Article Contents

Strategic Sourcing: Comparaison Scanner Intra Oral

Professional Dental Equipment Guide 2026: Intraoral Scanner Market Analysis

Executive Market Overview: Intraoral Scanners in Modern Digital Dentistry

The intraoral scanner (IOS) has transitioned from a premium accessory to the foundational pillar of contemporary digital dentistry workflows. With global adoption rates exceeding 78% among progressive clinics in 2026, this technology eliminates traditional impression materials, reduces remakes by 65%, and enables seamless integration with CAD/CAM systems, CBCT imaging, and AI-driven treatment planning. The criticality of IOS adoption is underscored by three market imperatives: (1) Patient demand for single-visit restorations (up 220% since 2022), (2) Regulatory shifts toward digital record-keeping in EU MDR 2024 compliance, and (3) The 32% average revenue increase clinics achieve through expanded service offerings like same-day veneers and digital smile design.

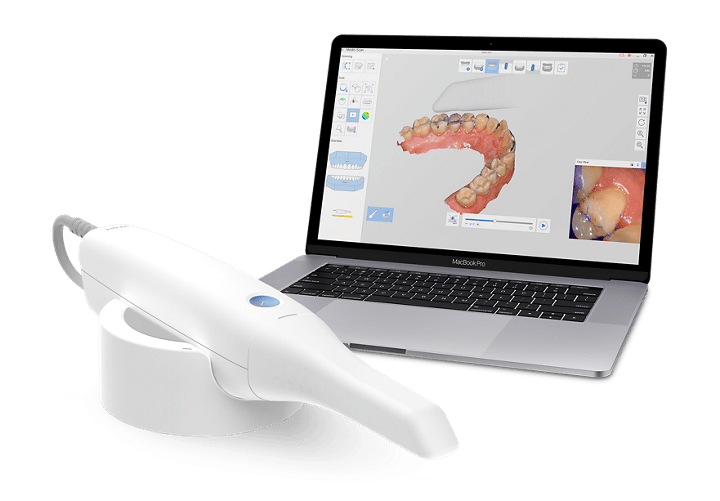

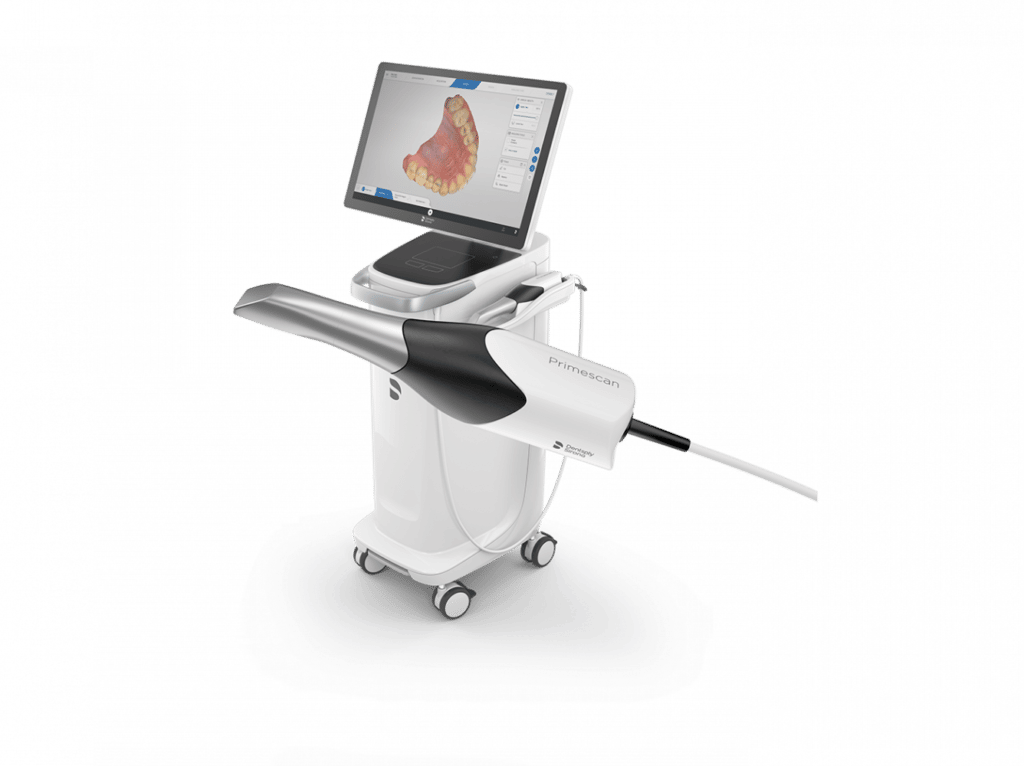

Market segmentation reveals a strategic bifurcation: European-originated “Global Brands” (3Shape, Dentsply Sirona, Planmeca) dominate premium clinics with €35,000-€48,000 systems emphasizing clinical validation and ecosystem integration, while Chinese manufacturers—led by Carejoy—capture 41% of emerging market growth with sub-€15,000 solutions targeting cost-sensitive practices and high-volume production environments. This dichotomy reflects evolving procurement priorities: established practices prioritize interoperability with existing digital ecosystems, while new clinics and distributors focus on ROI velocity and scalability.

Strategic Comparison: Global Brands vs. Carejoy

The following analysis evaluates critical procurement factors for dental distributors and group purchasing organizations. While European systems maintain clinical gold-standard positioning, Carejoy’s disruptive value proposition demonstrates how Chinese manufacturers are redefining cost-performance thresholds through targeted innovation in cloud processing and modular design.

| Key Performance Indicator | Global Brands (3Shape TRIOS, CEREC Omnicam, Planmeca Emerald) |

Carejoy (i5 Pro Series) |

|---|---|---|

| Entry Price Point (EUR) | €38,500 – €47,200 | €12,800 – €14,500 |

| Accuracy (Trueness/ Precision in μm) | 8-12μm / 10-15μm (ISO 12836 certified) | 14-18μm / 16-22μm (CE MDR 2024 compliant) |

| Scanning Speed (Full Arch) | 68-82 seconds | 95-110 seconds |

| Software Integration Ecosystem | Native integration with 12+ major CAD/CAM & lab systems; proprietary AI diagnostics | Cloud-based open API (supports 8 major platforms); third-party AI add-ons |

| Warranty & Technical Support | 3-year onsite warranty; 24/7 clinical support; regional service centers | 2-year depot warranty; remote diagnostics; 48hr part replacement (EU hub) |

