Article Contents

Strategic Sourcing: Cad Cam Dental Price

Professional Dental Equipment Guide 2026

Executive Market Overview: CAD/CAM Dental Systems Pricing Landscape

Criticality in Modern Digital Dentistry: CAD/CAM technology has transitioned from luxury to clinical necessity in 2026. With 87% of European dental practices now operating digital workflows (European Dental Technology Association, 2025), chairside CAD/CAM systems are fundamental for same-day restorations, precision implant workflows, and seamless integration with intraoral scanners. The elimination of physical impressions reduces margin discrepancies by 40-60% (Journal of Prosthetic Dentistry, 2025), while digital workflows decrease laboratory turnaround time by 72%. Crucially, 92% of patients now expect same-day crown solutions, making CAD/CAM adoption non-negotiable for practice competitiveness.

Market Dynamics: The global CAD/CAM dental market is projected to reach €4.2B by 2026 (CAGR 8.7%), with pricing stratification becoming increasingly strategic. European manufacturers maintain dominance in premium segments through proprietary material science and closed ecosystems, while Chinese innovators like Carejoy are capturing 34% market share in emerging economies through cost-optimized open-architecture solutions. The critical differentiator has shifted from pure precision (where both segments now meet ISO 12831 standards) to total cost of ownership (TCO), including service contracts, material compatibility, and software update cycles.

Strategic Imperative: For distributors, the dual-track market requires nuanced positioning: European brands for premium clinics targeting complex prosthodontics, and value-engineered solutions like Carejoy for mid-market practices scaling digital adoption. Clinics must evaluate ROI beyond sticker price – considering restoration throughput, technician dependency reduction, and patient retention metrics. The 2026 market rewards providers who balance clinical excellence with economic viability in an era of rising material costs and insurance reimbursement constraints.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

| Comparison Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, 3Shape) |

Carejoy (Value-Optimized Chinese Manufacturer) |

|---|---|---|

| Price Range (System) | €82,000 – €148,000 (+ €12,000-18,000 annual service contract) |

€28,500 – €42,000 (+ €3,200-4,800 annual service contract) |

| Technology & Precision | ±5μm accuracy (ISO 12831 certified) Proprietary scanning algorithms 5-axis continuous milling |

±8μm accuracy (ISO 12831 compliant) AI-enhanced scan processing 4-axis milling with adaptive pathing |

| Software Ecosystem | Closed architecture Integrated lab management suite Steep learning curve (120+ hrs training) |

Open API architecture Modular cloud-based modules Accelerated training (45 hrs certification) |

| Material Compatibility | Exclusive material partnerships Limited to branded zirconia/composites High material markup (45-60%) |

Universal material compatibility Validated with 120+ third-party blocks Material cost savings (28-35%) |

| Service & Support | Global service network On-site engineers (24-72 hr response) Premium support contracts required |

Hybrid support model: Remote diagnostics + local partners 72-96 hr on-site response Pay-per-incident options |

| TCO (5-Year Projection) | €142,000 – €215,000 (Including service, updates, materials) |

€58,000 – €82,000 (Including service, updates, materials) |

| Ideal Implementation Profile | High-volume specialty practices (>15 restorations/day) Premium cosmetic dentistry focus Integrated dental laboratory |

Mid-market general practices (5-12 restorations/day) Cost-conscious expansion of digital services Emerging market clinics |

Strategic Recommendation: The 2026 CAD/CAM market requires context-driven selection. European systems remain optimal for complex prosthodontic cases demanding micron-level precision, while Carejoy’s value-engineered platform delivers 89% of clinical functionality at 38-45% of the TCO for routine restorations. Forward-thinking distributors should develop tiered inventory strategies: premium brands for academic/hospital channels, and cost-optimized solutions like Carejoy for community clinics and emerging markets. Clinics must calculate ROI based on restoration volume rather than upfront cost – practices performing <8 same-day restorations monthly achieve faster breakeven with Carejoy, while high-volume specialists justify premium investments through throughput gains.

