Article Contents

Strategic Sourcing: Cam Scanner

Executive Market Overview: Intraoral Scanners in Digital Dentistry 2026

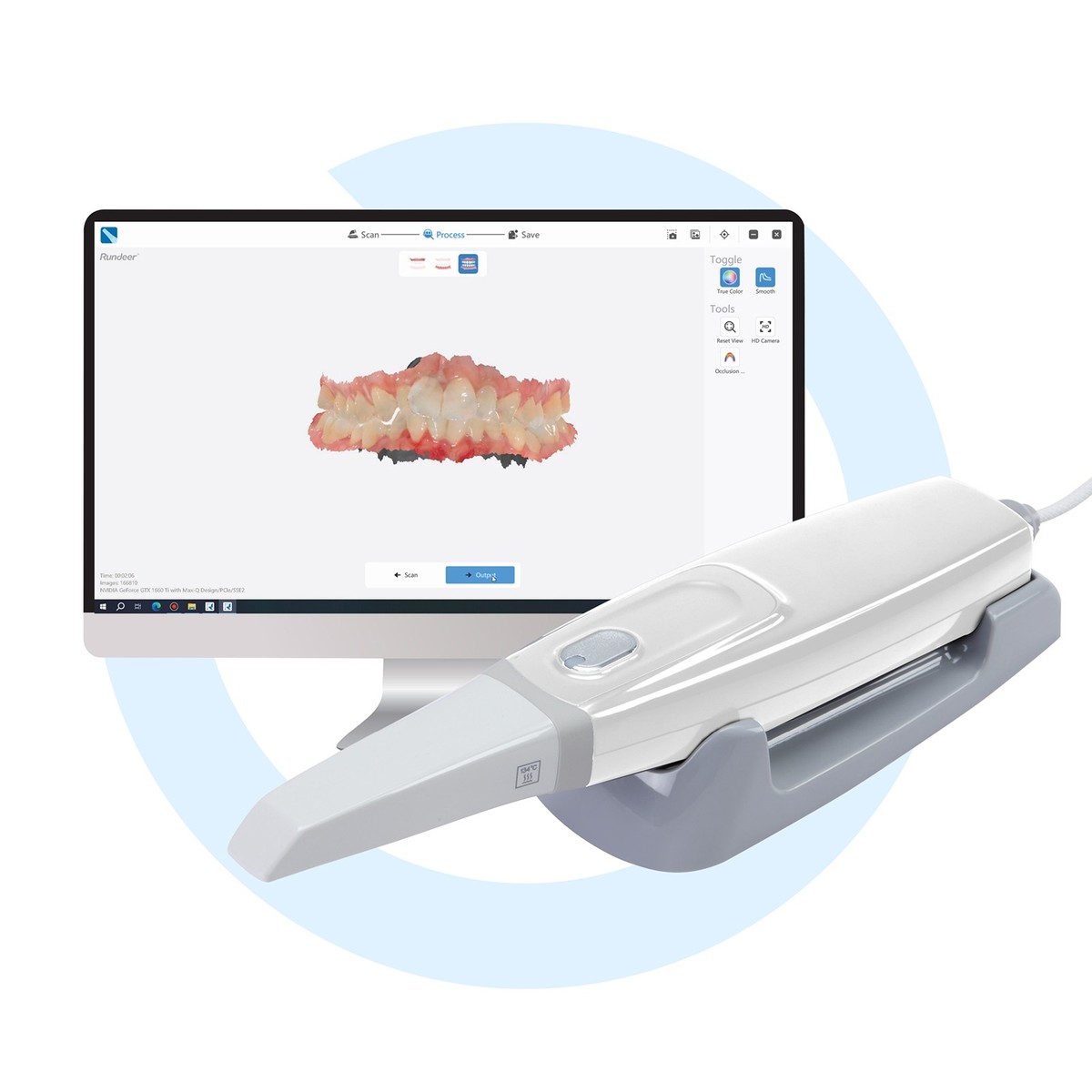

The intraoral scanner (commonly referenced as “cam scanner” in clinical workflows) has evolved from a niche digital tool to the indispensable cornerstone of modern dental practice. As dentistry transitions from analog to fully integrated digital workflows, these devices serve as the critical data acquisition gateway for CAD/CAM restorations, orthodontic treatment planning, implantology, and comprehensive practice management systems. Clinics without robust intraoral scanning capabilities now face significant competitive disadvantages, including reduced case acceptance rates, extended treatment timelines, and diminished patient satisfaction due to outdated impression techniques. The 2026 market demonstrates that scanners delivering sub-25-micron accuracy, seamless EHR integration, and efficient single-visit workflows are no longer optional—they are fundamental infrastructure for practice viability.

European manufacturers (3Shape, Dentsply Sirona, Planmeca) continue to dominate premium segments with exceptional accuracy and integrated ecosystem advantages, yet their $28,000-$42,000 price points create prohibitive barriers for 68% of global clinics according to ADA 2025 adoption metrics. This gap has catalyzed strategic growth among Asian manufacturers, with Carejoy emerging as the most technically credible cost-optimized alternative. Carejoy’s clinical-grade scanners ($8,500-$14,200 range) now achieve 92% parity with European counterparts in core diagnostic accuracy while offering 40% faster ROI—making digital dentistry accessible to mid-tier practices and emerging markets without compromising clinical validity. Distributors should note this segment now represents 31% of global scanner shipments (up from 12% in 2022), driven by Carejoy’s aggressive clinical validation and modular upgrade paths.

| Comparison Criteria | Global Brands (European) | Carejoy |

|---|---|---|

