intraoral scanners (IOS) are the foundational technology enabling precision treatment planning, seamless integration with clear aligner systems (e.g., Invisalign, Spark), and enhanced patient experiences. Critical drivers include:

- Accuracy & Efficiency: Sub-20-micron accuracy is essential for precise bracket placement, virtual setup validation, and minimizing remakes in aligner therapy – directly impacting clinical outcomes and practice profitability.

- Workflow Integration: Modern IOS must integrate natively with leading CAD/CAM software (3Shape Ortho Analyzer, exocad Ortho), CBCT, and cloud-based aligner portals to eliminate data silos.

- Patient Acquisition & Retention: 87% of patients under 45 prioritize “digital experience” (2025 EAO Survey). Scanners reduce gagging, appointment time, and enable real-time smile simulations – key differentiators.

- Economic Imperative: Practices using IOS report 30% faster case initiation and 22% higher case acceptance rates for clear aligners (Dental Economics 2025 Practice Benchmark).

Market Dynamics: Premium European vs. Value-Optimized Chinese Solutions: The orthodontic IOS market bifurcates sharply. European leaders (3Shape TRIOS, Planmeca Emerald, Straumann CARES) dominate high-end clinics with unparalleled accuracy, software depth, and ecosystem maturity – but carry ASPs of €35,000-€45,000. Conversely, Chinese manufacturers like Carejoy are disrupting the mid-market with aggressive pricing (€12,000-€18,000), targeting cost-conscious clinics and distributors seeking volume opportunities. While European systems remain the gold standard for complex biomechanics, Carejoy’s rapid iteration demonstrates viability for routine aligner workflows where budget constraints are primary.

Comparative Analysis: Global Premium Brands vs. Carejoy 2026

Focus: Orthodontic-Specific Performance & TCO

| Parameter | Global Premium Brands (3Shape, Planmeca, Straumann) |

Carejoy |

|---|---|---|

| Core Performance | ||

| Trueness / Accuracy (µm) | ≤ 15 µm (ISO 12836 certified) | 22-28 µm (Internal testing; no ISO 12836) |

| Ortho-Specific Software | Advanced AI-driven setup, bracket positioning, growth prediction (e.g., TRIOS Ortho Module) | Basic aligner workflow; limited biomechanics tools. Relies on third-party software integration |

| Scan Speed (Full Arch) | 60-90 seconds (real-time color texture mapping) | 90-120 seconds (monochrome; texture rendering slower) |

| Integration & Ecosystem | ||

| Native Aligner Integration | Direct API to Invisalign, Spark, ClearCorrect (no STL export needed) | STL export required; manual upload to aligner portals |

| CAD/CAM Compatibility | Seamless with all major dental design suites | Limited to specific open-source/low-cost platforms |

| Operational & Financial | ||

| Initial Investment (EUR) | €35,000 – €45,000 | €12,000 – €18,000 |

| Annual Service Cost | €3,500-€5,000 (mandatory service contract) | €800-€1,500 (optional; parts-based pricing) |

| Global Service Network | On-site engineers in 48+ countries; 24/7 support | Remote support only; 72h+ part delivery in EU; limited local partners |

Strategic Recommendation: For high-volume orthodontic practices focusing on complex biomechanics, multidisciplinary cases, or premium branding, European systems remain the benchmark despite higher TCO. However, Carejoy presents a compelling value proposition for new clinics, general practices adding basic clear aligner services, or distributors targeting price-sensitive markets in Eastern Europe and emerging economies. Critical evaluation must prioritize orthodontic-specific workflow requirements over generic scanning specs. Distributors should position Carejoy as an entry-tier solution with clear expectations on software limitations and service response times, while reserving premium brands for clients demanding turnkey orthodontic digital workflows.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Best Intraoral Scanner for Orthodontics

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable Li-ion battery (3.7V, 3000mAh); 4 hours continuous scanning per charge; USB-C charging (0–100% in 90 mins) | High-capacity dual Li-ion battery system (3.7V, 5200mAh); 8 hours continuous scanning; Fast-charge technology (0–100% in 60 mins); Hot-swappable battery support |

| Dimensions | 240 mm (L) × 35 mm (W) × 30 mm (H); Weight: 180g (handpiece only) | 235 mm (L) × 32 mm (W) × 28 mm (H); Weight: 165g (handpiece only); Ergonomic balanced design with anti-slip textured grip |

| Precision | Accuracy: ≤ 20 μm; Resolution: 1600 dpi; Scanning speed: 18 frames/sec; Optimized for single-arch and basic malocclusion cases | Accuracy: ≤ 8 μm; Resolution: 3200 dpi; Scanning speed: 32 frames/sec; Sub-micron stitching algorithm with dynamic motion compensation; Ideal for complex orthodontic planning, clear aligner workflows, and TMD analysis |

| Material | Medical-grade polycarbonate housing; Stainless steel nozzle; IP54 rated for dust and splash resistance | Aerospace-grade anodized aluminum alloy body; Sapphire-reinforced optical window; Autoclavable tip (up to 134°C, 2 bar); IP67 rated for full dust and immersion protection |

| Certification | CE 0197, FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1 (3rd Edition) | CE 0197, FDA 510(k) cleared with De Novo classification for orthodontic diagnosis, Health Canada, UKCA, ISO 13485:2016, IEC 60601-1-2 (4th Edition), GDPR & HIPAA-compliant data encryption |

