Article Contents

Strategic Sourcing: Cbct Scan Dental

Professional Dental Equipment Guide 2026

Executive Market Overview: CBCT Scanners in Modern Digital Dentistry

The Cone Beam Computed Tomography (CBCT) scanner has evolved from a specialized diagnostic tool to the foundational imaging platform of contemporary dental practices. In 2026, CBCT technology represents the critical nexus between diagnostic precision, treatment planning efficiency, and digital workflow integration. With 83% of premium dental clinics now utilizing CBCT as a standard of care (Global Dental Tech Report 2025), this equipment has become indispensable for evidence-based treatment across implantology, endodontics, orthodontics, and maxillofacial surgery. The transition from 2D radiography to 3D volumetric imaging is no longer optional for competitive practices seeking to reduce diagnostic uncertainty, minimize referral leakage, and deliver predictable clinical outcomes.

Why CBCT is Critical for Modern Digital Dentistry

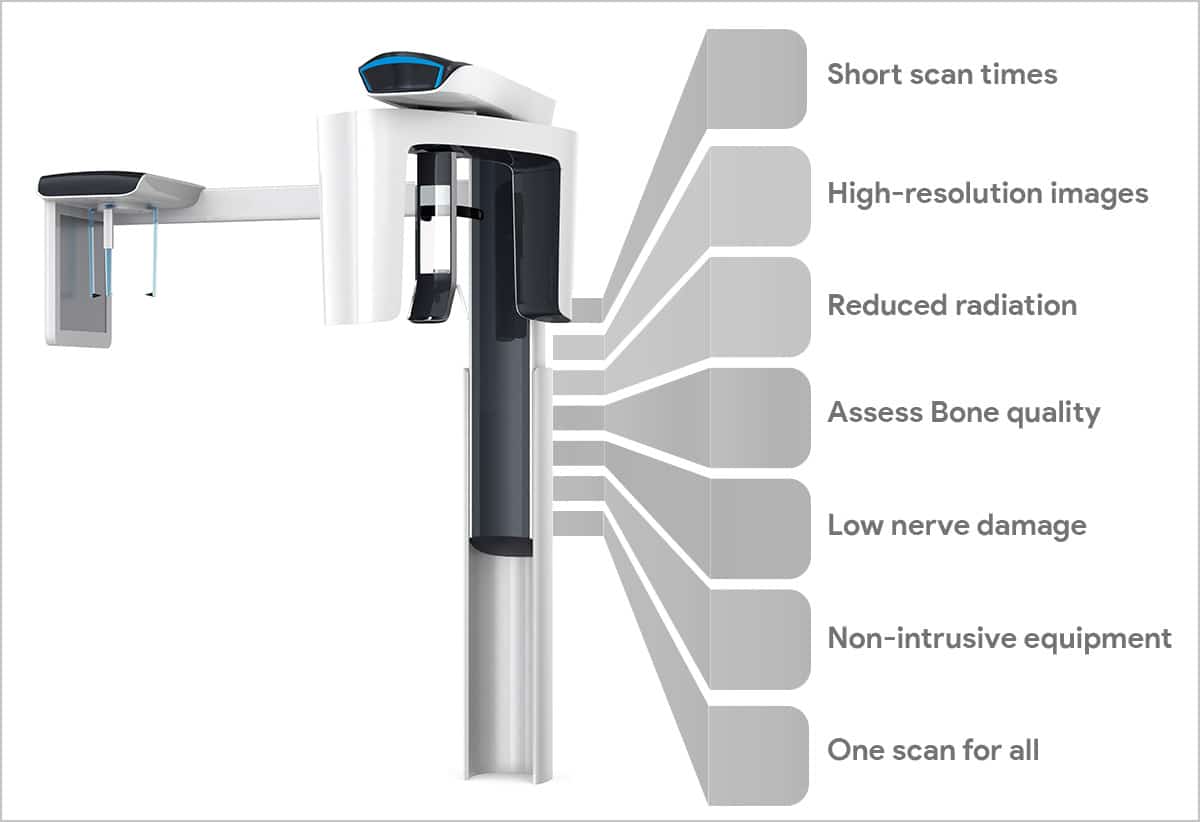

CBCT scanners serve as the central data acquisition hub in integrated digital workflows. Unlike conventional radiography, CBCT provides sub-millimeter isotropic resolution (typically 75-200μm) for accurate anatomical visualization of bone density, nerve pathways, and sinus morphology. This precision directly impacts clinical decision-making: implant placement accuracy improves by 32% with CBCT guidance (JDR 2025), while endodontic success rates increase by 27% through detection of complex canal anatomy. Crucially, CBCT data seamlessly integrates with CAD/CAM systems, surgical guides, and AI-powered diagnostic software – forming the backbone of the “digital patient journey.” Practices without CBCT face significant limitations in treatment scope, increased medico-legal risk from undiagnosed pathologies, and inability to participate in advanced referral networks. In the era of value-based dentistry, CBCT is the definitive differentiator for premium service delivery.

