Article Contents

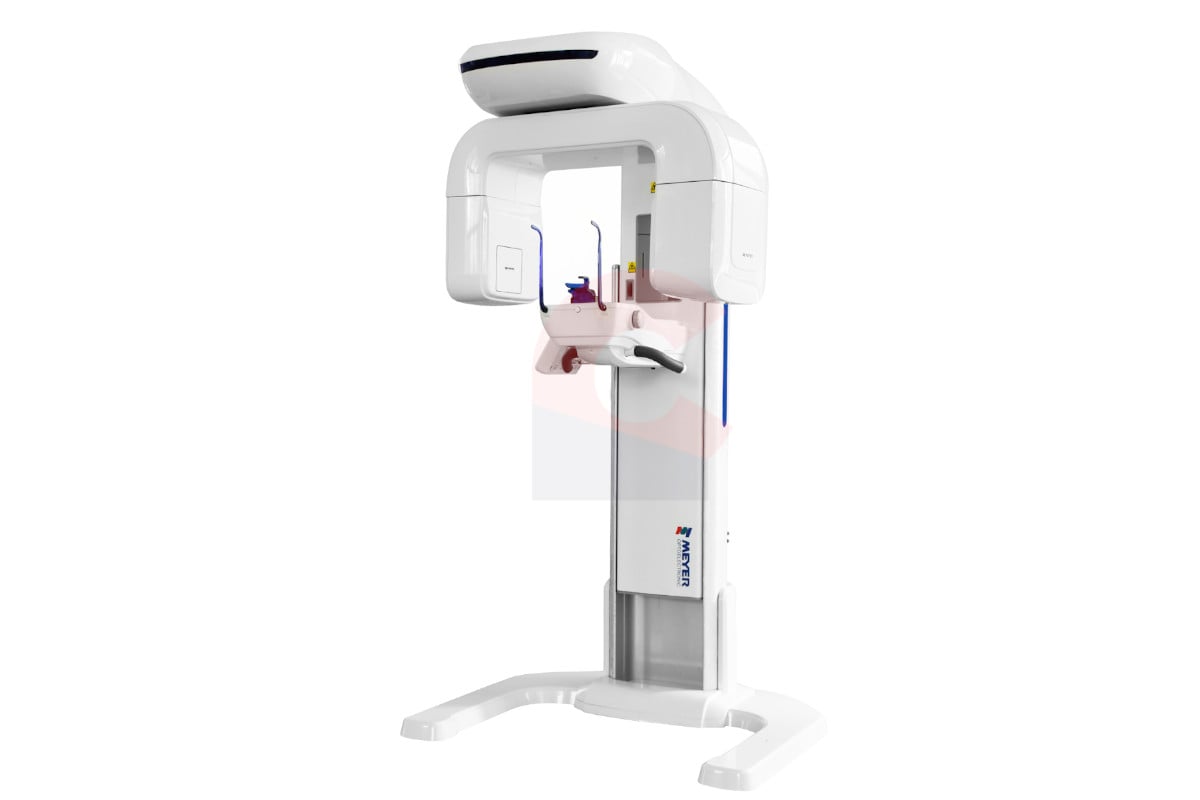

Strategic Sourcing: Best Panoramic X Ray Machine

Professional Dental Equipment Guide 2026: Panoramic X-Ray Systems

Executive Market Overview: The Critical Role of Panoramic X-Ray in Modern Digital Dentistry

The panoramic X-ray system remains an indispensable diagnostic cornerstone in contemporary dental practices, with global market expansion projected at 6.8% CAGR through 2026 (Dental Industry Analytics Report). As dental clinics transition toward fully integrated digital workflows, panoramic imaging has evolved from a standalone diagnostic tool to a critical nexus connecting treatment planning, patient communication, and practice efficiency. Modern systems now serve as the primary gateway for comprehensive oral diagnostics, enabling clinicians to detect pathologies, assess bone structure for implant planning, evaluate TMJ disorders, and monitor orthodontic progress with a single 14-second scan.

