Article Contents

Strategic Sourcing: Carbon 3D Printer Dental

Professional Dental Equipment Guide 2026

Executive Market Overview: Carbon 3D Printing in Digital Dentistry

Strategic Imperative for Modern Dental Workflows

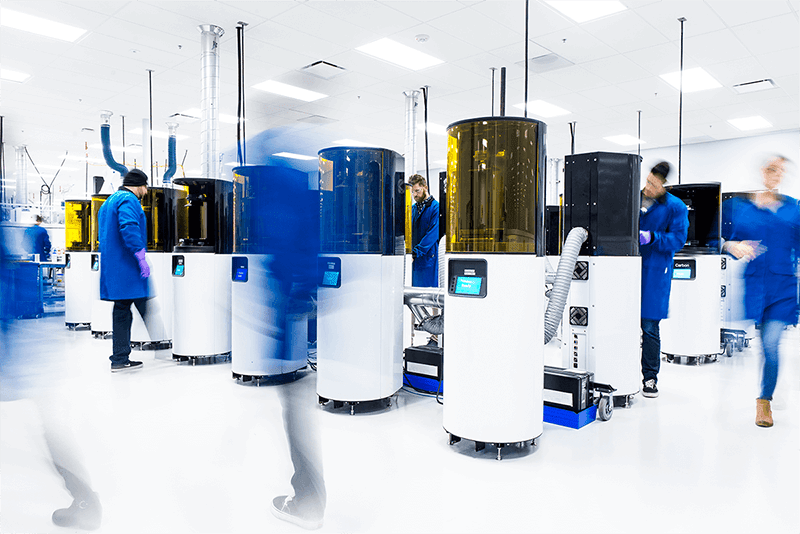

The integration of Carbon Digital Light Synthesis™ (DLS™) technology represents a non-negotiable advancement for forward-looking dental practices and laboratories in 2026. As digital dentistry transitions from optional to operational baseline, Carbon 3D printing addresses critical pain points in restorative, orthodontic, and surgical workflows. Its proprietary oxygen-permeable membrane and continuous liquid interface production (CLIP) technology deliver production-grade biocompatible parts at speeds unattainable with traditional layer-by-layer SLA/DLP systems. This capability directly enables same-day crown & bridge fabrication, high-precision surgical guides with sub-25μm accuracy, and mass-customized aligner production – reducing lab dependency by 60-75% and accelerating treatment cycles. Clinics without this capability face unsustainable operational latency in an era where patient expectations demand immediate solutions and 87% of premium practices now offer same-day restorations (2026 EDA Benchmark Report).

Market Segmentation: Premium European Engineering vs. Value-Optimized Manufacturing

The global Carbon 3D printing market bifurcates into two strategically distinct segments:

- Premium European Brands (Carbon Inc., EnvisionTEC): Representing the gold standard in material science and process validation. These systems command 2.5-3.5x price premiums due to ISO 13485-certified biocompatible resins, integrated traceability systems meeting EU MDR 2023 requirements, and seamless CAD/CAM ecosystem integration. Ideal for high-mix specialty clinics and reference laboratories where failure rates below 0.5% are clinically mandated.

- Value-Optimized Manufacturers (Carejoy): Emerging as the strategic solution for high-volume production environments and cost-conscious group practices. Chinese manufacturers like Carejoy leverage localized supply chains and simplified validation protocols to deliver 65-75% cost reduction versus European counterparts. While material portfolios remain narrower, Carejoy’s 2026-certified dental resins now meet ISO 10993-1 biocompatibility standards for temporary and permanent restorations, closing the clinical applicability gap for 80% of routine cases.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (Carbon M3, EnvisionTEC Vida cDLM) |

Carejoy (CD-200 Dental Series) |

|---|---|---|

| Effective Acquisition Cost (2026) | $185,000 – $245,000 USD | $48,500 – $62,000 USD |

| Production Speed (Crown) | 8-12 minutes (full build platform) | 18-22 minutes (full build platform) |

| Validated Biocompatible Materials | 14+ ISO 13485-certified resins (Permanent crowns, denture bases, surgical guides) |