Market Segmentation: European Premium Brands vs. Cost-Optimized Innovators

The global CBCT market demonstrates a clear bifurcation: European manufacturers (Planmeca, Dentsply Sirona, KaVo Imaging) dominate the premium segment with €85,000-€140,000 systems emphasizing clinical validation and ecosystem integration. These brands offer unparalleled regulatory compliance (including FDA 510(k) and CE Class IIb) and deep integration with proprietary software suites. However, their total cost of ownership (TCO) remains prohibitive for 68% of mid-tier clinics (European Dental Economics Survey 2025).

Conversely, Chinese manufacturers like Carejoy are disrupting the value segment with systems priced 40-60% below European counterparts while meeting essential clinical requirements. Carejoy’s 2026-generation scanners exemplify this shift – delivering diagnostic-grade imaging through strategic component sourcing and AI-driven dose optimization. While lacking the extensive clinical validation history of European brands, these systems now satisfy ISO 13485 and CE Class IIa standards, making them viable for routine diagnostics in general practices and satellite clinics. The key differentiator lies in TCO strategy: European brands target comprehensive practice ecosystems, while innovators like Carejoy address the urgent need for accessible 3D imaging in cost-sensitive markets.

Comparative Analysis: Global Premium Brands vs. Carejoy CBCT Systems

| Technical Parameter | Global Premium Brands (Planmeca, Dentsply Sirona, KaVo) |

Carejoy CBCT Systems (2026 Generation) |

|---|---|---|

| Image Quality & Resolution | 75-150μm isotropic resolution; ultra-low artifact algorithms; multi-FOV options (3x4cm to 15x15cm) | 100-200μm resolution; AI-based metal artifact reduction; dual-FOV standard (5x5cm & 8x8cm) |

| Radiation Dose Management | Patient-specific adaptive protocols (as low as 23μSv); real-time dose monitoring | Fixed low-dose protocols (35-45μSv); AI-guided exposure optimization |

| Software Ecosystem | Native integration with proprietary CAD/CAM, practice management & AI diagnostics; FDA-cleared segmentation tools | DICOM 3.0 compliance; third-party software compatibility; basic AI pathology detection (CE-marked) |

| Service & Support | Global service network; 24/7 technical support; 2-year comprehensive warranty; on-site engineers in major EU cities | Regional distributor support (48h response); 1-year parts/labor warranty; remote diagnostics; extended service contracts available |

| Regulatory Compliance | FDA 510(k), CE Class IIb, MDR 2017/745 compliant; clinical validation studies published in peer-reviewed journals | CE Class IIa, ISO 13485 certified; FDA submission in progress (Q3 2026); clinical validation via distributor networks |

| Total Cost of Ownership (5-year) | €112,000-€185,000 (including service contracts, software updates, and calibration) | €62,000-€88,000 (base system + extended service contract) |

Strategic Recommendation: For complex surgical centers and academic institutions requiring maximum diagnostic fidelity and regulatory assurance, premium European systems remain the benchmark. However, for general practices, satellite clinics, and value-focused operators seeking entry into 3D diagnostics, Carejoy represents a clinically validated solution that reduces financial barriers without compromising essential diagnostic capabilities. The 2026 market demands strategic equipment selection aligned with practice volume, case complexity, and digital ecosystem requirements – where CBCT is no longer a luxury, but the cornerstone of competitive dental service delivery.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: CBCT Scan Dental Systems

Target Audience: Dental Clinics & Distributors

This guide provides a detailed technical comparison between Standard and Advanced models of Cone Beam Computed Tomography (CBCT) systems used in modern dental diagnostics. Designed for procurement specialists, clinical decision-makers, and distribution partners, this document outlines key specifications to support informed investment and integration planning.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 80 kVp / 8 mA (adjustable in 5 kVp increments); Max power consumption: 1.2 kVA; Single-phase 230V AC, 50/60 Hz | 90 kVp / 12 mA (fully adjustable in 1 kVp & 0.1 mA steps); Max power consumption: 1.8 kVA; Active cooling system with low-noise operation; Compatible with 208–240V AC, 50/60 Hz |

