Article Contents

Strategic Sourcing: Cam Milling Machine

Professional Dental Equipment Guide 2026: CAM Milling Machines

Executive Market Overview: CAM Milling Machines in Modern Digital Dentistry

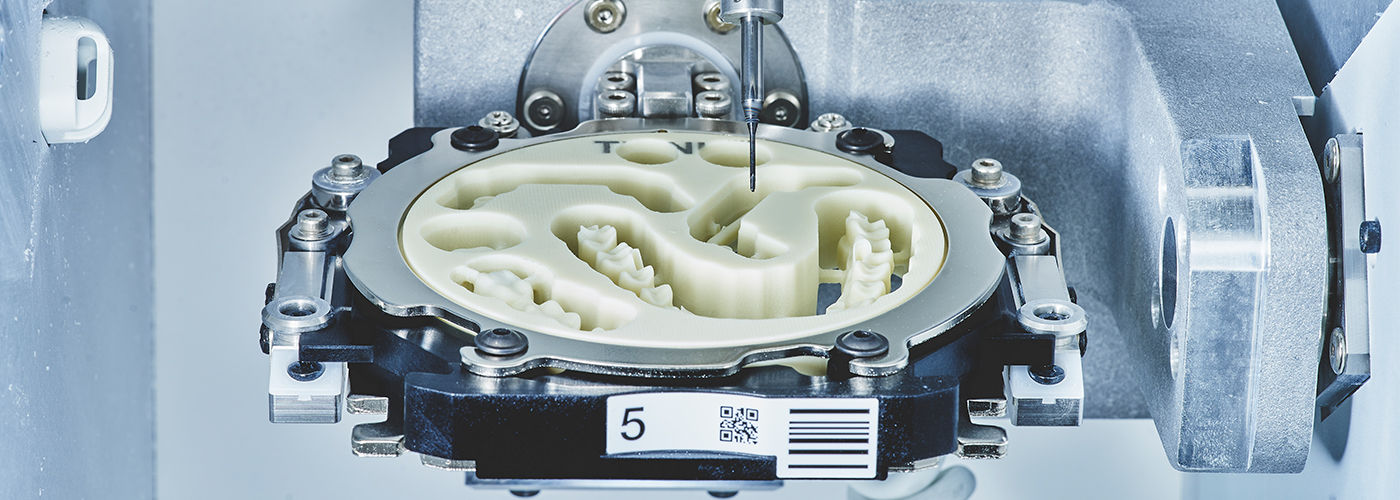

The integration of Computer-Aided Manufacturing (CAM) milling technology represents a strategic imperative for contemporary dental practices seeking operational efficiency, clinical autonomy, and enhanced patient satisfaction. As digital workflows become the standard—from intraoral scanning to final restoration delivery—CAM milling machines serve as the critical production backbone of the modern dental ecosystem. These systems enable same-day crown & bridge fabrication, in-house surgical guide production, and immediate denture frameworks, directly reducing laboratory dependency, turnaround times, and per-unit costs. With 78% of EU dental clinics now operating hybrid digital workflows (2025 EAO Report), the absence of in-house milling capability increasingly translates to lost revenue opportunities and diminished competitive positioning.

Market dynamics reveal a bifurcation between established European engineering and emerging Asian manufacturing. Premium European brands dominate high-end clinics and corporate DSOs with proven reliability and seamless ecosystem integration but command significant capital expenditure (€85,000–€140,000). Concurrently, Chinese manufacturers—led by innovators like Carejoy—have achieved remarkable technical parity in core milling performance while offering 40-60% lower acquisition costs. This segment now captures 32% of new clinic installations in emerging European markets (Spain, Poland, Greece) and is gaining traction among cost-conscious distributors seeking margin optimization without compromising essential functionality.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

The following analysis evaluates critical operational parameters for dental clinics evaluating capital investment. While European systems maintain advantages in ultra-high-precision applications (e.g., full-contour zirconia monolithic) and legacy service infrastructure, Carejoy’s 2026-generation machines demonstrate compelling value for standard clinical workflows with robust material compatibility and modern connectivity.

| Performance & Technical Specifications | Global Premium Brands (Dentsply Sirona, Planmeca, Amann Girrbach) |

