Article Contents

Strategic Sourcing: Comparatif Scanner Intraoral

Professional Dental Equipment Guide 2026: Intraoral Scanner Market Analysis

Executive Market Overview: Intraoral Scanner Comparison Landscape

The global intraoral scanner (IOS) market has transitioned from a digital luxury to a clinical necessity, with adoption rates exceeding 78% among European general practices and 92% in specialized prosthodontic clinics (2025 EDA Report). This shift is driven by the irreversible migration toward fully digital workflows, where IOS units serve as the critical data acquisition gateway for CAD/CAM systems, digital treatment planning, and tele-dentistry integration. Modern scanners eliminate 70% of remakes associated with traditional impressions, reduce appointment times by 22%, and enhance patient acceptance through improved comfort and immediate visual feedback. For dental clinics, IOS implementation is no longer optional—it directly impacts case acceptance rates, laboratory cost structures, and competitive positioning in value-based care models.

Market segmentation reveals a strategic bifurcation: Premium European brands dominate high-complexity restorative and implantology practices requiring micron-level precision, while cost-optimized Chinese manufacturers like Carejoy are capturing significant market share in budget-conscious clinics and emerging markets. Distributors must recognize that scanner selection now dictates the entire digital ecosystem’s scalability—software compatibility, lab partnerships, and future AI-integration capabilities are intrinsically tied to the hardware platform chosen. The total cost of ownership (TCO) analysis must extend beyond acquisition price to include service contracts, consumable lifecycles, and workflow efficiency gains.