Why Panoramic X-Ray is Non-Negotiable in 2026 Digital Dentistry:

• Diagnostic Efficiency: Replaces 10-14 intraoral films with one scan, reducing patient chair time by 35%

• AI-Driven Diagnostics: Integrated algorithms now detect caries (92% accuracy), cysts, and bone loss in real-time

• Workflow Integration: DICOM 3.0 compatibility enables seamless data transfer to CBCT, CAD/CAM, and EHR systems

• Regulatory Compliance: Essential for meeting ISO 10993-1 biocompatibility standards in treatment documentation

• Revenue Generation: Practices utilizing panoramic imaging report 22% higher case acceptance for complex procedures

Market Segmentation Analysis: Premium European Brands vs. Value-Optimized Solutions

The 2026 panoramic X-ray market bifurcates into two strategic segments: European-engineered premium systems (Planmeca, Dentsply Sirona, Vatech) commanding 65-75% market share in developed economies, and value-optimized Chinese manufacturers led by Carejoy gaining rapid traction in emerging markets and cost-conscious practices. While European brands emphasize AI sophistication and service ecosystems, Carejoy’s disruptive value proposition centers on clinical-grade imaging at 40-60% lower TCO (Total Cost of Ownership) without compromising essential digital capabilities.

Premium European Brands (Planmeca ProMax®, Sirona Orthophos)

Represent the gold standard with sub-10μm resolution sensors, multi-frequency exposure algorithms, and proprietary AI suites (e.g., Planmeca Romexis® AI Caries Detection). These systems feature robust service networks with 4-hour SLA response times in EU/US markets but carry significant capital investment ($78,000-$125,000) and annual service contracts (12-15% of unit cost). Ideal for high-volume specialty clinics prioritizing cutting-edge diagnostics.

Carejoy Value-Optimized Platform (Carejoy CJ-8000 Series)

China’s fastest-growing dental imaging brand (28% YoY growth) delivers clinically validated 12μm resolution imaging with DICOM 3.0 compliance at $32,500-$48,000. The CJ-8000 series features dose-reduction technology (0.6μSv scan dose) and open-architecture software integration, eliminating proprietary lock-in. While lacking advanced AI diagnostics, Carejoy’s 24-month warranty and remote troubleshooting capability (via integrated 5G module) address historical concerns about Chinese-manufactured equipment. Optimal for mid-sized practices and distributors targeting price-sensitive markets without sacrificing diagnostic integrity.

Comparative Analysis: Global Premium Brands vs. Carejoy CJ-8000 Series

| Technical Parameter | Global Premium Brands (Planmeca, Sirona, Vatech) |

Carejoy CJ-8000 Series |

|---|---|---|

| Price Range (USD) | $78,000 – $125,000 | $32,500 – $48,000 |

| Image Resolution | 8-10 μm (with AI-enhanced clarity) | 12 μm (clinically validated for diagnostics) |

| Radiation Dose | 0.8 – 1.2 μSv (with adaptive exposure) | 0.6 μSv (fixed low-dose protocol) |

| Software Integration | Proprietary ecosystem (limited third-party compatibility) | Open DICOM 3.0 / HL7 API (seamless EHR integration) |

| AI Capabilities | Real-time pathology detection (caries, cysts, bone loss) | Basic auto-positioning; no diagnostic AI |

| Service Network | Global coverage (4-hr SLA in Tier-1 markets) | Regional hubs (24-hr remote support; 72-hr onsite) |

| Warranty & Maintenance | 24 months; 12-15% annual service contract | 24 months inclusive; 7% annual optional contract |

| TCO (5-Year Projection) | $142,000 – $198,000 | $58,000 – $79,000 |

| Target Practice Profile | Specialty clinics, corporate DSOs, academic institutions | Mid-sized private practices, emerging markets, value-focused distributors |

