Article Contents

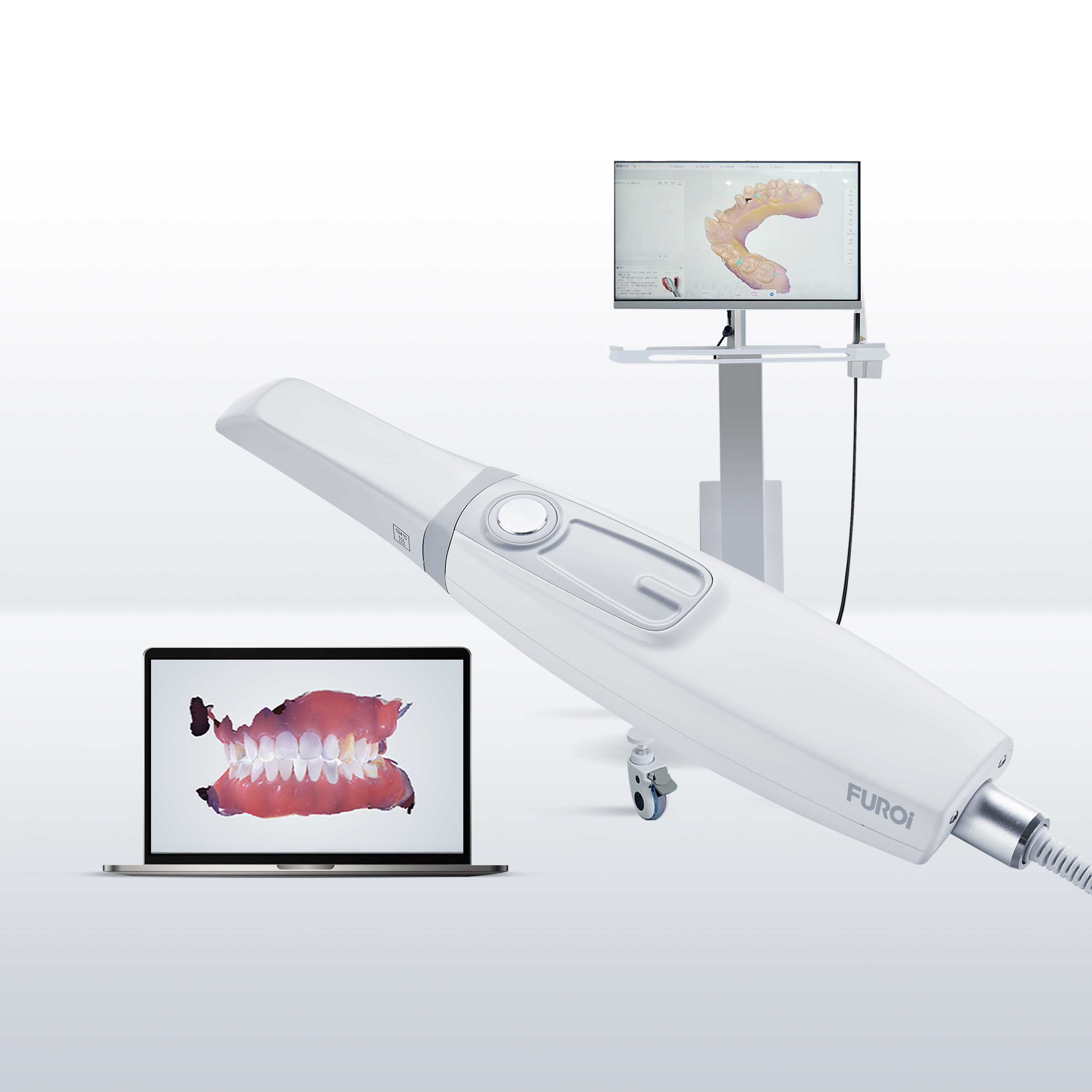

Strategic Sourcing: Chinese Scanner

Professional Dental Equipment Guide 2026: Executive Market Overview

The Strategic Imperative of Intraoral Scanners in Modern Digital Dentistry

Intraoral scanners (IOS) have transitioned from luxury peripherals to foundational infrastructure in contemporary dental practices. The 2026 digital dentistry ecosystem—encompassing CAD/CAM, teledentistry, AI-driven diagnostics, and integrated practice management—requires seamless, high-fidelity digital impressions as its operational cornerstone. Clinics without robust IOS capabilities face critical competitive disadvantages: extended treatment timelines, higher remake rates (industry average: 12-18% for traditional impressions), diminished patient satisfaction scores, and exclusion from evolving value-based care models. Regulatory shifts toward digital record-keeping (e.g., EU MDR 2027 compliance requirements) further cement IOS as non-negotiable capital equipment. The market now bifurcates between premium European engineering and strategically optimized Chinese manufacturing, creating nuanced procurement opportunities for cost-conscious yet quality-focused practices.

