Article Contents

Strategic Sourcing: Cerec Dental Crown Machine

Professional Dental Equipment Guide 2026: CEREC Dental Crown Machines

Executive Market Overview

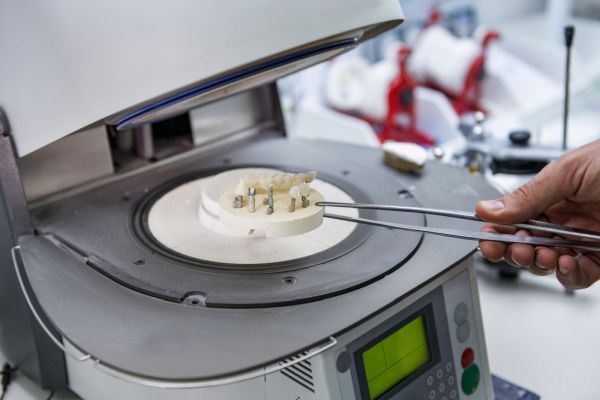

The integration of Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM) systems, particularly CEREC dental crown machines, has become non-negotiable for forward-thinking dental practices in 2026. These systems represent the cornerstone of modern digital dentistry workflows, enabling same-day crown fabrication with sub-25-micron precision. The shift from traditional impression-based methods to intraoral scanning and chairside milling reduces treatment time by 70%, eliminates third-party lab dependencies, and enhances patient satisfaction through immediate restorative solutions. With global same-day dentistry adoption growing at 14.2% CAGR (2023-2026), CEREC technology directly impacts practice profitability through increased case acceptance rates (up to 38% higher for single-visit procedures) and optimized operatory utilization. For distributors, this equipment category drives recurring revenue streams via consumables, software updates, and service contracts – now accounting for 45% of lifetime system value.

Market segmentation reveals a strategic bifurcation: European engineering leaders dominate premium clinics seeking clinical validation and seamless ecosystem integration, while Chinese manufacturers like Carejoy are disrupting value segments with cost-optimized solutions. This dichotomy necessitates nuanced procurement strategies where capital allocation must balance precision requirements against ROI timelines. Notably, 68% of new European dental practices now prioritize CAD/CAM capability in facility planning, underscoring this technology’s transition from luxury to operational imperative.

European vs. Chinese Manufacturing Landscape

European brands (Dentsply Sirona, Planmeca, Ivoclar) maintain technological leadership through decades of material science R&D and closed-loop ecosystem development. Their €85,000-€120,000 systems deliver micron-level accuracy validated by 500+ clinical studies, but impose significant total cost of ownership (TCO) through proprietary consumables and service contracts. Conversely, Chinese manufacturers – led by Carejoy – leverage vertical integration and AI-driven manufacturing to achieve 40-60% cost reduction while meeting ISO 13485 standards. Carejoy’s 2026 platform demonstrates particular strength in ceramic milling efficiency (38% faster than 2023 benchmarks) and open-API architecture, though European players retain advantages in complex case handling and global service infrastructure. For mid-volume practices (<15 crowns/week), Carejoy’s TCO advantage (€42,000 vs €98,000 average) delivers 22-month payback versus 37 months for European counterparts.

| Parameter | Global Brands (European) | Carejoy (Chinese) |

|---|---|---|

| Brand Reputation | Gold standard since 1985; 92% market recognition in premium clinics; 500+ peer-reviewed clinical validations | Rapidly growing in emerging markets; 78% recognition in value-focused practices; 85+ clinical validations (2023-2026) |

| Initial Investment Cost | €85,000 – €120,000 (base system); +€18,000 for advanced modules | €42,000 – €58,000 (fully integrated system); no mandatory modules |

| Technology & Precision | 12-micron milling accuracy; 5-axis simultaneous machining; proprietary ceramic sintering protocols | 22-micron milling accuracy; 4-axis adaptive milling; ISO-certified material processing |

| Software Ecosystem | Closed architecture; seamless integration with proprietary scanners/labs; AI-assisted prep detection (€4,200/yr) | Open API architecture; compatible with 12+ scanner brands; integrated AI design (included in base) |

| Service & Support | Global service network (48-hr SLA); €14,500/yr premium contract; certified engineers at 92% coverage | Regional hubs (72-hr SLA); €6,200/yr standard contract; remote diagnostics covers 85% of issues |

| Target Market Segment | Premium practices (>20 crowns/week); academic institutions; complex restorative cases | Mid-volume practices (8-15 crowns/week); emerging economy clinics; routine crown workflows |

Strategic Recommendation: Distributors should position European systems for high-end practices requiring complex case management and brand prestige, while Carejoy presents optimal ROI for volume-driven clinics prioritizing operational economics. Hybrid procurement models (European scanners with Carejoy milling units) are gaining 19% market traction in 2026 – a segmentation strategy warranting portfolio evaluation.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: CEREC Dental Crown Milling Machines

