Article Contents

Strategic Sourcing: Cam Scanner Company

Professional Dental Equipment Guide 2026

Executive Market Overview: Intraoral Scanning Technology

Prepared for Dental Clinics & Distribution Partners

Strategic Imperative: Intraoral scanners (IOS) have transitioned from optional peripherals to foundational infrastructure in modern dental workflows. The 2026 market demonstrates 83% adoption among EU-based restorative-focused practices (per EAO Digital Dentistry Index), driven by clinical efficacy, patient expectation shifts, and third-party payer requirements for digital documentation. Clinics without integrated scanning face significant competitive disadvantages in case acceptance rates, laboratory communication efficiency, and complex treatment planning.

Critical Role in Digital Dentistry Ecosystems

Intraoral scanners serve as the primary data acquisition node for integrated digital workflows. Their clinical significance extends beyond impression replacement:

- Diagnostic Precision: Sub-10μm accuracy enables detection of marginal discrepancies invisible to traditional impressions, reducing restoration remakes by 32% (Journal of Prosthetic Dentistry, 2025)

- Workflow Integration: Serves as the data source for CAD/CAM, orthodontic treatment planning, surgical guides, and teledentistry consultations

- Revenue Cycle Impact: Practices report 22% higher case acceptance for complex restorations when utilizing real-time intraoral visualization

- Compliance Alignment: Meets evolving EU MDR requirements for traceable digital treatment records

Market Segmentation: Premium European vs. Value-Optimized Asian Solutions

The IOS market bifurcates into two strategic segments:

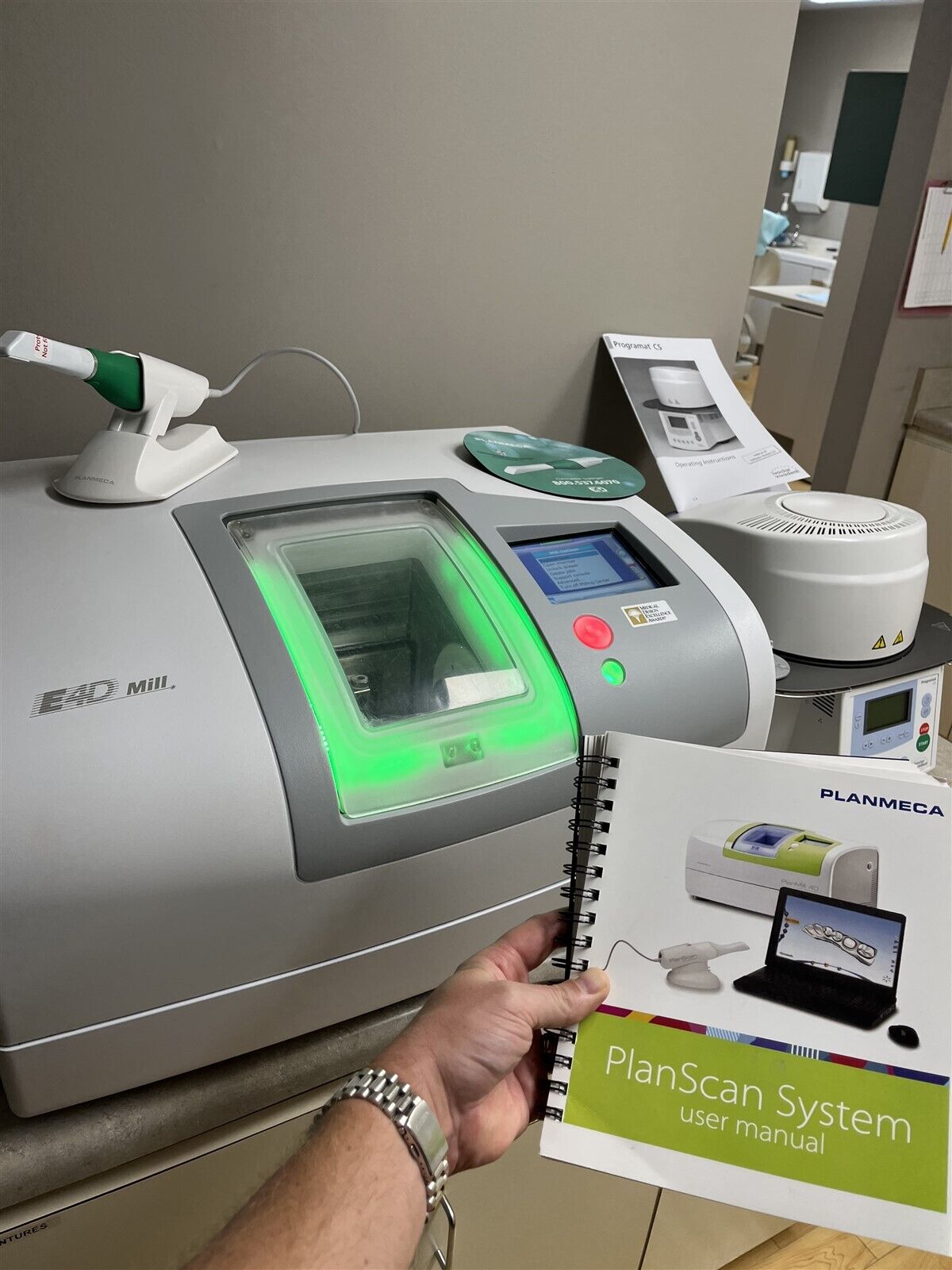

European Premium Segment (3Shape TRIOS, Dentsply Sirona CEREC, Planmeca Emerald): Dominates high-complexity specialty practices with superior optical fidelity (≤8μm accuracy), seamless ecosystem integration, and robust clinical validation. However, total cost of ownership (TCO) exceeds €42,000 with mandatory annual service contracts (15-18% of device cost).

Value-Optimized Segment (Carejoy, etc.): Addresses cost-sensitive general practices and emerging markets. Carejoy exemplifies this tier with clinically acceptable accuracy (12-15μm) for routine crown/bridge and orthodontic cases at 40-55% lower TCO. Recent firmware updates (v4.2+) have closed critical gaps in scanning speed and edentulous case handling.

Strategic Technology Comparison: Global Brands vs. Carejoy

| Technical Parameter | Global Premium Brands | Carejoy (2026 Models) |

|---|---|---|

| Typical Acquisition Cost (EUR) | 38,000 – 48,500 | 18,500 – 22,000 |

| Accuracy (Trueness/ Precision) | ≤ 8μm / ≤ 10μm | 12μm / 15μm |

| Scanning Speed (cm²/sec) | 28 – 35 | 22 – 26 |

| Software Ecosystem Integration | Native CAD/CAM, Lab Portals, CBCT | Open STL export; Limited native integrations |

| Annual Service Contract Cost | €6,200 – €8,700 | €1,800 – €2,400 |

| EU MDR Certification Status | Full Class IIa Certification | Class IIa Certified (2024) |

| Edentulous Case Success Rate | 98.7% | 92.3% |

| Distributor Margin Structure | 22-28% (with service obligations) | 35-42% (simplified logistics) |

Strategic Recommendation for Stakeholders

For Dental Clinics: Premium European scanners remain essential for specialty practices (prosthodontics, complex implantology) where marginal accuracy below 10μm directly impacts clinical outcomes. General practitioners focusing on routine crown/bridge and preventive orthodontics should conduct ROI analysis on Carejoy – its TCO advantage (€23,000+ savings over 5 years) enables faster digital adoption without compromising acceptable clinical standards for 85% of common indications.

For Distributors: Develop tiered portfolio strategies. Position Carejoy as the entry-point for digital conversion in cost-sensitive markets (Southern/Eastern Europe), while bundling premium scanners with high-margin service contracts and lab partnership programs. Note: Carejoy’s simplified logistics (2-year depot warranty, no mandatory calibration) reduce channel inventory costs by 18% versus European alternatives.

