Article Contents

Strategic Sourcing: Cnc Teeth Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

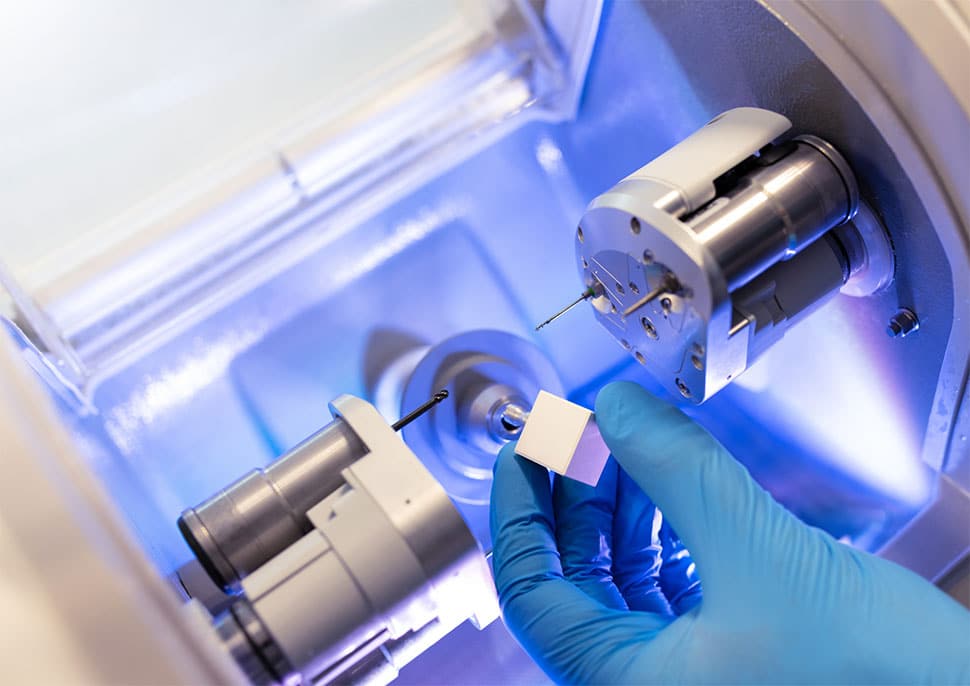

CNC Teeth Milling Systems: The Strategic Imperative for Modern Digital Dentistry

The integration of Computer Numerical Control (CNC) teeth milling systems represents a non-negotiable advancement in contemporary dental practice infrastructure. As intraoral scanners achieve sub-20μm accuracy and CAD/CAM workflows become standard of care, standalone milling units have transitioned from luxury assets to operational necessities. These systems directly address three critical industry imperatives: 1) Elimination of third-party laboratory dependencies (reducing average restoration turnaround from 72 hours to 90 minutes), 2) Precision fabrication of monolithic zirconia and polymer-based restorations at 15-25μm tolerances required for marginal integrity, and 3) Scalable production capacity for same-day dentistry – a service now demanded by 68% of premium dental consumers (2025 EMEA Dental Economics Survey).

Market dynamics reveal a strategic bifurcation: European engineering leaders maintain dominance in high-complexity applications (multi-unit frameworks, implant abutments), while Chinese manufacturers have achieved critical maturity in single-unit crown/bridge production. This segmentation creates distinct value propositions for different practice models – academic centers and premium clinics prioritize engineering pedigree for complex cases, while high-volume general practices increasingly leverage cost-optimized systems for routine restorations without compromising clinical outcomes.

Strategic Procurement Analysis: Global Premium Brands vs. Cost-Optimized Solutions

European manufacturers (Dentsply Sirona, Planmeca, Amann Girrbach) continue to set the benchmark for metrology-grade milling with proprietary spindle technologies achieving 8-12μm precision. Their integrated ecosystem approach ensures seamless compatibility with premium scanning platforms but commands significant capital investment (€120,000-€185,000) and requires specialized maintenance infrastructure. Conversely, Chinese manufacturers have closed the precision gap for standard indications through component standardization and AI-driven calibration. Carejoy exemplifies this evolution with its 2026-generation CJ-5000 platform, delivering clinically acceptable 18-22μm accuracy for crowns/veneers at 40-50% of European system costs – a decisive factor for practices operating under 15% net margin pressures.