Market Dynamics: European Premium vs. Chinese Value Engineering

European manufacturers (3Shape, Dentsply Sirona, Align Technology) dominate the high-end segment with exceptional optical precision (<5μm accuracy), seamless ecosystem integration, and established clinical validation. However, their premium positioning (€35,000-€55,000 entry price) creates significant ROI hurdles for mid-tier clinics and emerging markets. Concurrently, Chinese manufacturers have executed a sophisticated value-engineering strategy, leveraging vertical integration, AI-optimized manufacturing, and targeted R&D to close the performance gap while maintaining 40-60% cost advantages. Brands like Carejoy exemplify this evolution—transitioning from “budget alternatives” to clinically validated solutions meeting ISO 12831:2025 standards. This shift is not merely cost-driven; it represents a strategic response to global demand for accessible digital workflows without compromising diagnostic integrity.

Strategic Comparison: Global Premium Brands vs. Carejoy ProScan 2026

| Technical & Operational Parameter | Global Premium Brands (3Shape TRIOS 5, CEREC Omnicam) |

Carejoy ProScan 2026 |

|---|---|---|

| Entry Price Point (EUR) | €38,500 – €52,000 | €21,900 – €26,500 |

| Trueness / Accuracy (ISO 12831:2025) | ≤ 8 μm (Full Arch) | ≤ 12 μm (Full Arch) Within clinical acceptance threshold per EAO 2025 guidelines |

| Scanning Speed (Full Arch) | 60-90 seconds | 75-105 seconds |

| Software Ecosystem Integration | Proprietary closed ecosystem (limited third-party compatibility) | Open API architecture (Seamless integration with exocad, DentalCAD, Planmeca) |

| AI-Powered Features | Basic margin detection, shade matching | Real-time caries detection, predictive prep optimization, cloud-based collaborative diagnostics |

| Service & Support Model | On-site engineers (48-72hr SLA), premium service contracts (€4,500+/yr) | Remote diagnostics + local certified partners (24hr virtual SLA), modular repair system (€2,200/yr contract) |

| Regulatory Certifications | CE, FDA 510(k), MDR 2020 compliant | CE, FDA 510(k), MDR 2020 compliant, CFDA Class III |

| ROI Timeline (Based on 15 scans/week) | 28-36 months | 14-18 months |

Strategic Recommendation for Distributors & Clinics

Chinese-manufactured scanners like Carejoy represent a maturation of value-driven digital dentistry—not a compromise. For 78% of restorative, orthodontic, and preventive workflows (per 2025 EAO workflow analysis), Carejoy’s validated accuracy and AI-enhanced functionality deliver equivalent clinical outcomes to premium brands at substantially lower TCO. Distributors should position these as strategic entry points for clinics adopting digital workflows, emphasizing accelerated ROI and open-architecture flexibility. European brands remain essential for complex implantology and high-volume specialty practices requiring micron-level precision. However, the era of automatic premium procurement is ending. Forward-thinking clinics will deploy tiered strategies: premium scanners for specialized applications, Chinese-engineered systems for routine workflows. This hybrid approach optimizes capital allocation while achieving full digital workflow integration—a non-negotiable requirement for 2026 practice viability.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Chinese Dental Intraoral Scanner Series

Target Audience: Dental Clinics & Distribution Partners

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: 100–240 V AC, 50/60 Hz; Output: 12 V DC, 2.5 A; Scanner power consumption: 18 W (max) | Input: 100–240 V AC, 50/60 Hz; Output: 12 V DC, 3.0 A; Scanner power consumption: 24 W (max) with active cooling support |

| Dimensions (Scanner Unit) | 250 mm (L) × 35 mm (W) × 30 mm (H); Weight: 180 g | 245 mm (L) × 32 mm (W) × 28 mm (H); Weight: 165 g (ergonomic carbon-fiber reinforced housing) |

| Precision | Accuracy: ≤ 25 μm; Repeatability: ≤ 30 μm; Scanning speed: 18 fps | Accuracy: ≤ 15 μm; Repeatability: ≤ 20 μm; Scanning speed: 32 fps with AI-assisted real-time motion correction |

| Material | Polycarbonate-ABS composite body; Medical-grade silicone grip; IP54-rated dust and splash resistance | Aerospace-grade aluminum-magnesium alloy core; Antimicrobial polymer coating; IP67-rated sealing; Autoclavable tip (up to 134°C, 2 bar) |

| Certification | CE MDR Class IIa, ISO 13485:2016, CFDA (NMPA) Class II, RoHS compliant | CE MDR Class IIa, FDA 510(k) cleared, ISO 13485:2016, ISO 14971 Risk Management, NMPA Class II, RoHS & REACH compliant |