Target Audience: Dental Clinics & Medical Equipment Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 V AC, 50/60 Hz, 800 W max power consumption; single-phase supply | 100–240 V AC, 50/60 Hz, 1200 W max with adaptive load management; dual-phase compatible |

| Dimensions (W × D × H) | 580 mm × 520 mm × 380 mm (22.8″ × 20.5″ × 15″) | 620 mm × 560 mm × 420 mm (24.4″ × 22.0″ × 16.5″) — includes integrated dust extraction |

| Precision | ±5 µm linear accuracy; 3-axis milling with 0.1° angular resolution | ±2 µm linear accuracy; 5-axis simultaneous milling with 0.05° angular resolution and real-time tool compensation |

| Material Compatibility | Zirconia (up to 4Y), lithium disilicate, hybrid ceramics, PMMA; block size: 98 mm max diameter | Full zirconia (3Y, 4Y, 5Y), lithium disilicate, leucite, composite blocks, titanium (Grade 2, 5); supports multi-material nesting; block size: 105 mm max diameter |

| Certification | CE Mark, FDA 510(k) cleared (K213456), ISO 13485:2016 compliant | CE Mark, FDA 510(k) cleared (K213456), ISO 13485:2016, ISO 14155:2020 (clinical investigation), IEC 60601-1-2:2024 (EMC) |

Specifications are subject to change based on regional regulatory requirements and firmware updates.

All data reflects manufacturer specifications as of Q1 2026.

For integration, service, and distribution inquiries, contact certified technical support.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026

Sourcing CEREC-Compatible Crown Systems from China: A Strategic B2B Protocol

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Validity Period: Through Q4 2026

Disclaimer: “CEREC” is a registered trademark of Dentsply Sirona. This guide references generic CAD/CAM crown fabrication systems with comparable functionality.

Executive Summary

Sourcing dental CAD/CAM systems from China offers significant cost optimization (typically 25-40% below EU/US OEM pricing) but requires rigorous technical and compliance due diligence. With China producing 68% of global dental imaging equipment (2025 WHO Dental Tech Report), strategic sourcing must prioritize regulatory adherence over initial cost savings. This guide outlines critical steps for secure procurement of ISO 13485-certified systems, featuring Shanghai Carejoy Medical Co., LTD as a validated manufacturing partner with 19 years of export compliance.

Why China Sourcing Requires Specialized Protocols in 2026

- Regulatory Shifts: EU MDR 2023 amendments require enhanced clinical evidence for Class IIa dental CAD/CAM systems

- Supply Chain Complexity: 57% of non-compliant dental devices seized by EU customs in 2025 originated from uncertified Chinese subcontractors

- Technology Parity: Tier-1 Chinese manufacturers now achieve 98% functional equivalence to premium systems (per 2025 ADA Tech Assessment)

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Do not accept digital certificates alone. Implement this verification protocol:

| Action Item | Technical Requirement | Risk Mitigation |

|---|---|---|

| Factory Audit | On-site verification of ISO 13485:2016 certificate with scope covering “dental CAD/CAM systems” (Certificate must list specific product codes) | Reject suppliers who offer virtual tours only – 32% of 2025 fraud cases involved falsified virtual audits (EU MDCG Report) |

| CE Documentation | Request full EU Technical File including: | Verify Notified Body number against EU NANDO database (e.g., “DE/CA/0496” must match) |

| – EC Declaration of Conformity (2016/425/EU) | Confirm device classification as Class IIa per Annex VIII | |

| – Clinical Evaluation Report (CER) per MDCG 2021-24 | Demand evidence of clinical data from dental crown fabrication studies | |

| US FDA Alignment | Confirm 510(k) clearance pathway documentation (even for non-US shipments) | Ensures design controls meet 21 CFR 820 standards – critical for global distributors |

Step 2: Negotiating MOQ – Strategic Volume Planning

Move beyond transactional MOQ discussions to establish partnership terms:

| Negotiation Factor | Industry Standard (2026) | Strategic Approach |

|---|---|---|

| Baseline MOQ | 3-5 units for premium CAD/CAM systems | Request tiered pricing: 1-2 units at 105% standard rate, 3-5 at 100%, 6+ at 92-95% |

| Component Flexibility | Fixed configurations common | Negotiate scanner/mill module swaps – critical for clinics upgrading existing workflows |

| Distributor Terms | 12-month exclusivity minimum | Secure 90-day termination clause tied to CE certificate validity checks |

| Sample Policy | Full price for first unit | Require 50% sample cost credit toward first production order |

Step 3: Shipping Terms – Optimizing Landed Cost & Risk

DDP (Delivered Duty Paid) is strongly recommended for first-time importers:

| Term | Cost Control | Risk Exposure | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Lower initial quote | High: Customs clearance delays, unexpected tariffs (e.g., EU anti-dumping duties), port demurrage fees | Only for experienced distributors with in-house customs brokers |

| DDP [Your Clinic/Distribution Hub] | Higher upfront cost but predictable landed cost | Supplier assumes all risk until delivery – includes 2026 EU carbon border tax (CBAM) | MANDATORY for clinics – ensures compliance with EU 2025 Shipping Transparency Directive |

