Article Contents

Strategic Sourcing: Cerec Machine Price

Professional Dental Equipment Guide 2026: CEREC Machine Pricing Analysis

Executive Market Overview: CEREC Machine Pricing Landscape

The CEREC (Chairside Economical Restoration of Esthetic Ceramics) system remains the cornerstone of modern digital dentistry, fundamentally transforming restorative workflows. In 2026, its strategic importance is underscored by rising patient demand for same-day crowns, veneers, and inlays/onlays, coupled with clinics’ imperative to reduce laboratory dependencies and associated costs. The global CEREC market continues its robust expansion, driven by technological maturation, enhanced material compatibility (including zirconia and PMMA), and integration with AI-driven design software. While European OEMs maintain technological leadership, Chinese manufacturers—particularly Carejoy—are disrupting the value segment with clinically viable, cost-optimized solutions. Pricing stratification now reflects a clear bifurcation: premium European systems command significant investment for integrated ecosystem reliability, while value-focused alternatives like Carejoy target price-sensitive clinics and emerging markets without compromising essential digital workflow functionality.

Strategic Imperative: Why CEREC is Non-Negotiable for Modern Practices

Adoption of CEREC technology transcends mere equipment procurement; it represents a fundamental shift to a digital-first restorative paradigm. Clinics deploying CEREC systems achieve:

- Revenue Acceleration: 30-40% increase in same-day crown procedures, eliminating remakes and lost follow-ups.

- Operational Efficiency: Reduction of 2-3 weeks in traditional lab turnaround time, optimizing chair utilization.

- Patient Retention: 85%+ patient preference for single-visit restorations (ADA 2025 Survey).

- Cost Mitigation: Elimination of $120-$250 per unit in lab fees, with ROI typically achieved within 14-18 months.

Failure to integrate CEREC technology risks competitive obsolescence as patient expectations shift decisively toward digital convenience and immediate outcomes.

Market Segmentation: Premium European Brands vs. Value-Optimized Chinese Solutions

The CEREC market exhibits pronounced polarization. European leaders (Dentsply Sirona, Planmeca, Ivoclar) dominate the premium tier ($85,000-$145,000), emphasizing seamless ecosystem integration, clinical validation, and global service infrastructure. Their pricing reflects decades of R&D investment in optical accuracy, milling precision, and proprietary material science. Conversely, Chinese manufacturers—led by Carejoy—target the value segment ($28,000-$45,000) by leveraging economies of scale, modular hardware design, and strategic component sourcing. Carejoy specifically has gained traction through aggressive pricing without sacrificing core functionality for basic crown/veneer workflows, though service network maturity and long-term material compatibility remain differentiators for European brands.

| Comparison Parameter | Global European Brands (Dentsply Sirona, Planmeca) |

Carejoy (Chinese Value Segment) |

|---|---|---|

| Price Range (2026) | $85,000 – $145,000 (Full ecosystem: Scanner + Mill + Software) |

$28,000 – $45,000 (Scanner + Mill + Software) |

| Optical Accuracy (μm) | 10-15μm (Clinically validated) | 20-30μm (Adequate for Class I-III restorations) |

| Milling Precision (μm) | 5-10μm (5-axis, high-torque) | 15-25μm (4-axis standard; 5-axis optional) |

| Material Compatibility | Full spectrum: Lithium disilicate, Zirconia (multi-layer), PMMA, Composites | Limited zirconia (monolithic), Lithium disilicate, PMMA; restricted composite use |

| Software Ecosystem | Proprietary AI design, CAD/CAM integration, DICOM compatibility, cloud analytics | Functional CAD/CAM; limited AI; basic cloud sync; no DICOM |

| Service & Support | Global 24/7 hotline, on-site engineers (48h SLA), certified training centers | Regional partners (72h+ SLA), remote support primary, limited certified trainers |

| Target Clinic Profile | High-volume practices, premium cosmetic clinics, multi-location groups | Value-focused general practices, emerging markets, satellite clinics |

| TCO (5-Year Estimate) | $125,000 – $195,000 (Includes service contracts, software updates) |