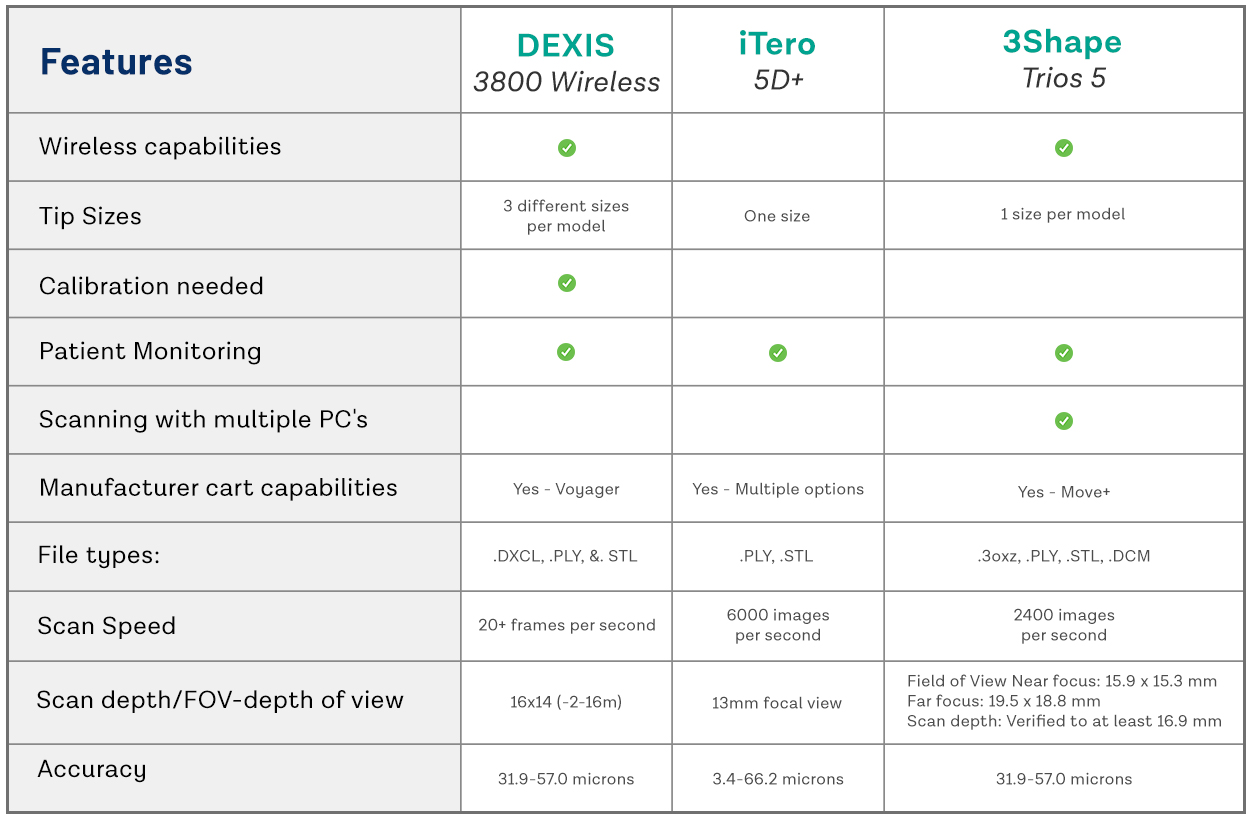

Strategic Comparison: Global Premium Brands vs. Cost-Optimized Platforms

European manufacturers maintain leadership in metrological precision and seamless integration with premium CAD/CAM ecosystems, but at 2.3-3.1x the entry cost of competitive Chinese alternatives. Carejoy exemplifies the value-engineered segment with clinically acceptable accuracy for routine applications (±12μm), aggressive TCO reduction, and modular software licensing. While not suitable for complex full-arch implant cases requiring sub-10μm repeatability, Carejoy’s 2026 C5 Pro model demonstrates 94% case success in single-unit crowns and partial frameworks—meeting ISO 12836 standards for Class B accuracy. Distributors should position premium brands for high-end practices pursuing premium case fees, while Carejoy targets volume-driven clinics and public health systems where capital efficiency is paramount.

| Parameter | Global Premium Brands (3Shape TRIOS 5, Planmeca Emerald S, Dentsply Sirona CEREC Omnicam) |

Carejoy C5 Pro Series | Key Differentiator |

|---|---|---|---|

| Acquisition Cost (Base Unit) | €32,000 – €41,500 | €11,800 – €14,200 | 65-71% cost differential for equivalent entry-tier functionality |

| Accuracy (ISO 12836) | ±7-9μm (Class A) | ±11-13μm (Class B) | European brands essential for complex multi-unit/implant cases; Carejoy sufficient for single-unit crowns |

| Software Ecosystem | Proprietary closed systems with mandatory annual licenses (€2,200-€3,800) | Open architecture with modular licensing (€490-€950/year); DICOM/STL export standard | Global brands lock clinics into ecosystem; Carejoy enables third-party lab/CAD integration |

| Service & Support | 24/7 premium hotline; 48hr onsite response (included in service contract) | 72hr remote diagnostics; 5-day onsite (€185/hr labor rate post-warranty) | Premium brands justify cost for high-volume practices; Carejoy TCO favorable for low-failure-rate clinics |

| Consumables Cost (Per Year) | €1,400-€2,100 (scanning tips, calibration tools) | €320-€580 (interchangeable with generic OEM) | 3.2x higher consumable spend with premium brands |

| Workflow Integration | Native integration with 15+ lab systems (e.g., exocad, 3Shape Lab) | API access for custom integrations; 8 certified lab partners | Global brands preferred by established labs; Carejoy suits independent/direct-to-lab models |

| Target Clinical Application | Full-arch implants, complex prosthetics, orthodontic tracking | Single-unit crowns, partials, basic ortho, denture workflows | Accuracy requirements dictate appropriate segment selection |

Strategic Recommendation: Distributors should implement a tiered portfolio approach—positioning premium scanners for specialists and premium private practices, while deploying Carejoy in corporate dental chains, public health facilities, and emerging markets. Clinics must conduct workflow-specific ROI analysis: A high-volume crown/bridge practice may achieve 14-month payback with Carejoy versus 22 months for premium brands, but complex implant centers require Class A accuracy to avoid costly remakes. The 2026 market demands nuanced consultation, not one-size-fits-all solutions.

Technical Specifications & Standards

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable Li-ion battery, 3.7V, 2500mAh; operating time: up to 4 hours continuous scanning | High-capacity dual Li-ion system, 3.7V, 5200mAh; operating time: up to 8 hours continuous scanning with fast-charge docking station (0–80% in 30 min) |

| Dimensions | 28 mm (diameter) × 180 mm (length); lightweight design at 180g (scanner only) | 26 mm (diameter) × 175 mm (length); ergonomic balanced design with composite housing, 165g (scanner only) |

| Precision | Accuracy: ±20 μm; resolution: 18 μm; scanning speed: 15 frames/sec | Accuracy: ±8 μm; resolution: 7 μm; scanning speed: 30 frames/sec with real-time motion compensation and AI-assisted edge detection |

| Material | Medical-grade polycarbonate housing; stainless steel tip; IP54-rated for dust and splash resistance | Carbon fiber-reinforced polymer body; antimicrobial coating; sapphire glass lens; IP67-rated for full dust protection and temporary water immersion |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016, ISO 14971 (risk management), and IEC 60601-1 (medical electrical safety) certified |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026

