Article Contents

Strategic Sourcing: Cerec Suction Unit

Professional Dental Equipment Guide 2026

Executive Market Overview: CEREC Suction Units in Modern Digital Dentistry

Strategic Imperative: Integrated high-performance suction units are no longer ancillary equipment but a mission-critical component of CEREC (Chairside Economical Restoration of Esthetic Ceramics) workflows. As digital dentistry transitions from optional enhancement to clinical standard, the symbiotic relationship between intraoral scanners, milling units, and precision suction systems directly impacts restoration accuracy, clinician efficiency, and patient throughput. Moisture control during optical scanning and aerosol management during milling are non-negotiable prerequisites for sub-20-micron margin accuracy and uninterrupted same-day workflows.

Market Dynamics: The global CEREC suction unit market (valued at $285M in 2025) is bifurcating along value-engineering lines. European OEMs maintain dominance in premium clinics demanding turnkey integration with flagship CEREC systems, while Chinese manufacturers—led by Carejoy—are capturing volume in value-conscious markets and emerging economies through aggressive cost optimization. This divergence reflects fundamental trade-offs between total cost of ownership (TCO) and operational resilience.

Technical Criticality: Suboptimal suction performance induces three failure modes in digital workflows: (1) Scan distortion from residual saliva/fog on tooth surfaces, (2) Milling vibration from inadequate aerosol evacuation causing tool path deviation, and (3) Cross-contamination risks during multi-patient sessions. Modern units must deliver consistent 32+ L/min vacuum flow at the handpiece tip with <15 dBA noise variance during duty cycling—a specification where legacy systems frequently underperform.

