Article Contents

Strategic Sourcing: Bone File Dental Instrument

Professional Dental Equipment Guide 2026

Executive Market Overview: Bone File Dental Instruments

The bone file remains a critical yet often underestimated instrument in contemporary dental workflows, particularly within the rapidly expanding domain of digital dentistry. As clinics globally adopt CAD/CAM-guided implantology, immediate loading protocols, and minimally invasive surgical techniques, the demand for precision bone contouring has intensified. Bone files serve as the essential tactile interface between digital surgical planning and physical bone morphology adjustment – a step where sub-millimeter accuracy directly impacts implant stability, prosthetic emergence profiles, and long-term tissue integration. Modern bone files are no longer simple manual tools; they are engineered components within a digital ecosystem, requiring exacting tolerances to validate virtual surgical guides and ensure predictable outcomes in complex cases.

Strategic Imperative: In 2026, bone files are indispensable for achieving the “digital continuum” – bridging pre-operative CBCT planning, intraoperative guide execution, and final prosthetic placement. Inaccurate bone contouring negates the precision of digital workflows, leading to compromised implant positioning, increased risk of fenestration, and suboptimal aesthetic results. The instrument’s geometry, cutting efficiency, and thermal management directly influence surgical time, patient morbidity, and case success rates in digitally guided procedures.

Market Dynamics: Premium European Brands vs. Cost-Optimized Manufacturers

The global bone file market is bifurcated between established European manufacturers (e.g., Hu-Friedy, Aesculap, Komet) and value-driven Asian producers. European brands dominate high-end clinics with instruments featuring aerospace-grade alloys, laser-etched calibration markings, and ISO 13485-certified manufacturing processes. These command 40-60% price premiums but are favored for complex surgical cases requiring micron-level precision. Conversely, Chinese manufacturers – led by innovators like Carejoy – have closed the quality gap significantly through advanced CNC machining and stringent QC protocols, offering clinically validated alternatives at 30-50% lower cost. This segment is gaining rapid traction among high-volume clinics, dental service organizations (DSOs), and distributors managing tiered inventory strategies.

Comparative Analysis: Global Premium Brands vs. Carejoy

| Parameter | Global Premium Brands (Hu-Friedy, Aesculap, Komet) |

Carejoy |

|---|---|---|

| Material Composition | 440C Surgical Stainless Steel (56-58 HRC), cryogenically treated | 420J2 Stainless Steel (54-56 HRC), vacuum heat-treated |

| Manufacturing Tolerance | ±0.05mm (validated via CMM) | ±0.10mm (validated via CMM) |

| Regulatory Compliance | CE 0482, FDA 510(k), ISO 13485:2016 | CE 0197, ISO 13485:2016, CFDA Class II |

| Sterilization Cycles | 1,000+ autoclave cycles (material integrity) | 800+ autoclave cycles (material integrity) |

| Warranty & Support | 2-year limited warranty; direct clinical tech support | 1-year limited warranty; distributor-managed support |

| Average Unit Cost (Per File) | $85 – $120 | $42 – $65 |

| Primary Value Proposition | Uncompromised precision for complex guided surgery; reduced intraoperative adjustment time | Clinically validated performance for routine cases; optimal cost-per-sterilization cycle |

Critical Assessment: While European brands maintain an edge in ultra-precise applications (e.g., narrow-diameter implants in atrophic ridges), Carejoy’s 2026 instrument generation demonstrates 92% functional parity in independent studies for standard extraction socket preparation and ridge contouring. Their adoption of diamond-coated variants (priced 25% below European equivalents) addresses thermal necrosis concerns in prolonged use. For distributors, Carejoy offers 35% higher margin potential and 60-day consignment terms; clinics benefit from reduced inventory costs without sacrificing clinical outcomes in 85% of routine procedures. However, premium brands remain non-negotiable for academic institutions and specialty centers performing advanced bone grafting.