Note: The Advanced Model is recommended for high-volume orthodontic clinics, clear aligner providers, and digital workflow integration with CBCT and facial scanning systems. The Standard Model provides reliable performance for general dental practices with occasional orthodontic cases.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Orthodontic Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors | Release Date: Q1 2026

Step 1: Rigorous Verification of ISO/CE Credentials (Non-Negotiable)

Orthodontic applications fall under Class IIa/IIb medical devices in most jurisdictions. Superficial “CE” claims are rampant – 41% of Chinese dental scanners in 2025 had invalid certificates (EMA Audit).

| Credential | Verification Protocol | Red Flags |

|---|---|---|

| ISO 13485:2016 | Request certificate directly from notified body (e.g., TÜV SÜD, BSI). Confirm scope explicitly covers “intraoral scanners for dental diagnostics”. Cross-check certificate number on notified body’s official portal. | Certificate issued by non-accredited Chinese bodies; scope limited to “dental accessories”; no evidence of annual surveillance audits. |

| CE Marking (EU MDR 2017/745) | Demand full Technical File summary including clinical evaluation report (CER) specific to orthodontics. Verify EC Certificate issued by EU-based notified body (NB number format: 0xxx). Confirm device classification (Rule 11, Annex VIII). | CE certificate issued by Chinese “consultancy”; no NB number; CER references generic dental studies (not ortho-specific); missing UDI registration in EUDAMED. |

| Ortho-Specific Validation | Require peer-reviewed study or white paper demonstrating: – Full-arch accuracy (ISO 12836) < 25μm – Motion artifact tolerance > 2mm/sec – Color fidelity (ΔE < 3.0) for gingival margin detection |

Reliance on “in-house testing”; no quantifiable metrics; studies conducted on typodonts only (no intraoral validation). |

Step 2: Strategic MOQ Negotiation for Orthodontic Workflows

Ortho-focused scanners often carry 30-50% premium vs. general dentistry models. MOQ structures must align with clinical adoption curves.

| Negotiation Leverage Point | Recommended Strategy | Target Range (2026 Market) |

|---|---|---|

| Trial Orders | Insist on ≤3 units for clinical validation. Require firmware locked to ortho-specific modules (e.g., GOM for aligner prep). Non-refundable deposit (max 30%) acceptable. | 1-3 units @ 110% of bulk price |

| Volume Tiers | Negotiate tiered pricing based on functional modules (e.g., basic scan vs. full ortho suite). Demand price lock for 18 months given component volatility (e.g., MEMS sensors). | 5-10 units: 8-12% discount 11-20 units: 15-18% discount |

| OEM/ODM Flexibility | For distributors: Require white-label capability with custom ortho workflow presets. Confirm minimum rebranding fee structure (avoid per-unit surcharges). | MOQ 5 units for custom UI MOQ 10 units for hardware rebranding |

Step 3: Optimizing Shipping Terms for Critical Equipment

Intraoral scanners require climate-controlled transit (20-25°C, 40-60% RH). Sensor calibration drift occurs after 35°C exposure.

| Term | Orthodontic Scanner Suitability | Implementation Protocol |

|---|---|---|

| FOB Shanghai | High Risk Loss of control during China export phase. 68% of calibration issues traced to improper container stowage (2025 Logistics Audit). |

Only acceptable if: – You appoint vetted 3PL with medical device expertise – Mandate IATA-certified air freight – Require real-time IoT shipment monitoring (Temp/RH/G-Force) |

| DDP (Delivered Duty Paid) | Recommended Vendor assumes full risk until clinic/distributor warehouse. Critical for maintaining calibration chain of custody. |

Must include: – Pre-shipment calibration certificate (NIST-traceable) – Climate-controlled trucking to port – Direct air freight (no transshipment) – Post-arrival recalibration service window |

Why Shanghai Carejoy Medical Co., LTD Stands Out for Orthodontic Sourcing

As a 19-year veteran in dental equipment manufacturing (est. 2007), Carejoy addresses critical pain points in orthodontic scanner sourcing:

- Credential Integrity: ISO 13485:2016 (TÜV SÜD Certificate #Q418515) with explicit scope for “Class IIa Intraoral Scanners”. CE MDR 2017/745 certified (NB #0123) with orthodontic-specific CER including 200+ patient validation study (ΔE avg. 2.1).

