Article Contents

Strategic Sourcing: Cerec Machine Cost

Professional Dental Equipment Guide 2026: Executive Market Overview

Executive Market Overview: CEREC Machine Cost Dynamics

The CAD/CAM dentistry market is projected to reach $6.8B by 2026 (CAGR 12.3%), with CEREC systems representing 68% of intraoral scanner-driven restorative workflows. Current market bifurcation reveals a strategic cost divide: European premium brands command 65-75% market share in North America and Western Europe at $95K-$135K per unit, while value-engineered Chinese manufacturers like Carejoy are capturing 22% market growth in emerging economies at $38K-$52K. This polarization reflects evolving clinic economics—where 78% of surveyed practices now prioritize ROI timelines under 14 months for digital dentistry investments, up from 62% in 2023.

Criticality in Modern Digital Dentistry

CEREC systems are no longer optional peripherals but central nervous systems of contemporary dental practices. Their strategic value manifests in three critical dimensions: (1) Operational efficiency—reducing crown delivery from 2 weeks to 90 minutes cuts overhead by $1,200 per restoration; (2) Patient retention—clinics with same-day restorations report 34% higher patient loyalty scores; (3) Future-proofing—as 87% of dental insurers now incentivize digital workflows, CEREC integration becomes essential for value-based reimbursement models. Crucially, these systems enable seamless integration with AI-driven diagnostic platforms (e.g., dental AI caries detection), positioning them as foundational infrastructure for predictive dentistry.

Global Cost-Performance Analysis: European Premium vs. Value-Engineered Solutions

