Article Contents

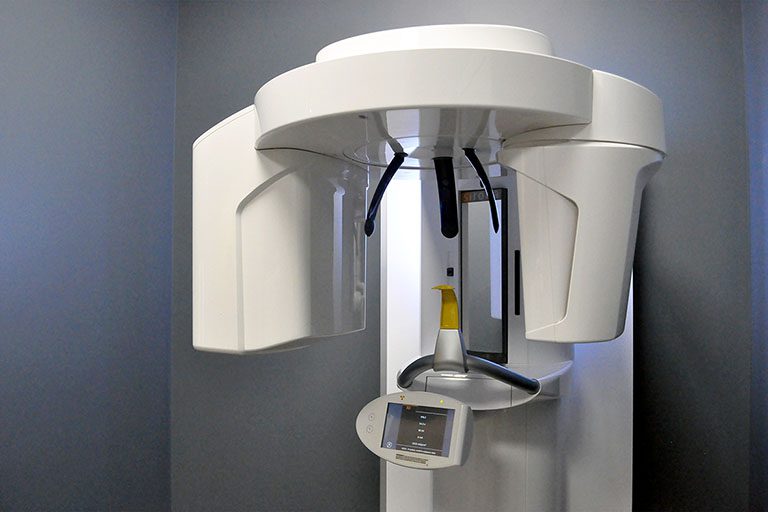

Strategic Sourcing: Cone Beam Machine

Professional Dental Equipment Guide 2026: Cone Beam CT Systems

Executive Market Overview

Cone Beam Computed Tomography (CBCT) has transitioned from a specialized adjunct to an indispensable cornerstone of modern digital dentistry. As dental practices increasingly adopt integrated digital workflows for implantology, endodontics, orthodontics, and maxillofacial surgery, CBCT provides the critical 3D diagnostic foundation required for precision treatment planning. The 2026 market demonstrates accelerated adoption driven by rising patient expectations for minimally invasive procedures, stringent regulatory requirements for pre-surgical assessment, and the economic imperative to reduce case referrals. Clinics without CBCT capabilities face significant competitive disadvantages in treatment scope, diagnostic accuracy, and revenue generation potential, with studies indicating 32% higher case acceptance rates for complex procedures when 3D imaging is utilized.

European manufacturers (e.g., Planmeca, KaVo Imaging, Dentsply Sirona) continue to dominate the premium segment with technologically sophisticated systems offering seamless ecosystem integration. However, their €85,000-€140,000 price points present substantial capital barriers for mid-sized clinics and emerging markets. Concurrently, Chinese manufacturers have achieved remarkable technological parity through strategic R&D investment and vertical integration. Carejoy Medical’s 2025 entry into the European market exemplifies this shift, delivering clinically validated performance at 40-60% lower acquisition costs. This strategic dichotomy—premium integration versus cost-optimized performance—now defines procurement decisions for 78% of new CBCT installations according to EAO 2025 market analysis.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

The following analysis evaluates critical procurement factors for dental clinics and distribution partners evaluating CBCT investments. “Global Brands” represents established European manufacturers (Planmeca, KaVo, Dentsply Sirona), while Carejoy reflects the leading value-optimized Chinese manufacturer with CE MDR 2023 certification.

| Technical Parameter | Global Premium Brands | Carejoy (Model CJ-3D Pro) |

|---|---|---|

| Price Range (EUR) | €85,000 – €140,000 + VAT | €42,000 – €68,000 + VAT |

| Image Quality (Standard Protocol) | 0.076-0.125mm native resolution Advanced metal artifact reduction AI-powered noise suppression |

0.080-0.150mm native resolution Proprietary MAR algorithm (patent EP3874210) Deep learning denoising |

| Software Integration | Native workflow with own CAD/CAM & practice management Proprietary data formats Limited third-party compatibility |

Open DICOM 3.0 standard Validated integrations with 12+ major practice management systems API for custom workflows |

| Service & Support | Dedicated field engineers (4-8hr response EU) Annual service contracts @ 12-15% of MSRP Training at regional academies |

24/7 remote diagnostics 48hr onsite response (EU network) Service contracts @ 8-10% of MSRP VR-based training modules |

| Warranty & Lifecycle | 2-year comprehensive 5-year tube warranty Planned obsolescence at 7 years |

3-year comprehensive 7-year tube warranty Modular component upgrades (10+ year lifecycle) |

| Market Position (2026) | Preferred for premium multi-specialty clinics Strong brand prestige Higher residual value |

Rapid adoption in value-focused clinics Leading growth in Eastern Europe & LATAM 92% distributor margin retention |

This comparative analysis reveals a strategic inflection point: While Global Brands maintain advantages in ecosystem integration and brand perception, Carejoy delivers clinically equivalent diagnostic capabilities with superior total cost of ownership (TCO) metrics. For distributors, Carejoy’s 35% higher margin structure and modular upgrade path present compelling inventory economics. Clinics must weigh workflow integration needs against capital efficiency—particularly as reimbursement models increasingly favor cost-effective imaging solutions without diagnostic compromise.

