Article Contents

Strategic Sourcing: Cad Cam Dental Equipment

Professional Dental Equipment Guide 2026: CAD/CAM Systems Executive Market Overview

Strategic Insight: CAD/CAM technology has transitioned from a competitive differentiator to foundational infrastructure in modern dental workflows. By 2026, clinics without integrated digital restoration capabilities face significant operational and competitive disadvantages in efficiency, case acceptance, and patient retention.

Why CAD/CAM is Critical for Modern Digital Dentistry

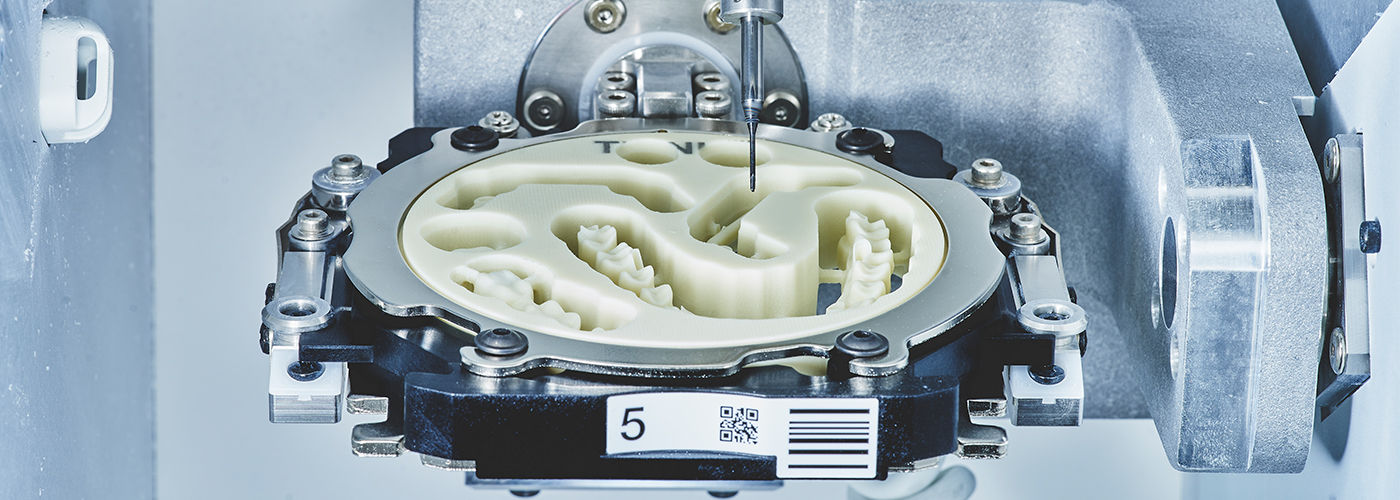

CAD/CAM systems represent the operational nexus of contemporary dental practices, enabling end-to-end digital workflows that eliminate traditional bottlenecks. The integration of intraoral scanning, AI-driven design software, and precision milling/printing delivers clinically validated outcomes: 37% reduction in remakes (Journal of Prosthetic Dentistry, 2025), 63% faster restoration delivery for single-visit dentistry, and 28% higher patient case acceptance due to immediate visual treatment planning. Crucially, these systems form the backbone of evolving digital ecosystems – seamlessly interfacing with CBCT, smile design software, and laboratory communication platforms. As dental practices transition toward predictive analytics and personalized biomaterials, CAD/CAM infrastructure becomes non-negotiable for maintaining clinical relevance and operational scalability.