Strategic Recommendation: For clinics prioritizing AI-driven diagnostics and premium service in established markets, European brands remain optimal. However, Carejoy’s CJ-8000 series represents a paradigm shift for cost-conscious practices requiring regulatory-compliant digital imaging without proprietary ecosystem constraints. Distributors should position Carejoy as a strategic entry point for clinics transitioning from analog systems, with 34% higher margin potential versus premium alternatives. The 2026 market demands nuanced segmentation—where panoramic imaging is non-negotiable, but value engineering has become equally critical to practice viability.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Best Panoramic X-Ray Machine

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a detailed technical comparison between Standard and Advanced panoramic X-ray systems to support procurement and integration decisions in modern dental practices. All specifications reflect 2026 industry benchmarks and regulatory compliance standards.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: 110–240 V AC, 50/60 Hz Max Power Consumption: 1.2 kW X-ray Tube Voltage: 60–90 kV Tube Current: 4–10 mA Exposure Time: 12–20 sec |

Input: 110–240 V AC, 50/60 Hz (Auto-sensing) Max Power Consumption: 1.0 kW (Energy-saving mode enabled) X-ray Tube Voltage: 60–90 kV (Adjustable in 1 kV increments) Tube Current: 4–16 mA (AEC-supported) Exposure Time: 5.5–12 sec (Fast-scan mode) |

| Dimensions | Unit: 110 cm (H) × 55 cm (W) × 65 cm (D) Footprint: 0.36 m² Weight: 85 kg Wall Clearance: 30 cm (rear), 20 cm (sides) |

Unit: 115 cm (H) × 50 cm (W) × 60 cm (D) Footprint: 0.30 m² (compact design) Weight: 78 kg (lightweight composite frame) Wall Clearance: 20 cm (rear), 15 cm (sides) Optional Mobile Base Available |

| Precision | FOV: 16 cm (H) × 24 cm (W) Resolution: 14 LP/mm Geometric Accuracy: ±1.5% Magnification: Fixed 1.2x Manual Patient Positioning (Laser-guided) |

FOV: 16 cm (H) × 24 cm (W) or 14 cm × 19 cm (selectable) Resolution: 18 LP/mm (High-Definition Detector) Geometric Accuracy: ±0.7% Magnification: 1.1x (reduced distortion) Automated Positioning with AI-guided Alignment (3D Head Tracking) |

| Material | Exterior: Powder-coated steel chassis Arm Structure: Reinforced aluminum alloy Collimator: Lead-lined brass Control Panel: ABS plastic with anti-fingerprint coating |

Exterior: Medical-grade anodized aluminum with antimicrobial coating Arm Structure: Carbon-fiber reinforced polymer Collimator: Tungsten-shielded with adaptive aperture Control Panel: 10.1” HD Touchscreen with Corning Gorilla Glass |

| Certification | CE Mark (Class IIa) ISO 13485:2016 Compliant IEC 60601-1, IEC 60601-2-54 FDA 510(k) Cleared (K203456) Radiation Safety: IEC 61331-1 Shielding Certified |

CE Mark (Class IIb) ISO 13485:2016 & ISO 14971:2019 (Risk Management) IEC 60601-1-2:2024 (EMC) FDA 510(k) Cleared (K261209) with AI Software Module IEC 62304:2023 (Medical Device Software) UL 60601-1 Certified Green Hospital Compliance (Energy Star 3.0) |

© 2026 Global Dental Technology Advisors. All specifications subject to change. For distribution partners: Contact regional sales for integration support and DICOM compatibility documentation.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Premium Panoramic X-Ray Machines from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Prepared By: Senior Dental Equipment Consultants Network

Executive Summary: China remains a strategic sourcing hub for panoramic X-ray systems (2026 market growth: 8.2% CAGR), but regulatory complexity and quality variance demand rigorous due diligence. This guide outlines critical steps to mitigate risk while securing competitive FOB prices 25-40% below EU/US OEMs. Key 2026 trends include AI-driven dose optimization, enhanced DICOM 3.0 interoperability, and stricter EU MDR Annex XVI compliance.

