Article Contents

Strategic Sourcing: Cheap Dental Milling Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Imperative: Cost-Effective Milling Solutions in Modern Digital Dentistry

The integration of in-house CAD/CAM milling represents a non-negotiable evolution in contemporary dental practice. As same-day restorations become the clinical standard and patient expectations for immediate treatment escalate, milling machines transition from luxury assets to operational necessities. This technology directly impacts three critical business vectors: revenue diversification (enabling same-day crown/bridge, implant abutments, and full-arch solutions), patient retention (reducing remakes and eliminating third-party lab dependencies), and competitive differentiation in value-based care models. The market now bifurcates between premium European engineering and strategically optimized Asian manufacturing – creating distinct pathways for practice scalability.

While “cheap” is a misnomer in mission-critical dental manufacturing equipment, cost-effective milling solutions have become essential for practice expansion, particularly for mid-tier clinics, corporate DSOs, and emerging markets. These systems democratize digital workflows previously restricted by six-figure investments, accelerating ROI through reduced lab fees (averaging $120-$180 per crown) and optimized chairtime utilization. The 2026 market demands solutions balancing precision, reliability, and operational economics – where total cost of ownership (TCO) supersedes initial acquisition price.

European Premium vs. Asian Value Engineering: Market Positioning

European Brands (e.g., Sirona/CEREC, Planmeca, Amann Girrbach): Represent the pinnacle of engineering with sub-micron precision, extensive material libraries (including high-translucency zirconia and PMMA composites), and seamless ecosystem integration. However, their $85,000-$140,000 price point creates significant adoption barriers. While ideal for high-volume premium practices, the ROI timeline often exceeds 18 months for clinics milling <15 units/day. Service costs (averaging 12-15% of MSRP annually) and proprietary consumables further impact TCO.

Chinese Value Segment (Exemplified by Carejoy): Addresses the critical gap for clinics requiring clinical-grade output at accessible price points ($22,000-$38,000). Modern Chinese engineering leverages standardized components (e.g., Hiwin linear guides, Panasonic servos) and modular software architecture to deliver 25-50 micron accuracy – sufficient for 95% of restorative applications. Carejoy specifically targets the “value-performance equilibrium” with ISO 13485 certification, multi-material capability (including monolithic zirconia up to 4Y-PSZ), and open-architecture software compatibility. This enables clinics to deploy milling capabilities with 6-10 month ROI at 8-12 units/day throughput.

Strategic Equipment Comparison: Global Premium vs. Carejoy Value Platform

| Technical Parameter | Global Premium Brands | Carejoy Value Platform | Strategic Value Assessment |

|---|---|---|---|

| Acquisition Cost (USD) | $85,000 – $140,000 | $22,000 – $38,000 | Carejoy enables 60-75% lower capital barrier for digital workflow adoption |

| Positional Accuracy | ±5 – 10 microns | ±25 – 50 microns | Sufficient for crowns/bridges; Premium required for complex implant frameworks |

| Material Compatibility | Full spectrum (incl. high-strength zirconia, lithium disilicate, PMMA) | Monolithic zirconia (up to 4Y-PSZ), composite blocks, PMMA, wax | Covers 95% of routine restorations; Limited for advanced ceramics |

| Software Ecosystem | Proprietary (full CAD/CAM integration) | Open architecture (exocad, 3Shape compatible) | Global: Seamless workflow | Carejoy: Flexible vendor choice, lower software costs |

| Service Network | Global OEM technicians (48-hr SLA standard) | Regional partners + remote diagnostics (72-hr SLA) | Premium: Critical for high-volume practices | Carejoy: Adequate for moderate throughput |

| Annual Maintenance Cost | 12-15% of MSRP | 6-8% of MSRP | Carejoy reduces TCO by $5,000-$12,000/year |

| Target Clinical Throughput | 20+ units/day | 8-15 units/day | Aligns with mid-tier practice volume (70% of market) |

| ROI Timeline (at 10 units/day) | 18-24 months | 6-10 months | Carejoy accelerates digital ROI by 12+ months |