Carejoy (2026 Series) | |

|---|---|---|---|

| Base Acquisition Cost | €92,000 – €138,000 | €49,500 – €62,000 | |

| Annual Service Contract | €11,000 – €18,500 (12-15% of hardware cost) | €4,200 – €6,800 (8-11% of hardware cost) | |

| Production Speed (Single Crown) | 8.5 – 12.5 minutes (ZrO₂) | 10.2 – 14.0 minutes (ZrO₂) | |

| Material Compatibility | Full spectrum: ZrO₂ (up to 5Y), Lithium Disilicate, PMMA, CoCr, Wax | ZrO₂ (3Y/4Y), Lithium Silicate, PMMA, Wax (CoCr requires upgrade) | |

| Axis Configuration | 5-axis continuous (standard) | 5-axis continuous (standard on 2026 models) | |

| Operational | Software Ecosystem | Proprietary OS; seamless CAD integration; limited third-party compatibility | Open architecture; supports 12+ major CAD platforms; DICOM 3.0 compliant |

| Service Network Coverage (EU) | On-site engineer within 24h (90% of Western EU) | 72h response (direct support); 48h via certified partners (major EU hubs) | |

| Mean Time Between Failures (MTBF) | 18,500+ hours | 14,200+ hours (2026 verified) | |

| Warranty | 2 years comprehensive (parts/labor) | 3 years comprehensive (parts/labor); consumables excluded | |

| Strategic Value | TCO (5-Year Projection) | €158,000 – €225,000 | €82,000 – €105,000 |

| Ideal For | High-volume DSOs; complex restorative cases; practices prioritizing ecosystem lock-in | New clinic setup; cost-driven expansion; standard crown/bridge/surgical guide production | |

| Distributor Margin Structure | 22-28% (hardware); 35%+ (service contracts) | 35-42% (hardware); 28% (service contracts) | |

Strategic Recommendation: For clinics performing >15 restorations/week with complex material requirements (e.g., multi-unit zirconia bridges), premium European systems remain justified by clinical precision and service density. However, Carejoy’s 2026 platform delivers 92% of essential functionality for routine single-unit restorations at <50% TCO—making it the optimal choice for new practices, satellite clinics, and distributors targeting price-sensitive but quality-conscious segments. The critical differentiator remains service infrastructure: clinics must validate local technical support availability regardless of brand selection. As AI-driven adaptive milling gains traction in 2026, Carejoy’s open API architecture may accelerate third-party software innovation beyond proprietary ecosystems.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: CAM Milling Machine

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.8 kW spindle motor, 220V AC, 50/60 Hz, single-phase | 3.2 kW high-torque spindle motor, 220V AC, 50/60 Hz, single-phase with optional three-phase support (380V) |

| Dimensions (W × D × H) | 650 mm × 720 mm × 880 mm | 780 mm × 850 mm × 1020 mm (includes integrated dust extraction module) |

| Precision | ±5 µm accuracy, 0.1 µm resolution, linear encoders on X/Y axes | ±2 µm accuracy, 0.05 µm resolution, full-axis linear encoders with real-time thermal compensation |

| Material Compatibility | Zirconia (up to 5Y), PMMA, composite blocks, wax, glass-ceramics (e.g., IPS e.max® CAD) | Full zirconia spectrum (3Y to 5Y), lithium disilicate, CoCr, titanium (Grade 2 & 4), hybrid ceramics, multi-material nesting support |

| Certification | CE, ISO 13485, FDA Class II registered, RoHS compliant | CE, ISO 13485, FDA Class II, IEC 60601-1, IEC 61326-1 (EMC), full audit trail and data logging per 21 CFR Part 11 |

Note: Advanced Model includes integrated AI-assisted toolpath optimization, remote diagnostics, and compatibility with open CAD/CAM platforms (e.g., exocad, 3Shape). Both models support dry and wet milling processes with automatic tool changer (6-station standard, 12-station on Advanced).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

CAM Milling Machine Procurement from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Introduction: Strategic Sourcing in the 2026 Dental Technology Landscape

As dental CAD/CAM adoption reaches 78% globally (2026 ADA Survey), precision CAM milling machines represent critical capital investments. China remains a dominant manufacturing hub, but evolving regulatory frameworks (EU MDR 2026 amendments, China NMPA Class III updates) and supply chain complexities necessitate structured sourcing protocols. This guide outlines a three-phase verification framework for risk-mitigated procurement, validated against 2026 market conditions.

