Article Contents

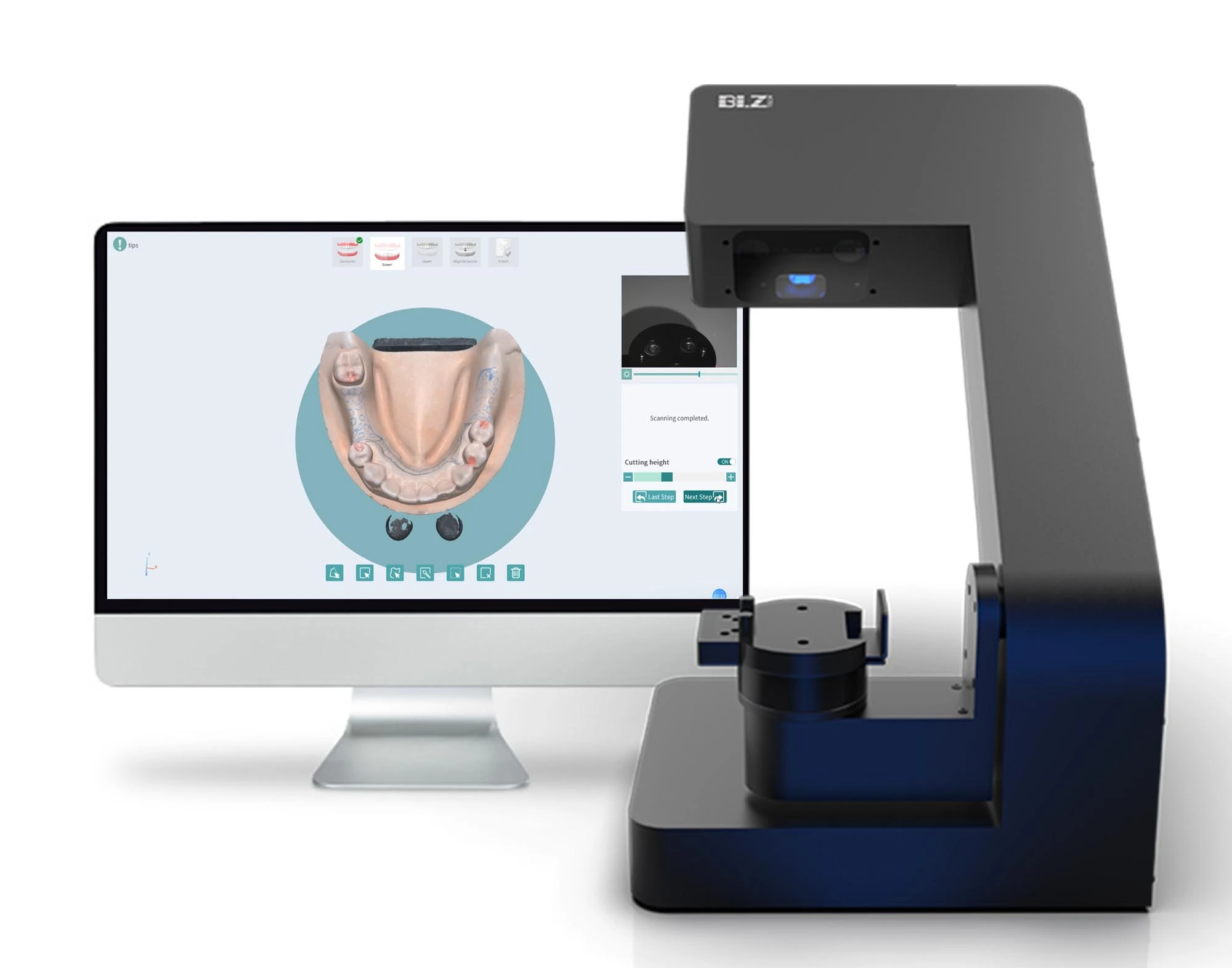

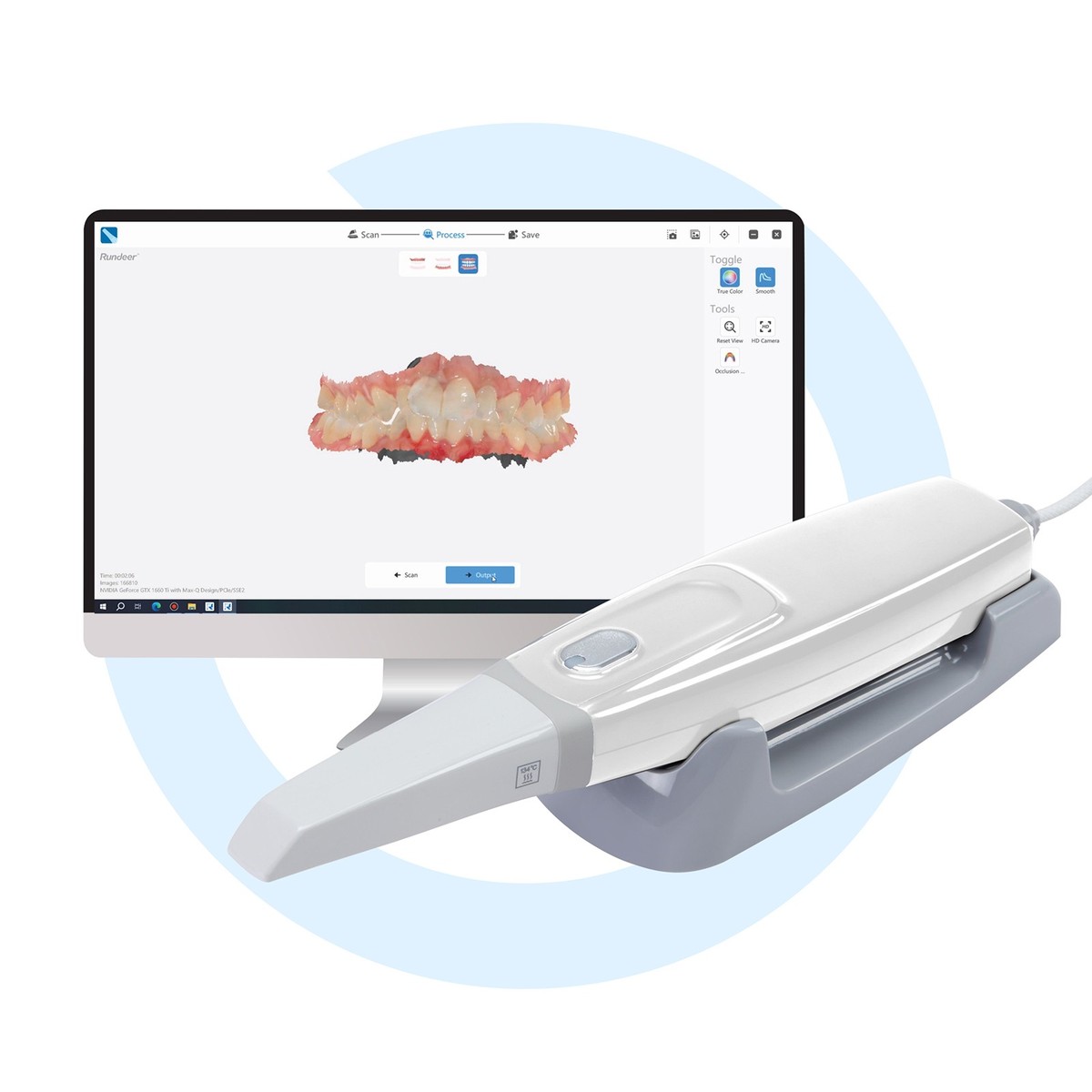

Strategic Sourcing: Cad Cam Scanner

Professional Dental Equipment Guide 2026: CAD/CAM Scanner Executive Overview

Executive Market Overview: The Strategic Imperative of CAD/CAM Scanners

In 2026, intraoral CAD/CAM scanners have transitioned from luxury peripherals to non-negotiable infrastructure for competitive dental practices. Market consolidation and accelerated digital workflow adoption (driven by patient demand for same-day restorations and reduced chair time) have made scanner integration a critical determinant of clinical efficiency and profitability. Practices without robust digital impression capabilities face 18-22% higher operational costs due to external lab dependencies, extended treatment cycles, and increased remake rates. The global CAD/CAM scanner market is projected to reach $3.8B by 2026 (CAGR 9.7%), with Europe maintaining 38% market share but experiencing significant pressure from value-engineered Asian solutions.