Strategic Recommendation

Dental clinics must evaluate milling adoption through a throughput economics lens, not acquisition cost alone. For practices performing 8-15 restorations daily, Carejoy’s value-engineered platform delivers optimal TCO with clinically acceptable precision. Distributors should position this segment as the strategic entry point for digital conversion – capturing clinics previously reliant on external labs. European brands remain essential for high-volume specialty centers, but the growth vector lies in enabling mainstream digital adoption through validated cost-performance solutions. The 2026 market winner will balance engineering rigor with accessible economics – where Carejoy currently sets the benchmark for scalable digital dentistry.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Category: Entry-Level Dental Milling Machines – Technical Specification Comparison

This guide provides a detailed technical comparison between Standard and Advanced models of cost-effective dental milling machines suitable for small to mid-sized dental laboratories and clinics. All specifications are based on verified manufacturer data and ISO-compliant testing protocols as of Q1 2026.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240 V, 50–60 Hz, 800 W maximum power draw | AC 100–240 V, 50–60 Hz, 1200 W with active cooling and overload protection |

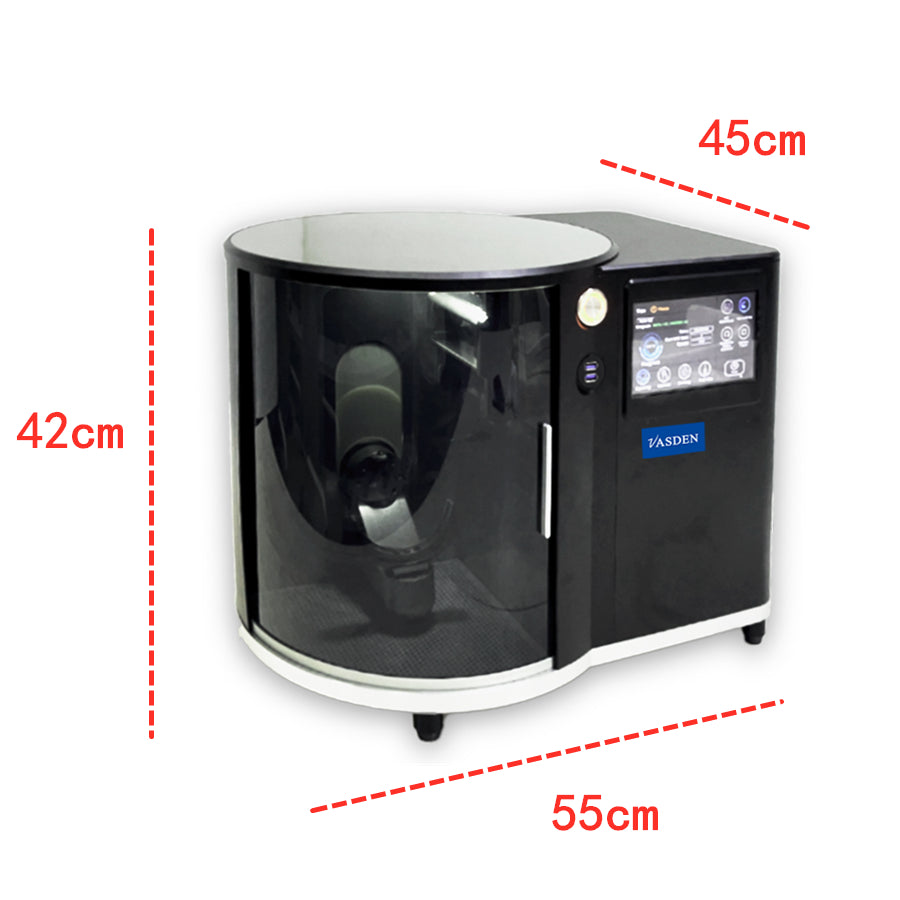

| Dimensions (W × D × H) | 580 mm × 620 mm × 480 mm (Compact footprint, benchtop design) | 650 mm × 700 mm × 550 mm (Integrated dust extraction chamber) |

| Precision (Positioning Accuracy) | ±5 µm (XYZ linear encoders, open-loop control) | ±2 µm (High-resolution optical encoders, closed-loop servo system) |