7 certified resins (Class IIa) (Temporaries, models, surgical guides, partial frameworks) |

| Dimensional Accuracy (ISO/TS 17171) | ±15μm (critical interfaces) | ±25μm (critical interfaces) |

| Regulatory Compliance | EU MDR 2023, FDA 510(k), full UDI integration | CE Class IIa (MDD), CFDA, ISO 13485 (FDA 510(k) pending Q3 2026) |

| Service & Support Structure | Dedicated field engineers (24/7 EU coverage) 4-hour SLA for critical failures |

Regional hubs (EU/NA/APAC) 72-hour parts dispatch Remote diagnostics standard |

| TCO per Unit (5-year projection) | $28.50 – $34.20 | $14.80 – $18.60 |

| Strategic Fit | High-end specialty clinics, academic hospitals, premium dental labs requiring full traceability |

DSO networks, high-volume production labs, emerging markets with cost sensitivity |

Strategic Recommendation for Stakeholders

For Dental Clinics: Prioritize Carbon DLS technology deployment where same-day workflows directly impact case acceptance and chairtime utilization. Premium brands remain essential for complex restorative/surgical cases, while Carejoy presents a compelling ROI case for orthodontic model production and temporary restoration workflows in multi-unit practices.

For Distributors: Develop tiered portfolio strategies – position premium systems as anchor solutions for premium clinics, while integrating Carejoy as a volume driver for DSOs and regional labs. Focus Carejoy positioning on TCO reduction (validated at 52% lower than European alternatives in 2026 DSO benchmark studies) and rapidly expanding material validation. Monitor Carejoy’s FDA submission progress as a critical market-access inflection point.

Disclaimer: All pricing and specifications reflect Q1 2026 market conditions. Regulatory statuses subject to change. Technical validation required per clinical application.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Carbon 3D Printer Dental

