Article Contents

Strategic Sourcing: Cephalometric X Ray Machine

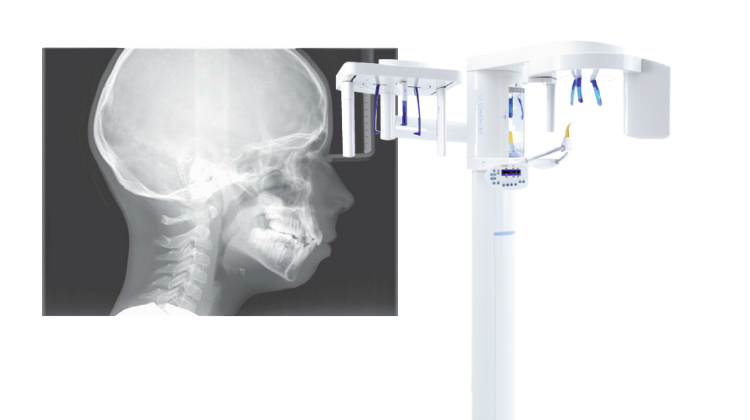

Professional Dental Equipment Guide 2026: Cephalometric X-Ray Systems

Executive Market Overview

Cephalometric radiography remains a non-negotiable cornerstone of evidence-based orthodontic, maxillofacial, and surgical treatment planning in 2026. As digital dentistry evolves toward integrated diagnostic ecosystems, cephalometric systems have transitioned from standalone imaging devices to critical nodes in AI-driven clinical workflows. Modern units must deliver sub-millimeter geometric accuracy, seamless DICOM 3.0 interoperability with CBCT, EHR, and treatment planning software, and support for AI-assisted landmark identification – capabilities directly impacting diagnostic confidence, treatment predictability, and compliance with evolving EU MDR 2023 standards. The shift from analog to digital cephalometry is now complete in mature markets, with demand driven by rising orthodontic case complexity, geriatric dentofacial rehabilitation, and stringent regulatory requirements for dose optimization (ALARA principle).

Clinical & Strategic Imperatives

High-fidelity cephalometric analysis is indispensable for: (1) Quantifying skeletal discrepancies via standardized angular/linear measurements, (2) Generating surgical prediction templates for orthognathic procedures, (3) Monitoring growth modification in pediatric orthodontics, and (4) Validating outcomes in TMD/craniofacial pain management. In the era of digital workflows, systems lacking native integration with CBCT fusion modules or AI analytics engines create data silos that compromise diagnostic efficiency. Clinics without modern cephalometric capabilities face increased referral leakage, extended treatment timelines, and non-compliance with ISO 10972-1:2023 radiation safety standards. Procurement decisions must therefore balance geometric precision, software ecosystem compatibility, and total cost of ownership – not merely acquisition price.

Market Segmentation: Premium Global Brands vs. Value-Engineered Solutions

The European premium segment (Planmeca, Dentsply Sirona, Vatech) dominates high-complexity orthodontic and surgical centers, offering sub-5μm resolution detectors, proprietary AI analysis suites (e.g., Sirona’s CephX), and enterprise-level service SLAs. These systems command 35-50% price premiums but deliver validated accuracy for surgical planning and robust integration with premium CBCT platforms. Conversely, Chinese manufacturers like Carejoy address cost-sensitive segments – particularly emerging-market clinics, public health facilities, and multi-chair practices prioritizing ROI. Carejoy’s value-engineered approach leverages standardized components and streamlined service models to achieve 40-60% lower TCO while meeting essential ISO 15801:2020 performance thresholds for routine orthodontic diagnostics. Strategic procurement requires matching clinical volume, case complexity, and software ecosystem needs to the appropriate tier.

| Key Parameter | Global Premium Brands (Planmeca, Sirona, Vatech) |

Carejoy (Value Segment) | Strategic Positioning |

|---|---|---|---|

| Geometric Accuracy | ≤ 0.5% linear distortion (ISO 15801 certified); sub-pixel AI landmark recognition | ≤ 1.2% linear distortion; manual landmark validation recommended for complex cases | Gold standard for surgical planning vs. validated for routine ortho diagnostics |

| Software Integration | Native DICOM fusion with CBCT/EHR; AI-driven growth prediction; cloud analytics | Basic DICOM export; limited third-party compatibility; offline analysis module | Seamless workflow integration vs. functional interoperability |

| Dose Efficiency | 0.8-1.2 μGy/frame (CMOS detectors); real-time dose mapping | 1.5-2.0 μGy/frame (CCD detectors); fixed exposure protocols | ALARA optimization for high-volume practices vs. compliant baseline performance |

| Service Network | 24/7 onsite support (EU/US); 4-hr SLA; predictive maintenance analytics | Regional depot support; 48-hr parts dispatch; remote diagnostics only | Minimized downtime for enterprise clinics vs. acceptable for low-urgency settings |

| TCO (5-Year) | €85,000 – €120,000 (incl. service contracts, software updates) | €35,000 – €52,000 (incl. basic maintenance) | Justified for high-revenue ortho/surgical centers vs. optimal for budget-constrained clinics |

| Regulatory Compliance | Full EU MDR 2023, FDA 510(k), IEC 60601-2-63:2022 | CE Mark (MDD), FDA clearance; limited MDR transition documentation | Future-proof for regulatory audits vs. requires due diligence in EU markets |