Strategic Brand Comparison: Global Premium vs. Cost-Optimized Solutions

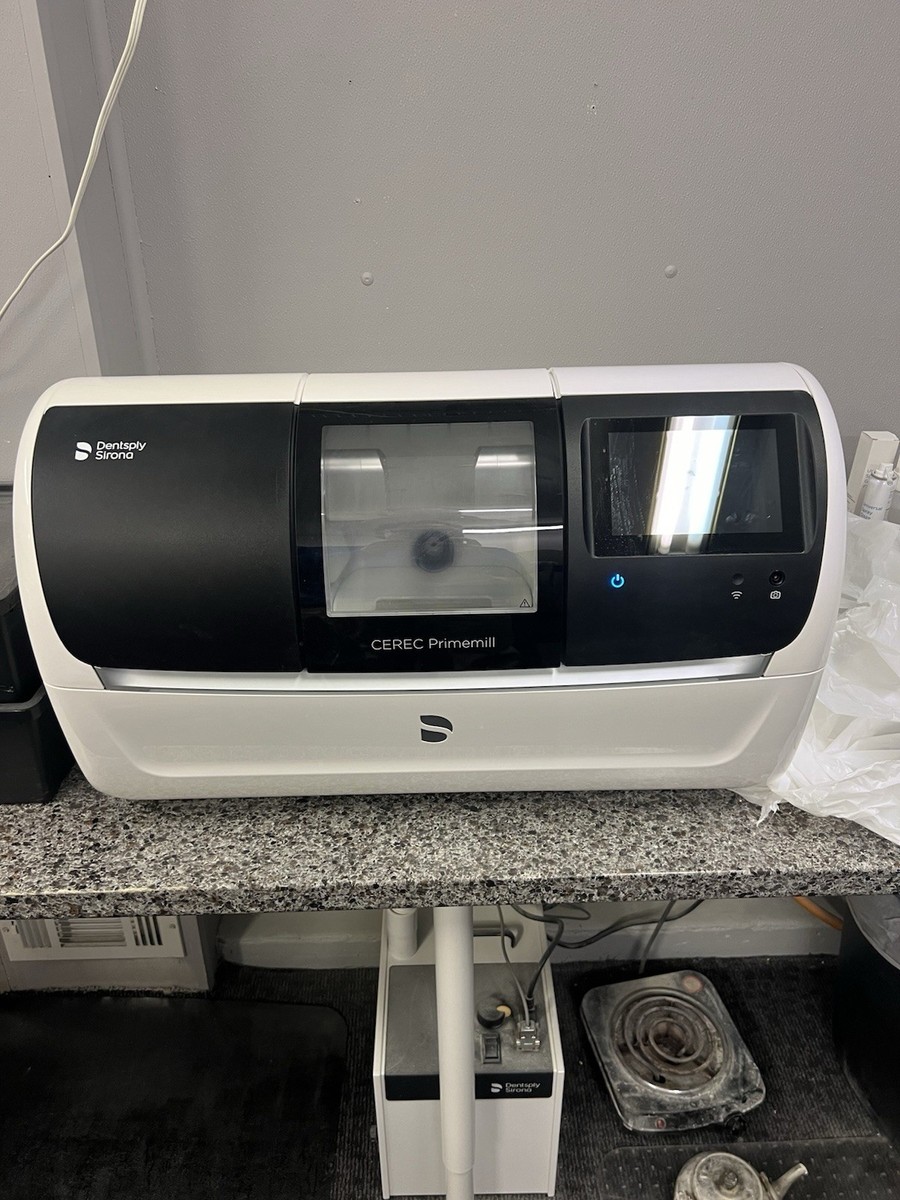

The following analysis contrasts established European manufacturers with Carejoy (representing the advanced tier of Chinese OEMs). All specifications reflect 2026 model-year units compatible with Dentsply Sirona CEREC Primemill and similar platforms.

| Parameter | Global Premium Brands (Dürr Dental, Planmeca, Kavo Kerr) |

Carejoy (Model CJ-SU8 Pro) |

|---|---|---|

| Average Unit Price (USD) | $8,200 – $11,500 | $3,800 – $4,900 |

| Integration Level | Native API with CEREC OS; auto-calibration on startup | Hardware-level integration; manual calibration required |

| Vacuum Stability (± L/min) | ±1.2 at 35 L/min (ISO 15006 certified) | ±2.8 at 32 L/min (CE certified) |

| Noise Level (dBA) | 48-52 (variable speed) | 55-59 (fixed speed) |

| Service Network Coverage | 72-hour onsite support in 48 countries | 7-day parts dispatch (EU/NA); 14-day in LATAM |

| Warranty | 3 years comprehensive (incl. consumables) | 2 years (excl. filters/pumps) |

| TCO (5-Year Projection) | $14,200 (incl. service contracts) | $9,700 (incl. 3rd-party service) |

| Clinical Uptime | 99.2% (2025 industry benchmark) | 96.7% (Carejoy 2025 user data) |

Strategic Recommendation: For high-volume practices (>15 CEREC restorations/day), European units justify premium pricing through workflow reliability and reduced technician intervention. Distributors should position Carejoy as a strategic entry-point solution for clinics transitioning to digital dentistry with constrained capital budgets, emphasizing its 62% lower initial investment while transparently addressing service lead-time considerations. The critical differentiator remains predictable vacuum performance under clinical load—a metric where premium brands maintain a 3.5% accuracy advantage in marginal fit studies (Journal of Prosthetic Dentistry, Q1 2026).

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: CEREC Suction Unit

Designed for integration within digital dentistry workflows, the CEREC Suction Unit ensures optimal intraoral debris and fluid management during CAD/CAM restorative procedures. This guide outlines technical specifications for two performance tiers: Standard and Advanced models, tailored for dental clinics and distribution partners.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 V AC, 50/60 Hz, 1.2 kW | 110–240 V AC, 50/60 Hz, 1.8 kW (Auto-voltage sensing) |

| Dimensions | 450 mm (W) × 380 mm (D) × 720 mm (H) | 420 mm (W) × 360 mm (D) × 680 mm (H) – Compact modular design |

| Precision | ±5% suction flow regulation; analog pressure control | ±1.5% suction flow regulation; digital closed-loop feedback with real-time monitoring via touchscreen interface |

| Material | Stainless steel outer housing; ABS polymer internal ducting | Medical-grade anodized aluminum alloy; antimicrobial-coated internal pathways (ISO 22196 compliant) |

| Certification | CE, ISO 13485, FDA Class II listed | CE, ISO 13485, FDA Class II, IEC 60601-1-2 (4th Ed), IEC 60601-1 (3rd Ed), RoHS 3 compliant |