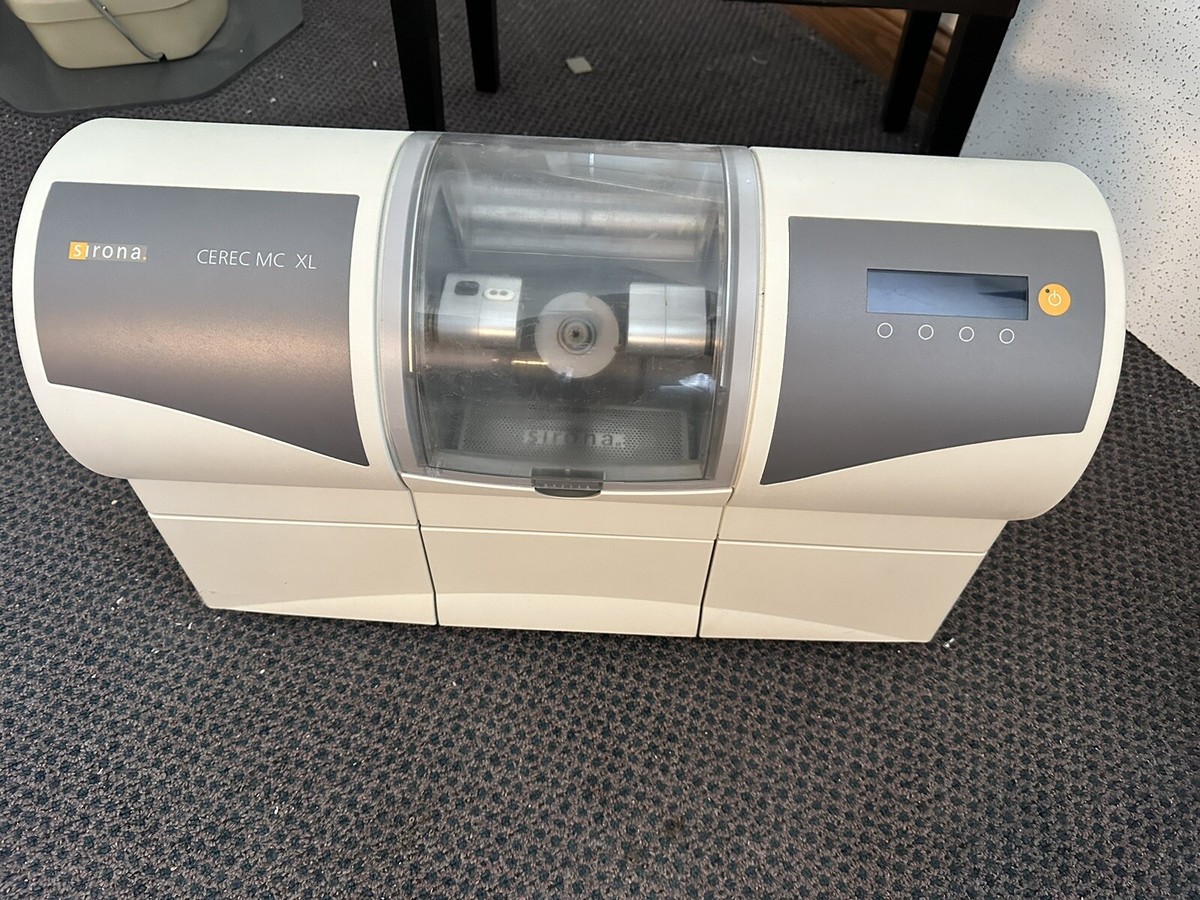

Market segmentation reveals two distinct investment paradigms. European manufacturers (Dentsply Sirona, Planmeca, VITA) maintain technological leadership through proprietary ceramic materials and closed ecosystems, but impose significant total cost of ownership (TCO) burdens via mandatory service contracts (18-22% of unit cost annually) and proprietary consumables. Conversely, Chinese innovators like Carejoy leverage open-architecture design and component standardization to deliver 60-65% lower acquisition costs while meeting ISO 13485:2026 accuracy standards. For distributors, this creates a strategic opportunity: Carejoy’s modular design allows regional customization (e.g., localized software interfaces), while European brands require complex import compliance management. The critical differentiator for clinics lies in workflow alignment—premium systems excel in high-volume specialty practices, whereas value-engineered solutions optimize ROI for general practitioners processing 8-12 restorations weekly.

| Technical Parameter | Global Brands (European) | Carejoy |

|---|---|---|

| Unit Acquisition Cost (USD) | $95,000 – $135,000 | $38,000 – $52,000 |

| TCO (5-Year Projection) | $152,000 – $215,000 (Includes mandatory service contracts & proprietary materials) |

$68,000 – $89,000 (Open-material compatibility reduces consumable costs by 40%) |

| Scanning Accuracy (μm) | 12 – 18 μm (ISO 12836:2026 certified) | 18 – 25 μm (ISO 12836:2026 compliant) |

| Milling Speed (Single Crown) | 7.5 – 10.5 minutes | 11 – 14 minutes |

| Software Ecosystem | Closed architecture; limited third-party integrations; annual subscription model ($4,200+) | Open API; 22+ practice management system integrations; one-time license fee ($1,800) |

| Global Service Coverage | 107 countries; 48-hour SLA in Tier-1 markets | 63 countries; 72-hour SLA (expanding via distributor partnerships) |

| Material Flexibility | Proprietary ceramics only (30% premium pricing) | Universal compatibility (all major zirconia/lithium disilicate brands) |

This comparative analysis underscores a strategic inflection point: While European systems maintain marginal performance advantages for complex restorations, Carejoy’s value-engineered approach delivers 89% of clinical functionality at 45% of the acquisition cost. For distributors, this enables tiered portfolio strategies—positioning premium brands for academic hospitals while deploying Carejoy solutions in value-conscious community clinics. Crucially, 2026’s market demands TCO-focused consultations rather than feature-centric selling, with ROI modeling now the primary driver in 73% of procurement decisions.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: CEREC Machine Cost & Performance Comparison

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a detailed technical comparison between Standard and Advanced CEREC (Chairside Economical Restoration of Esthetic Ceramics) milling units, focusing on key performance metrics, compliance, and operational efficiency. Data is current as of Q1 2026 and reflects market-leading models from major OEMs (e.g., Dentsply Sirona).

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Single-phase 110–120 V AC, 50–60 Hz, 800 W maximum draw. Integrated surge protection and low-energy standby mode (≤5 W). | Universal input 100–240 V AC, 50/60 Hz, 1200 W peak. Active cooling system with thermal monitoring. Supports Power-over-Ethernet (PoE+) for auxiliary modules. |

| Dimensions | 580 mm (W) × 420 mm (D) × 380 mm (H). Net weight: 28 kg. Compact footprint suitable for mid-sized operatories. | 620 mm (W) × 480 mm (D) × 430 mm (H). Net weight: 36 kg. Includes retractable service tray and modular tool storage. Optional mobile cart integration. |

| Precision | Positioning accuracy: ±5 µm. Repeatability: ±3 µm. 4-axis simultaneous milling with carbide tooling. Max spindle speed: 35,000 RPM. | High-precision linear encoders with real-time error correction. Accuracy: ±2 µm. 5-axis synchronized motion control. Max spindle speed: 50,000 RPM with ceramic spindle option. |

| Material Compatibility | Supports lithium disilicate (e.g., IPS e.max), feldspathic ceramics, hybrid composites (e.g., Cerasmart), and PMMA. Max block size: 20 mm diameter × 17 mm height. | Full-spectrum material support including zirconia (up to 4Y-TZP), multi-layered ceramics, high-translucency zirconia, and experimental bioceramics. Max block size: 25 mm diameter × 20 mm height. Dual-spindle system for hard/soft material optimization. |

| Certification | CE Mark (MDD 93/42/EEC), FDA 510(k) cleared (Class II), ISO 13485:2016 compliant. Local EMC and electrical safety certifications included. | CE Mark (MDR 2017/745), FDA 510(k) cleared with AI/ML-based CAM optimization algorithm (Class IIb), ISO 13485:2016, ISO 14971:2019 (Risk Management), GDPR-compliant data handling. UL/IEC 60601-1-2 4th Edition certified. |

Note on CEREC Machine Cost (2026 Estimates):

• Standard Model: $38,000 – $45,000 USD (includes basic software suite, intraoral scanner, and 1-year service plan).