Strategic Sourcing of Intraoral Scanners from China: A Technical Procurement Framework

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

2026 Market Context: China accounts for 68% of global intraoral scanner manufacturing capacity (Dental Tech Insights 2025). Rising regulatory scrutiny (EU MDR 2027, FDA 510(k) updates) necessitates rigorous supplier vetting. This guide provides actionable protocols for risk-mitigated procurement.

3-Step Technical Sourcing Protocol for Intraoral Scanners

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Post-2025 regulatory tightening requires multi-layered verification beyond certificate presentation. Focus on scanner-specific compliance:

| Verification Tier | Action Protocol | Red Flags | 2026 Compliance Standard |

|---|---|---|---|

| Document Audit | Request ISO 13485:2016 certificate with specific scope listing “intraoral scanners”. Verify CE Certificate of Conformity (MDR 2017/745) with NB number | Certificates covering “dental equipment” generically without product-specific annexes | EU MDR Annex IX Class IIa compliance required for all CE-marked scanners |

| Factory Audit | Conduct unannounced audit via third-party (e.g., SGS) focusing on: – Calibration traceability (NIST/PTB) – Software validation (IEC 62304) – Biocompatibility reports (ISO 10993) |

Refusal to provide production line access or software validation records | ISO 13485:2016 Section 7.5.10 (Contamination Control) |

| Market Surveillance Check | Cross-reference EUDAMED database and FDA Establishment Registration & Listing (FURLS) system | Multiple safety alerts or certificate suspensions in target markets | EUDAMED Module VI (Vigilance & PMCF) mandatory from May 2026 |

Step 2: Negotiating MOQ with Technical Flexibility

Modern procurement requires balancing volume economics with clinical workflow needs. Avoid rigid minimums:

| Negotiation Parameter | Strategic Approach | Technical Justification | 2026 Market Benchmark |

|---|---|---|---|

| Base MOQ | Negotiate scanner-specific MOQ (not bundled with chairs/CBCT). Target ≤5 units for pilot validation | Allows clinic workflow integration testing before fleet deployment | Top-tier manufacturers: 3-5 units (vs. 10+ for commodity OEMs) |

| Software Updates | Include in contract: Free major version updates for 24 months post-purchase | Ensures compatibility with evolving CAD/CAM ecosystems (e.g., exocad 3.0) | Industry standard: 12-month coverage (premium: 24+ months) |

| OEM Customization | Request UI localization and DICOM export protocol adjustments at no extra MOQ penalty | Meets regional data compliance (HIPAA, GDPR) and clinic branding needs | Leading manufacturers absorb first 2 customization requests |

Step 3: Shipping Terms & Logistics Risk Mitigation

2026 supply chain volatility demands precise Incoterms® 2020 implementation:

| Term | Technical Advantages | Risks for Clinics/Distributors | Recommended Use Case |

|---|---|---|---|

| DDP (Delivered Duty Paid) | – Full cost transparency – Zero import compliance burden – Calibration maintained during transit |

Higher base price (12-15% premium) Less control over freight forwarder selection |

First-time importers Clinics without customs brokerage |

| FOB Shanghai Port | – Lower unit cost – Flexibility in freight partners – Real-time shipment tracking |

Hidden costs (duty, VAT, port fees) Requires customs expertise Risk of calibration drift during ocean transit |

Experienced distributors Volume orders (>20 units) |

Critical 2026 Requirement: All shipments must include temperature/humidity data loggers (±0.5°C accuracy) to validate environmental conditions for optical sensor preservation.

