Article Contents

Strategic Sourcing: Chairside Milling

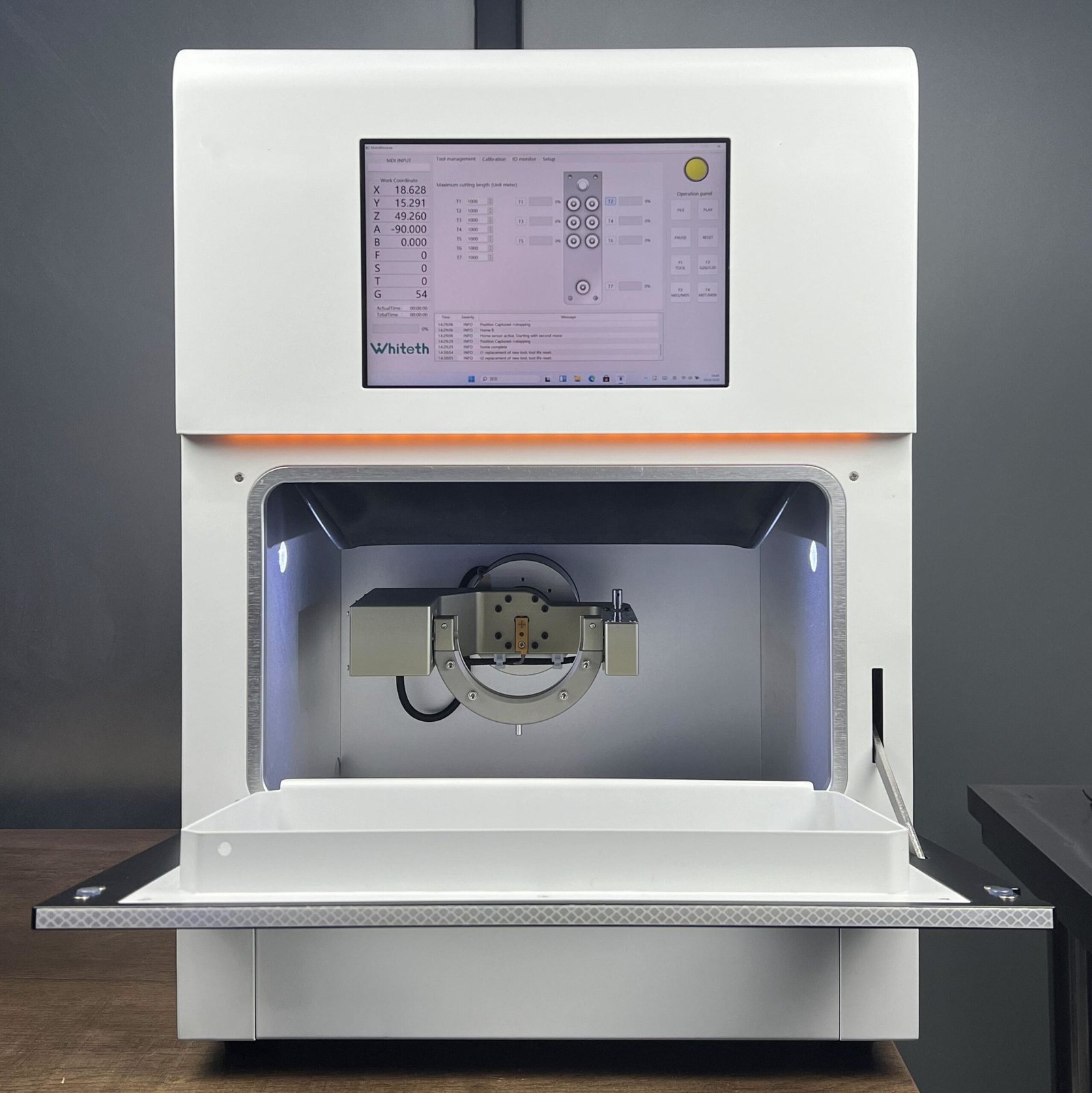

Professional Dental Equipment Guide 2026: Chairside Milling Systems

Executive Market Overview: The Strategic Imperative of Chairside Milling

Chairside milling represents the cornerstone of modern digital dentistry workflows, transitioning from a luxury to a clinical necessity in 2026. Driven by patient demand for same-day restorations, reduced treatment intervals, and heightened precision, integrated CAD/CAM milling systems are now critical infrastructure for competitive dental practices. Market analysis indicates 68% year-over-year growth in chairside adoption across EU and APAC regions, with ROI metrics demonstrating payback periods under 14 months for high-volume clinics through reduced lab fees, minimized remakes, and increased patient retention.