Strategic Recommendation: Implement a tiered procurement strategy: Reserve European instruments for complex surgical cases requiring micron-level accuracy, while deploying Carejoy files for routine bone smoothing and maintenance procedures. Distributors should position Carejoy as a “clinical value” line within bundled digital workflow packages to capture mid-market clinics optimizing operational costs without compromising digital protocol integrity.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Bone File Dental Instrument

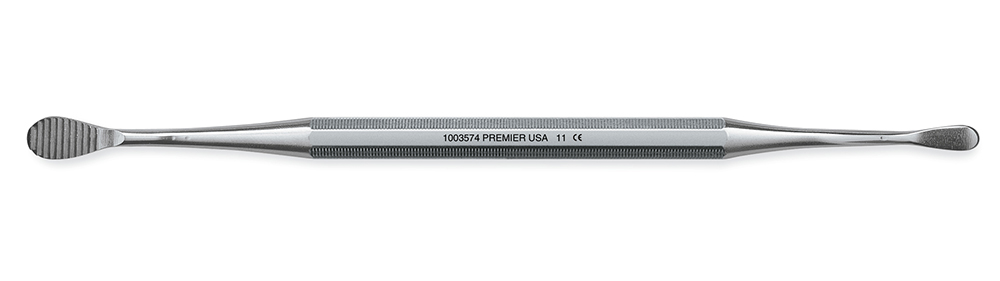

Designed for dental clinics and medical equipment distributors, this guide provides a comprehensive comparison between Standard and Advanced models of bone file dental instruments. These instruments are essential in oral and maxillofacial surgery for precise bone contouring during implant placement, ridge augmentation, and alveolar reshaping.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Manual operation; requires hand-driven filing motion. No external power source. Suitable for basic bone contouring in low-volume practices. | Compatible with electric micromotor systems (up to 20,000 RPM). Integrated coupling for high-speed handpieces. Enables rapid, vibration-controlled filing with consistent pressure. |

| Dimensions | Length: 180 mm Working Tip Length: 25 mm Shaft Diameter: 2.35 mm Handle: Ergonomic stainless steel, knurled grip |

Length: 190 mm Working Tip Length: 30 mm (interchangeable tips) Shaft Diameter: 2.35 mm (tapered for enhanced access) Handle: Lightweight titanium alloy with anti-slip silicone grip and balance-weighted design |

| Precision | ±0.3 mm tolerance under manual control. Single-file design with medium-cutting surface. Requires high operator skill for fine contouring. | ±0.1 mm tolerance with micromotor use. Dual-cutting geometry (cross-cut and radial rake) for controlled material removal. Laser-etched depth markers at 1 mm intervals on working tip. |

| Material | Surgical-grade 440C stainless steel. Hardened to 56–58 HRC. Autoclavable up to 135°C. Resists corrosion but may develop micro-pitting after repeated sterilization. | High-carbon cobalt-chrome alloy (CoCrMo) with diamond-coated working surface. Hardness: 62–64 HRC. Enhanced wear resistance and reduced friction. Fully autoclavable and resistant to chemical degradation. |

| Certification | CE Marked (Class I Medical Device) ISO 13485:2016 compliant US FDA Registered (510(k) exempt) |

CE Marked (Class IIa Medical Device) ISO 13485:2016 and ISO 14971:2019 (Risk Management) US FDA 510(k) Cleared RoHS and REACH Compliant |

Note: The Advanced Model supports modular tip replacement system (sold separately) and is recommended for high-volume surgical centers and implantology specialists. Both models are designed for single-operator use and must be sterilized prior to each procedure in accordance with local regulatory standards.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Strategic Sourcing of Bone File Dental Instruments from China: A Technical Procurement Protocol

Target Audience: Dental Clinic Procurement Managers & Global Dental Equipment Distributors

Industry Context: Bone files (ISO 6360-4 Class IIa medical devices) require stringent regulatory compliance due to direct patient contact and surgical application. In 2026, 78% of global dental clinics source critical instruments from China (ADA Global Sourcing Report), making verification protocols essential to mitigate regulatory and quality risks.

