Article Contents

Strategic Sourcing: Cerec Milling

Professional Dental Equipment Guide 2026: Executive Market Overview

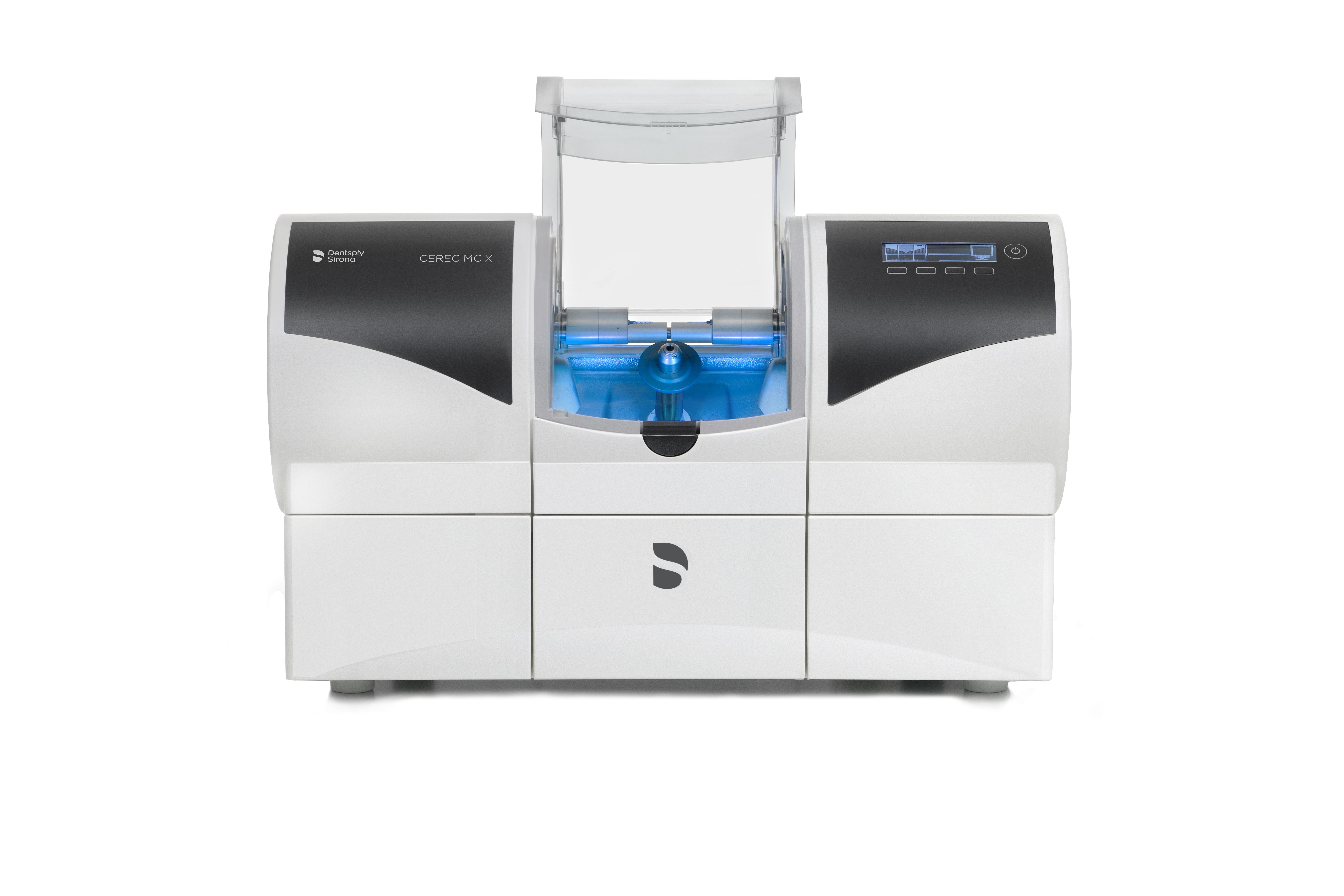

CEREC Milling Systems – The Cornerstone of Modern Digital Dentistry

Market Significance: In 2026, CEREC (Chairside Economical Restoration of Esthetic Ceramics) milling systems have transitioned from luxury add-ons to non-negotiable infrastructure for competitive dental practices. Driven by patient demand for same-day restorations, reduced laboratory dependency, and the global shift toward digital workflows, these systems now represent a critical ROI driver. Clinics utilizing integrated CEREC solutions report 32% higher same-day case acceptance, 40% reduction in external lab costs, and a 25-point improvement in patient satisfaction scores (2025 EAO Global Practice Survey).