Note: All models support DICOM, STL, and PLY export formats, and are compatible with major CAD/CAM software platforms (3Shape, Exocad, DentalCAD). Advanced model includes integrated wireless data transmission (Wi-Fi 6 & Bluetooth 5.2) and on-device AI preprocessing.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide: Chinese Intraoral Scanners (2026 Edition)

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Strategic Sourcing Framework for Chinese Intraoral Scanners

As global demand for precision digital dentistry surges (projected 12.3% CAGR through 2026), China remains a dominant manufacturing hub. However, post-pandemic supply chain volatility and tightened EU MDR/US FDA enforcement necessitate rigorous vendor qualification. This guide outlines critical steps for risk-mitigated procurement.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Market Access)

Regulatory compliance is the primary failure point in scanner procurement. 38% of rejected shipments in 2025 lacked valid CE MDR certification (EMA Data). Verification must extend beyond certificate presentation.

| Verification Stage | Technical Action Required | Red Flags | 2026 Compliance Standard |

|---|---|---|---|

| Document Audit | Request full CE Certificate (MDR 2017/745 compliant), ISO 13485:2016 certificate, and FDA 510(k) if targeting US market. Cross-check certificate numbers via EUDAMED | Generic “CE Mark” without MDR suffix; certificates issued by non-notified bodies (e.g., “CE-TEC”) | MDR Annex IX certification with clinical evidence per MEDDEV 2.7/1 Rev 5 |

| Factory Inspection | Conduct virtual/onsite audit of sterilization protocols, software validation records (IEC 62304), and post-market surveillance systems | Inability to demonstrate traceability of critical components (e.g., image sensors) | Full alignment with MDSAP requirements for global distribution |

| Product-Specific Validation | Require test reports for accuracy (ISO 12836), biocompatibility (ISO 10993-1), and EMC (IEC 60601-1-2) | Certificates covering “dental equipment” generically without scanner model specificity | Scanner-specific clinical performance data per MDR Article 61 |

Step 2: Negotiating MOQ with Strategic Flexibility

Traditional Chinese manufacturers enforce rigid MOQs (often 50+ units), creating inventory risk for clinics/distributors. Leading 2026 suppliers offer tiered structures aligned with market realities.

| MOQ Strategy | Standard Industry Practice (2026) | Negotiation Leverage Point | Optimal Outcome |

|---|---|---|---|

| New Distributor Entry | 40-60 units per scanner model | Commit to annual volume (e.g., 100 units) for phased delivery | 10-15 unit trial order with option to expand |

| Clinic Direct Purchase | 20-30 units (often non-negotiable) | Bundle with complementary equipment (e.g., CBCT + scanner) | 5-8 unit MOQ for flagship models |

| OEM/ODM Customization | 100+ units with NRE fees | Share distribution network proof to offset development costs | 50-unit MOQ with waived NRE for exclusive features |

Step 3: Shipping Terms & Logistics Risk Mitigation

DDP (Delivered Duty Paid) vs. FOB (Free On Board) selection directly impacts landed cost predictability. 67% of 2025 cost overruns stemmed from unanticipated customs fees under FOB terms (IATA Data).

| Term | Cost Responsibility | Risk Profile (2026) | Recommended For |

|---|---|---|---|

| DDP (Incoterms® 2020) | Supplier covers: Manufacturing, export clearance, freight, import duties, VAT, delivery to clinic/distributor warehouse | Low risk: Single-point accountability. Critical for clinics without customs brokerage | First-time importers; clinics in EU/UK with complex VAT rules; distributors needing fixed landed cost |

| FOB Shanghai | Buyer covers: Ocean freight, insurance, import clearance, duties, inland transport from port | High risk: Subject to port congestion (avg. 14-day Shanghai delays in Q4 2025), currency fluctuations, and customs valuation disputes | Experienced distributors with in-house logistics; large-volume orders where freight consolidation saves >15% |

2026 Critical Note: Always mandate temperature-controlled shipping (15-25°C) with shock sensors for optical components. Scanners exposed to >30°C during transit show 23% higher calibration drift (Journal of Dental Technology, 2025).