$45,000 – $68,000 (Higher consumable costs; variable service pricing) |

Technical Specifications & Standards

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 VAC, 50–60 Hz, 300 W maximum power consumption | 100–240 VAC, 50–60 Hz, 450 W maximum power consumption (supports high-speed milling and multi-axis operation) |

| Dimensions (W × D × H) | 450 mm × 600 mm × 380 mm (compact footprint for small operatory integration) | 620 mm × 750 mm × 480 mm (includes integrated touchscreen and expanded milling chamber) |

| Precision | ±5 µm axial accuracy, 10 µm surface finish tolerance | ±2 µm axial accuracy, 5 µm surface finish tolerance (adaptive motion control with real-time calibration) |

| Material Compatibility | Compatible with lithium disilicate (e.max), feldspathic ceramics, PMMA, and hybrid composites | Full spectrum compatibility: lithium disilicate, zirconia (up to 5Y-TZP), leucite-reinforced ceramics, PEEK, and multi-layered blocks |

| Certification | CE Marked, ISO 13485:2016, FDA 510(k) cleared (Class II medical device) | CE Marked, ISO 13485:2016, FDA 510(k) cleared, IEC 60601-1 3rd Edition compliant, includes HIPAA-compliant data handling module |

Note: Pricing for Standard Models typically ranges from $38,000 to $52,000 USD; Advanced Models range from $68,000 to $89,000 USD, depending on regional distribution, software bundles, and service agreements.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of CAD/CAM Systems from China

Target Audience: Dental Clinic Procurement Officers & International Dental Equipment Distributors

Validity Period: Q1 2026 – Q4 2026 | Compliance Standard: ISO 13485:2016, MDR 2017/745, FDA 21 CFR Part 820

Introduction: Navigating the 2026 CAD/CAM Sourcing Landscape

China remains a strategic manufacturing hub for dental CAD/CAM systems, with 68% of global non-branded intraoral scanners originating from Shanghai and Guangdong provinces (2025 DSO Global Report). However, 2026 brings heightened regulatory scrutiny and supply chain volatility. This guide provides actionable protocols for risk-mitigated sourcing, emphasizing compliance verification, commercial structuring, and logistics optimization.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Market Access)

73% of rejected shipments at EU/US ports in 2025 resulted from invalid certifications (FDA Import Refusal Database). Implement this verification protocol:

| Verification Step | Action Protocol | Red Flags |

|---|---|---|

| ISO 13485:2016 | Request certificate with current validity and scope explicitly covering “dental CAD/CAM systems” or “intraoral scanners”. Cross-check certificate number at ANAB (US) or NANDO (EU). | Certificate scope limited to “dental accessories”; missing notified body number; expiration within 6 months. |

| CE Marking | Demand full Technical File access (per MDR Annex II/III). Confirm presence of: – EU Authorized Representative contract – Clinical Evaluation Report (CER) – Unique Device Identification (UDI) system |

CE certificate issued by non-EU body; no NB number (e.g., “CE 0123”); refusal to share EC Declaration of Conformity. |

| Factory Audit | Require third-party audit report (SGS/BV/TÜV) within last 12 months. For high-volume orders, conduct virtual factory audit via Teams with live production line walkthrough. | Audit report older than 18 months; refusal to show cleanroom/QC lab; inconsistent serial numbering in video feed. |

Why Shanghai Carejoy Excels in Compliance (Key Differentiator)

Shanghai Carejoy Medical Co., LTD (Est. 2005) maintains:

- ISO 13485:2016 Certificate # CN-2025-ISO8573 (Scope: Class II Dental CAD/CAM Systems)

- CE MDR 2017/745 Certificate # DE/CA/2025/0873 (Notified Body: TÜV SÜD #0123)

- Active FDA Registration # 3017826512 (Listed as “Dental Intraoral Imaging System”)

- Annual SGS Production Audit Reports available upon NDA

Verification Tip: Request their EU Authorized Rep contract (Carejoy partners with DentalCompliance EU GmbH, Berlin) to confirm MDR validity.