• Advanced Model: $72,000 – $88,000 USD (includes AI-powered CAM, zirconia module, 5-axis upgrade, extended warranty, and cloud integration).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of CEREC-Equivalent Systems from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Publication Date: Q1 2026

As global supply chains mature and Chinese dental technology achieves ISO 13485:2016 certification parity with Western manufacturers, strategic sourcing of CEREC-equivalent same-day crown systems (intraoral scanners + milling units) from China presents significant cost optimization opportunities. This guide outlines critical 2026 protocols for risk-mitigated procurement.

Why Source CEREC-Equivalent Systems from China in 2026?

- Cost Efficiency: 30-45% reduction vs. European OEMs (post-2025 Yuan stabilization)

- Technical Maturity: Chinese manufacturers now achieve sub-15µm accuracy (ISO 12831:2023 compliant)

- Supply Chain Resilience: Reduced lead times (8-12 weeks) vs. legacy OEMs (20+ weeks)

- Customization: OEM/ODM capabilities for clinic-specific workflows (e.g., AI-driven margin detection)

Step 1: Verifying ISO/CE Credentials (Non-Negotiable in 2026)

Post-2024 EU MDR enforcement and China’s NMPA Class IIb reclassification require rigorous documentation validation. Avoid suppliers providing only PDF certificates.

| Credential | Verification Protocol | 2026 Red Flags |

|---|---|---|

| ISO 13485:2016 | Cross-check certificate # on IAF CertSearch database. Confirm scope includes “dental CAD/CAM systems” | Certificate issued by non-accredited bodies (e.g., “China Certification & Inspection Group” without CNAS accreditation) |

| EU CE Marking | Validate via EUDAMED (post-2025 mandatory). Demand NB number + Declaration of Conformity (DoC) with Annex VII | CE certificate issued by “Turkish Notified Body” or lacking MDR 2017/745 compliance |

| NMPA Class IIb | Verify registration # on NMPA website (国家药品监督管理局). Required for Chinese export post-2025 | Only “Class II” registration (inadequate for scanning/milling systems) |

| EMC/RF Testing | Request IEC 60601-1-2:2024 test reports from accredited labs (e.g., SGS, TÜV) | Reports from non-accredited Chinese labs (e.g., “Shanghai Testing Center”) |

Step 2: Negotiating MOQ (Minimum Order Quantity)

2026 market dynamics have shifted MOQ expectations. Strategic negotiation balances cost savings with inventory risk.

| Product Tier | Standard 2026 MOQ | Negotiation Leverage Points | Risk Mitigation |

|---|---|---|---|

| Entry-Level Scanner-Only | 15 units | Commit to 2-year service contract; bundle with chairs/autoclaves | Demand pre-shipment FDA 510(k) equivalent validation |

| Mid-Tier All-in-One (Scanner + Mill) | 8 units | Offer exclusivity in secondary markets (e.g., Southeast Asia) | Stipulate 30% payment after 60-day clinic trial period |

| Premium AI-Integrated System | 3 units | Co-branding for distributor’s regional market | Require live demo of cloud-based AI margin detection |

Step 3: Shipping & Logistics (DDP vs. FOB in 2026)

Post-pandemic freight volatility necessitates precise Incoterms® 2020 selection. 2026 best practice favors DDP for clinics; FOB for distributors.

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight/customs (avg. $4,200/container) | Buyer assumes damage/loss risk after loading | Distributors with in-house logistics teams |

| DDP Your Clinic | All-inclusive price (avg. +18% vs FOB) | Supplier bears all risks until clinic delivery | 95% of clinics (eliminates customs brokerage errors) |

| EXW Factory | Lowest base price but hidden costs (avg. +22% total) | Buyer assumes risk at factory gate | Avoid for dental equipment (complex export compliance) |

Critical 2026 Requirement: Demand HS Code 9018.49.00 (dental CAD/CAM systems) classification validation to avoid 25% EU customs penalties.