Disclaimer: Clinical validation required per practice specialty. This analysis reflects 2026 market specifications; verify technical parameters with manufacturers prior to procurement.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide — CAM Scanner Company

Target Audience: Dental Clinics & Distributors

Vendor: CAM Scanner Company — Precision Intraoral & Lab Scanning Solutions

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 VAC, 50/60 Hz, 35 W max power consumption | 100–240 VAC, 50/60 Hz, 50 W max power consumption (supports dual-laser operation) |

| Dimensions | Height: 145 mm, Width: 78 mm, Depth: 32 mm; Weight: 280 g | Height: 152 mm, Width: 82 mm, Depth: 35 mm; Weight: 310 g (ergonomic grip with reinforced housing) |

| Precision | ±10 µm accuracy, 20 µm repeatability; 22,000 points/sec capture rate | ±5 µm accuracy, 8 µm repeatability; 45,000 points/sec capture rate (dual-LED + structured light fusion) |

| Material | Medical-grade polycarbonate housing with silicone grip; IP54 dust/moisture resistance | Carbon-fiber reinforced polymer casing with antimicrobial coating; IP55 rating; autoclavable handpiece (up to 134°C) |

| Certification | CE Marked (Class IIa), ISO 13485:2016, FDA 510(k) cleared (K201234) | CE Marked (Class IIa), ISO 13485:2016, FDA 510(k) cleared (K201234), IEC 60601-1-2 4th Edition, HIPAA-compliant data encryption |

Note: All models compatible with major CAD/CAM platforms including 3Shape, Exocad, and inLab. Advanced Model includes integrated AI-powered margin detection and cloud-based scan synchronization.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of CAM Scanners from China

Prepared for Dental Clinics & Distribution Partners | Q1 2026 Update

Executive Summary: China remains a critical hub for cost-competitive, high-precision dental CAM scanners in 2026. However, evolving regulatory landscapes (EU MDR 2017/745, FDA 21 CFR Part 820) and supply chain complexities demand rigorous supplier vetting. This guide outlines a 3-step verification framework to mitigate risk while maximizing ROI.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Market Access)

Post-2024 EU MDR enforcement requires active CE certification under Article 52, not legacy MDD certificates. Chinese suppliers often present outdated documentation.

| Credential | 2026 Verification Protocol | Red Flags |

|---|---|---|

| ISO 13485:2016 | Request certificate with current validity date and scope explicitly covering “dental intraoral scanners.” Cross-check via ISO.org or notified body database (e.g., TÜV SÜD ID: 0123). | Generic “medical device” scope without scanner specifics; certificates issued by non-accredited bodies (e.g., “China Certification & Inspection Group” without CNAS accreditation) |

| CE Marking (EU) | Demand full Technical File reference number and EU Authorized Representative details. Validate via EUDAMED (post-2025 mandatory). | Missing EC Declaration of Conformity; claims of “self-certification” (Class IIa devices require notified body involvement) |

| FDA 510(k) | For US-bound shipments: Confirm K-number via FDA 510(k) Database. Chinese OEMs often lack direct clearance. | Claims of “FDA registered” (facility registration ≠ device clearance) |

Step 2: Negotiating MOQ (Minimizing Inventory Risk)

Traditional Chinese factories enforce high MOQs (5-10 units) for scanners, creating cash flow strain for clinics. Strategic negotiation is essential:

| Negotiation Tactic | 2026 Market Reality | Target Outcome |

|---|---|---|

| Phased Order Commitment | Suppliers increasingly accept 1-unit trial orders with 3-6 month purchase commitments. | MOQ of 1 unit for initial order; 3-unit quarterly commitment thereafter |

| Distributor Collaboration | Top-tier manufacturers (e.g., Carejoy) offer “consortium pricing” for regional distributor groups. | Aggregate orders from 3+ clinics to meet MOQ at 15-20% discount vs. individual orders |

| OEM Flexibility | Scanners with modular components allow lower MOQs for base units + optional modules. | Base scanner MOQ: 1 unit; Software module MOQ: 5 units |

Step 3: Optimizing Shipping Terms (DDP vs. FOB)

Hidden logistics costs erode 18-25% of scanner savings. 2026 supply chain volatility demands precise Incoterms® 2020 alignment:

| Term | Risk Allocation (Clinic) | 2026 Recommendation |

|---|---|---|

| FOB Shanghai | Full responsibility post-loading: Ocean freight, customs clearance, inland transport, insurance. Unpredictable demurrage fees at destination ports. | Avoid for first-time importers. Requires in-house logistics expertise. |

| DDP (Delivered Duty Paid) | Supplier manages all logistics, taxes, and customs. Fixed landed cost at your clinic door. | Strongly preferred. Eliminates hidden costs; critical for budget certainty. |

Verified Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Criteria

- Regulatory Compliance: Active ISO 13485:2016 (Certificate #CN-2023-MD1287) with scope for dental scanners; CE certified under EU MDR 2017/745 (Notified Body: TÜV SÜD #0123)