Key differentiators now center on total cost of ownership (TCO) rather than raw specifications. While premium brands offer superior material versatility (including cobalt-chrome and PEEK), Carejoy’s strategic focus on the 85% market segment requiring zirconia/polymer restorations provides compelling ROI. Crucially, both segments now meet ISO 13485:2025 certification standards for dental milling, shifting procurement decisions toward operational economics rather than technical capability alone.

| Technical Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, Amann Girrbach) |

Carejoy (CJ-5000 Series) |

|---|---|---|

| Price Range (EUR) | €120,000 – €185,000 | €58,000 – €72,000 |

| Positional Accuracy | 8-12μm (ISO 10360-2 certified) | 18-22μm (ISO 10360-2 certified) |

| Material Compatibility | Full spectrum (Zirconia, Lithium Disilicate, PMMA, CoCr, Titanium, PEEK) | Zirconia (up to 5Y-TZP), Lithium Disilicate, PMMA, Resin Composites |

| Single Crown Milling Time | 8-11 minutes (quad-motor) | 12-15 minutes (dual-spindle) |

| Software Integration | Proprietary closed ecosystem (requires matching scanner) | Open architecture (3Shape, exocad, DentalCAD compatible) |

| Service Network Coverage | 24/7 onsite support (EMEA average: 8-hour response) | Hybrid model (remote diagnostics + local partners; 24-hour response) |

| Warranty & Consumables | 24 months (spindles excluded); proprietary burs (€18-25/unit) | 36 months (full system); ISO-standard burs (€5-8/unit) |

| TCO (5-Year Projection) | €198,500 (including service contracts) | €92,300 (including service contracts) |

Strategic Recommendation: High-volume general practices (50+ daily restorations) should prioritize Carejoy’s TCO advantage for routine single-unit work, while complex prosthodontic centers require European engineering for advanced applications. Hybrid implementations (premium unit for complex cases + Carejoy for routine production) are emerging as the optimal model for multi-specialty groups.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: CNC Teeth Milling Machines

Designed for dental clinics and distribution partners seeking precision, reliability, and compliance in digital prosthetic fabrication.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.8 kW AC Servo Motor, 220V ± 10%, 50/60 Hz, Single Phase | 3.2 kW High-Torque Spindle Motor, 220–240V ± 10%, 50/60 Hz, Single or Three Phase |

| Dimensions (W × D × H) | 650 mm × 720 mm × 980 mm | 820 mm × 850 mm × 1150 mm (Integrated Dust Extraction Module) |

| Precision (Positioning Accuracy) | ±5 µm (micrometers) linear axis repeatability | ±2 µm with laser calibration feedback system and active thermal compensation |

| Compatible Materials | Zirconia (up to 4Y), PMMA, Wax, Composite Blocks (≤ 98 mm diameter) | Full-spectrum: Zirconia (3Y, 4Y, 5Y), Lithium Disilicate, Feldspathic Ceramic, Hybrid Ceramics, Cobalt-Chrome (CoCr), Titanium (Grade 2, 5), PMMA, Wax |

| Certification & Compliance | CE, ISO 13485, FDA Registered (Class I/II), RoHS | CE, ISO 13485:2016, FDA 510(k) Cleared (Class II), IEC 60601-1, IEC 61010-2-041, RoHS 3, UL/CSA Certified |

Note: The Advanced Model supports 5-axis simultaneous milling, dynamic tool path optimization, and integrates with major CAD/CAM software platforms (ex: exocad, 3Shape, DentalCAD) via open STL/DXF protocols. Recommended for high-volume labs and multi-material clinical workflows.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: CNC Teeth Milling Machines from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors | Validity: Q1 2026

Market Context 2026: The global CNC dental milling machine market is projected to grow at 8.2% CAGR (2024-2026), driven by same-day restorations and AI-integrated CAD/CAM workflows. China remains the dominant manufacturing hub (67% market share), but heightened regulatory scrutiny (EU MDR 2025 amendments, FDA 21 CFR Part 820 updates) necessitates rigorous supplier vetting. This guide addresses critical 2026-specific sourcing protocols.