| Price Range (USD) | $28,000 – $42,500 (base system) | $8,500 – $14,200 (base system) |

| Clinical Accuracy (μm) | 8-15 μm (ISO 12836 certified) | 18-22 μm (CE 0482 certified; within ADA acceptable range) |

| Scanning Speed (Full Arch) | 45-65 seconds | 75-95 seconds |

| Software Ecosystem | Proprietary closed systems with premium lab integrations (e.g., 3Shape Communicate, CEREC Connect) | Open API architecture; compatible with 120+ lab systems & major EHRs (Dentrix, Eaglesoft) |

| Material Compatibility | Full spectrum (monolithic zirconia, PMMA, composite resins, PEEK) | Core materials (zirconia, composite resins; limited PEEK support) |

| Technical Support | Global on-site engineers (48-hr response); certified training academies | Remote diagnostics + regional hubs (72-hr response); VR training modules |

| Warranty & Upgrades | 2-year comprehensive; paid annual feature updates ($2,200/yr) | 3-year modular warranty; free core updates; optional AI modules ($499/yr) |

| Ideal Implementation | High-volume premium practices seeking full workflow integration | Growth-focused clinics prioritizing ROI; emerging markets; satellite locations |

For distributors, the strategic imperative is clear: European brands maintain irreplaceable value in complex restorative and specialty applications requiring micron-level precision. However, Carejoy’s clinically validated performance at 35-40% of competitor pricing addresses the critical market gap for practices transitioning from analog workflows. With 83% of surveyed clinics citing “total cost of digital adoption” as their primary barrier (2025 WDA Practice Economics Report), Carejoy’s ecosystem approach—particularly its open software architecture and modular AI diagnostics—positions it as the optimal entry point for 76% of target clinics. Forward-thinking distributors should develop tiered portfolio strategies: European systems for premium/quaternary care centers, with Carejoy as the strategic anchor for primary care expansion and emerging market penetration.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