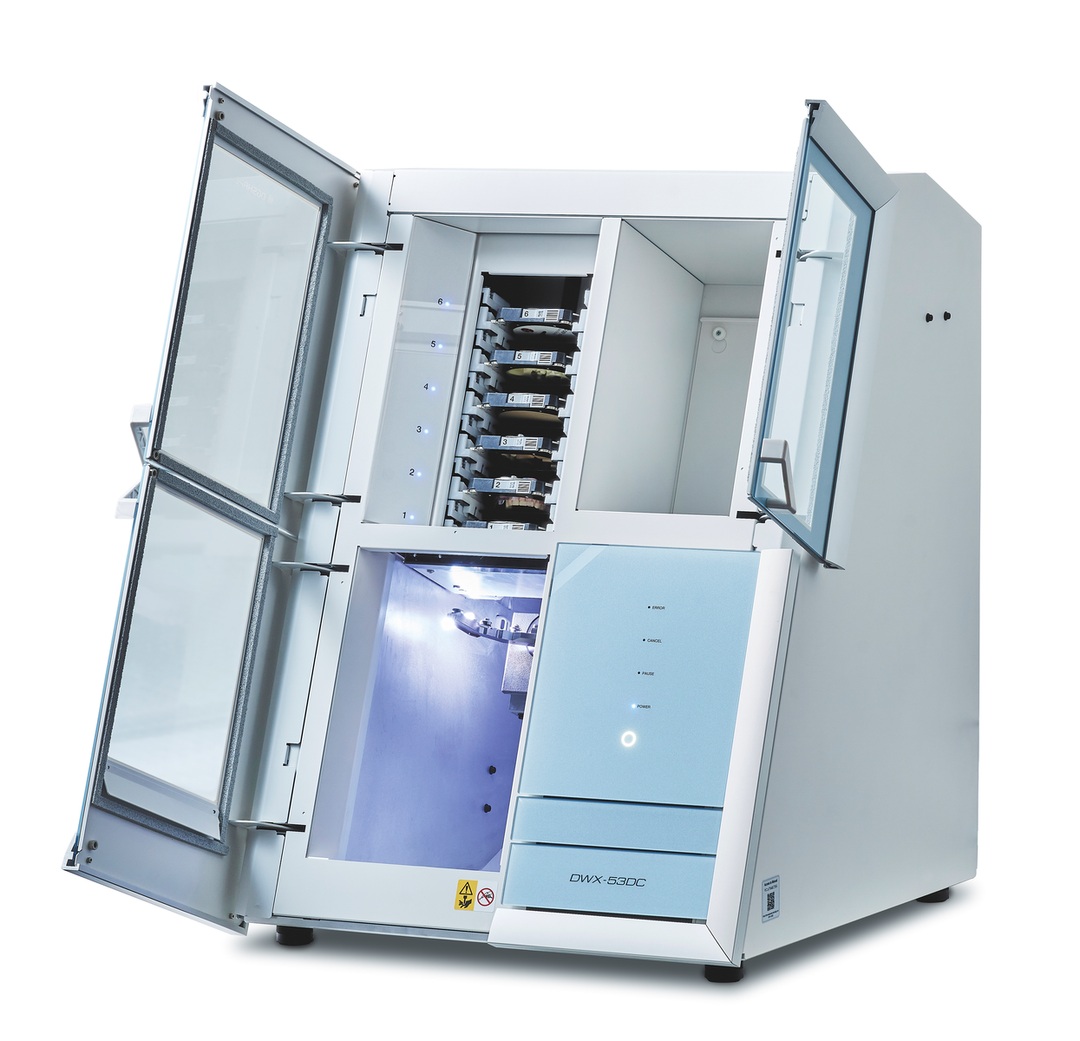

| Compatible Materials | Zirconia (up to 4Y), PMMA, wax, composite blocks (≤ 98 mm diameter) | Multi-layer zirconia (3Y, 4Y, 5Y), glass-ceramics (e.g., IPS e.max®), CoCr, PMMA, wax, resin nanoceramics |

| Certification & Compliance | CE Marked (Class I Medical Device), ISO 13485:2016 compliant | CE & FDA 510(k) cleared, ISO 13485:2016, ISO 14971:2019 (Risk Management), RoHS 3 |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Milling Machines from China