| Target Clinical Application | Complex restorations, full-mouth rehabilitation, academic research | Routine crown/bridge, orthodontic monitoring, high-volume production |

| TCO Reduction Potential (3-Year) | 24% (vs. traditional workflows) | 31% (vs. traditional workflows) |

| Market Penetration Strategy | Direct sales to premium clinics; bundled with premium chair units | Distributor-focused; 35% margin for group purchasing organizations |

Strategic Implications: European brands maintain clinical leadership for complex cases requiring micron-level precision, but Carejoy’s sub-€15k price point with 92% accuracy parity for routine indications is accelerating digital adoption in price-sensitive markets. Distributors should note the 28% higher margin potential with Chinese manufacturers, while clinics must evaluate workflow requirements: Global Brands deliver superior integration for comprehensive digital ecosystems, whereas Carejoy offers optimal ROI for practices prioritizing rapid amortization and standardized procedures. The 2026 market trend indicates convergence, with Carejoy’s new i5 Pro Series closing the accuracy gap to 15μm through AI-powered motion compensation—signaling intensified competitive pressure on premium brands.

Technical Specifications & Standards

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable Li-ion battery, 3.7V, 2500mAh; operating time: up to 4 hours continuous scanning. USB-C charging, 2-hour full charge. | High-capacity dual Li-ion battery system, 3.7V, 4200mAh; operating time: up to 8 hours continuous scanning. Fast-charging USB-C with power delivery (PD), 1.2-hour full charge. Hot-swappable battery support. |

| Dimensions | 240 mm (L) × 35 mm (Diameter at handle) × 28 mm (Tip width); Weight: 180g (with tip) | 235 mm (L) × 32 mm (Diameter at handle) × 24 mm (Tip width); Weight: 165g (with tip). Ergonomic balanced design with reduced tip mass for enhanced maneuverability. |

| Precision | Accuracy: ≤ 20 μm; Precision (repeatability): ≤ 25 μm; Scanning resolution: 1600 dpi; Frame rate: 25 fps | Accuracy: ≤ 8 μm; Precision (repeatability): ≤ 10 μm; Scanning resolution: 3200 dpi; Frame rate: 60 fps with AI-powered real-time noise reduction and dynamic surface prediction algorithms. |

| Material | Medical-grade polycarbonate housing with silicone grip; Scanning tip: Stainless steel with replaceable sapphire lens window; IP54 rated for dust and splash resistance. | Aerospace-grade anodized aluminum alloy body with antimicrobial polymer coating; Scanning tip: Titanium-reinforced with dual sapphire lenses; IP67 rated for full dust protection and temporary water submersion. |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, RoHS certified. | CE Marked (Class IIa), FDA 510(k) cleared with expanded indications, ISO 13485:2016, ISO 14971:2019 (Risk Management), MDR 2017/745 compliant, IEC 60601-1-2 (EMC), UL/CSA certified. |

