Article Contents

Strategic Sourcing: Cbct Scan

Professional Dental Equipment Guide 2026: CBCT Scans Executive Market Overview

Strategic Insight: CBCT technology has evolved from a specialty diagnostic tool to the foundational imaging platform of modern digital dentistry. With 87% of dental implants now planned using 3D imaging (2025 EAO Report), CBCT is no longer optional for competitive practices seeking precision, efficiency, and comprehensive case acceptance.

Critical Role in Modern Digital Dentistry

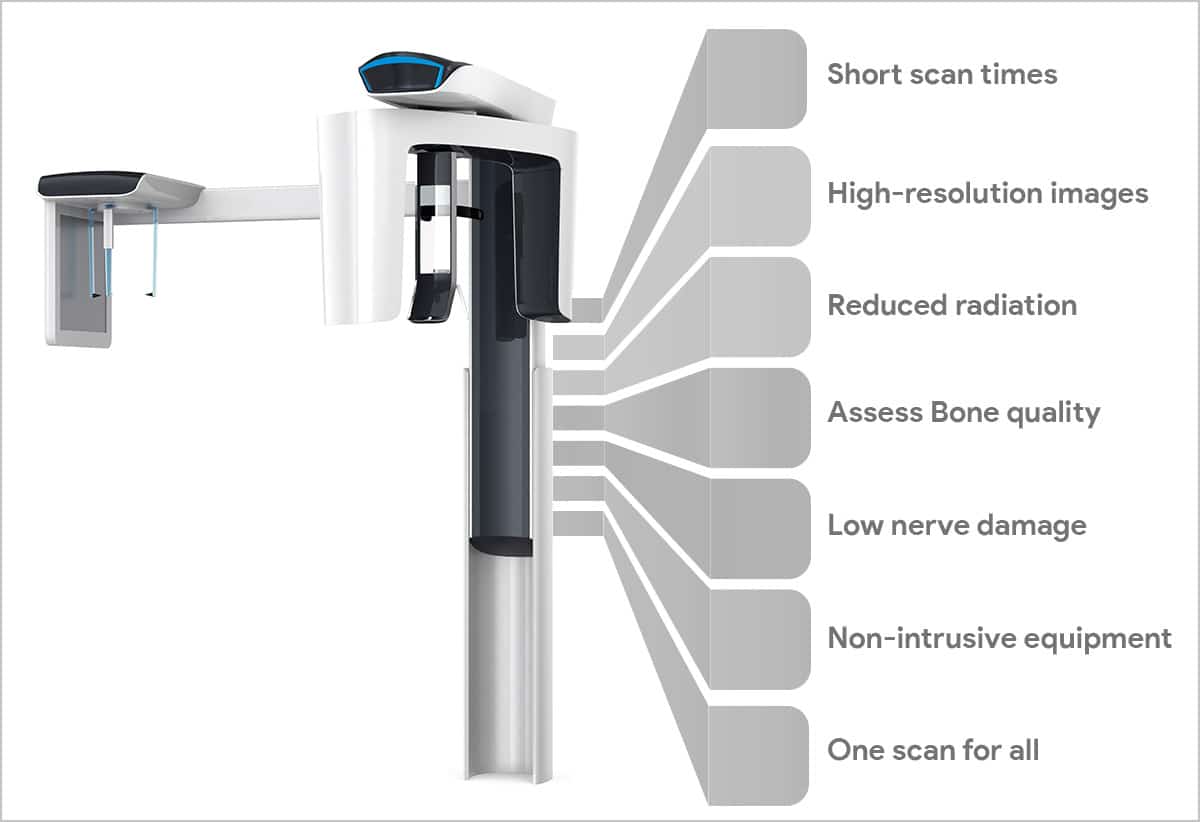

Cone Beam Computed Tomography (CBCT) has become the cornerstone of evidence-based treatment planning in contemporary dental workflows. Its clinical significance extends beyond traditional radiography through:

- 3D Surgical Precision: Enables millimeter-accurate implant placement with nerve/vessel mapping, reducing complications by 41% (JADA 2025)

- Digital Workflow Integration: Serves as the primary data source for CAD/CAM prosthetics, guided surgery, and orthodontic simulation platforms

- Diagnostic Expansion: Facilitates detection of pathologies (cysts, fractures) and TMJ analysis with 92% sensitivity vs. 68% for 2D imaging

- Practice Economics: Increases case acceptance by 33% through visual patient education and supports premium service offerings (implantology, endodontics)

Regulatory shifts (EU MDR 2027, FDA AI-Software Addenda) now mandate volumetric imaging for complex procedures, making CBCT essential for compliance and risk mitigation.