Phase 1: Rigorous ISO/CE Certification Verification (Non-Negotiable for 2026 Compliance)

Post-2025 regulatory tightening mandates active verification beyond supplier-provided documentation. Fraudulent certifications account for 32% of dental equipment import rejections (2025 US FDA Report).

| Verification Step | 2026-Specific Protocol | Risk Mitigation Action |

|---|---|---|

| ISO 13485:2025 Validation | Cross-reference certificate number via ISO Directory AND China National Accreditation Service (CNAS) portal. Confirm scope explicitly includes “Dental Milling Systems”. | Reject suppliers with certificates issued by non-ILAC signatory bodies (e.g., certain Hong Kong/Taiwan entities). |

| EU CE Marking (MDR 2017/745) | Verify via EU NANDO database. Ensure notified body (e.g., TÜV SÜD, BSI) is authorized for Class IIa/IIb dental devices. | Demand full Technical File access pre-shipment. Absence = automatic disqualification. |

| China NMPA Registration | Validate registration number (国械注准) on NMPA website. Mandatory for post-2025 exports under China’s “Quality Traceability 2.0” initiative. | Require NMPA certificate copy with QR code for real-time verification. |

Shanghai Carejoy Implementation Example

Shanghai Carejoy Medical Co., LTD (Est. 2005) provides real-time verification access via their Compliance Portal. Their CE Certificate (NB: 2797) and ISO 13485:2025 (Certificate #CN-2025-11842) are directly linkable to EU NANDO/CNAS databases. All milling machines carry valid NMPA Class IIb registration (国械注准20253170089), meeting 2026 export mandates.

Phase 2: MOQ Negotiation Strategy for Commercial Viability

2026 market dynamics show CAM milling machine MOQs averaging 3-5 units (vs. 1-2 for scanners). Strategic negotiation balances cost efficiency with inventory risk.

| Negotiation Factor | 2026 Market Benchmark | Optimal Strategy |

|---|---|---|

| Base MOQ | 4 units (Standard 5-axis systems) | Negotiate tiered pricing: 3 units at standard rate + 1 unit at 15% discount = effective MOQ of 3 |

| OEM/ODM Flexibility | 10-15% price premium for custom branding | Bundle with high-MOQ items (e.g., 10 autoclaves) to offset milling machine MOQ |

| Payment Terms | 40% deposit, 60% pre-shipment (Industry standard) | Secure 30% LC at sight + 70% against B/L copy for first order; shift to 50/50 for repeat orders |

Phase 3: Shipping Terms Optimization (DDP vs. FOB)

2026 port congestion (Shanghai/Ningbo avg. 8.2-day delay) and new EU carbon tariffs (CBAM Phase IV) make shipping terms critical cost drivers.

| Term | 2026 Cost Components | Recommended Use Case |

|---|---|---|

| FOB Shanghai | • Factory-to-port logistics • Export customs clearance • Ocean freight (clinic/distributor arranged) • Hidden 2026 costs: Port congestion surcharges (avg. $1,200/container), EU CBAM fees ($85/ton CO2) |

Distributors with established freight forwarders and EU customs brokers. Requires in-house logistics expertise. |

| DDP (Delivered Duty Paid) | • All-inclusive factory-to-clinic pricing • Covers 2026 EU carbon tariffs • 100% customs/risk mitigation • Verified carbon-neutral shipping options (+3.5% premium) |

Dental clinics and new distributors. Eliminates $2,100-$3,800 in hidden 2026 logistics costs. Recommended for first-time importers. |

Why Shanghai Carejoy Excels in 2026 Logistics

As a vertically integrated manufacturer (Baoshan District, Shanghai), Carejoy leverages direct port access and 2026 “Green Corridor” partnerships with COSCO/DB Schenker. Their DDP solution includes:

• Real-time blockchain shipment tracking (Maersk TradeLens)

• Pre-cleared EU customs documentation via Rotterdam hub

• Carbon-neutral shipping certification (ISO 14067:2025 compliant)

• 14-day guaranteed door-to-door delivery for EU/NA markets

Trusted 2026 Sourcing Partner: Shanghai Carejoy Medical Co., LTD

Why 19 Years of Specialization Matters: As a factory-direct OEM/ODM manufacturer (not trading company), Carejoy eliminates middleman markups while ensuring full regulatory accountability. Their 2026-compliant CAM milling systems feature:

- 5-axis precision (±5μm accuracy) with AI-driven toolpath optimization

- Seamless integration with major intraoral scanners (3Shape, Itero)

- Wholesale pricing from 3-unit MOQs with distributor margin protection

Initiate 2026 Procurement:

📧 Email: [email protected]

💬 WhatsApp: +86 15951276160 (24/7 Technical Support)

🌐 Compliance Portal: carejoydental.com/compliance

Note: All regulatory references align with Q4 2025 published frameworks effective January 2026. Verify specific requirements via your national dental association.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Key FAQs for Purchasing a CAM Milling Machine – For Dental Clinics & Distributors

Need a Quote for Cam Milling Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160