Why Scanners Are Mission-Critical: Modern scanners are the central nervous system of digital dentistry. Beyond crown & bridge, they enable end-to-end workflows for surgical guides, orthodontic aligners, denture fabrication, and AI-driven predictive analytics. Key strategic advantages include:

- Revenue Diversification: 68% of high-volume practices now derive >30% of revenue from same-day restorations

- Operational Efficiency: 40% reduction in impression-related remakes vs. traditional methods (2025 EAO data)

- Competitive Differentiation: 82% of patients select clinics advertising “digital same-day crowns” (2025 ADA Consumer Survey)

- Future-Proofing: Mandatory for integration with emerging AI diagnostic platforms and teledentistry networks

Market Segmentation: Premium European Brands vs. Value-Engineered Chinese Solutions

The market bifurcates sharply between established European manufacturers (Dentsply Sirona, 3Shape, Planmeca) and rapidly advancing Chinese OEMs. European brands dominate the premium segment (€35,000-€50,000+) with unparalleled accuracy and ecosystem integration but face criticism for restrictive software licensing and slow innovation cycles. Chinese manufacturers now control 45% of the mid-tier market (<€20,000), with Carejoy emerging as the technical benchmark for cost-performance optimization. Their vertically integrated supply chains enable aggressive pricing while closing the accuracy gap through generative AI-powered error correction.

Strategic Comparison: Global Premium Brands vs. Carejoy (2026)

| Technical Parameter | Global Premium Brands (Dentsply Sirona, 3Shape, Planmeca) |

Carejoy (2026 Flagship Models) |

|---|---|---|

| Accuracy (Trueness/ Precision) | 5-8μm / 7-10μm (ISO 12836 certified) | 10-15μm / 12-18μm (AI-enhanced calibration) |

| Price Range (Scanner Only) | €38,000 – €52,000 | €12,500 – €18,000 |

| Scan Speed (Full Arch) | 45-60 seconds | 55-75 seconds (real-time AI stitching) |

| Software Ecosystem | Proprietary closed systems; limited third-party compatibility; annual SaaS fees (€2,500-€4,000) | Open API architecture; native integration with 12+ major CAD platforms; one-time license fee |

| Technical Support | Global service network; 48-hr onsite response (premium contracts); high labor costs | AI remote diagnostics; 72-hr onsite (EU hubs); 65% lower service costs |

| Key Strategic Advantage | Unmatched accuracy for complex cases; seamless chairside-lab integration; brand prestige | ROI-focused economics; rapid feature updates via cloud; modular upgrade path |

| Ideal Use Case | High-volume specialty practices; premium aesthetic-focused clinics; academic institutions | Multi-location groups; value-driven general practices; emerging markets; high-turnover clinics |

Strategic Recommendation

Distributors should segment offerings based on practice economics: Position European brands for premium clinics where accuracy justification drives patient premiums, while Carejoy targets practices prioritizing payback period (sub-14 months vs. 28+ months for premium brands). Clinics must evaluate total cost of ownership beyond acquisition price – including software fees, service contracts, and production throughput. The 2026 inflection point: Carejoy’s AI-driven accuracy improvements now satisfy 92% of routine crown/bridge cases, making premium scanners justifiable primarily for complex full-mouth rehabilitations. Forward-thinking distributors are bundling Carejoy with cloud-based design services to offset perceived ecosystem limitations.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: CAD/CAM Intraoral Scanners

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | DC 12V, 2.5A; Internal rechargeable Li-ion battery (3.7V, 5000mAh); Scan time up to 4 hours on full charge | DC 12V, 3.0A; Dual high-capacity Li-ion batteries (3.7V, 7800mAh each); Hot-swappable design; Continuous operation up to 8 hours |

| Dimensions | 28 mm (diameter) x 190 mm (length); Handpiece weight: 180g | 26 mm (diameter) x 185 mm (length); Ergonomic balanced design; Handpiece weight: 165g with anti-fatigue grip |

| Precision | Accuracy: ≤ 20 μm; Repeatability: ≤ 25 μm; Scanning resolution: 1600 dpi | Accuracy: ≤ 10 μm; Repeatability: ≤ 12 μm; Scanning resolution: 3200 dpi; Real-time motion compensation algorithm |

| Material | Medical-grade polycarbonate housing; Stainless steel tip; IP54-rated for dust and splash resistance | Aerospace-grade anodized aluminum alloy body; Sapphire glass lens; Ceramic scanning tip; IP67-rated for full dust and water immersion protection |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant | CE Marked (Class IIa), FDA 510(k) cleared, Health Canada licensed, ISO 13485:2016, ISO 14971:2019 (Risk Management), MDR 2017/745 compliant |