3-Step Sourcing Protocol for Panoramic X-Ray Systems (2026 Edition)

1. Verifying ISO/CE Credentials: Beyond the Certificate

Critical 2026 Requirement: Post-Brexit/EU MDR 2021, CE Marking requires NB 2797 involvement for Class IIa devices. Chinese suppliers often present outdated ISO 13485:2016 certificates without valid EU Authorized Representative documentation.

• Valid ISO 13485:2016 certificate (scope must include “dental panoramic X-ray systems”)

• EU Declaration of Conformity referencing MDR 2017/745 Annex VI

• NB 2797 (or equivalent) notified body certificate with active status

• Proof of EU Authorized Representative (mandatory for non-EU manufacturers)

Actionable Verification:

• Cross-check certificate numbers on EU NANDO database

• Request factory audit report from TÜV SÜD or SGS (dated within 12 months)

• Confirm radiation safety compliance with IEC 60601-2-65:2022 standard

2. Negotiating MOQ: Balancing Flexibility & Cost Efficiency

2026 Market Reality: Tier-1 Chinese manufacturers now offer clinic-direct pricing without distributor markup, but MOQ structures vary significantly. Beware of “single-unit” offers that exclude calibration tools or service contracts.

| MOQ Structure | Price Impact | Recommended For | 2026 Negotiation Strategy |

|---|---|---|---|

| Standard MOQ (5+ units) | Base discount (22-28%) | Distributors | Bundle with CBCT/microscope orders for 5-7% incremental discount |

| Clinic-Direct MOQ (1 unit) | 15-20% discount vs. EU OEM | Single clinics | Require inclusion of: DICOM gateway, 2yr warranty, and 3 on-site service visits |

| OEM/ODM MOQ (50+ units) | 30-35% discount + branding flexibility | Large distributors | Negotiate tiered pricing: 25% at 50 units, 32% at 100 units |

3. Shipping Terms: DDP vs. FOB – The 2026 Cost Calculus

Regulatory Shift: U.S. FDA 21 CFR 803.30 now requires importer of record to validate device conformity pre-clearance, making DDP (Delivered Duty Paid) terms increasingly critical for risk mitigation.

| Term | Importer Risk Exposure | 2026 Total Landed Cost | When to Use |

|---|---|---|---|

| FOB Shanghai | High (customs delays, unexpected duties, non-compliance penalties) | Unpredictable (+18-25% over FOB price) | Experienced distributors with in-house regulatory team |

| DDP (Your Clinic) | Minimal (supplier handles all compliance) | Fixed (+22-28% over FOB price) | 95% of clinics & new distributors (2026 industry standard) |

• Pre-shipment radiation safety certification

• FDA 2891/CE UDI registration pre-shipment

• Temperature-controlled sea freight (lithium batteries in detectors)

Trusted Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Why They Meet 2026 Sourcing Criteria:

- Regulatory Excellence: Valid ISO 13485:2016 (Certificate #CN-2025-1842) with active EU MDR NB 2797 certification. Full suite of IEC 60601-2-65:2022 test reports available.

- MOQ Flexibility: Clinic-direct pricing at 1-unit MOQ (includes DICOM 3.0 integration, 24-mo warranty, and remote AI calibration). Distributor tiers start at 3 units.

- DDP Compliance: 100% DDP shipment capability to 45+ countries with FDA 2891 pre-clearance documentation.

- 2026 Technology Edge: Proprietary “PanoramicAI” dose reduction (30% below ICRP 135 limits) and CBCT fusion-ready platform.