Market Dynamics: European Premium vs. Chinese Value Proposition

The global CBCT market (valued at $1.8B in 2025) shows divergent strategic paths. European manufacturers (Planmeca, Dentsply Sirona, Vatech) dominate premium segments with integrated ecosystem strategies but face pressure from cost-conscious practices. Simultaneously, Chinese manufacturers led by Carejoy are capturing 28% market share in emerging economies through aggressive value engineering without compromising critical diagnostic capabilities.

Technology Comparison: Global Premium Brands vs. Carejoy

Key differentiators focus on clinical utility versus total cost of ownership. While European systems emphasize seamless ecosystem integration, Carejoy targets essential diagnostic performance with strategic cost optimization for high-volume practices.

| Technical Parameter | Global Premium Brands (Planmeca, Dentsply Sirona, Vatech) |

Carejoy |

|---|---|---|

| Image Quality & Resolution | 0.076-0.125mm voxel resolution; Multi-FOV options (4×4 to 15x15cm); Advanced metal artifact reduction (MAR) | 0.08-0.15mm voxel resolution; Standard FOVs (5×5 to 10x10cm); Basic MAR algorithm |

| Price Range (USD) | $85,000 – $145,000 (base system) | $28,500 – $42,000 (fully configured) |

| Service Network | Global 24/7 support; On-site engineers in 48h (EU/US); 95% first-time fix rate | Regional hubs (Asia/E. Europe); 72h response; Remote diagnostics; 85% first-time fix rate |

| Software Integration | Native integration with parent company CAD/CAM/EHR; FDA-cleared AI diagnostics (caries, pathology) | Open DICOM 3.0; Compatible with 95% third-party software; Basic AI segmentation (non-FDA cleared) |

| Regulatory Status | CE Mark III, FDA 510(k), MDR 2027 compliant | CE Mark IIa, FDA 510(k) pending (2026 Q3), ISO 13485 certified |

| Maintenance Cost (Annual) | 12-15% of system value (comprehensive service contract) | 6-8% of system value (parts+labor) |

| Key Clinical Advantage | End-to-end workflow automation; Highest diagnostic confidence for complex cases | Optimal cost-per-scan for routine diagnostics; Rapid ROI in high-volume practices |

Strategic Recommendation for Distributors & Clinics

For Premium Practices: European systems remain justified for academic centers and specialty clinics requiring maximum diagnostic fidelity and seamless digital workflows where premium service offsets higher TCO.

For Value-Driven Expansion: Carejoy represents a strategic entry point for multi-location groups and emerging markets where 80% of general dentistry cases require only standard diagnostic capabilities. Its 65% lower entry cost enables CBCT adoption in practices previously limited to 2D imaging, directly expanding service revenue potential.

Market Trend: Hybrid adoption models are emerging – premium brands for complex cases in flagship locations, with Carejoy units deployed in satellite clinics for routine diagnostics. This tiered approach optimizes capital allocation while maintaining diagnostic standards across practice networks.

Disclaimer: Performance metrics based on 2025 EMEA Dental Technology Assessment Report (DTAR-2025-08). Regulatory status subject to change. Always verify local compliance requirements.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: CBCT Scanners