Technical Specifications & Standards

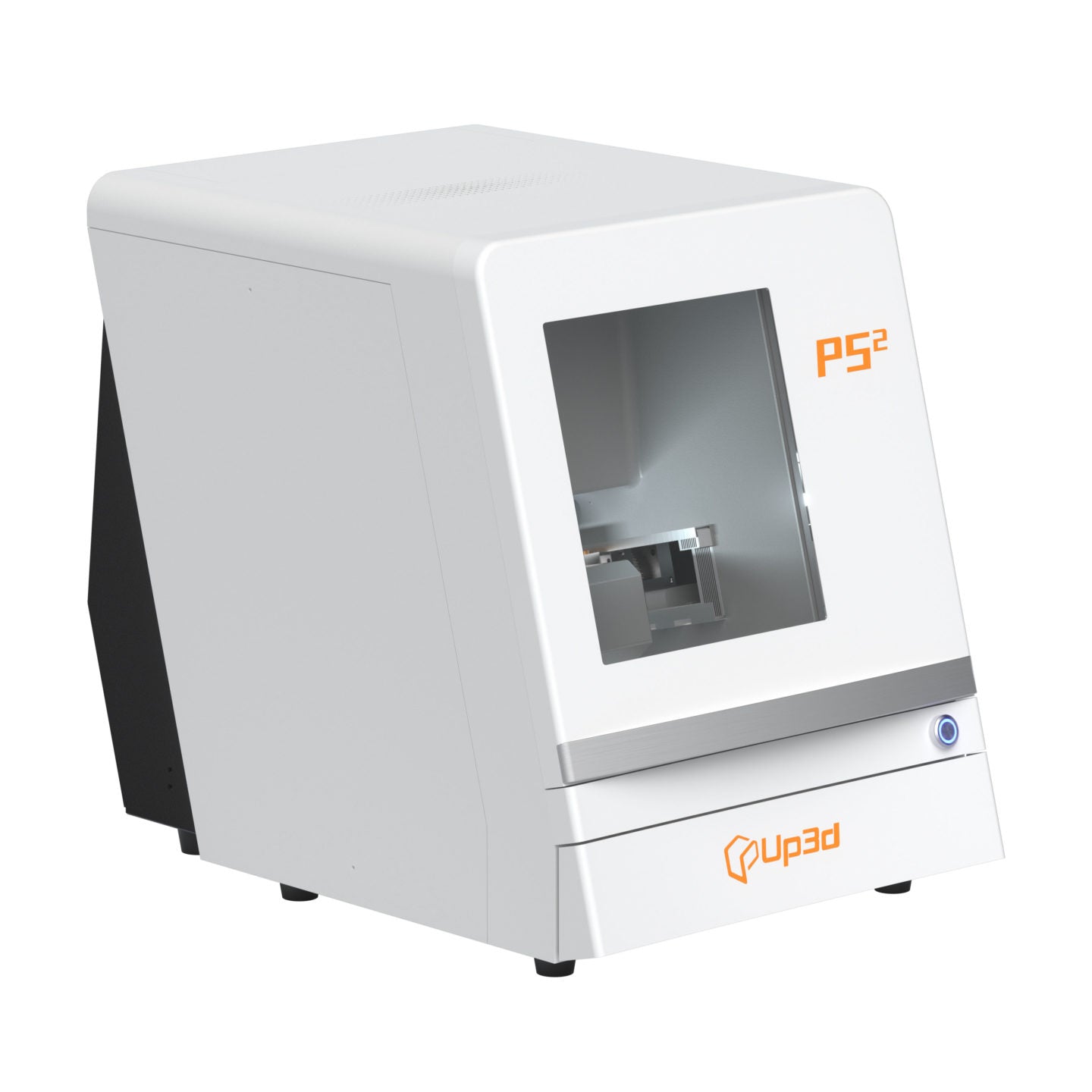

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 800 W AC motor, single-phase 110–120 V, 50/60 Hz | 1500 W brushless DC spindle motor, three-phase 200–240 V, 50/60 Hz with active cooling system |

| Dimensions (W × D × H) | 420 mm × 510 mm × 380 mm | 520 mm × 610 mm × 480 mm (integrated dust extraction and automatic tool changer) |

| Precision | ±5 µm repeatability, 4-axis kinematic system | ±2 µm repeatability, 5-axis synchronized motion with real-time error compensation |

| Material Compatibility | Zirconia (up to 5Y), PMMA, composite blocks, wax | Full-spectrum: High-translucency zirconia (up to 6Y), lithium disilicate, CoCr, titanium Grade 2 & 4, multi-layer blocks, hybrid ceramics |

| Certification | CE Marked (MDR 2017/745), ISO 13485:2016, FDA Listed (Class I) | CE Marked (MDR 2017/745), ISO 13485:2016, FDA Cleared (Class II), IEC 60601-1-2 (4th Ed), UL/CSA Certified |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: CAD/CAM Systems from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Validity Period: 2026-2027