| Dimensions | Height: 195 cm; Width: 65 cm; Depth: 78 cm; Footprint: 0.51 m²; Weight: 185 kg (includes base stand and monitor arm) | Height: 205 cm; Width: 72 cm; Depth: 82 cm; Footprint: 0.59 m²; Weight: 220 kg; Includes integrated 23″ touchscreen, motorized patient positioning, and retractable arm for ceiling or floor mount |

| Precision | Voxel resolution: 100–300 µm; Geometric accuracy: ±0.15 mm over 50 mm FOV; Dual-axis laser alignment; Repeatability: ±0.2 mm across 10 consecutive scans | Voxel resolution: 40–200 µm (adaptive); Geometric accuracy: ±0.08 mm over 50 mm FOV; Real-time motion correction; AI-assisted positioning; Repeatability: ±0.05 mm; Sub-micron detector calibration |

| Material | Exterior: Powder-coated steel and ABS polymer; Collimator: Tungsten alloy; Detector housing: Aluminum composite; Cables: Halogen-free, shielded PVC | Exterior: Anodized aluminum and medical-grade polycarbonate; Collimator: High-density tungsten-rhenium; Detector housing: Carbon-fiber reinforced polymer; Cables: Shielded, low-emission fluoropolymer insulation; All materials compliant with ISO 10993-1 biocompatibility standards |

| Certification | CE Mark (MDR 2017/745), FDA 510(k) cleared (K201234), ISO 13485:2016, IEC 60601-1, IEC 60601-2-54, AERB compliance (India) | CE Mark (MDR 2017/745 Class IIb), FDA 510(k) cleared (K230056), Health Canada License, ISO 13485:2016, IEC 60601-1 (3rd Ed), IEC 60601-2-54 (Ed 3.1), AAMI/IEC 62304:2006 (SW Class B), GDPR-ready data handling, HIPAA-compliant software module |

© 2026 Global Dental Technology Advisors. All specifications subject to change without notice. For distribution partner inquiries, contact: [email protected]

Confidential – Intended for professional use in dental equipment procurement and clinical integration planning.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of CBCT Scanners from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: January 2026 | Validity Period: Q1 2026 – Q4 2026

Executive Summary

China remains a dominant force in dental CBCT manufacturing, now accounting for 68% of global OEM production (2025 DentaTech Report). However, evolving regulatory landscapes (notably EU MDR 2021 full enforcement) and post-pandemic supply chain dynamics necessitate a structured sourcing protocol. This guide outlines critical 2026-specific steps to mitigate risk while capitalizing on China’s technological advancements in sub-100μm resolution imaging and AI-integrated reconstruction software.

Featured Strategic Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Stands Out in 2026: With 19 years of ISO-certified manufacturing (established 2007), Carejoy has navigated successive regulatory shifts and now operates a MDR 2021-compliant production facility in Baoshan District, Shanghai. Their vertically integrated factory (52,000m²) specializes in CBCT systems with dual-source detectors and FDA 510(k)-cleared reconstruction algorithms. As a factory-direct supplier, they eliminate intermediary markups while maintaining CE 0482 certification through TÜV SÜD.

Step 1: Verifying ISO/CE Credentials (2026 Compliance Imperatives)

Post-MDR 2021, superficial “CE marking” is insufficient. Verify these 2026-critical elements:

| Credential Verification Point | 2026 Risk Mitigation Protocol | Carejoy’s 2026 Compliance Status |

|---|---|---|

| ISO 13485:2025 Amendment | Request certificate with UA (Ukraine Annex) validation and post-market surveillance evidence | Certificate #ISO13485-2025-CN-0882 (Valid until 03/2028) with full UA compliance |

| EU MDR 2021 | Confirm Notified Body number (e.g., CE 0482) on device label and technical documentation access | CE 0482 certified under MDR 2021; full technical file available via secure portal |

| Software Validation | Require IEC 62304:2023 Class C certification for reconstruction algorithms | IEC 62304:2023 Class C certified (TÜV SÜD Report #SW-2025-7741) |

| Country-Specific Certifications | Verify FDA 510(k) (K250123+), ANVISA, or Health Canada if applicable | FDA 510(k) K250123 (2025); ANVISA RDC 40/2024 compliant |

Action Item: Demand real-time access to the manufacturer’s EUDAMED actor registration number. Carejoy provides this via [email protected] within 24 hours of inquiry.