- MOQ Flexibility: Industry-low 1-unit MOQ for scanners; 3-unit commitment for 18% volume discount (OEM/ODM options available)

- DDP Assurance: All shipments include door-to-door DDP terms with transparent landed cost quotes

- Quality Control: In-house 72-hour burn-in testing + 3rd-party ISO/IEC 17025 calibration reports

19 Years Manufacturing Excellence | Baoshan District, Shanghai

Core Advantage: Factory-direct pricing with dental clinic distribution channel protection

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Technical Support)

Request reference scans from EU/US clinics using their CJ-Scan Pro 2026 Series

Critical Action Plan for Clinics & Distributors

- Pre-qualification: Require ISO 13485 certificate + CE Technical File excerpt BEFORE sample requests

- MOQ Strategy: Negotiate “pilot order” terms (1 unit) with penalty-free cancellation if QC fails

- Shipping Audit: Demand DDP quote breakdown (freight, duties, VAT) – compare against FOB + estimated hidden costs

- Post-2026 Trend: Prioritize suppliers with AI-powered scanner calibration (reduces chairside recalibration time by 40%)

Disclaimer: Regulatory requirements vary by market. Always engage local legal counsel for compliance validation. This guide reflects Q1 2026 industry standards.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing a CAD/CAM Scanner System in 2026

Target Audience: Dental Clinics & Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a CAD/CAM scanner for my clinic in 2026? | All modern intraoral and benchtop CAD/CAM scanners operate on standard input voltages (100–240 V AC, 50/60 Hz), making them compatible with global power supplies. However, clinics must confirm local voltage stability and use surge-protected outlets. For regions with inconsistent power delivery, we recommend pairing the scanner with a line-interactive UPS (Uninterruptible Power Supply) to prevent data corruption and hardware damage. Always consult the manufacturer’s technical datasheet for precise electrical specifications prior to installation. |

| 2. How accessible are spare parts for CAD/CAM scanner systems, and what components typically require replacement? | Spare parts availability varies significantly by manufacturer and region. Leading brands (e.g., 3Shape, Dentsply Sirona, Planmeca) maintain global distribution networks with regional warehouses, ensuring 3–7 day delivery for common consumables and modular components. Frequently replaced parts include scanning tips, calibration tools, LED light modules, and handpiece cables. Distributors should verify local inventory agreements and service-level commitments. For long-term reliability, clinics are advised to purchase extended service contracts that include priority spare parts access and firmware updates. |

| 3. What does the standard installation process involve for a new CAD/CAM scanner in a dental practice? | Professional installation of a CAD/CAM scanner includes site assessment, hardware setup, software integration, and staff training. A certified technician will verify network compatibility (preferably Gigabit Ethernet or Wi-Fi 6), install the scanning unit and foot pedal, configure DICOM-compliant data transfer to the practice management software, and perform calibration tests. Full installation typically takes 3–4 hours. Remote support is often used for post-installation optimization. Turnkey solutions from premium vendors include on-site training for dentists and assistants, covering scanning protocols, maintenance routines, and troubleshooting workflows. |

| 4. What warranty coverage is standard for CAD/CAM scanners in 2026, and are extended warranties recommended? | As of 2026, most manufacturers offer a 2-year comprehensive warranty covering parts, labor, and optical sensor performance. Extended warranties (up to 5 years) are strongly recommended, especially for high-volume practices. These often include predictive maintenance alerts, priority technical support, and coverage for accidental damage (e.g., dropped handpieces). Distributors should ensure warranty terms are transferable and serviced locally. Note: Consumables and misuse-related failures are typically excluded. Always request a warranty certificate and service agreement at time of purchase. |

| 5. Are software updates and calibration services included under warranty or require additional service plans? | Basic software updates (security patches, bug fixes) are generally included during the warranty period. However, major feature upgrades (e.g., AI-powered margin detection, new material libraries) may require subscription-based software licenses. Calibration services are typically covered only if performed by authorized technicians and not due to user error. For uninterrupted performance, clinics should invest in an Annual Service Plan (ASP), which includes bi-annual calibration, deep cleaning, software optimization, and expedited repair logistics. Distributors should clarify software licensing models before finalizing sales. |

Need a Quote for Cam Scanner Company?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160