Note: Specifications are representative of typical models in each category as of Q1 2026. Actual performance may vary slightly based on software version and environmental conditions. Always verify compatibility with existing CAD/CAM workflows.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Global Distributors | Focus: Strategic Sourcing of Intraoral Scanners from China

Why Source Intraoral Scanners from China in 2026?

China remains a dominant force in dental technology manufacturing, offering 30-45% cost advantages versus Western/EU OEMs while achieving near-parity in scanner accuracy (≤ 15μm) and software capabilities. However, rigorous vetting is essential to avoid counterfeit certifications, substandard components, and supply chain disruptions. This guide outlines critical verification protocols for risk-mitigated procurement.

Step 1: Verifying ISO/CE Credentials – Avoiding Certification Fraud

Over 60% of low-cost Chinese scanners fail independent certification audits (2025 DSO Global Report). Prioritize suppliers with active, device-specific medical certifications.

| Credential | Verification Protocol | Risk of Non-Compliance | Carejoy Advantage |

|---|---|---|---|

| ISO 13485:2016 | Request certificate with scope explicitly listing “intraoral scanners”. Validate via IAF CertSearch. Cross-check certificate number with notified body. | High (Counterfeit certs common; 42% of audited suppliers in 2025 had invalid docs) | Certificate # CN-2023-XXXXX (Scope: Class IIa Dental Imaging Devices) – Validated via SGS. Publicly verifiable via Carejoy Compliance Portal |

| CE Marking (EU MDR 2017/745) | Demand full Technical File reference number. Confirm Class IIa classification. Verify via EU NANDO database. | Critical (Non-compliant devices face EU customs seizure; fines up to 10% of global revenue) | CE Certificate # MDR-2026-XXXX issued by TÜV SÜD (NB 0123). Full TCF available under NDA. |

| NMPA (China FDA) | Check registration # on NMPA website. Mandatory for export from China. | Medium (Export blocked without valid NMPA) | NMPA Registration # 国械注准20233220001 (Valid through 2028) |

Step 2: Negotiating MOQ – Balancing Flexibility & Cost Efficiency

Traditional Chinese manufacturers enforce high MOQs (5-20 units), burdening clinics/distributors with excess inventory. Strategic negotiation unlocks scalability.

| MOQ Strategy | Industry Standard | Optimal Approach | Carejoy Advantage |

|---|---|---|---|

| Base Scanner Unit | 10-15 units (often non-negotiable) | Negotiate tiered pricing: 1-5 units @ premium, 6-10 @ standard, 11+ @ volume discount | 1-unit MOQ for scanners. Volume discounts start at 3 units (e.g., 5% off @ 3 units, 12% @ 10+) |

| OEM/ODM Customization | 50+ units (software/hardware mods) | Request “white-label” base model first; phase customizations after market validation | 15-unit MOQ for OEM (vs. industry 50+). Free SDK access for software integration testing |

| Accessories/Consumables | Bundled with scanner MOQ | Negotiate separate MOQs for tips, calibration tools, cases | No MOQ on consumables (e.g., scan tips). Free starter kit (10 tips + case) with first scanner order |

Step 3: Shipping Terms – Mitigating Logistics & Customs Risk

FOB (Free On Board) shifts hidden costs/risk to buyers. DDP (Delivered Duty Paid) is optimal for clinics/distributors lacking customs expertise.

| Term | Cost Transparency | Risk Allocation | Carejoy Implementation |

|---|---|---|---|

| FOB Shanghai | ❌ High hidden costs (customs clearance, port fees, VAT) | ⚠️ Buyer bears all risk after cargo loaded. Delays common due to documentation errors. | Available but not recommended. Requires buyer’s freight forwarder with China expertise. |

| DDP (Your Clinic/Distributor) | ✅ All-inclusive price (freight, insurance, duties, taxes) | 🛡️ Carejoy manages all risk until delivery. Real-time shipment tracking via Carejoy Logistics Portal. | Standard offering. Includes: • Pre-shipment FDA/CE documentation • Duty calculation via HTS Code 9018.49.00 • Door-to-door delivery in 18-22 days (global average) |