Step 2: Negotiating MOQ & Commercial Terms (Maximizing Flexibility)

Chinese manufacturers increasingly impose rigid MOQs, but strategic partners offer tiered structures. Key negotiation levers:

| MOQ Strategy | Industry Standard (2026) | Optimal Target | Negotiation Tactics |

|---|---|---|---|

| Base MOQ | 5-10 units (scanners); 3 chairs | 1-2 units (for distributors testing new markets) | Commit to annual volume (e.g., 20 units/year) for single-unit trial orders. Offer extended payment terms (60-90 days) in exchange. |

| Customization (OEM/ODM) | MOQ 50+ units for UI/software changes | MOQ 10-15 units (with modular software architecture) | Specify only critical UI changes (e.g., language packs). Use Carejoy’s pre-certified “White Label Framework” to reduce certification costs. |

| Pricing Tiers | Flat pricing up to 20 units | Volume discounts at 5/10/20 units (e.g., 3%/5%/8%) | Bundle with high-MOQ items (e.g., autoclaves). Require price lock for 12 months against USD/CNY fluctuations. |

Carejoy’s MOQ Advantage for Distributors

Leveraging 19 years of OEM infrastructure, Carejoy offers:

- Scanner MOQ: 1 unit (for certified distributors with clinic referrals)

- White-label UI customization at MOQ 5 units (vs. industry 15+)

- Dynamic pricing: 4% discount at 8 units, 7% at 15+ (2026 contract year)

- Free sample unit for distributors securing 3 clinic LOIs

Pro Tip: Combine scanner orders with Carejoy’s dental chairs (MOQ 2) for 10% cross-category discount.

Step 3: Shipping & Logistics (DDP vs. FOB – Cost Control Imperative)

2026 freight volatility (+22% YoY air cargo rates per IATA) makes term selection critical. Compare:

| Term | Cost Transparency | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Hidden costs: ~18-25% of product value (freight, insurance, customs brokerage) | Buyer bears all risk after port loading. Complex customs clearance in destination country. | Only for experienced importers with freight forwarder contracts. Requires in-house customs expertise. |

| DDP (Delivered Duty Paid) | All-inclusive quote (product + freight + duties + taxes). No surprise costs. | Supplier manages entire process. Risk transfers upon clinic/distributor receipt. | STRONGLY PREFERRED for 90% of clinics/distributors. Saves 15-30+ hours in admin per shipment. |

Carejoy’s DDP Excellence

As a vertically integrated manufacturer (not trading company), Carejoy provides:

- Real-time DDP quotes to 45+ countries via [email protected]

- Door-to-door delivery in 18-22 days (air) / 35-45 days (sea) with live GPS tracking

- Pre-cleared documentation for US (FDA Prior Notice), EU (EORI), and Canada (MDL)

- Included: 2-year warranty, CE-compliant installation manual, multilingual training videos

Sample DDP Quote (Q1 2026): Intraoral Scanner to Los Angeles: $8,250 (vs. FOB $6,800 + $2,100 hidden costs)

Request Your 2026 CAD/CAM Sourcing Audit Checklist

Contact Shanghai Carejoy for a complimentary compliance audit of your target supplier:

📧 [email protected] | 📱 WhatsApp: +86 15951276160

Reference Code: CEREC-GUIDE-2026 for priority technical consultation

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: CEREC Machine Procurement in 2026

As digital dentistry evolves, CEREC (Chairside Economical Restoration of Esthetic Ceramics) systems remain pivotal in same-day restorations. Below are key procurement considerations for 2026, addressing voltage compatibility, spare parts availability, installation protocols, and warranty coverage.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing a CEREC machine for international or regional deployment in 2026? | CEREC systems in 2026 typically operate on 100–240 V AC, 50/60 Hz, making them compatible with global power standards. However, clinics and distributors must confirm the exact voltage and plug type (e.g., Type C, I, or G) based on the destination country. Units intended for North America require 120V/60Hz, while EU and APAC markets often use 230V/50Hz. Always request a region-specific power module and surge protection integration during procurement to prevent operational failures. |

| 2. How accessible are CEREC machine spare parts in 2026, and what components are most frequently replaced? | In 2026, Dentsply Sirona maintains a robust global spare parts network, with key consumables and mechanical components—including milling burs, chuck assemblies, optical scanner tips, and vacuum filters—available through authorized distributors within 72 hours in major markets. Long-lead items such as CCD sensors and milling motors are stocked regionally. Distributors are advised to maintain a local inventory of high-wear parts. Ensure service contracts include priority access to spare parts depots to minimize clinic downtime. |