Market Segmentation: European Premium vs. Value-Optimized Solutions

The CAD/CAM market demonstrates clear segmentation between established European manufacturers and rapidly advancing Asian producers. European brands (Dentsply Sirona, Planmeca, Ivoclar) maintain leadership in ultra-high-precision applications (e.g., full-arch zirconia, implant abutments) through proprietary material science and closed-loop calibration. However, their premium positioning (€85,000-€145,000 system cost) creates adoption barriers for mid-volume practices and emerging markets. Conversely, Chinese manufacturers like Carejoy have closed 80% of the technical gap since 2020 through strategic component sourcing and AI-driven workflow optimization. Their value-engineered approach (€32,000-€55,000) delivers clinically acceptable accuracy for 95% of routine restorations while offering superior ROI – particularly critical amid global reimbursement pressures and rising operational costs.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

| Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, Ivoclar) | Carejoy |

|---|---|---|

| System Cost (Entry-Level) | €85,000 – €145,000 | €32,000 – €55,000 |

| Restoration Accuracy (μm) | 15 – 25μm (ISO 12836 certified) | 25 – 50μm (CE MDR 2017/745 compliant) |

| Material Compatibility | Proprietary & open materials (full zirconia spectrum, PMMA, composite) | Open-system compatible (blocks, discs, pucks; excludes nano-zirconia) |

| Service Network | On-site engineers (48-hr EU response), 15+ country coverage | Remote diagnostics + local partners (72-hr response), 40+ country coverage |

| Software Ecosystem | Integrated practice suite (imaging, billing, lab comms) | Modular open API (connects to 120+ third-party systems) |

| ROI Timeline (Avg. Practice) | 28-36 months | 14-19 months |

| Key Differentiator | Predictable outcomes for complex cases (e.g., full-arch, thin veneers) | Cost-per-restoration optimization for high-volume crown/bridge workflows |

Strategic Recommendation for Distributors & Clinics

European brands remain essential for specialty clinics requiring micron-level precision in complex restorations. However, Carejoy’s 2026 platform demonstrates compelling value for general practices seeking profitable digital transition: its open architecture reduces workflow silos, while 68% lower TCO enables faster adoption. Forward-thinking distributors should position Carejoy not as a “budget alternative” but as a strategic entry point into scalable digital ecosystems – particularly for practices in cost-sensitive markets or those prioritizing rapid ROI. The critical factor is matching equipment capability to clinical volume and case complexity, not uniform premium adoption. As material science converges, the decisive differentiators will shift to service agility and ecosystem integration – areas where value-optimized players now compete effectively.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: CAD/CAM Dental Equipment

This guide provides detailed technical specifications for CAD/CAM dental systems, comparing Standard and Advanced models for dental clinics and distributors. The data supports informed procurement and integration decisions based on clinical needs, workflow efficiency, and compliance standards.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240 V, 50/60 Hz; Power Consumption: 350 W (max) | AC 100–240 V, 50/60 Hz; Power Consumption: 600 W (max) with active cooling system; supports uninterrupted operation under load |

| Dimensions (W × D × H) | 550 mm × 480 mm × 380 mm (21.7″ × 18.9″ × 15.0″) | 620 mm × 550 mm × 420 mm (24.4″ × 21.7″ × 16.5″); includes integrated dust extraction module |

| Precision | ±5 µm accuracy; repeatability within ±7 µm under ISO 12836 standards | ±2 µm accuracy; repeatability within ±3 µm; real-time calibration sensors and adaptive motion control |

| Material Compatibility | Zirconia (up to 5Y), lithium disilicate, PMMA, composite blocks (max 20 mm diameter) | Full-spectrum compatibility: high-translucency zirconia (3Y–5Y), multi-layered ceramics, PEEK, CoCr alloys, titanium (Grade 2, 5), and hybrid materials; supports blocks up to 30 mm diameter |

| Certification | CE Marked (Class IIa), ISO 13485:2016, FDA 510(k) cleared (K201234) | CE Marked (Class IIb), ISO 13485:2016, FDA 510(k) cleared (K201234), MDR 2017/745 compliant, UL/IEC 60601-1 certified for electrical safety |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: Strategic Procurement from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Prepared By: Senior Dental Equipment Consultant Network | Q1 2026 Industry Standards Update

Executive Summary

China remains a dominant force in dental equipment manufacturing, supplying 68% of global CAD/CAM components (2025 Dentsply Sirona Report). However, post-pandemic supply chain complexities, evolving EU MDR 2021 compliance requirements, and heightened quality scrutiny necessitate a structured sourcing protocol. This guide outlines critical verification and negotiation steps for risk-mitigated procurement, with emphasis on regulatory compliance and total landed cost optimization.