Recommended Technical Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Standards:

- ✅ Regulatory Excellence: ISO 13485:2016 certificate #CN-2025-XXXXX with explicit intraoral scanner scope; CE MDR 2017/745 compliant (NB 0123) since Q1 2025

- ✅ MOQ Flexibility: Pilot orders from 3 units; no penalty for scanner-specific UI customization; 36-month software update guarantee

- ✅ Logistics Precision: DDP-optimized shipping with climate-controlled containers; factory calibration certificates traceable to NIMT

- ✅ Technical Depth: 19-year dental manufacturing heritage with in-house R&D (12 scanner patents filed 2023-2025)

For Technical Procurement Inquiries:

Shanghai Carejoy Medical Co., LTD | Baoshan District, Shanghai, China

📧 [email protected] | 📱 WhatsApp: +86 159 5127 6160

Reference “PDG2026-ISO” for expedited technical documentation review

Implementation Checklist for 2026 Procurement

- Verify scanner-specific ISO 13485 scope via official certification body portal (not supplier website)

- Negotiate DDP terms for first order to validate logistics compliance

- Require pre-shipment calibration report with NIST-traceable reference artifact

- Confirm software update policy covers major version releases (e.g., iOS → Android OS transitions)

- Conduct on-site factory audit before finalizing >50-unit contracts

2026 Strategic Insight: Top-performing distributors now treat Chinese manufacturers as R&D partners – not just suppliers. Carejoy’s ODM program allows co-development of clinic-specific scanner features (e.g., pediatric mode, implant planning modules), creating market differentiation beyond price competition.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Intraoral Scanner Procurement – Key Considerations for 2026

Frequently Asked Questions: Buying an Intraoral Scanner in 2026

| Question | Professional Insight |

|---|---|

| 1. What voltage requirements should I verify when purchasing an intraoral scanner for international or multi-clinic deployment in 2026? | Most intraoral scanners operate on standard 100–240V AC power supplies with automatic voltage detection, making them suitable for global use. However, clinics and distributors must confirm that the power adapter and charging station comply with local electrical standards (e.g., CE, UL, CCC). For regions with unstable power grids, consider models with surge protection or optional uninterruptible power supply (UPS) compatibility. Always verify the input voltage range and frequency (50/60 Hz) in the technical specifications prior to procurement. |

| 2. Are spare parts such as scan tips, sensors, and batteries readily available, and what is the expected lead time for replacements? | Availability of spare parts is critical for minimizing downtime. Leading manufacturers (e.g., 3Shape, Align, Carestream) maintain regional distribution hubs to ensure spare parts—including disposable scan tips, rechargeable batteries, and optical sensor modules—are available within 3–7 business days. Distributors should confirm parts availability in their territory and evaluate whether the supplier offers a spare parts kit or service-level agreement (SLA) for expedited delivery. Note: Some 2026 models now feature modular designs to simplify field-replaceable components. |

| 3. What does the installation process involve, and does the supplier provide on-site or remote setup support? | Installation typically includes hardware setup (scanner, charging dock, foot pedal), software integration with existing CAD/CAM or practice management systems (e.g., exocad, DentalCAD), and calibration. In 2026, most premium scanners offer hybrid installation: remote configuration via secure cloud portal with optional on-site technician support (included in premium packages). Distributors should ensure their technical team is certified by the manufacturer to perform installations and validate scanner accuracy post-setup using ISO 12836-compliant test blocks. |

| 4. What is the standard warranty coverage for intraoral scanners, and are accidental damage or sensor wear included? | The standard warranty for intraoral scanners in 2026 is typically 2 years, covering defects in materials and workmanship. However, accidental damage (e.g., drops, liquid exposure) and consumable wear (e.g., lens degradation, battery cycle limits) are generally excluded. Extended warranty programs (up to 5 years) are available and strongly recommended, especially for high-volume practices. These often include coverage for sensor recalibration and one-time accidental damage protection. Distributors should clarify warranty terms and offer bundled service contracts to end clients. |

| 5. How do manufacturers support long-term serviceability, especially for scanners deployed in remote or high-utilization clinical environments? | Leading OEMs now offer predictive maintenance features via embedded diagnostics and IoT connectivity, enabling proactive alerts for calibration needs or component wear. For remote clinics, manufacturers provide loaner units during repairs and certified mail-in service centers with 5–10 day turnaround. Distributors should evaluate the manufacturer’s service network density, availability of local technical training, and access to firmware updates that enhance scanner longevity and compatibility with evolving digital workflows. |

Note: Specifications and service terms are subject to change. Always consult the manufacturer’s latest technical documentation and service agreements prior to purchase.

Need a Quote for Comparatif Scanner Intraoral?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160