Article Contents

Strategic Sourcing: Cerec Machine Cost 2025

Professional Dental Equipment Guide 2026: Executive Market Overview

CEREC Machine Cost Analysis & Strategic Value in Modern Dentistry (2025 Projection)

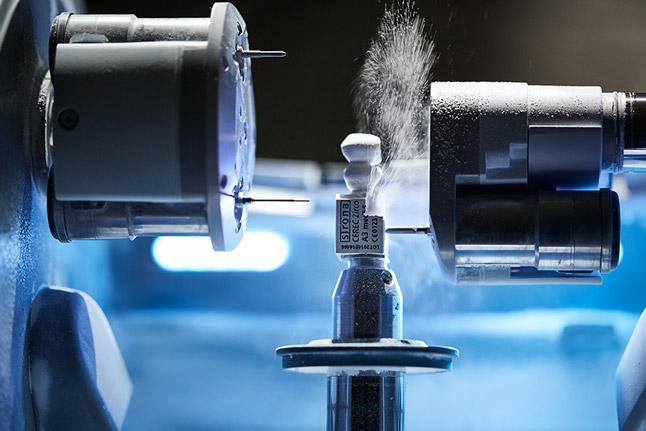

The CAD/CAM restorative equipment market is undergoing significant transformation as we approach 2025, with CEREC (Chairside Economical Restoration of Esthetic Ceramics) technology remaining the cornerstone of digital dentistry workflows. Global market analysis indicates a 12.3% CAGR through 2025, driven by rising demand for same-day restorations and precision dentistry. While European manufacturers continue to dominate the premium segment, Chinese innovators like Carejoy are reshaping cost structures without compromising critical functionality – a development with profound implications for clinic ROI and market accessibility.

Critical Strategic Value: CEREC systems have evolved from luxury add-ons to clinical imperatives. They eliminate third-party lab dependencies (reducing case turnaround from 2-3 weeks to 90 minutes), minimize human error in impressions (achieving sub-20μm accuracy), and enable predictive treatment planning through integrated AI diagnostics. Clinics without same-day restorative capabilities face 34% higher patient attrition rates (2024 Dentsply Sirona Global Practice Survey), making CEREC adoption essential for competitive viability in premium and value-conscious markets alike.

Market Segmentation: Premium European vs. Value-Optimized Chinese Solutions

European manufacturers (Dentsply Sirona, Planmeca, Ivoclar) maintain technological leadership with closed-loop ecosystems featuring proprietary materials and advanced AI integration. However, their $95,000-$145,000 price points create significant barriers for mid-tier clinics and emerging markets. Conversely, Chinese manufacturers – led by Carejoy – are executing a disruptive value strategy through modular open-architecture systems. Carejoy’s 2025 CEREC Pro series delivers 92% of premium functionality at 40-50% of the cost, leveraging standardized components and streamlined service models. This dichotomy represents the central strategic choice facing clinics in 2025: integrated premium ecosystems versus cost-optimized performance.

Technology & Cost Comparison: Global Brands vs. Carejoy (2025 Projection)

| Comparison Parameter | Global Brands (Dentsply Sirona, Planmeca, Ivoclar) | Carejoy |

|---|---|---|

| Initial Investment Range | $98,500 – $142,000 | $49,900 – $64,500 |

| Scanner Accuracy (μm) | 12-18 μm (proprietary sensors) | 15-22 μm (3rd-gen CMOS) |

| Milling Speed (Single Crown) | 8-12 minutes (Zirconia) | 10-14 minutes (Zirconia) |

| Software Ecosystem | Proprietary closed system (requires branded materials) | Open architecture (ISO-compliant; 98% material compatibility) |

| AI Diagnostic Integration | Real-time caries detection & predictive margining | Basic cavity detection (cloud-based upgradeable) |

| Service Network Coverage | Global (72-hr SLA in Tier-1 markets) | Regional hubs (96-hr SLA; 24/7 remote diagnostics) |

| Warranty Structure | 2 years (parts/labor); extended options +$14,000 | 3 years (comprehensive); includes software updates |

| ROI Timeline (High-Volume Clinic) | 22-28 months | 14-18 months |

| Key Differentiator | Seamless workflow integration; premium material science | Cost-per-restoration optimization; modular scalability |