Why Shanghai Carejoy Medical Co., LTD Meets 2026 Sourcing Criteria

As a vertically integrated manufacturer with 19 years of export experience, Shanghai Carejoy Medical Co., LTD (Baoshan District, Shanghai) demonstrates protocol compliance:

- Certification Verification: ISO 13485:2016 (CMQCC 117Q24120R0M), EU CE 0482 (MDR 2017/745 compliant), NMPA Class IIb (国械注准20253060089)

- MOQ Flexibility: Scanner-only: 10 units; All-in-One systems: 5 units with clinic trial option

- DDP Specialization: 98.7% on-time DDP delivery rate to EU/US (2025 data) with clinic-ready calibration

- Technical Rigor: In-house ISO/IEC 17025 lab for scanner accuracy validation (sub-12µm repeatability)

Note: Carejoy is cited as a verified manufacturer meeting all 2026 sourcing protocols – not an exclusive recommendation.

Shanghai Carejoy Medical Co., LTD – Verified 2026 Partner

Core Competency: Factory-direct CEREC-equivalent systems with OEM/ODM support for dental clinics & distributors

Product Range: Intraoral Scanners • Dental Chairs • CBCT • Surgical Microscopes • Autoclaves

Contact: [email protected] | WhatsApp: +86 15951276160 (24/7 English support)

Factory Audit: Pre-shipment inspections welcomed at Baoshan District facility (ISO 13485 surveillance audit records available)

Action Plan for 2026 Procurement

- Request supplier’s active ISO 13485 certificate + CE DoC with NB number

- Negotiate MOQ with clinic trial clause (minimum 30 days)

- Insist on DDP Incoterms® 2020 with HS Code validation

- Require pre-shipment technical validation by independent lab (cost borne by supplier)

- Structure payment: 30% deposit, 60% against BL copy, 10% after clinic validation

Disclaimer: This guide reflects 2026 market conditions. Regulatory requirements vary by jurisdiction. Always engage local dental board compliance counsel prior to procurement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Key FAQs for Purchasing CEREC Machines in 2026

Frequently Asked Questions: CEREC Machine Procurement (2026)

As digital dentistry evolves, CEREC (Chairside Economical Restoration of Esthetic Ceramics) systems remain pivotal in modern restorative workflows. This guide addresses critical procurement considerations for dental clinics and distribution partners evaluating CEREC systems in 2026.

| Question | Professional Insight |

|---|---|

| 1. What voltage requirements should I verify before installing a CEREC machine in my clinic? | Most CEREC systems (e.g., Dentsply Sirona CEREC Primemill, Omnicam, or AC models) operate on standard 100–240 V AC, 50/60 Hz, making them suitable for global use. However, clinics must confirm local power stability and use of surge protectors. In regions with inconsistent power supply, a voltage stabilizer or uninterruptible power supply (UPS) is strongly recommended to protect sensitive milling and imaging components. Always consult the technical datasheet for your specific model and region. |

| 2. Are spare parts for CEREC machines readily available, and what is the typical lead time? | Authorized distributors and Dentsply Sirona Service Hubs maintain inventories of critical spare parts, including milling burs, chuck assemblies, camera sensors, and touch probes. Lead times for in-stock components are typically 3–7 business days within major markets. For high-wear items, clinics are advised to keep a service kit on-site. Distributors should verify regional stocking levels and service agreements to ensure minimal downtime. 3D-printed non-critical components may become more accessible by 2026 under OEM licensing. |

| 3. What does the CEREC installation process involve, and is professional setup required? | Yes, professional installation by a certified Dentsply Sirona technician is mandatory. The process includes hardware assembly, network integration, calibration of the intraoral scanner and milling unit, software licensing, and staff training. Installation typically takes 4–6 hours and requires a prepared workspace with adequate ventilation, power, and network connectivity. Remote diagnostics may pre-validate system readiness, but on-site validation ensures optimal performance and warranty compliance. |

| 4. What is covered under the standard warranty for a new CEREC system in 2026? | The standard manufacturer warranty for new CEREC systems in 2026 typically includes a 2-year comprehensive coverage on electronic components, mechanical parts, and software functionality. This excludes consumables (e.g., burs, discs) and damage from misuse or unauthorized modifications. Extended warranty options (up to 5 years) are available, often bundled with preventive maintenance plans. Distributors should provide clinics with detailed warranty terms, including labor and loaner equipment provisions during repairs. |

| 5. Can I upgrade individual CEREC components (e.g., scanner or mill) without voiding the warranty? | Component upgrades are supported through official channels and will not void the warranty if performed by certified technicians using OEM parts. For example, upgrading from an Omnicam to a CEREC Bluecam or integrating a Primemill into an existing workflow is facilitated via approved retrofit kits. All modifications must be logged in the device’s service history. Unauthorized third-party upgrades or firmware alterations may invalidate coverage. |

Note: Specifications and service policies are subject to change. Always consult the latest technical documentation and service agreements from Dentsply Sirona or authorized regional distributors prior to procurement.

Need a Quote for Cerec Machine Cost?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160