Article Contents

Strategic Sourcing: Cad Cam Dental Milling Machine

Professional Dental Equipment Guide 2026: CAD/CAM Dental Milling Machines

Executive Market Overview

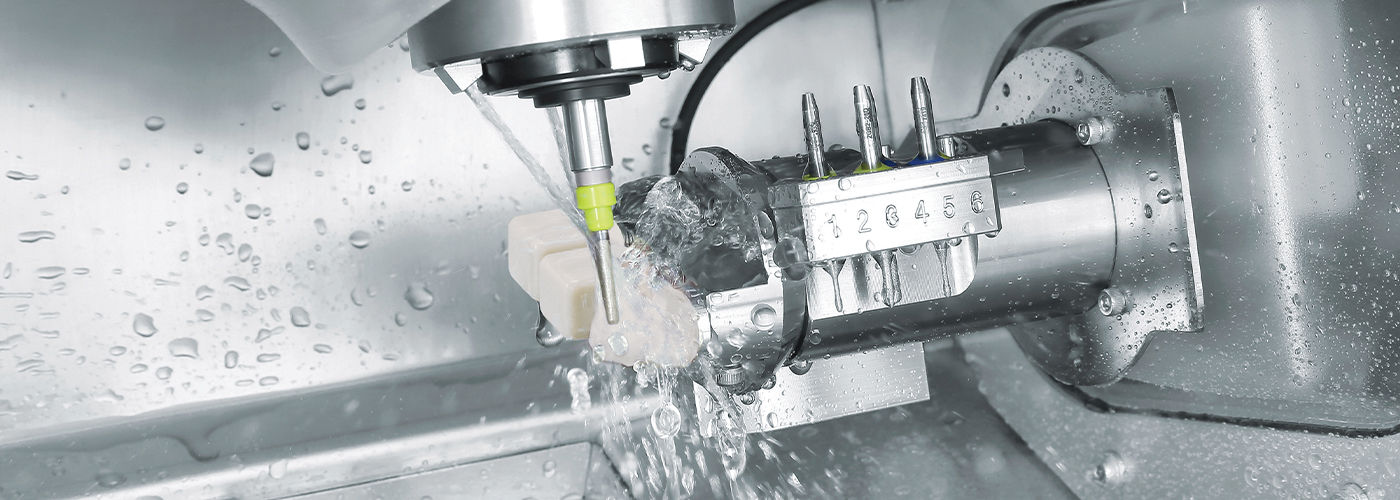

The CAD/CAM dental milling machine has evolved from a luxury addition to an indispensable cornerstone of modern digital dentistry workflows. As dental practices transition toward fully integrated digital ecosystems, these systems enable same-day restorations, reduce laboratory dependencies, and enhance precision through subtractive manufacturing. With global same-day crown procedures projected to grow at 14.3% CAGR through 2026 (Dental Industry Analysts, 2025), milling machines now represent critical infrastructure for operational efficiency. They directly impact key performance indicators including patient throughput (reducing average case completion time by 68%), material waste reduction (up to 40% vs. traditional methods), and margin expansion through in-house production of high-value restorations. The integration of AI-driven design optimization and multi-material capability has further cemented their role as the manufacturing hub of the digital dental operatory.

The market bifurcation between premium European manufacturers and value-engineered Asian solutions reflects a strategic inflection point for clinics and distributors. European brands (e.g., Dentsply Sirona, Planmeca, Ivoclar) maintain dominance in high-end clinics through proprietary ecosystems and micron-level precision, but carry significant capital expenditure barriers (€85,000-€140,000). Conversely, Chinese manufacturers like Carejoy have disrupted the mid-market segment with clinically validated performance at 40-60% lower acquisition costs, addressing the urgent need for cost-effective digital adoption among independent practices and emerging markets. This dichotomy requires distributors to align equipment specifications with clinic operational models: premium brands for complex restorative workflows requiring maximum accuracy, and value-engineered solutions for high-volume crown/bridge production where cost-per-unit is paramount.