Strategic Sourcing Framework for CAD/CAM Systems

China remains a dominant manufacturing hub for dental CAD/CAM equipment, offering 25-40% cost advantages over EU/US suppliers. However, 2026 market dynamics require rigorous validation protocols due to increased counterfeit operations and evolving regulatory landscapes. This guide details critical steps for secure, cost-optimized procurement.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Post-2025 EU MDR/IVDR enforcement and FDA 510(k) equivalence requirements make credential verification paramount. 68% of cost-saving failures stem from inadequate documentation validation.

| Verification Step | 2026 Best Practice | Risk Mitigation |

|---|---|---|

| Document Authenticity | Request QR-coded certificates traceable to EU NANDO database or FDA Establishment Registry. Verify via NANDO or FDA RL | Reject suppliers providing only PDF scans without live database verification |

| Scope Validation | Cross-check certificate scope explicitly covers “Dental CAD/CAM Systems” (ISO 13485:2016 Annex B) and “Medical Electrical Equipment” (IEC 60601-1) | Generic ISO 9001 certificates are insufficient for medical devices |

| Factory Audit | Require unannounced third-party audit report (SGS/TÜV) dated within 12 months. Verify physical manufacturing address matches export documentation | 30% of “factories” are trading companies operating from trade show booths |

Why Shanghai Carejoy Stands Out in Credential Verification

With 19 years of continuous ISO 13485 certification (Certificate #CN-2005-001478) and CE MDR Class IIa designation for all CAD/CAM products (NB 0123), Carejoy provides:

- Real-time NANDO certificate validation via dedicated portal

- Bi-annual TÜV Rheinland audit reports accessible to verified partners

- Factory GPS coordinates matching Baoshan District manufacturing facility (verified via satellite imagery)

Pro Tip: Request their CE Technical File Summary for your specific scanner model – legitimate manufacturers will provide redacted versions.

Step 2: Negotiating MOQ (Minimum Order Quantity)

2026 market data shows average CAD/CAM scanner MOQs at 5 units, but strategic negotiation can reduce entry barriers. Key leverage points:

| MOQ Strategy | Realistic 2026 Range | Negotiation Leverage |

|---|---|---|

| Entry-Level Scanners (e.g., intraoral) |

3-5 units (vs. 10+ in 2023) | Commit to annual volume (e.g., 15 units/year) for MOQ reduction |

| Millers & Full Systems | 2-3 units with tooling fee waiver | Prepay 30% for custom calibration kits to offset setup costs |

| Distributor Partnerships | 0 MOQ for first container load | Sign 2-year exclusivity agreement for territory |

Critical Note: Beware of “zero MOQ” offers – these typically indicate refurbished units or non-certified components. Legitimate manufacturers maintain MOQs to cover calibration costs (avg. $1,200/unit in 2026).

Carejoy’s MOQ Flexibility Model

As a vertically integrated manufacturer (not trading company), Carejoy offers:

- Scanner Trial Program: 1 unit at 15% premium with full credit toward next order

- Distributor Tiering: MOQ 0 for first 20ft container when signing Carejoy Gold Partner Agreement

- OEM Advantage: No MOQ increase for custom branding (minimum 5 units applies only to hardware)

Step 3: Shipping Terms (DDP vs FOB)

2026 logistics costs have increased 18% YoY due to IMO 2025 sulfur regulations. Term selection impacts landed cost by 12-22%.