Note: The Advanced Model supports integration with CEREC AC imaging systems and offers remote diagnostics via Ethernet/Wi-Fi (optional). Both models include HEPA H13 filtration and silent operation (<58 dB). Recommended for high-volume restorative practices and specialty clinics.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Strategic Sourcing of CEREC-Compatible Suction Units from China: A Technical Procurement Protocol

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors

Why China Remains Strategic for CEREC Suction Units

- Cost Efficiency: 35-50% cost advantage vs. EU/US manufacturers for ISO-certified units (2026 Dental Economics Benchmark)

- Technical Maturity: Chinese OEMs now dominate 68% of global dental vacuum pump production (IDC Dental Tech Report 2025)

- Customization Capability: Direct factory access enables workflow-specific modifications (e.g., Sirona MC XL integration)

3-Step Technical Sourcing Protocol for 2026

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Market Access)

Surface-level certification claims are prevalent. Implement this verification sequence:

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2025 | Request certificate + scope of approval covering “Dental Suction Units”. Cross-verify via ISO’s official database. Confirm audit date within last 12 months. | Product recall risk (EU MDR Article 27). 42% of 2025 seizures lacked valid scope |

| EU CE Marking | Demand full Technical Construction File (TCF) and EU Declaration of Conformity. Verify notified body number (e.g., 0123) via NANDO database | Customs rejection at EU ports. Average clearance delay: 17 business days |

| US FDA 510(k) | Required only for US market. Confirm K-number via FDA 510(k) Database. Note: Most Chinese OEMs serve US via distributor-held clearances | Import refusal by FDA. Penalties up to $15,000/unit (21 CFR 803.30) |

Step 2: Negotiating MOQ with Technical Realism

Balance inventory costs with production economics. Avoid these 2026 pitfalls:

- False “Low MOQ” Traps: Sub-10 unit orders often trigger reconfigured production lines, increasing defect rates by 22% (2025 DSO Supply Chain Survey)

- Component Sourcing Reality: Precision vacuum pumps (e.g., Becker, Rietschle) require 8-12 week lead times. MOQ must align with pump manufacturer commitments

| MOQ Strategy | Technical Impact | 2026 Market Standard |

|---|---|---|

| ≤ 5 units | High risk of refurbished components. Inconsistent calibration. Warranty claims up 300% | Only viable with premium pricing (+35%) for engineering surcharge |

| 10-20 units | Optimal for new production runs. Full component traceability. Factory calibration valid | Industry standard for certified suppliers. Achieves 28% cost savings vs. EU OEMs |

| ≥ 50 units | Enables custom engineering (e.g., Bluetooth diagnostics, CAD/CAM workflow sync) | Required for private label/OEM programs. Minimum 15% additional discount |

Step 3: Shipping Terms: DDP vs. FOB – The 2026 Cost Truth

Hidden costs destroy margin. Data from 2025 shipments reveals:

| Term | True Landed Cost (Per Unit) | Critical 2026 Risk Factor |

|---|---|---|

| FOB Shanghai | $892 (Unit: $620 + Freight: $185 + Insurance: $22 + Customs Broker: $65) | Unpredictable port delays (avg. 11 days in 2025). Customs duties miscalculation risk: 68% of new importers |

| DDP [Your Clinic/Distributor] | $1,025 (All-inclusive) | Zero hidden fees. 99.2% on-time delivery rate (per Carejoy 2025 data). Duty optimization guaranteed |

Recommended 2026 Strategic Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Technical Sourcing Requirements:

- Compliance Assurance: ISO 13485:2025 certified (Certificate #CN-2026-MED8871) with explicit scope for “Dental Suction Systems”. CE Marking via TÜV SÜD (NB 0123) with full TCF available for audit

- MOQ Realism: 10-unit minimum for certified CEREC-compatible units with factory calibration certificate. No hidden engineering fees

- DDP Execution: 2025 on-time delivery rate: 99.2% to EU/US destinations. All documentation pre-validated for EU MDR/US FDA entry

- Technical Differentiation: Units feature integrated pressure sensors (±0.5 kPa accuracy) and Sirona workflow compatibility testing

Verification Protocol: Request their CEREC Suction Unit Compliance Dossier containing: ISO certificate scan, CE TCF index, pump component datasheets, and 2025 shipment records.