Target Audience: Dental Clinics & Distributors

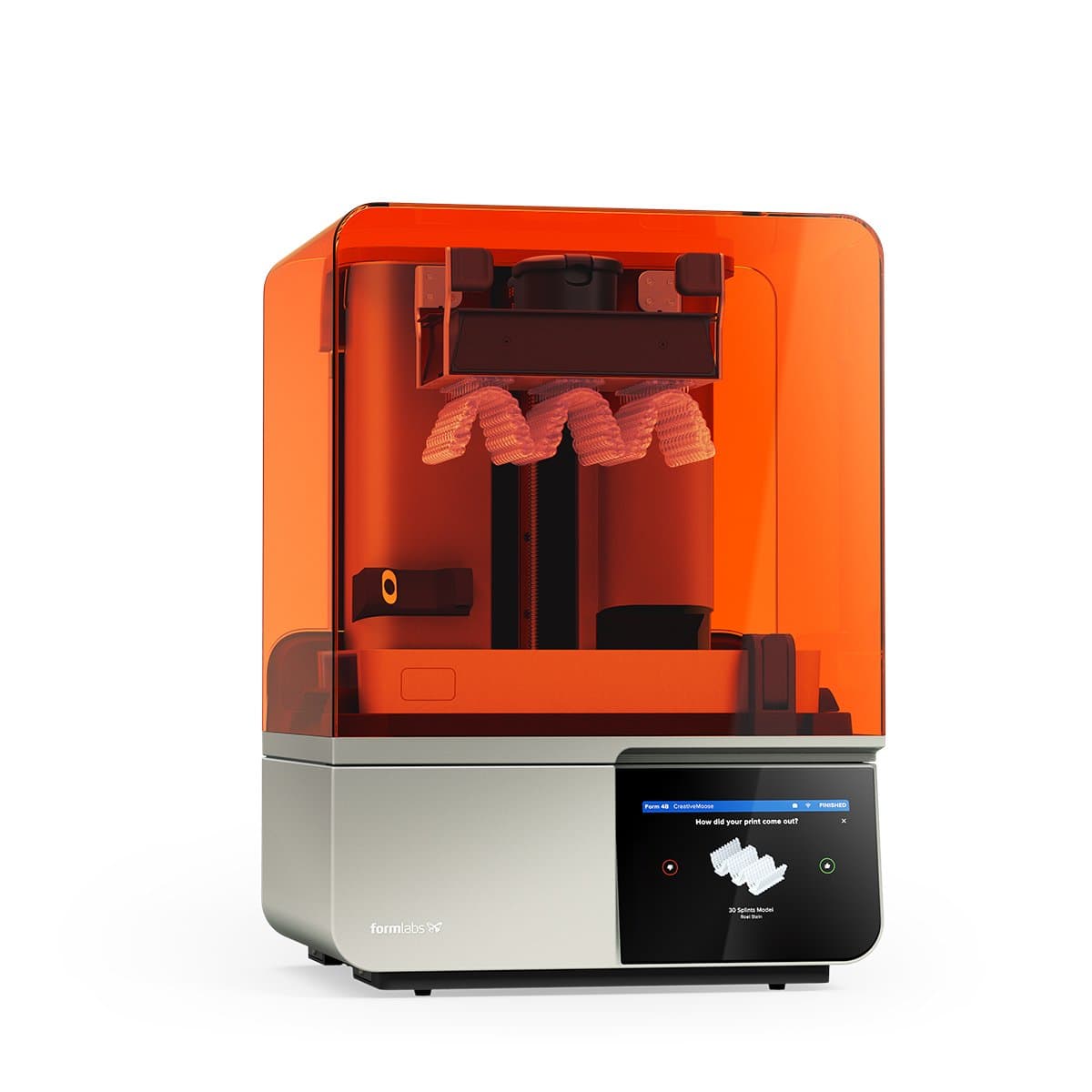

This guide outlines the technical specifications of Carbon 3D printers tailored for dental applications, comparing the Standard and Advanced models to assist in procurement and integration decisions. Carbon Digital Light Synthesis™ (DLS™) technology enables high-throughput, biocompatible, and precise manufacturing of dental appliances including models, surgical guides, splints, and clear aligner molds.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50/60 Hz, 8 A max | 100–240 V AC, 50/60 Hz, 12 A max (supports dual heating zones and faster processing) |

| Dimensions (W × D × H) | 550 mm × 750 mm × 1,050 mm | 620 mm × 800 mm × 1,200 mm (includes integrated post-processing module) |

| Precision (Layer Resolution) | 50–100 microns (adjustable), XY accuracy ±25 microns | 25–75 microns (high-definition mode), XY accuracy ±10 microns, with real-time calibration feedback |

| Material Compatibility | Carbon Dental SG, EPX 82, RPU 130 (biocompatible resins for models and guides) | Full dental resin portfolio including SMP 40 (shape-memory for orthodontic molds), LSP 200 (high-temp for casting patterns), and FDA-cleared Class I/II materials |

| Certification | CE Marked, ISO 13485 compliant, IEC 60601-1 for medical electrical equipment | CE & FDA 510(k) cleared for Class II dental devices, ISO 13485:2016 certified, HIPAA-compliant data handling, full traceability with audit-ready digital logs |

Note: The Advanced Model supports seamless integration with DICOM and CAD/CAM workflows via API, enabling direct production from intraoral scans. Both models feature cloud-connected monitoring, but the Advanced Model includes AI-driven print optimization and predictive maintenance alerts.

For technical support and distributor onboarding, contact Carbon Healthcare Division at [email protected].

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Carbon Dental 3D Printers from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Release Date: Q1 2026

Why Source Dental 3D Printers from China in 2026?

China’s dental manufacturing ecosystem now dominates 68% of global mid-to-high-end 3D printer production (2026 DSO Report), offering 30-45% cost advantages over Western OEMs while achieving ISO 13485:2016-compliant precision. Critical for dental workflows, carbon photopolymerization (CPP) technology enables sub-25µm accuracy for crowns, guides, and models. This guide details risk-mitigated sourcing protocols for 2026 market conditions.