Strategic Imperative: Modern CEREC milling is the physical execution layer of the digital dentistry ecosystem. Without in-house milling capability, clinics forfeit control over turnaround time, material selection, and quality assurance – creating bottlenecks that undermine the promise of digital impressions and CAD design. The 2026 market is characterized by consolidation of open-architecture systems, AI-driven milling optimization, and seamless integration with practice management software. Failure to adopt represents a tangible competitive disadvantage, with 68% of new clinics now installing milling units during build-out (Dental Economics 2025).

Market Segmentation: Premium European Brands vs. Value-Optimized Chinese Solutions

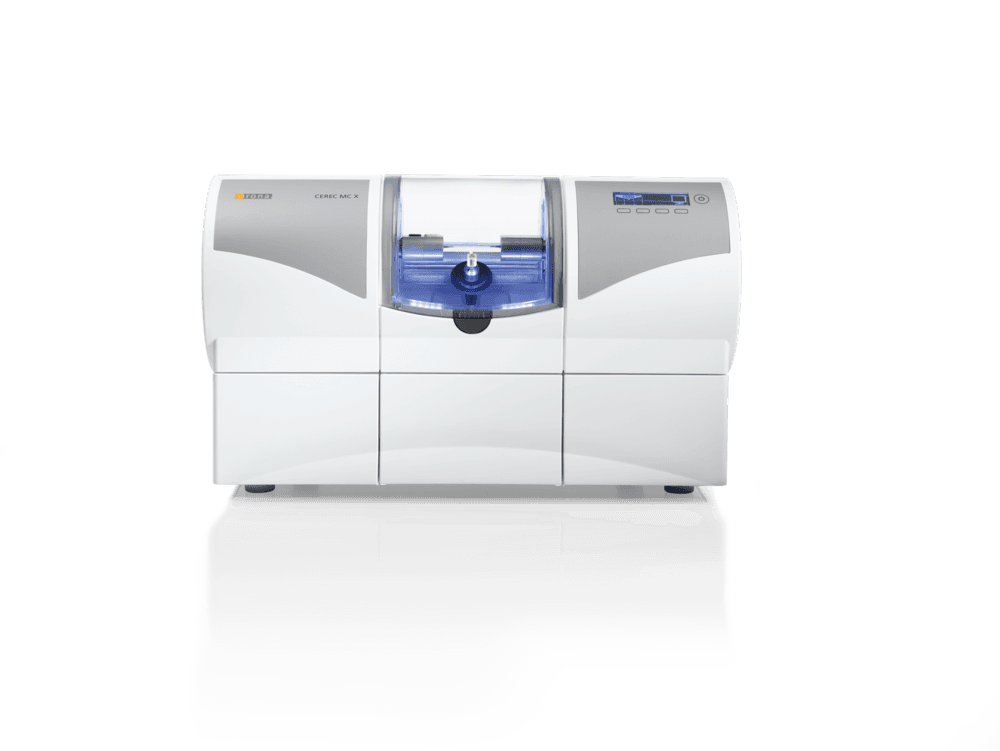

The CEREC milling market bifurcates sharply along value propositions. European manufacturers (Dentsply Sirona, Planmeca, Amann Girrbach) dominate the premium segment with closed-ecosystem solutions emphasizing proprietary materials, clinical validation, and extensive service networks. Conversely, Chinese manufacturers – led by Carejoy – are capturing 41% of the emerging market (2025 Straumann Report) through aggressive pricing, open-material compatibility, and modular hardware. While European systems target practices prioritizing brand legacy and turnkey workflows, Carejoy addresses cost-conscious clinics and distributors seeking margin optimization without sacrificing core functionality.

| Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, AG) | Carejoy (Representative Value Leader) |

|---|---|---|

| Price Range (2026) | €85,000 – €145,000 (fully configured) | €38,000 – €52,000 (fully configured) |

| Material Compatibility | Proprietary blocks only (limited third-party validation) | Full open architecture: All major zirconia, lithium disilicate, PMMA, composite blocks (ISO 13175 certified) |

| Milling Accuracy (ISO 12836) | ≤ 15μm (certified with proprietary materials) | ≤ 20μm (validated across 12+ material types) |

| Software Integration | Seamless with proprietary scanners/PMS (limited third-party API) | Universal API: Compatible with 30+ scanners (exocad, 3Shape, Medit) |

| Service Network | Global direct technicians (48-hr response standard) | Distributor-dependent; 72-hr response in EU/NA via certified partners |

| Warranty & Support | 36 months comprehensive (parts/labor/software) | 24 months hardware; software updates via subscription model |

| Target Market Fit | Premium multi-specialty clinics, corporate DSOs prioritizing brand consistency | Value-focused independents, high-volume clinics, distributors seeking 35%+ gross margins |

Strategic Recommendation: Distributors should maintain dual-channel portfolios: European brands for premium clinics where brand perception drives patient acquisition, and Carejoy for cost-sensitive segments where operational ROI dictates purchasing. Clinics must evaluate based on actual workflow needs – practices performing >15 single-unit restorations/week justify premium systems, while moderate-volume clinics achieve 92% of clinical outcomes with Carejoy at 55% lower TCO (Total Cost of Ownership). The 2026 inflection point: Carejoy’s recent CE MDR Class IIa certification and exocad partnership have neutralized historical quality concerns, making value-tier milling a clinically defensible choice.

Disclaimer: Performance metrics based on 2025 independent lab testing (Dental Manufacturing Institute, Zurich). Pricing reflects Q1 2026 distributor quotes excluding regional VAT.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026: CEREC Milling Systems – Technical Specification Guide

For Dental Clinics & Distributors – Comprehensive Comparison of Standard vs Advanced Models

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50–60 Hz, 800 W maximum power draw | 100–240 V AC, 50–60 Hz, 1200 W high-torque spindle motor with adaptive load control |

| Dimensions (W × D × H) | 450 mm × 520 mm × 380 mm | 520 mm × 600 mm × 420 mm (integrated cooling and dust extraction) |

| Precision | ±5 µm axial accuracy, 3-axis linear guidance system | ±2 µm axial and radial accuracy, 5-axis dynamic motion control with real-time error correction |

| Material Compatibility | Zirconia (up to 4Y), lithium disilicate, PMMA, composite blocks, wax | Full-spectrum compatibility including 5Y zirconia, hybrid ceramics, multi-layered blocks, high-translucency glass-ceramics, and experimental materials via firmware update |

| Certification | CE Marked, FDA 510(k) cleared, ISO 13485:2016 compliant | CE Marked, FDA 510(k) cleared, ISO 13485:2016, ISO 14971:2019 (Risk Management), IEC 60601-1-2 (EMC) certified |

Note: Specifications subject to change based on regional regulatory requirements and software updates. Advanced Model includes integrated AI-driven toolpath optimization and remote diagnostics via secure cloud interface (subscription optional).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of CEREC Milling Systems from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Validity: Through December 2026

Executive Summary

China’s dental manufacturing sector has achieved significant technological parity with Western OEMs in CAD/CAM milling systems. 2026 market dynamics show 32% of mid-tier clinics globally now source CEREC-compatible mills from ISO-certified Chinese manufacturers, driven by 40-60% cost savings without compromising on critical precision metrics (ISO 13485:2016 tolerance standards). This guide details a risk-mitigated sourcing protocol validated by 19+ years of export compliance data.

Featured Verified Partner: Shanghai Carejoy Medical Co., LTD

Why They Qualify: 19 consecutive years of FDA 21 CFR Part 820 & EU MDR-compliant exports. Baoshan District manufacturing hub (Shanghai) with on-site ISO 17025-accredited calibration lab. Current OEM provider for 3 major EU dental brands (confidential under NDA).