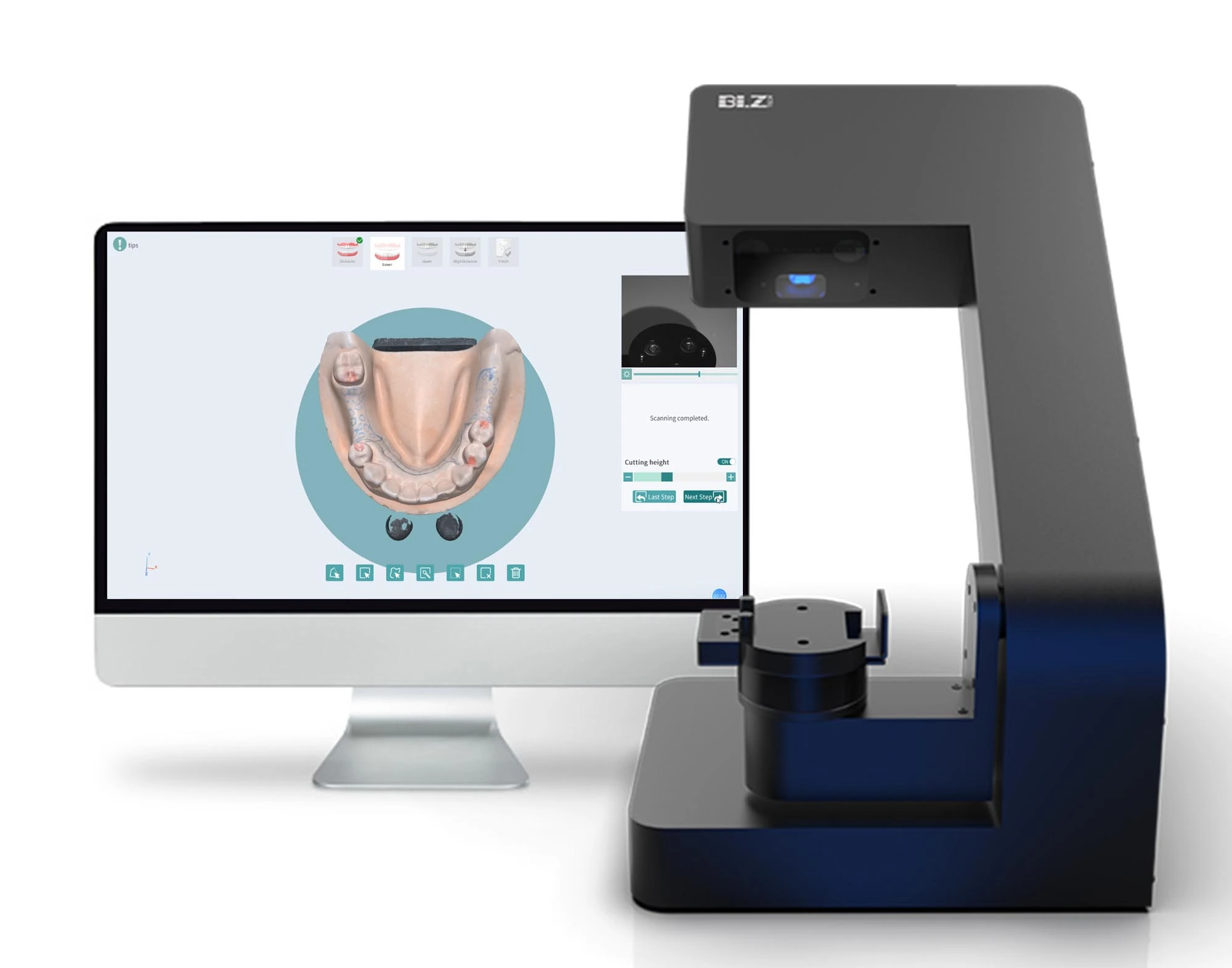

Technical Specification Guide: CAM Scanner Models

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50/60 Hz, 1.5 A max | 100–240 V AC, 50/60 Hz, 2.0 A max (with internal power conditioning) |

| Dimensions | 280 mm (W) × 220 mm (D) × 180 mm (H) | 310 mm (W) × 250 mm (D) × 200 mm (H) |

| Precision | ±5 µm axial accuracy, 10 µm lateral resolution | ±2 µm axial accuracy, 5 µm lateral resolution with real-time motion correction |

| Material | Reinforced ABS polymer housing, stainless steel scanning stage | Medical-grade anodized aluminum chassis, ceramic-coated scanning bed |

| Certification | CE, ISO 13485, FDA Class II (cleared) | CE, ISO 13485, FDA Class II, IEC 60601-1-2 (4th ed), RoHS 3 compliant |