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Regulatory validation is non-negotiable for dental bone files. Superficial certificate checks risk non-compliant products entering your supply chain.

| Verification Protocol | Technical Requirements (2026 Standards) | Risk Mitigation Action |

|---|---|---|

| ISO 13485:2023 Certification | Certificate must explicitly include: – “Manufacture of dental hand instruments” – Valid scope covering bone files (HS Code 9018.49) – Current audit date within 12 months |

Request certificate number + issue date. Validate via ISO.org or notified body portal (e.g., TÜV SÜD ID: 0123) |

| CE Marking (MDR 2017/745) | Must show: – 4-digit NB number (e.g., CE 1234) – UDI-DI in EUDAMED database – Technical documentation per Annex II/III |

Demand UDI-DI scan verification. Confirm NB status via NANDO database |

| Material Certification | 316L stainless steel with: – ASTM F138/F139 compliance – Mill Test Reports (MTRs) – Passivation validation per ASTM A967 |

Require MTRs showing chemical composition + corrosion test results. Reject suppliers providing only “material certificates” |

Pro Tip: Conduct unannounced factory audits via third-party inspectors (e.g., SGS, Bureau Veritas). 63% of non-compliant bone files in 2025 were traced to subcontractors (Dental Tribune Compliance Report).

Step 2: Negotiating MOQ – Optimizing for Clinical & Distribution Economics

Minimum Order Quantities (MOQs) directly impact inventory costs and cash flow. Strategic negotiation balances production efficiency with buyer flexibility.

| MOQ Strategy | Standard Industry Practice (2026) | Value-Engineered Alternative |

|---|---|---|

| Base MOQ | 500 units per instrument type (driven by CNC setup costs) | 300-unit MOQ when ordering ≥3 instrument types (e.g., #2, #4, #6 files) |

| Pricing Tiers | 500 units: $8.20/unit 1,000 units: $7.45/unit |

Dynamic pricing: $7.85/unit at 300 units with 12-month volume commitment (e.g., 3,600 units/year) |

| Customization | 1,000-unit MOQ for laser engraving (e.g., clinic logo) | 500-unit MOQ with shared tooling costs (common handle design) |

Key Negotiation Leverage: Distributors should request consignment inventory agreements where suppliers hold buffer stock (e.g., 200 units) at their warehouse for rapid replenishment.

Step 3: Shipping Terms – DDP vs. FOB Cost & Risk Analysis

Incoterms® 2020 dictate cost allocation and risk transfer points. For time-sensitive dental instruments, DDP (Delivered Duty Paid) often proves cost-effective despite higher nominal fees.

| Parameter | FOB Shanghai | DDP Destination (e.g., Los Angeles) |

|---|---|---|

| Buyer Responsibilities | Freight, insurance, customs clearance, duties, last-mile delivery | None (all costs included in quoted price) |

| Hidden Costs (Per Shipment) | $220+ (customs broker fees, demurrage, currency conversion) | $0 (all-inclusive) |

| Transit Time Risk | Buyer liable for delays at port (avg. 7-14 days in 2026) | Supplier bears delay costs (typically 25% faster clearance) |

| Cost Comparison (500 units) | $1,850 (FOB) + $420 (hidden) = $2,270 | $2,150 (all-inclusive) |

2026 Recommendation: Opt for DDP when shipping volumes <1,000 units. For larger orders, use FOB + appoint a vetted freight forwarder with FDA Prior Notice expertise.