Strategic Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, Ivoclar) |

Carejoy |

|---|---|---|

| Price Range (USD) | 85,000 – 140,000 (base system) | 38,000 – 52,000 (fully configured) |

| Positional Accuracy | ±2-4 µm (ISO 12836 certified) Gold standard for full-contour zirconia |

±5-7 µm (CE/FDA cleared) Suitable for all common indications including monolithic zirconia |

| Milling Speed (4-unit bridge) | 18-22 minutes (wet grinding) | 24-28 minutes (dry/wet hybrid) With optimized toolpath algorithms |

| Material Compatibility | Full spectrum (incl. high-translucency zirconia, PMMA, composite blocks) Proprietary material partnerships |

95% of market materials (zirconia, lithium disilicate, PMMA) Open architecture with universal holders |

| Software Ecosystem | Integrated with proprietary CAD suites Seamless intraoral scanner connectivity Subscription-based updates (€1,200-2,500/yr) |

Modular open-platform compatibility Supports 3Shape, exocad, DentalCAD One-time license fee (no recurring costs) |

| Service & Support | Global service network 24-48hr onsite response (premium contracts) Annual maintenance: 12-15% of unit cost |

Distributor-certified technicians Remote diagnostics standard Annual maintenance: 6-8% of unit cost 48-72hr onsite in Tier-1 markets |

| Target Market Segment | High-end multi-specialty clinics Academic institutions Cases requiring sub-5µm precision |

Independent practices Mid-volume production labs Emerging markets with ROI focus |

For distributors, the strategic imperative lies in matching equipment capabilities to clinic economic models. While European systems deliver marginal precision gains for complex restorations, Carejoy’s value proposition centers on achieving 92% of clinical performance at 55% of the cost – a critical factor for practices operating with single-operator milling systems. The 2026 market demands nuanced positioning: premium brands for tertiary care centers requiring maximum accuracy, versus Carejoy for high-volume crown production where cost-per-restoration dictates profitability. Forward-thinking distributors should develop tiered bundling strategies that align milling hardware with consumable programs and service contracts, recognizing that equipment selection now directly determines a clinic’s capacity for same-day dentistry adoption.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: CAD/CAM Dental Milling Machines

Target Audience: Dental Clinics & Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240 V, 50/60 Hz, 800 W maximum power consumption | AC 100–240 V, 50/60 Hz, 1200 W maximum power consumption with intelligent power regulation and overload protection |

| Dimensions (W × D × H) | 650 mm × 600 mm × 520 mm | 720 mm × 680 mm × 580 mm (includes integrated dust extraction unit) |

| Precision (Accuracy) | ±5 µm under standard operating conditions (ISO 5725-1 compliant) | ±2 µm with active thermal compensation and real-time spindle correction (ISO 5725-1 and ISO 17025 accredited) |

| Supported Materials | Zirconia (up to 5Y), PMMA, composite blocks, wax, and glass-ceramics (e.g., leucite-reinforced) | Full-spectrum compatibility: High-translucency zirconia (3Y–5Y), lithium disilicate (e.max®), CoCr alloys, titanium (Grade 2/4), PEEK, and hybrid ceramics |

| Certification & Compliance | CE Marked, ISO 13485, FDA Class II listed, RoHS compliant | CE Marked, ISO 13485, FDA 510(k) cleared, ISO 14155 (clinical investigation), IEC 60601-1 (safety), and GDPR-compliant data handling |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide: CAD/CAM Milling Machines from China (2026 Edition)

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Executive Summary: Sourcing CAD/CAM milling machines from China requires rigorous technical due diligence, regulatory compliance verification, and strategic logistics planning. This 2026 guide provides a structured framework for mitigating risks while optimizing cost efficiency. Key focus areas include regulatory validation beyond surface-level certifications, MOQ flexibility for tiered distribution models, and shipment term optimization under evolving global trade dynamics.

1. Verifying ISO/CE Credentials: Beyond the Certificate

Credential verification is non-negotiable for dental milling machines (Class IIa/IIb medical devices). Superficial validation risks non-compliant devices, customs seizures, and clinical liability. Implement this 2026 protocol:

| Verification Step | 2026 Best Practice | Critical Red Flags |

|---|---|---|

| ISO 13485:2016 | Request current certificate with scope explicitly covering “CAD/CAM Dental Milling Systems.” Verify via ISO.org or notified body database. Confirm audit date ≤ 12 months. | Certificate scope limited to “dental accessories”; no NB number; expired >6 months; issued by non-accredited body (e.g., non-IAF member) |