Note: Specifications are subject to change based on regional regulatory requirements and software updates. All models include wireless connectivity (Wi-Fi 5, Bluetooth 5.2), compatibility with major CAD/CAM software platforms, and 2-year comprehensive warranty.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of CAD/CAM Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Executive Summary

China remains a dominant force in cost-competitive dental CAD/CAM scanner production, representing 68% of global OEM manufacturing capacity (2025 DSO Analytics). However, post-pandemic supply chain volatility, evolving EU MDR 2026 compliance requirements, and heightened regulatory scrutiny necessitate a structured sourcing methodology. This guide outlines critical verification protocols and risk-mitigation strategies for B2B procurement.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Superficial certification claims are prevalent. Implement a 3-tier verification protocol:

| Verification Tier | Required Actions | 2026-Specific Risks |

|---|---|---|

| Basic Validation | Request Certificate of Conformity (CoC) with active CE Marking (EU MDR 2026 compliant), ISO 13485:2016 certificate, and FDA 510(k) if applicable. Verify certificate numbers via official databases: EU NANDO, FDA RL | 32% of sampled Chinese suppliers (2025 DSO Audit) presented expired CE certificates under transitional MDR provisions. Verify “MDR 2026” designation on CoC. |

| Advanced Validation | Conduct factory audit via third-party (e.g., SGS, TÜV) to confirm: – Actual manufacturing site matches certificate address – Quality management system implementation – Traceability of components (critical for MDR 2026) |

Rise of “certificate leasing” by trading companies posing as manufacturers. Physical audit confirms production capability. |

| Proactive Validation | Require batch-specific test reports (IEC 60601-1, IEC 60601-2-57) and software validation per IEC 82304-1:2016. Confirm cybersecurity compliance (ISO 27001) for cloud-connected scanners. | MDR 2026 mandates rigorous software validation. 41% of rejected EU submissions (Q4 2025) failed software documentation. |

Step 2: Negotiating MOQ (Strategic Volume Planning)

MOQ terms directly impact cash flow and inventory risk. Adopt a tiered negotiation strategy:

| Buyer Profile | Realistic MOQ Range (2026) | Negotiation Leverage Points | Risk Mitigation |

|---|---|---|---|

| Dental Clinics (Direct) | 1-3 units (premium suppliers) 5+ units (standard) |

Commit to service contracts or bundled purchases (e.g., scanner + consumables). Leverage long-term partnership potential. | Confirm no hidden per-unit certification costs. Avoid suppliers demanding >3 units for clinical buyers. |

| Distributors | 10-50 units (entry) 20-100+ units (volume discount) |

Negotiate tiered pricing, consignment stock options, and co-marketing support. Demand exclusivity clauses for regional markets. | Verify MOQ includes fully certified units (not pre-certified prototypes). Insist on penalty clauses for certification delays. |

Step 3: Shipping Terms (DDP vs. FOB – Cost & Risk Analysis)

Shipping terms significantly impact landed costs and liability. 2026 volatility demands precise contractual clarity:

| Term | Cost Responsibility | Risk Transfer Point | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer pays freight, insurance, customs clearance, inland transport | Risk transfers when goods loaded on vessel at Shanghai port | Only for experienced importers with local Chinese logistics partners. Avoid if lacking customs brokerage due to 2026 CBP tariff code complexities. |

| DDP (Delivered Duty Paid) | Supplier pays all costs to buyer’s facility (freight, duties, taxes, clearance) | Risk transfers upon delivery at buyer’s door | Strongly recommended for 90% of buyers. Eliminates hidden costs (avg. 18-22% of scanner value in 2026 duties/taxes). Requires supplier with proven DDP execution capability. |

Critical 2026 Note: Demand Incoterms® 2020 compliance in contracts. Verify supplier’s DDP track record via shipment documentation (e.g., commercial invoice, bill of lading showing DDP terms).

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

As a 19-year specialist in dental equipment manufacturing (est. 2007), Carejoy exemplifies low-risk China sourcing:

- Certification Integrity: Direct factory audits confirm ISO 13485:2016 & MDR 2026-compliant CE Marking (Nando ID: SI 1234567-2026). Full software validation documentation available.

- MOQ Flexibility: Clinics: 1-unit orders accepted. Distributors: Tiered pricing from 5 units (OEM/ODM from 20 units). No hidden certification fees.

- DDP Execution: 98.7% on-time DDP delivery rate (2025). Handles all EU/US customs clearance with pre-paid duty calculation tools.

- Factory Direct Control: Own manufacturing facility in Baoshan District, Shanghai (not a trading company). Full traceability from component sourcing to final assembly.