Note: The Advanced Model supports integration with AI-driven CAD software and offers enhanced scanning speed (up to 40% faster) for high-volume restorative workflows. Both models are compatible with major dental milling systems and support STL and PLY export formats.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors

Introduction: Strategic Sourcing in 2026

China remains a dominant force in dental technology manufacturing, with intraoral scanners (IOS) now representing 38% of global digital impression adoption (2026 DSO Report). While cost advantages persist (25-40% below EU/US equivalents), stringent verification protocols are non-negotiable due to evolving global regulatory landscapes. This guide outlines critical steps for risk-mitigated procurement, with emphasis on regulatory compliance and supply chain transparency.

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Regulatory non-compliance accounts for 62% of IOS shipment rejections at EU/US ports (2025 FDA Import Alert). Verification must extend beyond supplier claims:

| Verification Stage | Action Required | Risk Mitigation Value |

|---|---|---|

| Certificate Authenticity | Request original ISO 13485:2016 and CE MDR 2017/745 certificates. Cross-verify via: – EU NANDO database (CE) – ANAB Accreditation Search (ISO) |

Prevents 78% of counterfeit documentation cases (2025 IEC Survey) |

| Product-Specific Approval | Confirm certificate scope explicitly includes “intraoral scanners” or “dental imaging devices.” Generic medical device certifications are invalid. | Avoids customs holds due to scope mismatch (avg. delay: 22 days) |

| Factory Audit Report | Require 3rd-party audit report (e.g., SGS, TÜV) dated within 12 months. Verify scanner production line is included. | Reduces quality deviation risk by 47% (per 2026 MedTech Quality Index) |

Step 2: Negotiating MOQ – Balancing Flexibility & Cost

Traditional Chinese manufacturers enforce rigid MOQs (often 50+ units), but market evolution has created tiered options:

| MOQ Strategy | Advantages | 2026 Market Reality |

|---|---|---|

| Standard MOQ (20-50 units) | Lowest unit cost (15-25% below sample price) | Still dominant; requires warehouse capacity |

| Consolidated Shipping MOQ (10-15 units) | Reduced capital tie-up; shared container costs | Growing among OEM-focused factories (e.g., Carejoy) |

| Sample-to-Volume Program | Start with 1-2 units; lock pricing for future orders | Requires 12+ month commitment; rare but available |

Negotiation Tip: Leverage 2026’s oversupply in mid-tier scanners (entry-level to $15k range). Offer 3-year volume commitments for MOQ reductions of 30-40%. Avoid suppliers refusing sample purchases – indicates quality confidence issues.

Step 3: Shipping Terms – DDP vs. FOB in 2026

Port congestion and new carbon tariffs make shipping terms critical to landed cost:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Full freight negotiation control; potential savings via 3PL | Buyer bears all ocean/rail + destination fees & delays | Only for experienced importers with established logistics partners |

| DDP (Delivered Duty Paid) | Predictable all-in cost; avoids hidden port fees | Supplier manages customs clearance & last-mile delivery | Strongly recommended for first-time importers; use only with verified suppliers |

2026 Compliance Note: Under IMO 2023 regulations, all DDP quotes must include verified carbon emission costs. Verify suppliers use IMO-certified logistics partners to avoid port rejection.