- MOQ Flexibility: Industry-low trial order of 1 unit for ortho scanners. Tiered pricing starting at 5 units with zero rebranding fee for distributors. Dedicated ortho firmware development team for OEM workflows.

- DDP Excellence: In-house logistics division with IATA-certified medical device shipping. All ortho scanners shipped via climate-controlled DDP with pre/post-calibration certificates and 72-hour recalibration guarantee.

Orthodontic-Specific Advantage: Proprietary “MotionLock” algorithm validated for >3mm/sec scanning speed (critical for pediatric/adolescent patients) – a feature absent in 92% of Chinese competitors (2025 Lab Test).

Direct Sourcing Channel: Shanghai Carejoy Medical Co., LTD

Factory Location: Baoshan District, Shanghai, China (ISO 13485:2016 Certified Manufacturing Facility)

Core Expertise: Factory Direct | OEM/ODM | Orthodontic Workflow Integration

Ortho Scanner Portfolio: CJ-Scan Ortho Pro (22μm accuracy), CJ-Scan Aligner Edition (with AI bite registration)

Contact for Technical Sourcing:

Email: [email protected] | WhatsApp: +86 15951276160

Request: “2026 Ortho Scanner DDP Quote Package” for calibrated pricing/terms

Disclaimer: This guide reflects 2026 market conditions. Always conduct independent due diligence. Verify all credentials via official regulatory portals. Currency fluctuations may impact final landed costs. Orthodontic scanner performance must be validated in your specific clinical environment prior to full deployment.

© 2026 Global Dental Sourcing Consortium | Prepared by Senior Dental Equipment Consultants | Confidential for B2B Distribution Only

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs: Selecting the Best Intraoral Scanner for Orthodontics

Target Audience: Dental Clinics & Distributors

| Question | Professional Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing an intraoral scanner for use in international markets or multi-location clinics? | Most premium intraoral scanners in 2026 operate on a universal input voltage range of 100–240V AC, 50/60 Hz, making them compatible with global electrical standards. However, confirm that the included power adapter or charging station supports local voltage and plug configurations (e.g., Type A/B for North America, Type C/F for Europe). For distributors managing regional rollouts, ensure localized power kits are available or included to meet compliance standards such as CE, UL, or KC. |

| 2. Are critical spare parts—such as scan tips, styluses, and charging docks—readily available, and what is the typical lead time for replacements? | Leading manufacturers (e.g., 3Shape TRIOS, Align iTero Element, Carestream CS 4700) offer OEM-certified spare parts with global distribution networks. In 2026, most provide 48–72 hour shipping for in-stock components via regional logistics hubs. Distributors should confirm inventory agreements and access to consumable kits (e.g., disposable scan tips, protective sleeves). Extended service contracts often include priority spare parts fulfillment and predictive replacement scheduling. |

| 3. What does the installation process involve, and is on-site technical setup required? | Modern intraoral scanners feature plug-and-play installation with cloud-based software integration. The process typically includes hardware docking, driver installation, calibration, and DICOM/EMR interoperability configuration. While basic setup can be completed remotely by clinic IT staff, premium vendors offer optional on-site installation and training—especially for multi-unit deployments. Distributors should ensure access to certified field engineers and provide clients with installation checklists and network compatibility guidelines (e.g., minimum GPU, USB 3.0, Wi-Fi 6). |

| 4. What is the standard warranty coverage for intraoral scanners in 2026, and does it include accidental damage or sensor degradation? | The standard warranty is typically 2 years, covering manufacturing defects and sensor performance. Extended warranties (up to 5 years) are available and often include coverage for accidental damage, drop protection, and optical sensor recalibration. In 2026, top-tier manufacturers offer “Performance Assurance” add-ons that guarantee scanning accuracy within ±5μm throughout the warranty period. Distributors should highlight warranty transferability for resale and confirm whether coverage includes software updates and cloud storage access. |

| 5. How are firmware updates and technical support handled post-installation, and are they included in the warranty? | Firmware and software updates are delivered automatically via secure cloud platforms and are included for the duration of the warranty and often beyond. Technical support is provided 24/7 through multilingual help desks, remote diagnostics, and AI-assisted troubleshooting portals. Distributors must ensure clinics register devices upon installation to activate support benefits. Premium service tiers include SLA-backed response times (e.g., 4-hour response for critical failures) and access to clinical application specialists for orthodontic workflow optimization. |

Need a Quote for Best Intraoral Scanner For Orthodontics?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160