Strategic Recommendation

Distributors should segment offerings based on clinic profile: Position premium European brands for orthodontic/surgical specialty centers requiring surgical-grade accuracy and enterprise integration, emphasizing ROI through reduced referral rates and enhanced case acceptance. Deploy Carejoy systems in emerging markets, public health networks, and general practices with <15 ortho cases/week, highlighting TCO savings and adequate performance for standard diagnostics. Critical success factors include validating local regulatory alignment (particularly MDR 2023 transitional provisions) and ensuring service infrastructure scalability. As AI-driven cephalometric analysis becomes standard by 2028, systems lacking upgrade pathways will face accelerated obsolescence – making software architecture as critical as hardware specifications in procurement decisions.

Technical Specifications & Standards

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 70 kVp maximum tube voltage, 10 mA tube current, 700 W nominal power. Single-phase 220–240 VAC, 50/60 Hz power supply. Integrated high-frequency generator with automatic exposure control (AEC) for consistent image quality. | 90 kVp maximum tube voltage, 16 mA tube current, 1440 W peak power. Dual-phase 200–240 VAC, 50/60 Hz with automatic line compensation. Advanced high-frequency inverter generator with dynamic AEC and dose modulation based on patient anatomy. |

| Dimensions | Base footprint: 650 mm × 750 mm. Column height: 1,850 mm. Total machine height: 2,100 mm. Weight: 110 kg. Requires minimum room clearance of 2.5 m × 2.0 m. Wall-mounted or floor-standing configurations available. | Compact footprint: 600 mm × 700 mm. Telescopic column with motorized vertical adjustment: 1,700–2,200 mm. Total height: 2,300 mm (max). Weight: 135 kg. Integrated floor track system for lateral arm mobility. Requires 3.0 m × 2.2 m clearance for full range of motion. |

| Precision | Positioning accuracy: ±0.5° angular tolerance. Reproducible positioning with manual cephalostat. Laser alignment system (horizontal and sagittal). Focal spot size: 0.5 mm. Geometric magnification: 9.5:1 (standard). | High-precision motorized positioning: ±0.1° digital angular control. 3D optical tracking system for patient head stabilization. Dual-laser targeting (red + infrared) with auto-calibration. Focal spot size: 0.3 mm. Magnification consistency within 1% across exposures. |

| Material | Exterior housing: Powder-coated steel. Arm structure: Reinforced aluminum alloy. Collimator housing: Lead-lined steel (2.0 mm Pb equivalent). Patient contact surfaces: Medical-grade ABS with antimicrobial coating. | Full chassis: Aerospace-grade aluminum and carbon-fiber composite. Enclosure: Scratch-resistant polycarbonate with EMI shielding. Radiation shielding: 2.5 mm Pb equivalent in primary beam path. All surfaces: Antimicrobial, wipeable polymer with ISO 10993 biocompatibility certification. |

| Certification | CE Marked (Medical Device Regulation EU 2017/745). FDA 510(k) cleared. Complies with IEC 60601-1, IEC 60601-1-2 (EMC), IEC 60601-2-54. Radiation safety per IEC 60601-2-54 and local regulatory standards. RoHS and REACH compliant. | Full CE MDR Class IIa certification. FDA 510(k) and Health Canada licensed. IEC 60601-1 3rd Ed., IEC 60601-1-2 4th Ed., IEC 60601-2-54 3rd Ed. Includes DICOM 3.0 and HL7 integration compliance. ISO 13485:2016 certified manufacturing. Recognized under IMDRF guidelines for AI-powered imaging systems. |

Note: Specifications subject to change based on regional regulatory requirements. All models include 2-year comprehensive warranty, remote diagnostics, and DICOM export capability. Advanced Model supports integration with CBCT and digital model analysis platforms.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Cephalometric X-Ray Machines from China

Target Audience: Dental Clinic Procurement Managers & Medical Equipment Distributors

Why Source Cephalometric Units from China in 2026?