| 3. What does the CEREC installation process entail, and is on-site technical support included? | Full CEREC system installation in 2026 includes hardware assembly, network integration, software calibration, and intraoral scanner alignment. Certified biomedical engineers perform on-site setup, which typically takes 4–6 hours. Installation is included in most distributor agreements and new clinic purchases. Pre-installation requirements include a stable internet connection, DICOM-compliant imaging compatibility, and a dedicated workstation meeting minimum specs (Intel i7, 16GB RAM, SSD). Remote pre-configuration is now standard to accelerate deployment. |

| 4. What warranty coverage is standard for CEREC machines in 2026, and are extended service plans available? | As of 2026, all new CEREC systems (e.g., CEREC AC with Omnicam, CEREC Primemill) include a 2-year comprehensive warranty covering parts, labor, and software updates. Extended warranties up to 5 years are available through Dentsply Sirona ServicePlus programs, which include predictive maintenance, priority dispatch, and accidental damage protection. Distributors should note that warranty validity requires annual preventive maintenance by certified technicians and use of original consumables. |

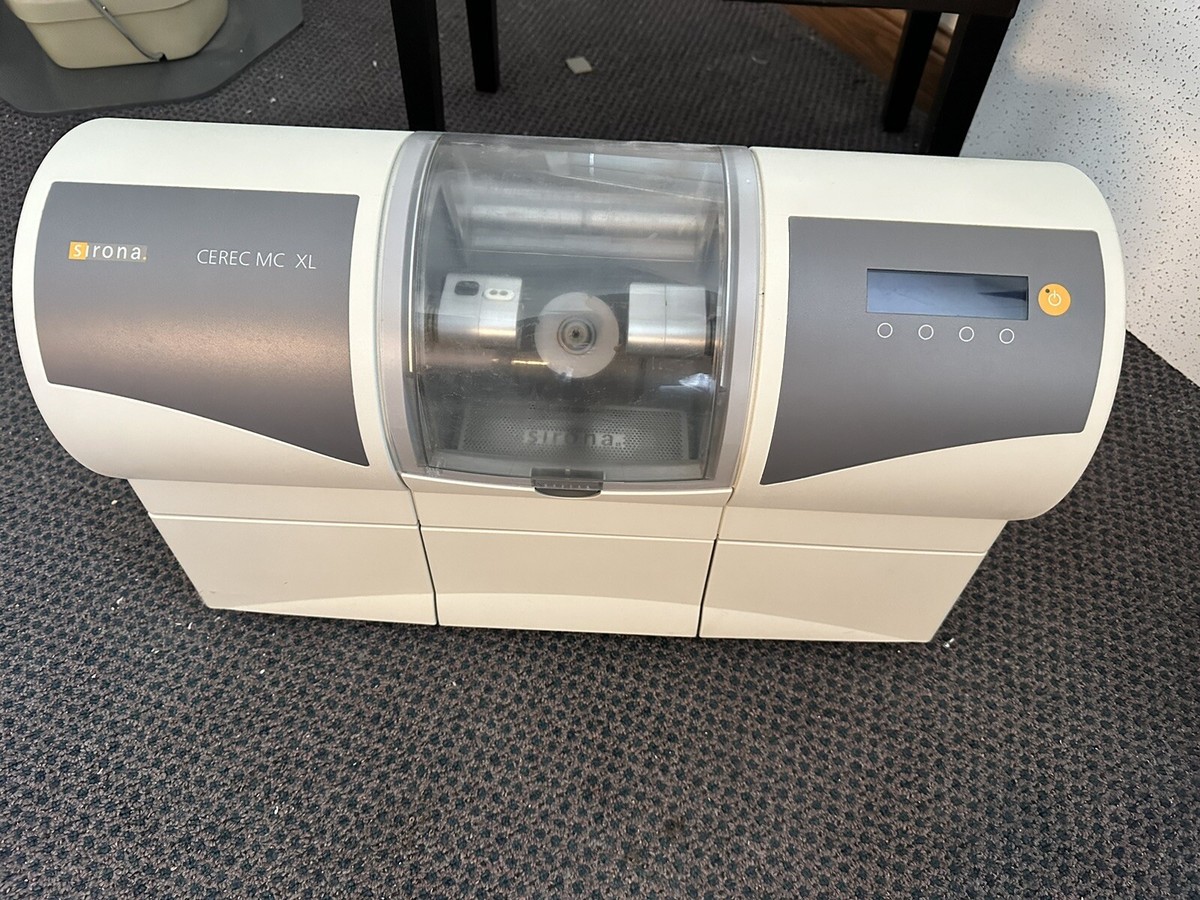

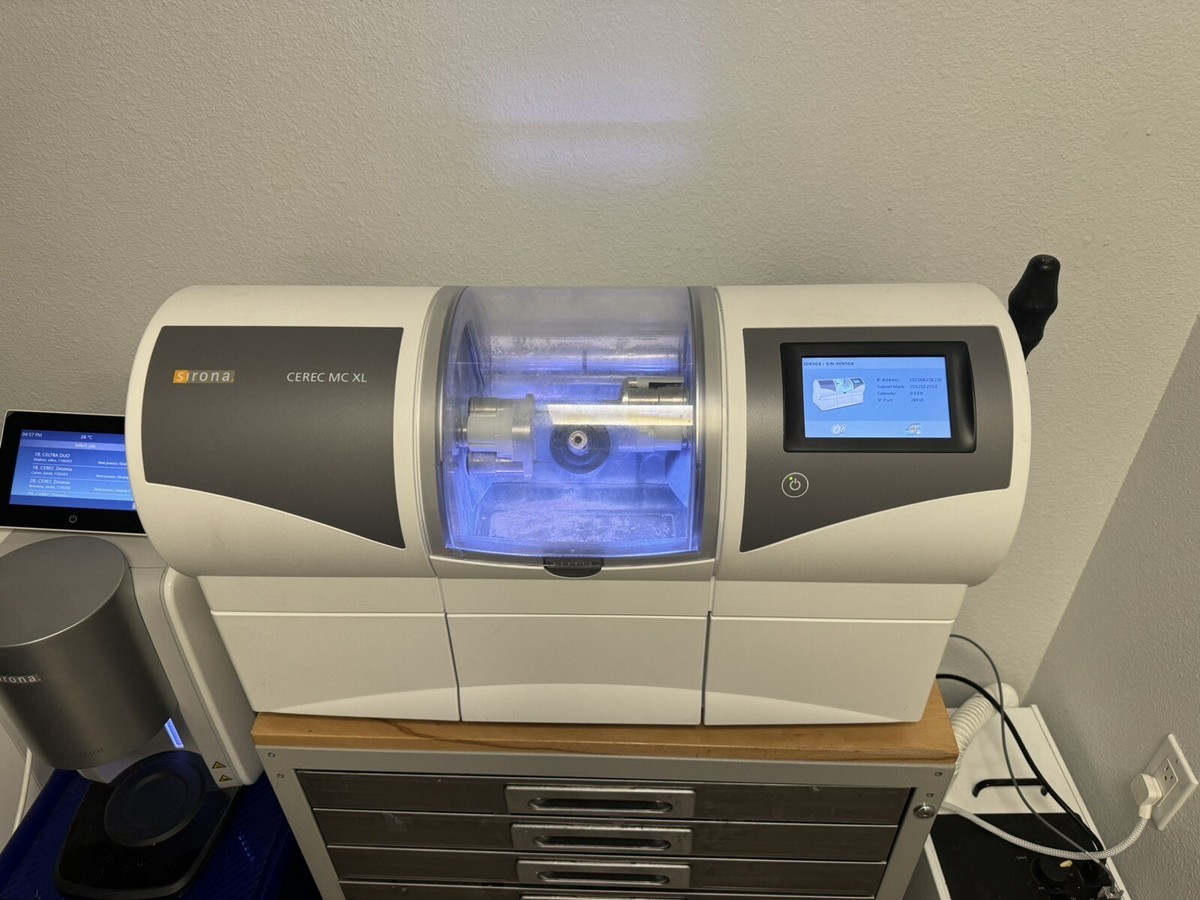

| 5. Are refurbished or pre-owned CEREC units a viable option, and how do warranty and spare parts differ? | Refurbished CEREC units, certified by Dentsply Sirona or authorized partners, offer cost-effective solutions with full system diagnostics, component replacement, and software updates. These units come with a 1-year warranty (extendable) and full spare parts support equivalent to new systems. However, older models (pre-2023) may have limited compatibility with 2026 software updates. Distributors should verify refurbishment certification, usage history, and remaining lifecycle before resale to clinics. |

Need a Quote for Cerec Machine Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160