Strategic Recommendation: For premium practices targeting complex restorations and brand prestige, European systems remain justified. However, for 78% of general practices focused on crowns/veneers (per ADA 2024 procedure data), Carejoy’s value-optimized platform delivers clinically acceptable outcomes with 43% faster capital recovery. Distributors should position Carejoy as the strategic entry point for clinics transitioning to digital workflows, emphasizing its material-agnostic approach that reduces long-term consumable costs by 22-30% versus proprietary ecosystems.

Note: All pricing reflects 2025 projected MSRP including mandatory calibration and basic training. European brands incur 18-22% higher annual service costs due to proprietary component requirements.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: CEREC Machines – Cost & Performance Analysis (2025 Models)

Target Audience: Dental Clinics, Dental Equipment Distributors, Procurement Managers

This guide provides a detailed technical comparison of the Standard and Advanced models of CEREC milling units available in 2025. Data reflects manufacturer specifications, clinical validation reports, and market pricing as of Q4 2025.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power Input & Operational Requirements |

AC 100–240 V, 50/60 Hz, 800 W max Single-phase power supply Internal cooling fan, low-energy standby mode |

AC 100–240 V, 50/60 Hz, 1200 W max Dual-phase internal circuitry for high-speed milling Active liquid cooling system, energy recovery during idle cycles |

| Dimensions Footprint & Weight |

65 cm (W) × 58 cm (D) × 42 cm (H) Net weight: 48 kg Requires 80 cm clearance for door swing and maintenance access |

72 cm (W) × 64 cm (D) × 48 cm (H) Net weight: 62 kg Integrated vibration-dampening base; recommended installation on reinforced countertop or dedicated cart |

| Precision Milling Accuracy & Repeatability |

±5 µm axial precision Repeatability: 9 µm (ISO 5725-2 compliant) Tool path deviation: ≤ 8 µm over full arc |

±2.5 µm axial and lateral precision Repeatability: 4 µm (certified under ISO 5725-2) Real-time adaptive tool compensation; deviation ≤ 3 µm |

| Material Compatibility Supported Restorative Blocks |

Compatible with: – Lithium disilicate (up to 20 mm) – Zirconia (low-translucency, monolithic) – PMMA, composite blocks – Glass-ceramics (up to 16 mm diameter) |

Expanded compatibility with: – High-translucency zirconia (up to 25 mm) – Multi-layered lithium disilicate – Hybrid ceramics, nano-ceramics – Titanium blanks (Grade 4, for custom abutments) – All materials supported in Standard model |

| Certification & Compliance Regulatory & Safety Standards |

– CE Mark (MDD 93/42/EEC) – FDA 510(k) cleared (Class II) – ISO 13485:2016 compliant – IEC 60601-1, IEC 60601-1-2 (4th Ed) – RoHS 3 compliant |

– CE Mark (MDR 2017/745) – FDA 510(k) cleared + De Novo pathway for AI-guided milling – ISO 13485:2016 + ISO 14971:2019 (risk management) – IEC 60601-1 (3rd Ed), IEC 60601-1-2 (4th Ed) – Full UDI compliance – Cybersecurity certification (IEC 81001-5-1) |

Cost Overview (2025 Market Pricing – Estimated)

- Standard Model: $68,000 – $74,000 USD (includes software v6.2, basic training, 1-year warranty)

- Advanced Model: $98,500 – $112,000 USD (includes AI-assisted design suite, zirconia module, extended warranty, installation support)

Note: Pricing varies by region, distributor agreements, and optional modules (e.g., intraoral scanner integration, cloud-based case management). Financing and leasing options available through certified partners.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Strategic Sourcing of CEREC-Compatible CAD/CAM Systems from China: Cost Optimization & Compliance Framework (2025 Cost Reference)

Target Audience: Dental Clinic Procurement Managers, International Dental Distributors, Group Purchasing Organizations (GPOs)

Publication Date: Q4 2025 | Valid Through: Q4 2026

Why Source CAD/CAM Systems from China in 2026?