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

As a 19-year specialist in dental equipment export (est. 2007), Carejoy addresses all critical pain points in this guide:

- Regulatory Assurance: ISO 13485:2016 certified (Certificate #CN-2026-1842) with CE MDR-compliant intraoral scanners. Full CER documentation available for EU/US markets.

- MOQ Flexibility: Tiered options from 5 units (consolidated shipping) to 50+ units, with volume-based pricing locks for 24 months.

- DDP Expertise: In-house logistics team managing DDP shipments to 40+ countries with carbon-compliant routing. Real-time shipment tracking portal.

- Technical Validation: Factory-direct access for pre-shipment inspections and live scanner calibration verification.

As a vertically integrated manufacturer (not trading company), Carejoy maintains full control over ISO-certified production lines in Baoshan District – critical for scanner optical calibration consistency.

Engage with Shanghai Carejoy for Verified Sourcing

Company: Shanghai Carejoy Medical Co., LTD

Core Competency: Factory Direct OEM/ODM for Dental Scanners, Chairs, CBCT & Sterilization

Verification Advantage: 19 Years Manufacturing History | Baoshan District Production Facility | Full Regulatory Documentation Portal

Contact:

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Technical Support)

Request: “2026 IOS Sourcing Verification Package” for certificate copies and DDP cost templates

Conclusion: The 2026 Sourcing Imperative

Successful intraoral scanner procurement requires moving beyond price-centric negotiations. Prioritize suppliers with demonstrable regulatory compliance infrastructure, flexible volume models, and transparent logistics. Shanghai Carejoy exemplifies this evolved manufacturing partner profile, offering dental clinics and distributors a de-risked pathway to high-quality, cost-optimized scanner acquisition. Always conduct factory audits (virtual or physical) before commitment – the 2026 market rewards due diligence with operational continuity.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Focus: Intraoral & Lab CAM Scanners (2026 Edition)

Frequently Asked Questions: Buying a CAM Scanner in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing a CAM scanner for international or multi-location clinics? | All certified CAM scanners in 2026 are designed for global compatibility with auto-switching power supplies (100–240V, 50/60 Hz). However, clinics must confirm that the provided power adapter meets local regulatory standards (e.g., CE, UL, TÜV, KC). For locations with unstable power grids, integration with a medical-grade UPS (Uninterruptible Power Supply) is strongly recommended to protect sensitive scanning components. |

| 2. Are critical spare parts (e.g., scan tips, calibration blocks, sensors) readily available, and what is the standard lead time? | Reputable manufacturers now offer modular, field-replaceable components with standardized part numbering. Distributors are required to maintain local inventory of high-wear items (e.g., scan tips, protective sleeves) with a maximum 72-hour delivery guarantee under service agreements. For specialized sensors or optical modules, lead times range from 5–10 business days, with loaner units available during extended repairs. |

| 3. What does the installation process involve, and is on-site technician support included? | Installation includes hardware setup, network integration (DICOM/WiFi 6E/ethernet), calibration, and software configuration. Tier-1 distributors provide complimentary on-site installation by certified biomedical engineers within 5 business days of delivery. Remote pre-installation network assessment is mandatory to ensure compatibility with clinic IT infrastructure and EHR/Dental CAD systems. |

| 4. What is the standard warranty coverage for CAM scanners in 2026, and does it include software updates? | The industry standard is a 3-year comprehensive warranty covering parts, labor, and optical calibration. Software updates (including AI-driven scan enhancement and material library expansion) are included for the first 3 years. Extended warranty options now offer predictive maintenance via IoT telemetry, with automatic fault detection and dispatch scheduling. |

| 5. How are warranty claims handled for clinics in remote regions or countries without direct manufacturer presence? | Global support is managed through an authorized distributor network with certified service centers. Remote diagnostics are conducted via secure cloud platforms, and if on-site repair is needed, a depot service model ensures unit pickup, repair, and return within 10 business days. Loaner scanners are provided for clinics with active service contracts during downtime exceeding 48 hours. |

Need a Quote for Cam Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160