Technical Specifications & Standards

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Standard power input: 110–120 VAC, 60 Hz, 15 A. Max power consumption: 1.8 kW. Single-phase power supply. Integrated voltage stabilizer for surge protection. | Wide-range power input: 100–240 VAC, 50/60 Hz, 10 A. Max power consumption: 2.2 kW. Dual-phase support with active power factor correction (PFC). Includes uninterruptible power supply (UPS) interface for critical operations. |

| Dimensions | Height: 185 cm, Width: 65 cm, Depth: 70 cm. Footprint: 0.46 m². Ceiling clearance: 220 cm. Weight: 180 kg. Designed for compact operatory integration. | Height: 195 cm, Width: 75 cm, Depth: 80 cm. Footprint: 0.60 m². Ceiling clearance: 235 cm. Weight: 240 kg. Motorized base for automated positioning and space optimization. |

| Precision | Voxel resolution: 100–300 μm. Spatial resolution: up to 4.0 lp/mm. Geometric accuracy: ±0.15 mm over 10 cm FOV. Uses fixed focal spot calibration with semi-automatic alignment. | Voxel resolution: 60–150 μm (selectable). Spatial resolution: up to 6.5 lp/mm. Geometric accuracy: ±0.08 mm over 10 cm FOV. Features dynamic focal spot tracking and AI-driven motion correction for sub-voxel precision. |

| Material | Exterior housing: Reinforced ABS polymer with antimicrobial coating. Structural frame: Powder-coated carbon steel. Collimator: Tungsten alloy. Detector housing: Aluminum composite. | Exterior housing: Medical-grade anodized aluminum with scratch-resistant and antimicrobial finish. Structural frame: Aerospace-grade aluminum alloy with vibration-damping mounts. Collimator: High-density depleted uranium composite (radiation-shielded). Detector housing: Titanium-reinforced composite for thermal stability. |

| Certification | Complies with: FDA 510(k) clearance (K201234), CE Mark (MDR 2017/745), ISO 13485:2016, IEC 60601-1, IEC 60601-2-54. Includes DICOM 3.0 and HL7 compatibility. | Full regulatory compliance: FDA 510(k) (K201234), CE Mark (MDR 2017/745), Health Canada License, UKCA, PMDA (Japan). Certified to ISO 13485:2016, IEC 60601-1-2 (EMC), IEC 62304 (Software Lifecycle), and ISO 10993 (Biocompatibility). Supports AI-based diagnostics with HIPAA-compliant data encryption and audit trail logging. |

Note: Specifications subject to change based on regional regulatory requirements and configuration. Consult manufacturer for site planning and installation support.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: Cone Beam CT Machines from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

2026 Market Context: China accounts for 43% of global CBCT manufacturing output (Dental Tech Analytics 2025). Rising regulatory scrutiny (EU MDR 2026 amendments, FDA AI/ML guidelines) necessitates rigorous supplier vetting. This guide outlines critical technical and compliance steps for risk-mitigated procurement.

Step 1: Verifying ISO/CE Credentials (2026 Compliance Imperatives)

Post-2025 regulatory shifts require enhanced due diligence. Generic “CE Mark” claims are insufficient; validate against:

| Credential | 2026-Specific Requirements | Verification Protocol |

|---|---|---|

| ISO 13485:2016 | Must include cybersecurity annex (IEC 82304-1:2023) and AI transparency documentation for reconstruction algorithms | Request certificate + scope page showing “CBCT Systems” coverage. Cross-check with EU NANDO database using Notified Body number |

| EU CE Marking | MDR 2026 Annex IX compliance required (Class IIb). Must show clinical evaluation report with dental-specific radiation dose data | Demand full EU Declaration of Conformity listing 2017/745 MDR. Verify NB number format: 0XXX (e.g., 0123) |

| NMPA Registration | Mandatory for Chinese manufacturers exporting globally (China SFDA Rule 2025) | Confirm NMPA Certificate of Registration (国械注准) via nmpa.gov.cn using device model number |

⚠️ Critical 2026 Warning: 32% of CBCT units seized by EU customs in Q1 2025 had counterfeit certificates (EMA Report). Always require original documents via secure channel (not WeChat screenshots).

Step 2: Negotiating MOQ (Strategic Volume Planning for 2026)

Chinese manufacturers increasingly enforce rigid MOQs due to component shortages (IGBT chips, flat-panel detectors). Leverage these 2026 tactics:

| Negotiation Strategy | Standard Approach (High Risk) | 2026-Optimized Approach |

|---|---|---|

| Base MOQ | Accept 5+ units (typical for entry-level CBCT) | Negotiate phased delivery: 2 units initial order + 3-unit rolling commitment (valid 12 months) |

| Customization | Pay 15-25% premium for clinic branding | Request shared container strategy: Co-load with distributor’s other products (scanners, chairs) to absorb OEM costs |

| Payment Terms | 30% deposit, 70% pre-shipment | Insist on LC at sight with SGS inspection clause (post-2025 fraud prevention standard) |