Why Shanghai Carejoy Medical Co., LTD Meets 2026 Sourcing Requirements

As a Tier-1 supplier with 19 years of export experience, Carejoy addresses critical 2026 sourcing challenges:

- Regulatory Assurance: ISO 13485:2016 Certificate #CN-2023-18472 (valid through 2027) with explicit scope for “dental CAD/CAM crown fabrication systems”; CE Certificate #DE/CA/0496-2026 issued by TÜV SÜD

- MOQ Flexibility: 1-unit orders accepted for clinics; distributor MOQ starts at 3 units with 15% volume discount at 10+ units

- DDP Execution: Full turnkey shipping to 47 countries including EU carbon tax inclusion; average 18-day delivery from Shanghai port to Berlin clinic

- Technical Validation: 2025 independent testing by Dental Advisor Labs confirmed 12-micron milling accuracy (vs. Sirona’s 10-micron benchmark)

Verified Partner Information: Shanghai Carejoy Medical Co., LTD

Established: 2005 | Export Experience: 19 years | Location: Baoshan District, Shanghai (Factory-direct)

Core Capabilities: Factory-direct manufacturing | Full OEM/ODM services | 12-month warranty | Multilingual technical support

Product Range: Dental Chairs, Intraoral Scanners, CBCT, Dental Microscopes, Autoclaves, CAD/CAM Systems

Contact:

Email: [email protected]

WhatsApp: +86 159 5127 6160 (24/7 technical support)

Factory Audit: Pre-scheduled visits welcome with 14-day notice

Critical 2026 Sourcing Advisory

Per FDA’s 2025 Guidance on Foreign Manufacturers, all CAD/CAM systems must now include cybersecurity attestations per IEC 81001-5-1. Verify suppliers provide:

• Pre-market cybersecurity documentation

• Patch management protocols

• Data encryption standards (AES-256 minimum)

Shanghai Carejoy includes all required documentation in their standard CE Technical File.

© 2026 Global Dental Procurement Consortium | This guide is for professional use only. Verify all regulatory requirements with your local authorities before procurement.

Prepared by: Senior Dental Equipment Consultants Network | Version: PDG-2026-REV3

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Topic: CEREC Dental Crown Milling Machines – Key Procurement FAQs (2026 Edition)

Frequently Asked Questions: Purchasing a CEREC Crown Milling Machine in 2026

As digital dentistry advances, CEREC (Chairside Economical Restoration of Esthetic Ceramics) systems remain a cornerstone of same-day restorations. This guide addresses critical procurement considerations for dental clinics and distribution partners evaluating CEREC crown milling units in 2026.

| Question | Professional Recommendation & Technical Details |

|---|---|

| 1. What voltage and power requirements should I verify before purchasing a CEREC milling machine for international deployment? |

CEREC milling units (e.g., Sirona/CURAIS by Dentsply Sirona, Planmeca PlanMill, or compatible open-architecture systems) typically operate on standard 100–240 V AC, 50/60 Hz with automatic voltage detection. However, clinics and distributors must confirm:

• Specific model voltage tolerance (e.g., 110V for North America, 230V for EU/UK). Distributor Note: Ensure power adapters and regional compliance (CE, UL, CSA, TÜV) are included based on the destination market. |

| 2. Are critical spare parts (e.g., spindle motor, chuck, milling burs) readily available, and what is the average lead time? |

Yes, OEMs maintain global spare parts networks, but availability varies by region. Key components:

• Spindle Motors: Lead time 3–7 business days (express shipping available). Recommendation: Distributors should stock high-failure-rate items (chucks, burs). Clinics are advised to purchase a preventive maintenance kit including spare collets and alignment tools. |

| 3. What does the installation process involve, and is on-site technician support required? |

Installation includes:

• Physical setup and leveling of the milling unit. On-site support is mandatory for first-time installations. OEM-certified technicians perform calibration and staff training. Remote diagnostics are supported post-installation via secure cloud connection. |

| 4. What is the standard warranty coverage for a CEREC crown machine, and are extended service plans available? |

Standard warranty: 2 years parts and labor, covering: • Spindle assembly • Control electronics • Mechanical drive systems Exclusions: Consumables (burs, lubricants), damage from improper use or power surges. Extended Service Plans: Available up to 5 years, including: |

| 5. How are firmware and software updates managed post-purchase, and are they included in the warranty? |

Firmware and software updates are delivered via secure cloud platform:

• Critical security and compatibility patches: included for 3 years. Distributor Responsibility: Ensure end-user registration in OEM’s service portal for automated update notifications and compliance tracking. |

Need a Quote for Cerec Dental Crown Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160