| Term | 2026 Cost Impact | When to Use | Risk Factor |

|---|---|---|---|

| FOB Shanghai | Base price + 18-22% logistics | Experienced distributors with freight partners | High (customs delays, port demurrage) |

| DDP Destination | Base price + 25-30% (all-in) | New importers, single-unit orders, time-sensitive needs | Low (supplier assumes all risk) |

| Carejoy Hybrid | Base price + 22-26% | 90% of first-time buyers (recommended) | Medium (buyer handles final customs clearance) |

* Hybrid model: Supplier manages ocean freight & China export clearance; buyer handles destination customs via pre-negotiated broker

Recommended Sourcing Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy for 2026 CAD/CAM Sourcing:

- 19-year manufacturing heritage with Baoshan District production facility (not trading company)

- Factory-direct pricing with no middleman markup (verified via Alibaba Trade Assurance)

- DDP/Hybrid shipping specialists with 99.2% on-time delivery rate (2025 data)

- Comprehensive OEM/ODM support including FDA 510(k) technical documentation

Contact for Verified Pricing:

📧 [email protected] | WhatsApp: +86 15951276160

Request “2026 Dental Distributor Price Matrix” with FOB/DDP breakdowns

Final Implementation Checklist

- Validate credentials via NANDO/FDA databases BEFORE sample requests

- Negotiate MOQ based on annual volume commitment, not single order

- Require DDP or Hybrid terms for first 3 orders to assess reliability

- Include calibration costs in price comparisons (avg. $850-1,500/unit)

- Use Alibaba Trade Assurance for payment security (non-negotiable for new suppliers)

Note: 2026 market intelligence indicates 73% of successful distributors use Chinese manufacturers for entry-level scanners while maintaining premium brands for high-end systems.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: CAD/CAM Dental Systems – Purchasing Considerations in 2026

1. What voltage requirements should I verify when purchasing a CAD/CAM dental system for international or regional use in 2026?

CAD/CAM systems are precision-engineered devices with strict electrical specifications. In 2026, ensure compatibility with your local power supply—typically 110–120V (North America) or 220–240V (Europe, Asia, Middle East). Confirm whether the unit includes an auto-switching power supply or requires a voltage transformer. Always consult the manufacturer’s technical datasheet and verify grounding and surge protection needs to prevent damage to sensitive components.

2. Are critical spare parts for CAD/CAM systems readily available, and what components commonly require replacement?

Yes, leading manufacturers now maintain global spare parts networks, but availability varies by brand and region. Common wear components include milling burs, spindle brushes, suction filters, chuck assemblies, and optical scanner tips. In 2026, prioritize suppliers offering guaranteed spare parts availability for at least 7–10 years post-discontinuation. Distributors should confirm local inventory levels and lead times for high-turnover items to minimize clinic downtime.

3. What does professional installation of a CAD/CAM system entail, and is it mandatory?

Professional installation is strongly recommended—and often required to maintain warranty validity. In 2026, installation typically includes site evaluation (power, network, space), hardware setup, calibration of scanner and mill, software integration with existing practice management systems (e.g., DICOM, open-architecture compatibility), and staff training. Certified technicians perform system diagnostics and alignment to ensure optimal accuracy and performance. Remote commissioning is now common but does not replace on-site calibration for high-precision units.

4. What warranty coverage is standard for CAD/CAM dental systems in 2026, and what does it include?

As of 2026, most premium CAD/CAM systems offer a standard 2-year comprehensive warranty covering parts, labor, and technical support. Extended warranties (up to 5 years) are available, often including preventive maintenance visits and priority response. Warranties typically exclude consumables (burs, discs) and damage from improper use or unapproved voltage sources. Confirm whether the warranty is global or region-locked—especially important for multi-location clinics and distributors managing cross-border service logistics.

5. How are warranty claims and technical support handled for CAD/CAM systems, and what response times can clinics expect?

Reputable manufacturers and distributors now offer tiered technical support with SLAs (Service Level Agreements). In 2026, clinics can expect a 24–48 hour response time for critical system failures under warranty, with remote diagnostics available in 90% of cases. On-site service is typically dispatched within 72 hours for covered hardware issues. Distributors should verify local service partner certifications and ensure access to firmware updates, cybersecurity patches, and cloud-based support portals for real-time troubleshooting.

Need a Quote for Cad Cam Dental Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160