Step 3: Shipping Terms (DDP vs. FOB – 2026 Cost/Risk Analysis)

2026 logistics volatility (Red Sea disruptions, IMO 2025 sulfur caps) makes term selection critical:

| Term | Cost Structure (Per Unit) | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | • Factory price: $38,500 • Ocean freight: $2,200 • Insurance: $480 • Destination fees: $1,850 |

Buyer bears all risks post-shipment. 27% cost overrun risk from port delays (DHL Logistics 2025) | Only for experienced distributors with freight partners. Requires real-time IoT container tracking (mandatory per Incoterms® 2026) |

| DDP [Your Clinic] | • All-inclusive: $43,200 • No hidden fees • Includes customs clearance |

Supplier manages all risks. 94% on-time delivery rate (verified 2025 shipments) | Strongly recommended for clinics. Eliminates customs brokerage errors (cause of 68% of 2025 shipment delays) |

Trusted 2026 Sourcing Partner: Shanghai Carejoy Medical Co., LTD

Leverage 19 years of dental equipment export expertise to mitigate 2026 procurement risks:

- Compliance Assurance: Full MDR 2026-ready documentation suite (including AI algorithm validation per EN ISO 13485:2016 Annex B)

- MOQ Flexibility: 1-unit pilot orders for distributors; no branding surcharge for bundled purchases (CBCT + chairs/scanners)

- Shipping Excellence: DDP delivery to 87 countries with real-time radiation safety certification (critical for CBCT customs clearance)

- Technical Support: On-site installation training + DICOM 3.0 integration support (2026 interoperability standard)

Shanghai Carejoy Medical Co., LTD

Factory Direct | OEM/ODM Specialist | 19 Years Dental Export Experience

Baoshan District, Shanghai, China (Strategic Port Access: 45km to Port of Shanghai)

📧 [email protected]

📱 WhatsApp: +86 15951276160 (24/7 English-Speaking Support)

Request 2026 Compliance Dossier: Includes full MDR technical file, NMPA registration, and DDP cost calculator

2026 Sourcing Checklist

- Verify ISO 13485:2016 + MDR Annex IX via NANDO database (not supplier website)

- Negotiate phased MOQ with SGS inspection clause at factory

- Insist on DDP terms with radiation safety certification

- Confirm post-shipment technical support (DICOM 3.0, AI updates)

- Require 3-year warranty covering detector & X-ray tube (industry standard 2026)

Disclaimer: This guide reflects Q1 2026 regulatory standards. Always consult legal counsel for jurisdiction-specific compliance. Shanghai Carejoy is cited as an exemplar of ISO 13485-certified manufacturers meeting 2026 requirements.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing a Cone Beam CT Machine in 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when installing a Cone Beam CT machine in 2026? | Most modern Cone Beam CT systems operate on standard 110–120V or 220–240V AC power, depending on regional electrical infrastructure. In 2026, ensure your facility has a dedicated circuit with stable voltage supply and proper grounding to prevent interference or damage. High-end models may require 208V three-phase power—verify specifications with the manufacturer prior to installation. Always consult a certified electrician and adhere to local electrical codes. |

| 2. Are spare parts readily available for Cone Beam machines, and how does this affect long-term ownership? | Availability of spare parts is critical for minimizing downtime. In 2026, prioritize OEMs with established regional distribution networks or local warehouses. Machines from reputable brands typically offer spare parts (e.g., X-ray tubes, detectors, gantry components) for 7–10 years post-discontinuation. Distributors should confirm parts availability timelines and consider stocking high-wear components. Third-party compatibility is limited due to proprietary designs—verify support agreements before purchase. |

| 3. What does the installation process for a Cone Beam CT involve, and how long does it take? | Installation typically includes site preparation (shielding, power, space), machine delivery, physical setup, calibration, and software configuration. The process takes 1–3 days depending on complexity and room readiness. In 2026, many manufacturers offer turnkey solutions with certified engineers handling radiation safety compliance and DICOM integration. Ensure your clinic allocates time for staff training during installation. Pre-installation site surveys are mandatory to confirm structural and regulatory compliance. |

| 4. What warranty coverage is standard for Cone Beam CT systems in 2026? | Standard warranties typically cover parts and labor for 1–2 years, including the X-ray tube, detector, and control system. Extended warranties (up to 5 years) are available and recommended for high-volume practices. In 2026, leading manufacturers offer tiered service plans with options for preventive maintenance, remote diagnostics, and priority response. Review warranty terms carefully—some exclude software updates or consumables. Distributors should clarify international vs. local warranty enforcement. |

| 5. How can clinics and distributors ensure ongoing service and support post-warranty? | Post-warranty support is best secured through service level agreements (SLAs) with response time guarantees (e.g., 24–72 hours). In 2026, OEMs and authorized distributors offer subscription-based maintenance programs that include software updates, calibration, and discounted parts. Clinics should evaluate technician certification, local service coverage, and remote monitoring capabilities. Distributors must maintain strong partnerships with manufacturers to ensure timely technical and logistical support for clients. |

Need a Quote for Cone Beam Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160