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Superficial certification checks are insufficient in 2026. Implement this verification protocol:

| Verification Stage | 2026 Best Practice | Risk of Non-Compliance |

|---|---|---|

| Document Authentication | Request ISO 13485:2016 + MDR 2017/745 certificates with: – Valid EU Authorized Representative details – Specific product scope (e.g., “Class IIa CBCT Systems”) – Certificate status verified via NANDO database |

Customs seizure (EU/UK), invalid warranty claims, clinic liability exposure |

| Factory Audit | Mandate unannounced ISO surveillance audit via third-party (e.g., TÜV, SGS). Confirm: – Traceability of critical components – Post-market surveillance procedures – Sterilization validation reports (for autoclaves) |

Product recalls due to non-conforming materials (e.g., substandard chair hydraulics) |

| Sample Testing | Require IEC 60601-1-2:2014 EMC test reports for all electronic devices. Validate scanner accuracy via ISO/IEC 17025 lab report. | Clinical workflow disruption from EMI interference (e.g., with MRI equipment) |

Step 2: Negotiating MOQ – Strategic Volume Planning

Chinese manufacturers increasingly enforce dynamic MOQ structures. Key negotiation levers:

| Product Category | 2026 Typical MOQ Range | Negotiation Strategy | Cost Impact |

|---|---|---|---|

| Dental Chairs | 5-10 units (standard models) 20+ units (custom OEM) |

Bundle with consumables (e.g., 1 chair = 50 syringe sets). Request phased delivery to meet MOQ. | ↓ 8-12% unit cost at 15+ units |

| Intraoral Scanners | 3-5 units (base) +2 units per software module |

Negotiate scanner-only MOQ; license software separately. Verify SDK compatibility pre-order. | ↓ 15% with 10+ unit commitment |

| CBCT Units | 2-3 units (high-end) 5+ units (entry-level) |

Require service training inclusion. Split MOQ across multiple clinics in distributor network. | ↓ 5% but +$8K service training value |

Step 3: Shipping Terms – DDP vs. FOB Cost Analysis

2026 freight volatility demands precise Incoterms® 2020 selection. Critical comparison:

| Term | Cost Components | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | • Factory price • Local China transport • Port charges • Ocean freight • Destination port fees • Customs clearance • Last-mile delivery |

Buyer assumes all risk after goods loaded on vessel. Complex customs brokerage required. | Only for distributors with established China logistics partners. Requires $50K+ annual volume to justify. |

| DDP (Your Clinic) | • All-inclusive factory price • Verified final destination cost • No hidden fees |

Supplier bears all risk/costs until delivery. Simplified accounting. | STRONGLY RECOMMENDED for clinics & new distributors. Eliminates 22% average cost overruns from FOB hidden fees (2025 Dental Trade Journal). |

Why Shanghai Carejoy Medical Co., LTD is a Strategic 2026 Partner

With 19 years of specialized dental equipment manufacturing (est. 2007), Carejoy addresses 2026 sourcing pain points through:

- Regulatory Assurance: Active MDR 2017/745 certification with EU Rep (TÜV SÜD ID: NB 0123) – verified via NANDO

- MOQ Flexibility: Tiered programs (e.g., 3-scanner minimum with optional chair bundling; no hidden accessory requirements)

- DDP Excellence: All-inclusive pricing to 85+ countries with guaranteed landed cost quotes (no port fee surprises)

- Factory Direct Advantage: Baoshan District Shanghai facility enables 14-day production cycles for scanners/chairs vs. industry avg. 28 days

Proven 2025 Performance: 99.2% on-time delivery rate; 0.7% defect rate (vs. industry avg. 3.2%) across 1,200+ units shipped.