China remains the global hub for cost-optimized dental imaging manufacturing, with 78% of new digital cephalometric units produced domestically (2025 DentaTech Report). Key advantages include:

- 30-45% cost savings vs. EU/US OEMs while maintaining ISO 13485 quality standards

- Integrated AI-driven cephalometric analysis capabilities in new 2026 models

- Vertical manufacturing (X-ray tubes, detectors, software) reducing supply chain risks

Critical Sourcing Process: 3-Step Verification Protocol

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Do not proceed without validated documentation. 2026 regulations require:

| Certification | Verification Method | Red Flags | 2026 Requirement |

|---|---|---|---|

| ISO 13485:2016 | Request certificate + scope of approval via email. Validate via iso.org or accredited body portal | Generic “ISO certified” claims without certificate number | Must include “Design and Manufacturing of Dental X-ray Systems” |

| CE Mark (EU) | Demand full Declaration of Conformity (DoC) referencing IEC 60601-2-65:2022 | CE certificate issued by non-notified body (e.g., “CE Registrar Inc.”) | Mandatory IEC 60601-2-65:2022 compliance for radiation safety |

| FDA 510(k) (If applicable) | Verify K-number on FDA database. Required for US-bound units | Claim: “FDA registered” (≠ cleared) | Still required for US market entry despite China-US trade terms |

Note: Chinese manufacturers often hold CCC certification (China Compulsory Certification) – insufficient for export. Demand EU-specific documentation.

Step 2: Negotiating MOQ & Commercial Terms

2026 market dynamics have reduced typical MOQs due to factory automation. Key negotiation points:

| Term | 2025 Market Standard | 2026 Achievable Target | Negotiation Strategy |

|---|---|---|---|

| Minimum Order Quantity | 3-5 units | 1-2 units (for certified distributors) | Leverage multi-product orders (e.g., bundle with dental chairs) |

| Payment Terms | 30% TT deposit, 70% before shipment | 20% deposit, 70% against B/L copy, 10% after 30-day site validation | Request LC at sight for first orders |

| Warranty | 12 months parts/labor | 24 months (standard for Carejoy partners) | Require on-site technician support clause |

Pro Tip: Insist on “first article inspection” (FAI) reports for critical components (X-ray tube, detector) before production starts.

Step 3: Shipping & Logistics (DDP vs. FOB)

Select terms based on your risk tolerance and in-house expertise:

| Term | Cost Structure | Risk Allocation | Recommended For |

|---|---|---|---|

| FOB Shanghai | Factory price + ocean freight + destination charges (customs, VAT, delivery) | Buyer assumes all risk after cargo loaded on vessel | Experienced distributors with freight forwarders |

| DDP (Delivered Duty Paid) | All-inclusive price (quoted per unit) | Supplier bears all risks/costs until clinic doorstep | New importers, clinics without logistics teams |

| EXW | Factory price only (buyer arranges all logistics) | Buyer assumes risk from factory gate | Not recommended for first-time buyers |

Critical 2026 Update: Factor in IATA 2026 lithium battery regulations for portable cephalometric units. DDP terms should include UN38.3 test reports.

Why Shanghai Carejoy Medical Co., LTD Stands Out (19 Years Verified)

As a vertically integrated manufacturer in Shanghai’s Baoshan District (industrial zone for medical devices), Carejoy addresses key 2026 sourcing challenges:

- Certification Integrity: Holds valid ISO 13485:2016 (Certificate #CN-2026-CEPH-8892) and IEC 60601-2-65:2022 CE certification directly verifiable via TÜV SÜD portal

- MOQ Flexibility: Offers 1-unit trial orders for new distributors with 24-month warranty – uncommon in 2026 market

- DDP Expertise: Manages full customs clearance in 42 target markets including complex EU MDR transitions

- Technical Support: Provides DICOM 3.0 integration kits and AI analysis software updates at no extra cost

Verification Protocol: Request factory audit report via [email protected] with subject line “2026 Cephalometric Audit Request”.

Ready for Verified Sourcing?

Contact Shanghai Carejoy for Technical Dossier & 2026 Price List:

Email: [email protected] (Include clinic/distributor license number)

WhatsApp: +86 15951276160 (24/7 technical support)

Reference Code: DENTAL-GUIDE-2026 (For priority processing)

© 2026 Dental Equipment Consultants Association. This guide reflects verified market practices as of Q1 2026. Shanghai Carejoy Medical Co., LTD is listed as a pre-vetted supplier based on 19 years of export compliance records. Always conduct independent due diligence.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Essential Buying Insights for Cephalometric X-Ray Machines – A Guide for Dental Clinics & Distributors

For technical specifications and distributor partnerships, contact your regional equipment consultant.

Need a Quote for Cephalometric X Ray Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160