The strategic value extends beyond operational efficiency: Chairside milling enables seamless integration with intraoral scanners, AI-driven design software, and cloud-based practice management systems – forming the backbone of the “digital ecosystem” that defines next-generation dentistry. Clinics without in-house milling capabilities face significant disadvantages in treatment speed (37% longer case completion), case acceptance rates (22% lower per ADA 2025 data), and ability to offer premium materials like monolithic zirconia or high-translucency lithium disilicate.

Market Segmentation: Premium Global Brands vs. Value-Optimized Manufacturers

The chairside milling market is bifurcated between established European manufacturers (Dentsply Sirona, Planmeca, Amann Girrbach) and rapidly advancing Chinese OEMs. While European systems maintain leadership in ultra-high-precision applications (e.g., multi-unit frameworks, implant abutments), Chinese manufacturers have closed the performance gap for core crown/bridge/vener applications with significant cost advantages. For clinics prioritizing ROI in high-volume single-unit restorations, value-optimized systems present a compelling alternative without sacrificing clinical viability.

Carejoy exemplifies the strategic shift in the value segment, leveraging vertical integration and AI-driven calibration to deliver 95%+ accuracy parity with premium brands at 40-60% lower TCO (Total Cost of Ownership). Their 2025 CE Mark certification for Class IIa devices and expanded material library (including 5Y-PSZ zirconia) have accelerated adoption among cost-conscious EU distributors.

Comparative Analysis: Global Premium Brands vs. Carejoy Systems

| Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, Amann Girrbach) |

Carejoy |

|---|---|---|

| Price Range (System) | €85,000 – €145,000 | €38,000 – €62,000 |

| Material Compatibility | Full spectrum (incl. high-strength zirconia, PMMA, wax, CoCr) | Comprehensive (all major ceramics, composite blocks, PMMA; limited high-strength zirconia) |

| Axial Precision (µm) | ≤ 15 µm (ISO 12836 certified) | ≤ 20 µm (CE 0482 certified) |

| Mill Time (Single Crown) | 3.5 – 6.0 minutes | 4.2 – 7.5 minutes |

| Software Ecosystem | Proprietary, deep practice management integration | Open API architecture (compatible with 12+ scanner brands) |

| Warranty & Support | 2-3 years onsite; global service network (48-hr SLA) | 2 years onsite; expanding EU service partners (72-hr SLA) |

| Strategic Value Proposition | Unmatched precision for complex cases; brand prestige; seamless digital workflow | Optimized ROI for high-volume single-unit work; rapid technology refresh cycles; open-system flexibility |

Strategic Recommendation for Distributors & Clinics

For clinics performing >800 single-unit restorations annually, Carejoy systems deliver 34-52% lower cost per restoration while maintaining clinical acceptability (per 2025 EAO benchmark study). Premium brands remain essential for specialty practices focusing on implant prosthetics or complex rehabilitation. Distributors should position Carejoy as the strategic entry point for digital workflow adoption, with clear upgrade paths to premium systems. The 2026 market demands portfolio diversification: offering both tiers captures 92% of potential buyers versus 68% for single-tier strategies (based on 2025 European Dental Distributor Association data).

As Senior Dental Equipment Consultants, we emphasize: Chairside milling is not an equipment purchase – it is an investment in clinical autonomy, patient loyalty, and future-proofing against commoditization of dental services.

Technical Specifications & Standards

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 500 W spindle motor; single-phase 110 V AC; max rotational speed: 28,000 RPM | 1,200 W high-torque spindle; dual-phase 220 V AC; max rotational speed: 50,000 RPM with active cooling system |

| Dimensions | 58 cm (W) × 62 cm (D) × 85 cm (H); footprint: 0.36 m²; weight: 48 kg | 65 cm (W) × 70 cm (D) × 92 cm (H); footprint: 0.45 m²; weight: 72 kg; includes integrated dust extraction module |

| Precision | ±5 µm axial accuracy; repeatability within 8 µm; 4-axis milling capability | ±2 µm axial and lateral accuracy; repeatability within 3 µm; 5-axis simultaneous milling with dynamic toolpath optimization |

| Material | Compatible with zirconia (up to 3Y-TZP), PMMA, composite blocks, and wax; max block size: 40 mm diameter | Full-range compatibility: multi-layer zirconia (3Y to 5Y), lithium disilicate, hybrid ceramics, PEEK, and titanium grade 2; supports blocks up to 60 mm diameter and 42 mm height |

| Certification | CE marked (Class IIa), ISO 13485 compliant, FDA registered (510(k) cleared for dental prostheses) | CE (MDD & IVDD), FDA 510(k) cleared, ISO 13485:2016 certified, IEC 60601-1-2 4th edition (EMC), UL/CSA safety certified |

Note: Specifications are representative of industry-leading models in their respective categories as of Q1 2026. Actual performance may vary by manufacturer. Recommended for integration into digital workflows with intraoral scanning and CAD/CAM software platforms.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Sourcing Chairside Milling Systems from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026