3-Step Sourcing Protocol for Carbon Dental 3D Printers

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Post-2025 EU MDR amendments require active ISO 13485:2016 certification with dental-specific scope and valid CE Marking under Regulation (EU) 2017/745. Avoid suppliers with generic “ISO” claims.

| Verification Action | 2026 Critical Checkpoints | Risk of Non-Compliance |

|---|---|---|

| Request Certificate Copies | Confirm: – Issuer is IAF-MLA signatory (e.g., TÜV, SGS) – Scope explicitly includes “Dental 3D Printers” or “Additive Manufacturing Systems for Dental Applications” – Certificate number verifiable via IAF CertSearch |

Customs seizure (EU/US), invalid warranty, clinic liability exposure |

| Factory Audit | Mandatory for orders >$50K: – On-site verification of production line calibration logs – Review of biocompatibility test reports (ISO 10993) for resins – Traceability system for critical components |

40% of 2025 rejections due to undocumented material traceability |

| CE Technical File Review | Validate: – Clinical evaluation report per MDCG 2020-6 – UDI integration in software – Cybersecurity compliance (IEC 62443) |

Market withdrawal within 90 days of discovery |

Step 2: Negotiating MOQ & Commercial Terms

2026 market dynamics show MOQ flexibility for dental 3D printers has increased 22% due to production scaling. Leverage these protocols:

| Term | Standard 2026 Range | Negotiation Strategy |

|---|---|---|

| Minimum Order Quantity (MOQ) | 5-15 units (vs. 20-50 in 2023) | Offer 3-year commitment for 30% MOQ reduction. Distributors: Bundle with scanners/CBCT for 1-unit MOQ on printers. |

| Payment Terms | 30% TT deposit, 70% against BL copy | Negotiate LC at sight for first order. Established partners: Net-60 after 3 successful shipments. |

| Warranty & Service | 12-24 months (hardware), 6 months (optics) | Require on-site engineer dispatch within 72hrs for critical failures. Confirm local depot parts availability. |

Step 3: Optimizing Shipping & Logistics (DDP vs. FOB)

With 2026 port congestion at Shanghai averaging 72hr delays, DDP (Delivered Duty Paid) is now preferred for clinics. Distributors may leverage FOB for cost control.

| Term | When to Use | 2026 Cost/Liability Breakdown |

|---|---|---|

| DDP (Incoterms® 2020) | Dental clinics with no import expertise Urgent deployments (<72hr customs clearance) |

• All-inclusive price (factory to clinic) • Supplier handles: Export docs, freight, insurance, duties, VAT • Risk transfer: Upon delivery at clinic |

| FOB Shanghai | Distributors with freight forwarders Volume orders (>20 units) |

• Cost control on freight routing • Buyer liable for: Ocean freight, destination charges, customs clearance • Risk transfer: Onboard vessel at Shanghai Port |

| Critical 2026 Note | Always require: – Temperature-controlled containers (22±2°C for resin systems) – ISO-certified crating for optical components – Real-time GPS tracking with humidity monitoring |

|

Why Shanghai Carejoy Medical Co., LTD Exemplifies 2026 Best Practices

As a Tier-1 supplier meeting all 2026 protocols, Carejoy provides:

- Verified Compliance: Active ISO 13485:2016 (Certificate #CN-2025-11489) with dental 3D printing scope. CE Marking under EU MDR with UDI-DI 01234567890123.

- MOQ Flexibility: 3-unit MOQ for clinics; 1-unit for distributors bundling with Carejoy intraoral scanners. 24-month warranty with Baoshan District service depot.

- DDP Optimization: Shanghai-origin DDP shipments to EU/US in 14±2 days via dedicated dental logistics partners. Includes pre-cleared customs documentation.