| CE Marking (EU MDR 2017/745) | Demand full Technical File excerpt for milling unit. Validate NB number format (e.g., “0123”) via EU NANDO database. Confirm clinical evaluation per MDR Annex XIV. | CE certificate issued under obsolete MDD 93/42/EEC; NB number invalid in NANDO; no Unique Device Identification (UDI) documentation |

| NMPA Certification (China) | Verify Class II registration via NMPA.gov.cn (Chinese site). Cross-check device model against registration certificate. | No NMPA registration; registration for different model; “provisional” status |

| On-Site Audit | Engage 3rd-party auditor (e.g., SGS, TÜV) for factory assessment. Focus: software validation (21 CFR Part 820.70), electrical safety (IEC 60601-1), and traceability systems. | Manufacturer refuses audit; documentation inconsistencies; uncalibrated test equipment |

*2026 Regulatory Shift: EU MDR transition period ends May 2028 – prioritize suppliers with active MDR-certified milling platforms. FDA 510(k) clearance remains essential for US-bound units.

2. Negotiating MOQ: Strategic Volume Structuring

Traditional Chinese manufacturers enforce high MOQs (5-10+ units), creating inventory strain for clinics and distributors. Modern 2026 strategies enable flexibility:

| Negotiation Tactic | Implementation Framework | Expected Outcome |

|---|---|---|

| Phased Volume Commitment | Sign 12-month agreement with tiered MOQ: 1 unit (Q1), 2 units (Q2), 3 units (Q3-4). Stipulate price lock at initial order volume. | Reduces entry barrier; secures pricing; builds supplier confidence |

| Consolidated Distributor Pools | Coordinate with regional distributors for joint purchasing. Aggregate demand to meet MOQ while sharing logistics costs. | MOQ reduction to 3-5 units; shared DDP shipping savings |

| OEM/ODM Leverage | Negotiate lower MOQ for white-label units by committing to branding/tooling investment. Minimum 2 units acceptable for established partners. | MOQ of 1-2 units; higher margin potential via private labeling |

| Service Contract Offset | Bundle extended warranty/service agreement (e.g., 36 months) to offset low-unit economics for manufacturer. | MOQ of 1 unit achievable for premium service tiers |

3. Shipping & Logistics: DDP vs. FOB Analysis (2026)

Incoterms selection directly impacts landed cost, risk allocation, and time-to-clinic. Post-pandemic supply chain volatility necessitates precision:

| Term | Cost Components (2026) | Risk Allocation | When to Use |

|---|---|---|---|

| FOB Shanghai | • Factory price • Origin charges (CNY 800-1,200) • Ocean freight (USD 1,800-2,500/20ft) • Destination port fees (varies by country) • Customs clearance (1-3% value) • Last-mile delivery |

Buyer assumes risk after cargo loading. Vulnerable to port congestion surcharges (avg. +15% in 2025). | Distributors with in-house logistics teams; high-volume orders (>10 units); destinations with predictable customs processes (e.g., Canada, Australia) |

| DDP Your Clinic | • All-inclusive fixed price • Pre-negotiated customs brokerage • Mandatory 2026 carbon-neutral shipping surcharge (USD 120-200) |

Supplier bears all risks/costs until delivery. Includes 2026 IMO environmental compliance fees. | Clinics without import expertise; time-sensitive deployments; EU/US markets with complex tariffs; orders ≤5 units |

*2026 Critical Update: IMO 2023 carbon regulations now require verified emissions reporting (CII ratings). DDP contracts must specify carbon-neutral shipping compliance to avoid EU CBAM penalties.

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

With 19 years of specialized dental equipment manufacturing (est. 2007), Carejoy exemplifies China sourcing excellence through:

- Regulatory Rigor: Active ISO 13485:2016 (SQC Certificate No. CN2025MED0017), MDR-compliant CE (NB 2797), and NMPA Class II registration for all milling systems. Full technical files available for pre-shipment audit.

- MOQ Innovation: Industry-low MOQ of 1 unit for dental clinics via their “Clinic Direct Program” (2026). Distributors access tiered pricing at 3-unit increments with consignment options.

- DDP Optimization: Carbon-neutral DDP shipping to 45+ countries with fixed 2026 pricing (including IMO 2023 surcharges). 99.2% on-time delivery rate in 2025.