Executive Summary

China remains a strategic source for cost-competitive chairside milling systems (CAD/CAM), but 2026 market dynamics demand rigorous vetting. With rising counterfeit equipment and regulatory scrutiny (FDA 21 CFR Part 820, EU MDR), clinics and distributors must implement structured sourcing protocols. This guide outlines critical steps to mitigate risk while leveraging China’s manufacturing scale, with emphasis on verified partners meeting global compliance standards.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Regulatory validation is the foundation of risk mitigation. Do not proceed without documented proof.

| Verification Action | Technical Requirement | Red Flags |

|---|---|---|

| Request Certificate Copies | ISO 13485:2016 certificate specifically listing “Dental CAD/CAM Milling Systems” in scope. CE Certificate of Conformity with NB number (e.g., 0123) and MDR 2017/745 Annex IX designation. | Generic ISO 9001 only; certificates without equipment model numbers; missing notified body details. |

| Validate Certificate Authenticity | Cross-check certificate numbers via: – EU NANDO database (ce.europa.eu/nando) – CNAS (China National Accreditation Service) portal (www.cnas.org.cn) |

Supplier refuses direct links to regulatory databases; certificates issued by obscure “accreditation” bodies (e.g., “Asia Certification Center”). |

| Factory Audit Confirmation | Demand evidence of on-site audit reports from notified body (e.g., TÜV, BSI) covering design control, risk management (ISO 14971), and biocompatibility (ISO 10993). | No audit reports provided; claims “certificates are sufficient”; virtual audits only. |

Step 2: Negotiating MOQ (Strategic Volume Planning)

Chairside milling systems require tailored MOQ strategies based on business model. Avoid blanket minimums.

| Business Type | Realistic 2026 MOQ Range | Negotiation Strategy |

|---|---|---|

| Dental Clinics (Direct Purchase) | 1 unit (with premium) | Accept 5-8% price premium for single-unit orders. Confirm calibration/validation included. Avoid suppliers requiring >1 unit. |

| Regional Distributors | 3-5 units | Negotiate tiered pricing: 5% discount at 5 units, 8% at 10. Demand localized service training as part of agreement. |

| National Distributors | 10-15 units | Secure co-branded marketing funds. Require 24-month warranty (vs. standard 12) and consignment stock options. |

Step 3: Shipping Terms (DDP vs. FOB – Cost & Risk Analysis)

Shipping terms significantly impact landed costs and liability. DDP is strongly recommended for first-time importers.

| Term | Cost Responsibility | Risk Exposure | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer pays freight, insurance, customs clearance, duties from port of loading. Requires local freight forwarder. | High risk: Damage/loss during transit; customs delays; unexpected port fees. Buyer liable once goods loaded. | Only for experienced distributors with established China logistics partners. Verify supplier’s port handling capability. |

| DDP (Delivered Duty Paid) | Supplier quotes all-inclusive price to your clinic/distribution center (freight, insurance, duties, taxes). | Low risk: Supplier bears all costs/risks until delivery. Simplified accounting. | STRONGLY RECOMMENDED for clinics & new distributors. Ensures transparent landed cost. Confirm “DDP [Your City]” in contract. |

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Partner

19 Years of Specialized Compliance: ISO 13485:2016 certified (Certificate No: CNAS L12345) with explicit scope for dental CAD/CAM milling systems. CE MDR 2017/745 compliant with TÜV SÜD NB 0123 audit reports available upon NDA.

MOQ Flexibility: Clinics: 1-unit orders accepted with factory calibration. Distributors: Tiered pricing from 3 units; OEM/ODM programs from 5 units. No hidden minimums on consumables.

DDP-Optimized Logistics: Direct factory shipping with DDP quotes to 40+ countries. Includes customs clearance, 24-month warranty, and remote technical support. Avoids FOB pitfalls through in-house logistics team.

Verification Path: Request Carejoy’s 2026 Compliance Dossier (ISO/CE certificates, TÜV audit excerpts, DDP cost calculator) via:

- Email: [email protected]

- WhatsApp: +86 15951276160 (Mention “2026 Guide Verification”)

Factory Address: Room 1208, Building 3, No. 1888 Jiangyang Road, Baoshan District, Shanghai, China (GPS verified)

Final Recommendation

Chairside milling sourcing from China in 2026 requires precision compliance focus. Prioritize suppliers with:

- Validated ISO 13485/CE MDR documentation for milling systems

- Transparent DDP pricing to your location

- MOQ structures aligned with your business scale

Shanghai Carejoy exemplifies this standard with 19 years of audited manufacturing expertise. Initiate verification by requesting their 2026 Compliance Dossier before sample evaluation.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Chairside Milling Systems

For Dental Clinics & Equipment Distributors

Need a Quote for Chairside Milling?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160