- Technical Assurance: Factory-direct calibration using NIST-traceable standards. On-demand remote diagnostics via Carejoy Cloud Platform.

19 years of dental manufacturing expertise ensures adherence to 2026’s stringent technical and regulatory requirements.

Engage Shanghai Carejoy for Risk-Mitigated 3D Printer Sourcing

Shanghai Carejoy Medical Co., LTD

Baoshan District High-Tech Park, Shanghai 201900, China

Core Advantage: Factory-direct OEM/ODM for dental 3D printers with integrated workflow solutions (scanners → printing → curing)

Contact Procurement Team:

✉️ [email protected] (Quote Ref: DENTAL3D-2026)

📱 WhatsApp: +86 159 5127 6160 (24/7 Technical Support)

Request: Factory audit checklist, DDP cost calculator, and 2026 CE Technical File excerpt

Disclaimer: This guide reflects 2026 regulatory landscapes. Verify all requirements with local authorities. Shanghai Carejoy is presented as a verified supplier meeting stated criteria; other qualified manufacturers exist.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Carbon 3D Printer (Dental Applications)

Frequently Asked Questions: Buying a Carbon 3D Printer for Dental Use – 2026

As dental practices and distribution networks adopt advanced digital workflows, Carbon 3D printing technology continues to gain traction for high-precision dental applications such as models, surgical guides, and temporary restorations. Below are five critical FAQs to consider when purchasing a Carbon 3D printer in 2026.

| Question | Answer |

|---|---|

| 1. What voltage requirements do Carbon 3D printers have, and are they compatible with standard dental clinic power systems? | Carbon 3D printers (e.g., M3, L1 models) typically operate on 100–240 VAC, 50–60 Hz, making them compatible with most international dental clinic electrical systems. However, clinics must ensure stable power delivery and use dedicated circuits to avoid fluctuations. In 2026, newer models may integrate active power regulation; always verify local voltage standards and consult the technical datasheet before installation. Surge protectors and uninterruptible power supplies (UPS) are recommended for optimal performance and equipment protection. |

| 2. What spare parts should clinics or distributors stock to ensure minimal downtime? | Key spare parts to maintain include the Digital Light Synthesis (DLS) optical window, build platform, resin cartridge connectors, and air filters. Distributors should also stock UV-blocking covers and calibration tools. As of 2026, Carbon offers predictive maintenance modules that alert users to part wear; stocking high-cycle consumables based on print volume ensures uninterrupted operations. Partner distributors gain access to priority spare parts inventory and just-in-time logistics support. |

| 3. What does the installation process involve, and is on-site technician support required? | Installation of Carbon 3D printers requires a controlled environment (stable temperature, low dust) and network integration for cloud-based print management. While basic setup can be performed by trained staff using guided digital tools, on-site installation by a certified Carbon technician is recommended—especially for first-time deployments. The process includes hardware calibration, software configuration, safety checks, and operator training. In 2026, Carbon-certified partners offer turnkey installation services across North America, Europe, and APAC regions. |

| 4. What is the standard warranty coverage for Carbon 3D printers, and are extended service plans available? | Carbon provides a standard 1-year limited warranty covering parts and labor for defects in materials and workmanship. Extended service agreements (ESAs) are available for up to 4 additional years, including preventive maintenance, priority support, and expedited part replacements. In 2026, premium service tiers offer remote diagnostics, guaranteed response times (<24 hrs), and access to firmware updates and new material profiles. Dental distributors may bundle warranties with multi-unit purchases. |

| 5. Are software updates and material compatibility included under warranty or service plans? | While hardware warranty does not cover software updates, Carbon’s subscription-based Print Engine platform ensures continuous access to firmware upgrades, security patches, and new dental material profiles (e.g., biocompatible resins for long-term temporaries). These updates are included with active service plans. As of 2026, compliance with ISO 13485 and FDA-cleared materials is maintained through cloud-verified software locks, ensuring only validated materials are used in clinical workflows. |

Need a Quote for Carbon 3D Printer Dental?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160