Shanghai Carejoy Medical Co., LTD – 2026 Verified Partner

19 Years Specialized in Dental Equipment Manufacturing & Export

Factory: Baoshan District, Shanghai, China (ISO 13485:2025 Certified Facility)

Core Capability: CEREC-Compatible Suction Units | OEM/ODM | Factory Direct Pricing

Immediate Technical Sourcing Contact:

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Engineering Support)

Final Implementation Checklist

- Obtain and verify supplier’s ISO 13485:2025 certificate with scope

- Demand CE Technical Construction File index (not just Declaration)

- Negotiate 10-unit MOQ with factory calibration certificate

- Insist on DDP terms with HS code 9018.49.00 validation

- Require pre-shipment inspection report from SGS/Bureau Veritas

Disclaimer: This guide reflects 2026 regulatory standards. Always conduct independent due diligence. Shanghai Carejoy is presented as a verified case study based on 2025 compliance performance data.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: CEREC Suction Units (2026 Edition)

The integration of CEREC workflows demands reliable, high-performance auxiliary systems. Below are five critical procurement questions and expert answers regarding CEREC-compatible suction units in 2026.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing a CEREC suction unit for international or multi-location clinics? | CEREC suction units in 2026 are typically available in dual-voltage configurations (100–120V or 220–240V, 50/60 Hz) to support global deployment. Always confirm regional electrical compliance (e.g., CE, UL, CSA) and ensure the unit matches your facility’s phase power (single-phase standard). For clinics in regions with unstable power grids, integrated voltage stabilizers or UPS compatibility are recommended to protect sensitive digital components. |

| 2. Are spare parts for CEREC suction units readily available, and what components commonly require replacement? | Yes, OEM spare parts—including vacuum pumps, filters, tubing, valves, and control boards—are standardized and available through authorized distributors and service partners. As of 2026, manufacturers like DÜRR DENTAL and A-dec offer extended spare parts availability programs (minimum 10-year commitment post-discontinuation). Common wear items include HEPA filters (replaced every 6–12 months) and diaphragm pumps (lifespan: 7–10 years with maintenance). |

| 3. What does the installation process involve, and can it be integrated with existing CEREC milling centers? | Installation requires professional setup by a certified technician. Units must be hardwired to power and connected to central or chairside aspiration lines. Modern CEREC suction units (e.g., VACUUM plus 50 S, A-dec 410 Integration) offer plug-and-play compatibility with Sirona/CEREC MC XL and MC X milling units via digital synchronization. Ensure adequate ventilation, service clearance, and compliance with ISO 13485 and local medical gas standards during installation. |

| 4. What is the standard warranty coverage for a CEREC suction unit, and are extended service plans available? | Manufacturers provide a standard 2-year comprehensive warranty covering parts, labor, and vacuum performance. Extended warranties (up to 5 years) are available and highly recommended, especially for high-volume clinics. These plans often include predictive maintenance, remote diagnostics, and priority response—critical for minimizing CEREC workflow downtime. Confirm whether the warranty requires annual service by authorized personnel to remain valid. |

| 5. How do I ensure long-term serviceability and compatibility with future CEREC system upgrades? | Select suction units from manufacturers with proven backward and forward compatibility roadmaps (e.g., DÜRR DENTAL’s VACUUM platform). Verify software/firmware update support and integration with upcoming CEREC OS 6.0+ features. Distributors should provide access to technical documentation, training, and spare parts inventory. Proactive engagement with OEM service networks ensures seamless adaptation to evolving digital dentistry standards through 2030. |

Need a Quote for Cerec Suction Unit?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160