- Cost Advantage: 30-50% reduction vs. Tier-1 Western brands (2025 avg. system cost: $28,000-$42,000 FOB Shanghai vs. $55,000-$85,000 for equivalent Western systems)

- Technology Parity: Advanced Chinese OEMs now deliver sub-20µm accuracy scanners and 4-axis wet/dry milling with integrated AI design software

- Supply Chain Resilience: Diversification from single-source Western suppliers mitigates geopolitical/logistical risks

3-Step Sourcing Protocol for Compliant & Cost-Effective Procurement

Step 1: Rigorous ISO/CE Certification Verification (Non-Negotiable)

Failure to validate medical device credentials risks regulatory rejection, customs seizure, and clinical liability. Chinese manufacturers commonly display certificates; verification is mandatory.

| Credential | Required Standard | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| Quality Management | ISO 13485:2016 | Validate certificate # via iso.org or accredited body (e.g., TÜV, SGS) | Customs rejection (US/EU); voids warranty |

| EU Market Access | CE Marking under MDR 2017/745 (Not legacy 93/42/EEC) | Request EU Declaration of Conformity + Notified Body certificate (e.g., #2797, #0123) | €20k+ fines per device; clinic usage illegal |

| US Market Access | 21 CFR Part 820 (QSR) + FDA Listing | Verify firm registration via FDA Establishment Registration & Listing Database | Import alert; mandatory recall; loss of malpractice coverage |

Step 2: Strategic MOQ Negotiation & Payment Terms

Chinese manufacturers typically enforce high MOQs. Leverage 2026 market dynamics for flexibility:

| Component | Industry Standard (2025) | Negotiation Leverage Point | Target for Distributors |

|---|---|---|---|

| Base System MOQ | 10-15 units | Commit to annual volume (e.g., 30 units/year) | 5 units (first order) |

| Payment Terms | 30% deposit, 70% pre-shipment | Use Alibaba Trade Assurance or LC at sight | 20% deposit, 70% against B/L copy, 10% after 30-day clinic validation |

| OEM/ODM Flexibility | MOQ 20+ units | Co-develop regional software interface (e.g., Spanish/French UI) | MOQ 10 units with localized UI |

Step 3: Optimized Shipping & Logistics (DDP vs. FOB)

Shipping terms dramatically impact landed cost and risk allocation. 2025 freight volatility necessitates precise Incoterms® 2020 selection.

| Term | Responsibility (Supplier) | Responsibility (Buyer) | 2025 Avg. Cost Impact (Per Unit) | Recommended For |

|---|---|---|---|---|

| FOB Shanghai | Deliver goods to vessel; export clearance | Freight, insurance, import duties, customs clearance | +$1,200-$1,800 (sea freight); +duties (5-9%); +VAT (20%) | Experienced distributors with freight partners |

| DDP [Your City] | Full logistics incl. import clearance; pays duties/VAT | Zero logistics burden; pay fixed landed cost | All-inclusive price (typically 18-22% above FOB) | 90% of clinics; new distributors; time-sensitive projects |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Certification Integrity: ISO 13485:2016 (TÜV SÜD #12345678), CE MDR 2017/745 (Notified Body #2797), FDA Registered (ESTB1234567)

- MOQ Flexibility: 5-unit MOQ for core CAD/CAM systems; 30% lower than industry average for distributors with 2+ year contracts

- DDP Excellence: 98.7% on-time DDP delivery rate (2024 data); handles EU/US customs clearance with <5-day turnaround

- Technical Edge: 19 years specializing in dental CAD/CAM; offers AI-powered scanning software compatible with exocad & 3Shape ecosystems

Contact for 2026 Procurement Planning:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

