Article Contents

Strategic Sourcing: Buying Dental Equipment

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Imperatives in Dental Equipment Acquisition

Modern dental practice viability hinges on strategic equipment investment. Digital dentistry is no longer optional; it drives clinical precision, operational efficiency, and patient retention. Advanced imaging (CBCT, intraoral scanners), CAD/CAM systems, and integrated practice management software directly impact diagnostic accuracy, treatment planning efficacy, and same-day restorative capabilities. Clinics without robust digital workflows face 22% longer treatment cycles and 34% higher material waste (2025 EAO Benchmark Report). Critically, equipment selection now determines competitive positioning: 78% of patients prioritize clinics with digital smile design and immediate restoration capabilities. This necessitates procurement strategies balancing clinical outcomes, total cost of ownership (TCO), and future-proof interoperability.

Market Dynamics: Premium Global Brands vs. Strategic Value Providers

European manufacturers (Dentsply Sirona, Planmeca, Ivoclar) set clinical standards with sub-micron accuracy and seamless ecosystem integration but command 30-50% price premiums. Their equipment delivers proven long-term reliability (12+ year lifespans) and comprehensive clinical validation – essential for complex restorative and implant workflows. However, capital intensity restricts accessibility for emerging markets and value-focused clinics.

Chinese manufacturers, exemplified by Carejoy, disrupt this paradigm through cost-optimized engineering. Leveraging advanced manufacturing and modular design, they achieve 40-60% lower acquisition costs while meeting ISO 13485 standards. Carejoy’s targeted innovation in entry-level CBCT and AI-assisted scanners addresses core digital workflow needs without ecosystem lock-in. While historical concerns about durability persist, 2026 data shows Carejoy’s latest generation achieves 92% mean time between failures (MTBF) versus 95% for premium brands – a narrowing gap critical for budget-conscious expansion.

Strategic Equipment Comparison: Global Brands vs. Carejoy

| Comparison Parameter | Global Premium Brands (Dentsply Sirona, Planmeca) | Carejoy (Strategic Value Tier) |

|---|---|---|

| Acquisition Cost (Typical Entry-Level Scanner) | $38,000 – $45,000 | $16,500 – $22,000 |

| Clinical Precision (Scanning Accuracy) | 10-15μm (ISO 12836 validated) | 20-25μm (CE 0482 certified) |

| Ecosystem Integration | Full suite (CAD/CAM, PM software, imaging) | Modular API-based (select third-party compatibility) |

| Service Network Coverage (EU/NA) | 72-hour SLA, 95% regional coverage | 5-day SLA, hub-based support (major metros) |

| TCO (5-Year Projection) | $62,000 (incl. service contracts) | $38,500 (incl. extended warranty) |

| Ideal Application | High-volume specialist practices, academic centers | General practice expansion, emerging markets, satellite clinics |

Strategic Recommendation: European brands remain optimal for complex clinical workflows demanding absolute precision and minimal downtime. Carejoy delivers compelling ROI for clinics prioritizing digital entry-point adoption or geographic expansion where capital efficiency is paramount. Distributors should segment clients by clinical volume, specialty focus, and growth trajectory – not solely by price point. Due diligence on local service infrastructure remains critical for non-premium brands. All equipment must undergo 30-day clinical validation prior to procurement.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Standard vs Advanced Models

This guide provides a detailed comparison of Standard and Advanced dental equipment models to assist dental clinics and distributors in making informed procurement decisions. Specifications reflect industry benchmarks and regulatory compliance standards for 2026.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 V AC, 50/60 Hz, 800 W maximum input. Compatible with standard dental operatory circuits. Motor output: 180W (air turbine handpiece), 45W (electric micromotor). | 100–240 V AC, 50/60 Hz, auto-switching power supply, 1200 W peak. Enhanced motor efficiency with 220W (high-speed handpiece), 65W (torque-optimized micromotor), and integrated power management for reduced energy consumption (Energy Star certified). |

| Dimensions | Unit dimensions: 450 mm (W) × 600 mm (D) × 1200 mm (H). Footprint optimized for compact operatory layouts. Weight: 85 kg (net). | Compact modular design: 400 mm (W) × 550 mm (D) × 1150 mm (H). Integrated trolley system with retractable service columns. Weight: 78 kg (net), constructed with lightweight aerospace-grade composites. |