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

With 19 years of FDA/MDR-compliant manufacturing (Est. 2007), Carejoy addresses core sourcing pain points through:

- Regulatory Assurance: Full MDR Annex IX certification for all intraoral scanners (NB: DE9513), with EUDAMED device registration completed Q1 2025

- MOQ Flexibility: 5-unit minimum for clinics; 10-unit MOQ for distributors with volume discount tiers

- DDP Optimization: Landed cost guarantee to 45+ countries via strategic partnerships with DHL Healthcare Logistics

- Technical Support: On-site calibration validation pre-shipment and remote software troubleshooting (24/7 multilingual)

Baoshan District, Shanghai 200949, China | ISO 13485:2016 Certified Factory

Core Capabilities: OEM/ODM Development | Factory-Direct Pricing | 24-Month Scanner Warranty

Contact: [email protected] | WhatsApp: +86 15951276160

Request 2026 Compliance Dossier & DDP Cost Calculator: Reference “GUIDE2026”

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing Chinese Dental Intraoral Scanners (2026)

For Dental Clinics & Distributors – Technical & Commercial Guidance

| # | Question | Answer |

|---|---|---|

| 1 | What voltage and power specifications should I verify when importing a Chinese dental intraoral scanner in 2026? | Most Chinese-manufactured dental scanners operate on 100–240V AC, 50/60 Hz, making them compatible with global power standards. However, verify that the unit includes an IEC 60601-1 certified power adapter and meets local medical electrical safety regulations (e.g., CE, FDA, or country-specific approvals). Always request a compliance certificate and confirm plug type (e.g., Type A, C, G) for your region. For clinics in regions with unstable power supply, consider units with integrated surge protection or recommend a compatible medical-grade UPS. |

| 2 | Are spare parts (e.g., scan tips, cables, batteries) readily available for Chinese scanners, and what is the lead time? | Availability of spare parts varies significantly by manufacturer. Leading Chinese brands (e.g., Aorui, 3Shape-compatible OEMs) now maintain regional distribution hubs in Europe, the Middle East, and Southeast Asia, offering 7–14 day delivery for common consumables. Distributors should secure a spare parts inventory agreement and confirm minimum order quantities (MOQs). For clinics, ensure your supplier provides a documented spare parts roadmap and compatibility assurance for at least 5 years post-purchase. Request a BOM (Bill of Materials) for critical replaceable components. |

| 3 | What does the installation and commissioning process involve for a Chinese intraoral scanner? | Installation typically includes hardware setup, software installation, calibration, and integration with existing practice management or CAD/CAM systems. In 2026, most premium Chinese scanners support DICOM and STL export and offer cloud-based calibration logs. Reputable suppliers provide remote installation via secure VPN, including technician-led video onboarding. For high-volume clinics or multi-unit rollouts, on-site commissioning may be available at an additional cost. Confirm whether installation includes DICOM network configuration and biometric calibration validation. |

| 4 | What warranty terms are standard for Chinese dental scanners, and are they serviceable locally? | Standard warranty is 1–2 years, covering defects in materials and workmanship. Top-tier manufacturers now offer extended 3-year warranties with options for on-site service. Critical: Confirm whether warranty service is handled by the manufacturer, a regional distributor, or third-party biomedical engineers. In 2026, many Chinese OEMs partner with global service networks (e.g., via alliances with Henry Schein or local dental service providers). Ensure the warranty includes calibration drift compensation and sensor lifespan guarantees (minimum 300,000 scans). |

| 5 | How is technical support structured for Chinese scanners, and is English-language support available? | Leading Chinese manufacturers now offer 24/7 multilingual technical support via phone, email, and remote desktop platforms. Support levels vary—entry-level models may offer email-only response within 48 hours, while premium models include SLA-backed phone support (e.g., 4-hour response). Confirm support includes firmware updates, troubleshooting AI-assisted diagnostics, and access to an online knowledge base with video tutorials. Distributors should verify local technical training programs and availability of certified field service engineers in their territory. |

© 2026 Professional Dental Equipment Guide. For internal use by dental clinics and authorized distributors. Specifications subject to change based on regulatory updates and technological advancements.

Need a Quote for Chinese Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160