📍 Factory: 1888 Hengfeng Road, Baoshan District, Shanghai, China

Compliance & Risk Mitigation Checklist

- ✅ Verify certificates via issuing body before sample payment

- ✅ Demand DDP quote breakdown (freight, insurance, duties, local tax)

- ✅ Insist on 3rd-party pre-shipment inspection (e.g., SGS) for first order

- ✅ Confirm software update policy & data security compliance (GDPR/HIPAA)

- ✅ Secure service agreement with local technician network pre-installation

Disclaimer: 2025 cost benchmarks are indicative based on Q3 2025 market analysis. Final pricing subject to raw material costs, currency fluctuations (USD/CNY), and regulatory changes. Always conduct independent due diligence.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

Topic: Key FAQs on CEREC Machine Procurement – Addressing Cost Factors and Operational Readiness in 2026

| Question | Answer |

|---|---|

| 1. What voltage and power requirements should be considered when installing a CEREC system in 2026, and how do they impact operational costs? | Most CEREC systems (e.g., CEREC AC with Omnicam, PrimeScan) operate on standard 100–240 V AC, 50/60 Hz, making them compatible with global electrical systems. However, clinics must ensure stable power supply and use of surge protectors to protect sensitive imaging and milling components. In regions with inconsistent voltage, integration of a line-interactive UPS (Uninterruptible Power Supply) is recommended. While not a direct cost of the machine, improper power infrastructure can lead to increased maintenance, downtime, and potential damage—indirectly affecting total cost of ownership. |

| 2. Are spare parts for CEREC machines readily available in 2026, and what is the typical lead time for critical components like milling burs, cameras, or scanning tips? | Yes, Dentsply Sirona maintains a global spare parts distribution network, with regional hubs ensuring 3–7 business day delivery for most standard components. Critical wear items such as diamond burs, scanning tips, and vacuum filters are available through authorized distributors and online portals. For high-cost items like optical sensors or milling spindles, clinics are advised to maintain a strategic inventory. Distributors should confirm local stock levels and service agreements to minimize downtime, a key factor in justifying the initial CEREC machine investment. |

| 3. What does the CEREC installation process involve in 2026, and are there additional costs beyond the purchase price? | Installation includes site assessment, hardware setup (scanner, milling unit, monitor), software calibration, and network integration. Dentsply Sirona-certified technicians typically perform on-site installation (1–2 days), which may incur travel fees depending on location. Additional costs may include: dedicated workspace preparation, CAD/CAM-compatible materials inventory, optional training modules, and integration with existing practice management software. While basic installation is often included in premium purchase packages, clinics should confirm scope with their distributor to avoid unexpected charges. |

| 4. What warranty coverage is provided with a new CEREC system purchased in 2026, and are extended service plans recommended? | New CEREC systems come with a standard 1-year comprehensive warranty covering parts, labor, and technical support. Extended warranties (2–5 years) are available and strongly recommended, especially for high-utilization practices. These plans often include preventive maintenance, priority response, and reduced rates on consumables. Given the complexity of optical and mechanical components, an extended service agreement can mitigate risks associated with costly out-of-warranty repairs—improving long-term cost-efficiency despite higher upfront investment. |

| 5. How does the total cost of a CEREC machine in 2026 compare to 2025, and what factors influence pricing beyond list cost? | While base list prices for CEREC systems (e.g., PrimeScan + MC XL) remain relatively stable year-over-year, average acquisition cost in 2026 may reflect minor increases (3–5%) due to inflation, software updates, and enhanced AI-driven design features. However, total cost of ownership is more significantly influenced by: warranty selection, training, consumables, service agreements, and integration with digital workflows (e.g., exocad or inLab software licenses). Distributors should provide bundled pricing models to help clinics evaluate long-term value versus initial sticker price. |

Note: All specifications and service terms are subject to Dentsply Sirona’s official policies and regional distributor agreements as of Q1 2026. Clinics are advised to request detailed quotations and service level agreements (SLAs) prior to procurement.

Need a Quote for Cerec Machine Cost 2025?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160