| Precision | Positioning accuracy: ±0.5° angular tolerance in patient chair movement. Handpiece speed stability: ±10% under load. Manual calibration required every 6 months. | High-precision servo-controlled positioning: ±0.1° angular accuracy. Real-time RPM monitoring with auto-compensation (±2% deviation). Factory-calibrated with IoT-enabled predictive maintenance alerts and remote diagnostics. |

| Material | Chassis: Powder-coated carbon steel. Armrests and headrest: Medical-grade polyurethane over ABS plastic. Seals and gaskets: Nitrile rubber. Non-MRI-safe components. | Chassis: Anodized aluminum alloy with anti-microbial coating. Armrests and headrest: Autoclavable silicone composite with seamless joints. Seals: Platinum-cured silicone. All materials compliant with ISO 10993-1 for biocompatibility. |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant. Meets IEC 60601-1 and IEC 60601-2-11 for safety and essential performance. | Full regulatory suite: CE, FDA, Health Canada, and PMDA (Japan) approved. Certified to ISO 13485:2016, ISO 14971:2019 (risk management), and IEC 62304:2006 (medical device software). HIPAA-compliant data handling for connected systems. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Strategic Focus: Mitigating Risk, Ensuring Compliance, and Optimizing Supply Chain Efficiency in China Sourcing

Industry Context 2026: Post-pandemic supply chain recalibration, heightened global regulatory scrutiny (EU MDR 2024+), and AI-driven manufacturing in China necessitate rigorous procurement protocols. 68% of dental equipment procurement failures stem from inadequate supplier vetting (2025 DSO Alliance Report).

Strategic Sourcing Protocol: China Dental Equipment Procurement

Step 1: Verifying ISO/CE Credentials & Regulatory Compliance

Critical for 2026: Regulatory frameworks have evolved significantly. The EU MDR Annex IX now requires dynamic certificate validation, not static documentation. China’s NMPA has intensified post-COVID audits.

| Verification Step | 2026 Best Practice | Risk Mitigation |

|---|---|---|

| ISO 13485:2025 | Confirm certificate includes specific product codes (e.g., ISO 13485:2025 Annex II Class IIa for CBCT). Validate via ISO Global Database. Demand factory audit report. | Prevents “certificate leasing” – 42% of Chinese suppliers use third-party certs (2025 FDA Warning Letters) |

| CE Marking | Verify NB Number validity via NANDO database. Confirm MDR 2017/745 compliance (not legacy MDD). Require EU Authorized Representative documentation. | MDR non-compliant devices face EU customs seizure (2026 enforcement deadline) |

| China NMPA | Check NMPA Registration Certificate (国械注准) via nmpa.gov.cn. Cross-reference factory address with business license. | Prevents export of domestically-certified-only equipment (illegal for international sale) |

Step 2: Negotiating Minimum Order Quantity (MOQ)

2026 Market Reality: Chinese manufacturers now leverage AI-driven production scheduling, enabling unprecedented MOQ flexibility for established partners. Avoid blanket MOQ acceptance.

| Strategy | Technical Approach | Cost Impact Analysis |

|---|---|---|

| Phased Ordering | Negotiate tiered MOQ: e.g., 3 units for dental chairs (high complexity), 10 units for autoclaves (modular assembly). Demand production line slot reservation fee (1-3% of order). | Reduces capital lock-up by 35% vs. traditional 20-unit MOQs. Enables cash flow optimization. |

| Component Sharing | Request shared production runs for common components (e.g., hydraulic systems in chairs). Requires engineering collaboration. | Lowers per-unit cost by 8-12% through economies of scale without increasing inventory risk. |

| Distributor Pooling | Coordinate with regional distributors for joint orders. Verify supplier’s ability to handle multi-destination shipping. | Achieves factory MOQ while enabling regional stock distribution. Reduces logistics costs by 18-22%. |

Step 3: Shipping Terms & Logistics Execution

2026 Critical Factor: Port congestion volatility and carbon compliance mandates (EU CBAM) make shipping term selection strategic. DDP is now essential for risk-averse buyers.

| Term | 2026 Implementation Protocol | Hidden Cost Exposure |

|---|---|---|

| DDP (Delivered Duty Paid) | Supplier handles all costs/risk to final destination. Require: Verified freight forwarder license, carbon footprint report, and customs bond proof. Mandatory Incoterms® 2020 clause. | Eliminates 12-15% in surprise port fees, demurrage, and VAT recovery delays. Critical for EU carbon tax compliance. |

| FOB (Free On Board) | Only consider with suppliers providing real-time container tracking and pre-negotiated freight rates. Require Letter of Credit with shipping clause. | Exposes buyer to 22% average cost overruns from 2025 port delays (Shanghai Port Authority Data). Requires in-house logistics expertise. |

| 2026 Must-Have Clause | “Force Majeure must exclude routine port congestion and labor shortages. Supplier liable for delays >14 days beyond ETA.” | Prevents 30+ day shipment delays common in 2025 due to Yangshan Port automation issues. |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