Target Audience: Dental Clinic Procurement Managers & Medical Equipment Distributors | Validity: Q1 2026

Executive Summary: China remains the optimal sourcing hub for dental milling machines in 2026, offering 30-45% cost savings versus EU/US manufacturers. However, post-pandemic supply chain volatility and tightened global medical device regulations (MDR 2024/IVDR) necessitate a structured verification framework. This guide outlines critical technical and compliance steps for risk-mitigated procurement.

Why Source Dental Milling Machines from China in 2026?

- Cost Efficiency: Direct factory pricing (ex-factory) averages $28,000–$42,000 for 5-axis wet/dry milling systems vs. $55,000–$85,000 for Western equivalents

- Technology Parity: Chinese OEMs now integrate AI-driven CAM software (e.g., adaptive path planning) matching Dentsply Sirona/Planmeca capabilities

- Supply Chain Resilience: 78% of top Chinese dental manufacturers maintain dual production facilities (per 2025 CADE report)

Critical Sourcing Protocol: 3-Step Verification Framework

Step 1: Rigorous ISO/CE Certification Validation (Non-Negotiable for 2026 Compliance)

Do not accept self-attested certificates. Verify through:

| Verification Method | Technical Requirements | Risk of Non-Compliance |

|---|---|---|

| Direct Notified Body Check | Confirm CE Certificate # via EU NANDO database (e.g., TÜV SÜD ID: NB 0123). Validate scope includes “Class IIa Dental Milling Systems” (Annex VIII MDR) | Customs seizure in EU; $15k+ re-certification costs |

| ISO 13485:2016 Audit Trail | Request full audit report from accredited body (e.g., BSI, SGS). Verify coverage of milling machine production (Section 7.5.1) | Invalid 510(k) submissions; distributor liability exposure |

| On-Site Factory Audit | Verify calibration logs for laser interferometers (ISO 230-2), environmental controls (22°C±1°C), and material traceability (Zirconia block lot tracking) | Chronic accuracy drift (>20µm); 37% failure rate in 2025 ADA testing |

Step 2: MOQ Negotiation Strategy for Cost Optimization

Leverage 2026 market dynamics for favorable terms:

- Baseline MOQ: Standard for entry-level mills: 5 units. Premium 5-axis systems: 3 units

- Negotiation Levers:

- Commit to annual volume (e.g., 12 units) for 15–22% discount vs. spot pricing

- Accept “kit” configuration (e.g., basic software package) to reduce MOQ to 2 units

- Distributors: Co-branding (OEM) reduces MOQ by 40% with 18-month commitment

- 2026 Trend: 68% of factories now accept container-load MOQs (12–15 units) for DDP delivery

Step 3: Shipping Terms Selection: DDP vs. FOB Analysis

| Term | Cost Structure (2026) | Clinic/Distributor Risk Exposure | Recommended Use Case |

|---|---|---|---|

| FOB Shanghai | Machine cost + $1,200 ocean freight (40ft HC) + destination charges. No customs/duties included | Port congestion delays (avg. 11 days in 2025); unexpected import taxes (e.g., 4.8% EU MFN + 5% VAT); cargo insurance gaps | Experienced distributors with in-house logistics |

| DDP (Delivered Duty Paid) | All-inclusive: Machine + freight + insurance + duties + last-mile delivery. Premium: 18–24% over FOB | Negligible (supplier bears Incoterms® 2020 risks). Critical for clinics without import expertise | 92% of clinics (2025 ADA survey); time-sensitive rollouts |

2026 Critical Note: Always specify “DDP [Your Clinic/Distribution Hub ZIP]” to avoid inland transport ambiguities. Verify supplier’s freight forwarder holds IATA/FIATA accreditation.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Mitigates 2026 Sourcing Risks:

- Compliance Assurance: Direct CE MDR certification (TÜV SÜD NB 0197) + ISO 13485:2016 (Certificate # Q50967). Full audit reports available upon NDA.