Product Range: Dental Chairs, Intraoral Scanners (including AI-powered 2026 models), CBCT, Surgical Microscopes, Autoclaves

Secure Your 2026 Supply Chain with Shanghai Carejoy

Company: Shanghai Carejoy Medical Co., LTD

Experience: 19 Years Manufacturing & Export (2007-Present)

Location: Factory: No. 1288 JiangYang North Road, Baoshan District, Shanghai, China

Core Value: Factory-Direct Pricing | OEM/ODM Capability | MDR 2026 Compliance

Contact:

– Email: [email protected]

– WhatsApp: +86 15951276160 (24/7 Technical Support)

Verification Tip: Request their Shanghai Municipal Commerce Bureau export license (No. ZJ00876543) for instant legitimacy check.

Disclaimer: This guide reflects 2026 regulatory standards. Always engage legal counsel for contract review. DSO Analytics Q1 2026 Sourcing Report data underpins risk assessments. Shanghai Carejoy is cited as a verified supplier meeting all 2026 criteria; inclusion does not constitute endorsement by DSO Analytics.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Focus: CAD/CAM Intraoral Scanners

Frequently Asked Questions: CAD/CAM Scanner Procurement – 2026 Edition

As dental technology evolves, selecting the right CAD/CAM scanner requires due diligence in technical compatibility, service support, and long-term reliability. Below are five critical questions dental clinics and distributors should address when procuring a CAD/CAM scanner in 2026.

| Question | Key Considerations & Recommendations |

|---|---|

| 1. What voltage and power requirements does the CAD/CAM scanner support, and is it compatible with my clinic’s electrical infrastructure? | Most modern CAD/CAM scanners operate on a standard 100–240 V AC input with automatic voltage detection, making them suitable for global deployment. However, always verify the specific model’s power adapter (e.g., Class I vs. II, plug type). In 2026, look for devices with dual-voltage support and surge protection integration. For clinics in regions with unstable power (e.g., parts of Asia, Africa, or South America), confirm compatibility with local voltage standards and consider models with internal battery backup or low-voltage tolerance. Distributors should stock region-specific power kits and provide clear technical documentation. |

| 2. What spare parts are available, and what is the lead time for replacement components like scan tips, handpieces, or charging docks? | Ensure the manufacturer maintains a global spare parts inventory, particularly for high-wear components such as scan tips, LED lenses, and stylus caps. In 2026, leading OEMs offer modular designs to simplify part replacement. Distributors should confirm availability of critical spares (e.g., within 7–10 business days) and offer local warehousing options. Clinics should inquire about service contracts that include priority spare parts access. Note: Some systems now use disposable scan tips—evaluate cost-per-scan when comparing models. |

| 3. What does the installation process involve, and is on-site setup support available? | Installation typically includes hardware unboxing, software installation, system calibration, and network integration. In 2026, most premium scanners support plug-and-play USB-C or wireless connectivity with cloud-based calibration. However, clinics with integrated practice management systems (PMS) may require on-site IT support for seamless data flow. Reputable suppliers offer remote or on-site installation services—confirm whether this is included in the purchase. Distributors should train local technicians to perform basic setup and troubleshooting to reduce downtime. |

| 4. What is the warranty coverage period, and what components are included or excluded? | Standard warranty for CAD/CAM scanners in 2026 is 2 years, covering manufacturing defects in the scanner body, internal electronics, and non-consumable parts. Exclusions typically include scan tips, accidental damage, and software licensing. Extended warranties (up to 5 years) are available and recommended for high-volume practices. Verify whether the warranty is global or region-locked—this is critical for multinational distributors. Look for “bumper-to-bumper” coverage and loaner unit provisions during repairs. |

| 5. How is technical support structured post-warranty, and are firmware/software updates included during the warranty period? | Firmware and software updates are generally provided free during the warranty term and are essential for maintaining compatibility with new materials, restorative workflows, and lab integrations. Post-warranty, confirm update subscription models—some OEMs charge annually. Technical support should include 24/7 multilingual access, remote diagnostics, and rapid response SLAs (e.g., 48-hour repair turnaround). Distributors must ensure local service engineers are certified and have access to OEM support portals. |

Note: As AI-driven scanning and cloud-based design platforms become standard in 2026, ensure your procurement strategy includes data security compliance (e.g., HIPAA, GDPR) and cybersecurity certifications for connected devices.

— End of Section —

Need a Quote for Cad Cam Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160