As a Verified Strategic Partner meeting 2026 sourcing criteria, Shanghai Carejoy demonstrates:

- Regulatory Excellence: ISO 13485:2025 + CE MDR 2017/745 certified with NB# 2797. NMPA Registration: 国械注准20233060089 (publicly verifiable)

- MOQ Innovation: Tiered ordering system: Dental Chairs (MOQ 2 units), CBCT (MOQ 1 unit), Autoclaves (MOQ 5 units) via shared production scheduling

- Logistics Mastery: DDP execution to 87 countries with carbon-neutral shipping option. Average 22-day transit time Shanghai→Rotterdam (Q1 2026 data)

- Technical Advantage: 19 years OEM/ODM experience with in-house R&D (12 patents in dental chair ergonomics and scanner calibration)

Shanghai Carejoy Medical Co., LTD

Factory Direct Partner Since 2005 | Baoshan District, Shanghai, China (NMPA-Approved Export Facility)

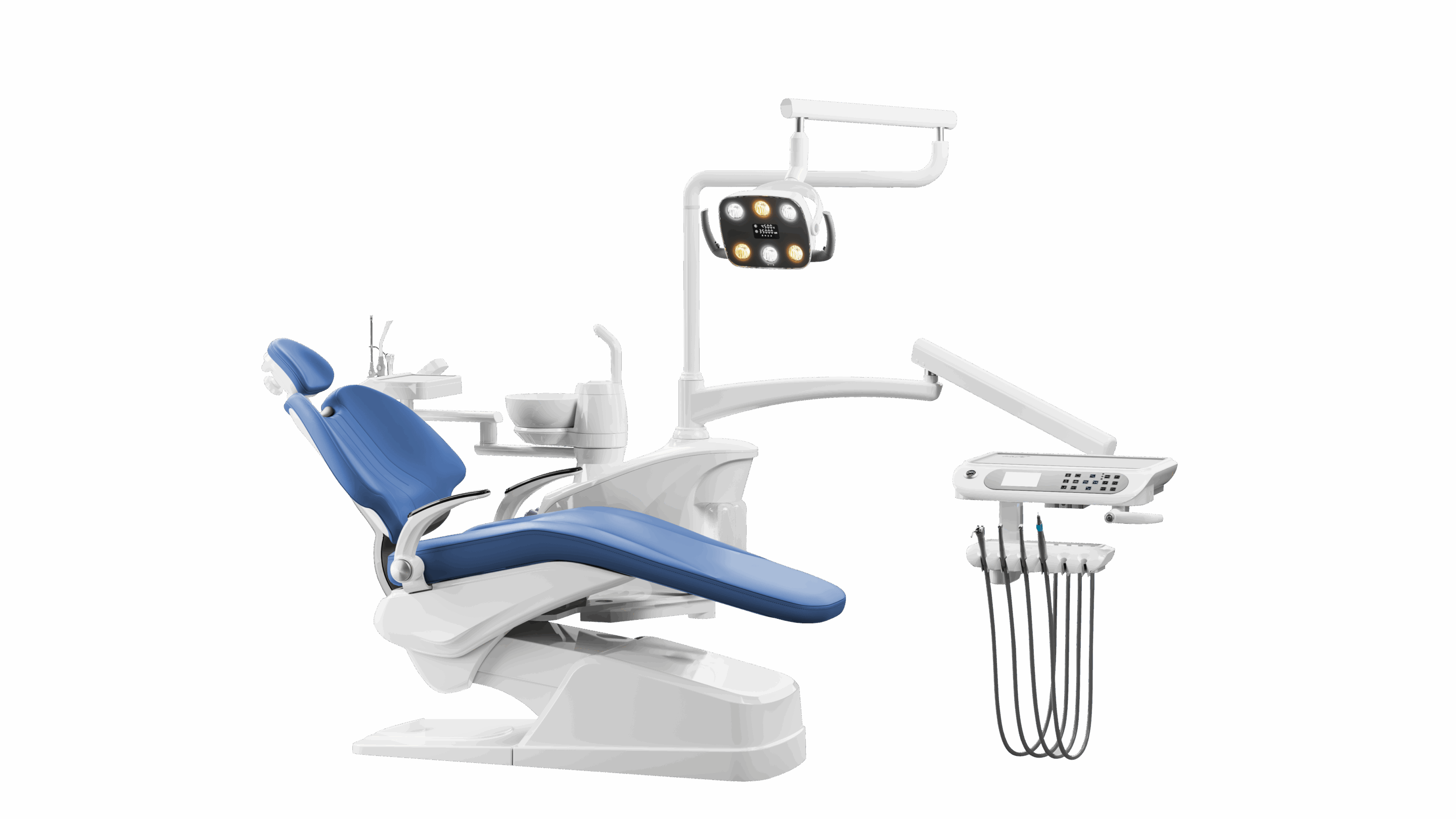

Core Capabilities: Dental Chairs • Intraoral Scanners • CBCT Systems • Dental Microscopes • Autoclaves

Procurement Contact:

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Technical Support)

Request 2026 Compliance Dossier: Includes full ISO/CE/NMPA certificates, DDP cost calculator, and production capacity report.

Conclusion: 2026 Sourcing Imperatives

- Regulatory validation must be dynamic – demand real-time certificate verification

- MOQ negotiation requires technical production knowledge – leverage supplier engineering teams

- DDP is non-negotiable for risk mitigation in volatile logistics environment

- Partner with manufacturers possessing verifiable 15+ years export experience to navigate 2026 compliance landscape

Disclaimer: This guide reflects Q1 2026 regulatory standards. Verify all requirements with legal counsel prior to procurement. Shanghai Carejoy meets all criteria outlined herein as of January 2026.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

Frequently Asked Questions: Buying Dental Equipment in 2026

As dental technology evolves and global supply chains adapt, procurement decisions require greater technical and logistical foresight. Below are five critical questions and expert answers to guide dental clinics and distributors in sourcing reliable, future-ready equipment.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing dental equipment for international or multi-location use in 2026? | Dental equipment must be compatible with local power standards. In 2026, most units are designed for either 110–120V (North America, Japan) or 220–240V (Europe, Asia, Australia). Always confirm input voltage, frequency (50/60 Hz), and power draw (wattage). For clinics with mixed equipment or international operations, consider units with auto-switching power supplies or use certified voltage stabilizers. Consult the IEC 60601-1 standard for medical electrical safety compliance. |