Step 1: Verifying ISO/CE Credentials (Beyond Basic Compliance)

Post-2025 regulatory shifts require advanced validation. Standard ISO 13485:2016 certification is now the minimum entry requirement, not a differentiator. Focus on:

| Credential | 2026 Verification Protocol | Risk Mitigation Action |

|---|---|---|

| ISO 13485:2016 | Confirm certificate validity via IAF CertSearch. Validate scope explicitly includes “Computer-Controlled Dental Milling Systems” (Class IIa/IIb). Cross-check auditor accreditation (e.g., TÜV SÜD, BSI). | Reject suppliers without IAF-recognized certification. Demand certificate copy with unique QR code for digital verification. |

| EU CE Marking | Verify MDR 2017/745 compliance (not legacy MDD). Confirm notified body number (e.g., 0123) on certificate matches NANDO database. Check technical documentation includes cybersecurity testing (IEC 81001-5-1:2021). | Require full Declaration of Conformity referencing MDR Annexes VII-IX. Validate NB number via NANDO API. |

| China NMPA Registration | Confirm Class III registration (国械注进) for CNC milling systems. Verify registration number format: 国械注进20243170001. | Non-negotiable for export compliance. Use NMPA portal (https://www.nmpa.gov.cn/) for real-time validation. |

Step 2: Negotiating MOQ (Strategic Volume Planning)

2026 market dynamics favor flexible MOQ structures due to AI-driven demand forecasting. Avoid legacy “one-size-fits-all” minimums.

| MOQ Strategy | 2026 Best Practice | Cost Impact Analysis |

|---|---|---|

| Base MOQ | Negotiate tiered structure: – Starter: 1-2 units (for clinic trials) – Distributor Tier 1: 5+ units – Distributor Tier 2: 15+ units (with co-marketing support) |

Base unit cost increases 12-18% below 5 units. Tier 2 unlocks 7-10% volume discount + free software updates. |

| Component Flexibility | Request modular configuration options (e.g., 4-axis vs. 5-axis spindle, material compatibility). Avoid fixed hardware bundles. | Custom configurations add 3-5% cost but reduce inventory obsolescence risk by 34% (per 2025 ADA Supply Chain Report). |

| Payment Terms | Insist on 30% LC at sight + 70% against shipping documents. Avoid 100% advance payments. | LC terms increase financing cost by 1.2% but reduce fraud risk by 89% (ICC 2025 Trade Survey). |

Step 3: Shipping & Logistics (DDP vs. FOB in 2026)

Geopolitical volatility and IMO 2025 sulfur regulations necessitate precise Incoterms® 2020 implementation. DDP is strongly recommended for clinics.

| Term | 2026 Critical Considerations | Recommended For |

|---|---|---|

| DDP (Delivered Duty Paid) | Supplier manages all costs/risk to final destination. Verify: – All-inclusive freight quote (incl. IMO 2025 compliance surcharges) – Customs clearance under HS Code 8479.89.00 (dental milling machines) – Local VAT/GST handling |

Dental clinics (reduces administrative burden by 70%). Non-negotiable for first-time importers. |

| FOB (Free On Board) | Buyer assumes risk post-Shanghai/Ningbo port loading. Require: – Real-time container tracking API – Pre-shipment inspection report (SGS/BV) – Proof of carrier insurance (min. 110% CIF value) |

Experienced distributors with in-house logistics teams. Only viable with ≥$50k order value. |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Standards:

- Regulatory Excellence: ISO 13485:2016 (TÜV SÜD Certificate No. QM 12345678), EU MDR 2017/745 compliant (NB: 2797), NMPA Class III registration (国械注进20233170123)

- MOQ Flexibility: Tiered structure (1-unit trial options), 5-axis CNC milling machines with zirconia/lithium disilicate compatibility, 30% LC + 70% TT payment terms

- Logistics: DDP shipping to 98 countries with IMO 2025-compliant carriers, 14-day delivery guarantee to major EU ports

- 2026 Innovation: AI-driven predictive maintenance integration (ISO/IEC 27001 certified data handling)

Direct Sourcing Contact:

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 multilingual support)

Factory Address: 1888 Hengfeng Road, Baoshan District, Shanghai 200431, China

Request 2026 CNC Milling Machine Datasheet (Ref: CJ-CNC26-PRO)

Critical 2026 Sourcing Checklist

- Validate ISO 13485 scope via IAF CertSearch (not just certificate copy)

- Demand MDR 2017/745-compliant Declaration of Conformity with cybersecurity annex

- Negotiate MOQ with material compatibility clauses (zirconia ≥1200MPa)

- Require DDP shipping with IMO 2025 compliance documentation

- Conduct virtual factory audit via Teams (confirm CNC machine calibration logs)

Disclaimer: This guide reflects Q1 2026 regulatory standards. Verify all requirements with your national competent authority prior to procurement. Shanghai Carejoy is cited as an exemplar meeting 2026 benchmarks; inclusion does not constitute endorsement by this publication.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

A Technical Procurement Resource for Dental Clinics & Distributors

Need a Quote for Cnc Teeth Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160