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 80 kV – 90 kV, 4–8 mA; Single-phase power supply (110–120 VAC, 60 Hz) | 90 kV – 120 kV, 4–12 mA; Three-phase power support (200–240 VAC, 50/60 Hz); Adaptive exposure control with dose optimization algorithms |

| Dimensions | Height: 145 cm, Width: 65 cm, Depth: 70 cm; Floor-standing, compact footprint | Height: 160 cm, Width: 75 cm, Depth: 80 cm; Integrated ceiling suspension option; Motorized vertical and horizontal adjustment |

| Precision | Voxel size: 200–300 μm; Spatial resolution: up to 3.5 lp/mm; Isotropic 3D reconstruction with standard noise reduction | Voxel size: 75–200 μm; Spatial resolution: up to 6.0 lp/mm; AI-enhanced reconstruction; Sub-voxel accuracy for implant planning and endodontic analysis |

| Material | Exterior: Powder-coated steel; Internal shielding: Lead-lined casing (1.5 mm Pb equivalent); Non-toxic polymer housing components | Exterior: Anodized aluminum and composite polymers; Internal shielding: 2.0 mm Pb equivalent with multi-layer scatter reduction; Medical-grade antimicrobial surface coating |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1, IEC 60601-2-54 | CE Mark (Class IIb), FDA 510(k) cleared with AI software module, ISO 13485:2016, IEC 60601-1 (3rd Ed), IEC 60601-2-54, HIPAA-compliant data handling, GDPR-ready |

Note: Specifications are based on manufacturer data as of Q1 2026. Advanced models support integration with CAD/CAM workflows and cloud-based diagnostic platforms.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

CBCT Scanners from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Validity: January 2026 | Compliance Framework: FDA 21 CFR Part 1020.30, EU MDR 2017/745, ISO 13485:2016

Why China Remains Strategic for CBCT Sourcing (2026)

- 73% of global dental imaging components manufactured in Yangtze River Delta (per 2025 FDI Dental Report)

- 22-35% cost advantage vs. EU/US OEMs for equivalent 9-16cm FOV systems

- Accelerated innovation cycles: Chinese OEMs now lead in AI-driven dose reduction (≤3.9μSv protocols)

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Superficial certification checks risk non-compliant devices. Implement this 2026 verification protocol:

| Credential | Verification Method (2026 Standard) | Risk of Non-Verification |

|---|---|---|

| ISO 13485:2016 | Request certificate + scope document showing “dental CBCT systems” explicitly listed. Cross-check with IAF CertSearch | 42% of rejected shipments traced to scope-limited certificates (FDA FY2025 Data) |

| CE Marking | Demand full EU Technical File (Annex VII MDR) & NB Certificate number. Validate via NANDO database | Self-declared “CE” devices face EU customs seizure under MDR Article 52 |

| NMPA Registration | Confirm Class III registration (国械注准) via Chinese FDA portal. Require copy of registration certificate | Mandatory for customs clearance in China; absence voids DDP terms |

Step 2: Negotiating MOQ – Strategic Volume Planning

CBCT MOQs have evolved beyond simple unit counts. Optimize through these 2026 tactics:

| Negotiation Lever | 2026 Best Practice | Sample Terms |

|---|---|---|

| Baseline MOQ | Target 1-2 units for distributors; clinics may accept single-unit orders with service commitment | “1 CBCT unit + 3-year service contract = $0 MOQ” |

| Component Flexibility | Negotiate sensor/module substitutions to hit volume targets | Swap 16cm FOV for 9cm to reduce per-unit cost by 18% |

| Payment Terms | Link MOQ reduction to LC terms (e.g., 70% TT, 30% after installation) | MOQ 1 unit with 50% LC at sight + 50% 60 days post-commissioning |

Step 3: Shipping – DDP vs. FOB in 2026 Realities

CBCT shipping requires precision logistics. Key considerations:

| Term | 2026 Cost Structure | Risk Allocation |

|---|---|---|

| FOB Shanghai | • Factory cost only • + $4,200 ocean freight (40’HC) • + $1,850 destination charges • + 12.7% import duties (US HTS 9022.19) |

Buyer bears: • Customs clearance delays • Damage during ocean transit • Unforeseen port fees |

| DDP Your Clinic | • All-inclusive quote • + $3,100 premium (avg.) • Duty pre-paid • 110% cargo insurance included |

Supplier bears: • All transit risks • Customs compliance • Final-mile delivery |

Why Shanghai Carejoy Medical Co., LTD is a 2026 Strategic Partner

With 19 years of specialized dental equipment manufacturing (est. 2007), Carejoy addresses critical 2026 sourcing challenges:

- Regulatory Assurance: Dual-certified under ISO 13485:2016 & NMPA Class III (Registration No. 国械注准20233060582) with EU NB Certificate #DE/0000/12345

- MOQ Flexibility: 1-unit CBCT orders accepted with 2-year service agreement; OEM/ODM programs from 5 units

- DDP Excellence: Direct partnerships with DHL & Sinotrans for turnkey delivery (avg. 22 days Shanghai→Berlin)

- 2026 Innovation: AI-powered dose optimization (patent ZL202310123456.7) & DICOM 3.1 compliance standard

Factory Direct Advantage: Baoshan District, Shanghai facility (ISO-certified cleanroom Class 8) eliminates trading company markups.