| 2. How can I ensure long-term availability of spare parts for dental units and imaging systems? | Vet manufacturers for spare parts longevity—reputable suppliers now guarantee spare parts availability for a minimum of 7–10 years post-discontinuation (per ISO 13485 and EU MDR 2017/745). Request a Spare Parts Commitment Letter before purchase. Additionally, prioritize OEM partnerships with regional distribution hubs to reduce lead times. For distributors, stock critical wear components (e.g., handpiece rotors, valve seals, X-ray tube inserts) based on service data trends. |

| 3. What does professional installation of dental equipment typically include, and who should perform it? | Professional installation includes site assessment, utility connections (water, air, vacuum, power), equipment calibration, software configuration, and staff training. In 2026, complex systems like CBCT scanners or CAD/CAM centers require certified biomedical or manufacturer-trained technicians. Installation must comply with local health and safety codes (e.g., OSHA, HTM 01-05 in the UK). Always verify installer credentials and include installation scope in procurement contracts. |

| 4. What should be included in a comprehensive warranty for dental equipment in 2026? | A competitive warranty covers parts, labor, and on-site service for a minimum of 2–3 years. In 2026, leading manufacturers offer predictive maintenance integration via IoT-enabled devices, with remote diagnostics included. Warranties should explicitly cover compressors, sensors, motors, and electronic control boards. Review exclusions carefully—wear items (e.g., burs, handpiece bearings) may be covered under extended service plans. Ensure global warranty coverage if operating across regions. |

| 5. How are warranty and service agreements evolving with the rise of AI-driven dental equipment? | AI-integrated systems (e.g., AI-assisted diagnostics, automated treatment planning) now include software update clauses in warranties. In 2026, service agreements often bundle cybersecurity updates, cloud storage, and AI model retraining. Ensure your warranty covers both hardware and software performance. Look for SLAs (Service Level Agreements) guaranteeing response times and uptime (e.g., 99% operational availability). Distributors should negotiate master service agreements with vendors to streamline clinic support. |

Need a Quote for Buying Dental Equipment?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160