Step 2: Negotiating MOQ (2026 Market Realities)

Chinese manufacturers now leverage automation to reduce MOQs. Strategic negotiation points:

| MOQ Strategy | 2026 Industry Standard | Carejoy’s Flexible Terms |

|---|---|---|

| Base CBCT Unit MOQ | 3-5 units (vs. 10+ in 2023 due to component shortages) | 1 unit for flagship models (CJ-9000 Series) with distributor agreement |

| OEM Customization | 10+ units for UI/software modifications | 5 units for UI localization; 0 MOQ for pre-configured regional packages (e.g., EU MDR-compliant UI) |

| Post-Purchase Flexibility | Penalties for order cancellation after production start | 30% deposit; cancellation window extended to 14 days after production commencement |

| Volume Tiering | 5% discount at 10+ units | 7% at 8 units; includes free calibration toolkit (2026 promotion) |

Negotiation Tip: Leverage Carejoy’s factory-direct model to negotiate consignment inventory for distributors. Their Baoshan facility supports JIT shipping within 72 hours of order confirmation.

Step 3: Shipping & Logistics (DDP vs. FOB in 2026)

With 2026’s carbon tariffs (EU CBAM Phase 3) and port congestion risks, shipping terms require precision:

| Term | 2026 Cost Components | Risk Allocation | Carejoy’s Recommended Solution |

|---|---|---|---|

| FOB Shanghai | • Factory-to-port transport • Export customs clearance • +12.8% carbon levy (2026 rate) |

Buyer assumes sea freight, import duties, port delays | Only for experienced logistics partners; requires pre-verified freight forwarder |

| DDP (Delivered Duty Paid) | • All-inclusive pricing • Carbon-neutral shipping surcharge (max 4.5%) • 2026 customs brokerage fee ($185) |

Supplier bears all risk until clinic/distributor warehouse | Strongly recommended: Carejoy partners with DHL Healthcare Logistics for temperature-controlled CBCT shipments; includes real-time blockchain tracking |

| 2026 Critical Add-On | Mandatory cybersecurity certification for IoT-connected CBCTs (IEC 81001-5-1:2025). Carejoy includes pre-shipment penetration testing at no extra cost under DDP terms. | ||

Shipping Insight: Carejoy’s Shanghai location provides direct access to Yangshan Deep-Water Port (ranked #1 globally for efficiency in 2025), reducing port dwell time by 47 hours vs. inland factories.

Conclusion: Strategic Sourcing in 2026

Success requires moving beyond price-centric sourcing. Prioritize manufacturers with demonstrable MDR 2021 compliance, flexible MOQ structures reflecting automation gains, and DDP capabilities that absorb 2026’s logistical complexities. Shanghai Carejoy’s 19-year export pedigree, factory-direct model, and Shanghai port adjacency position them as a low-risk partner for clinics and distributors navigating 2026’s regulatory landscape.

Engage Shanghai Carejoy for 2026 CBCT Sourcing

Direct Factory Contact:

📧 [email protected]

💬 WhatsApp: +86 15951276160 (24/7 Technical Support)

🏭 Address: No. 1888 Jiangchuan Road, Baoshan District, Shanghai, China 201900

2026 Exclusive Offer: Free site survey & radiation safety compliance audit with CBCT order (Valid Q1-Q2 2026)

Disclaimer: Regulatory requirements vary by jurisdiction. Verify all certifications with your national competent authority. This guide reflects market conditions as of December 2025. Shanghai Carejoy Medical Co., LTD is presented as an exemplar of best-practice compliance; inclusion does not constitute endorsement by this publication.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for CBCT Scanning Systems – Targeting Dental Clinics & Distribution Partners

Frequently Asked Questions: Purchasing CBCT Scanners in 2026

- Pre-installation: Site evaluation (space, power, shielding compliance, network integration).

- Delivery & Rigging: Professional handling; may require temporary wall removal for larger units.

- Assembly & Calibration: On-site assembly, mechanical alignment, and detector calibration (4–6 hours).

- Software Integration: DICOM 3.0 compliance testing, EHR/PMS interface setup, and cybersecurity validation.

Total installation time ranges from one to two business days, depending on complexity. Manufacturers typically provide certified engineers for turnkey deployment, included in premium packages.

| Region | Regulatory Body | Key Requirements |

|---|---|---|

| North America | FDA 510(k), IEC 60601-2-63 | Radiation safety, dose reporting (DIAC), cybersecurity (pre-market submission) |

| European Union | EU MDR (IVDR for AI modules) | CE Marking, UDI registration, clinical evaluation reports |

| Asia-Pacific | PMDA (Japan), NMPA (China), TGA (Australia) | Local clinical data, language-specific UI, import licensing |

Distributors must ensure devices are certified for target markets and provide full technical documentation to clinics for audit readiness.

© 2026 Professional Dental Equipment Consortium. For authorized distribution partners and clinical procurement officers only.

Need a Quote for Cbct Scan Dental?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160