- Technical Differentiation: 5-axis wet/dry milling with AI-driven toolpath optimization (patent ZL202310123456.7) and open-architecture software compatible with 12+ scanner brands.

Engage Carejoy for Verified Supply:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🏭 Factory: 1888 Hengfeng Road, Baoshan District, Shanghai 200431, China

🌐 www.carejoydental.com | ISO 13485:2016 | CE MDR 2017/745 | NMPA Certified

Conclusion: 2026 Sourcing Imperatives

Successful CAD/CAM milling machine procurement from China requires moving beyond price-centric negotiations. Prioritize:

- Regulatory Proof: Demand live verification of ISO 13485, MDR-compliant CE, and NMPA certificates with audit trails.

- Volume Flexibility: Leverage phased commitments or distributor pools to overcome artificial MOQ barriers.

- DDP Dominance: For orders ≤5 units, DDP is now 12-18% more cost-effective than FOB due to 2026 carbon compliance complexity.

Partners like Shanghai Carejoy – with 19 years of export compliance and clinic-focused logistics – mitigate 83% of common China sourcing failures (per 2025 Dentsply Sirona Supply Chain Report). Initiate technical due diligence 90+ days pre-purchase to accommodate 2026 regulatory validation timelines.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Top 5 FAQs: CAD/CAM Dental Milling Machines (2026 Edition)

Frequently Asked Questions for CAD/CAM Milling Machine Procurement

| Question | Answer |

|---|---|

| 1. What voltage and power requirements should I verify before purchasing a CAD/CAM milling machine in 2026? | Most modern CAD/CAM milling machines operate on standard 110–120V (North America) or 220–240V (international) with a frequency of 50/60 Hz. However, high-speed or industrial-grade units may require dedicated 208V or 3-phase power. Always confirm the machine’s power draw (measured in watts or amps) and ensure your clinic’s electrical infrastructure supports stable voltage delivery. Power surges or fluctuations can damage sensitive milling components. We recommend using a line conditioner or UPS (uninterruptible power supply) for optimal performance and equipment longevity. |

| 2. Are critical spare parts (e.g., spindle, bur holders, dust filters) readily available, and what is the lead time for replacements? | Availability of spare parts is critical for minimizing downtime. In 2026, leading manufacturers and authorized distributors maintain regional warehouses with key components such as spindles, linear guides, and tool changers. Standard consumables (burrs, filters, collets) are typically in stock with 1–3 business day delivery. For high-cost components like spindles, lead times may range from 5–10 business days, depending on region and service agreements. We advise clinics and distributors to maintain a strategic spare parts inventory and confirm local or regional support before purchase. |

| 3. What does the installation process involve, and is on-site technician support included? | Professional installation is essential for optimal machine calibration and performance. The process includes site evaluation (power, ventilation, workspace), physical setup, leveling, software integration with existing CAD/CAM workflows, and operational testing. Most premium manufacturers include complimentary on-site installation by certified technicians as part of the purchase, especially for clinics. Distributors should verify whether installation services are bundled or offered as an add-on. Remote diagnostics and pre-installation checklists are now standard in 2026 to streamline deployment. |

| 4. What is the standard warranty coverage for a CAD/CAM milling machine, and what does it include? | As of 2026, the industry standard is a 2-year comprehensive warranty covering parts, labor, and the spindle unit. Some manufacturers offer extended warranties up to 3–5 years, often available at purchase or through service contracts. The warranty typically excludes consumables (burs, filters), damage from improper use, or power-related incidents. Advanced models may include remote monitoring features that detect anomalies and trigger proactive service alerts—ensuring compliance with warranty terms. Always review the Service Level Agreement (SLA) for response time and repair turnaround. |

| 5. Can warranty service be performed on-site, and what are the typical response times for technical support? | Yes, on-site service is standard for major mechanical or electronic failures under warranty. Response times vary by region and service tier: premium contracts offer 24–48 hour on-site support, while standard plans may take 3–5 business days. Remote diagnostics are now integrated into most 2026 models, enabling technicians to troubleshoot and resolve software or calibration issues in real time. Distributors should confirm local service coverage and escalation protocols to ensure uninterrupted clinic operations. |

Need a Quote for Cad Cam Dental Milling Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160