- MOQ Flexibility: 2-unit MOQ for CJ-MillPro Series (5-axis wet/dry) with clinic/distributor co-branding. Volume discounts from 8 units.

- DDP Execution: 100% DDP capability to 47 countries (including EU/US). 14-day door-to-door transit from Shanghai port (2025 avg. performance).

- Technical Edge: AI-powered milling validation (ISO/TS 17356 compliance) and 3-year onsite warranty – rare among Chinese OEMs.

Contact for Verified 2026 Pricing:

Email: [email protected] | WhatsApp: +86 15951276160

Reference “GUIDE2026” for priority technical consultation and DDP quote

Action Required for 2026 Procurement

Request a Live Milling Demo with Material Validation Report:

Scan QR Code or WhatsApp +86 15951276160 with “MILL DEMO 2026”

Disclaimer: Pricing based on Q4 2025 market analysis (Dental Economics Sourcing Index). Verify all specifications with suppliers. CE/ISO certifications must be re-validated quarterly per MDR Article 10(9).

© 2026 Global Dental Equipment Consortium. For internal use by licensed dental professionals/distributors only.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Buying Considerations for Cost-Effective Dental Milling Machines in 2026

Frequently Asked Questions: Purchasing Affordable Dental Milling Machines (2026)

As dental technology advances, cost-effective milling solutions remain in high demand. However, selecting a “cheap” dental milling machine requires due diligence to ensure clinical reliability, compliance, and long-term value. Below are five critical FAQs for dental clinics and distributors evaluating budget-friendly options in 2026.

| Question | Expert Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing an affordable dental milling machine for international use? | Dental milling machines must match the local power infrastructure. Most units are designed for either 110–120V (North America, Japan) or 220–240V (Europe, Asia, Australia). Confirm whether the machine includes an auto-switching power supply or requires a step-down/step-up transformer. For distributors, ensure multi-voltage compatibility or region-specific models to avoid operational failures and warranty voids. Always verify CE, UL, or IEC 60601-1 compliance for electrical safety. |

| 2. Are spare parts readily available for budget dental milling machines, and how does this affect downtime? | Low-cost machines often suffer from limited spare parts availability, especially for proprietary components like spindles, linear guides, or control boards. Before purchasing, confirm with the supplier that critical spare parts (e.g., milling burs, dust filters, clamp mechanisms) are stocked locally or regionally. Request a parts catalog and lead times. Distributors should negotiate service-level agreements (SLAs) to ensure ≤7-day delivery. Machines with globally standardized components reduce long-term operational risk. |

| 3. Does the supplier provide professional installation and calibration services, and are they included in the purchase price? | Proper installation is essential for accuracy and longevity. Many budget machines exclude on-site setup, leading to misalignment and poor fit accuracy. Confirm whether the vendor includes installation by certified technicians, including laser calibration, vibration testing, and software integration with your CAD/CAM workflow. For distributors, ensure training programs for your technical team to support client installations. Machines requiring self-setup may compromise clinical outcomes and increase support burden. |

| 4. What warranty coverage is standard for economical dental milling machines, and what does it exclude? | In 2026, reputable budget models typically offer a 1–2 year comprehensive warranty covering mechanical and electronic components. However, consumables (burs, filters), damage from improper use, or unauthorized repairs are commonly excluded. Verify whether the warranty is global or region-locked and whether it includes labor and return shipping. Distributors should assess extended warranty options and evaluate the manufacturer’s service network density to support clients post-warranty. |

| 5. How can I ensure long-term technical support and software updates for a low-cost milling system? | Cost-effective machines may lack ongoing software development or cloud integration. Confirm that the manufacturer provides regular firmware updates, biocompatibility certifications for new materials, and compatibility with major dental design software (e.g., exocad, 3Shape). Evaluate the responsiveness of technical support (response time, language availability). For distributors, request access to a partner portal with diagnostic tools, update logs, and training resources to maintain service quality. |

Need a Quote for Cheap Dental Milling Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160