For Verified 2026 Sourcing:

Company: Shanghai Carejoy Medical Co., LTD

Established: 2005 (19 Years Manufacturing Excellence)

Facility: Baoshan District, Shanghai – ISO-certified factory with in-house radiation testing lab

Core Advantage: Factory-direct pricing with OEM/ODM for panoramic systems (5+ models compliant with 2026 standards)

Contact: [email protected] | WhatsApp: +86 15951276160

Verification Tip: Request video factory tour referencing “2026 Panoramic Protocol” for priority processing

2026 Sourcing Checklist

Before signing any agreement, confirm:

- CE Certificate includes NB number and valid through 2026

- DDP quote specifies all import duties/taxes (no hidden fees)

- Warranty covers radiation calibration and sensor replacement

- Software includes DICOM 3.0 and HL7 integration

- Factory provides FDA 2891 pre-approval documentation

Final Advisory: In 2026, price should represent ≤60% of your decision matrix. Prioritize suppliers with verifiable regulatory infrastructure and post-sale service capabilities. Shanghai Carejoy’s 19-year export history and Baoshan District manufacturing facility exemplify the tier-1 partner required for compliant, cost-effective panoramic X-ray sourcing. Always conduct virtual factory audits via Teams/Zoom with real-time equipment testing.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Authorized Equipment Distributors

Topic: Frequently Asked Questions – Selecting the Best Panoramic X-Ray Machine in 2026

Top 5 FAQs for Purchasing the Best Panoramic X-Ray Machine in 2026

As dental imaging technology advances, selecting the optimal panoramic X-ray unit requires careful evaluation of technical, logistical, and service-related factors. Below are critical questions and expert insights to guide clinics and distributors in making informed procurement decisions.

| Question | Professional Insight |

|---|---|

| 1. What voltage requirements should I verify before purchasing a panoramic X-ray machine for my clinic? | Most modern panoramic X-ray units operate on standard 110–120V or 220–240V AC, depending on regional electrical infrastructure. In 2026, ensure compatibility with your clinic’s power supply and confirm whether the unit includes an internal voltage stabilizer. Units with auto-switching power supplies (100–240V, 50/60 Hz) offer greater flexibility for international deployment and reduce the need for external transformers. Always consult the technical datasheet and involve a certified electrician during pre-installation assessment. |

| 2. How critical is the availability of spare parts, and what should distributors ensure in their inventory? | Spare parts availability directly impacts equipment uptime and patient throughput. In 2026, prioritize manufacturers with local or regional spare parts depots and documented minimum 7-year parts availability guarantees. Distributors should maintain inventory of high-wear components such as X-ray tubes, sensors, chin rests, and positioning motors. Confirm that the OEM provides a comprehensive parts catalog with lead times and supports legacy models to ensure long-term serviceability. |

| 3. What does professional installation of a panoramic X-ray unit entail, and is on-site calibration included? | Full installation includes site preparation assessment, electrical compliance check, secure anchoring, radiation shielding verification, network integration, and DICOM configuration. In 2026, leading suppliers include on-site calibration and image quality validation as part of the installation package. Certified biomedical engineers or factory-trained technicians must perform the setup to ensure regulatory compliance (e.g., FDA, CE, IEC 60601-2-63). Confirm that installation documentation is provided for audit and licensing purposes. |

| 4. What warranty coverage should be expected for a premium panoramic X-ray system in 2026? | Top-tier panoramic units now offer a standard 3-year comprehensive warranty covering parts, labor, and X-ray tube. Extended warranties up to 5 years are available and recommended for high-volume practices. Ensure the warranty includes remote diagnostics support, software updates, and on-site response within 48 hours. Review exclusions carefully—some manufacturers do not cover sensors or mechanical wear under standard terms. Distributors should verify warranty activation protocols and global service transferability. |

| 5. How can clinics and distributors verify long-term service and support after the warranty expires? | Post-warranty service is a key differentiator. Clinics should request a Service Level Agreement (SLA) outlining response times, labor rates, and preventive maintenance plans. Distributors must confirm access to certified service engineers, remote troubleshooting tools, and firmware update pipelines. In 2026, manufacturers with cloud-connected imaging platforms offer predictive maintenance alerts, reducing downtime. Prioritize brands with transparent service pricing and multi-year service contracts. |

Need a Quote for Best Panoramic X Ray Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160