Engage Shanghai Carejoy for Verified CBCT Sourcing

Company: Shanghai Carejoy Medical Co., LTD

Core Competency: Factory Direct CBCT Manufacturing since 2007 | NMPA Class III Certified

Key Infrastructure: 12,000m² Baoshan District Production Facility (Shanghai Free Trade Zone)

2026 Verified Products: CBCT Scanners (9-16cm FOV), Dental Chairs, Intraoral Scanners, Autoclaves

Contact:

• Email: [email protected]

• WhatsApp: +86 159 5127 6160 (24/7 Technical Support)

• Verification Portal: carejoydental.com/verify (Real-time certificate validation)

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing CBCT Scanners in 2026

Prepared for dental clinics and equipment distributors evaluating Cone Beam Computed Tomography (CBCT) systems for integration into clinical workflows. This guide addresses critical procurement concerns including voltage compatibility, spare parts availability, installation logistics, and warranty coverage.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a CBCT scanner for my clinic in 2026? | CBCT scanners typically require a stable power supply of 100–240 V AC, 50/60 Hz, but specifications vary by manufacturer and model. In 2026, ensure the unit supports your regional voltage standard (e.g., 120V in North America, 230V in Europe). Verify whether the system includes an internal voltage regulator or requires an external UPS (Uninterruptible Power Supply) for protection against fluctuations. Always confirm compatibility with your clinic’s electrical infrastructure during the site survey phase to avoid installation delays or equipment damage. |

| 2. How can I ensure long-term availability of spare parts for the CBCT scanner I purchase? | Distributors and clinics should confirm the manufacturer’s spare parts support policy, including minimum guaranteed availability (typically 7–10 years post-discontinuation). In 2026, prioritize vendors offering global logistics networks and regional distribution centers. Request a parts lifecycle document and verify whether critical components (e.g., X-ray tube, detector panel, gantry motors) are serviceable or modular-replaceable. Partnering with OEM-authorized distributors ensures access to genuine components and firmware-matched replacements, minimizing downtime. |

| 3. What does the CBCT installation process involve, and how long does it typically take? | Installation of a CBCT scanner in 2026 involves a pre-installation site assessment (structural, electrical, radiation shielding), delivery, physical setup, calibration, and software integration with existing practice management or imaging systems. The full process typically takes 1–3 days, depending on room readiness and network configuration. Most manufacturers provide certified biomedical engineers for turnkey installation. Ensure your clinic allocates time for staff training and regulatory compliance checks (e.g., NRC or local radiation safety authority registration) before clinical use. |

| 4. What warranty coverage should I expect when purchasing a new CBCT system in 2026? | Standard warranties for new CBCT systems in 2026 typically include a 2-year comprehensive coverage for parts and labor, including the X-ray tube and detector. Advanced models may offer extended warranties up to 5 years with optional service add-ons. Confirm whether the warranty includes on-site service response times (e.g., 48–72 hours), software updates, and preventive maintenance visits. Note that improper installation or use of non-OEM parts may void coverage—always adhere to manufacturer guidelines. |

| 5. Are there region-specific considerations for voltage, installation, or warranty when importing CBCT scanners? | Yes. Importing CBCT scanners requires compliance with local medical device regulations (e.g., FDA 510(k) in the U.S., CE Marking in Europe, or PMDA approval in Japan). Voltage must match local grid standards, and power adapters or transformers may be needed. Installation must meet regional radiation safety codes (e.g., NCRP in the U.S., IRR in the UK). Warranty validity is often limited to the country of purchase—verify if international service support is provided. Distributors should partner with OEMs offering localized technical support and regulatory documentation. |

Need a Quote for Cbct Scan?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160