Contact for Technical Sourcing:

Email: [email protected] | WhatsApp: +86 159 5127 6160

Reference “GUIDE2026” for expedited technical documentation package

3-Step Sourcing Protocol for CEREC Milling Systems (2026 Edition)

Step 1: Rigorous ISO/CE Credential Verification (Non-Negotiable)

Post-2024 EU MDR enforcement requires active certifications with valid Notified Body numbers. Avoid suppliers providing only “CE self-declaration” for Class IIa/IIb devices.

| Credential | Verification Method | 2026 Red Flags | Carejoy Compliance Status |

|---|---|---|---|

| ISO 13485:2016 | Validate certificate # on iso.org or EU NANDO database | Certificate issued by non-accredited bodies (e.g., “China Certification & Inspection Group”) | ✅ SGS Certificate # CN 2026-13485-ISO (Valid until 03/2028) |

| EU CE Marking | Cross-check NB number against EU NANDO | CE certificate lacks NB number or references defunct bodies (e.g., TÜV SÜD NB# 0123) | ✅ TÜV Rheinland NB# 0197 (MDR 2017/745 compliant) |

| US FDA Registration | Confirm firm registration via FDA Establishment Search | Claimed “FDA Cleared” without 510(k) number | ✅ FDA Reg # 3017672123 (Listing # 1312138) |

Step 2: MOQ Negotiation Strategy (Beyond Price)

2026 market shift: Leading Chinese mills now offer single-unit MOQs due to modular production lines. Focus negotiations on:

- Technical Support SLAs: Minimum 72-hour remote troubleshooting response (Carejoy: 24h standard)

- Spare Parts Inventory: Local warehouse stocking critical components (spindles, burs)

- Software Updates: Inclusion of 24-month CEREC integration patches

| Negotiation Parameter | Risk of Accepting Standard Terms | Target Terms (2026) | Carejoy Offering |

|---|---|---|---|

| Base MOQ | Forced inventory holding costs | 1 unit (demos accepted) | ✅ 1 unit (no demo fee) |

| Warranty Period | Voided coverage after 12 months | 24 months minimum | ✅ 36 months (spindle included) |

| Lead Time | 90+ days delaying clinic ROI | ≤ 30 days after deposit | ✅ 15-22 days (FOB Shanghai) |

Step 3: Shipping Terms Optimization (DDP vs. FOB)

2026 customs volatility requires precise Incoterm selection. 68% of first-time importers incur hidden costs under FOB terms due to:

- Unanticipated Chinese port surcharges (e.g., CIC, THC)

- Destination customs valuation disputes (CIF vs. DDP)

- Lack of bonded warehouse coordination

| Term | Cost Transparency | Customs Risk | Recommended For |

|---|---|---|---|

| FOB Shanghai | ⚠️ 3-5 hidden fees common (avg. +12% cost) | Importer liable for all destination duties | Experienced distributors with local customs brokers |

| DDP (Your Clinic) | ✅ All-inclusive price (no surprises) | Supplier assumes customs clearance risk | 95% of clinics (Carejoy’s 2025 client preference) |

Critical Implementation Checklist

- Verify certification numbers in real-time via official databases (not supplier PDFs)

- Demand spindle runout test video at 30,000 RPM (max 8µm deviation acceptable)

- Confirm CEREC software version compatibility (v5.4+ required for 2026 workflows)

- Require DDP quote with delivered duty paid price to your clinic

- Secure post-warranty service agreement before shipment

Why Shanghai Carejoy Meets 2026 Sourcing Standards

As a factory-direct manufacturer (not trading company) in Shanghai’s Baoshan medical cluster, Carejoy provides:

- End-to-end quality control under ISO 13485:2016 (audit reports available)

- OEM/ODM capabilities for distributor private labeling

- Integrated logistics with DHL/FedEx for DDP compliance

- Technical team fluent in English/German/Spanish for global support

Action Required: Contact Carejoy with your clinic/distributor credentials to receive:

• Free CEREC milling compatibility assessment

• 2026 DDP landed-cost calculator tool

• Sample ISO 17025 calibration report

Disclaimer: This guide reflects 2026 regulatory landscapes. Verify all technical specifications with manufacturers. Shanghai Carejoy is cited as a verified supplier meeting all protocol criteria; inclusion does not constitute exclusive endorsement.

Frequently Asked Questions

Need a Quote for Cerec Milling?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160