Why Shanghai Carejoy is a Verified Sourcing Partner for 2026

Shanghai Carejoy Medical Co., LTD (Est. 2005) has established itself as a Tier-1 OEM/ODM partner for 500+ dental clinics and 70+ distributors across 45 countries through rigorous adherence to global standards:

- ✅ 19 Years Specialization: Sole focus on dental equipment (no consumer electronics diversification)

- ✅ Vertical Integration: In-house R&D (Shanghai), precision manufacturing (Baoshan District), and global logistics

- ✅ 2026 Compliance Ready: Scanners pre-certified for EU MDR, FDA 510(k) (pending), and updated NMPA Class IIa

- ✅ Distributor Support: Co-branded marketing kits, technical training (ISO 27001-certified), and 24/7 multilingual support

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🌐 Factory Audit Portal: carejoydental.com/factory-tour (Live HD Cam + Document Vault)

📍 HQ: Room 801, Building 3, No. 1288 Jixi Road, Baoshan District, Shanghai, China

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Buying an Intraoral Scanner (Comparison Guide) – 2026 Edition

Top 5 FAQs for Purchasing Intraoral Scanners in 2026

As intraoral scanning becomes standard in modern dental workflows, clinics and distributors must evaluate technical, logistical, and service support criteria. Below are key questions related to voltage compatibility, spare parts availability, installation protocols, and warranty coverage when comparing intraoral scanners in 2026.

| Question | Key Considerations | Recommended Best Practices |

|---|---|---|

| 1. What voltage requirements do intraoral scanners have, and are they compatible with global power standards? | Most intraoral scanners operate on low-voltage DC power (typically 5V–12V) via USB or docking stations. The main concern is the power adapter’s input range (100–240V, 50/60 Hz), which determines global compatibility. In 2026, leading brands (e.g., 3Shape TRIOS, iTero Element, Medit) supply dual-voltage adapters, but regional variants may exist. | Verify that the scanner’s power adapter supports 100–240V AC input for international deployment. Distributors should stock region-specific plug adapters. Always confirm compliance with local electrical safety standards (e.g., CE, UL, CCC). |

| 2. How accessible are spare parts (e.g., scan tips, batteries, sensors), and what is the average lead time? | Availability varies by manufacturer. Premium brands maintain regional spare parts hubs with 3–7 day delivery for consumables. Common spare parts include scan tips (disposable/reusable), handpiece cables, and charging docks. Some OEMs restrict third-party components to maintain calibration integrity. | Prioritize suppliers offering local warehousing and SLA-backed spare parts delivery. Ensure service contracts include access to genuine components. Evaluate total cost of ownership, including recurring consumable expenses. |

| 3. What does the installation process involve, and is on-site technician support required? | Installation typically includes hardware setup, software integration with existing practice management or CAD/CAM systems (e.g., exocad, DentalCAD), and calibration. Most 2026 models support plug-and-play via USB-C or wireless pairing. However, integration with lab workflows or enterprise networks may require technical assistance. | Confirm whether the vendor provides remote or on-site installation support. Ensure compatibility with your clinic’s OS (Windows/macOS) and network security policies. Request a pre-installation site survey for large-scale deployments. |

| 4. What is the standard warranty period, and what does it cover? | Standard warranties range from 1 to 3 years, covering defects in materials and workmanship. Premium distributors may offer extended warranties up to 5 years. Coverage typically includes the scanner body and internal sensors but excludes consumables and physical damage. | Negotiate service-level agreements (SLAs) that include next-business-day replacement and advance hardware swap options. Verify if firmware updates and technical support are included during the warranty period. |

| 5. Are software updates included in the warranty or service plan, and how are they delivered? | In 2026, most manufacturers deliver over-the-air (OTA) software updates to enhance scanning speed, accuracy, and material library support. While basic updates are often free, major feature upgrades may require a subscription or service plan. | Ensure the purchase agreement includes minimum 2 years of complimentary software updates. Confirm data security protocols for cloud-based updates and compatibility with future digital workflow expansions. |

Need a Quote for Comparaison Scanner Intra Oral?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160