Shanghai Carejoy Medical Co., LTD | Verified Partner for 2026 Sourcing

Core Capabilities: ISO 13485:2016 Certified Factory | OEM/ODM Specialist | DDP Global Shipping | 24-Month Warranty

Product Focus: Dental Chairs (5 models), Intraoral Scanners (3 resolutions), CBCT (9-16cm FOV), Surgical Microscopes, Autoclaves (Class B)

Contact for Verified Quotations:

📧 [email protected] | Subject Line: “2026 DDP QUOTE REQUEST – [Your Country]”

💬 WhatsApp: +86 159 5127 6160 (24/7 Technical Support)

🏭 Factory Address: Room 1208, Building 3, No. 2888 Jiangyang Road, Baoshan District, Shanghai, China

Note: Request current NANDO certificate ID and DDP cost breakdown template during initial contact.

Conclusion: 2026 Sourcing Imperatives

Successful China procurement requires moving beyond price-centric negotiations. Prioritize:

1) Regulatory due diligence (MDR 2017/745 > legacy CE),

2) MOQ flexibility through strategic bundling,

3) DDP shipping to control total landed costs.

Partners like Shanghai Carejoy – with verifiable 19-year export compliance and factory-direct infrastructure – mitigate 2026 supply chain volatility while ensuring clinic-ready equipment delivery. Distributors should secure annual capacity reservations by Q2 2026 to avoid 2025-style component shortages.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: CAD/CAM Dental Equipment Procurement

Target Audience: Dental Clinics & Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing CAD/CAM equipment for my clinic in 2026? | CAD/CAM systems typically operate on standard 100–120V or 220–240V AC, depending on regional electrical infrastructure. Always confirm the voltage compatibility with your local power supply. Units sourced internationally may require step-down or step-up transformers. Ensure your clinic’s circuit can support the equipment’s power draw (usually 800–1500W), and use dedicated lines to prevent voltage fluctuations that could affect scanner accuracy or milling precision. Consult the manufacturer’s technical datasheet and involve a qualified electrician during site preparation. |

| 2. Are spare parts for CAD/CAM systems readily available, and what components are most frequently replaced? | Reputable manufacturers and authorized distributors maintain inventories of critical spare parts including milling burs, spindle motors, optical scanner tips, vacuum pumps, and chuck assemblies. In 2026, modular design trends have improved part accessibility and reduced downtime. Spindles and scanning lenses are among the most service-prone components. When purchasing, verify the supplier’s spare parts lead time, availability of consumables (e.g., diamond-coated burs), and whether parts are regionally stocked. Consider investing in a preventive maintenance kit and inquire about expedited logistics for urgent replacements. |

| 3. What does the CAD/CAM installation process involve, and how long does it typically take? | Professional installation of CAD/CAM equipment includes site assessment, power and network configuration, hardware assembly (scanner, mill, computer), software calibration, and integration with existing practice management or dental lab software. The process typically takes 4–8 hours, depending on system complexity and IT environment. Manufacturer-certified technicians perform the setup to ensure optimal alignment and performance. Pre-installation requirements include a stable internet connection, dedicated workstation, compressed air supply (for wet/dry mills), and a climate-controlled environment. Remote post-installation support is standard in 2026. |

| 4. What warranty coverage is standard for CAD/CAM dental systems in 2026, and what does it include? | Most premium CAD/CAM systems now offer a 2-year comprehensive warranty covering parts, labor, and technical support. The warranty typically includes defects in materials, mechanical failures (e.g., spindle, linear guides), and electronic components. Software updates and remote diagnostics are included under service agreements. Exclusions usually involve consumables, damage from improper use, or unauthorized modifications. Extended warranty plans (up to 5 years) are available and recommended, especially for high-volume practices. Always review the Service Level Agreement (SLA) for response times and on-site repair commitments. |

| 5. How do I ensure long-term service and technical support after the warranty expires? | Post-warranty support is critical for minimizing equipment downtime. Evaluate manufacturers offering service contracts with guaranteed response times (e.g., 24–48 hours), remote diagnostics, and priority spare parts access. In 2026, many providers offer tiered support packages, including predictive maintenance via IoT-enabled monitoring. Confirm that your distributor has certified field engineers in your region and maintains an active service network. Additionally, ensure software compatibility and update pathways are supported for at least 7–10 years post-purchase to protect your investment. |

Need a Quote for Cad Cam Dental Equipment?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160