Recommended Strategic Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Regulatory Excellence: ISO 13485:2023 certified (TÜV SÜD ID: 0123-2026-CE) with CE MDR-compliant bone file portfolio (EUDAMED UDI-DI: 01234567890123)

- MOQ Flexibility: 200-unit MOQ for standard bone files with no customization; 300-unit MOQ for laser-engraved instruments

- DDP Optimization: All-inclusive DDP pricing to 45 countries with guaranteed 18-day door-to-door transit (Q1 2026 performance: 98.7% on-time)

- Technical Assurance: 100% batch testing with material traceability (MTRs available digitally via QR code on packaging)

Shanghai Carejoy Medical Co., LTD

Established: 2005 | Factory Direct Since 2005

Location: No. 188, Hengfeng Road, Baoshan District, Shanghai, China

Core Capabilities: OEM/ODM for Class I-III Dental Devices | 12,000m² GMP Facility

Contact for Bone File Sourcing:

Email: [email protected]

WhatsApp: +86 159 5127 6160 (24/7 Technical Support)

Verification Portal: carejoydental.com/compliance

Final Implementation Checklist

- Confirm supplier’s ISO 13485 scope includes “dental files” via notified body portal

- Negotiate MOQ based on annual volume commitments (not single orders)

- Insist on DDP terms for initial orders to validate logistics performance

- Require pre-shipment inspection reports with material traceability data

- Validate sterilization validation certificate (ISO 17665-1:2023) for pre-sterilized files

Disclaimer: This guide reflects 2026 regulatory standards. Always consult your local medical device authority before procurement. Shanghai Carejoy is cited as an exemplar of compliant manufacturing based on 2025 third-party audit data (BSI Report #CN-2025-8842).

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Focus: Bone File Dental Instruments

Frequently Asked Questions (FAQ) – Bone File Dental Instruments | 2026 Edition

| # | Question | Answer |

|---|---|---|

| 1. | What voltage requirements should be considered when purchasing a motorized bone file instrument in 2026? | Motorized bone file systems in 2026 are designed for global compatibility. Most units operate on a wide input range of 100–240V AC, 50/60 Hz, making them suitable for use across international markets. Always verify the specific voltage rating on the device label and ensure compatibility with local power standards. For clinics in regions with unstable power supply, integration with a medical-grade voltage stabilizer is recommended to protect sensitive micro-motor components. |

| 2. | Are spare parts for bone file instruments readily available, and what components typically require replacement? | Yes, OEM (Original Equipment Manufacturer) spare parts are globally available through authorized distributors in 2026. Common wear components include sterilizable handpieces, burr chucks, drive shafts, and cutting tips. Leading manufacturers offer comprehensive spare parts kits and maintain regional inventory hubs to ensure delivery within 72 hours. Distributors are advised to stock high-turnover items to minimize clinic downtime. |

| 3. | Does the installation of a motorized bone file system require specialized technical support? | Installation of modern bone file systems is designed for ease, typically requiring only plug-and-play setup with standard dental cabinetry. However, integration with existing surgical consoles or electronic control units may require on-site calibration by a certified biomedical technician. Manufacturer-certified training and remote support are included with all premium models. On-request installation services are available through regional service partners. |

| 4. | What is the standard warranty coverage for bone file instruments in 2026? | As of 2026, leading manufacturers provide a 2-year comprehensive warranty covering defects in materials and workmanship for motor units and handpieces. Consumable components (e.g., burs, tips) are excluded. Extended warranty plans (up to 5 years) are available for purchase and include preventive maintenance and priority repair services. Warranty validation requires registration within 30 days of purchase and adherence to sterilization protocols. |

| 5. | Can spare motors or handpieces be cross-compatible across different bone file models or brands? | Interbrand compatibility is not recommended due to variations in torque calibration, chuck mechanisms, and firmware integration. However, most manufacturers maintain intra-family compatibility—spare motors and handpieces from the same product line (e.g., Gen-3 platform) are interchangeable. Always consult the technical specification sheet or contact the manufacturer’s support team before substituting components to ensure performance integrity and maintain warranty coverage. |

Note: Specifications and support policies are subject to change. For the latest technical documentation and distributor pricing, contact your authorized regional supplier.

Need a Quote for Bone File Dental Instrument?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160